AGEC 424 Homework for Chapter 14 As ALWAYS show your work where work is required. 2. The use of fixed-cost financing is referred to as: a. operating leverage. b. a leveraged buyout. c. financial leverage. d. combined leverage. 4. The degree of financial leverage is measured by relating the percentage change in earnings per share to the percentage change in: a. sales. b. EBIT. c. debt ratio. d. share price. 10. Financial leverage has the following effect on financial performance. a. During periods of reasonably good performance, leverage enhances results in terms of ROE and EPS. b. Leverage adds variability to financial performance making the firm’s stock a riskier investment. c. Leverage always makes performance better and thereby increases stock price. d. Both a and b 11. A DFL (degree of financial leverage) of 3.0 indicates that a 27% increase in EPS is the result of a _____ increase in EBIT.

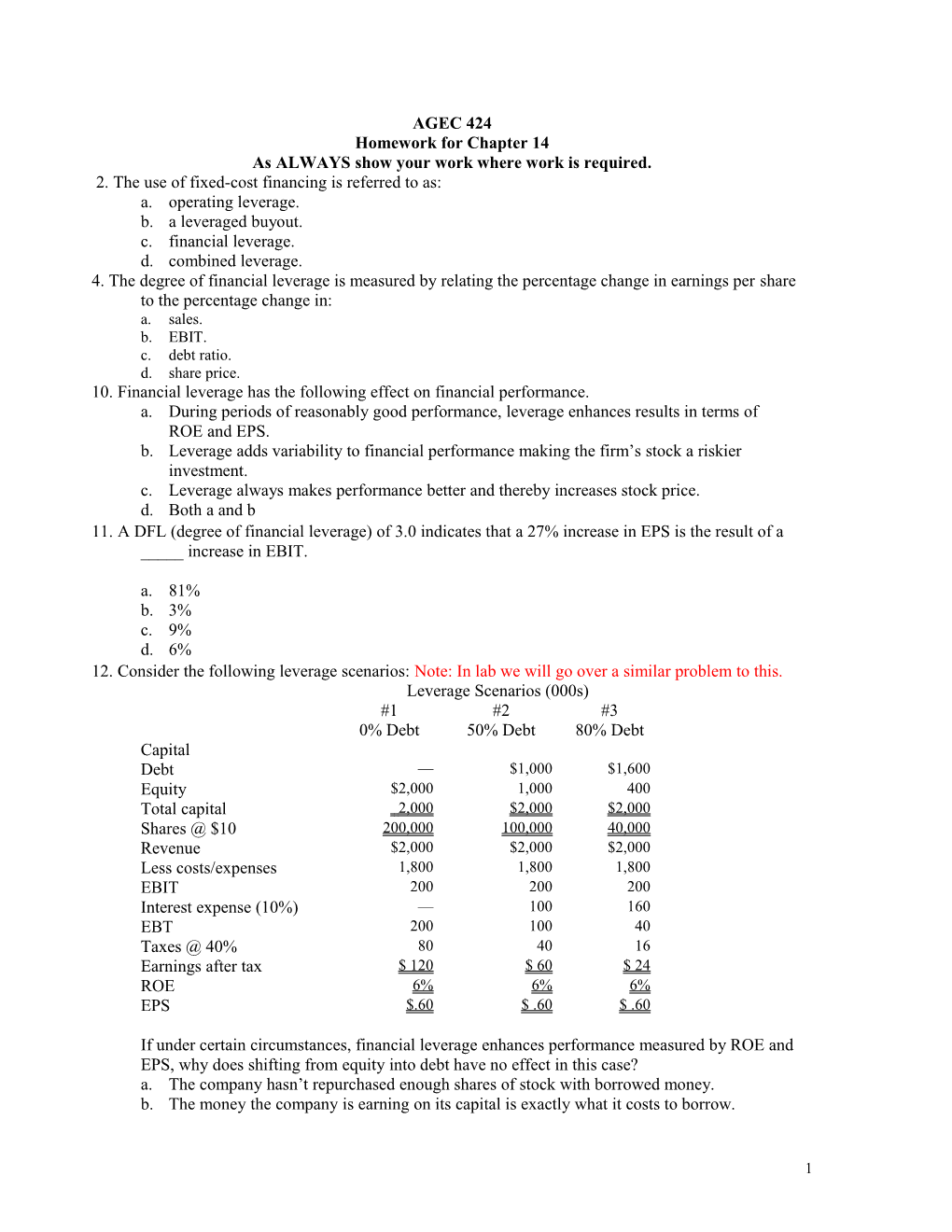

a. 81% b. 3% c. 9% d. 6% 12. Consider the following leverage scenarios: Note: In lab we will go over a similar problem to this. Leverage Scenarios (000s) #1 #2 #3 0% Debt 50% Debt 80% Debt Capital Debt — $1,000 $1,600 Equity $2,000 1,000 400 Total capital 2,000 $2,000 $2,000 Shares @ $10 200,000 100,000 40,000 Revenue $2,000 $2,000 $2,000 Less costs/expenses 1,800 1,800 1,800 EBIT 200 200 200 Interest expense (10%) — 100 160 EBT 200 100 40 Taxes @ 40% 80 40 16 Earnings after tax $ 120 $ 60 $ 24 ROE 6% 6% 6% EPS $.60 $ .60 $ .60

If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case? a. The company hasn’t repurchased enough shares of stock with borrowed money. b. The money the company is earning on its capital is exactly what it costs to borrow.

1 c. Return on Capital Employed (ROCE) is too high. d. ROCE is equal to the after tax cost of debt.

Note: In the first lab or two we looked at basic earnings power (BEP), which is the pre-tax rate of return the company earns on investment and can be compared to the interest rate. The return on capital employed (ROCE) is BEP multiplied by (1-T) and is compared to the after tax interest rate (where T is the income tax rate). 13. Financial leverage increases a firm’s ROE and EPS under which of the following circumstances? a. ROCE = cost of debt b. ROCE > after tax cost of debt c. ROCE < pre tax cost of debt d. ROCE = cost of equity 57. Assume the following facts about a company: Capital (000’s) EBIT (000’s) $1,000 Debt — Less Interest Expense — Equity $3,000 EBT $1,000 Total Capital $3,000 Taxes @ 40% 400 Shares @ $10 = 300 Earnings after Tax $ 600

What will be the company’s new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share. a. $3.33 b. $4.89 c. $2.93 d. none of the above 61. Internet Corporation has EBIT of $1 million, 30% debt in their capital structure, and total capital of $10 million. Their tax rate is 35%. What is their return on capital employed (ROCE)? a. 6.5% b. 10.0% c. 33.33% d. 21.67%

63. A firm has EBIT of $3.6M and debt of $15M on which it pays 8% interest. What is its Degree of Financial Leverage (DFL)? a. 1.0 b. 1.4 c. 1.5 d. 1.6

64. Harris Inc. has EBIT of $1,500 and debt of $5,000 on which it pays 12% interest. Its EPS is currently $2.35 per share. Management anticipates a difficult period ahead and fears EBIT could decline by as much as 20%. What will the new EPS be if that happens? a. $1.88 b. $1.41 c. $1.57 d. Can’t tell from the information given

2 65. Illinois Tool Company’s (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70. The firm’s debt consists of a $6,000,000 bond issue (par value), which pays a coupon rate of 9%. Sales are $9 million per year. What is ITC’s degree of financial leverage? a. 1.20 b. 1.875 c. 3.0 d. 1.60

67. A firm has a product that sells for $25. The direct cost of manufacturing the product is $15 per unit. The product’s contribution margin is: a. $10 b. 40% c. 60% d. 67%

69. Assume the following facts about a firm that sells just one product:

Selling price per unit = $24.00 Variable costs per unit = $18.00 Total monthly fixed costs = $2,500

What is the firm’s monthly breakeven volume in units? a. 417 units b. 1,250 units c. 5,000 units d. 1,667 units 70. Assume the following facts about a firm that sells just one product:

Selling price per unit = $24.00 Variable costs per unit = $18.00 Total monthly fixed costs = $2,500

What is the firm’s annual breakeven volume in units? a. 417 units b. 1,250 units c. 5,000 units d. 1,667 units 72. Assume the following facts about a single product firm:

Selling price per unit = $25.00 Variable costs per unit = $20.00 Total annual fixed costs = $30,000

What is the firm’s annual breakeven volume in sales revenues? a. $6,000 b. $250,000 c. $150,000 d. $1,500

3 75. Last year Avator’s operating income (EBIT) increased by 22 percent while its dollar sales increased by 15%. What is Avator’s degree of operating leverage (DOL)? a. . 68 b. 2.0 c. 1.47 d. . 32

76. Porter Productions sells videotapes for $15.00 each. Their variable cost per unit is $9.00. In addition, they incur $180,000 in fixed costs each year. At 40,000 units of sale, what is Porter’s degree of operating leverage (DOL)? a. 1.33 b. 2.50 c. 3.00 d. 4.00 e. 6.00

80. If a firm’s degree of operating leverage is 8, what percentage change in sales revenue is required to double the firm’s EBIT? a. 100% b. 8% c. 12.5% d. none of the above 81. Illinois Tool Company’s (ITC) degree of total leverage (DTL) is 3.00 at a sales volume of $9 million. Determine ITC’s percentage change in earnings per share (EPS) if forecasted sales increase by 20 percent to $10,800,000. a. 60% b. 50% c. 32% d. none of the above 82. Kermit’s Hardware’s (KH) fixed operating costs are $20.8 million and its variable cost ratio is 0.30. The firm has $10 million in bonds outstanding with a coupon interest rate of 9%. KH has 200,000 shares of common stock outstanding. The firm has revenues of $32.2 million and its marginal tax rate is 40%. Compute KH’s degree of total leverage. a. 26.8 b. 5.5 c. 29.1 d. 4.7 85. A firm’s degree of financial leverage is 2 and the degree of operating leverage is 2.5. What is their degree of total leverage? a. 6.0 b. 4.5 c. 5.0 d. none of the above

4