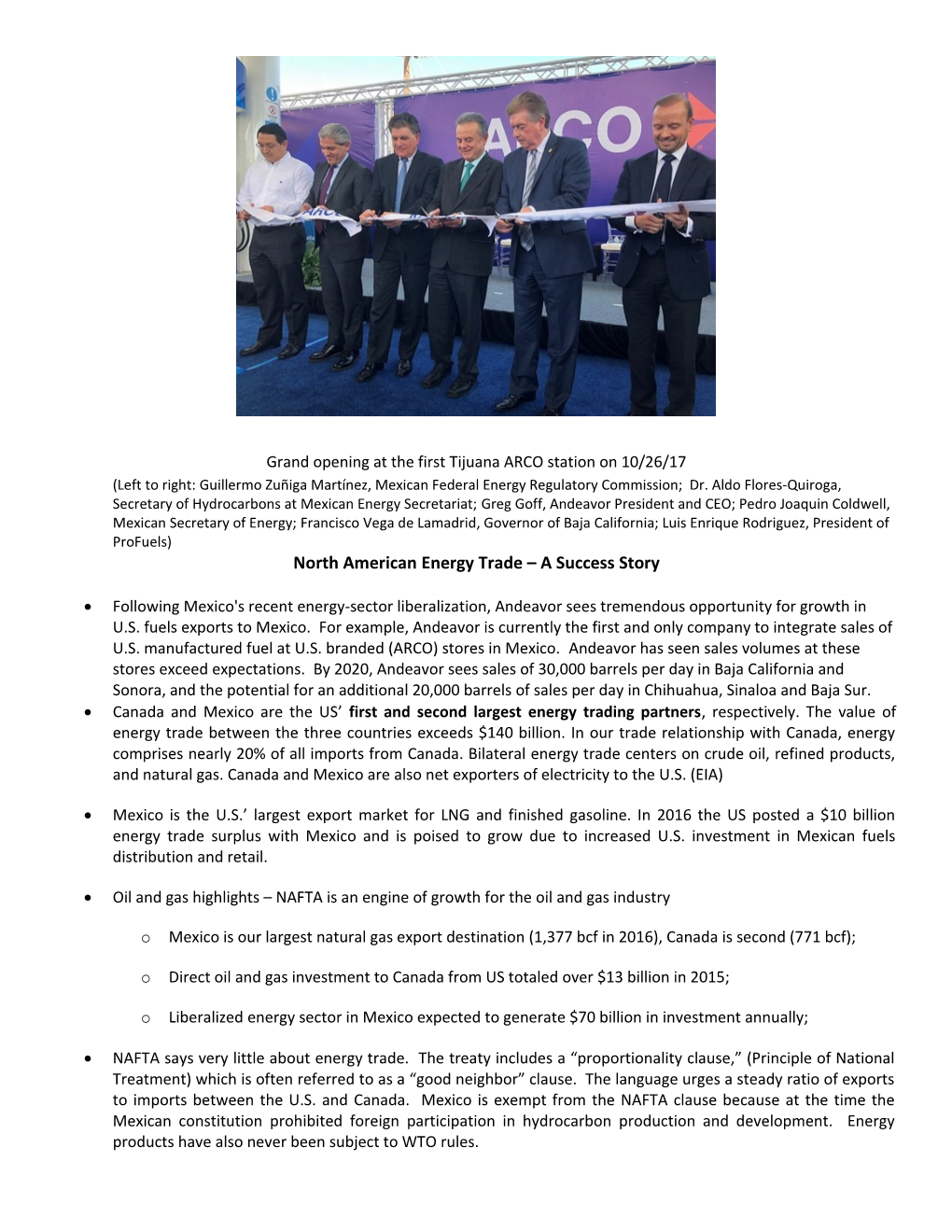

Grand opening at the first Tijuana ARCO station on 10/26/17 (Left to right: Guillermo Zuñiga Martínez, Mexican Federal Energy Regulatory Commission; Dr. Aldo Flores-Quiroga, Secretary of Hydrocarbons at Mexican Energy Secretariat; Greg Goff, Andeavor President and CEO; Pedro Joaquin Coldwell, Mexican Secretary of Energy; Francisco Vega de Lamadrid, Governor of Baja California; Luis Enrique Rodriguez, President of ProFuels) North American Energy Trade – A Success Story

Following Mexico's recent energy-sector liberalization, Andeavor sees tremendous opportunity for growth in U.S. fuels exports to Mexico. For example, Andeavor is currently the first and only company to integrate sales of U.S. manufactured fuel at U.S. branded (ARCO) stores in Mexico. Andeavor has seen sales volumes at these stores exceed expectations. By 2020, Andeavor sees sales of 30,000 barrels per day in Baja California and Sonora, and the potential for an additional 20,000 barrels of sales per day in Chihuahua, Sinaloa and Baja Sur. Canada and Mexico are the US’ first and second largest energy trading partners, respectively. The value of energy trade between the three countries exceeds $140 billion. In our trade relationship with Canada, energy comprises nearly 20% of all imports from Canada. Bilateral energy trade centers on crude oil, refined products, and natural gas. Canada and Mexico are also net exporters of electricity to the U.S. (EIA)

Mexico is the U.S.’ largest export market for LNG and finished gasoline. In 2016 the US posted a $10 billion energy trade surplus with Mexico and is poised to grow due to increased U.S. investment in Mexican fuels distribution and retail.

Oil and gas highlights – NAFTA is an engine of growth for the oil and gas industry

o Mexico is our largest natural gas export destination (1,377 bcf in 2016), Canada is second (771 bcf);

o Direct oil and gas investment to Canada from US totaled over $13 billion in 2015;

o Liberalized energy sector in Mexico expected to generate $70 billion in investment annually;

NAFTA says very little about energy trade. The treaty includes a “proportionality clause,” (Principle of National Treatment) which is often referred to as a “good neighbor” clause. The language urges a steady ratio of exports to imports between the U.S. and Canada. Mexico is exempt from the NAFTA clause because at the time the Mexican constitution prohibited foreign participation in hydrocarbon production and development. Energy products have also never been subject to WTO rules. Despite the lack of international governance on energy, North American energy trade is unparalleled and growing.

To insure that this trade is protected and that further growth is encouraged, a more robust energy chapter should be included in NAFTA.

NAFTA protections for cross-border investments should not be weakened.

If current political and policy concerns focus on U.S. trade deficits with Mexico and Canada, then growing energy trade will be a positive trade counterbalance.