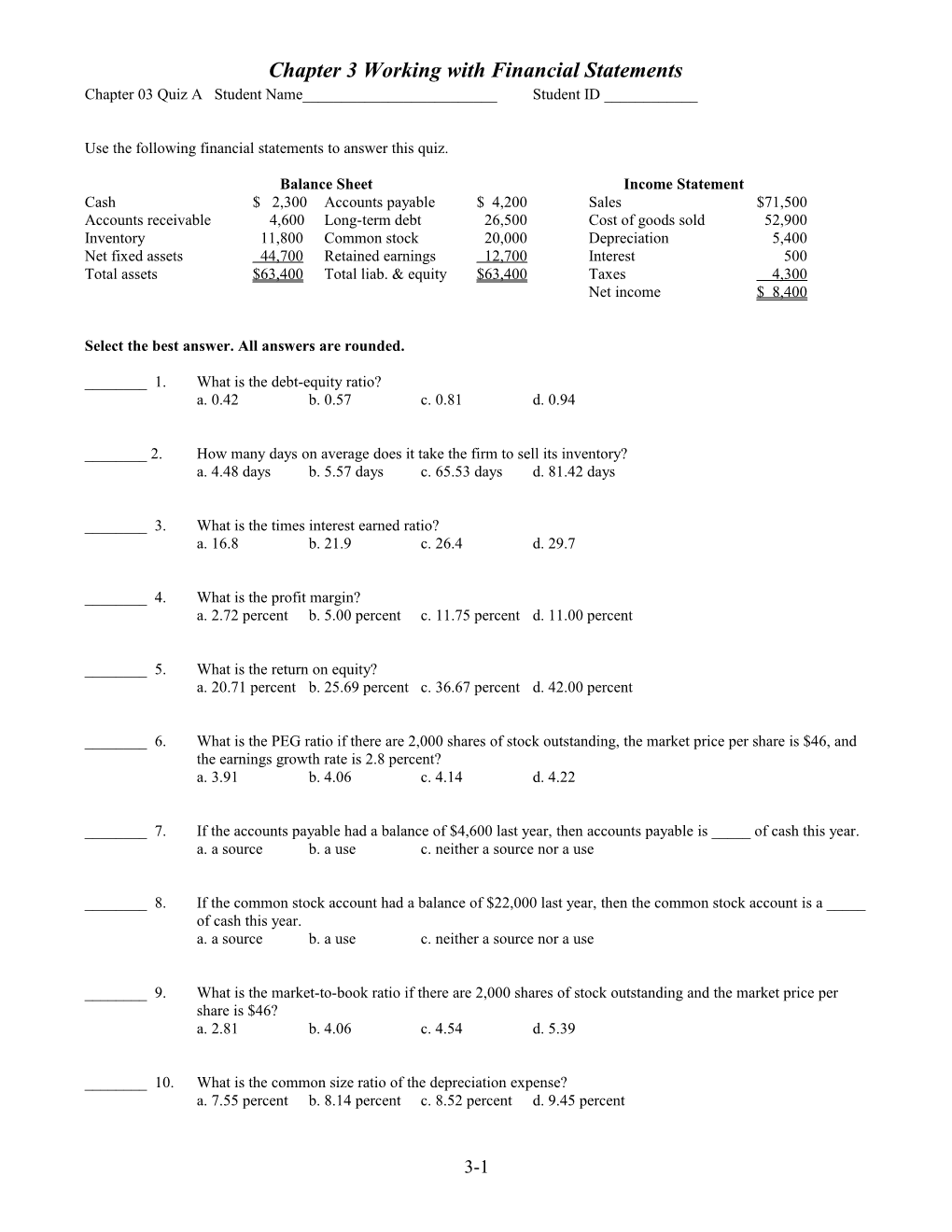

Chapter 3 Working with Financial Statements Chapter 03 Quiz A Student Name______Student ID ______

Use the following financial statements to answer this quiz.

Balance Sheet Income Statement Cash $ 2,300 Accounts payable $ 4,200 Sales $71,500 Accounts receivable 4,600 Long-term debt 26,500 Cost of goods sold 52,900 Inventory 11,800 Common stock 20,000 Depreciation 5,400 Net fixed assets 44,700 Retained earnings 12,700 Interest 500 Total assets $63,400 Total liab. & equity $63,400 Taxes 4,300 Net income $ 8,400

Select the best answer. All answers are rounded.

______1. What is the debt-equity ratio? a. 0.42 b. 0.57 c. 0.81 d. 0.94

______2. How many days on average does it take the firm to sell its inventory? a. 4.48 days b. 5.57 days c. 65.53 days d. 81.42 days

______3. What is the times interest earned ratio? a. 16.8 b. 21.9 c. 26.4 d. 29.7

______4. What is the profit margin? a. 2.72 percent b. 5.00 percent c. 11.75 percent d. 11.00 percent

______5. What is the return on equity? a. 20.71 percent b. 25.69 percent c. 36.67 percent d. 42.00 percent

______6. What is the PEG ratio if there are 2,000 shares of stock outstanding, the market price per share is $46, and the earnings growth rate is 2.8 percent? a. 3.91 b. 4.06 c. 4.14 d. 4.22

______7. If the accounts payable had a balance of $4,600 last year, then accounts payable is _____ of cash this year. a. a source b. a use c. neither a source nor a use

______8. If the common stock account had a balance of $22,000 last year, then the common stock account is a _____ of cash this year. a. a source b. a use c. neither a source nor a use

______9. What is the market-to-book ratio if there are 2,000 shares of stock outstanding and the market price per share is $46? a. 2.81 b. 4.06 c. 4.54 d. 5.39

______10. What is the common size ratio of the depreciation expense? a. 7.55 percent b. 8.14 percent c. 8.52 percent d. 9.45 percent

3-1 Chapter 3 Working with Financial Statements Chapter 03 Quiz A Answers

1. d Debt-equity ratio = ($4,200 + $26,500) / ($20,000 + $12,700) = $30,700 / $32,700 = .94 2. d Inventory turnover ratio = $52,900 / $11,800 = 4.48305 Days’ sales in inventory = 365 / 4.48305 = 81.42 days 3. c Times interest earned = ($71,500 − $52,900 − $5,400) / $500 = 26.4 4. c Profit margin = $8,400 / $71,500 =.11748 = 11.75 percent 5. b Return on equity = $8,400 / ($20,000 + $12,700) = .25688 = 25.69 percent 6. a PEG = [$46 / ($8,400 / 2,000)] / 2.8 = 10.95238 / 2.8 = 3.91 7. b A decrease in a liability account is a use of cash. 8. b A decrease in an equity account is a use of cash. 9. a Market-to-book ratio = $46 / [($20,000 + $12,700) / 2,000] = $46 / $16.35 = 2.81 10. a Common size ratio of depreciation = $5,400 / $71,500 = .0755 = 7.55 percent

3-2 Chapter 3 Working with Financial Statements Chapter 03 Quiz B Student Name ______Student ID ______

Use the following financial statements to answer this quiz.

Balance Sheet Income Statement Cash $ 980 Accounts payable $ 3,610 Sales $52,600 Accounts receivable 4,160 Long-term debt 15,740 Cost of goods sold 40,960 Inventory 11,750 Common stock 18,400 Depreciation 4,610 Net fixed assets 32,500 Retained earnings 11,640 Interest 1,260 Total assets $49,390 Total liab. & equity $49,390 Taxes 1,970 Net income $ 3,800

Select the best answer. All answers are rounded.

______1. What is the quick ratio? a. 0.10 b. 0.27 c. 1.42 d. 4.68

______2. On average, how long does it take the firm to collect payment from a customer? a. 12.64 days b. 16.28 days c. 22.42 days d. 28.87 days

______3. What is the price-sales ratio if there are 2,500 shares of stock outstanding at a price per share of $72? a. 3.42 b. 3.87 c. 4.14 d. 4.20

______4. What is the profit margin? a. 6.67 percent b. 7.22 percent c. 7.69 percent d. 8.03 percent

______5. What is the cash coverage ratio? a. 8.67 b. 9.24 c. 10.31 d. 10.59

______6. What is the total asset turnover? a. 0.42 b. 0.57 c. 0.84 d. 1.06

______7. If the accounts payable had a balance of $4,210 last year, then accounts payable is ____ of cash this year. a. a source b. a use c. neither a source nor a use

______8. The average inventory turnover rate for the industry best related to this firm is 3.6. This indicates that this firm is selling its inventory _____ its peers on an average basis. a. faster than b. slower than c. at the same pace as

______9. What is the PEG ratio if there are 2,500 shares of stock outstanding with a market price of $18.40 per share? The expected earnings growth rate is 3.4 percent. a. 3.56 b. 4.27 c. 4.41 d. 4.90

______10. What is the common size ratio for long-term debt? a. 24.08 percent b. 27.79 percent c. 31.87 percent d. 34.20 percent

3-3 Chapter 3 Working with Financial Statements Chapter 03 Quiz B Answers

1. c Quick ratio = ($980 + $4,160) / $3,610 = 1.42 2. d Accounts receivable turnover = $52,600 / $4,160 = 12.64423; Days sales in receivables = 365 / 12.64423 = 28.87 days 3. a Price-sales ratio = $72 / ($52,600 / 2,500) = $72 / $21.04 = 3.42 4. b Profit margin = $3,800 / $52,600 = .07224 = 7.22 percent 5. b Cash coverage ratio = ($52,600 − $40,960) / $1,260 = 9.24 6. d Total asset turnover = $52,600 / $49,390 = 1.06 7. b Accounts payables decreased which is a use of cash. 8. b Inventory turnover = $40,960 / $11,750 = 3.49. The lower the turnover rate, the slower the pace at which the inventory is selling. 9. a PEG =[ $18.40 / ( $3,800 / 2,500)] / 3.4 = 12.10526 / 3.4 = 3.56 10. c Common size ratio for long-term debt = $15,740 / $49,390 = .31869 = 31.87 percent

3-4 Chapter 3 Working with Financial Statements Chapter 03 Quiz C Student Name ______Student ID ______

Use the following financial statements to answer questions 1 through 8.

Balance Sheet 2006 2007 2006 2007 Cash $ 2,100 $ 1,800 Accounts payable $ 6,300 $ 5,900 Accounts receivable 3,700 4,400 Long-term debt 26,400 26,300 Inventory 14,500 16,700 Common stock 18,000 21,000 Net fixed assets 41,300 45,800 Retained earnings 10,900 15,500 Total assets $61,600 $68,700 Total liab. & equity $61,600 $68,700

Income Statement Sales $66,900 Cost of goods sold 50,700 Depreciation 5,600 Interest 2,300 Taxes 2,900 Net income $ 5,400

Select the best answer. All answers are rounded.

______1. What is the current ratio for 2007? a. 0.92 b. 1.05 c. 3.22 d. 3.88

______2. What is the accounts receivable turnover rate? Use the average receivables for 2006 and 2007. a. 14.87 b. 16.52 c. 22.10 d. 24.55

______3. What is the profit margin for 2007? a. 7.23 percent b. 7.45 percent c. 7.86 percent d. 8.07 percent

______4. What is the common size ratio for retained earnings for 2007? a. 22.56 percent b. 26.93 percent c. 27.65 percent d. 28.49 percent

______5. What is the price-sales ratio if there are 4,000 shares of stock outstanding and the market price per share is $37.50? a. 2.24 b. 2.99 c. 3.07 d. 3.80

______6. What is the return on equity based on 2007 values? a. 13.33 percent b. 14.14 percent c. 14.79 percent d. 16.78 percent

______7. What are the dividends per share if there are 4,000 shares of stock outstanding? a. $0.02 b. $0.15 c. $0.20 d. $0.35

______8. What is the common size ratio for the inventory for 2007? a. 21.08 percent b. 21.17 percent c. 23.54 percent d. 24.31 percent

______9. Which one of the following accounts represents an investment activity? a. inventory b. accounts payable c. cost of goods sold d. net fixed assets

______10. Which of the following are correct formulas for computing the return on equity? I. ROE = Net income / Total equity II. ROE = Return on assets × (1 + Debt-equity ratio) III. ROE = Profit margin × Total asset turnover × Equity multiplier IV. ROE = Return on assets × (1 + Equity multiplier) a. I and III only b. II and IV only c. I, II, and III only

3-5 Chapter 3 Working with Financial Statements d. I, III, and IV only

3-6 Chapter 3 Working with Financial Statements

Chapter 03 Quiz C Answers

1. d Current ratio for 2007 = ($1,800 + $4,400 + $16,700) / $5,900 = 3.88 2. b Average A/R = ($3,700 + $4,400) 2 = $4,050 ; A/R turnover = $66,900 / $4,050 = 16.52 3. d Profit margin = $5,400 / $66,900 = .0807 = 8.07 percent 4. a Common size ratio for retained earnings for 2007 = $15,500 / $68,700 = .2256 = 22.56 percent 5. a Price-sales ratio = $37.50 / ($66,900 / 4,000) = $37.50 / $16.725 = 2.24 6. c Return on equity based on 2007 equity = $5,400 / ($21,000 + $15,500) = .1479 = 14.79 percent 7. c Dividends per share = [$5,400 − ($15,500 − $10,900)] / 4,000 = $800 / 4,000 = $0.20 8. d Common size ratio for inventory for 2007 = $16,700 / $68,700 = .2431 = 24.31 percent 9. d Net fixed assets is the investment activity account. 10. c Options I, II, and III are correct formulas for computing the return on equity.

3-7