Financial Daily Ideas Stocks Featured: SBI, Economy (IIP, CPI, Trade), DLF PhillipCapital (India) Pvt. Ltd. INSTITUTIONAL USE ONLY 25 May 2018

Contents Stock/Sector Ticker Reco News/Analysis 1 Economy IIP, CPI, Trade IIP worsened, CPI declined and trade deficit stabilized 2 State Bank of India SBI IN Buy Perils of Slowdown 3 DLF DLFU IN UR DLF – Q1FY14 Result First cut

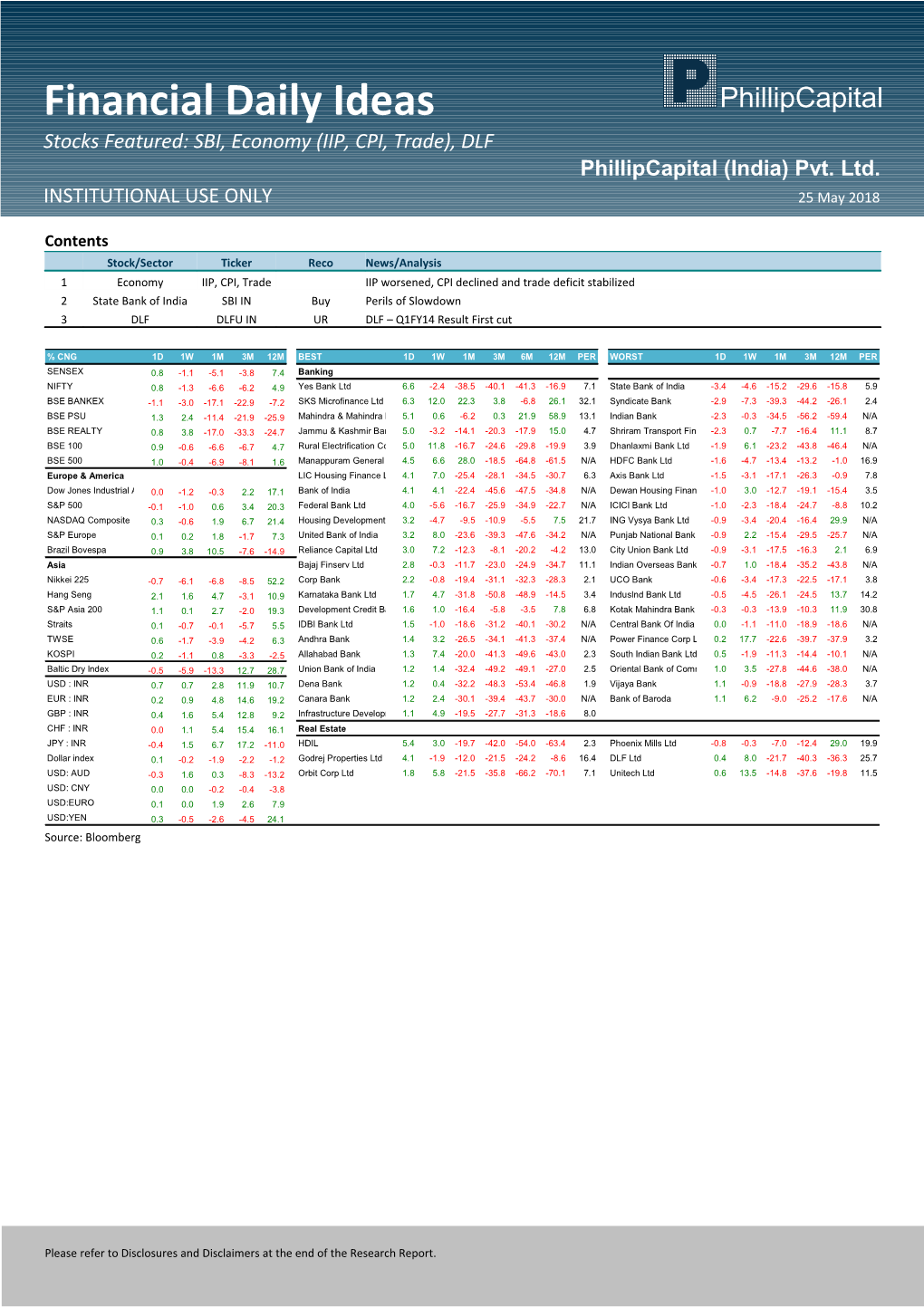

% CNG 1D 1W 1M 3M 12M BEST 1D 1W 1M 3M 6M 12M PER WORST 1D 1W 1M 3M 12M PER SENSEX 0.8 -1.1 -5.1 -3.8 7.4 Banking NIFTY 0.8 -1.3 -6.6 -6.2 4.9 Yes Bank Ltd 6.6 -2.4 -38.5 -40.1 -41.3 -16.9 7.1 State Bank of India -3.4 -4.6 -15.2 -29.6 -15.8 5.9 BSE BANKEX -1.1 -3.0 -17.1 -22.9 -7.2 SKS Microfinance Ltd 6.3 12.0 22.3 3.8 -6.8 26.1 32.1 Syndicate Bank -2.9 -7.3 -39.3 -44.2 -26.1 2.4 BSE PSU 1.3 2.4 -11.4 -21.9 -25.9 Mahindra & Mahindra Financial5.1 Services0.6 Ltd-6.2 0.3 21.9 58.9 13.1 Indian Bank -2.3 -0.3 -34.5 -56.2 -59.4 N/A BSE REALTY 0.8 3.8 -17.0 -33.3 -24.7 Jammu & Kashmir Bank Ltd5.0 -3.2 -14.1 -20.3 -17.9 15.0 4.7 Shriram Transport Finance-2.3 Co Ltd0.7 -7.7 -16.4 11.1 8.7 BSE 100 0.9 -0.6 -6.6 -6.7 4.7 Rural Electrification Corp Ltd5.0 11.8 -16.7 -24.6 -29.8 -19.9 3.9 Dhanlaxmi Bank Ltd -1.9 6.1 -23.2 -43.8 -46.4 N/A BSE 500 1.0 -0.4 -6.9 -8.1 1.6 Manappuram General Finance4.5 & Leasing6.6 28.0 Ltd -18.5 -64.8 -61.5 N/A HDFC Bank Ltd -1.6 -4.7 -13.4 -13.2 -1.0 16.9 Europe & America LIC Housing Finance Ltd 4.1 7.0 -25.4 -28.1 -34.5 -30.7 6.3 Axis Bank Ltd -1.5 -3.1 -17.1 -26.3 -0.9 7.8 Dow Jones Industrial Avg. 0.0 -1.2 -0.3 2.2 17.1 Bank of India 4.1 4.1 -22.4 -45.6 -47.5 -34.8 N/A Dewan Housing Finance Corp-1.0 Ltd 3.0 -12.7 -19.1 -15.4 3.5 S&P 500 -0.1 -1.0 0.6 3.4 20.3 Federal Bank Ltd 4.0 -5.6 -16.7 -25.9 -34.9 -22.7 N/A ICICI Bank Ltd -1.0 -2.3 -18.4 -24.7 -8.8 10.2 NASDAQ Composite 0.3 -0.6 1.9 6.7 21.4 Housing Development Finance3.2 Corp-4.7 -9.5 -10.9 -5.5 7.5 21.7 ING Vysya Bank Ltd -0.9 -3.4 -20.4 -16.4 29.9 N/A S&P Europe 0.1 0.2 1.8 -1.7 7.3 United Bank of India 3.2 8.0 -23.6 -39.3 -47.6 -34.2 N/A Punjab National Bank Ltd-0.9 2.2 -15.4 -29.5 -25.7 N/A Brazil Bovespa 0.9 3.8 10.5 -7.6 -14.9 Reliance Capital Ltd 3.0 7.2 -12.3 -8.1 -20.2 -4.2 13.0 City Union Bank Ltd -0.9 -3.1 -17.5 -16.3 2.1 6.9 Asia Bajaj Finserv Ltd 2.8 -0.3 -11.7 -23.0 -24.9 -34.7 11.1 Indian Overseas Bank -0.7 1.0 -18.4 -35.2 -43.8 N/A Nikkei 225 -0.7 -6.1 -6.8 -8.5 52.2 Corp Bank 2.2 -0.8 -19.4 -31.1 -32.3 -28.3 2.1 UCO Bank -0.6 -3.4 -17.3 -22.5 -17.1 3.8 Hang Seng 2.1 1.6 4.7 -3.1 10.9 Karnataka Bank Ltd 1.7 4.7 -31.8 -50.8 -48.9 -14.5 3.4 IndusInd Bank Ltd -0.5 -4.5 -26.1 -24.5 13.7 14.2 S&P Asia 200 1.1 0.1 2.7 -2.0 19.3 Development Credit Bank Ltd1.6 1.0 -16.4 -5.8 -3.5 7.8 6.8 Kotak Mahindra Bank Ltd -0.3 -0.3 -13.9 -10.3 11.9 30.8 Straits 0.1 -0.7 -0.1 -5.7 5.5 IDBI Bank Ltd 1.5 -1.0 -18.6 -31.2 -40.1 -30.2 N/A Central Bank Of India 0.0 -1.1 -11.0 -18.9 -18.6 N/A TWSE 0.6 -1.7 -3.9 -4.2 6.3 Andhra Bank 1.4 3.2 -26.5 -34.1 -41.3 -37.4 N/A Power Finance Corp Ltd 0.2 17.7 -22.6 -39.7 -37.9 3.2 KOSPI 0.2 -1.1 0.8 -3.3 -2.5 Allahabad Bank 1.3 7.4 -20.0 -41.3 -49.6 -43.0 2.3 South Indian Bank Ltd 0.5 -1.9 -11.3 -14.4 -10.1 N/A Baltic Dry Index -0.5 -5.9 -13.3 12.7 28.7 Union Bank of India 1.2 1.4 -32.4 -49.2 -49.1 -27.0 2.5 Oriental Bank of Commerce1.0 3.5 -27.8 -44.6 -38.0 N/A USD : INR 0.7 0.7 2.8 11.9 10.7 Dena Bank 1.2 0.4 -32.2 -48.3 -53.4 -46.8 1.9 Vijaya Bank 1.1 -0.9 -18.8 -27.9 -28.3 3.7 EUR : INR 0.2 0.9 4.8 14.6 19.2 Canara Bank 1.2 2.4 -30.1 -39.4 -43.7 -30.0 N/A Bank of Baroda 1.1 6.2 -9.0 -25.2 -17.6 N/A GBP : INR 0.4 1.6 5.4 12.8 9.2 Infrastructure Development1.1 Finance4.9 Co -19.5Ltd -27.7 -31.3 -18.6 8.0 CHF : INR 0.0 1.1 5.4 15.4 16.1 Real Estate JPY : INR -0.4 1.5 6.7 17.2 -11.0 HDIL 5.4 3.0 -19.7 -42.0 -54.0 -63.4 2.3 Phoenix Mills Ltd -0.8 -0.3 -7.0 -12.4 29.0 19.9 Dollar index 0.1 -0.2 -1.9 -2.2 -1.2 Godrej Properties Ltd 4.1 -1.9 -12.0 -21.5 -24.2 -8.6 16.4 DLF Ltd 0.4 8.0 -21.7 -40.3 -36.3 25.7 USD: AUD -0.3 1.6 0.3 -8.3 -13.2 Orbit Corp Ltd 1.8 5.8 -21.5 -35.8 -66.2 -70.1 7.1 Unitech Ltd 0.6 13.5 -14.8 -37.6 -19.8 11.5 USD: CNY 0.0 0.0 -0.2 -0.4 -3.8 USD:EURO 0.1 0.0 1.9 2.6 7.9 USD:YEN 0.3 -0.5 -2.6 -4.5 24.1 Source: Bloomberg

Please refer to Disclosures and Disclaimers at the end of the Research Report. 25 五月 2018 / INDIA EQUITY RESEARCH / FINANCIAL DAILY IDEAS

KEY ECONOMIC INDICATORS Latest 1M-Ago 3M-Ago 6M-Ago 12M-Ago KEY BANKING STATISTICS Latest 1M-Ago 3M-Ago 6M-Ago 12M-Ago

Policy rates Business growth Repo,% 7.3 7.3 7.5 7.8 8.0 Credit Growth (%) yoy 17.0 16.0 NA NA NA Reverse Repo,% 6.3 6.3 6.5 6.8 7.0 Deposit Growth (%) yoy 17.4 13.1 NA NA NA CRR,% 4.0 4.0 4.0 4.0 4.8 CD Ratio (%) 78.1 77.4 NA NA NA SLR,% 23.0 23.0 23.0 23.0 24.0 Certificate of deposit outstanding Rs bn 3248 3719 3321 3276 2286 Daily data Commercial paper outstanding Rs bn 1037 989 1231 1273 962 Call Rate, % 10.3 7.1 6.5 7.8 8.1 Deposits rates 91 day T-Bill, % 10.9 7.5 7.6 8.0 8.2 1yr Deposit rate (SBI) 8.75 8.75 8.75 8.50 9.00 1-Yr Bond Yield, % 9.5 7.5 7.3 7.7 8.0 Lending rates 5-Yr Bond Yield, % 8.8 7.7 7.4 7.9 8.2 BPLR, % (SBI) 14.8 14.8 14.8 12.3 10-Yr Bond Yield,% 8.7 7.8 7.6 8.0 8.3 Mortgage rate, (HDFC Floating rate) 10.5 10.5 9.5 9.3 8.8 USD : INR 61.3 59.6 54.7 53.9 55.3 BASE RATE, % (SBI) 10.0 8.3 8.5 9.2 9.1 EUR : INR 81.5 77.8 71.1 72.4 68.4 Gsec yield (1yr) 10.9 7.5 7.6 8.0 8.2 GBP : INR 94.9 90.0 84.1 84.0 86.9 Corporate Bond Yield (1yr AAA) 9.5 7.5 7.3 7.7 8.0 CHF : INR 66.1 62.7 57.3 58.7 56.9 Corporate Bond Spread -1.5 0.0 -0.4 -0.2 -0.3 JPY : INR 0.6 0.6 0.5 0.6 0.7 6M LIBOR 0.4 0.4 0.4 0.5 0.7 Dollar index 81.4 83.0 83.3 80.1 82.4 Sector wise credit growth EURO:USD 1.3 1.3 1.3 1.3 1.2 AGRI 15.9 12.9 21.8 24.4 8.1 USD:YEN 97.2 99.9 101.8 93.4 78.3 Retail 18.4 17.3 17.2 19.1 11.4 Weekly data Housing 19.9 18.5 19.1 17.4 11.2 Forex Reserves, $Bn 277 285 296 295 289 Credit Card 20.1 21.9 23.7 25.7 10.7 Government Borrowing, Rs Bn 2250 1510 450 5220 2490 Personal Loan 32.2 32.8 28.4 31.4 11.2 Monthly data SERVICES 9.4 11.2 11.1 13.2 15.2 Inflation Commercial real estate 5.2 4.6 4.0 2.9 11.6 WPI,% 4.9 4.7 5.7 7.3 7.6 NBFC 8.5 15.8 16.5 30.3 30.9 CPI,% 11.1 10.7 11.4 11.2 10.1 Trade 26.1 24.9 27.6 25.7 15.7 Index of Industrial Production,% -2.2 -2.8 3.5 -0.6 -2.0 INDUSTRY 14.5 13.4 16.0 17.7 19.1 8-core Industry,% 0.1 2.3 2.5 2.9 5.1 Iron and steel 24.3 22.7 24.0 23.2 17.9 Exports, $ Bn 25.8 23.8 23.7 25.7 23.1 Chemicals 39.5 41.5 37.3 22.0 13.6 Imports, $ Bn 38.1 36.0 41.9 45.7 40.6 Textile 16.1 14.8 14.6 9.5 10.1 Trade Deficit, $ bn -12.3 -12.2 -18.3 -20.0 -17.5 Food processing 21.8 14.6 17.3 25.0 19.1 Quarterly data Telecom -4.0 -6.2 0.7 0.9 -6.0 GDP,% 4.5 - 5.3 5.5 6.0 Power 33.3 26.5 30.4 23.5 23.0 Agriculture,% 1.1 - 1.2 2.9 4.1 Roads 17.4 14.8 17.7 19.5 25.8 Industry,% 2.3 - 1.1 0.8 0.9 Valuation (1yr forward P/ABV) Services,% 6.0 - 7.1 7.4 8.1 PSB 1.4 1.7 1.6 1.8 1.5 Exports, $ Bn 84.8 - 74.2 72.6 80.0 Private 2.4 2.6 2.6 2.8 2.3 Imports, $ Bn 130.4 - 132.6 120.4 131.7 Premium (Private-PSB) 1.0 0.9 1.0 1.0 0.8 Trade Deficit, $ Bn -45.6 - -58.4 -47.8 -51.6 SBI 1.6 2.0 2.2 2.6 1.9 Invisibles, $ Bn 27.5 - 26.6 26.7 17.7 ICICI Bank 2.0 2.0 2.3 2.3 2.1 Current Account Deficit, $ Bn -18.2 - -31.8 -21.1 -34.0 AGRI 3.7 3.4 3.8 4.4 3.5 Net capital flows, $ Bn 23.9 - 16.1 16.6 17.2 Source: Bloomberg

– 2 of 8 – 25 五月 2018 / INDIA EQUITY RESEARCH / FINANCIAL DAILY IDEAS

FINANCIAL Manish Agarwalla (+9122 6667 9962 / [email protected]) Sachit Motwani, FRM (+9122 6667 9953 / [email protected])

Perils of Slowdown Moderation in topline growth, higher opex (on the back of provisioning for changes in mortality assumptions) and MTM losses on international investments resulted in a PAT de-growth of 13.6% YoY to Rs 32.4 bn. Asset quality deteriorated with fresh slippages of Rs 137.7 bn stemming from agri, large corporate, retail and SME. Though the management indicated that recoveries will pick up in the ensuing quarters (especially in agri) and upgradation of few accounts due to restructuring, we believe the same is difficult given the challenging economic environment. Fresh restructuring was also high at Rs 58 bn which coupled with a higher restructuring pipeline at Rs 100 bn+ gives us further discomfort. The overall performance of the restructured stock has not been satisfactory and consequently the NPA from restructured book remains high at 26%. Key highlights for Q4FY13 NII grew by only 3.5% YoY to Rs 115 bn due to a 41 bps YoY decline in NIMs to 3.16% (domestic 3.44%, overseas 1.49%). NIM declined largely on the back of sharp fall in yields owing to growth in low yielding advances like large corporate & home loan. Interest reversals for Q1FY14 stood at Rs 4 bn. Gross Advances increased by 15.8% YoY driven by refinancing in the large and mid-corporate book and continued growth in retail. Deposits grew by 14% YoY driven by 18% YoY growth in term deposits. CASA ratio declined to 44.7% (46.5% as on FY13). Non-interest income grew by 27.9% YoY driven by strong trading profits in the domestic book. Fee income growth remained subdued owing to slower credit offtake in the corporate segment. Opex grew by 31% YoY driven by higher employee costs owing to provision for wage revision and additional pension provision factoring change in mortality assumption. The bank made an additional provision of Rs6bn towards change in mortality table for pension calculation and it would continue for next three quarters. Provisions declined by 31.5% QoQ due to a QoQ decline in NPA provisions and provision write back on assets moving out of restructured book. PCR declined from 66.58% as on FY13 to 60.6%. Slippages remained high at Rs 137.7 bn resulting in an 81 bps QoQ increase in GNPAs to 5.56%. Slippages were largely driven by agri, large corporate, SME and retail. The bank restructured assets worth Rs 58 bn taking the total outstanding restructured book to Rs 330 bn (3.1% of advances). . Outlook and Valuation We remain skeptical about the bank’s ability to maintain domestic NIMs at 3.6% going forward as the deposit cost continues to remain sticky, lending rates continues to head southwards. Asset quality may further deteriorate on the back of higher slippages from restructured stock. We expect earnings to remain under pressure over FY13-15E owing to higher wage provisions, provisions on NPA (aging effect) and on incremental restructuring. Nonetheless, given SBI’s strong corporate book (limited exposure to sensitive sectors) and a strong liability franchise, we retain our Buy rating on the stock with a revised PT of Rs 1856, valuing the core banking business of SBI and its subsidiaries at 1x FY15E Adj BV (excl investment in non-banking subsidiaries).

ECONOMY Anjali Verma (+9122 6667 9969 / [email protected])

IIP worsened, CPI declined and trade deficit stabilized • Jun’13 IIP at -2.2%, in line with expectations; sharp downward revision in June data. • July’13 CPI stood high at 9.6%, led by higher food inflation. • Trade deficit remained stable at US$ 12.3bn due to jump in exports.

IIP growth in line and in Red and on low base: IIP growth for Jun’13 came in at -2.2% YoY (PC estimate: -2.5%, Consensus estimate: -1.1%). Growth rate in the previous month stood at a revised -2.8% and -2% a year ago. 13/22 industries (11/22 in last month), recorded negative growth on an annual basis. Mining stood at -4.1%, Manufacturing at -2.2% and Electricity at 0%. May IIP data is substantially revised lower from -1.6% to -2.8% owing to revision in manufacturing sector from -2% to -3.6%.

– 3 of 8 – 25 五月 2018 / INDIA EQUITY RESEARCH / FINANCIAL DAILY IDEAS

Weak performance across industries: Sectors like Wearing apparels, Chemicals, and Food products were the highest contributors to IIP growth. Sectors which contributed negatively are Furniture, Motor vehicles, Machinery, Basic metals.

Sequential growth in consumer segments: Basic, capital, and intermediate goods recorded negative sequential growth. Consumer goods recorded growth of 4.4% MoM, due to sharp up move in Consumer durables (up 8.6%, led by 36% growth in three wheelers, inclusive of passenger and goods carrier). On an annual basis, de-growth was seen across the segments except for intermediate and consumer non-durable goods.

CPI declined to 9.6%; sequential rise remained high particularly for food inflation: CPI for July’13 stood at 9.6% (PC estimate: 9.07%; Consensus estimate: 9.7%) vs. 9.9% last month as well as last year. On a sequential basis, CPI rose by 1.3% after rising by a strong 1.7% last month. Sharp rise was recorded in food inflation (1.8% MoM) for the third consecutive month, fuel rise was similar to last month (0.8%), housing inflation grew at slower pace of 0.6% vs. 1.2% last month, inflation in clothing grew by 0.8% (similar to last month), and miscellaneous inflation grew by 1% vs. 0.9% last month. Rural CPI stood at 9.1% and Urban CPI at 10.3%. It is worrisome that retail inflation continues to rise at a faster pace.

Impressive pick-up in exports, and imports: July exports rose sharply by US$ 2bn MoM and US$ 2.7bn YoY (growth rate 11.6%; 21- month high). Imports rose by US$ 2.1bn (-6% YoY) due to higher gold imports on sequential basis. Oil imports remained stable at US$ 12.7bn while non-oil imports rose by US$ 2.1bn MoM. Trade deficit remained stable at US$ 12.2bn, much lower than US$ 17.5bn recorded a year ago. Increase in exports is encouraging, if it sustains it will reflect exports responding to Rupee weakness and improving global demand.

Deteriorating industrial output and stubborn retail inflation should continue to dampen growth. We expect IIP to remain in red and CPI elevated for the rest of the year. RBI and government measures are unable to contain Rupee weakness even at the cost of interest rate tightening. We retain FY14 GDP estimate at 4.5%, much below the consensus view. Positive: Weak Rupee if continues to aid exports like seen in July’13.

REAL ESTATE Abhishek Ranganathan (+9122 6667 9752 / [email protected]) Neha Garg (+9122 6667 9992 / [email protected])

DLF – Q1FY14 Result First cut DLF (DLFU IN: U/R: CMP: Rs140 )Q1FY 14 results were above our expectation at EBITDA and PAT level. The variance was mainly on account of lower than estimated other operating expenses (down 33% YoY, 23% QoQ). However, revenues were inline with our estimates. Reported PAT at Rs 1812mn (down 38% YoY). We shall publish detailed note with our revised estimates and recommendation after the conference call (91 022- 6629 3068) today at 16.00 hours IST

Key Highlights of the results Revenues grew by 5% (YoY) and 4% (QoQ) at Rs 23.14bn (Q4FY13: Rs 22.26bn). EBDITA in absolute terms was down 14% YoY at Rs 9.160bn. Operating margins are lower during the quarter at 56% as compared to 71% in Q1FY13 on account of older projects such as NTH Gurgoan, OMR , Fist two Phases of Capital greens would have margins in range of 25% and are around 90% complete thereby lowering margins. Company reported profit of Rs 1.8bn as compared to Rs2.9bn same quarter last year. Interest cost has remained flat at Rs 5.9bn for Q1FY14. Exceptional item includes Rs 731mn towards profit booked on transfer of undertaking from DLF home developers to Tulip Renewable Powertech. Both are wholly-owned subsidiary of DLF. Total sales booked for Q1FY14 in the residential segment were at 1.81MSF as against 1.34MSF in Q1FY13 and 1.99MSF in Q4FY13. Rs 1.85bn received on the wind transaction. Net debt at the end of quarter stood at Rs 204bn as compared to Rs217bn in Q4FY13. Mainly on account of increase receipts on IPP (Institutional private placements ) amounting Rs 18.55bn. Company received strong response from the launch of ‘Crest’ in DLF 5. Test marketing of ‘Camellias’ met with an encouraging response. All contracts with respect to the project already finalized and awarded.

– 4 of 8 – 25 五月 2018 / INDIA EQUITY RESEARCH / FINANCIAL DAILY IDEAS

MyPadLucknow–More than 60% stock sold at the launch. Signed the agreement to sell Insurance business. Expect IRDA approval in 3QFY14. Upon completion, this will result in positive impact of Rs 1bn on annual basis. Mall of India, NOIDA is under final stage of completion and is expected to open by the end of FY14.

Q1FY14 Results (Consolidated) Rs mn Q1FY13 Q4FY13 Q1FY14 YoY QoQ Sales and other receipts 21,977 22,256 23,141 5% 4% Cost of land, plots, development rights, constructed properties and others 6,442 10,508 10,205 58% -3% Gross Profit 15,536 11,747 12,936 -17% 10% Employee benefit expenses 1,406 1,449 1,451 3% 0% Other expenses 3,459 3,041 2,329 -33% -23% EBITDA 10,670 7,258 9,156 -14% 26% Depreciation, amortisation and impairment 1,786 1,861 1,782 0% -4% Other income 1,311 932 1,391 6% 49% EBIT 10,196 6,330 8,765 -14% 38% Finance costs 6,226 5,882 5,914 -5% 1% Profits before tax and exceptionals 3,970 448 2,851 -28% 536% Exceptional Items 0 330 -58 PBT 3,970 118 2,909 -27% 2357% Tax 1,137 -196 913 -20% -566% Net profit 2,833 314 1,996 -30% 535% Minority interest - share of loss/ (profit) 74 -175 -245 -429% 39% Share of profit/ (loss) in associates 36 32 73 104% 124% Net profit for the period (before prior period adjustments) 2,943 171 1,824 -38% 964% Prior period adjustments (net) -15 -213 -12 -16% -94% Reported Net Profit 2,928 -42 1,812 -38% -4424% Key Ratios (%) Gross Margins 71% 53% 56% Employee benefit expenses 6% 7% 6% Other expenses 16% 14% 10% EBITDA margins 49% 33% 40% Tax Rate 29% -166% 31% Source: Company, PhillipCapital India Research

Debt reduction target of Rs 175bn in FY14 Net debt increased by Rs 13.62bn on Q-o-Q to Rs 203bn. During the quarter, company received Rs 1850mn on the wind transaction. The company expects to end FY14 with the net debt of Rs 175bn. Company expects to received Rs6.25bn from wind assets, Rs 17.70bn from land divestitures and Rs 4.75bn from Business divestitures (IDFC+Insurance+Star+Noida).

Receding Debt levels Debt Position Q3FY13 Q4FY13 Q1FY14 Gross Debt(Net of equity shown as Debt/JV Co Debt) 243,630 236,040 235,470 Pref. Shares 2,020 2,020 2,020 Gross Debt Position(Net of equity shown as Debt/JV Co Debt) 245,650 238,060 237,490 Less: Cash In Hand 31,520 20,750 31,750 Less: Exchange Fluctuations 0 2,050 Net Debt Position 214,130 217,310 203,690 Source: Company, PhillipCapital India Research

– 5 of 8 – 25 五月 2018 / INDIA EQUITY RESEARCH / FINANCIAL DAILY IDEAS

Economic Calendar

Date Time Event Survey ECO IN Prior Revised 08/13/2013 04:31 UK RICS House Price Balance Jul 24% 36% 21% -- 08/13/2013 05:20 JN Machine Orders MoM Jun -7.00% -2.70% 10.50% -- 08/13/2013 05:20 JN Machine Orders YOY Jun 2.60% 4.90% 16.50% -- 08/13/2013 07:00 AU NAB Business Conditions Jul -- -7 -8 -7 08/13/2013 07:00 AU NAB Business Confidence Jul -- -3 0 -- 08/13/2013 11:30 GE Wholesale Price Index MoM Jul -- -- -0.40% -- 08/13/2013 11:30 GE Wholesale Price Index YoY Jul -- -- 0.70% -- 08/13/2013 11:30 GE CPI MoM Jul F 0.50% -- 0.50% -- 08/13/2013 11:30 GE CPI YoY Jul F 1.90% -- 1.90% -- 08/13/2013 11:30 GE CPI EU Harmonized MoM Jul F 0.40% -- 0.40% -- 08/13/2013 11:30 GE CPI EU Harmonized YoY Jul F 1.90% -- 1.90% -- 08/13/2013 14:00 UK PPI Input NSA MoM Jul 1.10% -- 0.20% -- 08/13/2013 14:00 UK PPI Input NSA YoY Jul 5.50% -- 4.20% -- 08/13/2013 14:00 UK PPI Output NSA MoM Jul 0.20% -- 0.10% -- 08/13/2013 14:00 UK PPI Output NSA YoY Jul 2.10% -- 2.00% -- 08/13/2013 14:00 UK PPI Output Core NSA MoM Jul 0.10% -- 0.00% -- 08/13/2013 14:00 UK PPI Output Core NSA YoY Jul 1.20% -- 1.00% -- 08/13/2013 14:00 UK ONS House Price YoY Jun 3.50% -- 2.90% -- 08/13/2013 14:00 UK CPI MoM Jul 0.00% -- -0.20% -- 08/13/2013 14:00 UK CPI YoY Jul 2.80% -- 2.90% -- 08/13/2013 14:00 UK CPI Core YoY Jul 2.20% -- 2.30% -- 08/13/2013 14:00 UK Retail Price Index Jul 249.7 -- 249.7 -- 08/13/2013 14:00 UK RPI MoM Jul 0.00% -- -0.10% -- 08/13/2013 14:00 UK RPI YoY Jul 3.20% -- 3.30% -- 08/13/2013 14:00 UK RPI Ex Mort Int.Payments (YoY) Jul 3.10% -- 3.30% -- 08/13/2013 14:30 GE ZEW Survey Current Situation Aug 12 -- 10.6 -- 08/13/2013 14:30 GE ZEW Survey Expectations Aug 39.9 -- 36.3 -- 08/13/2013 17:00 US NFIB Small Business Optimism Jul 94.5 -- 93.5 -- 08/13/2013 18:00 US Import Price Index MoM Jul 0.80% -- -0.20% -- 08/13/2013 18:00 US Import Price Index YoY Jul 1.50% -- 0.20% -- 08/13/2013 18:00 US Retail Sales Advance MoM Jul 0.30% -- 0.40% -- 08/13/2013 18:00 US Retail Sales Ex Auto MoM Jul 0.40% -- 0.00% -- 08/13/2013 18:00 US Retail Sales Ex Auto and Gas Jul 0.40% -- -0.10% -- 08/13/2013 18:00 US Retail Sales Control Group Jul 0.40% -- 0.10% -- 08/13/2013 19:30 US Business Inventories Jun 0.20% -- 0.10% -- 08/13/2013 AU Pre-Election Economic and Fiscal Outlook, Australia 08/14/2013 05:30 AU Bloomberg Aug. Australia Economic Survey 08/14/2013 06:00 AU Westpac Consumer Conf SA MoM Aug -- -- -0.10% -- 08/14/2013 06:00 AU Westpac Consumer Conf Index Aug -- -- 102.1 -- 08/14/2013 07:00 AU Wage Cost Index QoQ 2Q 0.70% -- 0.70% -- 08/14/2013 07:00 AU Wage Cost Index YoY 2Q 3.00% -- 3.20% -- 08/14/2013 11:30 GE GDP SA QoQ 2Q P 0.60% -- 0.10% --

– 6 of 8 – 25 五月 2018 / INDIA EQUITY RESEARCH / FINANCIAL DAILY IDEAS

Management Vineet Bhatnagar (Managing Director) (91 22) 2300 2999 Sajid Khalid (Head – Institutional Equities) (91 22) 6667 9972 Jignesh Shah (Head – Equity Derivatives) (91 22) 6667 9735

Research Automobiles Engineering, Capital Goods Retail, Real Estate Deepak Jain (9122) 6667 9758 Ankur Sharma (9122) 6667 9759 Abhishek Ranganathan, CFA (9122) 6667 9952 Jishar Thoombath (9122) 6667 9986 Neha Garg (9122) 6667 9996 Banking, NBFCs Manish Agarwalla (9122) 6667 9962 Metals Mid-caps Sachit Motwani, CFA, FRM (9122) 6667 9953 Dhawal Doshi (9122) 6667 9769 Kapil Bagaria (9122) 6667 9965 Dharmesh Shah (9122) 6667 9974 Raheel Arathodi (9122) 6667 9768 Consumer, Media, Telecom Naveen Kulkarni, CFA, FRM (9122) 6667 9947 Infrastructure & IT Services Technicals & Quant Ennette Fernandes (9122) 6667 9764 Vibhor Singhal (9122) 6667 9949 Neppolian Pillai (9122) 6667 9989 Vivekanand Subbaraman (9122) 6667 9766 Varun Vijayan (9122) 6667 9992 Shikha Khurana (9122) 6667 9948 Raheel Arathodi (9122) 6667 9768 Cement Sr. Manager – Equities Support Vaibhav Agarwal (9122) 6667 9967 Oil&Gas, Agri Inputs Rosie Ferns (9122) 6667 9971 Gauri Anand (9122) 6667 9943 Economics Saurabh Rathi (9122) 6667 9951 Anjali Verma (9122) 6667 9969

Sales & Distribution Kinshuk Tiwari (9122) 6667 9946 Dilesh Doshi (Sales Trader) (9122) 6667 9747 Mayur Shah (Execution) (9122) 6667 9945 Ashvin Patil (9122) 6667 9991 Rajesh Ashar (Sales Trader) (9122) 6667 9746 Shubhangi Agrawal (9122) 6667 9964 Kishor Binwal (9122) 6667 9989 Dipesh Sohani (9122) 6667 9756

Contact Information (Regional Member Companies)

SINGAPORE MALAYSIA HONG KONG Phillip Securities Pte Ltd Phillip Capital Management Sdn Bhd Phillip Securities (HK) Ltd 250 North Bridge Road, #06-00 Raffles City Tower, B-3-6 Block B Level 3, Megan Avenue II, 11/F United Centre 95 Queensway Hong Kong Singapore 179101 No. 12, Jalan Yap Kwan Seng, 50450 Kuala Lumpur Tel (852) 2277 6600 Fax: (852) 2868 5307 Tel : (65) 6533 6001 Fax: (65) 6535 3834 Tel (60) 3 2162 8841 Fax (60) 3 2166 5099 www.phillip.com.hk www.phillip.com.sg www.poems.com.my JAPAN INDONESIA CHINA Phillip Securities Japan, Ltd PT Phillip Securities Indonesia Phillip Financial Advisory (Shanghai) Co. Ltd. 4-2 Nihonbashi Kabutocho, Chuo-ku ANZ Tower Level 23B, Jl Jend Sudirman Kav 33A, No 550 Yan An East Road, Ocean Tower Unit 2318 Tokyo 103-0026 Jakarta 10220, Indonesia Shanghai 200 001 Tel: (81) 3 3666 2101 Fax: (81) 3 3664 0141 Tel (62) 21 5790 0800 Fax: (62) 21 5790 0809 Tel (86) 21 5169 9200 Fax: (86) 21 6351 2940 www.phillip.co.jp www.phillip.co.id www.phillip.com.cn THAILAND FRANCE UNITED KINGDOM Phillip Securities (Thailand) Public Co. Ltd. King & Shaxson Capital Ltd. King & Shaxson Ltd. 15th Floor, Vorawat Building, 849 Silom Road, 3rd Floor, 35 Rue de la Bienfaisance 6th Floor, Candlewick House, 120 Cannon Street Silom, Bangrak, Bangkok 10500 Thailand 75008 Paris France London, EC4N 6AS Tel (66) 2 2268 0999 Fax: (66) 2 2268 0921 Tel (33) 1 4563 3100 Fax : (33) 1 4563 6017 Tel (44) 20 7929 5300 Fax: (44) 20 7283 6835 www.phillip.co.th www.kingandshaxson.com www.kingandshaxson.com UNITED STATES AUSTRALIA SRI LANKA Phillip Futures Inc. PhillipCapital Australia Asha Phillip Securities Limited 141 W Jackson Blvd Ste 3050 Level 37, 530 Collins Street Level 4, Millennium House, 46/58 Navam Mawatha, The Chicago Board of Trade Building Melbourne, Victoria 3000, Australia Colombo 2, Sri Lanka Chicago, IL 60604 USA Tel: (61) 3 9629 8380 Fax: (61) 3 9614 8309 Tel: (94) 11 2429 100 Fax: (94) 11 2429 199 Tel (1) 312 356 9000 Fax: (1) 312 356 9005 www.phillipcapital.com.au www.ashaphillip.net/home.htm INDIA PhillipCapital (India) Private Limited No. 1, C-Block, 2nd Floor, Modern Center , Jacob Circle, K. K. Marg, Mahalaxmi Mumbai 400011 Tel: (9122) 2300 2999 Fax: (9122) 6667 9955 www.phillipcapital.in

– 7 of 8 – 25 五月 2018 / INDIA EQUITY RESEARCH / FINANCIAL DAILY IDEAS

Disclosures and Disclaimers

PhillipCapital (India) Pvt. Ltd. has three independent equity research groups: Institutional Equities, Institutional Equity Derivatives and Private Client Group. This report has been prepared by Institutional Equities Group. The views and opinions expressed in this document may or may not match or may be contrary at times with the views, estimates, rating, target price of the other equity research groups of PhillipCapital (India) Pvt. Ltd.

This report is issued by PhillipCapital (India) Pvt. Ltd. which is regulated by SEBI. PhillipCapital (India) Pvt. Ltd. is a subsidiary of Phillip (Mauritius) Pvt. Ltd. References to "PCIPL" in this report shall mean PhillipCapital (India) Pvt. Ltd unless otherwise stated. This report is prepared and distributed by PCIPL for information purposes only and neither the information contained herein nor any opinion expressed should be construed or deemed to be construed as solicitation or as offering advice for the purposes of the purchase or sale of any security, investment or derivatives. The information and opinions contained in the Report were considered by PCIPL to be valid when published. The report also contains information provided to PCIPL by third parties. The source of such information will usually be disclosed in the report. Whilst PCIPL has taken all reasonable steps to ensure that this information is correct, PCIPL does not offer any warranty as to the accuracy or completeness of such information. Any person placing reliance on the report to undertake trading does so entirely at his or her own risk and PCIPL does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements and past performance is not necessarily an indication to future performance.

This report does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors must undertake independent analysis with their own legal, tax and financial advisors and reach their own regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. In no circumstances it be used or considered as an offer to sell or a solicitation of any offer to buy or sell the Securities mentioned in it. The information contained in the research reports may have been taken from trade and statistical services and other sources, which we believe are reliable. PhillipCapital (India) Pvt. Ltd. or any of its group/associate/affiliate companies do not guarantee that such information is accurate or complete and it should not be relied upon as such. Any opinions expressed reflect judgments at this date and are subject to change without notice

Important: These disclosures and disclaimers must be read in conjunction with the research report of which it forms part. Receipt and use of the research report is subject to all aspects of these disclosures and disclaimers. Additional information about the issuers and securities discussed in this research report is available on request.

Certifications: The research analyst(s) who prepared this research report hereby certifies that the views expressed in this research report accurately reflect the research analyst’s personal views about all of the subject issuers and/or securities, that the analyst have no known conflict of interest and no part of the research analyst’s compensation was, is or will be, directly or indirectly, related to the specific views or recommendations contained in this research report. The Research Analyst certifies that he /she or his / her family members does not own the stock(s) covered in this research report.

Independence: PhillipCapital (India) Pvt. Ltd. has not had an investment banking relationship with, and has not received any compensation for investment banking services from, the subject issuers in the past twelve (12) months, and PhillipCapital (India) Pvt. Ltd does not anticipate receiving or intend to seek compensation for investment banking services from the subject issuers in the next three (3) months. PhillipCapital (India) Pvt. Ltd is not a market maker in the securities mentioned in this research report, although it or its affiliates may hold either long or short positions in such securities. PhillipCapital (India) Pvt. Ltd does not hold more than 1% of the shares of the company(ies) covered in this report.

Suitability and Risks: This research report is for informational purposes only and is not tailored to the specific investment objectives, financial situation or particular requirements of any individual recipient hereof. Certain securities may give rise to substantial risks and may not be suitable for certain investors. Each investor must make its own determination as to the appropriateness of any securities referred to in this research report based upon the legal, tax and accounting considerations applicable to such investor and its own investment objectives or strategy, its financial situation and its investing experience. The value of any security may be positively or adversely affected by changes in foreign exchange or interest rates, as well as by other financial, economic or political factors. Past performance is not necessarily indicative of future performance or results.

Sources, Completeness and Accuracy: The material herein is based upon information obtained from sources that PCIPL and the research analyst believe to be reliable, but neither PCIPL nor the research analyst represents or guarantees that the information contained herein is accurate or complete and it should not be relied upon as such. Opinions expressed herein are current opinions as of the date appearing on this material and are subject to change without notice. Furthermore, PCIPL is under no obligation to update or keep the information current.

Copyright: The copyright in this research report belongs exclusively to PCIPL. All rights are reserved. Any unauthorized use or disclosure is prohibited. No reprinting or reproduction, in whole or in part, is permitted without the PCIPL’s prior consent, except that a recipient may reprint it for internal circulation only and only if it is reprinted in its entirety.

Caution: Risk of loss in trading in can be substantial. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances.

For U.S. persons only: This research report is a product of PhillipCapital (India) Pvt Ltd. which is the employer of the research analyst(s) who has prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States (U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst account.

This report is intended for distribution by PhillipCapital (India) Pvt Ltd. only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities andExchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with Major Institutional Investors, PhillipCapital (India) Pvt Ltd. has entered into an agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo").Transactions in securities discussed in this research report should be effected through Marco Polo or another U.S. registered broker dealer

PhillipCapital (India) Pvt. Ltd. Registered office: 2nd Floor, C-Block, Modern Centre, Mahalaxmi, Mumbai – 400011

– 8 of 8 –