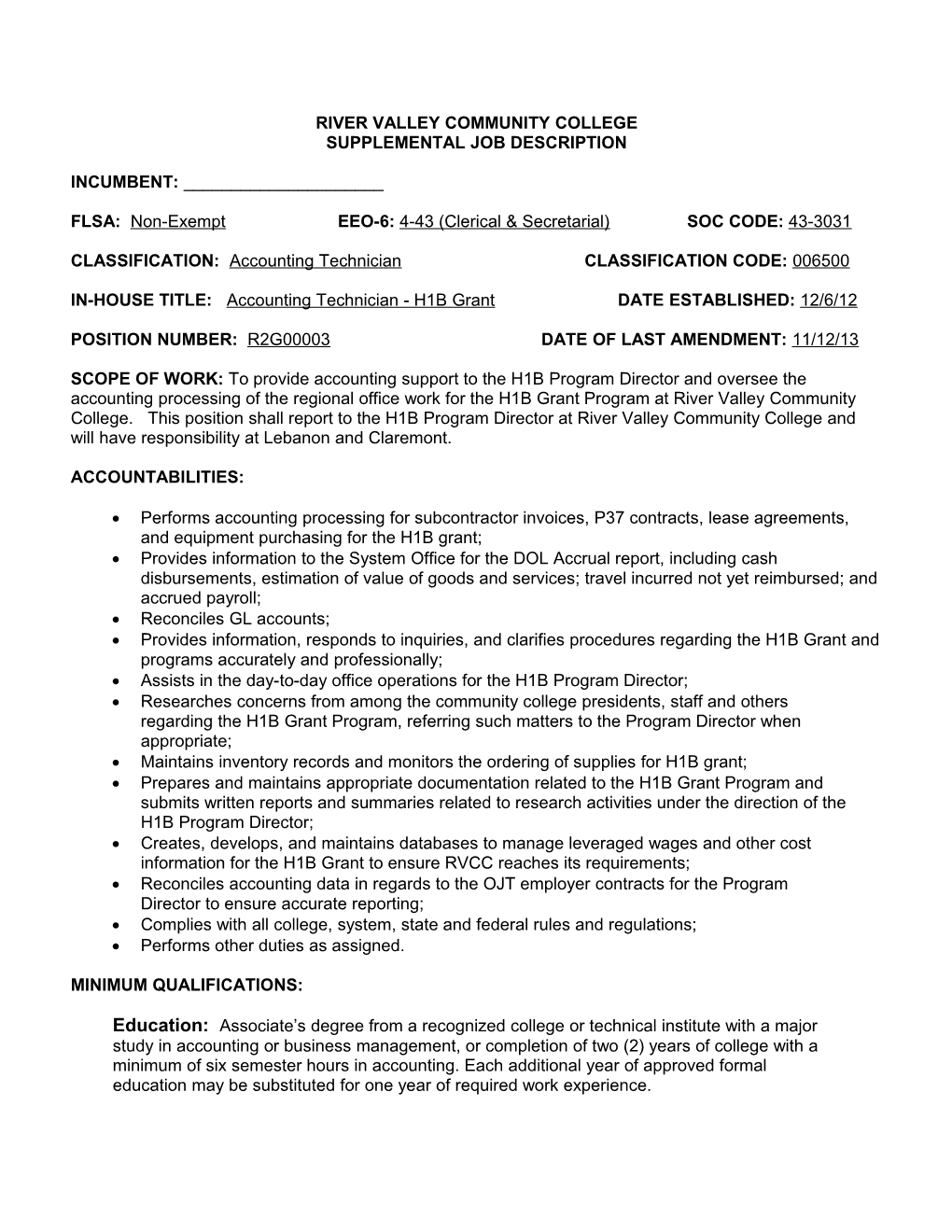

RIVER VALLEY COMMUNITY COLLEGE SUPPLEMENTAL JOB DESCRIPTION

INCUMBENT: ______

FLSA: Non-Exempt EEO-6: 4-43 (Clerical & Secretarial) SOC CODE: 43-3031

CLASSIFICATION: Accounting Technician CLASSIFICATION CODE: 006500

IN-HOUSE TITLE: Accounting Technician - H1B Grant DATE ESTABLISHED: 12/6/12

POSITION NUMBER: R2G00003 DATE OF LAST AMENDMENT: 11/12/13

SCOPE OF WORK: To provide accounting support to the H1B Program Director and oversee the accounting processing of the regional office work for the H1B Grant Program at River Valley Community College. This position shall report to the H1B Program Director at River Valley Community College and will have responsibility at Lebanon and Claremont.

ACCOUNTABILITIES:

Performs accounting processing for subcontractor invoices, P37 contracts, lease agreements, and equipment purchasing for the H1B grant; Provides information to the System Office for the DOL Accrual report, including cash disbursements, estimation of value of goods and services; travel incurred not yet reimbursed; and accrued payroll; Reconciles GL accounts; Provides information, responds to inquiries, and clarifies procedures regarding the H1B Grant and programs accurately and professionally; Assists in the day-to-day office operations for the H1B Program Director; Researches concerns from among the community college presidents, staff and others regarding the H1B Grant Program, referring such matters to the Program Director when appropriate; Maintains inventory records and monitors the ordering of supplies for H1B grant; Prepares and maintains appropriate documentation related to the H1B Grant Program and submits written reports and summaries related to research activities under the direction of the H1B Program Director; Creates, develops, and maintains databases to manage leveraged wages and other cost information for the H1B Grant to ensure RVCC reaches its requirements; Reconciles accounting data in regards to the OJT employer contracts for the Program Director to ensure accurate reporting; Complies with all college, system, state and federal rules and regulations; Performs other duties as assigned.

MINIMUM QUALIFICATIONS:

Education: Associate’s degree from a recognized college or technical institute with a major study in accounting or business management, or completion of two (2) years of college with a minimum of six semester hours in accounting. Each additional year of approved formal education may be substituted for one year of required work experience. Experience: One year of experience in bookkeeping or accounting work. Each additional year of approved work experience may be substituted for one year of required formal education.

Licensure/Certification: None Required.

RECOMMENDED WORK TRAITS: Knowledge of accounting principles and methods. Knowledge of office methods and procedures. Knowledge of computers and computer software. Ability to apply and adapt established methods to varied bookkeeping transactions. Ability to perform detailed work involving written or numerical data. Ability to make accurate arithmetical calculations. Ability to prepare complete and accurate accounting reports and statements of moderate difficulty. Ability to supervise, train, and assign work to subordinates. Ability to establish and maintain effective working relationships with fellow employees and the public. Must be willing to maintain appearance appropriate to assigned duties and responsibilities as determined by the college appointing authority.

DISCLAIMER STATEMENT: The supplemental job description lists typical examples or work and is not intended to include every job and responsibility specific to a position. An employee may be required to perform other related duties not listed on the supplemental job description provided that such duties are characteristic of that classification.

SIGNATURES:

The above is an accurate reflection of the duties of my position.

______Employee’s Name [print] Employee’s Signature Date Reviewed

Supervisor’s Name and Title: James Britton, H1B Grant Program Director

The above job description accurately measures this employee’s job duties.

______/_____/_____ Supervisor’s Signature Date Reviewed

______/_____/_____ CCSNH Director of Human Resources Date Approved