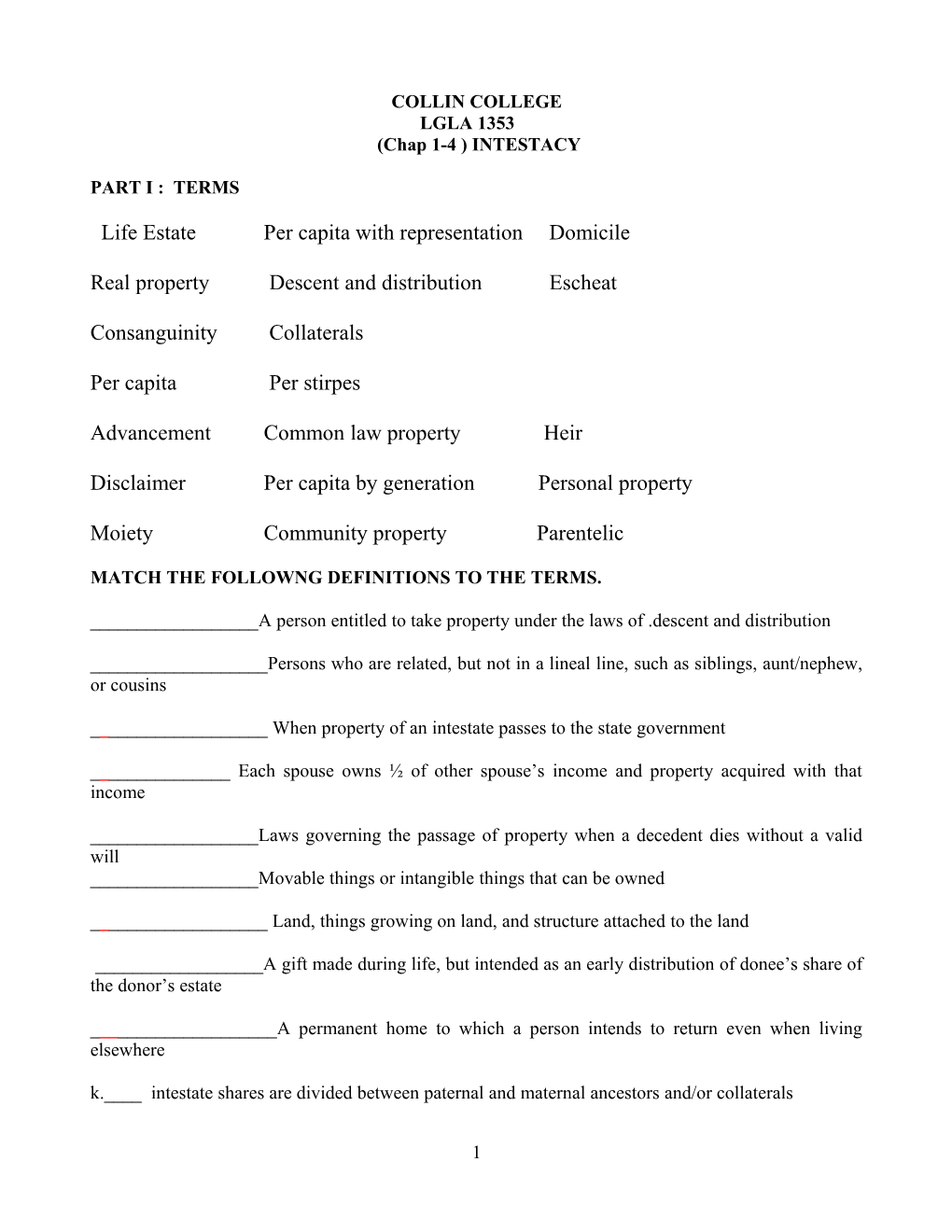

COLLIN COLLEGE LGLA 1353 (Chap 1-4 ) INTESTACY

PART I : TERMS

Life Estate Per capita with representation Domicile

Real property Descent and distribution Escheat

Consanguinity Collaterals

Per capita Per stirpes

Advancement Common law property Heir

Disclaimer Per capita by generation Personal property

Moiety Community property Parentelic

MATCH THE FOLLOWNG DEFINITIONS TO THE TERMS.

______A person entitled to take property under the laws of .descent and distribution

______Persons who are related, but not in a lineal line, such as siblings, aunt/nephew, or cousins

______When property of an intestate passes to the state government

______Each spouse owns ½ of other spouse’s income and property acquired with that income

______Laws governing the passage of property when a decedent dies without a valid will ______Movable things or intangible things that can be owned

______Land, things growing on land, and structure attached to the land

______A gift made during life, but intended as an early distribution of donee’s share of the donor’s estate

______A permanent home to which a person intends to return even when living elsewhere k.____ intestate shares are divided between paternal and maternal ancestors and/or collaterals

1 ______Renunciation of an interest in decedent’s property

______A portion of the whole (usually ½)

______Each spouse owns his/her own entire income and the property purchased with it

______An estate in property lasting for the life of a designated person

______Sharing a blood, or biological, relationship

______Method of distribution in which distributees in each subsequent generation take equal shares following an initial division at the generation closest to decedent with living members

______Method of distribution in which distributees take shares by right of representation at the generation closest to decedent that has living members

______Method of distribution in which distributees takes shares by right of representation through the generation closest to the decedent

______Method of distribution in which all distributees receive an equal share

PART II. SHORT ANSWER:

1. Which of the following is NOT TRUE with respect to inheritance rights between an adopted child and his/her parents (CHECK ANY ORALL THAT APPLY)?

_____ An adopted child may always inherit through biological parents

_____ An adopted child may inherit through adoptive parents, but not from collateral relatives of the adoptive parents.

_____ Adoptive parents may always inherit through a child who was adopted while a minor.

_____ An adopted child may inherit from his adoptive parents and all relatives, except in some States which do not always permit inheritance by a child adopted during adulthood

2. A disclaimer that satisfies tax code requirements to avoid making a taxable gift is

called a ______disclaimer.

2 3. Distribution of personal property is controlled by the law of the state where decedent’s

______is located.

4. Descent of real property is governed by the law of the state where decedent’s

______is located.

5. A laughing heir is a person who:

_____ Is a member of collateral line that is remotely related to an intestate

_____ Receives an advancement that turns out to be larger than the intestate share he/she would have been entitled to without the advancement

_____ Takes under intestacy when a decedent’s will turns out to be invalid

_____ Receives a larger proportionate share of the estate when the per capita by generation distribution method is used, rather than the pure per stirpes distribution method

6. A half-blood relative shares what connection to the intestate ?

______

7. Under the per capita with representation method of distribution, which is the “root” generation?

_____ The closest generation to the intestate decedent which has either a surviving member or a deceased member who has living descendants.

_____ The generation closest to the intestate decedent

_____ The generation having a living member in the closest degree of relationship to intestate

_____ The closest generation to the intestate decedent which has a surviving member

8. A posthumous heir of an intestate can always inherit from his ______,

but cannot always inherit from his ______relations.

3 9. Under the pure per stirpes distribution method, intestate shares are always determined by starting at the generation, which is:

______.

10. All living distributees in a given generation receive equal shares of an intestate decedent’s property when which of the following methods is used (CHECK ALL THAT APPLY)?

_____ per capita

_____ per capita with representation

_____ per capita at each generation

_____ per stirpes

With thanks to Professor Catherine Tolliver for use of materials.

4