Iceland x

United Kingdom x------Poland Germany------x

United States x-----Greece Japan

China

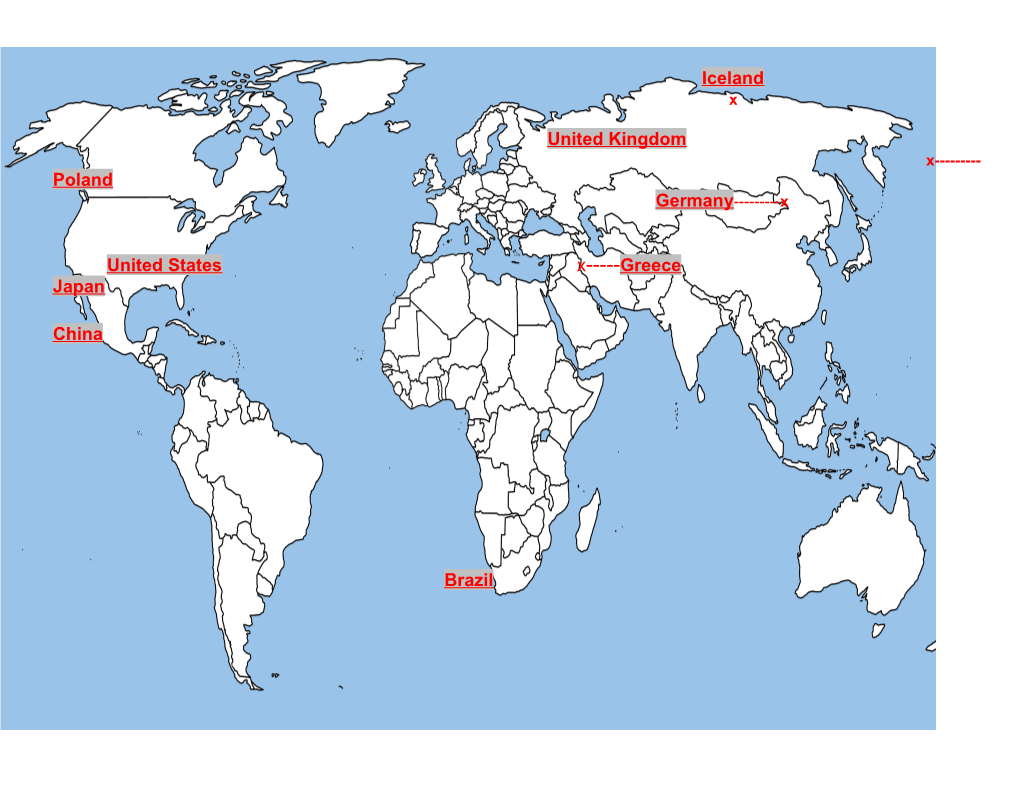

Brazil A Global Analysis of the 2008 Financial Crisis Click a country name to begin Huck Finn, Wendy McDonald, Abbie Bibliography GREECE OVERVIEWi

2009 2010 GDP $333.2 billion $318.1 billion Population below poverty line 20% Unemployment 9.5%ii 12.5% Public debt 127.5% of GDP 142.7% of GDP Exports $21.34 billion $22.66 billion Imports $64.21 billion $60.19 billion $532.9 billion $583.3 billion External debt (June 30, 2010) (June 30, 2011)

Greece’s economy is capitalistic, but its public sector features as 40% of its total GDP.

Greece is also a member of the EU and is a continual recipient of the aid it offers.

Greece’s GDP Growth in an Annual Percentageiii

NARRATIVE OF THE CRISIS

Before Greece was struck by the recession in 2009, it experienced five years of growth

(2003-2007) partially due to its increased spending for the 2004 Athens Olympics and to the higher credit availability. Due to the later tightening of credit, the government’s ignorance of its growing deficit (from a decrease in state profits) and increased spending, and the financial crisis that had hit America and other parts of the world, the recession hit. In 2009, Greece experienced a 2% contraction of its economy, which helped bring its deficit to 15.4% of its GDP, and then a

4.8% contraction in 2010. The crisis was further impacted by the lowering of Greece’s debt rating by credit agencies, which had taken into account Greece’s poor public financing, credibility, and performance with enforcing its reforms. Greece soon instituted austerity measures, which decreased its deficit by almost 5% in 2010.iv The new policy, however, brought about further contraction of the economy and increased the unemployment rate.v Greece quickly ran out of “fresh funds on the financial markets at sustainable interest rates” and then asked

Brussels and the IMF for a €110 billion “rescue package.”vi When this failed, a new plan was instituted, but its many loopholes and unresolved issues have left the general public, and the EU, unsure of its effectiveness.vii

GOVERNMENT RESPONSE

The government’s immediate response to the recession was to institute a “medium-term” austerity program, which incorporated decreasing government spending, shrinking the public sector, lowering tax avoidance by the people, reforming the health and pension arrangements, and increasing competition with altering market constructions; Greece’s lenders began to put pressure on the country to better institute these reforms to pay back its debts.viii This plan, however, because of the previously mentioned economical contraction and the refusal by the rich to pay taxes, soon failed, and the new, plan (also previously mentioned) was put into place. The new plan calls for more austerity, tax payments, and privatization of the public sector, but the

Greek middle class is expressing large amounts of opposition to it.ix On October 2, 2011, the

Greek government placed 30,000 Greeks into a plan that calls for early retirement for some and dismissal for others in order to ease the pressure from its lenders and reduce its public sphere, which has caused several riots and demonstrations by the work force.x The people are also frustrated at the bailout system, which resembles more of a loan system with extremely high interest rates.xi ASSESSMENT

There are several doubts about the Greek system that are worrisome for its people and their country’s future. Firstly, the reduction of the public sector, being such a large part of GDP, is potentially dangerous if the economy is then not supplemented with another system. It is possible to substitute foreign investments as a source of income, but there is very little trust in

Greece throughout the rest of the world. Large corporations claim that their main reasons for not putting investments in Greece are its corruption, bureaucracy, and cronyism and the complexity of its economic regulations.xii The public sector reduction has also caused major upset among the

Greek people. They have expressed their desire to see Greece fail and take responsibility for its actions, but this failure could lead to the default of the euro and the entire EU system.xiii

The plan that Greece has instituted could help alleviate much of its economic problem, but it also needs to look into stricter law enforcement, a more organized tax system, and a source of income other than its public sector. The country must devise a strategy for more efficient tax collection; the rich cannot have the power of avoiding the law. It must also rid of its corruption and clarify its legislation if it wishes to encourage foreign investment, as it has indicated with its latest investment incentives.xiv The riots and strikes that have been occurring must also be minimized if Greece desires the ability to enforce other legislation as well. Its economic plan has the potential to be sound and decrease its debt, but only if Greece clarifies its legislation and adds to it a stronger law enforcement system.

Return_to_Map GERMANY

OVERVIEWxv

2009 2010 GDP $2.841 trillion $2.94 trillion Population below poverty line 15.5% Unemployment 7.7% 7.1% Public debt 73.5% of GDP 83.4% of GDP Exports $1.161 trillion $1.303 trillion Imports $972.5 billion $1.099 trillion $4.713 trillion $5.624 trillion External debt (June 30, 2010) (June 30, 2011)

Germany has the largest and most powerful economy of the countries in the EU. It relies heavily on its exports for income; as shown in the table, Germany’s exports accounted for almost

45% of its GDP in 2010. Germany’s GDP Growth in an Annual Percentagexvi

NARRATIVE OF THE CRISIS

Germany’s financial sector was relatively stable in the years preceding the crisis. The country has a workforce that is aging, high savings rates, and an economy that is mainly driven by its exports. Like Poland, Germany had attempted to institute reforms and deregulation measures such as liberalization and privatization before the crisis hit. Even with all of these changes, however, Germany still featured a high public debt rate.xvii

Because of Germany’s high reliance on its export industry, when the global crisis hit, it suffered a great amount. Its economy contracted quickly, with its income growth shrinking by

6.9% between the middles of the 2008 and 2009 fiscal years, but then increasing to normal levels again by the end of 2009. Because of Germany’s fast and strong crisis management measures, unemployment did not skyrocket and many reforms were instituted in order to stabilize the economy and strengthen the banking system.xviii

GOVERNMENT RESPONSE In response to the crisis, the government implemented the Financial Market Stabilisation

Fund (“SoFFin”), which was only in operation until December 31, 2009, focused on increasing the trust in the financial system (specifically the banks) and increasing economic interactions within the market.xix The strategy for trust restoration in the system came from guarantees, recapitalization, and the government purchase of toxic assets from financial institutions.xx To supplement the fund, the government instituted rules for limiting the salaries of bank managers, the financial help offered to one Financial Sector Institution (FSI), and the number of toxic assets the fund can buy from one company. The government also planned on using any money obtained from the resale of the assets, as well as money from fees or the interest on loans to FSIs, in order to pay for its other pursuits.xxi

Germany also instituted two economic stimulus packages, the first in November 2008 and the second in March 2009. The first package focused on securing money for investments and protecting financial resources and liquidity. It included the devaluation of SMEs, broader funding for short working hours, the bolstering of regional finances, infrastructure, and tax exemptions for people who purchased new cars. The second package was centered on maintaining jobs, stabilizing growth and modernization.xxii

ASSESSMENT

The measures that have been taken on by the German government are extensive and seem to cover most of the economic bases. Germany must be cautious, however, of the toxic assets that its Stabilisation Fund are taking on and the reselling for money. If something interferes with their resale, the German government will be left in the possession of these assets, which could be further detrimental to the health of the country’s financial sector. It must also be wary of the idea that if these assets cannot be sold, it will need an alternative to fund its other undertakings.

Germany is taking a risk with the acquisition of these assets, but it could pay off if the government is cautious.

Germany also needs to focus on restoring international faith in its economy. Although its first economic package focused on doing so, the assurance that investors have in the German economy had decreased substantially in October while German factories also suffered from a decrease in demand.xxiii The German government is looking to revitalize its export-based economy with the development of a Third Industrial Revolution which will introduce an “energy

Internet” and allow Germans to share sustainable electricity as hydrogen in a network. Once established, the concept will expand internationally in order to bolster the global economy. The idea will help Germany accomplish its goal of more “green” energy, especially with the closing of all of its nuclear power plants.xxiv Germany needs to be especially careful, however, of the repercussions of this undertaking if the plan fails in any way. Being left without any source of power will hurt Germany more than fixing its economy will help it.

It was worrisome for a while that if Germany only worked toward fixing itself and running the EU on its own interests, the system would either fail, or Germany would have to pick up the slack.xxvxxvi Because of Germany’s power in the EU, it controls much of the transfer of money throughout the system. With this new program, however, Germany seems to be focusing on the welfare of the continent rather that just its own. If it wants to survive, and if it wants to maintain the EU and its currency, Germany will have to really push for the success of this energy program, or develop new ideas that will not only bolster its economy, but also that of the countries that are responsible for buying into Germany’s largest profit mechanism – its exports. Return_to_Map

POLAND

OVERVIEWxxvii

2009 2010 GDP $694.8 billion $721.3 billion Population below poverty line 17% (2003) Unemployment 11% 12.1% Public debt 49.3% of GDP 52.8% of GDP Exports $142.1 billion $162.3 billion Imports $149.7 billion $173.7 billion $272.2 billion $365.4 billion External debt (December 31, 2010) (June 30, 2011) Poland’s Budget Deficit as a Percentage of GDPxxviii

NARRATIVE OF THE CRISIS

The extent of the crisis in Poland is smaller than that in the other EU nations because of

Poland’s rate of growth in the years preceding the recession. In 2002, Poland was dealing with the latter end of a massive privatization movement and major unemployment (20% of the population). Poland was also in the midst of public reforms, such as decentralizing the national government roles in order to transfer power to the local governments. After it joined the EU in 2004, Poland’s situation began to improve and had regulated and stabilized a large part of its economy when the crisis hit.xxix The structure of Polish banks also helped to minimize the effect of the crisis on Poland. Between their focus on domestic investments and their avoidance of risky loans and policies, the banks were well guarded against the turmoil of the crisis that was sending a shockwave through the rest of

Europe.xxx Poland’s use of its own currency, the zloty, rather than the euro, helped in protecting it from the crisis as well.

Poland felt the crisis mainly in its decreased trade with its neighboring countries and the deceleration of its growth.xxxi Poland instituted several reforms that focused mainly on preserving public financial stability and economic growth, and various measures to prevent future crises, such as increasing the availability of credit and supporting market systems.xxxii In 2009, distrust of markets and shrunken business and consumer mindsets caused a major contraction of bank related activities, which then decreased Poland’s profits.xxxiii GOVERNMENT RESPONSE

The Polish response to the crisis is similar to that of the Greek response. Like Greece,

Poland’s policies revolve partially around shrinking its public sector, although its private sector accounts for three-quarters of GDP, significantly larger than the private sector in Greece. Poland instituted, starting on January 1, 2009, a pension plan that significantly decreased the number of people who are allowed to retire early. Poland has also developed an extensive system of incentives for foreign investors, which includes tax breaks, various grants, and partial forgiveness for owed debt. Supplementing these incentives are several forms of investment insurance for different companies.xxxiv Poland has also begun to focus on new market models that are forcing them to enforce strict cost control and to be wary of lending to the interconnected banking market.xxxv The aforementioned reforms and measures that were instituted call for lower interest rates and increased trust in banks (to encourage saving), competition, consumer spending, funds for infrastructure undertakings, loan availability, and investment demands; they also take into account decreasing the number of negative repercussions on the members of society.xxxvi

ASSESSMENT

Poland has developed incredibly well thought out and widespread policies for reform and prevention of another crisis, but it, again like Greece, needs to tackle other issues in order to maximize the efficiency of its reforms. Investors in Greece often complain about the country’s slow legal system, sudden changes in laws and regulations, and harsh repercussions for small mistakes.xxxvii Although Poland has developed its incentive system, if these flaws are not taken care of, or at least curtailed, it will not attract as many foreign investors as possible in order to reinvigorate its income. This becomes an even larger problem when looked at from the view of

Poland’s financial health being reliant on the health of its surrounding countries, those with which it trades and economically interacts the most.xxxviii In order to care for itself, Poland must either assist with the stimulus of its neighbors or encourage foreign investment as much as it possibly can. Poland also features corruption and although there are laws against it, it is a common feature of the economy.xxxix Especially in a place where foreign investment is lower than that in other countries, lowering corruption would help to expand Poland’s economy and foster its growth and development.

Bravely, Poland refuses to ask for outside help to relieve itself of the crisis. Doing so will help Poland to refrain from increasing its debt, but it will also call for extreme measures of austerity which could cause contraction of the economy. Poland has chosen to prevent this with a risky decision: increasing taxes by one percentage point. This measure, although it could serve as an assistant to public funding commitments and a substitute for austerity measures, and could lower the deficit spending while controlling the debt, could also lower demand and consumer spending and affect inflation.

One of the biggest worries about the Polish economy, however, is how it will manage to both reform the system to advance the economy and continue its process of growth and also reform it to prevent another crisis. Accomplishing both will be a difficult task for Poland and will require some slick maneuvering, but if done correctly, could really enhance and protect

Poland’s economy.xl

Return_to_Map Republic of Iceland Country Overview:

Population: 311,058 (July 2011 est.)xli GDP (PPP) $11.82 billion (USD) Education Spending: 7.4% of GDP Health Spending: 4.2% of GDP Unemployment: 8.1% (2010 est.) Budget Deficit: 7.8% of GDP Public Debt: 126% of GDP Life expectancy: 81.5 years Major Industries: Fisheries; Aluminum production Ethnic Groups: 94% homogeneous Norse-Celt

Currency: Krona (ISK) Exchange rate ISK/US Dollar:xlii ISK per Dollar: 139.32 (2010) 123.64 (2009) 85.619 (2008) 63.391 (2007) 70.195 (2006)xliii

GDP Growth Rate (vs. US):xliv xlv xlvi

Background Economic Condition: Iceland’s fundamentally capitalist economy includes a broad welfare state similar to those of Scandinavian nations. Banks and major corporations remained under state control until Iceland began a dramatic liberalization of its economy in 1991. Corporate tax rates were reduced from forty-five percent to eighteen percent and marginal tax rates were cut from forty-seven percent to thirty-six percent. The state privatized fish-processing plants and completed the privitization of its banks in 2003.xlvii As shown in the graphs above, unemployment dropped and GDP expanded following this Milton Friedman-inspired legislation; most of this growth occurred in the suddenly less restricted financial sector of the economy. Facing little resistance from the nation’s inadequate regulation systems, banks expanded into international markets and aggressively sold bonds to foreign investors. These sales added to the flow of money into Iceland’s economy; additional investment in aluminum smelting industries compounded inflationary pressures.

The central bank responded with high interest rates that approached fifteen percent by 2005. Currency speculators manipulated this condtion: they borrowed at low rates from countries like the United States and lent the money in Iceland, earning a profit on the difference.xlviii As the value of the Icelandic krona increased, Icelanders began using cheap foreign currencies to finance homes, cars, and other acquisitions. The artificial strength of the krona created massive bubbles in these markets.

The 2008 Crisis: By the time of the subprime-mortgage crisis in the United States, the value of Icelandic banks’ assets had grown to one thousand percent of the nations GDP.xlix As the international credit market contracted, Iceland’s banks lost the foreign investment they needed to meet payments. The Icelandic government refused a loan to Glitner, the smallest of the nation’s three largest banks, instead announcing a plan to purchase a majority stake of the firm below market price on September 9. Before the completion of the sale, the global market reacted to the government’s announcement with a sudden loss of faith in the entire Icelandic economy. Credit became further constricted and the krona began a drop in value that would reach a loss of forty percent on the dollar by the end of 2008.l On October 7, the Icelandic government seized control of Glitner and Landsbanki, another of the three largest Icelandic Banks. Two days later, Kaupthing, the final large Icelandic firm had collapsed into government management.

The United Kingdom’s response to the condition of Icelandic banks had accelerated their failure. In an attempt to protect the deposits of its citizens held in Landsbanki accounts, Prime Minister Gordon Brown urged the UK to freeze the bank’s assets in that region. On October 8, the UK implemented this strategy using an antiterrorism law. The UK eliminated any remaining trust in Kaupthing Bank when it seized control of the British branch of that firm.li

Iceland ended the year with stocks down seventy-seven percent and a debt of over fourteen billion dollars to foreign investors and depositors.lii With such a small GDP relative to the size of its banks, Iceland had little power to bail them out without international assistance. When European banks proved unwilling to extend credit, Iceland allowed its banks to fail. The government then turned to the International Monetary Fund and European natoins to acquire ten billion dollars in loans to begin reconstructing the nation’s financial sector. The state created three new banks to manage the property of Icelandic depositors; these firms allowed the Icelandic banking system to recover while the “old” banks retained ownership of most foreign debt.liii Though the Icelandic government has guaranteed the domestic deposits in these banks, most citizens continue to face massive debt on foreign currency loans. Unlike nations such as Ireland that experienced a comparable banking crisis, the state has allowed the banks to default on foreign loans; various European nations continue to engage in discussions with the IMF and Iceland on settling the losses acquired by foreign depositors in Icelandic banks.

Assessment: Iceland’s recent economic history reveals the potential magnitude of the “boom, bust” effects of sudden deregulation. The growth of Iceland’s financial sector mirrors developments in the United States economy following the Reagan tax cuts and the later repeal of Glass-Steagall’s limitations on bank behavior. The Icleandic government proved unprepared to adapt to the rapid developments in an economy of newly privatized firms. Several economists claim that the young bankers who replaced state business leaders lacked experience and pursued especially risky strategies.liv This behavioral trend is difficult to quantify; Icelandic banks made massive purchases of foreign credit throughout the early 200s largely because of its cheap availability.

The failings of government oversight are more explicit. Even if regulators proved unable to prevent investment banks from engaging in high-risk practices, they could have prevented the massive over-extension of Icelandic firms. The nation could not afford to allow its three leading banks to reach a size such that the government could not act to restore confidence in them; “too big to fail” was not an option for Iceland’s government in 2008. Iceland’s central bank also failed to implement sustainable monetary policy. The central bank’s commitment to raising interest rates to combat inflation despite the policy’s repeated failure exacerbated Iceland’s crash by distorting the krona’s value. The central bank should have worked with the government to reduce inflation through other means, perhaps taxation or other fiscal policies. Even without a downturn on the scale of the 2008 credit crisis, the overvalued krona was likely to weaken dramatically in response to reductions in foreign investment.

Though the 2008 meltdown crippled Iceland’s economy and has left most citizens with massive debt in foreign currencies, the government’s quick response to contain the crisis effectively mitigated its impact on the nation. By allowing its banks to fail, Iceland sheltered its citizens from the debt burden they would have received had the government attempted to fully cover the banks losses. In contrast, Ireland has struggled to promote a successful recovery because of the massive deficits it incurred after deciding to guarantee all failing Irish firms in 2008.lv Though the Icelandic government did not bail out its banks, its ability to seize control of them and create three new viable firms restored the popular trust needed to stabilize the national economy. The government stimulated exports by devaluing the krona and protected national business with the establishment of controls on the flow of capital out of the country.lvi Defying the precedent that banks must be bailed out at the expense of the taxpayer, Iceland has limited unemployment to eight percent of the workforce and lowered GDP contraction to 3.4 percent.lvii Economist Paul Krugman cited Iceland’s 2008 collapse as a model for resolving bank crises without taxpayer sacrifice. At first, the limits of the nation’s recession even after the failure of the entire banking sector suggest that the preservation of moral hazard is feasible in contemporary economies. Yet, Iceland’s biggest banks in 2007 were much smaller than leading Wall Street firms. Had the Icelandic banks been significantly larger, their failures would have had much broader impact on the global economy. The hostility of UK policy regarding Icelandic firms throughout 2008 demonstrated the power of nationalist interests to prevent effective collaboration; the future success of international intervention to address larger economic failures remains in question.

Return_to_Map

The United States of America Country Overview:

Population: 313,232,044 (July 2011 est.)lviii GDP (PPP) $14.66 trillion (USD) Education Spending: 5.5% of GDP Health Spending: 16.2% of GDP Unemployment: 9.6% (2010 est.) Budget Deficit: 8.8% of GDP Public Debt: 62.9% of GDP Life expectancy: 78 years Major Industries: technology, petroleum, steel, motor vehicles, chemicals, electronics Ethnic Groups: 79.9% white, 12.9% black, 4.4% Asian

Exchange Rate:lix USD/Euro

Historical GDP Growth Rate:lx Unemployment rate since 1990:lxi

Year-to-Year Percent Changes in US Home Prices, 1988 to 2009:lxii

Brief Background on Economic Condition: The US government reduced regulation of stockbroker bonuses in the 1970s and repealed Glass-Steagall’s banking restrictions in the 1990s. The availability of cheap credit increased as Bush lowered taxes and the Federal Reserve reduced interest rates in response to a 2001 recession.lxiii Investment banks responded to this liberalized climate with expanded speculation; the high-risk strategies of these firms, most of which existed beyond federal regulations as “shadow banks,” became most evident in the subprime mortgage market. Banks offered loans to consumers with increasingly poor credit and gathered these mortgages into securities that were sold to larger firms. Unable to assess the securities on their own, investors relied on information from rating agencies to judge the value of the bundled loans. Agencies’ private interest and poor models reduced the accuracy of their ratings; absolute values of risk and value remained obscured.lxiv Similar lack of transparency developed in the derivatives markets.

Subprime mortgages extended credit to homebuyers previously excluded from the housing market. As these mortgages increased demand for housing, the bubble in home prices shown above formed. When the growth of the housing market began to decline in late 2005, borrowers’ mortgages came to exceed the value of their homes. Many leveraged consumers lacked the means or the will to meet payments and began defaulting on loans. Foreclosures increased, accelerating the feedback loop of falling home prices and growing numbers of defaults on mortgages.

The 2008 Crisis: Hundreds of billions of failed mortgages undermined the viability of the portfolios of many Wall Street firms that had invested heavily in mortgage-backed securities.lxv These “toxic assets” led to the collapse of the investment bank Bear Sterns, prompting the Federal Reserve to organize its acquisition by JP Morgan in March of 2008. Following drops in their stock, the Treasury Department nationalized Fannie Mae and Freddy Mac (two government sponsored firms responsible for guaranteeing most US mortgages) on September 7. Credit became increasingly scarce as apprehensive banks stopped lending, and Lehman Brothers failed later in September after Treasury Secretary Henry Paulson and other government officials denied that firm emergency aid. Stock prices continued a sharp decline. The Federal Reserve organized the bailout of American Insurance Group on September 16 having decided that the potential for systemic risk was so great that the company was “too big to fail.”

In October, Congress approved a seven hundred billion dollar plan to stabilize the economy after initially refusing to do so. Orginially designed to allow the government to purchase toxic assets, Paulson led the decision to inject money directly into major banks. Following Obama’s election, Congress passed another plan for $787 billion to stimulate economic recovery. By the end of 2009, major US banks again reported profits, but unemployment had continued to rise. On July 21, 2010, Obama approved the Dodd-Frank Wall Street Reform and Consumer Protection Agency Act. This bill hopes to prevent future crisis with the foundation for expanded regulation of the financial sector and increased restrictions on investment practices.

Assessment: The National Bureau of Economic Research declared that the economic recession ended in June of 2009 and that the economy had recovered since that time.lxvi The United States government had achieved its short-term goal of avoiding economic collapse. Many large banks had returned the money they received from the government by this time, and the credit market showed signs of stable improvement.

The long-term success of the US government’s massive initiatives remains doubtful. Unemployment increased from 2009 to 2010, and the development of the Occupy Wall Street protests demonstrates continuing discontent with the US economic system. Many frustrations stem from the failure of the government to effectively reform the financial sector. The Dodd- Frank Act’s “improved” regulation of market relies on many of the same agencies that failed to prevent the 2008 crisis. The effective implementation of 243 new laws is unlikely; the bill has instead served to increase uncertainty in the market, a mood that most business leaders identify as their greatest problem.lxvii The bill also fails to address the global nature of the current market. Restrictions on US banks and businesses will reduce their competitiveness with foreign firms and threaten the competiveness of the national economy as a whole.

The imperfect oversight that Dodd-Frank authorizes is seemingly necessary in our current business climate of reduced moral hazard. Paulson’s initial commitment to leaving businesses exposed to the market’s punishments for excessive risk-taking eventually yielded to the strategy of rescuing firms if those costs were lower than the potential damage of a failure.lxviii Because “too big to fail” incentivizes growth and excessive risk, the government’s bailouts have created a regulatory challenge that is most likely beyond the capacity of any government agency to address. In the long run, the government would be better served with a series of anti-trust efforts to reduce the size of businesses than in implementing Dodd-Frank. Once businesses have been reduced to a size that they can fail without endangering the entire system, the need for micro-regulation will lessen.

Many of the challenges facing the economic policy of the United States relate to the partisan nature of its politics and the swings that occur with each election cycle. The refusal of Congress to approve Paulson’s first plan to purchase troubled assets in October of 2008 spread crippling pessimism into the stock market. In their appeals to popular discontent, leaders fail to employ the foresight needed to effect successful economic leadership. Because of the importance of economic conditions in elections, President Obama has attempted to improve market stability with the quick solution of stabilizing the nation’s largest firms. The close relationship that has arisen between government and business grants government the high level of control of citizens’ lives that Hayek warns against in his denouncement of central planning in “The Road to Serfdom.” Luigi Zingales observes an immediate consequence of the alignment of government with big business: the economy loses its most powerful protector of free-market qualities. When the government chooses to support business at the expense of the dynamism and freedom of the market, it erodes the historically powerful faith that American citizens placed in their capitalist system.lxix

Though politically unlikely, expansion of the powers of the Federal Reserve might help to improve the effectiveness of long-term economic reform; the governors of that institution are isolated from the political influence of elections and lobbyists. In the same manner that Supreme Court Justices can interpret the constitution without concern for their careers, leaders of a more powerful Fed could create laws initially antagonistic to business interests that would strengthen the market in the future. Again, any Fed or central government regulatory policies should focus on preventing firms from reaching the size at which they exert enough influence to divert government aid away from the market as a whole.

Return_to_Map Federative Republic of Brazil

Country Overview: Population: 203,429,773 (July 2011 est.)lxx GDP (PPP) $2.172 trillion (USD) Education Spending: 5.08% of GDP Health Spending: 9% of GDP Unemployment: 6.17% (2010 est.) Budget Surplus: 2.9% of GDP Public Debt: 54.7% of GDP Life expectancy: 72.53 years Major Industries: agriculture, textiles, shoes, chemicals, Ethnic Groups: 53.7% white, 38.5% mulatto, 6.2% black

Exchange Rate:lxxi Brazilian Real/USD Historical GDP Growth Rate(%):lxxii

Historical Unemployment Rate(% of labor force):lxxiii

Export Volume of Goods (% Change):lxxiv

Economic Background: Brazil’s economy had grown rapidly in the years preceding 2008 fueled by the successes of developed export industries in agriculture, mining, and textiles as well as a large services sector. Under the leadership of President Luiz Inácio Lula da Silva, Brazil expanded its social welfare state and liberalized its credit market. His administration claims to have raised over twenty million Brazilians out of poverty and into the market from 2003 to 2008.lxxv This policy increased domestic demand for goods. While maintaining low inflation rates and high interest rates, Lula also expanded government spending on infrastructure as part of a major initiative accelerate national growth.

The 2008 Crisis: Brazilian businesses recorded record profits in 2006 and 2007 before the global economic downturn reduced international credit. By 2008, Lula had overseen the quadrupling of foreign reserves since 2002 to $205 billion and the transfer of most Brazilian debt to domestic holdings.lxxvi Though Brazil’s financial sector was well equipped for a downturn, decreased foreign investment and decline in demand for exports ended the nation’s three-year development boom in September of 2008. Two quarters of recession ensued. The diversity of Brazil’s exports and the size of its domestic market (185 million people) reduced the gravity of the downturn.lxxvii

The Brazilian government’s response to economic contraction included loosening monetary policy and extending credit to the nations banks, including smaller firms. The government also funneled money into the market by raising the salaries of state employees and further expanding the social welfare spending that Lula had initiated earlier in his administration.lxxviii Though recovery lagged in Brazil’s heavy industries, domestic consumer confidence improved rapidly and along with increases in foreign investment. Brazil became one of the first nations to emerge from the global downturn. China’s similarly rapid recovery assisted in this rebound by restoring demand for Brazilian commodities and raw exports.

Assessment: Brazil’s success in surviving the global economic contraction of 2008 indicates the benefit of strict government regulation of banks. Brazilian firms were not highly leveraged or in possession of significant quantities of toxic assets. Thus, large foreign reserves and timely government intervention allowed Brazilian banks to avoid the loss of investor confidence that crippled the stock market of the United States and other more developed nations. The size of Brazil’s domestic economy also sheltered its finance sector from global developments; only thirty percent of bank’s assets were foreign-owned in 2008 compared to eighty percent of the assets of Mexican banks.lxxix Likewise, government spending and reduced interest rates could almost fully revive the nation’s consumer goods market, which has a predominantly domestic base. Brazil’s wealth of natural resources also ensured that the export industries would revive as soon as foreign demand reappeared.

The long-term effects of the government’s broad increases in spending will have contradictory effects on the economy. That emergency spending measures have not yet been fully reversed can be related to politicians’ unwillingness to reform social security in the United States; fear of losing popularity prevents elected officials from removing benefits that government has once provided. Brazil’s high levels of state spending continue to fuel domestic development by expanding the consumer power of Brazilian citizens. However, the expansion of the government under Lula has also threatened to dampen overall growth and add to problems with inflation. The government has already instituted taxes on foreign investment to reduce the appreciation of the real. The effects of the collapse of the Icelandic krona in 2008 suggest that this aggressive anti-inflation policy is worthwhile despite the checks that it places on the market. Yet, already high government spending exacerbates its necessity.

Brazil’s fiscal solutions for its recession have far exceeded the level of government expansion that Keynes envisioned, especially in their longevity. The success of Brazil’s spending in reviving its market must be viewed in the context of the nation’s wealth distribution. Many of the millions of citizens who received government cash were poor; these individuals were more likely to spend the money than the wealthy recipients of tax refunds in the United States. Brazil’s plan was therefore much more cost-efficient than its American counterpart: the Recovery and Reinvestment Act of 2009.

All nations should consider the ability of Brazil’s preemptive extension of credit to banks— including smaller firms—to contain the severity of a credit crunch before the entire stock market could fall. Though any transfer of funds from the public sector to private business has the potential to weaken moral hazard, anticipatory lending does not reward risk so much as it rewards responsible banking; only firms stable enough to help alleviate credit shortages should be supported. Countries with highly developed financial sectors can learn from Brazil’s ability to achieve massive expansion before the 2008 crisis without over-extended banks or market bubbles. The sacrifice of involvement in lucrative high-risk securities markets proved essential in the maintenance of a strong domestic economy. Return_to_Map

China Overviewlxxx

2008 2009 2010 GDP (PPP) $8.374 trillion $9.144 trillion $10.09 trillion Population Below Poverty Line 2.8% or 21.5 million Chinese live below the “absolute poverty” line, which is $90 per year Unemployment 6.3% (up to 9% 6.1% -- including migrant workers) Public Debt (Percent of GDP) -- 16.5% 16.3% Exports -- $1.204 trillion $1.581 trillion Imports -- $954.3 billion $1.327 trillion External Debt -- $428.4 billion $529.2 billion Inflation -0.7% 3.2% Brief Background on economic conditions

As if to wipe clean any memory of the Communist reforms of the mid-1900’s, which were, for the most part, planned and executed ineffectively by an incompetent, centralized government, China has recently plowed through the late 1990’s and the 2000’s with renewed confidence, armed with a more streamlined and market-driven economy. Collectivized agriculture has long been swept aside to make room for fiscal decentralization, a full-fledged banking system, stock markets, and, most importantly, a flourishing, state-permitted private sector, which has naturally led to an explosion of foreign investment and trade in China. Although China’s per capita income is still floundering under the world average, the country’s skyrocketing GDP growth has been unstoppable, especially with the nation’s coronation in 2010 as the world’s second largest economy.lxxxi At least until the jolts of the American financial crisis were felt in China, the year 2008, especially with the prediction for a double-digit GDP growth rate, was not much different from any previous boom years.lxxxii

Narrative of the 2008 Crisis With an upward trajectory for GDP and several years of double-digit growth rates, Year 2008 only spelled another season of success for China—at least until, halfway around the world, Wall Street struck the first chord of alarm, pushing all the right buttons for a global crisis. After all, at the beginning of the crisis, China was boasting an unwavering $29.3 billion trade surplus, in addition to a heap of $1.9 trillion in foreign reserves. So assuring was this mountain of surplus and foreign reserves owned by China, that in the early stages of the 2008 financial crisis, some predicted China would emerge unscathed and “immune” from the downturn.lxxxiii Such predictions quickly proved naïve since, ailing from the credit crisis, the United States and Europe immediately receded into a saving spree and naturally began to curtail consumption. Such an abrupt decrease in consumption dealt a heavy blow to China, whose economic promise depended largely on its exports to Europe and America. It wasn’t long until China, too, fell ill, with factories closing from falling foreign demand, thus, creating a spike in unemployment. The cities of Guangzhou and Dongguan, for example, were both forced to displace tens of thousands of workers in 2008 as a result of the crisis, which had effectively eliminated foreign demand for Chinese factories.lxxxiv It did not help much that despite its large foreign reserves, China was reluctant, disillusioned after recent failures in investments, to actually utilize its ample supply of cash to invest in funds and businesses abroad. For example, despite widespread predictions that the China Investment Corporation (CIC) would invest in Morgan Stanley, China simply averted the situation, electing, rather, to commit to domestic, internal growth, rather than to salvaging America.lxxxv In the meantime, the tremors of the 2008 financial crisis began to shake China, as China’s trade plunged for 7 straight months from December 2008 to May 2009. lxxxvi In the fourth quarter of 2008, the precipitous slide in exports even led to the lowest industrial output in China since 2001.lxxxvii In January 2009, the Chinese government even approximated that over 20 million migrant workers had become unemployed due to the crisis. lxxxviii In response, the Chinese government took several measures to keep the nation’s economy afloat. First, the CIC (Chinese Investment Corporation) poured $20 billion into China Development Bank and another $47 billion into Agricultural Bank of China. Although China wished to maintain low inflation levels, it had to cut back interest rates for the first time in 6 years to promote lending. The government even granted tax cuts for new homeowners, boldly shaving the property contract tax from 3 to 1 percent.lxxxix Most importantly, on November 9, 2008, the Chinese government decided to inject a $586 billion stimulus package (13.3% of GDP) to revive the ailing economy with the creation of numerous infrastructure projects.xc The stimulus financed the creation of projects including construction of railways, highways, and airports, which helped create more jobs for China’s large labor force. xci Moreover, China included in this package incentives for individuals to purchase goods (i.e. furniture, TV’s), hoping to offset the dropping foreign demand with a boost in domestic consumption.xcii To boost domestic consumption, the Chinese government even subsidized small car purchases, which peaked at a record-high level in April 2009.xciii Assessment In its ascent to wealth, China has been plagued by two major economic challenges that could potentially and easily affect the nation’s future as an economic powerhouse: 1. Encouraging domestic spending while discouraging domestic savings (i.e. reducing dependency on exports) 2. Creating enough jobs for the continuous (and valuable) influx of migrant workers.xciv First of all, with the crisis in America and Europe forcing factory closures in China, China had to realize quickly and painfully that its reliance on exports could easily become detrimental to its growth in global crises. After all, China evolved into an export-driven economy, with profits from exports contributing 37.8% of total GDP in 2008. (see graph) xcv To compare, in 1985, only 9.1% of China’s GDP came from exports.xcvi China’s swift decision, then, to implement a stimulus package, to cut taxes, and to loosen its monetary policy by lowering interest rates was a successful way to offset the negative effects of declining foreign demand, since it promoted lending and domestic spending. And Chinese consumer spending did, indeed, improve as intended; thanks to increased domestic spending, factory production resumed and auto-sales, backed by government subsidies, also soared.xcvii By boosting domestic spending and inching away from over-reliance on exports in this way, China could even become better prepared for future downturns. The stimulus package, by creating construction projects and expanding the job market, also effectively sated the need for employing displaced migrant workers. In order to provide enough jobs for the projected 20 million Chinese who enter the labor force each year, China must maintain a GDP growth of at least 7 to 8 percent.xcviii By managing to achieve a growth of about 7.9% in the second quarter of 2009, China did just that. xcix With timely government intervention, the 2008 crisis left not much more than a dent on China’s overall growth in the past two year. c After all, China’s economy responded to the crisis with brilliant resilience, by far, surpassing other major, sluggish economies with a promising GDP growth rate of 10% in 2010.ci And for this, China can smile. But not all stories can finish with a happy ending. In 2011, it can clearly be seen now that the stimulus in 2008 inevitably led to an eruption of credit, which led, for instance, to newly built skyscrapers and towers that are not even inhabited.cii Moreover, inflation has consistently been climbing, reaching 3.2% in 2010.ciii Plagued now with inflation, if another recession were to hit Europe or United States, China may not be so eager to implement another giant stimulus package as in 2008. civ Return_to_Map

1. http://www.peherald.com/news/article/3574 2. http://chinadigitaltimes.net/2008/12/2008-financial-crisis-and-china/ 3. http://blogs.wsj.com/chinarealtime/2011/10/17/of-blind-men-and-elephants-–- grasping-china’s-economy/ 4. http://www.chinavortex.com/2008/10/understanding-global-financial-crisis/ 5. http://articles.latimes.com/2011/aug/16/business/la-fi-china-economy-20110817 6. http://www.time.com/time/magazine/article/0,9171,1914978,00.html 7. http://www.forbes.com/feeds/afx/2009/06/30/afx6605608.html 8. http://www.telegraph.co.uk/finance/financialcrisis/8684245/China-cant-and- wont-save-the-world.html 9. http://www.guardian.co.uk/world/2008/oct/21/china-globalrecession 10. http://chineseculture.about.com/od/thechinesegovernment/a/Chinaeconomy.htm 11. http://chineseculture.about.com/od/thechinesegovernment/a/Chinastimulus.htm 12. http://beta.adb.org/news/speeches/chinas-policy-response-global-financial-crisis 13. http://www.chinadaily.com.cn/cndy/2011-01/28/content_11930468.htm 14. http://www.die-gdi.de/CMS-Homepage/openwebcms3.nsf/ (ynDK_contentByKey)/MSIN-7SVEYB/$FILE/Berlin%20workshop%20090831.pdf 15. http://www.fas.org/sgp/crs/row/RS22984.pdf 16. http://www.globalbusinesslawreview.org/wp- content/uploads/2011/01/Chow.pdf 17. http://www.fas.org/sgp/crs/misc/RL34742.pd

Japan

Overviewcv

2008 2009 2010 GDP (PPP) $4.424trillion $4.146 trillion $4.31 trillion Population Below Poverty Line 15.7% (2007) Unemployment -- 5% 5% Public Debt (Percent of GDP) -- 199.7% 194.1% Exports -- $545.3 billion $730.1 billion Imports -- $501.6 billion $639.1 billion External Debt -- $2.441 trillion -- (2010) $2.719 trillion (2011) Inflation -- -1.3% -0.7%

http://ronanlyons.wordpress.com/2009/04/14/a-brand-new-scare-graph-japans-collapsing-exports/ http://www.istockanalyst.com/images/articles/Japan-GDP-Growth-Rate-Chart-000003.png2009333150.jpg

brief background on economic conditions

Japan, the world’s third largest economy, clawed its way to wealth from the ruins of World War II. With only 1% of GDP devoted to defense expenditures, the nation endorsed a technologically advanced economy, which allowed a war-torn nation like itself to boast, in so little time, a splendid 10% average GDP growth per year by the 1960’s, 5% in the 70’s, and 4% in the 80’s. cvi Japan, however, was plagued with sluggish growth in the 90’s, due to unwise investments and heavy debts from the 80’s, which took all of the 90’s and a full “lost” decade of very slow growth (about 2% per year) to recover. cvii With a debt that exceeded 200% of its GDP, Japan, having just emerged from slow growth, was combating deflation, an aging population, and an excessive reliance on exports when the 2008 financial crisis terrorized the rest of the world. cviii Narrative of the 2008 Crisis Japan’s story is extremely unique, insofar as while the financial crisis wreaked havoc on most of the world in 2008, Japan managed, somehow, to remain detached and almost unaffected. While Americans despaired over the news of Lehman Brothers, one Japanese economist Atushi Nakajima felt compelled to say, “The financial crisis looks like fire on a distant shore.” cix Japanese broadcasting stations paid more attention to an approaching typhoon and a scandal over rice than to the “Lehman Shock.” cx Even as this “global” economic crisis toppled European and American companies, it was not even included at the top of the agenda for the Prime Minister race in Japan. cxi How could this be? How was Japan able to dodge the immediate effects of the crisis? After its bitter experience in the 90’s with ineffective investments and bad loans, Japanese financial companies so fervently avoided subprime loans that total Japanese losses from sub- prime loans in 2008 only added up to $8 billion (as compared to the global total of $1 trillion.) cxii Quite literally, Japan had “learned its lesson in the 1990s,” and did not entangle itself in risky investments and loans the way Wall Street did. cxiii Moreover, Japan, in 2008, owned $14 trillion in household savings, only made possible through decades of thrift by the Japanese. cxiv In other words, the immense household savings empowered Japan to manage a huge deficit of $8.1 trillion and still be able to remain the world’s largest creditor nation. cxv Also, Japan held assets abroad that totaled up to $2.4 trillion, which helped shield Japan’s domestic economy from being shattered by the economic crisis (since Japan had not borrowed from those foreign markets in which it held assets.) cxvi The 2008 financial crisis did, in the end, affect Japan’s economy—but in a roundabout way. Due to decreasing demand for Japanese exports in client nations such as the United States and major European nations, the Japanese economy suffered heavy losses in industries involving automobiles and electronics. cxvii Japanese exports suffered, and Sony, for example, announced it would have to slash 8000 jobs. cxviii The Japanese government reacted quickly, though not necessarily to the 2008 crisis, since the domestic economy was ailing from deflation unrelated to the 2008 crisis. Nonetheless, the Japanese government unleashed a 23 trillion yen package ($250 billion) which helped the nation recover more efficiently from the loss in exports through tax cuts and job creation. cxix Assessment Since Japan, for the most part, emerged unscathed from the direct shock of the 2008 financial crisis, it is difficult to weigh the effectiveness of its policies. However, once Japan suffered losses in its exports, the stimulus package contributed to a swift recovery. In fact, with the help of the stimulus, Japanese exports rebounded from about $500 billion in 2009 to $700 billion in 2010. cxx

Perhaps, it could be argued that other nations could remain detached the way Japan was from an economic crisis involving risky investments by simply avoiding such risky investments in the first place. The compromise, of course, in choosing stability by avoiding risk would be quick profits and progress. Return_to_Map

1. https://www.cia.gov/library/publications/the-world-factbook/geos/ja.html 2. http://www.nytimes.com/2008/09/20/business/worldbusiness/20yen.html 3. http://www.nytimes.com/2008/12/13/business/worldbusiness/13stimulus.html 4. http://seekingalpha.com/article/97137-u-s-financial-crisis-a-boon-for-japanese- banks UNITED KINGDOM

Overviewcxxi

2008 2009 2010 GDP (PPP) $2.256 trillion $2.146 trillion $2.173 trillion Population Below Poverty Line 14% (2006 est.) Unemployment -- 7.6% 7.8% Public Debt (Percent of GDP) -- 68.2% 76.1% Exports -- $356.4 billion $410.2 billion Imports -- $484.9 billion $563.2 billion External Debt -- -- $8.981 trillion (2010) $9.836 trillion (2011) Inflation 2.2% 3.3% Brief Background on economic conditions Trailing behind Germany and France, the United Kingdom is not only the third largest economy in Europe, but also the financial heart of the continent. Since the 1980’s, the UK government has shown a tendency to reduce government intervention by curbing social welfare programs and restraining public ownership to allow the private sector to thrive without many regulations from the government. The country underwent a recession in 1992, but since then until the financial crisis of 2008, cruised along a decade of undisturbed expansion and witnessed a significant rate of growth that surpassed the growth of most other Western European nations.cxxii

Narrative of the 2008 Crisis

Perhaps cursed by the prominent role of its own financial sector in Europe, the UK quite simply lay in the path of the global economic crisis that shook Wall Street in 2008.cxxiii Threatened by the recession that the crisis heaped on America on the other side of the Atlantic, flustered London banks stopped lending money to each other, halting the engine of the UK economy. cxxiv It didn’t help that emerging from a decade-long period of growth, the UK was already ridden with the problem of falling home prices and high consumer debt.cxxv The UK, in this way, was quickly ensnared by the whirlpool of economic recession towards the end of year 2008.cxxvi The British government proceeded to provide the economy with a stimulus plan and hoped to pacify and appease the qualms of the financial sector. The Monetary Policy Committee in the Bank of England, for example, immediately set out to reduce interest rates to a dramatic 0.5%, the lowest since 1939, to promote lending by banks to the economy.cxxvii Fully equipped with a $680 billion rescue package, comparable in size to the United States’ $700 billion package, the UK, on October 8, 2008, injected billions of pounds in capital into the economy and nationalized or part-nationalized leading banks in the country. cxxviii UK bank Bradford and Bingley, for example, was delivered from bankruptcy by the UK government at the high price of 18 billion pounds. cxxix In total, the UK government poured 81 billion pounds to salvage failing banks from failure.cxxx When the first stimulus package, however, failed, with additional “turbulence in bank share prices,” the UK government had to present another stimulus plan on January 19th, 2009. cxxxi In addition, the government actively intervened, cutting taxes and funding capital projects such as building roads to help stimulate the failing economy. cxxxii In 2010, the British government dramatically reversed its role in the economy, with the new Prime Minister David Cameron in charge, and attempted to cut back on everything the previous administration, led by Prime Minister Gordon Brown, had attempted in order to contain the economic crisis. Sensitive to the growing deficit of the UK, Cameron launched his five-year austerity program, which attempted to shrink UK’s deficit from 10% of GDP to a more manageable 1% by 2015. cxxxiii In order to accomplish this, the UK government decided ambitiously to rid the public sector of 490,000 jobs and to minimize government spending by 19% by increasing taxes, ending housing subsidies for middle class citizens, trimming education spending by 3.6 %, defense costs by 8%, and the budgets for public university teaching staff by 40%.cxxxiv In its confrontation with the 2008 financial crisis, the UK had, in a span of two years, espoused two utterly opposed policies—one that endorsed government intervention, and the other that mercilessly struck down government involvement.

Assessment The decision by the UK government to reverse its policies from 2008 and instead, to cut government policies in the hope of reducing national deficit, was not only terribly inappropriate for the economic atmosphere of the UK, but also detrimental to overall confidence in the UK market and its consumer population. Prime Minister Cameron’s decision to shrink the national deficit is well-intentioned, since the cost that UK taxpayers will have to pay for the stimulus packages of 2008 and 2009 is “potentially enormous,” and “much larger in relation to GDP than the equivalent figures in the United States.” cxxxv

In order to pay off its deficit, however, the UK decides to cut 490,000 jobs from all government agencies, which, if calculated proportionately for the United States population, would be the equivalent of 2,450,000 jobs in America. cxxxvi It is unreasonable that in a time of severe economic anxiety and low confidence in the consumer population, the government would actively slash tens of thousands of jobs as if to fuel unemployment, already near 8%.cxxxvii By cutting jobs, reducing education and defense budgets, and eliminating subsidies for housing, the UK government has essentially destroyed the incentive to consume.

The IMF does not make a secret of this fact either, as it admonished Britain in May 2009, “Faced with falling house prices, significant reductions in the value of pensions and other assets, a deteriorating and uncertain employment outlook, consumers are likely to retrench spending to reduce debt and rebuild savings.” cxxxviii

Perhaps, the UK government is attempting to exploit the fact that the public, in times of economic distress, is more receptive to reforms, even those that it would, in times of growth, would oppose. cxxxix Perhaps, then, the UK government, headed by Cameron, is attempting to use the economic crisis as a means to slash government policies, in general. cxl Whether or not this proposition is true, it is imperative that the British government commit to restoring confidence in the consumer population and the fallen financial sector, instead of creating more anxiety by eliminating jobs in a time of uncertainty. Return_to_Map 1. https://www.cia.gov/library/publications/the-world-factbook/geos/uk.html 2. http://news.bbc.co.uk/2/hi/business/7644238.stm 3. http://gre.academia.edu/MJReid/Papers/252220/UK_Response_to_the_Global_Fina ncial_Crisis 4. http://bankingcommission.independent.gov.uk/wp- content/uploads/2011/01/Which-Issues-Paper-Resonse.pdf 5. http://www.guardian.co.uk/business/2008/oct/08/creditcrunch.marketturmoil 6. http://news.bbc.co.uk/2/hi/business/8059861.stm 7. http://www.becker-posner-blog.com/2010/10/the-united-kingdoms-dramatic- response-to-the-economic-crisisposner.html 8. http://www2.lse.ac.uk/publicEvents/events/2008/20081203t1159z001.aspx 9. http://www.ablemesh.co.uk/thoughtsukfinancialcrisis.html 10. http://news.smh.com.au/breaking-news-business/debt-crisis-has-chilling-effect- on-uk-20111122-1nrdp.html 11. http://www.mofo.com/files/uploads/Images/090204UKGovernmentsBankingSupp ortMeasures.pdf 12. http://www.mwe.com/index.cfm/fuseaction/publications.nldetail/object_id/8b1e8 003-f820-481d-b6a9-0e72bdc42703.cfm 13. http://www.publications.parliament.uk/pa/cm200809/cmselect/cmtreasy/956/9 56.pdf

Return_to_Map Bibliography (for Germany, Poland, and Greece Reports)

“2011 Investment Climate Statement – Greece.” U.S. Department of State. http://www.state.gov/e/eeb/rls/othr/ics/ 2011/157284.htm (accessed November 16, 2011).

Brockett, Matthew and Gabi Thesing. San Francisco Chronicle. “German Growth May Grind to Halt as Crisis Saps Exports.” November 21, 2011. www.sfgate.com/cgibin/article.cgi? f=/g/a/20 11/11/21/bloomberg_articlesLV0GTY6K50XT.DTL (accessed November 21, 2011).

Broich, Josef. “Symposium on Governmental Assistance for Industries and Businesses.” www.rieti.go.jp/jp/events/ 09121601/pdf/1-3_E_Broich_PPT_o.pdf (accessed November 19, 2011).

Dimireva, Ina. “Poland Investment Climate 2009.” EU Business. http://www.eubusiness.com/ europe/poland/invest (accessed November 19, 2011).

“Europe :: Germany.” CIA – The World Factbook. https://www.cia.gov/library/publications/the world-factbook/geos/gm.html (accessed November 19, 2011).

“Europe :: Greece.” CIA – The World Factbook. https://www.cia.gov/library/publications/the world-factbook/geos/gr.html (accessed November 19, 2011).

“Europe :: Poland.” CIA – The World Factbook. https://www.cia.gov/library/publications/the world-factbook/geos/pl.html (accessed November 19, 2011).

“Germany’s Response to the Current Global Financial Crisis.” Fried Frank. http://www.fried frank.com/siteFiles/Publications/329CA8056DE289A17671852A7B176412.pdf (accessed November 19, 2011).

“GPD growth (annual %).” The World Bank. http://data.worldbank.org/indicator/NY.GDP.MK TP.KD.ZG/ countries/DE?display=graph (accessed November 21, 2011).

“Greece.” The World Bank. http://data.worldbank.org/country/greece (accessed November 19, 2011). Hartung, Wilhelm and Oliver M. Kern. “German Measures to Address the Financial Crisis.” Global Financial Markets Watch. http://www.globalfinancialmarketwatch.com/2008 /11/articles/ german-measures-to-address-the-financial-crisis/ (accessed November 19, 2011).

Krynska, Elzbieta. “Analysis of the ‘Stability and Development Plan – strengthening the Polish economy in the time of the world financial crisis.” European Employment Observatory. www.eu-employment-observatory.net/resources/reports/PolandStabilityAndDevpt Plan.pdf (accessed November 16, 2011).

Lanchester, John. “Once Greece goes…” London Review of Books Volume 33, Issue 14 (July 14, 2011). http://www.lrb.co.uk/v33/n14/john-lanchester/once-greece-goes (accessed November 16, 2011).

The New York Times. “Economic Crisis and Market Upheavals.” October 3, 2011. http://topics.nytimes.com/top/reference/ timestopics/subjects/c/credit_crisis/index.html (accessed November 16, 2011).

Orendt, Moritz. “Consequences of the Financial Crisis on Europe.” BiLGESAM. http://www.bilgesam.org/en/index.php? option=com_content&view=article&id=234:consequences-of-the-financial-crisis-on- europe&catid=70:ab-analizler&Itemid=131 (accessed November 16, 2011).

Reichardt, Adam. “Poland and the Global Economic Crisis: Observations and Reflections in the Public Sector.” The Chartered Institute of Public Finance & Accountancy. www.cipfa.org.uk/the journal/download/Adam_Reichard.pdf (accessed November 16, 2011).

Rifkin, Jeremy. Huffington Post Business. “Beyond the Financial Crisis: Germany’s Plan To Regrow The Global Economy.” October 24, 2011. http://www.huffingtonpost.com/ mobileweb /1969/12/31/germany-euro-economy-_n_1028736.html (accessed November 21, 2011).

Strojwas, Michal. “The Polish banking system: hit by the crisis or merely by a cool breeze?” European Commission. http://ec.europa.eu/economy_finance/publications/country_ focus/2010/pdf/cf-7-02_en.pdf (accessed November 16, 2011). Bibliography (For Iceland, United States, and Brazil Reports)

Barrionuevo, Alexi. “Strong Economy Propels Brazil to World Stage .” New York Times, July 31, 2010. Accessed November 19, 2011. http://www.nytimes.com//////31brazil.html? pagewanted=all.

BBC News. “US jobless rate increases to 8.1%.” March 6, 2009. Accessed November 19, 2011. http://news.bbc.co.uk///7927790.stm.

Bernanke, Ben. “Causes of the Recent Financial and Economic Crisis.” Before the Financial Crisis Inquiry Commission, September 2, 2010.

Brookings. “Global Financial Crisis: Is Brazil a Bystander?” October 15, 2008. Accessed November 19, 2011. http://www.brookings.edu///_financial_crisis_cardenas.aspx.

Cabral, Paulo. “Enduring Legacy of Brazil’s Lula.” BBC News, December 26, 2010. Accessed November 19, 2011. http://www.bbc.co.uk//latin-america-12068515.

“Currency Exchange Rates.” OANDA. Accessed November 19, 2011. http://www.oanda.com//rates/.

Danielsson, Jon. “Why Raising Interest Rates Won’t Work.” BBC News, October 28, 2008. Accessed November 19, 2011. http://news.bbc.co.uk////.stm.

Economist. “Brazil’s presidential election Lula’s legacy.” September 30, 2010. Accessed November 19, 2011. http://www.economist.com//.

Economist. “Coming in from the Cold.” December 16, 2010, print edition. Accessed November 19, 2011. http://www.economist.com/node/.

Economist. “Cracks in the Crust.” December 11, 2008. Accessed November 19, 2011. http://www.economist.com//.

Eggertsson, Thráinn, and Tryggvi Thor Herbertsson. System Failure in Iceland and the 2008 Global Financial Crisis. University of Iceland, 2009. Eichengreen, Barry. “Anatomy of an Economic Crisis.” Real Clear Markets, September 22, 2008.

Google World Development Indicators. Accessed November 19, 2011. http://www.google.com//.

Kraul, Chris. “Crisis Hits as Brazil Builds.” Los Angelese Times, October 27, 2008. Accessed November 19, 2011. http://articles.latimes.com/////brazil27.

Krugman, Paul. “The Icelandic Post-Crisis Miracle.” New York Times, June 30, 2010. Accessed November 18, 2011. http://krugman.blogs.nytimes.com////icelandic-post-crisis-miracle/? scp=1&sq=+Iceland%.

———. “Iceland Provides Lessons for Dealing with Slumps.” New York Times, October 28, 2011. Accessed November 19, 2011. http://www.chron.com////provides-lessons-for- dealing-with-slumps-2241646.php.

Mendonça de Barros, José. “The Impact of the International Financial Crisis on Brazil.” Real Instituto Elcano. Accessed November 19, 2011. Last modified December 4, 2010. http://www.realinstitutoelcano.org//portal/_eng/? WCM_GLOBAL_CONTEXT=//_in/_in/+economy/-2010.

New York Times. “Economic Crisis and Market Upheavals.” October 3, 2011. Accessed November 19, 2011. http://topics.nytimes.com/top/////_crisis/.html? scp=1&sq=2008%20financial%20crisis&st=cse.

Parker, Ian. “Lost: After Financial Disaster, Icelanders Reassess Their Identiy.” The New Yorker, March 9, 2009, 39-45. Accessed November 18, 2011. http://www.newyorker.com//// /fa_fact_parker.

Rampell, Catherine. “The Recession Has (Officially) Ended.” New York Times, September 20, 2010. Accessed November 19, 2011. http://economix.blogs.nytimes.com////recession-has- officially-ended/#.

Wall Street Journal. “The Uncertainty Principle.” July 14, 2010.

“World Databank.” World Bank. Accessed November 19, 2011. http://data.worldbank.org/.

Zingales, Luigi. “Capitalism After the Crisis.” National Affairs, Fall 2009. i “Europe :: Greece,” CIA – The World Factbook, https://www.cia.gov/library/publications/the-world- factbook/geos/gr.html (accessed November 19, 2011). All of the information in the table, except for that which is noted, was derived from this site.

ii “Greece,” The World Bank, http://data.worldbank.org/country/greece (accessed November 19, 2011). iii “GPD growth (annual %),” The World Bank, http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG/ countries/GR?display=graph (accessed November 21, 2011). iv “Europe :: Greece,” CIA – The World Factbook, https://www.cia.gov/library/publications/the-world- factbook/geos/gr.html (accessed November 19, 2011).

v John Lanchester, “Once Greece goes…” London Review of Books Volume 33, Issue 14 (July 14, 2011), http://www.lrb.co.uk/v33/n14/john-lanchester/once-greece-goes (accessed November 16, 2011).; The New York Times, “Economic Crisis and Market Upheavals,” October 3, 2011, http://topics.nytimes.com/top/reference/ timestopics/subjects/c/credit_crisis/index.html (accessed November 16, 2011). vi “2011 Investment Climate Statement – Greece,” U.S. Department of State, http://www.state.gov/e/eeb/rls/othr/ics/ 2011/157284.htm (accessed November 16, 2011). vii “Europe :: Greece,” CIA – The World Factbook, https://www.cia.gov/library/publications/the-world- factbook/geos/gr.html (accessed November 19, 2011).

viii “Europe :: Greece,” CIA – The World Factbook, https://www.cia.gov/library/publications/the-world- factbook/geos/gr.html (accessed November 19, 2011). ix John Lanchester, “Once Greece goes…” London Review of Books Volume 33, Issue 14 (July 14, 2011), http://www.lrb.co.uk/v33/n14/john-lanchester/once-greece-goes (accessed November 16, 2011). x The New York Times, “Economic Crisis and Market Upheavals,” October 3, 2011, http://topics.nytimes.com/top/ reference/timestopics/subjects/c/ credit_crisis/index.html (accessed November 16, 2011).

xi John Lanchester, “Once Greece goes…” London Review of Books Volume 33, Issue 14 (July 14, 2011), http://www.lrb.co.uk/v33/n14/john-lanchester/once-greece-goes (accessed November 16, 2011). xii “2011 Investment Climate Statement – Greece,” U.S. Department of State, http://www.state.gov/e/eeb/rls/othr/ics/ 2011/157284.htm (accessed November 16, 2011). xiii John Lanchester, “Once Greece goes…” London Review of Books Volume 33, Issue 14 (July 14, 2011), http://www.lrb.co.uk/v33/n14/john-lanchester/once-greece-goes (accessed November 16, 2011).

xiv “2011 Investment Climate Statement – Greece,” U.S. Department of State, http://www.state.gov/e/eeb/rls/othr/ics/ 2011/157284.htm (accessed November 16, 2011). xv “Europe :: Germany,” CIA – The World Factbook, https://www.cia.gov/library/publications/the-world- factbook/geos/gm.html (accessed November 19, 2011). xvi “GPD growth (annual %),” The World Bank, http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG/ countries/DE?display=graph (accessed November 21, 2011). xvii Josef Broich, “Symposium on Governmental Assistance for Industries and Businesses,” www.rieti.go.jp/jp/events/ 09121601/pdf/1-3_E_Broich_PPT_o.pdf (accessed November 19, 2011).

xviii Moritz Orendt, “Consequences of the Financial Crisis on Europe,” BiLGESAM, http://www.bilgesam.org/en/index .php?option=com_content&view=article&id=234:consequences-of-the-financial-crisis-on-europe&catid=70:ab- analizler&Itemid=131 (accessed November 16, 2011). xix Wilhelm Hartung and Oliver M. Kern, “German Measures to Address the Financial Crisis,” Global Financial Markets Watch, http://www.globalfinancialmarketwatch.com/2008/11/articles/german-measures-to-address-the-financial-crisis/ (accessed November 19, 2011). xx Josef Broich, “Symposium on Governmental Assistance for Industries and Businesses,” www.rieti.go.jp/jp/events/ 09121601/pdf/1-3_E_Broich_PPT_o.pdf (accessed November 19, 2011).

xxi “Germany’s Response to the Current Global Financial Crisis,” Fried Frank, http://www.friedfrank.com/siteFiles /Publications/329CA8056DE289A17671852A7B176412.pdf (accessed November 19, 2011). xxii Josef Broich, “Symposium on Governmental Assistance for Industries and Businesses,” www.rieti.go.jp/jp/events/ 09121601/pdf/1-3_E_Broich_PPT_o.pdf (accessed November 19, 2011). xxiii Matthew Brockett and Gabi Thesing, San Francisco Chronicle, “German Growth May Grind to Halt as Crisis Saps Exports,” November 21, 2011, www.sfgate.com/cgi-bin/article.cgi?f=/g/a/2011/11/21/bloomberg_articlesLV0GTY6 K50XT.DTL (accessed November 21, 2011).

xxiv Jeremy Rifkin, Huffington Post Business, “Beyond the Financial Crisis: Germany’s Plan To Regrow The Global Economy,” October 24, 2011, http://www.huffingtonpost.com/mobileweb/1969/12/31/germany-euro-economy- _n_1028736.html (accessed November 21, 2011). xxv John Lanchester, “Once Greece goes…” London Review of Books Volume 33, Issue 14 (July 14, 2011), http://www.lrb.co.uk/v33/n14/john-lanchester/once-greece-goes (accessed November 16, 2011). xxvi

xxvii “Europe :: Poland,” CIA – The World Factbook, https://www.cia.gov/library/publications/the-world- factbook/geos/pl.html (accessed November 19, 2011). xxviii Adam Reichardt, “Poland and the Global Economic Crisis: Observations and Reflections in the Public Sector,” The Chartered Institute of Public Finance & Accountancy, www.cipfa.org.uk/thejournal/download/ Adam_Reichard.pdf (accessed November 16, 2011). xxix Adam Reichardt, “Poland and the Global Economic Crisis: Observations and Reflections in the Public Sector,” The Chartered Institute of Public Finance & Accountancy, www.cipfa.org.uk/thejournal/download/ Adam_Reichard.pdf (accessed November 16, 2011). xxx Michal Strojwas, “The Polish banking system: hit by the crisis or merely by a cool breeze?,” European Commission, http://ec.europa.eu/economy_finance/publications/country_focus/2010/pdf/cf-7-02_en.pdf (accessed November 16, 2011).

xxxi Adam Reichardt, “Poland and the Global Economic Crisis: Observations and Reflections in the Public Sector,” The Chartered Institute of Public Finance & Accountancy, www.cipfa.org.uk/thejournal/download/ Adam_Reichard.pdf (accessed November 16, 2011). xxxii Elzbieta Krynska, “Analysis of the ‘Stability and Development Plan – strengthening the Polish economy in the time of the world financial crisis,” European Employment Observatory, www.eu-employment- observatory.net/resources/reports/Poland-StabilityAndDevptPlan.pdf (accessed November 16, 2011). xxxiii Michal Strojwas, “The Polish banking system: hit by the crisis or merely by a cool breeze?,” European Commission, http://ec.europa.eu/economy_finance/publications/country_focus/2010/pdf/cf-7-02_en.pdf (accessed November 16, 2011).

xxxiv Ina Dimireva, “Poland Investment Climate 2009,” EU Business, http://www.eubusiness.com/europe/poland/invest (accessed November 19, 2011). xxxv Michal Strojwas, “The Polish banking system: hit by the crisis or merely by a cool breeze?,” European Commission, http://ec.europa.eu/economy_finance/publications/country_focus/2010/pdf/cf-7-02_en.pdf (accessed November 16, 2011). xxxvi Elzbieta Krynska, “Analysis of the ‘Stability and Development Plan – strengthening the Polish economy in the time of the world financial crisis,” European Employment Observatory, www.eu-employment- observatory.net/resources/reports/Poland-StabilityAndDevptPlan.pdf (accessed November 16, 2011).

xxxvii Ina Dimireva, “Poland Investment Climate 2009,” EU Business, http://www.eubusiness.com/europe/poland/invest (accessed November 19, 2011). xxxviii Adam Reichardt, “Poland and the Global Economic Crisis: Observations and Reflections in the Public Sector,” The Chartered Institute of Public Finance & Accountancy, www.cipfa.org.uk/thejournal/download/ Adam_Reichard.pdf (accessed November 16, 2011). xxxix Ina Dimireva, “Poland Investment Climate 2009,” EU Business, http://www.eubusiness.com/europe/poland/invest (accessed November 19, 2011).

xl Adam Reichardt, “Poland and the Global Economic Crisis: Observations and Reflections in the Public Sector,” The Chartered Institute of Public Finance & Accountancy, www.cipfa.org.uk/thejournal/download/ Adam_Reichard.pdf (accessed November 16, 2011). xli Data in table from: CIA-The World Factbook, s.v. "Iceland," accessed November 19, 2011, https://www.cia.gov/library/publications/the-world-factbook/geos/ic.html. xlii "Currency Exchange Rates," OANDA, accessed November 19, 2011, http://www.oanda.com/currency/historical-rates/. xliii

CIA-The World Factbook.

xliv

Google World Development Indicators, accessed November 19, 2011, http://www.google.com/publicdata/explore. xlv

"World Databank," World Bank, accessed November 19, 2011, http://data.worldbank.org/country. xlvi

Gerald Dwyer, Economic Effects of Banking Crises: A Bit of Evidence from Iceland and Ireland, http://www.frbatlanta.org/cenfis/pubscf/nftv_1103.cfm, Accessed November 20, 2011.

xlvii

Ian Parker, "Lost: After Financial Disaster, Icelanders Reassess Their Identity," The New Yorker, March 9, 2009, 42, accessed November 18, 2011, http://www.newyorker.com/reporting/2009/03/09/090309fa_fact_parker. xlviii

Jon Danielsson, "Why Raising Interest Rates Won't Work," BBC News, October 28, 2008, accessed November 19, 2011, http://news.bbc.co.uk/2/hi/ business/7658908.stm. xlix

CIA-The World Factbook.

l

Ian Parker, 46. li

Thráinn Eggertsson and Tryggvi Thor Herbertsson, System Failure in Iceland and the 2008 Global Financial Crisis (University of Iceland, 2009), 23. lii

Ian Parker, 45.

liii Ibid, 30.

liv

Ian Parker, 43. lv

Gerald Dwyer. lvi

Paul Krugman, "The Icelandic Post-Crisis Miracle," New York Times, June 30, 2010, accessed November 18, 2011, http://krugman.blogs.nytimes.com/2010/06/ 30/the-icelandic-post-crisis-miracle/?scp=1&sq=+Iceland%.

lvii

Paul Krugman, "Iceland Provides Lessons for Dealing with Slumps," New York Times, October 28, 2011, accessed November 19, 2011, http://www.chron.com/opinion/outlook/article/ Iceland-provides-lessons-for-dealing-with-slumps-2241646.php. lviii

Data in table from: CIA-The World Factbook, s.v. "United States," accessed November 19, 2011, https://www.cia.gov/library/publications/the-world-factbook/geos/ic.html. lix

"Currency Exchange Rates," OANDA, accessed November 19, 2011, http://www.oanda.com/currency/historical-rates/.

lx Google World Development Indicators, accessed November 19, 2011, http://www.google.com/publicdata/explore.

lxi

"US jobless rate increases to 8.1%," BBC News, March 6, 2009, accessed November 19, 2011, http://news.bbc.co.uk/2/hi/7927790.stm. lxii

Standard and Poors, Accessed November 19, 2011, http://www.worldpropertychannel.com/us- markets/residential-real-estate-1/december-2008-case-shiller-home-prices-index-david-blitzer-standard-poors- home-foreclosures-2008-home-sales-479.php.

lxiii Barry Eichengreen, "Anatomy of an Economic Crisis," Real Clear Markets, September 22, 2008.

lxiv

Ben Bernanke, "Causes of the Recent Financial and Economic Crisis" (Before the Financial Crisis Inquiry Commission, September 2, 2010). lxv

"Economic Crisis and Market Upheavals," New York Times, October 3, 2011, accessed November 19, 2011, http://topics.nytimes.com/top/reference/ timestopics/subjects/c/credit_crisis/ index.html?scp=1&sq=2008%20financial%20crisis&st=cse. lxvi

Catherine Rampell, "The Recession Has (Officially) Ended," New York Times, September 20, 2010, accessed November 19, 2011, http://economix.blogs.nytimes.com/2010/09/20/the-recession-has-officially-ended/ #.

lxvii "The Uncertainty Principle," Wall Street Journal, July 14, 2010.

lxviii

Bernanke. lxix

Luigi Zingales, "Capitalism After the Crisis," National Affairs, Fall 2009.