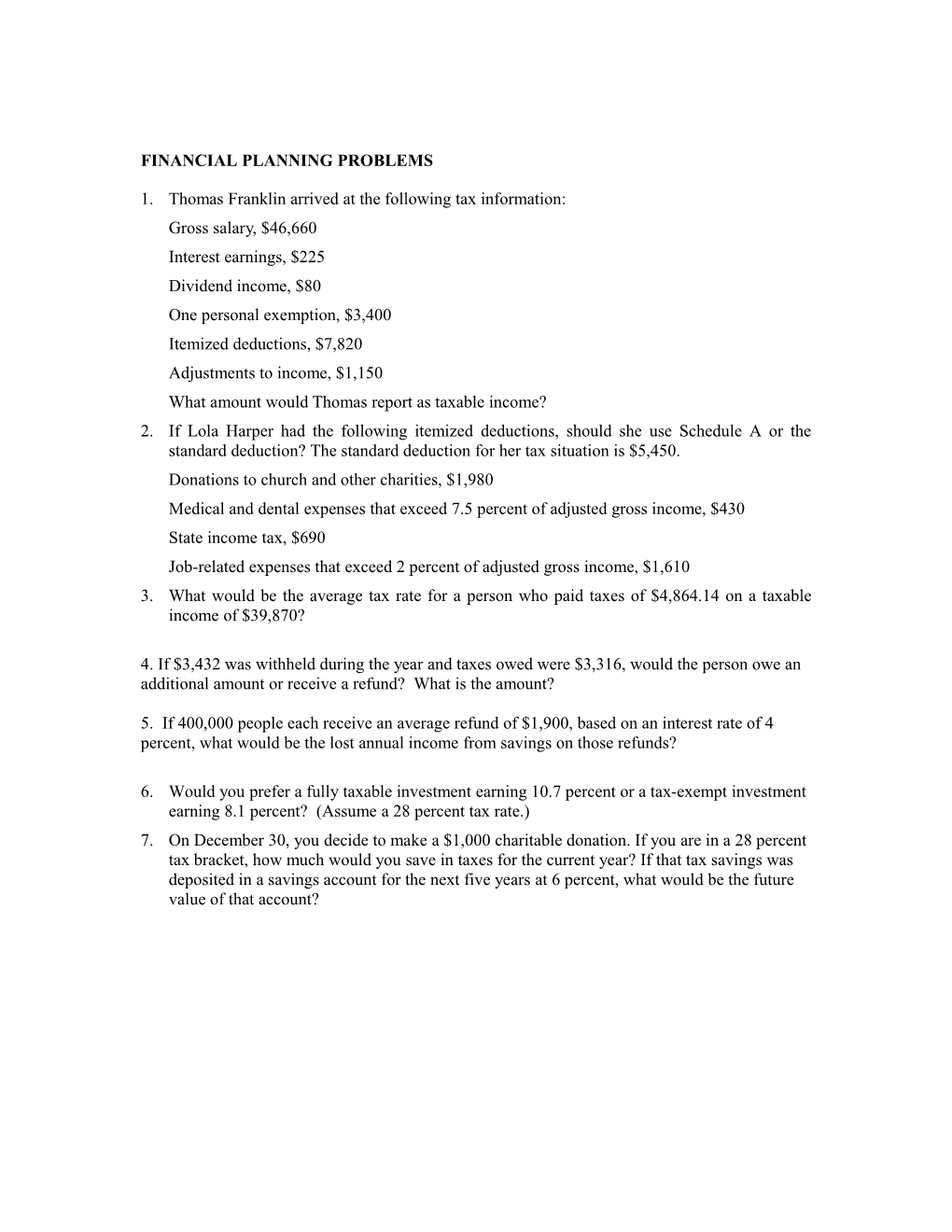

FINANCIAL PLANNING PROBLEMS

1. Thomas Franklin arrived at the following tax information: Gross salary, $46,660 Interest earnings, $225 Dividend income, $80 One personal exemption, $3,400 Itemized deductions, $7,820 Adjustments to income, $1,150 What amount would Thomas report as taxable income? 2. If Lola Harper had the following itemized deductions, should she use Schedule A or the standard deduction? The standard deduction for her tax situation is $5,450. Donations to church and other charities, $1,980 Medical and dental expenses that exceed 7.5 percent of adjusted gross income, $430 State income tax, $690 Job-related expenses that exceed 2 percent of adjusted gross income, $1,610 3. What would be the average tax rate for a person who paid taxes of $4,864.14 on a taxable income of $39,870?

4. If $3,432 was withheld during the year and taxes owed were $3,316, would the person owe an additional amount or receive a refund? What is the amount?

5. If 400,000 people each receive an average refund of $1,900, based on an interest rate of 4 percent, what would be the lost annual income from savings on those refunds?

6. Would you prefer a fully taxable investment earning 10.7 percent or a tax-exempt investment earning 8.1 percent? (Assume a 28 percent tax rate.) 7. On December 30, you decide to make a $1,000 charitable donation. If you are in a 28 percent tax bracket, how much would you save in taxes for the current year? If that tax savings was deposited in a savings account for the next five years at 6 percent, what would be the future value of that account? Name______Date______

CHAPTER 4 QUIZ

TRUE-FALSE _____1. A general sales tax is also referred to as an excise tax. _____2. Taxable income refers to the amount deducted from a person’s pay. _____3. A tax deduction directly reduces the amount of taxes owed. _____4. Most people mail the full amount owed in federal income tax each April. _____5. Enrolled agents are IRS auditors who visit people’s homes to verify deductions.

MULTIPLE CHOICE _____6. ______is deductible as an itemized deduction. a. Mortgage interest b. Credit card interest c. An IRA contribution d. An automobile expense

_____7. An example of an adjustment to income is a. passive income. b. child care expenses. c. IRA contributions. d. commission and bonuses.

_____8. An exemption refers to a. taxable income. b. deductible expenses. c. a reduction from adjusted gross income. d. amounts not subject to an IRS audit.

_____9. When an IRS agent visits your home or office to verify tax records, this is referred to as a(n) a. office audit. b. field audit. c. correspondence audit. d. research audit.

_____10. An example of tax-exempt income is a. gambling winnings. b. pension funds. c. rental income. d. interest from municipal bonds.