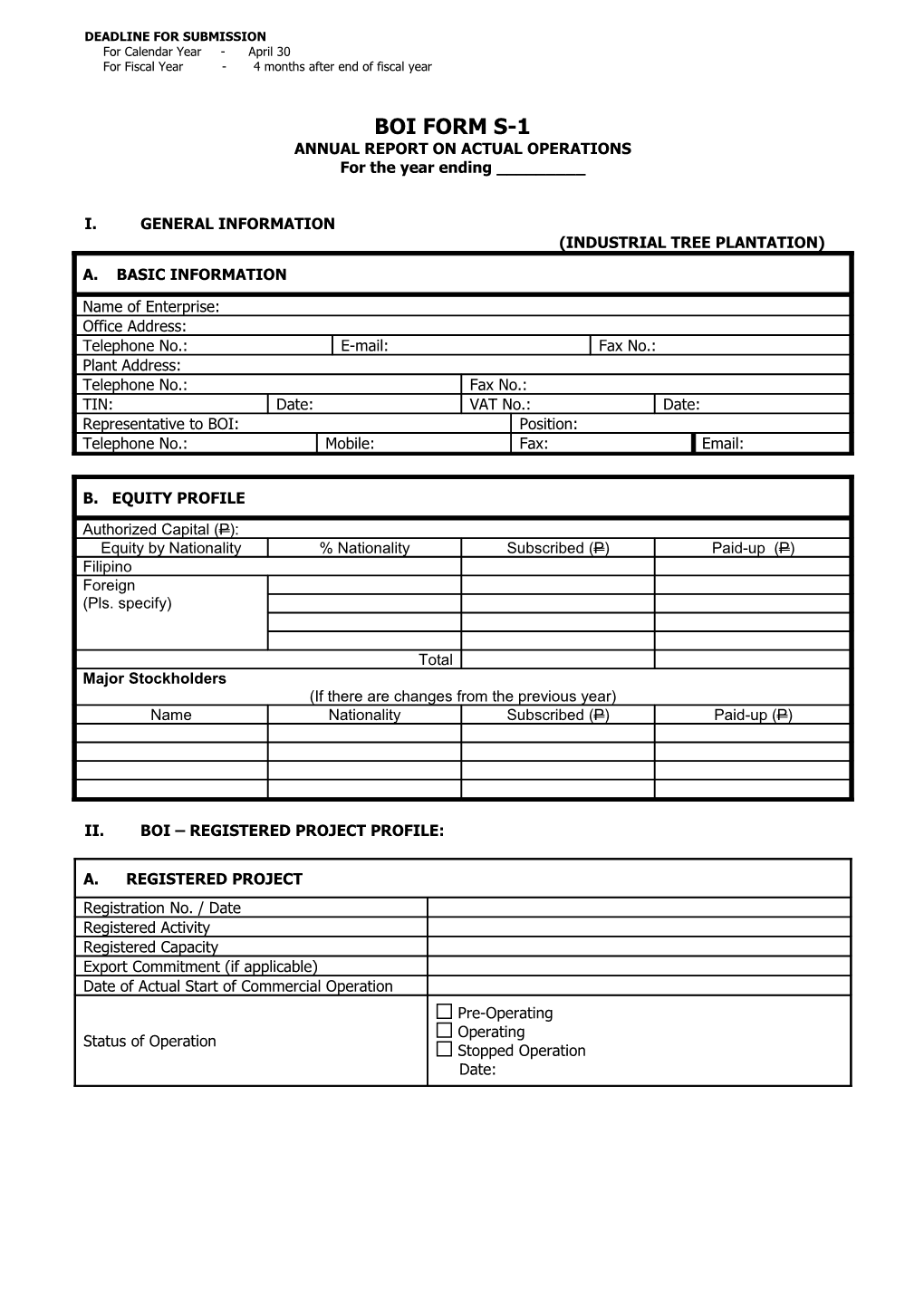

DEADLINE FOR SUBMISSION For Calendar Year - April 30 For Fiscal Year - 4 months after end of fiscal year

BOI FORM S-1 ANNUAL REPORT ON ACTUAL OPERATIONS For the year ending ______

I. GENERAL INFORMATION (INDUSTRIAL TREE PLANTATION)

A. BASIC INFORMATION

Name of Enterprise: Office Address: Telephone No.: E-mail: Fax No.: Plant Address: Telephone No.: Fax No.: TIN: Date: VAT No.: Date: Representative to BOI: Position: Telephone No.: Mobile: Fax: Email:

B. EQUITY PROFILE

Authorized Capital (P): Equity by Nationality % Nationality Subscribed (P) Paid-up (P) Filipino Foreign (Pls. specify)

Total Major Stockholders (If there are changes from the previous year) Name Nationality Subscribed (P) Paid-up (P)

II. BOI – REGISTERED PROJECT PROFILE:

A. REGISTERED PROJECT Registration No. / Date Registered Activity Registered Capacity Export Commitment (if applicable) Date of Actual Start of Commercial Operation Pre-Operating Operating Status of Operation Stopped Operation Date: III. ACTUAL INVESTMENTS, FINANCING, AND EMPLOYMENT

A. INVESTMENTS Amount (P) Land Building Machinery & Equipment Others (specify)

Total B. SOURCES OF FUNDS Foreign (P) Filipino (P) Total (P) Equity (Fresh Capital) Retained Earnings Loans: Inter-Company Commercial Bank Government Financial Institution Others:

Total

C. ACTUAL EMPLOYMENT Number Annual Payroll Filipino Management (P) Administrative/Sales Direct Labor Indirect Labor Expatriate ($) (specify position & nationality)

IV. PAYMENT OF TAXES, LICENSES, FEES & OTHER CONTRIBUTIONS

A. Gross Income Amount (P) 1. With Exemption 2. Income from all operation A. Internal Revenue Taxes/Fees 1. Corporate/Income Tax/Minimum Corporate Tax 2. VAT 3. Documentary Stamps 4. Withholding Taxes on Employees’ Salaries and Wages 5. Annual Registration/Fees/Others B. Local Taxes 1. Real Estate Taxes 2. Business Taxes/Permits 3. Occupation Taxes/Other Taxes and Fees C. Others 1. Taxes and duties on Importation 2. Warehousing Fees for Bonded Warehouse 3. Wharfage Fees 4. Motor Vehicle Registration Fees 5. Filing Fees 6. R & D Expense 7. Infrastructure Works 8. Training Expenses 9. Donations to LGUs 10. Others Total

V. PERFORMANCE AND SALES DATA

Area Developed (Has.) Total Cumulative Area Developed (Has.) No. of Seedlings Planted Species Harvest Residual Forest Area Logged (Has.) Volume (m3) Gross Net Plantation Forest Area Logged (Has.) Volume (m3) Gross Net Sales Volume (m3) Domestic Value (P) Volume (m3) Export Value (US$) (P equiv.)

Export Markets

Total

Plantation Development Cost Nursery Plantation establishment Seedlings Maintenance (Pruning, Thinning, Weeding, etc.) Fertilizer Supplies, Chemicals, etc. Utilities Buildings & Improvement Road Construction/ Maintenance Community Program Logging/Harvest Forest Charges Land Rental Total VI. INFLOWS & OUTFLOWS Foreign Exchange Inflows Amount (US$) Export Earnings (FOB/ CMT) Equity Investments Loan Proceeds Others Foreign Exchange Outflows Acquisition of Equipment Purchase of Spare parts Purchase of Raw Materials and Supplies Remittances Others

VII. INCENTIVES AVAILED

Amount (P) Tax Exemptions 1. Income Tax Holiday 2. Imported Capital Equipment 3. Spare Parts 4. ADLE 5. Imported Breeding Stocks & Genetic Materials 6. Others (please specify) Tax Credits 1. Raw Materials, Supplies & Semi-Manufactured Products 2. Domestic Breeding Stocks & Genetic Materials 3. Domestic Capital Equipment 4. Others (please specify) Total

CERTIFICATION

I,______,of legal age, ______(status), with address at ______, after having been sworn in accordance with law, hereby state that:

1. I am occupying the position of ______in ______with business address at ______2. I have caused the preparation of the annual report on actual operations. 3. I have read and understood the contents thereof and that all information therein are true and correct.

Done in ______on ______.

______Name/Signature