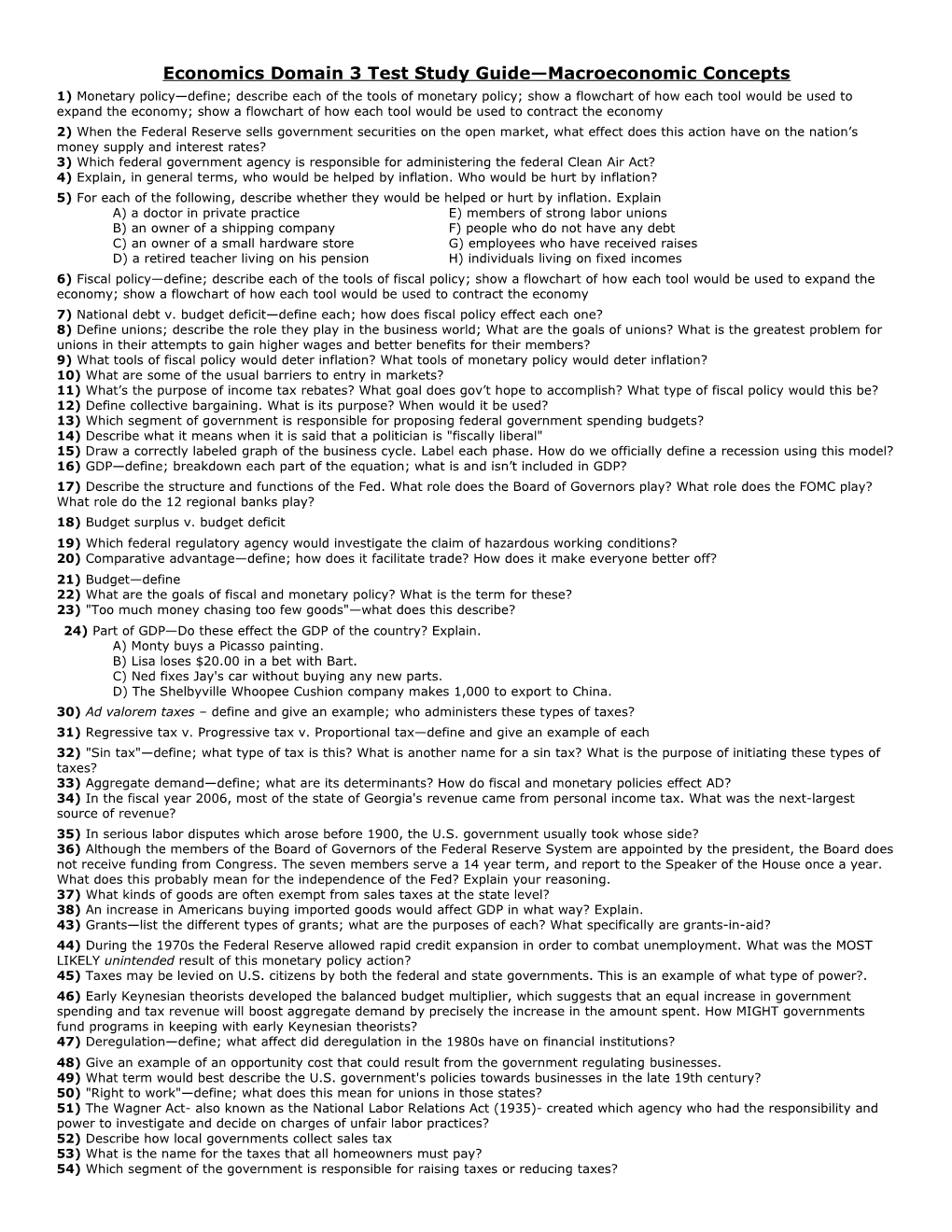

Economics Domain 3 Test Study Guide—Macroeconomic Concepts 1) Monetary policy—define; describe each of the tools of monetary policy; show a flowchart of how each tool would be used to expand the economy; show a flowchart of how each tool would be used to contract the economy 2) When the Federal Reserve sells government securities on the open market, what effect does this action have on the nation’s money supply and interest rates? 3) Which federal government agency is responsible for administering the federal Clean Air Act? 4) Explain, in general terms, who would be helped by inflation. Who would be hurt by inflation? 5) For each of the following, describe whether they would be helped or hurt by inflation. Explain A) a doctor in private practice E) members of strong labor unions B) an owner of a shipping company F) people who do not have any debt C) an owner of a small hardware store G) employees who have received raises D) a retired teacher living on his pension H) individuals living on fixed incomes 6) Fiscal policy—define; describe each of the tools of fiscal policy; show a flowchart of how each tool would be used to expand the economy; show a flowchart of how each tool would be used to contract the economy 7) National debt v. budget deficit—define each; how does fiscal policy effect each one? 8) Define unions; describe the role they play in the business world; What are the goals of unions? What is the greatest problem for unions in their attempts to gain higher wages and better benefits for their members? 9) What tools of fiscal policy would deter inflation? What tools of monetary policy would deter inflation? 10) What are some of the usual barriers to entry in markets? 11) What’s the purpose of income tax rebates? What goal does gov’t hope to accomplish? What type of fiscal policy would this be? 12) Define collective bargaining. What is its purpose? When would it be used? 13) Which segment of government is responsible for proposing federal government spending budgets? 14) Describe what it means when it is said that a politician is "fiscally liberal" 15) Draw a correctly labeled graph of the business cycle. Label each phase. How do we officially define a recession using this model? 16) GDP—define; breakdown each part of the equation; what is and isn’t included in GDP? 17) Describe the structure and functions of the Fed. What role does the Board of Governors play? What role does the FOMC play? What role do the 12 regional banks play? 18) Budget surplus v. budget deficit 19) Which federal regulatory agency would investigate the claim of hazardous working conditions? 20) Comparative advantage—define; how does it facilitate trade? How does it make everyone better off? 21) Budget—define 22) What are the goals of fiscal and monetary policy? What is the term for these? 23) "Too much money chasing too few goods"—what does this describe? 24) Part of GDP—Do these effect the GDP of the country? Explain. A) Monty buys a Picasso painting. B) Lisa loses $20.00 in a bet with Bart. C) Ned fixes Jay's car without buying any new parts. D) The Shelbyville Whoopee Cushion company makes 1,000 to export to China. 30) Ad valorem taxes – define and give an example; who administers these types of taxes? 31) Regressive tax v. Progressive tax v. Proportional tax—define and give an example of each 32) "Sin tax"—define; what type of tax is this? What is another name for a sin tax? What is the purpose of initiating these types of taxes? 33) Aggregate demand—define; what are its determinants? How do fiscal and monetary policies effect AD? 34) In the fiscal year 2006, most of the state of Georgia's revenue came from personal income tax. What was the next-largest source of revenue? 35) In serious labor disputes which arose before 1900, the U.S. government usually took whose side? 36) Although the members of the Board of Governors of the Federal Reserve System are appointed by the president, the Board does not receive funding from Congress. The seven members serve a 14 year term, and report to the Speaker of the House once a year. What does this probably mean for the independence of the Fed? Explain your reasoning. 37) What kinds of goods are often exempt from sales taxes at the state level? 38) An increase in Americans buying imported goods would affect GDP in what way? Explain. 43) Grants—list the different types of grants; what are the purposes of each? What specifically are grants-in-aid? 44) During the 1970s the Federal Reserve allowed rapid credit expansion in order to combat unemployment. What was the MOST LIKELY unintended result of this monetary policy action? 45) Taxes may be levied on U.S. citizens by both the federal and state governments. This is an example of what type of power?. 46) Early Keynesian theorists developed the balanced budget multiplier, which suggests that an equal increase in government spending and tax revenue will boost aggregate demand by precisely the increase in the amount spent. How MIGHT governments fund programs in keeping with early Keynesian theorists? 47) Deregulation—define; what affect did deregulation in the 1980s have on financial institutions? 48) Give an example of an opportunity cost that could result from the government regulating businesses. 49) What term would best describe the U.S. government's policies towards businesses in the late 19th century? 50) "Right to work"—define; what does this mean for unions in those states? 51) The Wagner Act- also known as the National Labor Relations Act (1935)- created which agency who had the responsibility and power to investigate and decide on charges of unfair labor practices? 52) Describe how local governments collect sales tax 53) What is the name for the taxes that all homeowners must pay? 54) Which segment of the government is responsible for raising taxes or reducing taxes? 55) Why are "toll roads" and other "user fees" are often used by governments? 56) How are Georgia Department of Transportation employees and projects funded? 57) Rationing—define; what are the problems with rationing? 58) In what cities are the 12 regional Federal Reserve banks? 59) What form of taxation has been criticized for placing an excessive burden on people with less ability to pay? Give an example. 60) Nations, governments, corporations, and individuals are reassessing their use of two natural resources that are expected to one day be depleted. These are fossil fuels and ______. 61) Consumer Price Index (CPI)—define; what does it measure? What is the equation? 62) Local governments generally receive their highest amounts of revenue from what source? 63) The Pullman Strike (1894) was significant in American labor history because it showed what? 64) Unemployment insurance, Welfare, Medicare, Medicaid, and Social Security are examples of ______payments. What type of policy would this be considered—fiscal or monetary? Explain.

Economics Domain 3 Test Study Guide Macroeconomic Concepts

Total Page:16

File Type:pdf, Size:1020Kb

Recommended publications