Jun 13, 2013

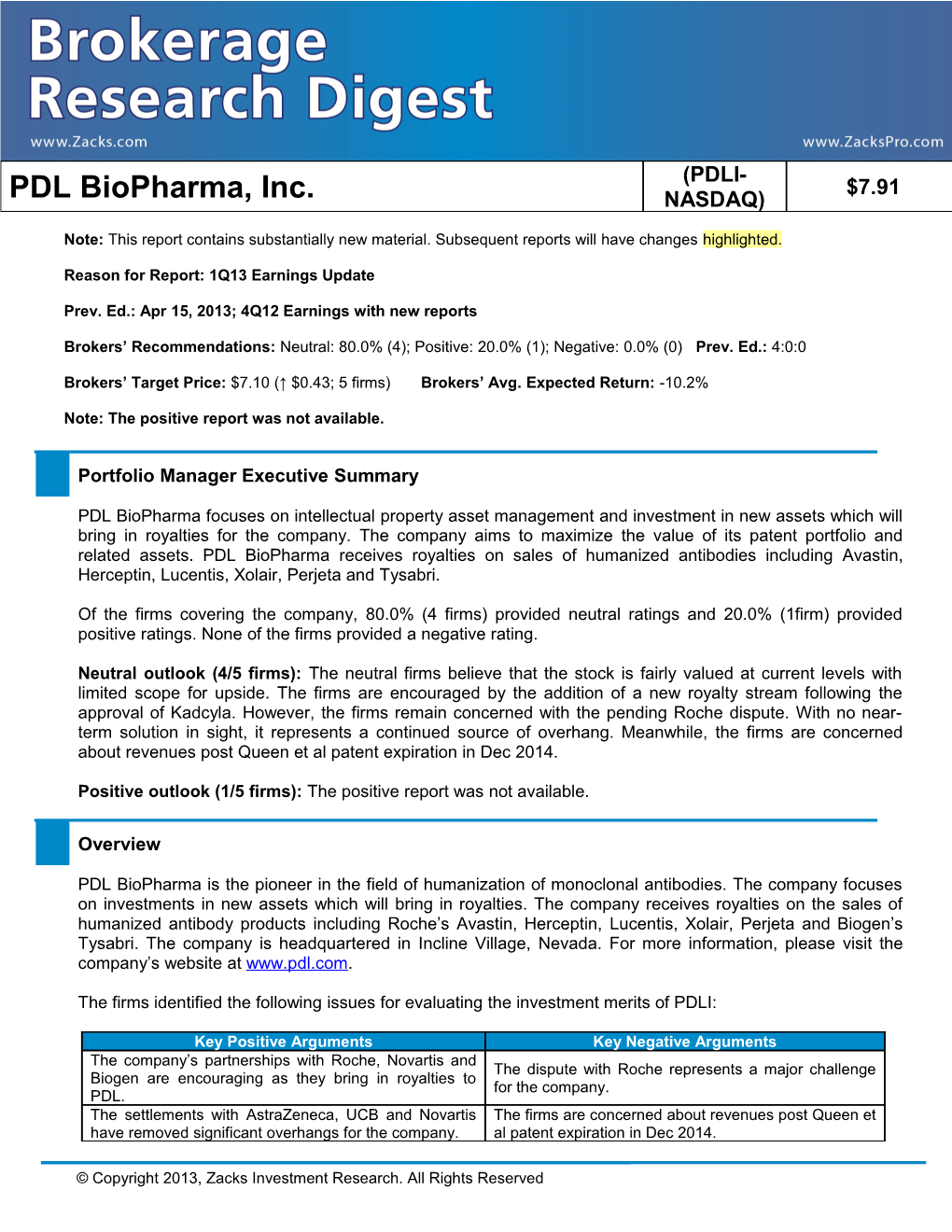

(PDLI- $7.91 PDL BioPharma, Inc. NASDAQ)

Note: This report contains substantially new material. Subsequent reports will have changes highlighted.

Reason for Report: 1Q13 Earnings Update

Prev. Ed.: Apr 15, 2013; 4Q12 Earnings with new reports

Brokers’ Recommendations: Neutral: 80.0% (4); Positive: 20.0% (1); Negative: 0.0% (0) Prev. Ed.: 4:0:0

Brokers’ Target Price: $7.10 (↑ $0.43; 5 firms) Brokers’ Avg. Expected Return: -10.2%

Note: The positive report was not available.

Portfolio Manager Executive Summary

PDL BioPharma focuses on intellectual property asset management and investment in new assets which will bring in royalties for the company. The company aims to maximize the value of its patent portfolio and related assets. PDL BioPharma receives royalties on sales of humanized antibodies including Avastin, Herceptin, Lucentis, Xolair, Perjeta and Tysabri.

Of the firms covering the company, 80.0% (4 firms) provided neutral ratings and 20.0% (1firm) provided positive ratings. None of the firms provided a negative rating.

Neutral outlook (4/5 firms): The neutral firms believe that the stock is fairly valued at current levels with limited scope for upside. The firms are encouraged by the addition of a new royalty stream following the approval of Kadcyla. However, the firms remain concerned with the pending Roche dispute. With no near- term solution in sight, it represents a continued source of overhang. Meanwhile, the firms are concerned about revenues post Queen et al patent expiration in Dec 2014.

Positive outlook (1/5 firms): The positive report was not available. Jun 13, 2013

Overview

PDL BioPharma is the pioneer in the field of humanization of monoclonal antibodies. The company focuses on investments in new assets which will bring in royalties. The company receives royalties on the sales of humanized antibody products including Roche’s Avastin, Herceptin, Lucentis, Xolair, Perjeta and Biogen’s Tysabri. The company is headquartered in Incline Village, Nevada. For more information, please visit the company’s website at www.pdl.com.

The firms identified the following issues for evaluating the investment merits of PDLI:

Key Positive Arguments Key Negative Arguments The company’s partnerships with Roche, Novartis and The dispute with Roche represents a major challenge Biogen are encouraging as they bring in royalties to for the company. PDL. The settlements with AstraZeneca, UCB and Novartis The firms are concerned about revenues post Queen et have removed significant overhangs for the company. al patent expiration in Dec 2014.

© Copyright 2013, Zacks Investment Research. All Rights Reserved Note: The company’s fiscal year coincides with the calendar year. Jun 13, 2013

Long-Term Growth

Management at PDL is looking to increase returns to stockholders either through the acquisition of royalty assets or by paying higher dividends or making share repurchases. The company aims to acquire new assets and royalty streams to diversify its business beyond the Queen et al patent estate and is specifically targeting commercial-stage biological agents with strong patent protection. The addition of Roche’s Perjeta and Kadcyla to PDL’s royalty stream is encouraging. The company has to make such additions to its royalty stream to sustain growth.

The company is also aiming to derive further value from the Queen patents through new product launches and continued efforts by partners to manufacture products ex-US, from which PDL derives a higher royalty rate.

The company is exploring different sources of revenue generation. In Jul 2012, PDL gave a loan of $35 million at a 13.5% interest rate to Merus Labs International, Inc. to acquire Enablex/Emselex from Novartis. Additionally, PDL had agreed to a $20 million letter of credit at a 14.0% interest. The loan matures on Mar 31, 2015. Jun 13, 2013

Target Price/Valuation

Rating Distribution Positive 20.00%↑ Neutral 80.00%↓ Negative 0.00% Avg. Target Price $7.10↑ Highest Target Price $9.00↑ Lowest Target Price $6.00 No. of firms with target price/total 5/5

The risks to the target price include a dispute with Roche over its licensing agreement.

Recent Events

PDL BioPharma Guides Higher 2Q Royalties- Jun 11, 2013

PDL BioPharma Inc. announced that it expects to receive royalty revenues of around $143 million in second quarter 2013, up 14% from the royalties earned in the second quarter of 2012.

PDL BioPharma receives royalties from companies like Roche Holdings Ltd. and Novartis. The royalties are earned on worldwide net sales of products like Avastin, Herceptin, Lucentis, Xolair, Kadcyla, Tysabri and Perjeta.

Royalty payments for Roche’s products are tiered (1-3%) in the US, while PDL BioPharma receives a flat 3% royalty if a product is both manufactured and sold outside the US.

Zacks Investment Research Page 2 www.zackspro.com The anticipated growth in royalty revenues primarily emanates from higher sales of Herceptin (up 7%), Avastin (up 8%), Tysabri (up 12%) and Lucentis (up 8%) during the first quarter of 2013 for which PDL will receive royalties in the second quarter of 2013.

Effective from the second quarter of 2011, PDL BioPharma started paying back a portion of the royalties it receives on Lucentis sales outside the US to Novartis. The payment is made in accordance with a settlement agreement, which the companies had entered into in Feb 2011. The second quarter 2013 royalty guidance includes this payment.

PDL BioPharma also announced that it had filed a Notice of Arbitration against Roche with the American Arbitration Association in Voorhees. The Notice of Arbitration was filed as PDL BioPharma believes that Roche has paid it lower royalties from at least 2007. Roche also did not allow PDL BioPharma to check its books and records to determine whether the paid royalty amounts were calculated accurately.

PDL BioPharma Misses Earnings Estimates – May 9, 2013

PDL BioPharma Inc. posted first-quarter 2013 earnings of $0.36 per share, below the Zacks Consensus Estimate of $0.38 but ahead of the year-ago figure of $0.29 per share. The increase in year-over-year earnings was attributable to higher revenues.

PDL BioPharma generated first-quarter 2013 revenues of $91.8 million, up 18.8% year over year. Revenues were in line with the company’s guidance announced in Mar 2013. Revenues were ahead of the Zacks Consensus Estimate of $90 million.

Quarter in Detail

PDL BioPharma derived revenues for the first quarter of 2013 solely from royalties. PDL BioPharma receives royalties from companies like Roche Holdings Ltd. and Novartis. The royalties are earned on worldwide net sales of products like Avastin, Herceptin, Lucentis, Xolair, Tysabri and Perjeta.

Increased royalties on sales of Avastin, Herceptin, Lucentis, Tysabri and Actemra drove first-quarter 2013 royalties.

Effective from the second quarter of 2011, PDL BioPharma started paying back a portion of the royalties it receives on Lucentis sales outside the US to Novartis. The payment is made in accordance with a settlement agreement, which the companies had entered into in Feb 2011. The first-quarter 2013 revenue is net of this payment.

General and administrative (G&A) expenses were $7.2 million in the reported quarter, up approximately 3.5%.

The company is expected to provide revenue guidance for the second quarter of 2013 in early June this year.

Other Developments

In Apr 2013, PDL BioPharma entered into a credit agreement with Avinger Inc. PDL BioPharma paid $20 million in cash on Apr 18, 2013 and is expected to provide additional funds of around $20 million on achieving certain specified revenue milestones. As per the agreement PDL BioPharma will be receiving interest on the principal amount outstanding along with a low, single-digit royalty on the sale of Avinger's suite of products till Apr 2018.

Zacks Investment Research Page 3 www.zackspro.com Revenue

The company currently derives a significant portion of its revenue from licenses granted to companies under the Queen patents, covering the humanization of antibodies. The patents are set to expire in Dec 2014. At present the company receives royalty from worldwide net sales of Avastin, Herceptin, Xolair and Perjeta, which are marketed by Roche; Lucentis, which is marketed by Roche and Novartis; and Tysabri, which is marketed by Biogen. Royalty payments for Roche’s products are tiered (1-3%) in the US, while PDL BioPharma receives a flat 3% royalty if a product is both manufactured and sold outside the US. However, Tysabri royalties are calculated at a flat rate as a percentage of sales, irrespective of the manufacturing or sales location.

PDL reported total revenue of $91.8 million in 1Q13, up 18.8% y/y. Revenues were in line with the company’s guidance announced in Mar 2013. The company derived revenues for 1Q13 solely from royalties. The upside was primarily driven by increased royalties on sales of Avastin, Herceptin, Lucentis, Tysabri and Actemra.

Effective from 2Q11, PDL started paying back a portion of the royalties it receives on Lucentis sales outside the US to Novartis. The payment is made in accordance to a settlement agreement, which the companies had entered into in Feb 2011. The 1Q13 revenue is net of this payment.

In Feb 2013, the FDA approved Roche/ImmunoGen’s Kadcyla for the second line treatment of HER2+ metastatic breast cancer and first line treatment of those patients who relapse within six months following adjuvant therapy. PDL BioPharma expects to receive royalties on sales of Kadcyla from 2Q13. Roche is also seeking EU approval of the product. The company also received royalties on Roche’s Perjeta (pertuzumab), which was launched in the US in Jun 2012.

In Oct 2012, Roche announced that Avastin was approved in the EU in combination with standard chemotherapy for the treatment of women suffering from first recurrence of platinum-sensitive ovarian cancer.

2Q13 Outlook

On Jun 11, 2013, PDL announced that it expects to receive royalties in 2Q13 of $143 million, up 14% y/y. The increased forecast is based on higher 1Q13 sales of Herceptin (up 7%), Avastin (up 8%), Tysabri (up 12%) and Lucentis (up 8%) for which PDL would receive royalties in 2Q13.

Roche Dispute

PDL’s European patents expired in Dec 2009. The company was granted supplementary certificates (SPCs) for some jurisdictions in the EU which have extended the patent protection till Dec 2014 (Jul 2014 for Herceptin). PDL believes that the SPCs granted to it by various EU countries are enforceable against Roche’s products. Roche has disputed its need to pay royalties on ex-US sales. Roche is asserting that it does not owe PDL BioPharma royalties on sales of Avastin, Herceptin, Lucentis and Xolair manufactured and sold outside the US. Lucentis is co-marketed by Novartis and Roche. Roche holds the US marketing rights for the drug.

In addition, in Aug 2010, PDL filed a complaint against Roche and Novartis in Nevada to enforce its rights against Roche under the 2003 settlement agreement. PDL believes that Roche has breached the agreement, which could lead to payment of liquidated and other damages of more than $1 billion by Roche, including a retroactive royalty of 3.75% on past US sales. PDL is also entitled to either terminate the license agreement with Roche or be paid a flat 3.75% royalty on all future US sales.

In Nov 2010, Roche filed a motion claiming that the complaint should be dismissed as the 2003 agreement relates only to PDL’s US patents and Nevada does not have jurisdiction over Roche. Roche believes it

Zacks Investment Research Page 4 www.zackspro.com does not own PDL royalties on sales of products manufactured and sold outside the US, which currently accounts for approximately 35% of PDL’s revenues. In mid-Jul 2011, PDL BioPharma announced that the Second Judicial District Court of Nevada rejected Roche’s motion filed in Nov 2010 to dismiss PDL’s lawsuit due to lack of personal jurisdiction. The court also denied Roche and Genentech’s (a subsidiary of Roche) motion to dismiss four of PDL's five claims for relief. The court however, dismissed one claim brought by PDL that Genentech committed a bad breach of the covenant of good faith and fair dealing. The effect of the court’s ruling is that PDL can continue with four key claims.

Roche, however, continues to pay quarterly royalties to PDL since the receipt of the letter. The timing of a potential resolution is uncertain. A trial is expected to begin in Oct 2013. If the final ruling is favorable, PDL would be entitled to an increased royalty rate of 3.75% of US product retro- and proactively. On the contrary, the most PDL can lose is continued legal expenses. Meanwhile, a settlement between PDL and Roche also remains a possibility.

In Jun 2013, PDL BioPharma announced that it had filed a Notice of Arbitration against Roche with the American Arbitration Association in Voorhees, as it believes that Roche has paid lower royalties from at least 2007. Roche also did not allow PDL BioPharma to check its books and records to determine whether the paid royalty amounts were calculated accurately.

Other Settlements

In 2011 PDL resolved a number of legal disputes, both US and ex-US challenges to its patents. In Feb 2011, PDL entered into settlements with MedImmune (a wholly-owned subsidiary of AstraZeneca), UCB Pharma and Novartis, following which all the parties challenging the validity of the ‘216B patents formally withdrew their participation. In Feb 2011, the acquisition of BioTransplant (a bankrupt company) by PDL was approved and BioTransplant subsequently withdrew its opposition appeal challenging the validity of the ‘216B patent. Accordingly, the EPO validated its 2007 decision upholding the ’216B patent. In 1Q11, PDL derived approximately 40% of its revenues from sales of products that were made in Europe and sold outside the US. An adverse ruling at the hearing could have negatively impacted these revenues.

Almost all the firms in the Digest group believe the settlements with AstraZeneca, UCB and Novartis have removed significant overhangs for the company. They are particularly encouraged by the EPO’s confirmation of the key Queen EU patent as valid. Settlements with MedImmune, Novartis and UCB, and termination of European opposition to ‘216B Patent, reduce uncertainty and ensure a constant revenue stream for the company.

Agreements

In Apr 2013, PDL BioPharma entered into a credit agreement with Avinger Inc. PDL BioPharma paid $20 million in cash on Apr 18, 2013 and is expected to provide additional funds of around $20 million on achieving certain specified revenue milestones. As per the agreement PDL BioPharma will be receiving interest on the principal amount outstanding along with a low, single-digit royalty on the sale of Avinger's suite of products till Apr 2018.

In Oct 2012 the company completed a structured financing transaction, under which PDL provided an aggregate of $20.8 million to AxoGen for royalties of certain AxoGen revenues.

In Nov 2012, the company entered into a credit agreement of $40 million with Wellstat Diagnostics. Wellstat intends to use the amount for the development and commercialization of small point of care diagnostic systems.

Margins

General and administrative (G&A) expenses climbed 3.5% y/y in 1Q13 to $7.2 million.

Zacks Investment Research Page 5 www.zackspro.com Earnings per Share

PDL posted 1Q13 earnings of $0.36 per share, up 24.1% y/y. Earnings were boosted by higher revenues.

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about PDL BioPharma Inc. (PDLI) at:

PDLI profile on StockResearchWiki.com

Analyst Neelakash Sarkar Copy Editor Pushpanjali Banerjee Content Editor Maharathi Basu Lead Analyst Maharathi Basu Last Updated By Neelakash Sarkar

QCA Arpita Dutt

Reason for Update 1Q13

Zacks Investment Research Page 6 www.zackspro.com