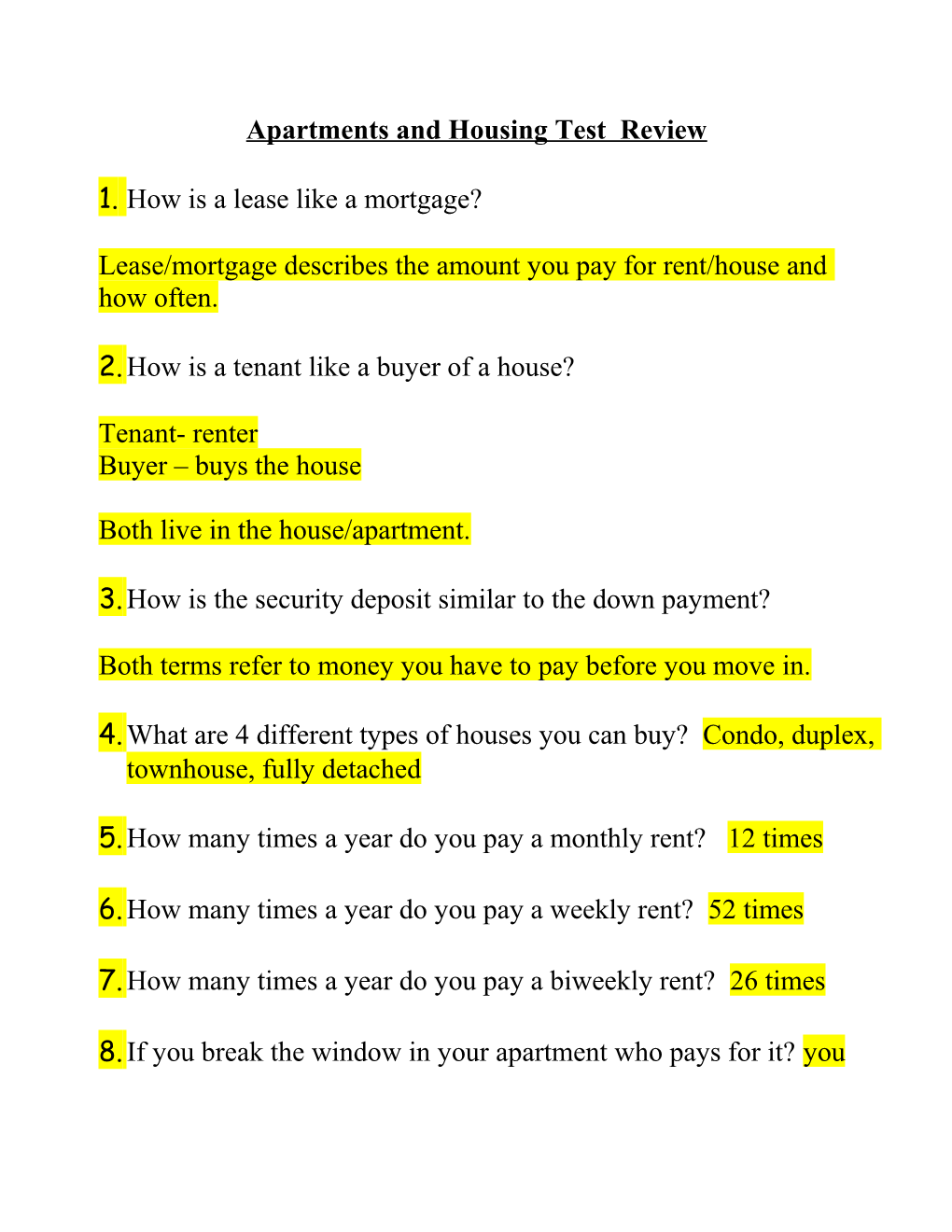

Apartments and Housing Test Review

1. How is a lease like a mortgage?

Lease/mortgage describes the amount you pay for rent/house and how often.

2. How is a tenant like a buyer of a house?

Tenant- renter Buyer – buys the house

Both live in the house/apartment.

3. How is the security deposit similar to the down payment?

Both terms refer to money you have to pay before you move in.

4. What are 4 different types of houses you can buy? Condo, duplex, townhouse, fully detached

5. How many times a year do you pay a monthly rent? 12 times

6. How many times a year do you pay a weekly rent? 52 times

7. How many times a year do you pay a biweekly rent? 26 times

8. If you break the window in your apartment who pays for it? you 9. If your friend breaks the window in your apartment who pays for it? You

10. If you break the window in your condo who pays for it? You

11. If your condo needs a new roof, who pays for it? Condo manager

12. If your semi-detached house needs a new roof, who pays for it? You

13. What is the most common type of house in the Eastern Shore? Fully detached

14. If you want to paint your fully-detached house, do you have to have permission from anyone? No – it is your house

15. If you want to paint your condo, do you have to have permission from anyone? Condo manager

16. If there is a snowstorm, who will plow your driveway if you own a townhouse? You

17. If there is a snowstorm, who will plow your driveway/parking spot if you own a condo? Condo manager

18. Where can you find apartments and houses to rent/buy? Newspaper, internet, tv 19. What are some monthly costs of renting an apartment that are not usually included? Heat, hot water, parking, cable, internet, etc

20. What are the costs of moving when you buy a house? Moving van, property tax, HST, renovations, hookup fees (cable, etc), realtor, legal fees

21. What type of house is most like renting? Condo – you have a “landlord” or condo manager

22. Which is better: paying a monthly mortgage or a biweekly mortgage? Why? Biweekly – you pay it off quicker and have less interest (so it is cheaper)

23. Why would someone want a shorter amortization on their mortgage? Shorter time to pay off mortgage, you pay it off faster and therefore have to pay less interest.

24. Why would someone want a longer amortization on their mortgage? Your monthly payments are smaller – so you have more money to do other things.

25. What is the minimum percentage amount you need to pay the bank for a mortgage? 5% 26. What is the minimum percentage amount you need to pay the bank for a high-ratio mortgage? 5%

27. What is the minimum percentage amount you need to pay the bank for a conventional mortgage? 25%

28. What is more expensive: a house/apartment in Halifax or in Toronto? Why do you think this is? Toronto – bigger cities are more expensive

29. Which is more expensive: a house/apartment in Halifax or in Chezzetcook? Why? Halifax – more expensive in cities than rural areas

30. Can you get evicted from your apartment if you get caught selling drugs by the police? Yes

31. Can you get evicted from your apartment for being 1 day late on the rent? No– you must be 1 month late and then the landlord give you notice (15 days more)

32. Can you get evicted from your apartment for being 2 months late on rent? Yes

33. Fill in the table below: Type of House Advantages Disadvantages Fully Detached Private expensive No sharing of walls Condo Cheaper Like an apartment Condo manager fixes things Duplex/Semi- Cheaper than fully Share walls detached detached Close neighbours Town House Cheaper than fully Share walls detached Close neighbours

34. Calculate the yearly costs for the following apartments. Show work. a) $124 per week 124 x 52 = $6448 b) $250 biweekly 250 x 26 = $6500 c) $600 monthly 600 x 12 = $7200

35. If I rent an apartment for $850 per month and my lease starts on January 1, 2010: a) When is my anniversary date? January 1, 2011 b) What do I have to pay for a security deposit? Half = 850÷2 = $425 c) What do I get back at the end of the year from the landlord if I don’t cause any damage and pay all rent? 1% = 1 ÷100 x 425 = $4.25 Security Deposit + 1% = 425 + 4.25 = 429.25 d) For 2011, the maximum rent increase is 3.4%. How much would the monthly rent be if I stayed at this apartment in 2011? Increase = 3.4% = 3.4 ÷100 x 850 = $28.90 Total: Monthly rent + increase = 850 + 28.90 = $878.90

36. How much notice must the landlord give the tenant, on a yearly lease, of a rent increase? a. 1 month b. 2 months c. 3 months d. 4 months

37. How much notice must the landlord give a tenant to end a yearly lease? a. 30 days b. 3 months c. 14 days d. 2 months

38. Kyle has a yearly lease that expires on June 30th. He plans to leave his apartment on June 30th. What is the latest date he can give notice to his landlord? a. March 1st b. April 1st (3 months) c. June 1st d. June 30th

39. List 2 features that you would require when renting an apartment.

Parking, pets allowed, loud music allowed, smoking inside, etc

40. List 2 features you would want when buying a house.

3 bedrooms, 2 bathrooms, oceanfront, fireplace, etc

41. Bob wants to buy a new house for $400 000. a. Calculate the HST on Bob’s house. House price x 15% = 15 ÷100 x 400 000 = $60 000

b. What is the total price of the house with HST? Original price + HST= 400 000 + 60 000 = $460 000

c. Calculate the Land Transfer Tax (1.5%). 1.5 ÷100 x 400 000 = $6000

d. Calculate how much he needs to pay for a 10% down payment. 10 ÷100 x 400 000 = $40 000

e. If Bob was buying an OLD house, what would he not have to pay? HST

42. If you are moving and had the following fees, what would be your additional moving costs? Legal fees: $1244 Moving Van: $700 Hookup fee: $235 Realtor Fee: $1234

Additional moving costs = 1244 + 700 + 235 + 1234 = $3413

43. Bob wants the $400 000 home. He goes to the bank to get a mortgage.

a) With a 30-year amortization, his monthly mortgage would be $1200. How much would he pay over the 30-year period? Monthly cost x 12 x years of amortization = 1200 x 12 x 30 = $432 000

b) If Bob makes payments every 2 weeks instead, what would his payment be?

Monthly cost x 12 ÷ 26 = 1200 x 12 ÷ 26 = $553.85

c) If Bob makes these biweekly payments (as in b), what would he pay in total for his home if he needs to make 554 payments in total?

Biweekly payment x number of payments = 553.85 x 554 = $306 832.90

44. Use the MLS listing to find the following:

a) Asking price: $439 000

b) Address: HWY #107 EAST, Exit #22

c) New or resale? (circle) Resale

d) 4 features of this home Look in description or on right side

4 bedrooms, 2 bathrooms, 1 partial bathroom, Cape Cod style house, , solid oak wood work, etc

e) Type of house: condominium, townhouse, duplex, or fully detached (circle) – look at picture!

Key Terms to Know: Check the powerpoints from Nov. 4 and Oct. 27

Lease Landlord Tenant Security Deposit

Anniversary Date Eviction Condominium Townhouse

Fully Detached House Duplex or semi-detached house

Amortization Asset Property Tax Land Transfer Tax

Down Payment High Ratio Mortgage Conventional Mortgage