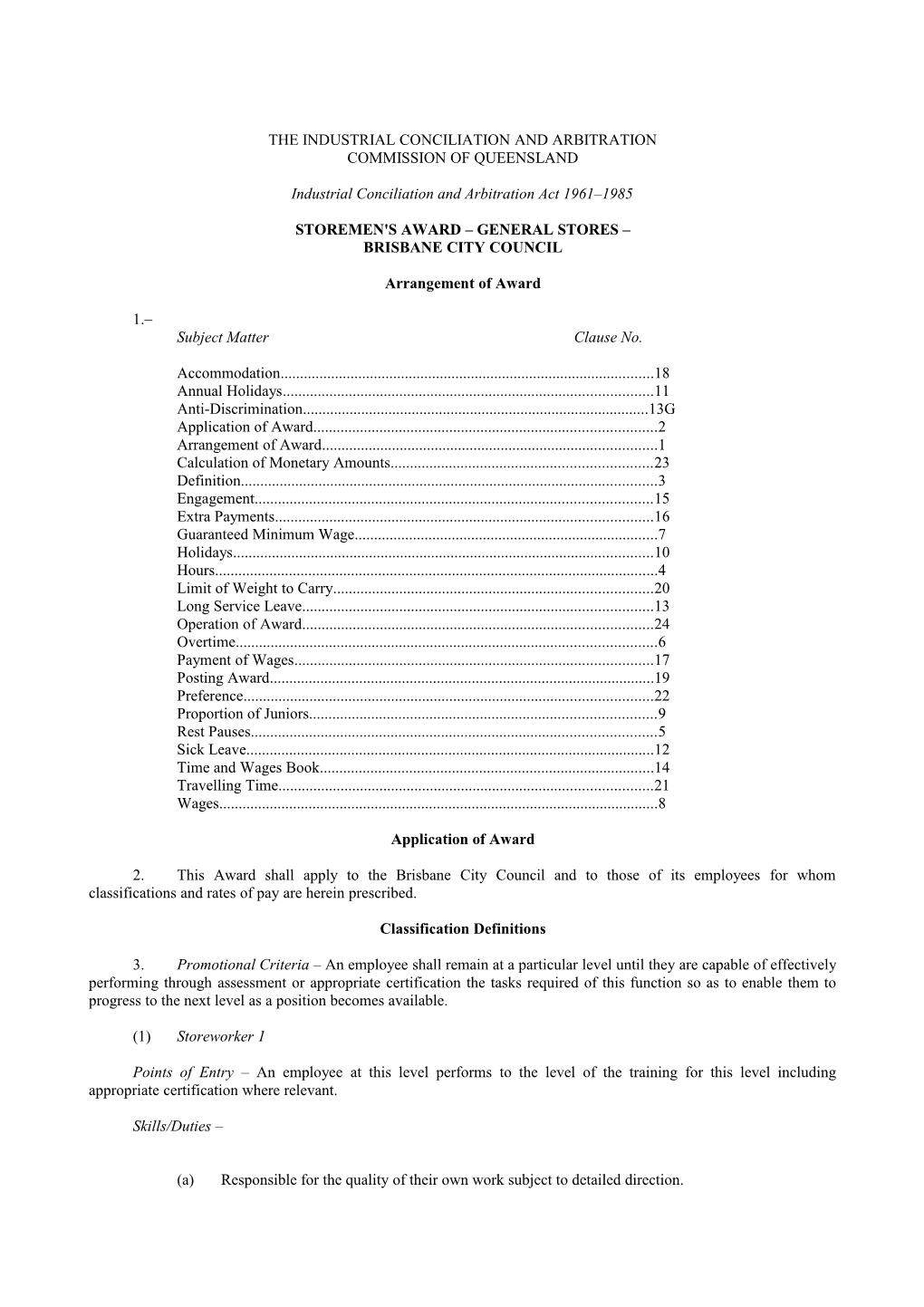

THE INDUSTRIAL CONCILIATION AND ARBITRATION COMMISSION OF QUEENSLAND

Industrial Conciliation and Arbitration Act 1961–1985

STOREMEN'S AWARD – GENERAL STORES – BRISBANE CITY COUNCIL

Arrangement of Award

1.– Subject Matter Clause No.

Accommodation...... 18 Annual Holidays...... 11 Anti-Discrimination...... 13G Application of Award...... 2 Arrangement of Award...... 1 Calculation of Monetary Amounts...... 23 Definition...... 3 Engagement...... 15 Extra Payments...... 16 Guaranteed Minimum Wage...... 7 Holidays...... 10 Hours...... 4 Limit of Weight to Carry...... 20 Long Service Leave...... 13 Operation of Award...... 24 Overtime...... 6 Payment of Wages...... 17 Posting Award...... 19 Preference...... 22 Proportion of Juniors...... 9 Rest Pauses...... 5 Sick Leave...... 12 Time and Wages Book...... 14 Travelling Time...... 21 Wages...... 8

Application of Award

2. This Award shall apply to the Brisbane City Council and to those of its employees for whom classifications and rates of pay are herein prescribed.

Classification Definitions

3. Promotional Criteria – An employee shall remain at a particular level until they are capable of effectively performing through assessment or appropriate certification the tasks required of this function so as to enable them to progress to the next level as a position becomes available.

(1) Storeworker 1

Points of Entry – An employee at this level performs to the level of the training for this level including appropriate certification where relevant.

Skills/Duties –

(a) Responsible for the quality of their own work subject to detailed direction. 2

(b) Works in a team environment and/or under routine supervision.

(c) Undertakes duties in a safe and responsible manner.

(d) Exercises discretion within their level of skills and training.

(e) Possesses basic interpersonal and communication skills.

(f) Indicative of the tasks which an employee at this level may perform are the following:–

– storing and packing goods and materials in accordance with appropriate procedures and/or regulations;

– preparation and receipt of appropriate documentation including liaison with suppliers;

– allocating and retrieving goods from specific warehouse areas;

– responsible for housekeeping in own work environment and periodic stock-ckecks;

– basic operation of VDU or similar equipment.

(2) Storeworker 2

Points of Entry – An employee at this level performs work above and beyond the skills of an employee at Storeworker 1 level to the level of their training for this level including certification where relevant. An employee having successfully completed an agreed traineeship to the level of this grade shall fall within this classification.

Skills/Duties –

(a) Able to understand detailed instructions and work from procedures.

(b) Able to co-ordinate work in a team environment under limited supervision.

(c) Responsible for quality of their own work.

(d) Possesses sound interpersonal and communication skills.

(e) Must be competent to perform one or more of the following tasks/duties or a combination of both.

(f) Inventory and warehousing control, including:–

– licensed operation of all appropriate materials handling equipment;

– use of tools and equipment within the warehouse basic non trades maintenance;

– VDU operation at a higher level than that of a Storeworker 1;

– bulk iron and steel yards storeworker;

– maintenance and material storeworker;

– spare parts machinery and maintenance material;

– employees who operate a fork-lift as their primary responsibility.

(3) Storeworker 3

Points of Entry – An employee at this level performs work above and beyond the skills of an employee at Storeworker 2 level and to the level of their training for this level including certification where relevant. 3

Skills/Duties –

(a) Understands and is responsible for quality control standards.

(b) Possesses an advanced level of interpersonal and communication skills.

(c) Competent keyboard skills.

(d) Sound working knowledge of all warehousing/stores duties performed at levels below this grade, exercises discretion within scope of this grade.

(e) may perform work requiring minimal supervision either individually or in a team environment.

(f) indicative of the tasks which an employee at this level may perform are the following:–

– use of VDU for purpose such as maintenance of a deposit storage system information input/retrieval etc. at a higher level than that of Storeworker 2;

– assistance with development and refinement of a store layout including proper location of goods and their receipt and despatch;

– ability to work singularly or in control of an isolated store where no direct supervision is exercised.

(4) Storeworker 4

Points of Entry – A Storeworker 4 works above and beyond an employee at Storeworker 3 level and to the level of their training, applied the skills acquired through successful completion of a certificate level or equivalent qualification relevant to the industry according to the needs of the enterprise.

Skills/Duties –

(a) Implements quality control techniques and procedures.

(b) Understands and is responsible for a warehouse or a large section of a warehouse.

(c) Highly developed level of interpersonal and communication skills.

(d) Ability to supervise and provide direction and guidance to other employees including the ability to assist in the provision of on-the-job training and induction.

(e) Exercises discretion within the scope of this grade.

(f) Exercises skills attained through the successful completion of an appropriate warehousing certificate.

(g) Indicative of the tasks which an employee at this level may perform are the following:–

– liaising with management, suppliers and customers with respect to stores operations;

– maintaining control registers including inventory control and being responsible for the preparation and reconciliation of regular reports or stock movement, despatches, etc.

(h) Has sound knowledge of the Employers operation.

Hours 4

4.(1) The ordinary working hours of day working employees shall not exceed 38 hours per week or 7 hours 36 minutes per day to be worked between 7.30 a.m. and 5.30 p.m. Monday to Friday inclusive:

Provided that by agreement between the Union and the Brisbane City Council the ordinary hours may be worked over a fortnightly period on 9 consecutive working days and not more than 8 hours 27 minutes shall be worked on any such day at ordinary rates.

(2) Not less than one hour shall be allowed for the midday meal on each day from Monday to Friday and such hour shall be between the hours of noon and 2 p.m. as may be arranged between the Council and its employees.

The Employer and a majority of employees may agree to take less than one hour for the midday meal: Provided that the time taken for the midday meal shall not be less than thirty minutes and the ordinary working hours shall not exceed eight on any one day.

(3) When the hours between noon and 2 p.m. are worked continuously, one hour shall be paid for at double the ordinary rates, and such rates shall continue until a break for a meal is made.

(4) Except in case of emergency, one week's notice must be given by the Employer to the employee of his intention to alter the meal hour.

Rest Pauses

5. Every employee covered by this Award shall be entitled to a rest pause of ten minutes' duration in the Employer's time in the first and second half of his daily work. Such rest pauses shall be taken at such times as will not interfere with continuity of work where continuity is necessary.

Overtime

6.(1) All time worked outside or in excess of the hours prescribed by clause 4 of this Award shall be deemed overtime, and shall be paid for at the rate of time and a-half for the first three hours on any one day and thereafter at the rate of double time.

(2) All time worked on Sundays or in excess of four hours on Saturdays shall be paid for at the rate of double time.

(3) When an employee is called upon to work overtime for more than one hour after the ordinary ceasing time, he shall be paid by the Employer the sum of $7.50 as meal money in addition to overtime payment for the time worked.

(4) Employees who are required to continue work after their usual ceasing time shall be entitled to a thirty minute paid crib break after two hours, or after one hour if overtime continues beyond 6.00 p.m.

After each further period of four hours the employee shall be allowed forty-five minutes for crib. No deduction of pay shall be made in respect of any such crib breaks.

(5) When an employee is required to work overtime exceeding one hour after the usual ceasing time and works through the meal break, he shall be paid double the appropriate rate for such meal break and such rate shall continue until such meal break is allowed.

(6) An employee who works so much overtime between the termination of his ordinary work one day and the commencement of his ordinary work on the next day that he has not had at least 10 consecutive hours off duty between those times shall, subject to this subclause, be released after completion of such overtime until he has had ten consecutive hours off duty without loss of pay for ordinary working time occurring during such absence.

If on the instructions of his Employer such an employee resumes or continues work without having had such ten consecutive hours off duty, he shall be paid double rates until he is released from duty for such period and he shall then be entitled to be absent until he has had ten consecutive hours off duty without loss of pay for ordinary working time occurring during such absence: 5

Provided that, where an employee is recalled to work after the ordinary ceasing time, overtime worked in such circumstances shall not be regarded as overtime for the purposes of this subclause where the actual time worked is less than three hours on such recall or on each of such recalls.

(7) Working on Agreed Day Off – Employees working a fortnightly period of 9 consecutive working days, who are required to work on their agreed day off, shall be paid the overtime rates prescribed for work on Mondays to Fridays in this Award.

Queensland Minimum Wage

7. (1) The Queensland Minimum Wage

No employee shall be paid less than the Queensland minimum wage.

(2) Amount of Queensland Minimum Wage

(a) The Queensland minimum wage for full-time adult employees not covered by subclause (4) special categories, is $359.40 per week.

(b) Adults employed under the Supported Wage Award – State shall continue to be entitled to receive the wage rate determined under that Award:

Provided that such employees shall not be paid less than the amount determined by applying the percentage in the Supported Wage Award – State applicable to the employee concerned to the amount of the minimum wage specified in subclause 2(a).

(c) Adults employed as part-time or casual employees shall continue to be entitled to receive the wage rate determined under the casual and part-time clauses of the Award:

Provided that such employees shall not be paid less than pro rata the minimum wage specified in subclause 2(a) according to the number of hours worked.

(3) How the Queensland Minimum Wage Applies to juniors

(a) The wage rates provided for juniors by the Award continue to apply unless the amount determined under subclause 3(b) is greater.

(b) The Queensland minimum wage for an employee to whom a junior rate of pay applies is determined by applying the percentage in the junior wage rates clause applicable to the employee concerned to the relevant amount in subclause (2).

(4) Application of Minimum Wage to Special Categories of Employee

This clause has no application to employees, undertaking a State Training Wage Award Traineeship, an Australian Traineeship, a Career Start Traineeship, a Jobskills placement, a trainee covered by an Order of the Queensland Industrial Relations Commission made under the Vocational Education, Training and Employment Act 1991 (or successor legislation) or an apprenticeship (whether covered by an award, industrial agreement, certified agreement, currently operating enterprise flexibility agreement, Queensland workplace agreement, or Order of the Queensland Industrial Relations Commission).

(5) Application of Queensland Minimum Wage to Award Rates Calculation

The Queensland Minimum Wage:

(a) applies to all work in ordinary hours;

(b) applies to the calculation of overtime and all other penalty rates, superannuation, payments during sick leave, long service leave and annual leave, and for all other purposes of this Award; and

(c) is inclusive of the $10 per week arbitrated safety net adjustment granted by The Declaration of General Ruling of 15 August 1997 and all previous safety net and State wage adjustments. 6

Wages

8. The minimum rates of wages payable to the following classes of employees shall be:–

Seniors – Award Rate Classification Level Relativity Per Week % $ Storeworker 1...... 87.4 439.60 Storeworker 2...... 92.4 460.50 Storeworker 3...... 96 475.50 Storeworker 4...... 100 492.20

The percentage relativities column relates to percentages applying before the applications of the $8.00 arbitrated safety net adjustment made in accordance with the February and November 1994 Review of Wage Fixing Principles and payable under the November 1994 State Wage Case decision. The percentage relativities are based on a base rate and supplementary payment totalling $417.20 per week.

The rates of pay in this Award are intended to include the arbitrated wage adjustment payable under the 1 September 2000 Declaration of General Ruling and earlier Safety Net Adjustments. [Disputed cases are to be referred to the President.] This arbitrated wage adjustment may be offset against any equivalent amount in rates of pay received by employees whose wages and conditions of employment are regulated by this Award which are above the wage rates prescribed in the Award. Such payments include wages payable pursuant to certified agreements, currently operating enterprise flexibility agreements, Queensland workplace agreements, award amendments to give effect to enterprise agreements and overaward arrangements. Absorption which is contrary to the terms of an agreement is not required.

Increases made under previous State Wage Cases or under the current Statement of Principles, excepting those resulting from enterprise agreements, are not to be used to offset arbitrated wage adjustments.

Juniors – Percentage of Minimum adult rate % 15 and under 16 years of age...... 45 16 and under 17 years of age...... 50 17 and under 18 years of age...... 55 18 and under 19 years of age...... 65 19 and under 20 years of age...... 75 20 and under 21 years of age...... 85

And thereafter at the appropriate rate of pay prescribed for Seniors.

Junior rates shall be calculated in multiples of ten cents with any result of five cents or more being taken to the next highest ten cent multiple.

Casuals – Casual employees shall be paid 22% in addition to the rates above prescribed.

Employees in charge – The minimum rates of wages payable to any employee who has the supervision or direction of employees, with or without juniors, shall be:–

Per Week $ Employees in charge of – From 1 to 3 employees...... 3.80 From 4 to 7 employees...... 4.60 From 8 to 11 employees...... 6.60 From 12 to 15 employees...... 7.50 Over 15 employees...... 9.40 In addition to the weekly rates above prescribed.

Proportion of Juniors 7

9. The proportionate number of juniors who may be employed in any store shall be one junior to one, two, three, or four seniors; two to five or six; and one to every additional three seniors thereafter.

Not more than one junior shall be employed in a store where there is no senior employed.

Holidays

10. All work done by any employee on Good Friday, Christmas Day, the twenty-fifth day of April (Anzac Day), the first day of January, the twenty-sixth day of January, Easter Saturday (the day after Good Friday), Easter Monday, the Birthday of the Sovereign, and Boxing Day, or any day appointed under the Holidays Act 1983, to be kept in place of any such holiday, shall be paid for at the rate of double time and a-half with a minimum of four hours.

All employees covered by this Award shall be entitled to be paid a full day's wage for Labour Day (the First Monday in May or other day appointed under the Holidays Act 1983, to be kept in place of that holiday) irrespective of the fact that no work may be performed on such day, and if any employee concerned actually works on Labour Day, such employee shall be paid a full day's wage for that day and in addition a payment for the time actually worked by him at one and a-half times the ordinary rates prescribed for such work with a minimum of four hours.

All work done by employees in a district specified from time to time by the Minister by notification published in the Gazette on the day appointed under the Holidays Act 1983, to be kept as a holiday in relation to the annual agricultural, horticultural or industrial show held at the principal city or town, as specified in such notification, of such district shall be paid for at the rate of double time and a-half with a minimum of four hours.

No employee shall be entitled to receive more than one day per year as Show Day.

For the purposes of this provision, where the rate of wages is a weekly rate, "double time and a-half" shall mean one and one-half day's wages in addition to the prescribed weekly rate, or pro rata if there is more or less than a day.

Any and every employee who, having been dismissed or stood down by his Employer during the month of December in any year shall be re-employed by that Employer at any time before the end of the month of January in the next succeeding year shall, if that employee shall have been employed by that Employer for a continuous period of two weeks or longer immediately prior to being so dismissed or stood down, be entitled to be paid and shall be paid by his Employer (at the ordinary rate payable to that employee when so dismissed or stood down) for any one or more of the following holidays, namely, Christmas Day, Boxing Day, and the first day of January occurring during the period on and from the date of his dismissal or standing down to and including the date of his re-employment as aforesaid.

Annual Holidays

11.(1) Every employee (other than a casual employee) covered by this Award shall at the end of each year of his employment be entitled to an annual holiday on full pay of four weeks.

For the purposes of this provision "year of employment" shall mean and include any year of employment completed on or after 3rd December, 1973.

Such annual holiday shall be exclusive of any statutory holiday which may occur during the period of that annual holiday and (subject to subclause (2) of this clause) shall be paid for by the Employer in advance–

In the case of any and every employee in receipt immediately prior to that holiday of ordinary pay at a rate in excess of the ordinary rate payable under this Award, at that excess rate; and

In every other case, at the ordinary rate payable to the employee concerned immediately prior to that holiday under this Award.

If the employment of any employee is terminated at the expiration of a full year of employment, the Employer shall be deemed to have given the holiday to the employee from the date of the termination of the employment and shall forthwith pay to the employee in addition to all other amounts due to him, his pay, calculated in accordance with subclause (2) hereof, for four weeks and also his ordinary pay for any statutory holiday occurring during such period of four weeks. 8

If the employment of any employee is terminated before the expiration of a full year of employment, such employee shall be paid, in addition to all other amounts due to him, an amount equal to one-twelfth of his pay for the period of his employment calculated in accordance with subclause (2) hereof.

Reasonable notice of the commencement of annual holiday shall be given to the employee.

Except as hereinbefore provided, it shall not be lawful for the Employer to give, or for any employee to receive payment in lieu of annual holiday.

(2) Calculation of Annual Holiday Pay.–In respect to Annual Holiday entitlements to which this clause applies, annual holiday pay (including any proportionate payments) shall be calculated as follows:–

(A) Shift Workers.–Subject to paragraph (C) hereof the rate of wage to be paid to a shift worker shall be the rate payable for work in ordinary time according to the employee's roster, or projected roster, including Saturday, Sunday or holiday shifts.

(B) Leading Hands, & c.–Subject to paragraph (C) hereof, Leading Hand allowances and amounts of a like nature otherwise payable for ordinary time worked shall be included in the wages to be paid to employees during Annual Holidays.

(C) All Employees.–Subject to the provisions of paragraph (D) hereof, in no case shall the payment by an Employer to an employee be less than the sum of the following amounts:–

(i) The employee's ordinary wage rate as prescribed by the Award for the period of the Annual Holiday (excluding shift premiums and week-end penalty rates);

(ii) Leading Hand allowance or amounts of a like nature;

(iii) A further amount calculated at the rate of seventeen and one-half per centum of the amounts referred to in provisions (i) and (ii) of this paragraph.

(D) The provisions of paragraph (C) hereof shall not apply to the following:–

(a) Any period or periods of Annual Holidays exceeding–

(i) five weeks in the case of employees employed in a calling where three shifts per day are worked over a period of seven days per week; or

(ii) four weeks in any other case.

(b) Employers (and their employees) who are already paying (or receiving) an annual holiday bonus loading or other annual holiday payment which is not less favourable to employees.

(3) Calculation of such entitlements to annual leave of employees shall be in hours as agreed between the Union and the Brisbane City Council.

Sick Leave

12. Every employee shall become entitled to one week's sick leave for each completed year of his employment with the Employer.

Moreover, as respects any completed period of employment of less than one year with the Employer, an employee shall become entitled to one day's sick leave for each two months of such period.

Every employee absent from work through illness on the production of a certificate from a duly qualified medical practitioner specifying the nature of the illness of the employee and the period or approximate period during which the employee will be unable to work, or of other evidence of illness to the satisfaction of his Employer, and subject to his having promptly notified his Employer of his illness and of the approximate period aforesaid, shall, subject as herein provided, be entitled to payment in full for all time he is so absent from work:

Provided that it shall not be necessary for an employee to produce such a certificate if his absence from work on account of illness does not exceed two days. 9

Sick leave shall be cumulative but no employee shall be entitled to receive, and the Employer shall not be bound to make, payment for more than seven weeks' absence from work through illness in any one year.

Trade Union Training (TUTA) Leave

12A. Upon written application by an employee to an employer such application being endorsed by the Union and giving to the employer at least one month's notice, such employee shall be granted up to five working days' leave (non- cumulative) on ordinary pay each calendar year to attend courses and seminars conducted by the Australian Trade Union Training Authority (T.U.T.A.).

For the purposes of these provisions 'ordinary pay' shall mean at the ordinary weekly rate paid to the employee exclusive of any allowance for travelling time and fares or shift work.

The granting of such leave shall be subject to the following conditions:–

(a) An employee must have at least twelve months uninterrupted service with an employer prior to such leave being granted or be the elected union delegate.

(b) This clause shall not apply to an employer with less than 5 full- time employees bound by this Award.

(c) The maximum number of employees of one and the same employer attending a T.U.T.A course or seminar at the same time will be as follows:–

Where the employer employs between 5 and 15 employees – 1

Where the employer employs from 15 to 50 employees – 2

Where the employer employs from 50 to 100 employees – 3

Where the employer employs over 100 employees – 4

Provided that where the employer has more than one place of employment in Brisbane, then the formula above shall apply to the number of employees employed in or from each individual place of employment.

(d)The granting of such leave shall be subject to the convenience of the employer and so that the operations of the employer will not be unduly affected.

(e)The scope, content and level of the course shall be such as to contribute to a better understanding of industrial relations within the employer's operations.

(f)In granting such paid leave, the employer is not responsible for any additional costs except the payment of extra remuneration where relieving arrangements are instituted to cover the absence of the employee.

(g)Leave granted to attend T.U.T.A. courses will not incur additional payment if such course coincides with the employee's day off in the 9 day fortnight working arrangements or with any other concessional leave.

(h)Such paid leave will not affect other leave granted to employees under this Award.

Long Service Leave

13. All employees covered by this Award shall be entitled to long service leave on full pay under, subject to, and in accordance with, the Brisbane City Council Ordinances.

13A. The Union undertakes not to pursue any additional claims, award or overaward, with the exception of matters relating to State Wage Cases, until 1 April 1992.

Incidental or Peripheral Tasks

13B. Arising out of the decision of the State Wage Case of October 1989, and in consideration of the wage increases resulting from the first structural efficiency adjustment, operative from the twenty-seventh day of November, 10

1989, employees are to perform a wider range of duties, including work which is incidental or peripheral to their main task or functions.

Award Modernisation

13C.(1) The parties are committed to modernising the terms of the relevant Award so that they provide for more flexible working arrangements, improve the quality of working life, enhance skills and job satisfaction and assist positively in the restructuring process.

(2) The parties commit themselves to the following principles as part of the structural efficiency process in accordance with the provisions of this clause:

(a) Acceptance in principle that the new award skill level definitions and agreed classification structures will be more suitable for the needs of the Brisbane City Council, generally more broadly based, more truly reflective of the different skill levels of the tasks now performed, and which shall incorporate the ability for an employee to perform a wider range of duties where appropriate.

(b) The parties will create a genuine career path for employees which allows advancement based on relevant accreditation and access to training.

(c) Co-operation in the transition from the old structures to the new award skill level definitions and agreed classification structures in an orderly manner without creating false expectations or disputation.

(d) The parties will agree to allow for the trialing of all agreed outcomes arising from the participative work redesign process.

(e) The Industrial Organizations will not unreasonably oppose any agreement.

(f) Agreements will be ratified by the Queensland Industrial Relations Commission.

(g) If agreement cannot be reached on a particular issue, such issue may be referred to the Queensland Industrial Relations Commission for resolution.

Wage Adjustments

13D. The parties affirm that wage increases arising from broadbanding and adjustment of minimum rates are subject to absorption into existing overaward payments.

Structural Efficiency

13E.(1)(a) An Employer may direct an employee to carry out such duties as are within the limits of the employee's skill, competency and training consistent with the classification structure of this Award to be determined, provided that such duties are not designed to promote de-skilling. This paragraph shall not have effect until the new classification structure and definitions are inserted into the Award.

(b) Any direction issued by an Employer shall be consistent with the Employer's responsibilities to provide a safe and healthy working environment.

(2) The parties to this Award are committed to co-operating positively to increase the efficiency, productivity and competitiveness of the Brisbane City Council and to enhance the career opportunities and job security of its employees.

(3) The parties have established, through a process identified as Workforce Analysis Methodology, work changes for testing and/or trialing with various skill levels to be negotiated in fulfilment of matters consistent with the objectives of subclause (b) herein. The parties shall process any such matters arising from issues unresolved through the Negotiating Team (Joint Restructuring Committee).

(4) Measures raised for consideration consistent with subclause (3) herein shall be related to implementation of new classification structure(s) once agreed to and developed; any facilitative provisions contained in this Award and matters concerning training. 11

(5) Without limiting the rights of either the Council or an Industrial Organization to arbitration, any other measure designed to increase flexibility at the individual work location sought by any party shall be notified to the Awards and Remuneration Sub-Committee and by agreement of the parties involved shall be implemented subject to the following requirements:

(a) The changes sought shall not affect provisions reflecting national standards.

(b) The majority of employees affected by the change at the work location should agree to the change.

(c) No employee shall lose income as a result of the change.

(d) The relevant Industrial Organization/s must be a party to the agreement.

(e) Any agreement shall be subject to approval by the Queensland Industrial Relations Commission and if approved, shall operate, if it does not affect all employees subject to this Award, as a schedule to this Award and take precedence over any provisions of this Award to the extent of any inconsistency.

(6) Award restructuring should be given its wider meaning, and Award restructure should not be confined to the restructuring of classifications but may extend to the review of other restrictive provisions which currently operate and have and will be identified. To that end, such restrictive provisions will be reviewed on an ongoing basis.

(7) Any disputes arising out of the Award Restructuring process shall be referred to the Negotiating Team (Joint Restructuring Committee) and if unresolved be referred to the Queensland Industrial Relations Commission for resolution.

Training

13F.(1) The parties to this Award recognise that in order to increase the efficiency, productivity and competitiveness of the Brisbane City Council, a greater commitment to training and skill development is required. Accordingly, the parties commit themselves to:

(a) developing a more highly skilled and flexible workforce;

(b) providing employees with career opportunities through appropriate training to acquire additional skills; and

(c) removing barriers to the utilisation of skills acquired.

(2) Following proper consultation in accordance with subclause (2) of clause 13E (Structural Efficiency), or through the establishment of a Joint Training Body, the Council shall develop a training programme consistent with:

(a) the current and future skill needs of the Council;

(b) the size, structure and nature of the operations of the Council; and

(c) the need to develop vocational skills relevant to the Brisbane City Council through courses conducted by accredited educational institutions and providers.

Anti-Discrimination

13G.(1) It is the intention of the parties to this Award to achieve the principal object in s. 3(k) of the Industrial Relations Act 1990 by helping to prevent and eliminate discrimination on the basis of sex, marital status, pregnancy, parental status, age, race, impairment, religion, political belief or activity, trade union activity, lawful sexual activity, and association with, or relation to, a person identified on the basis of any of the above attributes.

(2) Accordingly, in fulfilling their obligations under the disputes avoidance and settling clause, the parties to the Award must make every endeavour to ensure that neither the Award provisions nor their operation are directly or indirectly discriminatory in their effects. 12

(3) Nothing in this clause is to be taken to affect –

(a) any different treatment (or treatment having different effects) which is specifically exempted under the Anti-Discrimination Act 1991;

(b) an employee, employer or registered organisation, pursuing matters of discrimination, including by application to the Human Rights and Equal Opportunity Commission/Anti-Discrimination Commission;

(c) the exemptions in ss. 291(3)(a) and (b) of the Act.

Time and Wages Book

14. A time and wages book or other record showing the designation, time worked, starting and finishing times each day of employees, and wages paid to such employees, shall be kept by the Employer and shall be open to inspection not more than once in each week by any paid officer of the Federated Storemen and Packers' Union of Employees of Australia (Queensland Branch) authorised by such Union or any Sub-branch Secretary when he suspects any breach of this Award, provided that he shall state to the Employer the suspected breach.

Engagement

15.(1) Except in the case of casual hands, the engagement shall be a weekly one, terminable by one week's notice on either side or payment or forfeiture of one week's wages.

Any employee who is incompetent or guilty of misconduct, dishonesty or drunkenness may be dismissed at any time without notice and without payment in lieu of notice:

Provided that the week's notice shall not be continued from week to week, that it shall not be counted as annual leave, and that it shall not be given until at least one week has been worked.

(2) Unless the Employer notifies a casual employee before ordinary ceasing time on any one day that his services will not be required on the following day, or specifies the period for which the casual employee's services will be required, such casual employee shall be provided with four hours' work or payment in lieu thereof.

Extra Payments

16.(1) Work in the Rain.–Where practicable suitable waterproof clothing shall be supplied by the Employer to the employees who are required to work in the rain.

Notwithstanding the foregoing, where in the performance of his work an employee gets his clothes wet, he shall be paid double rates for all work so performed and such payment shall continue until the employee is able to change into dry clothing or until he ceases work, whichever is the earlier.

(2) Employees engaged in handling and/or carrying without mechanical contrivances cement in bags, carbon black, coils of wire rope, full drums of petrol, oil, distillate, tarring pipes or other material, or handling any material covered with wet tar shall be paid 23.35 cents per hour whilst so engaged with a minimum payment of 46.7 cents.

(3) First Aid Man.–Where an Employer appoints an employee who holds an appropriate first-aid certificate as a first-aid attendant an additional $5.40 per week in which an employee works 3 days or more shall be paid to such employee.

(4) Two or more classes of work.–Where any person on any one day performs two or more classes of work to which a differential rate fixed by this Award is applicable, such person if employed for more than four (4) hours on the class or classes of work carrying a higher rate shall be paid in respect of the whole time during which he works on that day at the same rate, which shall be at the highest rate fixed by the Award in respect of any of such classes of work, and if employed for four (4) hours or less on the class or classes of work carrying a higher rate he shall be paid at such highest rate for four (4) hours.

Payment of Wages

17. All wages, including overtime, shall be paid on Friday in each week, unless mutually agreed otherwise, except in the case of casual hands, who shall be paid within thirty minutes of their services being dispensed with. 13

Not more than two days' pay shall be kept in hand.

Accommodation

18. Employees shall be provided with reasonable accommodation in which to change their clothes and have their meals and also proper facilities for washing themselves, and hot water shall be provided at meal times.

Posting Award

19. A copy of this Award shall be displayed by the Employer in each store in a prominent position so as to be easily read without let or hindrance by the employees.

Limit of Weight to Carry

20. No employee, unaided by proper auxiliary appliances or by another person shall be permitted to lift or carry weights exceeding 70 kg.

Travelling Time

21. An employee who on any day or from day to day is required to work at a job away from his accustomed depot shall at the direction of his Employer present himself for work at such job at the usual starting time; but for all time reasonably spent in reaching and returning from such job (in excess of the time normally spent travelling from his home to such depot and returning) he shall be paid travelling time and also any fares reasonably incurred in excess of those normally incurred in travelling between his home and such depot. The rate of pay for travelling time shall be ordinary rates, except on Sundays and holidays when it shall be time and a-half.

An employee who with the approval of his Employer uses his own means of transport for travelling to or from outside jobs may make an arrangement as to car allowances. Provided that when an employee is directed to use his own car, he shall be paid on a distance basis at the rate of 13.4c per kilometre (or 20c per mile).

Consultation

21A.(1) The parties to this Award are committed to co-operating positively to increase the efficiency, productivity and competitiveness of the industries covered by this Award and to enhance the career opportunities and job security of employees in such industries.

(2) At each plant or enterprise, an Employer, the employees and their relevant Union or Unions commit themselves to establishing a consultative mechanism and procedures appropriate to the size, structure and needs of that plant or enterprise. Measures raised by the Employer, employees or Union or Unions for consideration consistent with the objectives of subclause (1) herein shall be processed through that consultative mechanism and procedures.

Enterprise Agreements

21B.(1) It is a term of this Award that an "Enterprise Agreement" shall override all or any party of this Award only to the extent of the express inconsistency pursuant to provision (d) of subclause (2) of this clause.

(2) For the purpose of this Award, an "Enterprise Agreement" shall mean one that complies with the following conditions:–

(a) Such agreement shall not, in the context of a total package, provide for a set of conditions of a lesser standard than that provided by the Award and no employee shall have a lesser income as a result of the conditions provided for such an agreement.

(b) The majority of employees at each enterprise must genuinely agree to the implementation of such agreement.

(c) The Industrial Organization shall be a party to the agreement, in particular where enterprise level discussion are considering matters requiring any Award variation, the Industrial Organization shall be invited to participate. 14

(d) The Industrial Organization shall not unreasonably oppose any agreement.

(e) Agreements must be approved by the Queensland Industrial Relations Commission and inserted as a schedule to the Award.

(f) Such agreement shall expressly stipulate the sections of the Award intended to be overridden as a consequence of the agreements operation.

Incidental and Peripheral Tasks

21C.(1) An Employer may direct an employee to carry out such duties as are reasonably within the limits of the employee's skill, competence and training.

(2) An Employer may direct an employee to carry out such duties and use such tools and equipment as may be required provided that the employee has been properly trained in the use of such tools and equipment (where relevant).

(3) Any direction issued by an Employer pursuant to subclauses (1) and (2) shall be consistent with the Employer's responsibilities to provide a safe and healthy working environment.

Preference

22.(1) Regular Employees.– Preference of employment in the case of regular employees over 17 years of age shall be given to financial members of the Federated Storemen and Packers' Union of Employees of Australia (Queensland Branch) or to persons who give an undertaking in writing to make application to join such Union within fourteen days of accepting engagement, and notify the Union to that effect. The Secretary of the Union shall notify the Employer if such undertaking has not been carried out.

(2) Casual Employees.– Preference of employment in the case of casual employees shall be given to returned soldiers or sailors or members of the Federated Storemen and Packers' Union of Employees of Australia (Queensland Branch).

Calculation of Monetary Amounts

23. Notwithstanding anything to the contrary in this Award the following shall apply in calculating the entitlements of employees in respect of any monetary amounts prescribed in this Award:–

(1) Any monetary amount specified as applying on a per hour basis shall be multiplied by the fraction 40/38. If expressed on a daily basis shall be multiplied by the fraction 10/9.

(2) Any monetary amount specified as applying on a rate per week basis shall be divided by 38 where it is necessary to determine an hourly rate in order to calculate an entitlement in respect to a part of a week.

Operation of Award

24. This Award shall take effect and have the force of law as from the twenty-fourth day of February, 1969.

Dated this twenty-seventh day of February, 1969.

By the Commission,

[L.S.] A.C. MARSHALL,

Industrial Registrar.