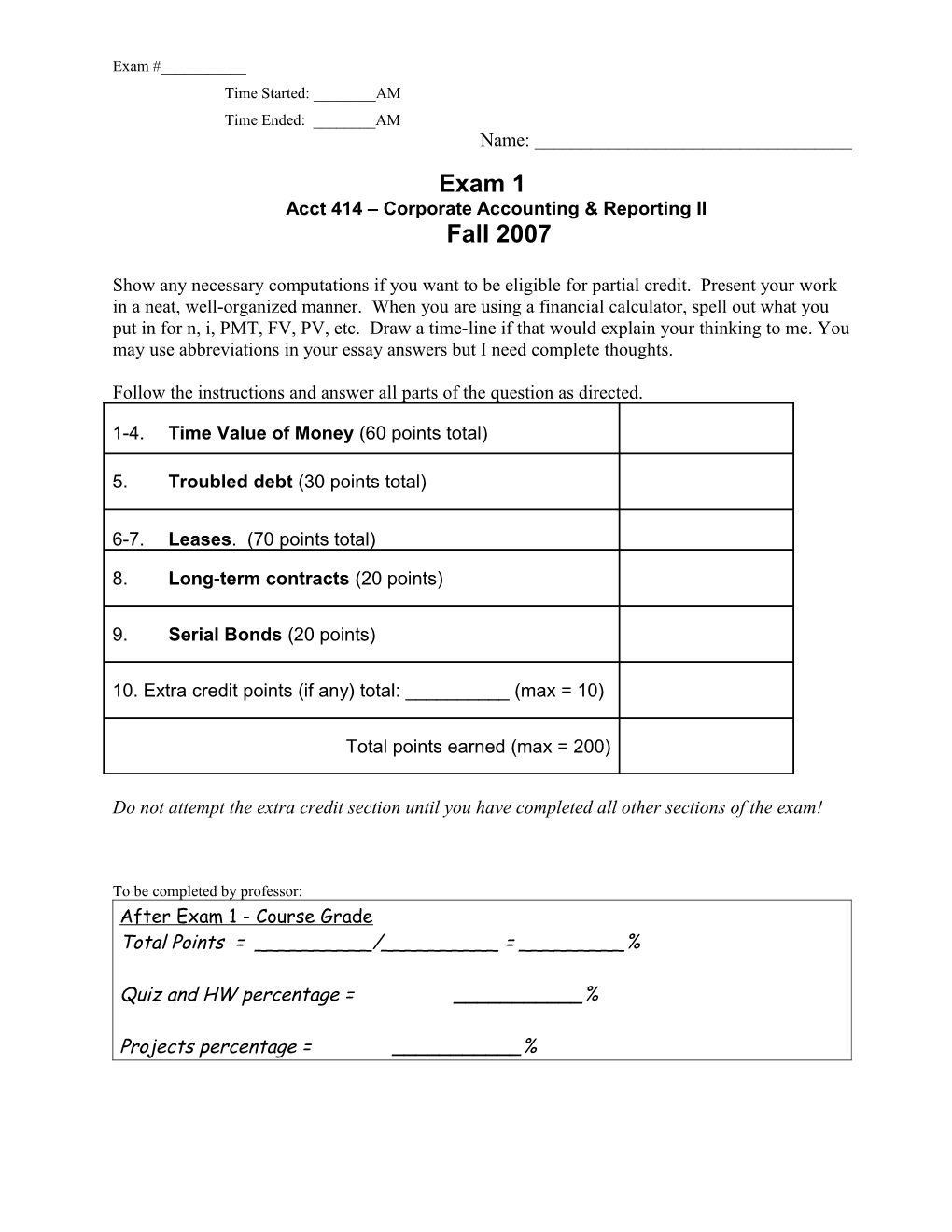

Exam #______Time Started: ______AM Time Ended: ______AM Name: ______Exam 1 Acct 414 – Corporate Accounting & Reporting II Fall 2007

Show any necessary computations if you want to be eligible for partial credit. Present your work in a neat, well-organized manner. When you are using a financial calculator, spell out what you put in for n, i, PMT, FV, PV, etc. Draw a time-line if that would explain your thinking to me. You may use abbreviations in your essay answers but I need complete thoughts.

Follow the instructions and answer all parts of the question as directed.

1-4. Time Value of Money (60 points total)

5. Troubled debt (30 points total)

6-7. Leases. (70 points total)

8. Long-term contracts (20 points)

9. Serial Bonds (20 points)

10. Extra credit points (if any) total: ______(max = 10)

Total points earned (max = 200)

Do not attempt the extra credit section until you have completed all other sections of the exam!

To be completed by professor: After Exam 1 - Course Grade Total Points = ______/______= ______%

Quiz and HW percentage = ______%

Projects percentage = ______% Exam 1 – Acct 414 – Fall 2007 Page 2

Record ordinary gain Are assets or or loss on asset. an ownership Difference between fair interest transferred Is the debt value of asset or equity Yes Yes interest and amount from debtor to settled in full? due on debt is ordinary creditor in settlement gain for debtor and of debt? ordinary loss for creditor No

Record ordinary gain or loss on asset or equity interest transferred. Difference between fair value of asset or equity interest and carrying No value of debt is recognized as an ordinary gain from restructuring for debtor and an ordinary credit loss for creditor.

Is entity the No (Debtor pays LESS CREDITOR? than amount owed at restructuring) Are the The difference cash flows to be between carrying made under the modified value of debt and terms greater than the total future cash No carrying value of the debt flows is recorded as Yes after transfer of any asset a gain from or equity restructuring for interest? DEBTOR. No interest expense will be recorded in CREDITOR discounts future years. expected future cash flows to be received under modified terms using original Yes (historical) interest rate

(Debtor pays MORE than amount owed at restructuring) No gain is recorded by Difference between carrying DEBTOR. Find interest rate to value of receivable and set cash flow equal to carrying present value of expected value of debt. Use this future cash flows is ordinary interest rate to amortize the loss for CREDITOR restructured debt over its term.

TROUBLED DEBT RESTRUCTURING (FASB 15, 114, 118 & 145)

Prepared by T. Gordon 8-31-06 Exam 1 – Acct 414 – Fall 2007 Page 3

[1] Lessor. Assume that you are working for a leasing company. The boss asks you to compute the monthly lease payment that the company should charge to earn a 13% return on the following lease: Fair market value of leased asset $360,000. The first payment on lease will be made immediately upon signing and the second payment will be made at the end of the first month. The lease term is 4 years and the useful life of the asset is 6 years. At the end of the lease, the lessee must return the leased asset to the leasing company. The leasing company estimates that the asset will be worth $80,000 at the end of the lease term.

REQUIRED: What is the monthly payment? $______

[2] Sinking Fund. Wegman Waterbeds, Inc. wants to accumulate $1,000,000 on December 31, 2012 to retire preferred stock. The company deposits $100,000 in a savings account on January 1, 2008 which will earn interest at 5% compounded monthly. Wegman wants to know what additional amount it has to deposit at the end of each month for 5 years to have $1,000,000 available at the end of 2012. The periodic deposits will earn interest at the same rate as the original deposit.

REQUIRED: What is the amount of the necessary monthly deposit? $______Exam 1 – Acct 414 – Fall 2007 Page 4

[3]. Fair Value Disclosures – Bonds. Moonshine Mines issued $1,000,000 in semi-annual bonds on January 1, 2000 at face value. The bonds mature on January 1, 2013. The coupon interest rate was 9% per annum (4.5% each six months). It is now early January in 2008, six years until maturity. Moonshine Mines is preparing its December 31, 2007 financial statements and, according to FASB No. 107, needs to disclose the fair value of the bonds. The bonds are not actively traded but the interest rate for bonds with similar bond ratings and maturities were being sold to yield 10% per annum (5% each six months) as of 12/31/07.

REQUIRED: What is the estimated fair value of the bonds at 12/31/07? (Hint: If the bonds were issued on 12/31/07, what would people be willing to pay to buy them?) $______

[4]. Troubled debt restructuring - DEBTOR: The debtor owes $65,000 on a 3 year note. On January 1, 2008, the creditor agrees to modify the terms of the agreement such that the debtor will pay $4,000 per year (beginning December 31, 2008) in interest for 5 years on a reduced principal balance of $40,000. The principal will be paid at the end of the fifth year.

REQUIRED: What interest rate is implied by the modification of terms? (Show at least 2 decimal points, e.g., 5.16%. The answer could be as low as zero.) ______% Exam 1 – Acct 414 – Fall 2007 Page 5

[5] Troubled Debt Restructuring (30 points) On May 1, 2007, a $100,000 note due to Idaho Last Bank & Trust came due but Henry’s Hardware does not have enough cash to make the payment. Henry’s Hardware has already recorded as interest expense the $12,000 unpaid accrued interest and the bank has, likewise, booked the interest revenue receivable. The note specified annual payments of $25,000 per year plus 12% interest on the unpaid balance. Since Henry’s Hardware is unable to make the payments, the bank has agreed to restructure the terms of the loan.

Under the new terms, Henry’s Hardware will pay interest only for four years at a 10% rate on a reduced principal amount of $80,000. Five years from now, the balloon payment will come due, i.e., $80,000 principal plus $8,000 interest. a. Creditor: What is the fair value of the restructured receivable on Idaho Last Bank & Trust’s books immediately on May 1, 2007?

b. Creditor: What amount of interest revenue on the restructured note will be recognized by Idaho Last Bank & Trust for the fiscal year ending 12/31/07 if it uses the effective interest method?

c. Debtor (a variation of creditor problem). If Henry’s Hardware settled the full amount of the debt on May 1, 2007 by transferring to the bank land worth $50,000 without paying any cash, what would be the gain recognized from the restructuring? Exam 1 – Acct 414 – Fall 2007 Page 6

[6] Lease Classification (20 points). On March 1, 2007, Idaho Telephone Co. (lessee) and Colton Computer Industries (lessor) sign a lease with the following terms:

1. Term: 5 years 2. Annual payments of 43,996 3. Implicit interest rate (not known to lessee) 4. Lessor retains ownership of asset at end of 10% lease

5. Fair value of asset $200,000 6. Cost of asset $175,000 (not known to lessee)

7. Incremental borrowing rate: 12% 8. First payment due at inception of lease

9. Estimated useful life of asset: 7 years 10. No collection or cost uncertainties for lessor

11. Est. fair value of asset at end of lease: 12. The residual value is NOT guaranteed by $30,000 lessee

13. Initial direct costs (attorney's fee) are 14. Lessor and lessee both use straight-line incurred by the Lessor in the amount of depreciation method for fixed assets. $1,000.

15. The Lessor is responsible for property taxes on the leased asset. Property taxes are expected to be $500 per year.

To save time, you should use the following present values to work this problem: The PV of $30,000 (n=5, i=10%) = 18,628 The PV-AD of 43,496 (n=5, i=10%) = 181,372 The PV of $30,000 (n=5, i=12%) = 17,023 The PV-AD of 43,496 (n=5, i=12%) = 175,609

The FV of $30,000 (n=5, i=10%) = 48,315 The PV-AD of 43,996 (n=5, i=10%) = 183,457

The FV of $30,000 (n=5, i=12%) = 59,215 The PV-AD of 43,996 (n=5, i=12%) = 177,627

a. Classify this lease from the perspective of the lessee, Idaho Telephone Co. Explain. This is an SHORT essay question. Abbreviations are fine. Use complete sentences and let me know that you know the criteria! Give me the “numbers” for the numeric tests! If the lease is a capital lease, tell me the amount that would be capitalized as an asset.

b. Classify this lease from the perspective of the lessor, Colton Computer Industries (CCI). Explain. This is an SHORT essay question. Use complete sentences and let me know Exam 1 – Acct 414 – Fall 2007 Page 7

that you know the criteria! Abbreviations are fine and you may refer to your Part a answer above. Exam 1 – Acct 414 – Fall 2007 Page 8

[7]. Lease Accounting (50 points)

On June 1, 2007, Harrison Ford, Inc. and Oregon First Bank sign a lease with the following terms: 1. Term: 5 years 2. Annual payment = $23,203 3. Implicit interest rate (known to lessee) 9% 4. Est. fair value of asset at end of lease $10,000

5. Fair value of asset $100,000 6. Cost of asset $85,000

7. Incremental borrowing rate: 10% 8. First payment due immediately

9. Estimated useful life of asset: 7 years 10. Purchase option at end of lease: $2,500

11. Both lessor and lessee use the straight-line 12. The present value of the minimum lease depreciation method (no salvage value) payments for lessee and lessor is $100,000.

13. The lessor paid $500 to an attorney to draw up the lease agreement. a. This is a capital lease for the lessee and for the lessor. Prepare a lease amortization schedule for the first two years. [12 points]

Date Lease Payment Interest Expense Amortized Principal Balance or Revenue

b. What is the amount of depreciation expense that would be recognized by the lessee at 12/31/07? (Show or explain computations. [10 points]

c. Prepare all necessary journal entries for the lessor for the year ending December 31, 2007. [28 points] Exam 1 – Acct 414 – Fall 2007 Page 9

[8] Revenue Recognition – Long-term contracts (20 points)

Ramos, Inc. began work in 2007 on contract #3814, which provided for a contract price of $7,200,000. Other details follow: 2007 2008 Costs incurred during the year $1,200,000 $3,675,000 Estimated costs to complete, as of December 31 3,600,000 0 Billings during the year 1,350,000 5,400,000 Collections during the year 900,000 5,850,000 a. Assume that Ramos uses the percentage-of-completion method of accounting. What amount of gross profit should be recognized in 2007?

b. Assume that Ramos uses the completed-contract method of accounting. What is the amount of gross profit that should be recognized in 2008?

c. Make the journal entries related to accounts receivable for 2007.

d. Under the percentage of completion method, what amount will be reported on the balance sheet at 12/31/07 with respect to this contract? Give the account title and whether it is a current or noncurrent asset or liability. Exam 1 – Acct 414 – Fall 2007 Page 10

[9] Serial Bonds (20 points maximum). On Nov. 1, 2007, Moses Corporation issued $2,000,000 in serial bonds. The bond principal will be repaid in $1,000,000 increments beginning on Nov. 1, 2008 with the final payment to be made on Nov. 1, 2009. The bonds pay interest semi-annually on May 1 and Nov. 1. The coupon rate is 10% per annum. An investment banker handled the transaction and you have just received a check for $2,055,160. Moses’ fiscal year ends on December 31.

You may choose either the bonds outstanding method or the effective interest method of amortizing bond premiums. Check the appropriate box so I’ll know what you are attempting! Prepare the journal entry that would be needed on December 31, 2007. You do NOT need to prepare an amortization table – just the journal entry.

[ ] I’m using the bonds outstanding method for a maximum of 20 points. [ ] I’m using the effective interest method for a maximum of 18 points. If you choose this option, you may assume that the effective simple interest rate per year is 8%.

December 31, 2007 Exam 1 – Acct 414 – Fall 2007 Page 11

10. Extra credit - MATCHING: [1 point each, maximum 10 points] Do not attempt the extra credit section until you have completed all other sections of the exam!

For each term, select the best phrase or description from the answers listed below. An answer may be used once, more than once, or not at all.

______1. Operating lease ______2. Present value of minimum lease payments ______3. Initial direct costs ______4. Bargain renewal option ______5. Implicit interest rate ______6. Residual value ______7. Unearned interest ______8. Nonrenewal penalty ______9. Guaranteed residual value ______10. Capital lease

A. The present value of this amount is never included in the minimum lease payments for the fair value test. B. The rate that is never used by the lessor to determine the present value of the minimum lease payments. C. Is included in the minimum lease payments if it is too small to assure that the lease will be renewed. D. Minimum lease payments plus any unguaranteed residual value. E. Depreciation expense related to the leased asset is reported on the lessor's income statement over the lease term. F. The lessor is a manufacturer or a dealer. G. Costs which are capitalized and amortized over the term of an operating lease. H. Amortized over the term of the lease using the effective interest method. I. The fair value of the leased asset is equal to the cost of the asset to the lessor. J. The rate used by the lessee to determine the present value of the minimum lease payments if the lessee's incremental borrowing rate is greater than the lessor's implicit interest rate (known to lessee). K. Included in the lessee’s minimum lease payments. L. Always included in minimum lease payments unless there is a title transfer or a bargain purchase option. M. Included in the lessor's gross investment N. Includes all periods up to the date of a bargain purchase option. O. Increases or decreases in lease payments based upon sales volume or machine useage. P. Amount recorded as sales revenue when the cost of the leased asset is less than its fair value. Q. Costs normally paid by the owner of property. R. Depreciation expense is recognized on the lessee’s income statement. Exam 1 – Acct 414 – Fall 2007 Page 12

SOLUTIONS

Problem 1 - determine lease payment for lessor Problem 2 - Sinking fund Annual rate= n= 48 mos. n= 60 5% i= 1.08% per mo. i= 0.42% pmt= ? PMT= pv= (360,000.00) pv= 100,000 fv= 80,000.00 Face value = (1,000,000) ordinary annuity = 0; ordinary annuity=0;annuity annuity due = 1 1 due=1 0 =PMT $8,288.57 Solve for pmt $ 12,817.44 Problem 4 - Debtor's interest rate Problem 3 - Fair value of bonds Stated rate= Carrying value of debt before TDR 65,000 Principal (FV) $ 1,000,000 4.50% Future cash flows - new terms: 60,000 Yield rate 5% =i n= 5 Number of payments 12 =n PV= 65,000.00 PMT= 45,000 =PV pmt= (4,000.00) Gain= ordinary=0; due=1 0 fv= (40,000.00) 5,000 Solve for PV $955,683.74 =PVMLP ordinary annuity = 0; annuity due = 1 0 0% Solve for implied interest -1.82% Since the entire amount will NEVER be repaid, per flow chart, there will be no interest recognized at all (0%). This is also apparent from the negative interest rate you might get on your calculator - meaningless! 5a n=12% original rate, new interest pmt=8,000, new principal is the FV=80,000, n=5, Solve for PV = $74,232.36 5b Interest is based on the fair value from 5a: $74,232.36 * 12% = $8,907.88 but we have to prorate for the 8 months between restructure date and end of year. $8,907.88 * 8/12 = $5,938.60 5c If the debt is settled, the debtor and creditor have “mirror image” gain/loss. For the debtor, the carrying value is $112,000 - $50,000 fair value of the asset given up = $62,000 gain. There might also be a gain or loss depending on the purchase price of the asset but that is not part of the gain from the troubled debt restructuring. Lease Solution [6] Note that executory costs paid by the lessor should not be included in the minimum lease payments. In other words, the lease portion of the payment is $43,496. Knowing this was worth 2 point. Also note that neither party includes the unguaranteed residual value in the minimum lease payments. The lessee uses 12% interest rate because they do not know the lessor’s implicit interest rate. Lessors always use their implicit interest rate, never the lessee’s incremental borrowing rate! 6-a This is an operating lease for the lessee because there is no title transfer, no bargain purchase option, the lease term is only 71% of the economic life and the present value of the minimum lease payments is $175,609 which is less than 90% of $200,000. 6-b While there was no title transfer or bargain purchase option, and the lease term was only 71% of the economic life, this is a sales type lease for the lessor because the present value of the minimum lease payments is $181,372 which is more than 90% of the $200,000 fair value. The lease also satisfied both of the 2 extra rules for lessors: the lessor expects to be able to collect the lease payments and there are no important cost uncertainties for the lessor. It is a sales type lease rather than a direct financing lease because there is a profit, i.e., the fair value is greater than the cost of the asset. Note: An unguaranteed residual value does not necessarily cause it to be an operating lease. Exam 1 – Acct 414 – Fall 2007 Page 13

7a Lessor and lessee amortization table – same because the implicit interest rate was known to lessee and lower than the lessee’s own incremental borrowing rate. Item 12 in the instructions even GAVE the present value of the minimum lease payments! I was hoping to reduce errors but didn’t succeed very well. Date Lease Payment Interest Principal Balance 06/01/07 100,000 0 06/01/07 23,203 0 23,203 76,797 1 06/01/08 23,203 6,912 16,291 60,506 2 06/01/09 23,203 5,446 17,757 42,748 3 06/01/10 23,203 3,847 19,356 23,393 4 06/01/11 23,203 2,105 21,098 2,295 5 06/01/12 2,500 205 2,295 0 7b. Depreciation expense for 2007 = $100,000 divided by 7 years = 14,285.71 * 7/12 proration = $8,333.33 We use the life of the asset rather than lease term because the lessee is presumed to buy the asset at the end of the lease since there is a bargain purchase option. 7c Lessor journal entries – remember that initial direct costs are expensed for sales type leases. Although I told you it was a “capital lease” you had to determine the type of lease (direct financing or sales-type) for the lessor. debit credit 06/01/07 Net Investment in Lease 76,797 Sales 100,000 COGS 85,000 Inventory 85,000 Cash 23,203

Initial direct costs (selling expense) 500 Cash or A/P 500 Prorated: 7/12 12/31/07 Net Investment in Lease (6912 * 7/12) 4,032 Interest Revenue 4,032

8a 66.b $1,200,000 ————— = 20% ×($7,200,000 – $4,800,000) = $600,000 for 2007. $4,800,000 Alternately, 25% of revenue = $1,800,000 less costs incurred to date $1,200,000, therefore $1.8M - $1.2M = $600,000 gross profit on the contract so far and because it is the first year, that is also the amount recognized on the income statement under the percentage of completion method.

8b Under the completed contract method: $7,200,000 – $4,875,000 total costs both years = $2,325,000

8c Same for both completed contract and percentage of completion method. Note that I underlined entries (plural!) Accounts Receivable...... 1,350,000 Billings on Construction in Process ...... 1,350,000 Cash ...... 900,000 Accounts Receivable...... 900,000

Construction in Progress For part d Progress Billings 1,200,000 1,350,000 600,000 1,800,000 8d – On the balance sheet, the net of Construction in Progress and Progress Billings will be reported as a CURRENT ASSET of $450,000 with the title: Construction costs in excess of related billings on uncompleted contracts. If I had asked for the completed contract method, the amount would have been reported as current liability of $150,000 with the title “Billings on uncompleted Exam 1 – Acct 414 – Fall 2007 Page 14 contracts in excess of cost” – the amount would be difference because the gross profit on the contract is NOT added to the inventory account under the completed contract method. However, 100% of any gross loss on the contract would be subtracted from the construction in progress account for both methods. Exam 1 – Acct 414 – Fall 2007 Page 15

9. Serial bonds. Easiest is to do bonds outstanding method. Just count up the face values outstanding: 2M + 2M + 1M + 1M = $6 million total. So the discount/premium will be amortized with the 2/6 fraction for the first 2 interest payments. Since this bond was issued at a premium, the amortization of the premium DECREASES interest expense (as compared to interest paid). To use the effective interest rate, you need to know what it is – the 8% given. I’ve pasted in complete answers for study purposes but the amortization tables are NOT necessary.

Exam 1 - Fall 2007, Acct 414 Exam 1 - Fall 2007, Acct 414 EFFECTIVE INTEREST AMORTIZATION SCHEDULE Bonds Outstanding Method 5.00% 4.000% Face Value: 2,000,000 5.00% Face Value: 2,000,000 Period Date Interest Principal Interest Amorti- Carrying BALANCE FACE Period Date Interest Principal Interest Amorti- Carrying BALANCE FACE Amortization Paid Payment Expense zation Value PREMIUM VALUE Paid Payment Expense zation Value PREMIUM VALUE Fraction 0 11/01/07 0 0 0 2,055,160 55,160 2,000,000 0 11/01/07 - - - 2,055,160 55,160 2,000,000 1 05/01/08 100,000 82,206 17,794 2,037,366 37,366 2,000,000 1 05/01/08 100,000 - 81,613 18,387 2,036,773 36,773 2,000,000 0.33333 2 11/01/08 100,000 1,000,000 81,495 18,505 1,018,861 18,861 1,000,000 2 11/01/08 100,000 1,000,000 81,613 18,387 1,018,387 18,387 1,000,000 0.33333 3 05/01/09 50,000 40,754 9,246 1,009,615 9,615 1,000,000 3 05/01/09 50,000 - 40,807 9,193 1,009,193 9,193 1,000,000 0.16667 4 11/01/09 50,000 1,000,000 40,385 9,615 0 (0) 0 4 11/01/09 50,000 1,000,000 40,807 9,193 0 - 0 0.16667 6,000,000 1 Journal entries: Exam 1 - Fall 2007, Acct 414Effective Interest Method Journal entries: Exam 1 - Fall 2007, Acct Bonds414 Outstanding Method Debit Credit Debit Credit 11/01/07 Cash 2,055,160 11/01/07 Cash 2,055,160 not req'd Premium on Bonds Payable 55,160 not req'd Premium on Bonds Payable 55,160 Bonds Payable 2,000,000 Bonds Payable 2,000,000 2K/6k = 1/3 fractikon for Yr 1 12/31/07 Interest Expense 27,402 12/31/07 Interest Expense 27,204 Interest Payable 33,333 Interest Payable 33,333 Premium on Bonds Payable 5,931 0 Premium on Bonds Payable 6,129 0 =1/3*55,160*2mos/6mos 2,088,493 2,088,493 ok 2,088,493 2,088,493 ok FRACTION OF YEAR FOR ENTRY ABOVE: 33.3% (Using yearfrac function) FRACTION OF YEAR FOR ENTRY ABOVE: 33.3% (Using yearfrac function) 33.3% 2 Months to year end 33.3% 2 months to year end

05/01/08 Interest Expense 54,804 05/01/08 Interest Expense 54,409 Interest Payable 33,333 Interest Payable 33,333 Premium on Bonds Payable 11,862 Premium on Bonds Payable 12,258 Cash 100,000 Cash 100,000 100,000 100,000 ok 100,000 100,000 ok

Computation of interest expense for effective interest method = carrying value $2,055,160 * 4% yield rate * 2/6 months. The interest payable is the coupon rate 5% * face value $2,000,000 * 2/6 months. We then BACK INTO the amortization of the premium.

For the bonds outstanding method, we compute the amortization n of the premium (a debit) by taking the faction 2,000K/6,000K * 55,160 original amount of premium and prorating for 2/6 months. The interest payable is coupon rate 5% times face value $2,000,000 * 2/6 months. We then BACK INTO interest expense. Remember, a premium REDUCES interest expense (as compared to interest paid) while a discount increases interest expense.

Extra Credit: Lease terminology 1 E 2 P 3 G 4 L 5 J 6 M 7 H, M 8 C 9 M,L,K 10 R There was no “R” on the actual exam – none of the above would have been the best answer. I also accepted “N” although that is really the “lease term.”