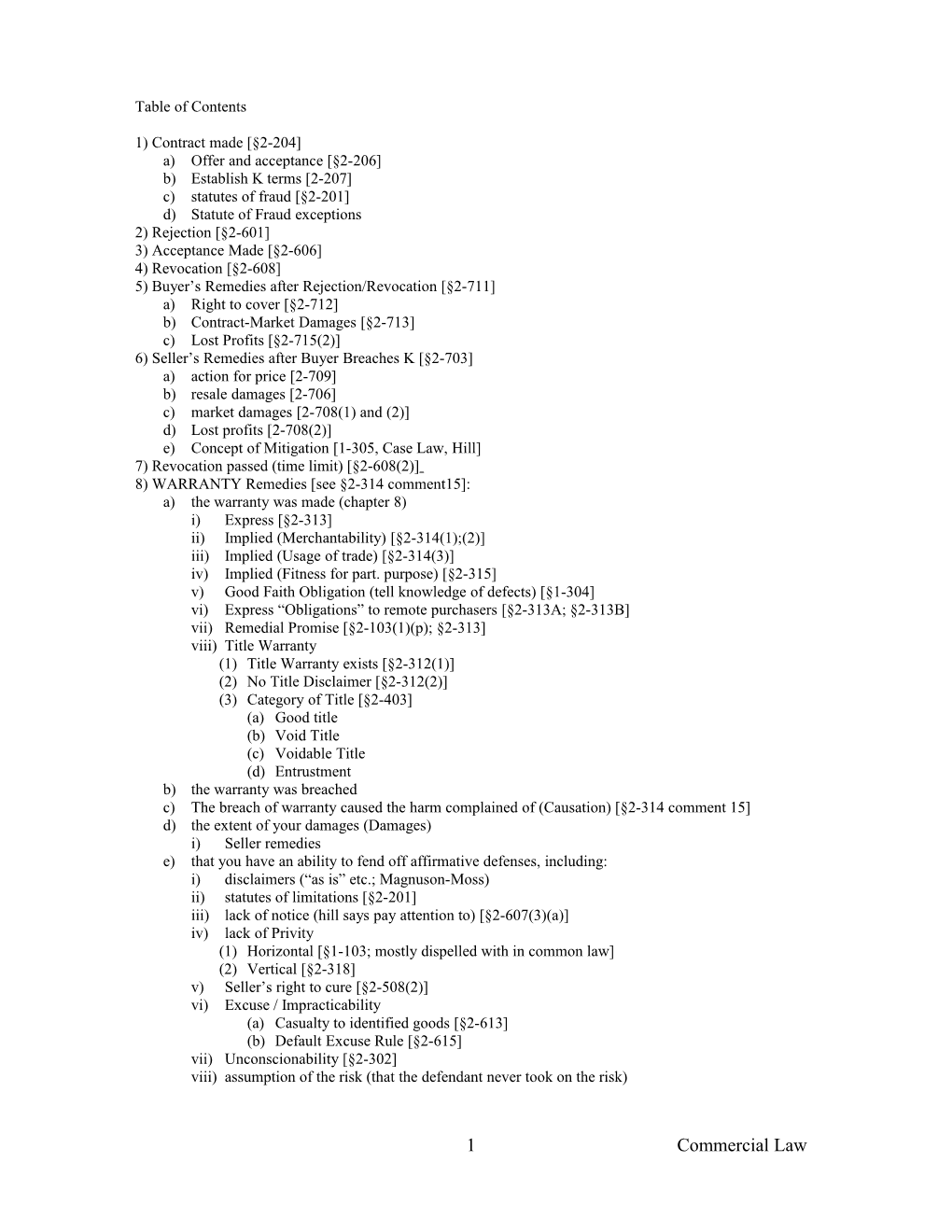

Table of Contents

1) Contract made [§2-204] a) Offer and acceptance [§2-206] b) Establish K terms [2-207] c) statutes of fraud [§2-201] d) Statute of Fraud exceptions 2) Rejection [§2-601] 3) Acceptance Made [§2-606] 4) Revocation [§2-608] 5) Buyer’s Remedies after Rejection/Revocation [§2-711] a) Right to cover [§2-712] b) Contract-Market Damages [§2-713] c) Lost Profits [§2-715(2)] 6) Seller’s Remedies after Buyer Breaches K [§2-703] a) action for price [2-709] b) resale damages [2-706] c) market damages [2-708(1) and (2)] d) Lost profits [2-708(2)] e) Concept of Mitigation [1-305, Case Law, Hill] 7) Revocation passed (time limit) [§2-608(2)] 8) WARRANTY Remedies [see §2-314 comment15]: a) the warranty was made (chapter 8) i) Express [§2-313] ii) Implied (Merchantability) [§2-314(1);(2)] iii) Implied (Usage of trade) [§2-314(3)] iv) Implied (Fitness for part. purpose) [§2-315] v) Good Faith Obligation (tell knowledge of defects) [§1-304] vi) Express “Obligations” to remote purchasers [§2-313A; §2-313B] vii) Remedial Promise [§2-103(1)(p); §2-313] viii) Title Warranty (1) Title Warranty exists [§2-312(1)] (2) No Title Disclaimer [§2-312(2)] (3) Category of Title [§2-403] (a) Good title (b) Void Title (c) Voidable Title (d) Entrustment b) the warranty was breached c) The breach of warranty caused the harm complained of (Causation) [§2-314 comment 15] d) the extent of your damages (Damages) i) Seller remedies e) that you have an ability to fend off affirmative defenses, including: i) disclaimers (“as is” etc.; Magnuson-Moss) ii) statutes of limitations [§2-201] iii) lack of notice (hill says pay attention to) [§2-607(3)(a)] iv) lack of Privity (1) Horizontal [§1-103; mostly dispelled with in common law] (2) Vertical [§2-318] v) Seller’s right to cure [§2-508(2)] vi) Excuse / Impracticability (a) Casualty to identified goods [§2-613] (b) Default Excuse Rule [§2-615] vii) Unconscionability [§2-302] viii) assumption of the risk (that the defendant never took on the risk)

1 Commercial Law CISG

1) Closing/Rejection under CISG [Assignment 19] 2) CISG Seller Remedies [Assignment 23] a) Seller that “avoids” contract: b) Seller suing for price, not avoiding K 3) CISG Buyer's remedies [Assignment 26] a) Buyer Remedies when not avoiding b) Avoiding buyer may sue the seller for 4) CISG Finance Leases, International Leases [Assignment 11]

Hill: We are given a series of interrelated steps 2-301: obligation is seller to accept and deliver and buyer accept and pay 2-503: how you tender delivery 2-308: tells you where the default place of delivery is: the seller's place of business 2-310: Open time for Payment or running of credit. 2-511: Tender of payment 2-513: Buyer has a right to inspection 2-606: acceptance 2-607 tells us the consequences of acceptance 2-608: important: revoke acceptance.

2 Commercial Law PAYMENT SYSTEMS 1. Definitions [4-104] a. Overdraft[§4-401(a)] b. Overdraft not customer’s fault[§4-401(b)] c. Post Dating[§3-113] d. Stopping Payment[§4-403(a)] i. Stop payment lasts 6 months [§4-403(b)] ii. Improper payment remedy applies to Consequential Damages [§4-402(b)] e. Stale Checks [§4-404]: applies to greater than 6 mos. old f. Subrogation of rights [4-407] g. Ordinary Care[§4-103] 2. Payor Bank's Obligation to Payee a. payee has no rights against the payor bank: 3. Special checks a. Certified check [§3-409(d)]: a "pre-accepted" check b. "Cashier's" or "teller's" check: [§3-104(g),(h) 4. Process of Collection ( Payee obtains payment) a. Cash the check [§4-301(a)] i. Cash payment is final. [§§4-215(a)(2), 4-215 comment 4 (paragraph 5)] ii. Obtain direct payment b. depositor credit ("provisional settlement") i. "midnight deadline" to decide whether to honor check [§4-301(a),(b)] ii. (midnight of the next banking day, [§4-104(a)(10)]) 1. payor bank honors check, 2. payor bank decides not to honor payee/customer. 3. Payor bank does nothing, it loses the right to dishonor [§4-214(c), §4-301(b)] 5. transfer and presentment warranties. a. Transfer of an instrument [§3-203(a)] b. "person entitled to enforce" an instrument [§3-301] c. “Holder” definition[1-201(b)(21)] d. Allocating Losses§3-415 6. Indorsement: Simple way to transfer rights a. Indorsement Methods i. blank" indorsement: [§3-204] ii. "Special" indorsement[§3-205(a)] iii. "restrictive indorsements"[ §3-206] iv. Stale Indorsements [3-415(e)] – 30 days b. Indorser-Liability Rule[§3-415] i. Indorser liability [§3-415] ii. Drawer liability [§3-414] 7. Risk of Loss in Checking system a. SEE pp 24-25 in STUDENT OUTLINE b. No Delivery of check = no conversion claim [§3-420(a)(ii)] c. Employee Theft [§3-405(b)] d. Imposter/Lack of intent to issue payee [§3-404(b)(1)] i. Bank must exercise ord. care to avoid obligation [§3-404(d); see §4-103] e. Uncertified chk dishonored, if obligor owes obligation, obligee can enforce [§3-310(b) i. If 3rd party check, then when instrument discharged, so is obligation. 8. Letters Of Credit a. International Use b. Advising and Confirming Banks[§5-107(b),(c); UCP 7(a)]. c. Choice of Law UCP [§5-116(c)] d. Consideration[§5-105]. e. Issuing LOC[§5-106(a)] f. Reimbursement g. Drawing on the Credit. i. Reimbursement: 9. Negotiable Instruments 3 Commercial Law a. Defining if Neg. Instrument [3-104]: b. Two broad categories of neg inst. 3-104(e) c. Negotiable instrument must [Hill says work through 3-104(a) d. Effect of Instrument on underlying obligations i. SEE p 42 STUDENT OUTLINE ii. Near cash instruments [§3-310(a, c)] iii. Ordinary instruments [§3-310(b)] iv. Accord and Satisfaction [§3-311] 10. Transfer and Enforcement of Negotiable Instruments [Assignment 22] a. Thief on indorsed check b. types of indorsements 3-205 and 3-206. i. Special indorsement (it is to a person), ii. blank indorsement (anything other than person), and iii. anomalous iv. restrictive indorsement 11. Assignment 23: Holders in Due Course a. Requirements for Holder in Due Course Status. b. Rights of Holders in Due Course[§3-305(b)]. i. Real Defenses (four) [§3-305(a)(1)] c. Payment and Discharge d. Transferees Without Holder-in-Due Course Status

4 Commercial Law Contract Made

FORMATION OF THE SALES CONTRACT (UCC 2-201 to 2-210) 2-201 to 2-210 – rules for formation of a sales contract. They are exceptional rules. Overall, simple contract rules of formation apply to sales law. Generally, price, time and place of payment or delivery, general quality of goods, or any particular warranties not needed to form a contract. See Comments to 2- 201. Question is whether there was intent to create a contract. Contract formation and related issues: i. Whether a contract was formed. ii. What are the terms of the contract. iii. Whether the contract is enforceable. Do you need some writing to make the contract enforceable? This is different question than whether a contract was formed. Hypo. Suppose A and B at party around pool and drinking and close to drunk. Seller, A, brags that his company manufactures a brand new modern efficient vacuum cleaner without a filter bag and it is hottest item around. B, a supplier of home appliances, listens to this puffery and says “I want a 100 of these.” Next day, A, who was probably more sober sends an email “confirming your order of 100 vacuum cleaners price $400 per vacuum cleaner.” Was an enforceable contract created? Raises issues of S/F and indefiniteness.

A. OFFER AND ACCEPT ANCE. Determining whether a contract was formed is the first analytical piece. [§2-206] Principal code provisions for K formation - 2-204 (Formation in General) and 2-206 (Offer and Acceptance in Formation of Contract). Contract Formation in General. "A contract for sale of goods may be made in any manner sufficient to show agreement, including offer and acceptance, conduct by both parties that recognizes existence of the contract, ..." 2-204(1). "Even though one or more terms are left open a contract for sale does not fail for indefiniteness, if the parties have intended to make a contract and there is a reasonably certain basis for giving an appropriate remedy." 2-204(3). Offer and Acceptance in Formation of Contract. "Unless otherwise unambiguously indicated by the language or circumstances, (a) an offer to make a K shall be construed as inviting acceptance in any manner and by any medium reasonable; (b) an offer or other offer to buy goods for prompt shipment is construed as inviting acceptance wither by prompt promise to ship or by prompt or current shipment of conforming or nonconforming goods, but shipment of nonconforming goods is not acceptance if seller seasonably notifies buyer that it is offered only as accommodation to buyer." 2- 206(1). Acceptance not required to be mirror image of offer to form a contract - discrepancies between offer and acceptance permitted. "A definite and seasonable expression of acceptance in a record operates as acceptance even if it contains terms additional to or different from the offer." 2-206(3). Record needed for Quantity of goods and price greater than $5000 2-201(1) says "A contract for sale of goods for price of $5,000 or more is not enforceable unless some record sufficient to indicate a K was made and signed by party against which enforcement is sought. A record is not insufficient because it omits or incorrectly states a term agreed upon but a K is not enforceable under this subsection beyond the quantity of goods shown in the record

B. WHAT ARE THE TERMS OF THE CONTRACT? The second analytical question. Presuming a contract is formed, revised 2-207 talks of the contract terms.

5 Commercial Law C. IS THE CONTRACT ENFORCEABLE - THE STATUTE OF FRAUD. The third analytical question. 2-201(1), the SIF provision that applies to the sale of goods, says a contract for sale of goods for more than $5K is not enforceable without a writing. Exceptions

Between merchants, if within a reasonable time a record confirming the contract is sent, and the party receiving it has reason to know its contents, it satisfies the SIF unless the recipient sends notice of objection within 10 days. 2-201(2). 2-201(3) says a contract that does not satisfy 2-201(1) is still enforceable if: o The goods are specially manufactured for buyer and not suitable for sale to others in ordinary course of seller's business and seller has already made substantial beginning of their manufacture or commitments for their procurement; or o Party against which enforcement is sought admits in a pleading, or in testimony, or otherwise under oath that a K was made, but not beyond the quantity of goods admitted; or o With respect to goods for which payment was made and accepted or which have been received and accepted. Volume Sellers. See 2-708(2). "Course of dealing is a sequence of previous conduct between parties to particular transaction which is fairly regarded as establishing a common basis of understanding for interpreting their expressions and other conduct. § 1-205(1). Two part inquiry as to whether contract exists and is it enforceable. Hill says don't focus on what the terms are, but: (1) whether there is a K at all; then, (2) If you find a K, why is there a K? Is there a K because of conduct of the parties or because of a writing between the parties, or because of an exchange of forms. 2-204(1) - Formation in General. 2-204 is the starting point for contract formation 2-206 - Offer and Acceptance in Formation of Contract. A 2-204 subspecies. Talks about an offer and acceptance Contracts formed by conduct of the parties. E.g., A ships goods to B, and he pays. We assume there is a K for sale of goods. Contract formed by “definite and seasonable expression of acceptance.” 2- 206(3) says: “A definite and seasonable expression of acceptance in a record operates as an acceptance even if it contains terms additional to or different from the offer.” i. “Seasonable expression” means timely expression. Defined in 1-205. E.g., A sends offer to B to buy product. B immediately sends the product and 3 days later sends a confirmation with different terms from the offer. It may be that we will not exclude that acceptance even though it came in 3 days later. That is a seasonable acceptance. Under 2-206, conflicting terms do not prevent formation of a contract. Sometimes conflicting terms do prevent formation of a contract.

E. DETERMINING IF A CONTRACT IS ENFORCEABLE - STATUTE OF FRAUDS Difference between K formation and S/F . They are two different things. Once you find a K, then there is a Q as to whether the K is enforceable. It mayor may not depending on whether the SIF is applicable and whether you complied with the S/F 2-201- Formal Requirements; Statute of Frauds. New 2-201 says for the sale of goods for $5K or more, all you need is a record sufficient to say a K has been made and signed by the party against whom enforcement is sought. It must be signed at least by the person against whom you are trying to enforce it. 2-201 requires "a record sufficient to indicate a K ... has been made" and Official Comment suggests leniency. Per 2-201(2), record in confirmation of oral agreement is not effective against a non- merchant. E.g., in Decatur Cooperative the co-op sent a written confirmation to the farmer to confirm an oral agreement to buy wheat. Farmer successfully argued he was not a merchant 6 Commercial Law Merchant defined. 2-104 says " A merchant is a person who deals in goods of the kind or otherwise holds itself out by occupation as having knowledge or skill peculiar to the practices or goods involved in the transaction ..." Hill would argue the farmer is a merchant. -Comment 4 to 2-201 supports finding a farmer is a merchant. Comment 4 to 2-201 says, "thus a farmer or professional should be a merchant ..."

Acceptance 1. Accepting Goods [§2-606] a. Created in three ways, when the buyer: [§2-606(1)] i. “signifies to the seller that the goods are conforming” or will take despite, after “reasonable opportunity to inspect goods” [§2-606(1)(a)] ii. “fails to make an effective rejection” after reasonable opportunity to inspect goods; [§2-606(1)(b)] iii. “does any act inconsistent with the seller’s ownership” [§2-606; see §2-608(4)] b. Buyer is always given the “right before payment or acceptance to inspect [goods] at any reasonable place and time and in any reasonable manner.” [§2-513(1)] i. Until inspection, buyer may “reject” goods ii. After inspection time and acceptance, buyer may “revoke” acceptance c. Requires the buyer: [§2-607] “effect of acceptance” i. Pay K rate for any accepted goods [§2-607(1)] ii. Be precluded from rejection of goods iii. Be precluded from revocation of goods if made with knowledge of nonconformity unless there was an assumption of cure.

Rejection: Useful b/c allows buyer (but does not require), to cancel the contract with seller 1. Rejection is effective where[§2-601]: a. There has been no acceptance [§2-607(1)] b. it occurs within a reasonable time after delivery of goods [§2-605(1)] c. goods "fail in any respect to conform to the K" (the "perfect tender" rule) [§2-601], exceptions include: i. Installment K (series of separate deliveries): buyer may reject installment only if “non-conformity substantially impairs the value of that installment and cannot be cured." §2-612(2) ii. Explicit K limits: buyer remedies may be contractually limited, including right to reject, thereby obligating buyer to accept seller's efforts to repair or replace defective parts. iii. Right to Cure by Seller: seller's right to cure often reverses buyer's rejection. iv. Commercial leeway: concepts such as usage of trade, course of dealing, and course of performance may allow some "commercial leeways in performance" precluding rejection of less than perfect tender [official comment 2 to §2-106] d. buyer seasonably notifies the seller [§2-602] e. buyer states specific rejection grounds (or risk losing grounds to justify rejection) [§2-605] 2. Rejection requires: a. Buyer exercise good faith; and b. If Non-merchant buyer: hold goods (little responsibility) [§2-602(2)(b)] i. with reasonable care; and ii. for a time sufficient to enable seller to remove them c. If Merchant Buyers: (slightly higher duty) [§2-603(1)] i. When goods are 1. in buyer's possession; and 2. Seller has no agent at place of rejection, ii. Merchant Buyer must follow 1. any reasonable instructions of the seller to resale, storage, or like

7 Commercial Law 2. If goods are perishable (or will quickly lose value), buyer must sell on seller's behalf Revocation [§2-608] Useful where buyer has accepted or the has lost legal right to reject [§2-607(2)] 1. Revocation is effective if [§2-608]: a. Non-conformity will "substantially impair" the value of goods [§2-608(1)]; and b. buyer seasonably notifies the seller [§2-608(2)]; and c. Buyer must have either [§2-608(1)]: i. reasonably believed problem would be cured and Problem has not been cured; or [(a)] ii. been unaware of problem; and lack of awareness is due to: [(b)] 1. seller's assurances; or [see N.A. Light v. Hopkins Mfg 7th 1994] 2. problem was too hard to discover before acceptance

Buyer’s Remedies after Revocation or Rejection [§2-711]: If Seller in breach, buyer has [§2-711]: 1. Right to get money back 2. Right to cover [(d); §2-712] (Useful where buyer buys replacement goods) a. Eligible where i. Seller "wrongfully fails to deliver or repudiates," or Buyer "rightfully rejects or justifiably revokes acceptance"[§2-712(1)] 1. Repudiation Includes: a. Language reasonably interpreted to mean other party will not or cannot make a performance still due [§2-610(2)], or b. Affirmative conduct that would appear to a reasonable person that future performance by other party impossible. [§2-610(2)] c. If reasonable grounds for insecurity: i. following seller receipt of justified demand and failure to provide within a reasonable time (not exceeding 30 days) adequate assurance of due performance [§2- 609(4)] d. May be retracted [§2-611] ii. Buyer makes "reasonable purchase" (or contract to purchase) [§2-712(1)] 1. for "goods in substitution for those due from seller" a. Were the goods really the same as the contract goods? 2. in good faith a. Did the buyer pay too much to cover goods (would go to good faith and reasonability of purchase)? 3. "without unreasonable delay" a. Did the buyer wait too long to cover? iii. For anticipatory repudiation, explicitly states aggrieved party (buyer) may "for a commercially reasonable time await performance" [§2-610(1)] iv. "The proper test is whether at time and place of cover buyer acted in good faith and in a reasonable manner" [Comment 4 of §2-712] b. Damage Formula is [§2-712(2), §2-715, §1-305] i. RBPP + CC - KP + ID + CD - ES, where [§2-712(2)]: 1. RBPP = Return of any Purchase price paid by buyer 2. CC = Cost of Cover [Comment 4 for §2-712] a. Definition of cover is flexible 3. KP = Contract Price 4. ID = Incidental Damages [§2-715(1)] a. Incident to delay or other breach, expenses reasonably incurred in inspection, receipt, transportation and care and custody of goods rightfully rejected, any commercially reasonable charge, expenses or commissions in connection with effecting cover or expenses 5. CD = Consequential Damages [§2-715(2)] a. Category I allows damages (due to breach) [§2-715(2)(a)] i. of any kind, including purely economic loss 8 Commercial Law ii. of a particular requirement or need which seller had reason to know at time of contracting 1. selling "wares to one in the business of reselling . . . is one of the requirements of which the seller has reason to know" [Comment 6 of §2-715] 2. follows common law which makes seller liable for all consequential damages he had "reason to know" in advance but modified by mitigation need [§2-715 Comment 2; Hadley v. Baxendale (on forseeability)] iii. that were "caused in fact" (mere "but-for" cause rather than "proximate cause") iv. that could not be prevented "by cover or otherwise (basic mitigation principle) v. includes Lost Profits [Jetpac v. Bostek (D. Mass. 1996)] b. Category II allows damages which are [§2-715(2)(b)] i. personal injury or property damage (economic loss does not qualify here), and ii. proximately caused by seller's breach (mere but-for cause is not enough) iii. and there is no: 1. Hadley v. Baxendale foreseeability limit, nor 2. explicit language to mitigate. 6. ES = Expenses Saved as a result of seller's breach ii. Cover remedy is optional, whereby failure to cover "does not bar the buyer from any other remedy" [§2-712(3)] iii. Lost Profits Limit (minority of courts) [§1-305] 1. Damage Formula losses may not exceed lost profits. a. No court has yet used §1-305 to limit contract-cover damages. i. Possible where initial buyer (B1) has K with own buyer (B2) whereby B1 profit is unaffected by MP (e.g. a "cost plus" valid expenses K). [see KGM Harvesting v. Fresh Network (Cal. Ct. App. 1995)] 1. If seller backs out, B2 must pay additional expenses. 2. B1 may then get K-market damages, and unless he passes on to B2, B1 gets windfall, contrary to §1-305 b. Under K-Market i. Some courts have said this limit does not apply, if windfall occurs it should go to non breaching party [Texpar v. Murphy Oil (7th Cir. 1995)] ii. Some courts have said limit does apply under §1-305 [Allied Canners v. Victor Packing (Cal Ct. App., 1984)] 3. Right to Contract-Market Damages [§2-713] (Useful where buyer rejected, revoked, or never received goods and isn’t covering) a. Eligible where [§2-712(1)] i. Seller "wrongfully fails to deliver or repudiates"; or ii. Buyer "rightfully rejects or justifiably revokes acceptance" b. Damage formula: i. RBPP + MP - KP + ID + CD - ES, where [§2-713]: 1. RBPP = Return of any Purchase price paid by buyer 2. MP = Market Price; a. Measure Time at [see §2-713(1)(a),(b)]:

9 Commercial Law i. For seller non-delivery, buyer rejection or revocation: Time for Tender [§2-713(1)(a)] ii. For seller anticipatory repudiation: Commercially reasonable time after buyer learned of repudiation, but no later than time for tender. [§2-713(1)(b)] iii. Repudiation includes: 1. Language reasonably interpreted to mean other party will not or cannot make a performance still due [§2-610(2)], or 2. Affirmative conduct that would appear to a reasonable person that future performance by other party impossible. [§2-610(2)] 3. If reasonable grounds for insecurity: 4. following seller receipt of justified demand and failure to provide within a reasonable time (not exceeding 30 days) adequate assurance of due performance [§2-609(4)] iv. Repudiation may be retracted [§2-611] b. Measure Place at [§2-713(2)] i. "Place for tender," (most cases) or ii. "Place of arrival" for rejection or revocation occurring after arrival 3. KP = Contract Price 4. CD = Consequential Damages [§2-715(2)] a. Category I allows damages due to breach [§2-715(2)(a)] i. of any kind, including purely economic loss ii. of a particular requirement or need which seller had reason to know at time of contracting 1. selling "wares to one in the business of reselling . . . is one of the requirements of which the seller has reason to know" [Comment 6 of §2-715] 2. follows common law which makes seller liable for all consequential damages he had "reason to know" in advance but modified by mitigation need [§2-715 Comment 2; Hadley v. Baxendale (on forseeability)] iii. that were "caused in fact" (mere "but-for" cause rather than "proximate cause") iv. that could not be prevented "by cover or otherwise (basic mitigation principle) Which include Lost Profits v. Includes lost profits [Jetpac v. Bostek (D. Mass. 1996)] b. Category II allows damages which are [§2-715(2)(b)] i. personal injury or property damage (economic loss does not qualify here), and ii. proximately caused by seller's breach (mere but-for cause is not enough) iii. and there is no: 1. Hadley v. Baxendale foreseeability limit, nor 2. explicit language to mitigate. 5. ID = Incidental Damages [§2-715(1)] ii. Lost Profits Limit (minority of courts) [§1-305, caselaw] 1. Damage Formula losses may not exceed lost profits [§1-305] a. Some courts have said this limit does not apply, if windfall occurs it should go to non breaching party [Texpar v. Murphy Oil (7th Cir. 1995)]

10 Commercial Law b. Some courts have said limit does apply under §1-305. Court said limit applies if: [Allied Canners v. Victor Packing (Cal Ct. App., 1984)] i. seller knew of buyer resale K ii. buyer unable to show it will pay damages to its own buyer iii. seller acted in good faith 4. Right to Specific Performance (certain circumstances) 5. Right to hold goods [§2-711(3)] a. Useful where buyer (applying a self help remedy) [Text 393]: i. Still holds goods it intends to revoke or reject ii. Has paid either all or some of purchase price b. Eligible where buyer i. Has "rightful rejection or justifiable revocation of acceptance" [§2-711(3)] c. Buyer receives (damage formula): i. Security Interest in goods in buyer's control as security for repayment of [§2- 711(3)] 1. Buyer's purchase price ("any payments made on their [goods] price"), and 2. any expenses the buyer incurs in holding or storing the goods (inspection, receipt , transportation, care and custody) ii. Right to resell goods "in like manner as an aggrieved seller" [§2-711(3); see §2- 706(1)]

Seller’s Remedies after Buyer Breaches Contract Two general UCC provisions related to seller's remedies

"Spirit of the remedies" section, sets down two principles [§1-305]:

1. Goal of all remedy provisions is "that the aggrieved party may be put in as good a position as if the other party had fully performed" [§1-305(a)]. a. "Benefit of the bargain" idea from common law b. Provides way to measure conflicting interpretations of each seller's remedies c. Contextual 2. Consequential damages are not allowed unless a specific provision allows [§1-305(a)]. a. Seller's Consequential damages apply where [§2-710]: i. Buyer breach [§2-710(2)]. ii. Loss results from Seller's general or particular reqmnts or needs [§2-710(2)]. iii. Buyer (at time of contracting) had reason to know of req. and needs. [§2-710(2)]. iv. Losses "could not reasonably be prevented by resale or otherwise." [§2-710(2)]. v. Recovery not from a Consumer ("may not recover CD from a consumer") [§2- 710(3)] b. Broad definition of "incidental damages" under §2-710 often supplies way around this provision, whereby CD become indistunguisable from Incidenal damages [see Firwood Mfg Co. v. General Tire (6th Cir. 1996)]

Seller's Remedies in General; section lists [§2-703]: 1. Ways buyer might breach contract include [§2-703(1)]: a. Five acts listed explicitly [§2-703(1)]: i. Wrongfully reject goods ii. Wrongfully revoke acceptance iii. Fail to perform a contractual obligation iv. Fail to make a payment when due, or v. Anticipatorily repudiate the contract 1. Involve buyer failing to timely pay the full price for goods purchased. [§2-703(1)]. 2. Remedies available to seller include [§2-703(2)]: a. Actions seller may take to limit damages [§2-703(2)(a)-(e)] 11 Commercial Law i. Withhold delivery [(a); §2-703A] ii. Stop delivery in “possession of a carrier or other bailee" [(b); §2-705] iii. Identify goods to the contract (anticipatory repudiation) [(c); §2-704] 1. Apex Oil v. Belcher: page 6: has discussion on what identification means, includes §2-103(2);§2-501 iv. Reclaim goods if [(d); §2-507(2); §2-702(2)] 1. “Delivery on Condition” [§2-507(2)] 2. Payment due and demanded on delivery of goods (or documents of title) [§2-507(2)]; a. Refers to a seller receiving a check later dishonored [Comment 3 §2-507] 3. Demand to reclaim is made within reasonable time after: a. seller discovers (or should have discovered) payment was not made 4. “Buyer has received goods on credit while insolvent” [§2-702(2)] a. Buyer received goods on credit b. Buyer was insolvent c. Demand to reclaim made within a reasonable time after: i. Buyer’s receipt of goods v. Require payment directly from buyer if [(e); §2-325(c)] b. Measures of monetary damages. [§2-703] i. Resell and recover damages [(g); §2-706] 1. Seller is eligible whenever [§2-706]: a. Buyer breaches [§2-706(1)], b. Resale made in good faith & commercially reasonable manner [§2-706(1)], i. Hill takes this as a Mitigation hint c. Seller reasonably identifies goods being resold as referring to broken contract [§2-706(2)], d. Seller gives buyer notice of resale [§2-706(3); (4)(b)(c)]; and i. Except in case of perishable goods or subject to quick decline in value. [§2-706(4)(b)] e. Seller resells goods at a public or private resale [§2-706(2)]. 2. The damages formula is: [§2-706(1)] a. KP – RP + ID – ES, where i. KP = contract price ii. RP = resale price iii. ID = incidental damages iv. ES = expenses saved due to buyer’s breach v. CD = consequential damages b. Any resale profit belongs to Seller [§2-706(6)]. 3. When resale takes place over extended period of time, two issues raised are: a. May seller’s resale still be considered commercially reasonable? b. will seller be compensated for time value of money lost to the delay c. Case: Firwood Mfg. Co. v. General Tire (6th Cir 1996) 4. Firwood suggest wisdom of allowing sellers be eligible for consequential damages. a. §2-709(1)(b): “if seller is unable after reasonable effort to resell at a reasonable price or the circumstances reasonably indicate that such effort will be unavailing” b. Had seller in Firwood case sued immediately for price. Despite good faith efforts that mainly benefit breaching buyer, sixth circuit was not willing to give seller time value of its money. c. Policy not is seller is in much better position than buyer to dispose of goods for highest possible price.

12 Commercial Law d. If sellers are encouraged to immediately sue for price rather than wait to resell, it will be the buyer rather than the seller that will ultimately have to dispose of the goods. ii. Recover contract-market damages [(h); §2-708(1)] (without resale) 1. Eligible where buyer [§2-708(1)] a. Non-accepts (wrongfully) [§2-708(1); §2-703(1)] b. Repudiates, [§2-708(1)] 2. Damage formula is [§2-708]: a. KP – MP + (ID + CD) – ES; where i. KP = contract price ii. MP = Market price at time and place for tender 1. Time: earlier of a. K tender time [§2-708(1)(a)]; or b. “commercially reasonable time” after seller learned of a repudiation [§2- 708(1)(b)] 2. Place: function of the delivery term. iii. ID = incidental damages [§2-708(1)(a); §2-710] iv. ES = expenses saved as a consequence of buyers breach [§2-708(1)(a)] v. CD = consequential damages iii. Recover Lost Profits §2-708(2): Complicated formula will be covered in assignment 24. 1. Think of lost-profits seller as one who, had buyer not breached, would have sold those same goods to another buyer and made an additional profit. Thus, the seller will have lost a profit by buyer’s breach, and 2. neither contract-resale nor contract-market damage measures truly puts this seller in the same position had buyer not breached. iv. Sue for the price under §2-709; [(j);§2-709] 1. This remedy is the seller’s right of specific performance: it allows seller to file suit forcing the buyer to pay the agreed upon price. 2. Remedy not always available. Seller is eligible to sue for price in any of the following three circumstances (all of which assume buyer has not paid) where: a. Buyer has accepted goods or b. There are: or i. Conforming goods, whether or not accepted, have been lost or damaged ii. and loss or Damage occurred “within a commercially reasonable time after risk of loss passed to buyer c. Seller has i. identified goods to contract and ii. there is no reasonable prospect of reselling them [§2- 709(1)] d. If none of circumstances exists, seller cannot sue for price i. Case: Weil v. Murray (S.D.N.Y. 2001) 3. Requirements a. If seller sues for price, seller must hold contracted goods for buyer [§2-709(2)]. b. If buyer has to pay, the buyer is entitled to goods. c. If while seller is holding goods, resale becomes possible then seller may resell and must deduct from its action any proceeds of resale. §2-709(2). i. Seller who sues for price is also eligible to recover incidental damages (under §2-709 amended, consequential damages as well). 1. Incidental damages are defined as 13 Commercial Law a. “any commercially reasonable charges, expenses or commissions b. incurred in stopping delivery, transportation, care and custody of goods after buyer’s breach, c. in connection with return or release of the goods or otherwise resulting from the breach.” [§2-710] 2. Consequential damages defined in §2-710 amended in same way as buyer’s consequential damages in §2-715(2)(a): a. any loss resulting from breach that breaching party had “reason to know” at time of contracting and that b. could not be prevented by the aggrieved party. v. Damages in any manner “reasonable under the circumstances.”[(m)] c. Other remedies i. Cancel the contract [(f); 2-703A] ii. Specific performance [(k); §2-716] iii. Liquidated damages [(l); §2-718] iv. Damages in any manner “reasonable under the circumstances.”[(m)] i. Note that 1. First three remedies listed are actually actions seller may take to limit damages [§2-703(a)- (c)] 2. Last four represent measures of damages. [§2- 703] 3. Remedies set out in §2-703 are probably intended to encompass all of seller’s remedies, but are not meant to be mutually exclusive to each other. a. Example: ii. Buyer anticipatorily repudiated contract before seller identified the goods. iii. Seller could theoretically pursue four of the listed remedies: 1. Withhold delivery, 2. Identify them to contract, 3. Resell them to a third party buyer and sue for resale damages, and 4. Cancel the original contract (since the “canceling” party always retains the right to sue for breach, §2-106(4)) iv. Whether pursuit of one remedy should bar another is not always as simple as the example. a. Example: v. If aggrieved seller resells goods intended for original contract prior to original performance date, 1. Can seller later choose to pursue contract- market damages rather than resale damages if former end up being more lucrative than latter? vi. UCC guidance is cryptic [comment 1 to §2-703]: 1. “rejects any doctrine of election of remedy as a fundamental policy" and thus:

14 Commercial Law a. "Remedies are essentially cumulative in nature and include all of the available remedies for breach." b. "Whether the pursuit of one remedy base another depends entirely on the facts of the individual case” Concept of Mitigation [1-305, Case Law, Hill] Nothing in code requires mitigation, but Hill believes: 1. if you have a good faith concept that says you must exercise of in executing a K, that may have mitigation effects 2. Case law is there for mitigation (Hill knows it is in NJ) 3. There is a dictate in the UCC that you behave reasonably, commercially reasonably

Revocation Time limits [§2-608(2)] 1. Revocation must occur within: [§2-608(2)] a. a reasonable time after the buyer actually discovered or should have discovered grounds for revocation; and b. Before any substantial change in goods that were not caused by own defects. 2. As with rejection, revocation is not effective until buyer notifies seller of it.

Post Rejection/Revocation Remedies:

"Deduction of Damages from Price" [2-717] (Useful where buyer only seeks damages to unpaid purchase price) 1. Eligible where buyer [§2-717] a. Notified seller of intention to deduct damages 2. Gives buyer power to (damage formula) [§2-717] b. Deduct: "all or any part of the damages" due to contract breach c. Deduct from: "any part of the price still due under same contract"

Sue under Breach of Warranty ("Breach in Regard to Accepted Goods") [§2-714]: Useful where buyer can no longer reject or revoke [Comment 1 §2-714]. 1. Eligible where buyer a. Accepted; whereby buyer has either [§2-714(1); §2-606(1)] i. Had reasonable time to inspect and [§2-606(1)(a),(b)]: 1. Signified to buyer goods are conforming or that will retain despite nonconformity [§2-606(1)(a)]; or 2. Failed to make effective rejection under §2-602(1) [§2-606(1)(b)]; or ii. Does any act inconsistent with seller's ownership [§2-606(1)(c)] 1. Subject to rules defining buyer use after a rightful rejection or revocation. [§2-606(1)(c); 2-608(4)] b. Given notice "within a reasonable time after the buyer discovers or should have discovered any breach." [§2-714(1), §2-607(3)] i. Failure to give notice bars remedy as far as seller prejudiced by failure c. Fulfilled other requirements of warranty application [my own comment] i. Privity; meet a warranty provision in code (such as warranty of title, warranty of merchantability, particular use) 2. Damage formula is [§2-714]: a. If Repair possible: Cost of repair [Text 393; §2-714(1); §1-305(a)] i. Viewed as an acceptable surrogate to VCG - VNCG value 1. Buyer is permitted to recover for his loss 'in any manner which is reasonable'" [Comment 2 of §2-714] 2. Buyer may "recover as damages for any nonconformity. . . the loss resulting . . . from the seller's breach as determined in any reasonable manner" [§2-714(1)] 3. "recover damages in any manner that is reasonable under circumstances" [§2-711(j)] 15 Commercial Law ii. Practical way to provide buyer with expectation [see 1-305(a)] 1. If practical, most cases apply even when repair cost exceeds (VCG - VNCG) b. If Repair impossible: VCG - VNCG + ID + CD; i. VCG = Value of Conforming goods at time and place of acceptance 1. Hill: calculate value as if the "goods arrived as warranted," not Contract Price (KP). KP is evidence of the "Value as Warranted," but not the value itself. ii. VNCG = Value of Non-Conforming Goods that buyer in fact received (Accepted goods) at time and place of acceptance iii. ID = Incidental Damages iv. CD = Consequential Damages. [§2-715(2)] 1. Category I allows damages due to breach [§2-715(2)(a)] a. of any kind, including purely economic loss b. of a particular requirement or need which seller had reason to know at time of contracting i. follows common law which makes seller liable for all consequential damages he had "reason to know" in advance but modified by mitigation need [§2-715 Comment 2; Hadley v. Baxendale (on forseeability)] c. that were "caused in fact" (mere "but-for" cause rather than "proximate cause") d. that could not be prevented "by cover or otherwise (basic mitigation principle) 2. Category II allows damages which are [§2-715(2)(b)] a. personal injury or property damage (economic loss does not qualify here), and b. proximately caused by seller's breach (mere but-for cause is not enough) c. and there is no: i. Hadley v. Baxendale foreseeability limit, nor ii. explicit language to mitigate.

Warranties Available 1. Express Warranty by Affirmation, Promise, Description, Samplem[§2-313] a. Express warranty created if i. Transaction between Seller to Immediate buyer 1. “Immediate buyer” means a “buyer that enters into a contract with the seller” [§2-313(1)] a. “contract” means the total legal obligation that results from the parties’ agreement, determined by UCC and “any other applicable laws.” [§1-201(12)] b. “buyer” is a person that buys or contracts to buy goods. [§2- 103(1)(a)] ii. Seller makes any 1. “affirmation of fact or promise which:” [§2-313(2)(a)] or a. relates to the goods; and b. becomes part of the basis of bargain 2. “description of the goods which is made part of the basis of bargain” [§2- 313(2)(b)]; Or 3. “sample or model” made part of bargain basis for “whole of goods” b. Requires goods or “whole of goods” conform to the fact, promise, description, or sample i. If not clear what requirement is, then warranty may not apply (like saying a car “runs like a camel on gas”, what did he promise? what is the remedy?) 2. Implied Warranty: Merchantability; [§2-314] a. Implied warranty created if i. Seller is a merchant with respect to goods of that kind [§2-314] 1. “merchant” means a person that [§2-104(1)] 16 Commercial Law a. deals in goods of the kind; or b. “holds itself out by occupation as having knowledge or skill peculiar to the practices or goods” in the transaction; or c. employs “an agent or broker or other intermediary that holds itself out by occupation as having knowledge or skill” ii. Because Merchantability warranty “is so commonly taken for granted” exclusion from the contract is “a matter threatening surprise and therefore requiring special precaution.” b. Requires that goods be Merchantable, that they: [§2-314(1); §2-314(2)] i. pass w/out objection in the trade under K description [§2-314(2)(a)] ii. if fungible goods, are of fair average quality within description [§(b)] 1. “fungible goods” means goods which any unit, by nature or trade usage, “is the equivalent of any other like unit”; or goods treated as equivalent by agreement [§1-201(18)] iii. “are fit for ordinary purposes for which goods of that description are used” [(c)] c. Causation: ascertaining Proximate Cause often a factor [see §2-314 comment 15] 3. Implied Warranty: Usage of trade/ Course of dealing [§2-314(3)] a. “Implied Warranties may arise from course of dealing or usage of trade” 4. Implied Warranty: Fitness for Particular Purpose [§2-315] a. Implied warranty created if [§2-315] i. Seller at time of contracting has reason to know any particular purpose for which the goods are required; and ii. the buyer is relying on the seller’s skill or judgment to select or furnish suitable goods, b. Requires that the goods shall be fit for such purpose 5. Obligation to tell knowledge of any defects; Good Faith [§1-304] a. Hill thinks seller should have an obligation to expose this hidden defect which he is aware. i. Good Faith requirement: “every contract or duty within the UCC imposes an obligation of good faith in its performance and enforcement” [§1-304] ii. Supplement law to UCC includes “misrepresentation” [§1-103(b)] iii. “Seller’s knowledge of any defects not apparent…in keeping with underlying reason of [UCC Section 2] and provisions on good faith, impose an obligation that known material but hidden defects be fully disclosed” [§2-314 comment 4 last sentence] 6. Express “Obligations” to remote purchasers [§2-313A; §2-313B] (page 144 text) a. Created where: i. Expressions are present that “relate to the goods” & include an affirmation of fact, descriptions, or promise concerning product w/in either [§2-313A&B]: And 1. Statements made by the non-immediate seller in any record that accompanies the goods [§2-313A]; or a. “Record’ [§2-103] 2. Communications (e.g. advertising) made by seller to public [§2-313B] ii. Affirmations are not merely the seller’s opinion and a reasonable purchaser should know that (“puffing”) [§2-313A/B (3)]; and iii. Seller did not include limitation to purchaser limiting remedies available (such as state “no later than the time of purchase” [§2-313A/B(4)(a)];and iv. Seller only responsible for breach of obligations when the breach existed at the time the goods left seller’s control [§2-313A/B(5)] b. Requires 7. Remedial Promise [§2-103(1)(p); §2-313] a. Defined as “a promise by the seller to repair or replace goods or to refund all or part of the price upon the happening of a specified event” [§2-103(1)(p)] b. Not a warranty b/c it is not a promise about goods quality, but rather a commitment that the seller act in a certain way in the future c. Key functional distinction between a warranty and a remedial promise is how each is treated under the statute of limitations. i. Since Remedial Promise not a warranty, should not expire before the buyer knows or should have known about the breach. [§2-725] 17 Commercial Law 1. SOL: the later of either four years from when the cause of action accrued or one year after the buyer knows or should have known of the breach. a. Remedial Promise: right of action does not accrue until promise is not performed when due [§2-715(2)(c)] b. Warranty: right of action accrues upon seller’s tender of goods whether or not the warranty breach is evident at that point. 8. Warranty of Title [Assignment 16] a. Warranty of title i. Created Where 1. There is a sale by any seller [§2-312(1)] 2. Broadest implied warranty of Art 2 a. Most warranties attach to sales by merchant sellers ii. Requires that 1. Seller strictly liable a. No matter if seller completely ignorant of title problems or completely innocent 2. Seller warrants title of goods sold: [§2-312(1)] a. has good title, and b. that its transfer is rightful, and c. is delivered free of third-party liens or encumbrances which buyer is unaware. 3. possession does not equate to good title (though usually) e.g. thief b. Disclaiming Warranty of Title [§2-312(2)] i. Requires seller wishing to disclaim to[§2-312(2)]: 1. use very specific language to that effect; Or 2. If Under special circumstances (such as a sheriff's sale), by implication. 3. Though an implied warranty, unable to disclaim as other implied warranties (such as merchantability or fitness for a particular purpose). c. Three categories of titles (help distinguish loss when wrongdoer is judgment-proof or not available [§2-403] i. "Good title" ii. Void Title: "Bona fide purchaser from a thief gets nothing" [§2-403] 1. Created where [common law] a. thief in title chain prevents any later party having good title, though statute doesn’t explicitly state so [Courts; §2-403] i. Common law interpretation equates to: "Bona fide purchaser from a thief gets nothing" ii. all subject to statute of limitations rules, rules of equity, and other applicable principles. 2. Power to Transfer [Common law; §2-403(1)] a. Any party acquiring goods after a thief stole them has "void title,” (no title) i. Innocence or good faith of buyer irrelevant ii. Buyer will not have good title, since thief had no title: “a purchaser of goods acquires all title which his transferor had" [§2-403(1)] iii. Voidable Title: transfers only to "a good faith purchaser for value" 1. Determining Title status: void vs. voidable a. Did transferor intend, at exchange time, to transfer title of goods. i. Yes: transferee will have a least voidable title, if not good title. ii. No: transferee did not intend to transfer title, transferee has void title 2. Created where [§2-403(1)] a. Seller does not itself have good title [else would be good title] b. "Goods have been delivered" [§2-403(1)]; and

18 Commercial Law i. all things exchanged "are moveable at the time of identification to a K for sale” [§2-103(k) “goods”] ii. there is a voluntary transfer of physical possession or control of goods [§2-103(1)(e) “delivery”] 1. title holder tricked true owner to voluntary transfer possession of goods [§2-403(1)]. c. "Delivery is under transaction of purchase" [§2-403(1)] i. the transfer is a "voluntary transaction creating an interest in property [§1-201(29) ‘purchase”]; or d. Explicitly includes the following transfers: [§2-403(a)(1)-(4)] i. Transferor was "deceived as to identity of purchaser” [(1)] or ii. Delivery was "in exchange for a check ... later dishonored" [(2)] or iii. "it was agreed that the transaction was to be a 'cash sale'" [(3)] or iv. "the delivery was procured through criminal fraud" [(4)] or 3. Voidable title transfer can create good title where [§2-403(1)] a. There is a person with voidable title [§2-403(1)] b. There is a good faith purchaser for value: [§2-403(1)] i. The transfer is a "voluntary transaction creating an interest in property [§1-201(29) purchase] ii. The purchase exhibits "honesty in fact and observance of reasonable commercial standards of fair dealing" [§1-201(20); §2-103(1)(j) "Good faith"] iii. The person acquires rights: [§1-204 "value"] 1. in return for a binding commitment to extend credit 2. as security for a preexisting claim 3. by accepting delivery under a preexisting contract for purchase 4. in return for any consideration sufficient to support a simple K c. Otherwise, only voidable title has been passed i. "a purchaser of goods acquires all title which his transferor had" [§2-403(1)] iv. Entrustment (conceptually close to voidable title doctrine) 1. Entrustment created [§2-403(3)] a. in any delivery or acquiescence of possession i. there is a voluntary transfer of physical possession or control of goods [§2-103(1)(e) delivery defined] b. only by true owner c. “regardless of any condition expressed between parties to the delivery or acquiescence.” 2. Entrustee has power to transfer all rights of the entruster if [UCC §2- 403(2)]: a. “any entrusting of possession of goods” [see §2-403(3)] b. Entrustee is a “merchant” c. Entrustee deals in goods of that kind (being entrusted) d. Transferee is a buyer e. Transfer occurs in ordinary course of business [must see §1- 201(9) "buyer in ordinary course of business" defined] i. Person buys goods in good faith 1. The purchase exhibits "honesty in fact and observance of reasonable commercial standards of fair dealing" [§1-201(20); §2- 103(1)(j) "Good faith" defined] 19 Commercial Law 2. Test for good faith is actual belief, not the reasonableness of that belief (Case law) ii. No knowledge that sale violates rights of another person iii. Sale is in ordinary course 1. sale comports with the usual or customary practices a. of “the kind of business in which seller is engaged” or b. of the seller procedures himself (seller’s own usual and customary practices) 2. Cannot be a pawnbroker (explicitly left out) 3. person “may buy for cash, by exchange of other property, or on secured or unsecured credit, and may acquire goods or documents of title under preexisting contract” iv. Sale is from a person in the business of selling goods of that kind 3. Example: you bring computer in for repairs at a computer dealer who both sells and repairs computers. If dealer sells computer to a buyer in ordinary course of business (whether accidentally or purposively), you would have an action against computer dealer, but not against new owner of computer. v. Differences between Voidable Title Rule and Entrustment Rule 1. Merchant Requirement a. Voidable Title rule takes affect when any party - merchant or not - dupes owner into delivering possession. b. Entrustment rule operates only when goods are entrusted to a merchant who deals in goods of that kind. 2. “Good Faith Purchaser for Value” vs. “buyer in ordinary course of business a. Voidable rule requires there be a good-faith purchaser for value b. Entrustment rule requires a buyer in the ordinary course of business (slightly narrower)

Part III: The breach of warranty caused the harm complained of (Causation)

1. Causation [§2-314 comment 15]: a. To recover, the breach of warranty must be “the proximate cause of the loss sustained.” [§2-314 comment 15, see also §1-103(b)] b. The loss cannot have “resulted from some action or event following the seller’s delivery of goods.” [2-314 comment 15] i. No breach if the injury was caused by factors other than the product’s defect. 1. Relevant is whether the seller “exercise[d] care in the manufacture, processing, or selection of goods” [§2-314 comment 15] 2. For fungible goods, warranty only requires goods to be “of fair average quality within description” [§2-314(2)(b)] a. “fungible goods” means goods which any unit, by nature or trade usage, “is the equivalent of any other like unit” [§1- 201(18)] 3. Defect can be alleged as caused by the buyer following purchase, and therefore no breach of warranty by seller at all

20 Commercial Law Part V: that you have an ability to fend off affirmative defenses, including

2. Disclaimers a. In problems, ask self [Hill]: i. What is the warranty we believe seller made? ii. What is he trying to disclaim (all warranties, implied warranties, implied warranty of merchantability, etc.)? iii. Is this a limitation on warranty or an attempt by seller to reduce or limit remedy (e.g. may say only remedy available is repair of a part) b. Seller may Disclaim: [§2-316] i. “all implied warranties are excluded” by: [§2-316(3)] 1. “expressions like ‘as is’, ‘with all faults’ or other language that in common understanding calls buyer’s attention to wrrnty exclusion” and makes plain there is no implied warranty; and 2. In a consumer K w/ record, by setting “forth conspicuously in record.” ii. Implied warranty of Merchantability/Fitness (or any part of it) if: [§2-316(2)] 1. language in a record 2. Conspicuous [see §1-201(b)(10)]: "so written so that a reasonable person ought to notice." , e.g.: capital letters, large type, colors, something to make it stand out. Issue for court 3. seller states for a. Merchantability: “The seller undertakes no responsibility for the qualty of the goods except as otherwise provided in this k” b. Fitness: “The seller assumes no responsibility that the goods will be fit for any particular purpose for which you may be buying these goods, except as otherwise provided in the K” iii. Regardless if buyer read (don’t want to penalize people for reading K) c. Seller may Limit remedies if i. included in agreement are provisions that “limit or alter the measure of damages recoverable.” [§2-719(a)] ii. Limitation is not “unconscionable” [§2-719(3)] 1. limits to injury consequential damages are prima fascia unconscionable iii. Limitation causes the remedy “to fail of its essential purpose.” [§2-719(2)]. 1. Ask: what is the essential purpose of the remedy being limited. In class, a. given a remedy on parts, Hill found “essential purpose” to be the implied remedy of merchantability and not a more specific remedy of replacing exact parts mentioned. b. Given a remedy that excludes in writing all warranties iv. Even if all warranties disclaimed (and no limitation exists to apply 2-719), may invoke “Unconscionable K or Terms” provision (but success unlikely) [§2-302] d. Seller may use Express Warranty to limit other warranties [§2-317(c)] i. “Express warranties displace inconsistent implied warranties other than implied warranty of fitness for a particular purpose” 3. Statute of Limitations 4. Notice [§2-607(3)(a)]:[Hill says don’t overlook] a. Buyer must, following acceptance [§2-607(3)(a)]: i. Notify seller within a reasonable time after the buyer “discovers or should have discovered any breach.” 1. Means buyer must follow customary inspection procedures or risk waiving right to warranty. 2. unreasonable delay in notice if [Hebron v. American Isuzu Motors (4th cir. 1995)]: a. No reason presented for delay; and b. Actual prejudice occurred 3. Hill: where consumer sues sellers higher in the Privity ladder, Hill thinks clear example of need to give notice. Hill says could say notice wan’t required under circumstances. I say consumer should be judged by

21 Commercial Law circumstances and looked at if this was bad faith. See Hebron case. [Hill] b. failure to give timely notice “bars the buyer from a remedy only to the extent that the seller is prejudiced by the failure.” [§2-607(3)(a)] [Hill thinks word “prejudiced” allows court to give justice in any case] 5. Privity: a. Plaintiff must show privity because warranty is contract law based (“supplemental principle of law”), therefore a warrantor is directly liable only to party he contracted with. [§1-103] i. In practice, most manufacturers will treat warranties as if they run directly to ultimate purchaser (as a matter of good business). b. Plaintiff must over come lack of: i. Vertical Privity: the ability of a buyer to sue a seller other than its immediate seller. 1. Common Law: Most states have common law that allows consumers to press claim despite lack of vertical privity. [Spring Motors Case]. 2. “Vouch in” allows a seller 2 being sued to “vouch in” seller 1 to defend the suit against a buyer. [§2-607(5)(a)] a. Applies to an obligation seller 1 should have been responsible. b. Seller 2 (or the buyer being sued for a subsequent sale) may give the first seller written notice of litigation. c. If seller 1 refuses to come in and defend for seller 2, then seller 1 will be bound by any finding of fact in the first litigation when seller2 sues seller 1 ii. Horizontal Privity: the ability of a non-buyer who uses or is affected by a product to sue a seller for breach of warranty. [§2-318] 1. Offers injured buyers unable to recover from immediate seller based on tort theory (negligence or strict products liability) to claim against first seller though lack of Privity is evident. [§2-318] 2. Three different alternatives for adoption. Designed to create exceptions to the usual Privity requirement of any damages on a warranty theory (not necessarily excluding any one type, such as economic loss). [§2- 318(2)] a. Alternative A (majority of states) – removes horizontal Privity barrier. If claimant: i. family member or household guests of buyer, and ii. the non-buyers has suffered personal injury, and iii. Injury is due to seller’s breach of warranty. b. Alternative B (broader class of plaintiffs) –Privity removed for i. “any natural person who may reasonably be expected to use, consume, or be affected by the goods,” and ii. suffered personal injury, and iii. Injury due to seller’s breach of warranty c. Alternative C (broadest, eliminating need for injury) – i. any natural person who may reasonably be expected to use, consume, or be affected by the goods,” 1. means that property damage or economic loss recoverable 6. Excuse/Impractability a. Created where i. neither party could reasonably anticipate occurrence. ii. There are no “Force Majeure” Clauses 1. excuse provisions within agreement or K 2. Such provisions supersede applicable UCC sections, yet often provide no more guidance on excuse issue than the fuzzy UCC standard itself. iii. There has been either an: 1. Unexpected failure of seller supply source: excuse basis for seller only [§2-613] 22 Commercial Law 2. Dramatic price fluctuation: excuse basis for seller or buyer [§2-615] b. “Casualty to Identified Goods” §2-613 (seller only) i. Applies only where the K 1. “requires for its performance goods identified;” and a. K cannot simply identify goods, must require for performance i. e.g. “I’ll buy that painting”; “I’ll sell my tennis racket” ii. fungible goods don’t qualify (use §2-615) 2. goods are damaged or destroyed; and 3. No fault of either party in damage; and 4. damage occurs before risk passed to buyer 5. Buyer Excuse a. UCC does not define what circumstances excuse a party from its performance obligations, speaking strictly in terms of seller’s ability of excuse in §2-613 and §2-616. b. Courts have considered a buyer’s defense of excuse by applying either: i. Analogy to §2-615 “Commercial impracticability” rules for sellers; or ii. Common law of excuse. ii. Remedy: 1. “Total” loss: Contract is avoided completely 2. “Partial” Loss: Buyer may demand inspection and a. either [2-613 (b)]: i. “Treat the contract as avoided,” or ii. “Accept the goods with due allowance from K price for deterioration” c. §2-615: the Default excuse rule [§2-615] i. Applies only if party seeking excuse: 1. Gives Notice [§2-615(c)] a. Seller who wishes to claim excuse is required to notify buyer of any delay or non-delivery 2. Had an inability to Avert Event; considers: a. Foreseeability [§2-615(a)] i. Event causing excuse must be “a contingency the non- occurrence of which was a basic assumption on which the contract was made.” b. Good Faith[§2-615(a)] i. Good-faith compliance with government regulations (by seller) is a permissible basis for excuse ii. Allows party seeking to excuse a: 1. Delay in delivery [§2-615(a)] a. Delay in delivery (or “performance”) or a complete non- delivery is not a breach of seller’s duty under contract (if seller that qualifies for excuse) 2. Price Fluctuation [§2-615 Comment 4] a. “Increased cost alone does not excuse performance unless rise in cost is: i. “due to some unforeseen contingency” and ii. event altering “the essential nature of the performance” 3. Seller Supply Source Failing if (inability of a particular supplier) [Comment 5 §2-615] a. both buyer and seller had reason to believe b. Source of supply was to be seller’s excusive source 4. In practice, commercial buyers not as harsh as comment 5 suggests. [Alamance County BOE v. Murray Chevy N.C. 1996] a. buyer’s willingness to accept supplier-related excuses from the seller significantly diminished when the buyer’s dealing with

23 Commercial Law the seller are not a long term relationship as it is a one shot proposition. iii. Limited Ability to Perform [§2-615(b)] 1. Often, problems with obtaining adequate supply will affect only a portion of seller’s ability to perform, or only some of those buyers. 2. Applies to seller who is a. Claiming excuse under §2-615 b. has more than one buyer, and c. has Limited capacity to perform 3. Requires that seller: a. Must allocate production and delivery among its customers in a “fair and reasonable” manner. Does not give exactly what constitutes fair and reasonable allocation. b. may still (leeway given) i. Include regular customers not under contract ii. Honor own requirements iv. Seller’s allocation in times of shortage 1. Premise of §2-615 is seller should not be free in time of shortage to disregard his long term commitments and favor short term buyers who will pay higher prices. Rarely justify addition of new customers under §2-615 in time of shortage. 2. Ways sellers deviated from pro-rata distribution in time of shortage: a. diverting greater than pro-rata share to their internal uses b. sold to new customers despite not fulfilling all of obligations to customers already under contract c. giving grater than pro-rata share to favored customers v. Willingness to grant a customers request for a price modification 1. Most common reasons: a. request was reasonable in the trade b. long-tome valued customer 2. Hypothetical: long-term supply contract and price fluctuation would put seller out of business if original price enforced. a. Best solution in a harsh long term contract appears to be “splitting the baby”: having a court re-write contract. b. However, American courts rarely believe in adjusting terms of contract (unlike German Law). 3. If judicial contract reformulation is not a viable approach, only other approaches would be either: a. never allow any price increase as basis for commercial excuse: i. Encourages parties to be prudent in making contracts. Parties who act imprudently, making no reasonable attempt to draft protection into the contrac, should not be favorablhy received. b. Allow only very significant price increases to be basis: i. Has serious theoretical problems, such as where do you draw line: 95% increase? 100%?, question of fairness vi. Commercial Impracticability and International Sales 1. UCC and CISG approach to excuse is essentially the same: a. CISG Article 79 excuses party from performance where: i. inability due “to an impediment beyond control” of seller; ii. impediment was unavoidable; and iii. Neither party reasonably expected impediment at contract formation 2. One respect CISG excuse is arguably stingier than UCC §2-615 is case where source of supply fails to deliver to the seller.

24 Commercial Law a. UCC official Comment 5 to §2-615 suggests as long as both parties assumed source to be the exclusive source for seller, seller is excused. b. CISG by contrast says party is only excused by the failure of a 3rd party source when the 3rd part source itself has a valid basis of excuse. 7. Unconscionability [Assignment 15] a. The concept of unconscionability is i. an amorphous feature of the sales system. ii. basis by which a party in an otherwise enforceable sales agreement may avoid that agreement. iii. While impossibility used most successfully by commercial seller, unconscionability used by consumer buyer. b. §2-302: basic Unconscionability section [§2-302] i. Unconscionability is not defined within the statute. Closest definition appears in §2-302 comment 1: 1. Basic test: in light of commercial background and commercial needs of particular case, are clauses so one-sided to be unconscionable under circumstances existing at K making. 2. principle is prevention of oppression and unfair surprise, not disturbance of risk allocation due to superior bargaining power ii. Definition used by courts [Williams v. Walker-Thomas (DC 1965)] 1. A successful unconscionability defense usually will require defendant to show: a. Procedural Unconscionability: "absence of meaningful choice" on the part of one of the parties. b. Substantive Unconscionability: "unreasonably favorable terms" of contract to the party not lacking choice. 2. Some courts require both elements to show unconscionability, some believe either one or the other will suffice. c. Guidelines to Unconscionability in practice (UCC §2-302) i. Though undefined, UCC gives useful information pieces on how unconscionability is to operate in practice: [§2-302] 1. Unconscionability determination is a matter of law, out of the hands of a likely consumer friendly jury. [§2-302(1)] 2. Indicates appropriate time for measuring unconscionability of a K or clause is when contract was made. Fact K a terrible deal in retrospect should not be sufficient [§2-302(1)] 3. Functional consequences (On finding K unconscionable, judge has three options [§2-302(1)]: a. Refuse to enforce contract at all b. Enforce reminder of K w/out unconscionable clause c. Limit application of any unconscionable clause to avoid unconscionable result 4. Requires a hearing afforded to parties giving "a reasonable opportunity to present evidence as to commercial setting, purpose and effect to aid the court in making unconscionable determination." a. Idea is unconscionability very contextual, thus parties have specific opportunity to present context evidence. d. Unconscionability Policy i. claims rarely succeed. Most likely to be successful involving unsophisticated consumer buyer and an aggressive seller with onerous terms. It is not uncommon for "substantive unconscionability" to consist in part credit terms that strike the court as overreaching. ii. personal views of he judge must be contended with. iii. Unconscionability doctrine not taken lightly by courts. If routinely allowed for escaping contract liability, entire sales system would suffer from uncertainty.

25 Commercial Law iv. Excuse doctrines must also minimize the potential for costly opportunism, thereby encouraging parties to bargain more effectively. e. Unconscionability with International Sales i. It is unlikely a court would recognize an unconscionability argument raised in a sales contract covered by CISG because: 1. CISG also does not apply because: a. CISG does not include any provision on unconscionability (even though it contains a commercial impracticability provision) b. CISG specifically excludes sales of goods to consumers. [CISG Art. 2(a)] i. UCC §2-302 is generally applied to consumers, while c. CISG does not concern itself with the "validity of the contract or of any of its provisions" [CISG Art. 4(a)] 8. Assumption of risk General Points 1. Negligent Party Bears Loss: If destruction or damage occurs through fault of either buyer or seller, a. negligent party must bear loss and b. usual risk of loss rules do not come into play. 2. Insurance companies: in practice, a. ROL fights usually involve insurance companies, either: i. Against each other ii. Against the buyer or seller b. Insurance Use i. Common Carriers: if seller uses a common carrier, carrier almost always has insurance to cover losses in transit ii. Buyers and sellers: have back up insurance policies c. Real question in ROL: which party (buyer or seller) will have to deal with hassle of going against carrier’s insurance company 3. Business considerations: Business considerations may cause parties to agree to another result technically inconsistent with legal obligations. a. Example: Contract may state that i. ROL shifts to buyer when goods leave seller’s factory ii. seller will arrange transportation, charging buyer for use of seller’s captured carrier (applies especially to High volume sellers) 4. All ROL rules, just like rules for ROL involving a carrier, are subject to three important qualifications: a. if parties specifically agree when ROL will pass, agreement governs b. if one party cause the loss, negligent party assumes that loss c. if one party is in breach under contract, then special rules of §2-510 will determine when risk passes from seller to buyer. Delivery Terms

Whenever a third party carrier is involved, seller and buyer almost always specify when risk of loss passes. FOB means “free on board” literally means: Seller must pay all charges necessary for merchandise to arrive, on board, at the designated location, free of charge to buyer.

1. Two basic delivery terms: a. Shipment Contract (FOB Seller’s Place) [§2-509(1)(a)]: i. Risk of loss shifts to buyer: when goods are delivered to carrier ii. Buyer responsible for costs of Freight iii. Seller must [“Shipment by Seller” §2-504]: 1. Put goods in possession of carrier [§2-504(a)]; 2. Make a reasonable contract for transportation;[? Code says “proper”] a. Case: Cook Specialty Co. v. Schrlock (E.D. Pa. 1991) 3. Deliver any document necessary [§2-504(b)]; and a. “to enable buyer to take delivery”; or b. required by agreement or usage of trade 26 Commercial Law 4. Promptly notify buyer of shipment [§2-504(c)] b. Destination Contract (FOB Buyer’s Place) [§2-509(1)(b)]: i. Risk of loss shifts to buyer: when goods are tendered to buyer at stated destination (not before). ii. Seller responsible for cost of freight. iii. Seller must [“Seller’s tender of delivery” §2-503]: [hill says use if carrier] 1. Put and hold goods at the buyer’s disposition [§2-503(1)]; 2. Keep goods available for “period necessary for buyer to take possession” [§2-503(1)(a)]; 3. Give buyer “any notification reasonably necessary” to allow delivery [§2-503(1)] 4. Give buyer any documents needed for buyer to take delivery. [? Not sure where explicit] 2. If no delivery term specified: a. Default Rule [§2-308(a); official comment 5 to §2-503]: i. shipment contract applies if parties fail to specify a delivery term

Meaning of “reasonable contract” What constitutes “reasonable contract” for goods’ transportation is not always clear. Case: Cook Specialty Co. v. Schrlock (E.D. Pa. 1991)

Operation of §2-504: Ambiguous last sentence Ambiguities in §2-504 besides what constitutes a "reasonable” contract: Uncertainty about operation of §2-504 from last sentence of section:

"Failure to notify buyer under paragraph (c) or to make a proper contract under paragraph (a) is a ground for rejection only if material delay or loss ensues"

Last sentence raises question: Are requirements for proper shipment by seller under §2-504: 1. are truly prerequisites for passing risk of loss to the buyer or 2. Instead are merely requirements on which buyer can rely to recover damages directly related to seller's inability to fulfill them.

Different scenarios: 1. Can seller argue buyer has risk of loss since seller delivered to the carrier and promptly notified buyer 2. Can buyer argue that seller still has the risk since seller did not make a reasonable contract of transportation required under §2-504(a). 3. Can seller counter that even if it failed in its obligation, its failure was not the cause of the loss and therefore, under the "no harm, no foul" concept of last sentence, buyer cannot complain therefore.

No clear answer in case law. Oft cited is North Carolina Court, where seller's failure to notify caused the buyer's loss to “ensue.”

ROL under Breached Contract In a case where buyer or seller is in breach of underlying contract, UCC gives way to a special set of ROL rules.

1. §2-510: Effect of breach by either buyer or seller on passage of ROL. a. §2-510(1) provides “where a tender or delivery of goods fails to conform to contract as to give right of rejection, the ROL remains on the seller until cure or acceptance.” i. Example: 1. Seller agrees to ship buyer 24 Z model bikes to FOB Sellers Factory (shipment contract). 2. Seller mistakenly ships 24 X model Bikes 3. If Delivery is destroyed in transit through no fault of either party, seller keeps ROL since goods delivered “so failed to conform to contract as to give a right of rejection” 27 Commercial Law b. §2-510(2): provides when buyer rightfully revokes acceptance, buyer may treat ROL as if it had rested on seller from the beginning, but only to the extent of a deficiency in the buyer’s insurance coverage. i. Example: suppose same bike model above 1. Suppose buyer a. received X model bikes, and b. accepted them without discovery of nonconformity (which was difficult to discover), c. Then revoked acceptance by notifying seller. 2. While waiting for seller to pick up bikes, bikes destroyed through no fault of buyer 3. if buyer a. had insurance that covered destroyed machines, insurer would pay for loss b. did not have insurance, then ROL would be with seller i. Normally a shipment contract would put risk with buyer as soon as seller delivered goods to carrier c. §2-510(3): effect of breach by buyer on ROL. Provides where buyer repudiated conforming goods already identified to contract, ROL will be on buyer for a commercially reasonable time to the extent of any deficiency in sellers’ insurance coverage. i. Example: 1. suppose a. bike seller had identified to contract 12 dozen machines that conformed to contract with buyer b. buyer called seller before machines left sellers warehouse and told seller deal was off c. shortly after call, machines destroyed in fire at seller warehouse 2. Buyer would have ROL if sellers insurance were deficient. True even though seller never delververed the goods to the tird party carrier (which maramlly would be required for seller to pass risk to buyer even in a shipment contract here) ROL in Non-carrier situations 1. Seller is using third party bailee to hold goods for buyer. ROL passes to buyer at the first of three events [§2-509(2)] a. Buyer receives a negotiable document of title covering goods b. Baillee acknowledges the buyer’s right to possession of the goods; or c. Buyer receives a non-negotiable document of title or other written direction to bailee to deliver 2. Default rule of ROL involving neither third party carrier nor a bailee (such as buyer is coming to sellers to pick up goods). If seller is a [§2-509(3)]: a. Merchant: Risk passes to buyer on receipt of goods if seller is a merchant b. Not a merchant: risk passes to the buyer when seller tenders delivery of goods to buyer.

CISG

Closing/Rejection under CISG [Assignment 19]

Difference in "closing" concepts between international sales system and domestic sales system is international system is much more averse to letting buyers use goods-oriented remedies.

CISG: only two situations where buyer may "avoid" K [CISG Art. 49(1)]. 1.) Where seller has committed a "fundamental breach" of contract i. Fundamental breach: is a breach that amounts to a substantial deprivation of aggrieved party's benefit of the bargain. [CISG Art. 25] 1. Must give notice 28 Commercial Law 2. Notice must come in a reasonable period following 3. Time where buyer a. Knew, or b. Should have known defect 2.) Where Seller's delivery is later than the agreed due date plus any additional time that buyer has agreed to give seller [CISG Art. 49(1)(b)] i. Where buyer gives seller additional time, buyer does not affect its right to damages for delay [CISG Art. 47(2)].

CISG Seller Remedies [Assignment 23]

CISG creates a major distinction between seller that avoids a contract and one that does not.

Two features to note on CISG remedy structure 1. CISG combines in single articles: a. Buyer’s “cover” remedy (asgmnt 26) with seller’s resale remedy [Art. 75] b. both buyers and seller’s contract-market damages [Art. 76] 2. CISG Combines in single article buyer’s incidental and consequential damages with seller’s incidental and consequential damages (including “lost profit”) [Art.74]. a. describes damages solely as CD [Art 74] and contains the Hadley v. Baxendale limit on foreseeability of the harm ultimately suffered by the aggrieved party.

Seller that “avoids” contract: 1. May avoid only when buyer commits a “fundamental breach” [Art. 64(1)(a)] a. “Fundamental Breach”[Art. 25]: i. breach that substantially deprives the other party of “what he is entitled to expect under contract” ii. does not include losses that 1. party did not foresee; and 2. reasonable person of the same kind in the same circumstances would not have foreseen 2. Result of Contract Avoidance by either party is it a. Releases both parties of obligations [Art 81(1)], i. Thus seller that chooses to avoid contract may no longer bring “an action for price” since buyer is no longer obligated to pay. b. Reserves right to sue for damages by Avoiding party [Art 81(1)] i. Avoiding seller may sue the buyer for 1. Contract-resale damages [Art 75]; or a. Applies where i. Contract is avoided ii. Seller has resold goods iii. Resale occurs a reasonable time after avoidance. b. May recover i. difference between contract price and price in substitute transaction: KP - RS ii. Any further damages under Art 74, which includes losses [Art 75; Art 74]: 1. “as a consequence of the breach” [Art 74] a. Includes thereby incidental or consequential damages to be calculated under article 75 and 76 2. Not to "exceed the loss which party in breach foresaw or ought to have foreseen" [Art 74]

2. Contract-market damages [Art. 76]. a. Applies where i. Contract is avoided ii. There is current price for goods 29 Commercial Law b. May recover i. Difference between price fixed by contract and current price at time of avoidance: KP – CP time of avoidance; and 1. CPtime of avoidance is [Art 76(2)] a. “price prevailing at the place where delivery of the goods should have been made” or, b. if there is no current price at that place, the price at such other place serves as a reasonable substitute. Must make due allowance for differences in cost of transporting goods ii. Any further damages under Art 74, which includes losses [Art 76(1); Art 74]: 1. “as a consequence of the breach” [Art 74] a. Includes thereby incidental or consequential damages to be calculated under article 75 and 76 b. Not to "exceed the loss which party in breach foresaw or ought to have foreseen" [Art 74] iii. If seller avoided after taking over the goods, the current price at time of avoidance applies. iv. Must not make a purchase or resale under Art 75

3. Seller may recover losses [Art. 74] a. “as a consequence of the breach” i. Includes thereby incidental or consequential damages to be calculated under article 75 and 76 b. Not to "exceed the loss which party in breach foresaw or ought to have foreseen"