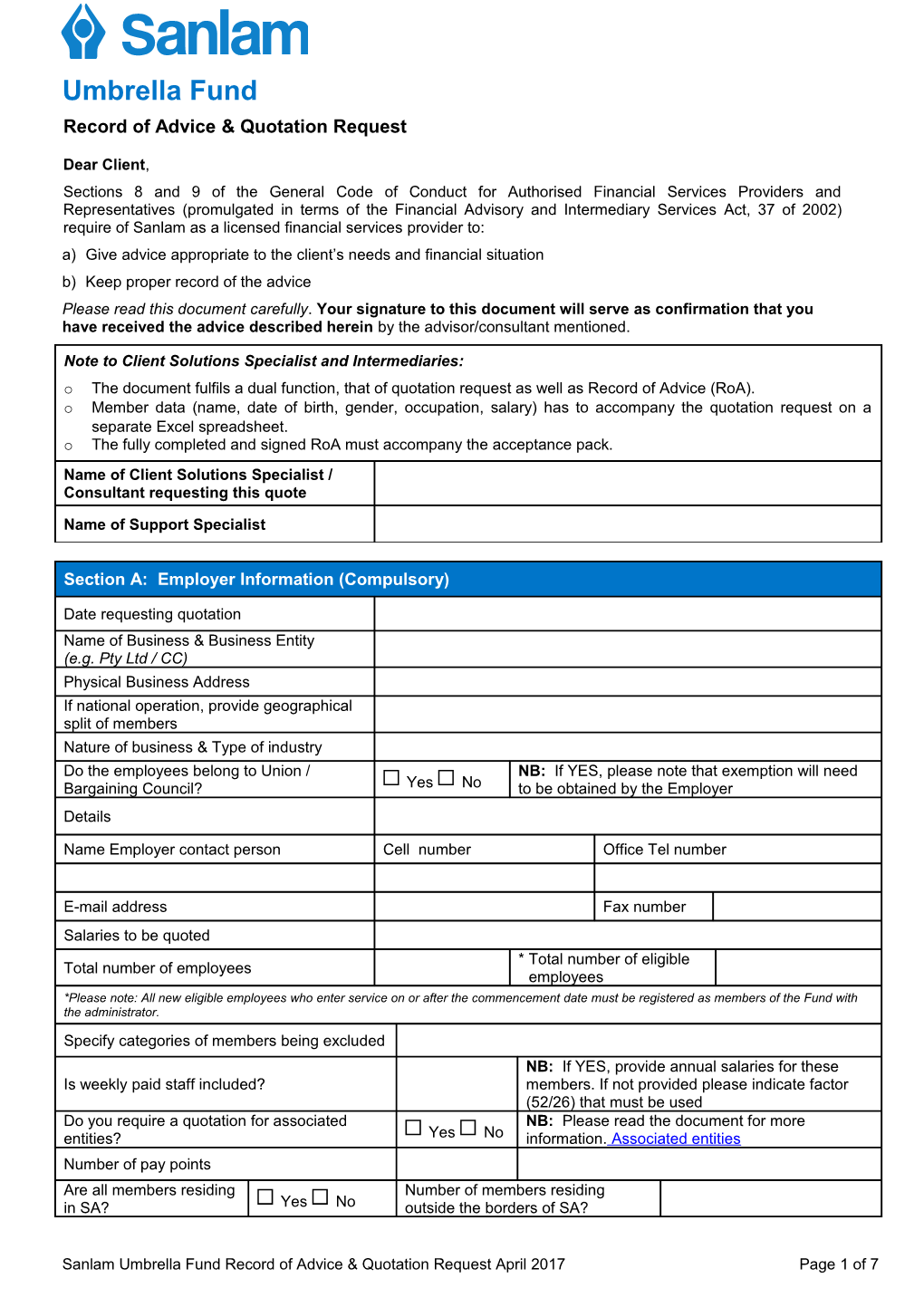

Umbrella Fund Record of Advice & Quotation Request

Dear Client, Sections 8 and 9 of the General Code of Conduct for Authorised Financial Services Providers and Representatives (promulgated in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002) require of Sanlam as a licensed financial services provider to: a) Give advice appropriate to the client’s needs and financial situation b) Keep proper record of the advice Please read this document carefully. Your signature to this document will serve as confirmation that you have received the advice described herein by the advisor/consultant mentioned.

Note to Client Solutions Specialist and Intermediaries: o The document fulfils a dual function, that of quotation request as well as Record of Advice (RoA). o Member data (name, date of birth, gender, occupation, salary) has to accompany the quotation request on a separate Excel spreadsheet. o The fully completed and signed RoA must accompany the acceptance pack. Name of Client Solutions Specialist /

Consultant requesting this quote

Name of Support Specialist

Section A: Employer Information (Compulsory)

Date requesting quotation Name of Business & Business Entity

(e.g. Pty Ltd / CC) Physical Business Address If national operation, provide geographical split of members Nature of business & Type of industry Do the employees belong to Union / NB: If YES, please note that exemption will need Bargaining Council? Yes No to be obtained by the Employer Details

Name Employer contact person Cell number Office Tel number

E-mail address Fax number Salaries to be quoted * Total number of eligible Total number of employees employees *Please note: All new eligible employees who enter service on or after the commencement date must be registered as members of the Fund with the administrator. Specify categories of members being excluded NB: If YES, provide annual salaries for these Is weekly paid staff included? members. If not provided please indicate factor (52/26) that must be used Do you require a quotation for associated NB: Please read the document for more entities? Yes No information. Associated entities Number of pay points Are all members residing Number of members residing in SA? Yes No outside the borders of SA?

Sanlam Umbrella Fund Record of Advice & Quotation Request April 2017 Page 1 of 7 If NO - specify countries members are residing in Are any non-SA citizens included in the NB: If yes, provide actual date of birth for these quotation? Yes No members Type of fund

Benefit design option (Please select ONE of the options listed below)

Option required Yes/No

Unity Option

Standard Option

Optimal Option

Comprehensive Option Cost of Insured benefits and expenses (Optimal option: Fund operating expenses will employer’s contributions be recovered from members shares outside of the monthly contribution receipting cycle) Method of costing Administration fees (Excludes Optimal option which will be expressed as a % of assets.) Retirement Optimisation Premium Service

Preferred Insurer for risk

Comments

Section B: Intermediary Information (Compulsory) Brokerage Name: Intermediary Name Office Tel Cell number E-mail

Channel of business SFA Branch SBD Branch Does the intermediary’s FSP licence allow them to market and provide advice relating to pension fund benefits? / Is the SFA licensed in terms of the FAIS Act to provide pension Yes No fund advice? Sanlam Commission FAIS license number Code: (if applicable) For Sanlam Umbrella Fund quotations Negotiated rand Method of costing consulting fees amount consulting fee Is the intermediary offering a discount on the standard consulting fee? If “yes” - supply details below (minimum of 50% allowed) CFA % discount CBC % discount offered offered CFA consulting fee is 0.50% of salaries For Sanlam Unity quotations (unless otherwise authorised)

Sanlam Umbrella Fund Record of Advice & Quotation Request April 2017 Page 2 of 7 Section C: Take-over of existing fund (Compulsory) Name of existing fund PF Reg. No. If “other” previous administrator Current total fund value (this has an Select name of Previous Insurer/ was selected, please supply effect on admin. fees) Administrator name

Current number of active Number of fully paid-up

members members Reason for change

Section D: Benefits

1. Categories (insert description if applicable) 1.1 Member Contributions: % % % % 1.2 Employer Contributions: % % % % The minimum net monthly member plus employer contribution rate is 5% of salaries and is subject to the net employer contribution rate being positive for all members. 2. Normal Retirement Age 3. Death Benefits (Combined Core plus Flex Cover may not exceed 15 x annual salary) 3.1 Option to continue to age 70 3.2 Group Core Life insurance Multiple of salary (Core Cover may not exceed 10 x annual salary) 3.2.1 Approved (under Fund): Yes No 3.2.2 Unapproved (separate

policy): Yes No 3.3 Reinforced Group Life insurance 3.4 Group Flexible Life insurance (Minimum of 50 members are required) 3.4.1 Approved (under Fund): 3.4.2 Unapproved (separate policy) 4. In the event of Group Income Disability insurance/Group Temporary Income Disability insurance 4.1 Continuation of life cover during disability 4.2 Growth on death benefits Please note: The growth rate will increase at a rate equal to the selected disability increase growth rate subject to a maximum between the lesser of 10% or the increase in the Consumer Price Index. 5. Are we taking over the life cover of existing and pending disability claims? (supply details, including date of disability) 6. Conversion Option 7. Group Accident insurance - Death 50% or 100% of core Group Life Insurance 8. Group Lump Sum Disability insurance (Cover cannot exceed the death cover.) NB! Your lump sum disability is a rider benefit of the Core Group Life insurance; therefore, you are restricted to the exact same choice as in section D.3.2 (approved/unapproved).

8.1 Approved (under Fund): Yes No Unapproved (separate 8.2 policy) Yes No 8.3 Conversion Option

Sanlam Umbrella Fund Record of Advice & Quotation Request April 2017 Page 3 of 7 9. Group Spouse’s Life insurance Marital status of members plus DOB of spouses to be provided at quotation stage 9.1 Conversion Option 10. Group Income Disability insurance 10.1 Waiting Period 10.2 Conversion Option 10.3 Growth Rate for Income Benefits 10.4 Waiver of Employer Contribution Included NB: If no disability has been selected, please indicate if Income Disability is provided outside the umbrella. Yes No 11. Group Temporary Income and Lump Sum

Disability insurance 12. Group Critical Illness insurance 12.1 Multiple of Salary 13. Group Family Funeral insurance 13.1 Number of Units for quotation purposes (min 5

units, max 55 units)

Section E: Benefits (as proposed) and tender request for Unity option 1. Categories (insert description if applicable) 1.1 Member Contributions: % % % % 1.2 Employer Contributions: % % % % 2. Death and Group Lump Sum Disability insurance 3. Group Family Funeral insurance 3.1 Cost of Group Family Funeral insurance employer’s contributions 4. Normal Retirement Age

(will be 65 unless otherwise stipulated)

Section F: Client Needs & Requirements

Retirement Benefits Yes No Undecided

Type of Fund / Scheme Pension Provident Hybrid

Group Core Life insurance Yes No Undecided

Group Lump Sum Disability insurance Yes No Undecided

Group Income Disability insurance Yes No Undecided

Group Spouse’s Life insurance Yes No Undecided

Group Critical Illness insurance Yes No Undecided

Group Family Funeral insurance Yes No Undecided

Group Accident insurance - Death Yes No Undecided Additional Comments

Sanlam Umbrella Fund Record of Advice & Quotation Request April 2017 Page 4 of 7 Section G: Investment Indicator

Are some of your employees within five years of retirement? Yes % No Do some of your employees fall into a “low financially literate” category? Yes % No Do some of your employees fall into a “high financially literate” category? Yes % No

Do you have a high staff turnover? Yes % No

Default Investment Portfolio Yes No

Do you require: Individual member investment choice Yes No

Glacier Yes No Additional Comments

Section H: Recommendations

Final Recommendation

Does the recommended solution include replacing in whole or in part any existing benefits? Yes (If YES, please No complete section I) Motivation for recommendations of a fund / scheme and the type of fund / scheme are as follows: Additional copies of proposed benefits (Section D is included) Yes No The client has accepted the recommendations Yes No Despite the advice provided by the adviser, the client has concluded a transaction that differs from the Yes No recommendations If the client has decided to conclude a transaction that differs from the recommended solution, and this could put him or his employees at risk, he should have been alerted to the clear existence of risk. What risks have been pointed out to the client?

Section I: Product (Fund Replacement) Name of Fund/ Scheme that is replaced: Fund/Scheme Code:

Defined Individual Defined Benefit Funding method of the product that is replaced Contribution (DC) Policies (DB) Funding Funding Detail (as applicable) of the actual and potential financial implications, costs & Replacement Fund Existing Fund consequences of the replacement as disclosed to the client: o Fees and charges in respect of the

replacement fund: o Special terms and conditions, waiting periods, loadings, penalties, pre-existing conditions, restrictions or circumstances in

which benefits will not be provided, which may be applicable to the replacement product: o In the case of risk benefits, the impact of age and health changes on the premium payable:

Sanlam Umbrella Fund Record of Advice & Quotation Request April 2017 Page 5 of 7 o Differences between the tax implications of the replacement fund and the terminated fund: o Material differences between the investment risk of the replacement fund and the terminated fund: o Penalties or un-recouped expenses deductible or payable due to termination of the terminated fund: o The extent to which the replacement fund is readily realisable or the relevant funds

accessible, compared to the terminated fund: o Vested rights, minimum guaranteed benefits or other guarantees or benefits, which will be lost as a result of the replacement: List of PHI claimants / pending claimants on existing fund to be provided to SUF by previous underwriters Comparison of Benefits Proposed New Fund Existing Fund o Eligible groups o Member contribution % / rate o Employer contribution % / rate o Is the employer contribution % inclusive or

exclusive of risk and administration fees? o Benefit payable on death o Benefit payable on disability (if admitted by

underwriter) o Benefit payable on withdrawal o Benefit payable on retirement o Normal retirement age o Conversion option available and for which

benefits? o Are housing loans provided? o What is the cost of administration and related costs (e.g. commission) as a % of employer’s contribution? o What are the investments fees? o What is the cost of risk cover as a % of the

employer’s contribution? o Are any other benefits available to members on old fund/scheme that are not under the

new fund/scheme (e.g. funeral or monthly disability benefits)? o Is there investment choice and if so who

qualifies? o Request current investment portfolios the

fund is invested in.

Sanlam Umbrella Fund Record of Advice & Quotation Request April 2017 Page 6 of 7 Section J: Basis of Advice (Always to be completed) Advice given (i.e. an analysis was The analysis incorporates the following: done) O Identifying the client’s employee benefit needs; O Considering solutions to address those needs; O My recommendations; O An explanation why the recommended solution is appropriate to the client’s situation. Explanation of special terms and The following were explained: conditions O Exclusions of liability, O Waiting periods, O Loadings, O Penalties, O Excesses, O Pre-existing conditions, O Restrictions, O Circumstances in which benefits will not be provided. Product Guidance (the client has You have not provided me with the required information to enable me elected not to provide the required to do a full analysis of your employee benefits needs, as you only information to enable an advisor to do wish to receive guidance on specific products. Please note that there an analysis of his/her needs, and only may be limitations on the appropriateness of the advice I have given wished to receive guidance on a you. Please take particular care to consider whether my advice to you specific product, e.g. a stand-alone is appropriate considering your objectives, financial situation and funeral benefit scheme or a pure particular needs. retirement funding product) I have read Sections A to I of this form and confirm that the information contained in it ……………………………………… is accurate. Client’s Name I confirm that I have been given a copy of the advisor’s PERMIT confirming that he/she is authorised to give advice on employee benefits. I also confirm that I have been given a product quotation containing comprehensive information on the relevant product providers, product …………………………………………. features, premiums, claims procedures and ……….../…………/…… Client’s Signature other rights I have in terms of legislation. Date

……………………………………… Name of FAIS intermediary I have fully discussed the information in Sections A to I with the client. …………………………………………. Signature of FAIS intermediary who advised the client ……….../…………/…… Date

Section K: Disclosure

Sanlam has a complaints resolution system in terms of the Sanlam’s Compliance Officer’s contact details: requirements of the FAIS Act. All complaints should be René Louw channelled into this system in writing. Clients could pursue Sanlam Life: Employee Benefits complaints that are not resolved through the complaints Tel: (021) 947 6977 resolution system, with the Ombud or Financial Services Fax: (021) 957 3012 Board. E-mail: [email protected] The FAIS Ombud’s contact details: The Financial Services Board’s contact details: P.O. Box 74571 P.O. Box 35655 0040 Lynwood Ridge 0102 Menlo Park Tel: (012) 470 9080 Tel: 0800 110 443 or 0800 202 087 Fax: (012) 548 5447 Fax: (012) 347 0221 Call Center: [email protected]

Sanlam Umbrella Fund Record of Advice & Quotation Request April 2017 Page 7 of 7