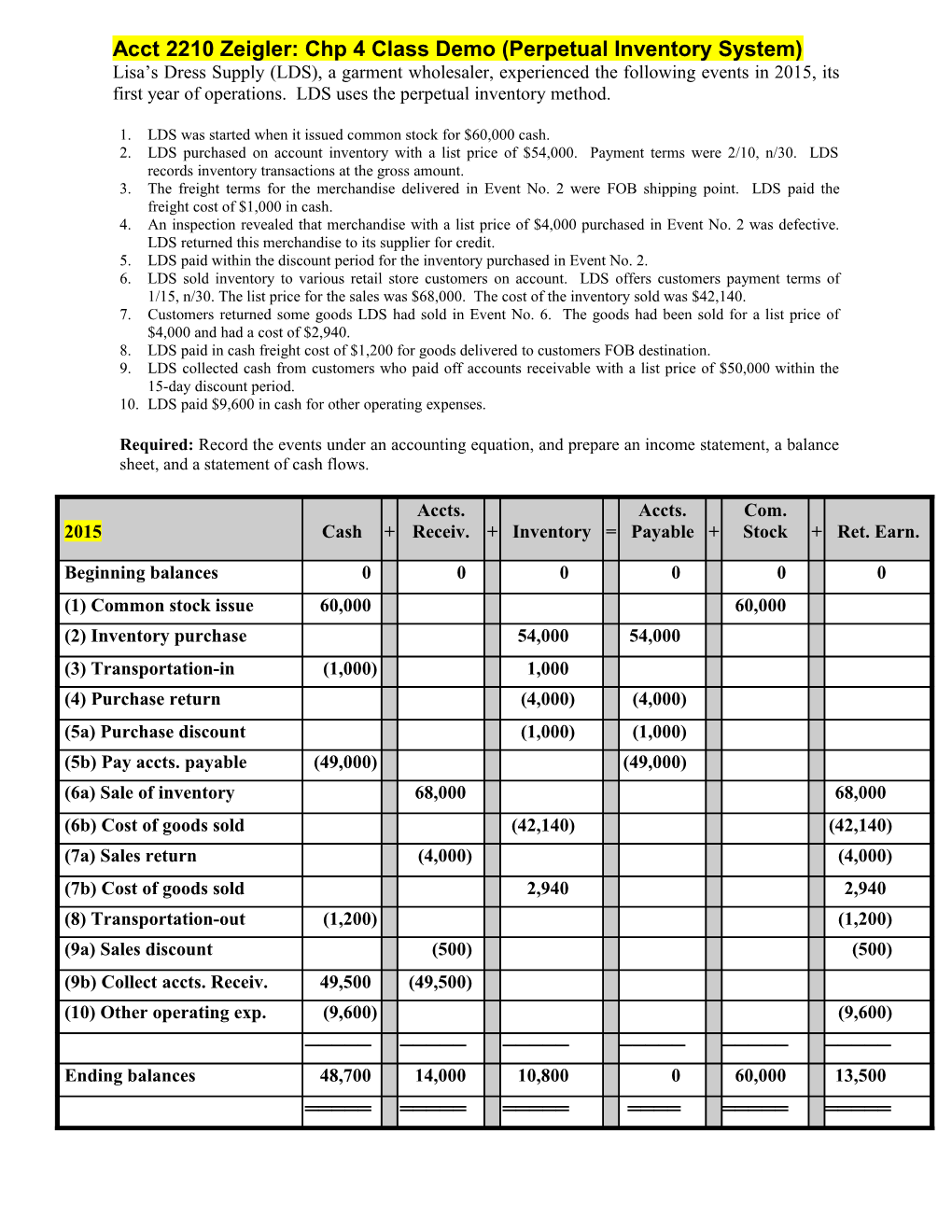

Acct 2210 Zeigler: Chp 4 Class Demo (Perpetual Inventory System) Lisa’s Dress Supply (LDS), a garment wholesaler, experienced the following events in 2015, its first year of operations. LDS uses the perpetual inventory method.

1. LDS was started when it issued common stock for $60,000 cash. 2. LDS purchased on account inventory with a list price of $54,000. Payment terms were 2/10, n/30. LDS records inventory transactions at the gross amount. 3. The freight terms for the merchandise delivered in Event No. 2 were FOB shipping point. LDS paid the freight cost of $1,000 in cash. 4. An inspection revealed that merchandise with a list price of $4,000 purchased in Event No. 2 was defective. LDS returned this merchandise to its supplier for credit. 5. LDS paid within the discount period for the inventory purchased in Event No. 2. 6. LDS sold inventory to various retail store customers on account. LDS offers customers payment terms of 1/15, n/30. The list price for the sales was $68,000. The cost of the inventory sold was $42,140. 7. Customers returned some goods LDS had sold in Event No. 6. The goods had been sold for a list price of $4,000 and had a cost of $2,940. 8. LDS paid in cash freight cost of $1,200 for goods delivered to customers FOB destination. 9. LDS collected cash from customers who paid off accounts receivable with a list price of $50,000 within the 15-day discount period. 10. LDS paid $9,600 in cash for other operating expenses.

Required: Record the events under an accounting equation, and prepare an income statement, a balance sheet, and a statement of cash flows.

Accts. Accts. Com. 2015 Cash + Receiv. + Inventory = Payable + Stock + Ret. Earn.

Beginning balances 0 0 0 0 0 0 (1) Common stock issue 60,000 60,000 (2) Inventory purchase 54,000 54,000 (3) Transportation-in (1,000) 1,000 (4) Purchase return (4,000) (4,000) (5a) Purchase discount (1,000) (1,000) (5b) Pay accts. payable (49,000) (49,000) (6a) Sale of inventory 68,000 68,000 (6b) Cost of goods sold (42,140) (42,140) (7a) Sales return (4,000) (4,000) (7b) Cost of goods sold 2,940 2,940 (8) Transportation-out (1,200) (1,200) (9a) Sales discount (500) (500) (9b) Collect accts. Receiv. 49,500 (49,500) (10) Other operating exp. (9,600) (9,600) ───── ───── ───── ───── ───── ───── Ending balances 48,700 14,000 10,800 0 60,000 13,500 ═════ ═════ ═════ ════ ═════ ═════ Demonstration Problem: Solution Financial Statements Lisa’s Dress Supply Financial Statements Income Statement For the Year Ended December 31, 2015 Net sales $63,500 Cost of goods sold (product cost) (39,200) Gross margin 24,300 Transportation-out (period cost) (1,200) Other operating expenses (period cost) (9,600) Net income $13,500 Balance Sheet at December 31 Assets Cash $48,700 Accounts receivable 14,000 Inventory 10,800 Total assets $73,500 Stockholders’ equity Common stock $60,000 Retained earnings 13,500 Total stockholders’ equity $73,500 Statement of Cash Flows Net cash flow from operating activities1 $(11,300) Net cash flow from investing activities 0 Net cash flow from financing activities 60,000 Net change in cash 48,700 Beginning cash balance 0 Ending cash balance $48,700 1Net cash flow from operating activities: $49,500 inflow from revenue less outflows of $1,000 for transportation-in, $49,000 for payments of accounts payable, $1,200 for transportation-out, and $9,600 for other operating expenses [$49,500 ─ $1,000 ─ $49,000 ─ $1,200 ─ $9,600 = ($11,300)]. Note: In this case, LDS is reporting a profit of $13,500 to its shareholders, BUT has negative cash flow from operations. This is due to the fact that all inventory has been paid for, but $14,000 is still due from the sale of inventory and $10,800 of inventory is yet to be sold.

This is a very typical situation which requires bank financing (i.e. credit lines) to be readily available to provide cash flow for the company until inventory is sold and the cash is collected from the sale. LDS has no credit lines now, but the sale of the common stock is what is keeping this company in a positive OVERALL cash flow position. Either the company should issue more stock or (more likely) go to the bank and negotiate a credit line to provide for future funding.