Solvay Business School Université Libre de Bruxelles

Corporate Finance – Useful formulas Hanoi April 2006

André Farber May 2006

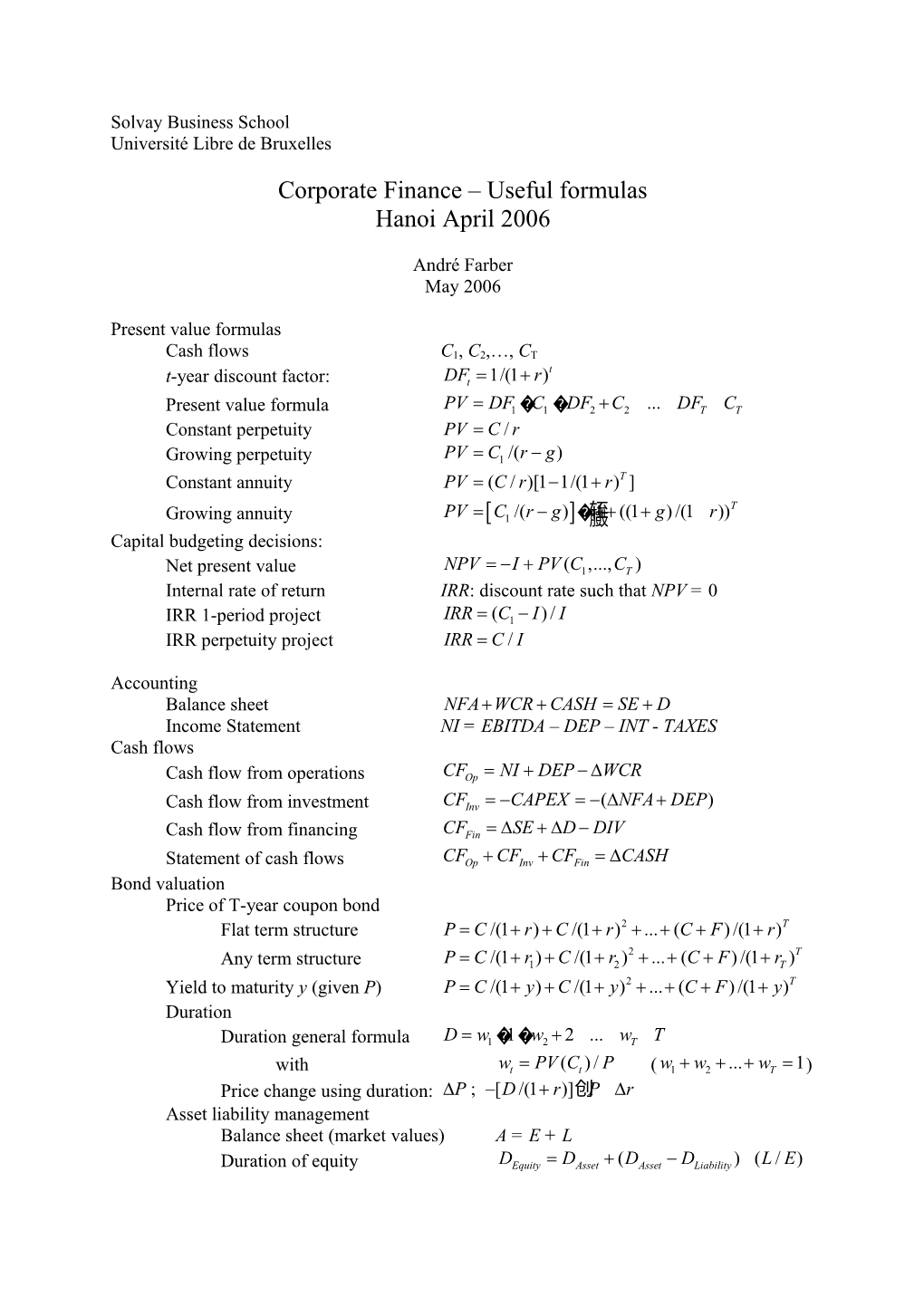

Present value formulas Cash flows C1, C2,…, CT t t-year discount factor: DFt =1/(1 + r )

Present value formula PV= DF1� C 1 � DF 2 + C 2 ... DFT C T Constant perpetuity PV= C/ r

Growing perpetuity PV= C1 /( r - g ) Constant annuity PV=( C / r )[1 - 1/(1 + r )T ] PV= C/( r - g )轾 1 + ((1 + g ) /(1 r ))T Growing annuity [ 1 ]�臌 Capital budgeting decisions:

Net present value NPV= - I + PV( C1 ,..., CT ) Internal rate of return IRR: discount rate such that NPV = 0

IRR 1-period project IRR=( C1 - I ) / I IRR perpetuity project IRR= C/ I

Accounting Balance sheet NFA+ WCR + CASH = SE + D Income Statement NI = EBITDA – DEP – INT - TAXES Cash flows

Cash flow from operations CFOp = NI + DEP - D WCR

Cash flow from investment CFInv = - CAPEX = -( D NFA + DEP )

Cash flow from financing CFFin = D SE + D D - DIV

Statement of cash flows CFOp+ CF Inv + CF Fin = D CASH Bond valuation Price of T-year coupon bond Flat term structure P= C/(1 + r ) + C /(1 + r )2 + ... + ( C + F ) /(1 + r )T 2 T Any term structure P= C/(1 + r1 ) + C /(1 + r 2 ) + ... + ( C + F ) /(1 + rT ) Yield to maturity y (given P) P= C/(1 + y ) + C /(1 + y )2 + ... + ( C + F ) /(1 + y )T Duration

Duration general formula D= w1�1 � w 2 + 2 ... wT T

with wt= PV( C t ) / P ( w1+ w 2 +... + wT = 1) Price change using duration: DP; -[ D /(1 + r )]创 P D r Asset liability management Balance sheet (market values) A = E + L

Duration of equity DEquity= D Asset +( D Asset - D Liability ) ( L / E ) t t-1 Forward interest rate: ft=(1 + r t ) /(1 + r t-1 )

Stock valuation Discount rate r = Risk free rate + risk premium div div( div+ P ) DDM (dividend discount model) P =1 + 2 +... + T T 0 (1+r ) (1 + r )2 (1 + r )T

Constant growth rate P0= div 1 /( r - g ) Growth rate g = (RORE)(Retention ratio) RORE= D NI/ D SE t Unlevered company valuation V= FCFt /(1 + r ) t Basic statistics Random return R Possible values: R1, R2,…,Rn

Probabilities p1, p2,…,pn ( p1+ p 2 +... + pn = 1)

Expected value E( R )= R = p1 R 1 + p 2 R 2 + ... + pn R n Variance s 2=E( R - R ) 2 = E ( R 2 ) - R 2 Standard deviation s= s 2

Random returns RA, RB 2 Covariance sAB=E[( R A - R A )( R B - R B )] NB: s AA = s A

Correlation: rAB= s AB/( s A s B ) -1# r AB + 1 Normal distribution: R: N( R ,s ) Proba(R- 1s# R R + 1 s ) = 0.6826 Proba(R- 2s# R R + 2 s ) = 0.9544 Proba(R- 3s# R R + 3 s ) = 0.9972

Portfolio theory 1 risky asset + 1 riskfree asset Expected return RP= R F + X A( R A - R F ) Standard deviation sP= X A s A 2 risky assets: Expected return: RP= X A R A + X B R B 2 2 2 2 2 sP=X A s A + X B s B + 2 X A X B s AB Variance: 2 2 =XA( X As A + X B s AB ) + X B ( X B s B + X A s AB ) =XAs AP + X B s BP Rj- R F Sharpe ratio: SR j = (expected excess return per unit of risk) s j N risky assets RP= X j R j = x' r j sjP= X k s jk k 2 sP=邋 X j X k s jk = x' Vx j k

= X js jk j Capital Asset Pricing Model

CAPM equation Rj= R F +( R M - R F )b j 2 Definition of beta bj= s jM/ s M = r jM ( s j / s M ) Capital structure and cost of capital (assuming perpetuities + risk free debt) Assumptions: CAPEX = DEP & ∆WCR = 0 →FCFU = EBIAT Earnings before interest after taxes EBIAT = EBIT(1-TC)

Value of unlevered firm VU= EBIAT/ r A

Value of tax shield (D constant) VTS = TC D Value of levered firm V = E+ D = VU +VTS

Beta equity bEquity= b Asset[1 + (1 -T C ) ( D / E )]

Cost of equity rEquity= r Asset +( r Asset - r Debt )(1 - T C )( D / E ) Value of levered firm: V = EBIAT / WACC

WACC= rEquity�( E / V ) - r Debt (1 T C ) ( D / V ) Weighted average cost of capital =rAsset - r Asset创 T C ( D / V )