UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN College of Business DEPARTMENT OF FINANCE

First Exam

Finance 432 Name:______Spring, 2008 Maximum Number of Points: 30

This exam is open book, open note. You may use a calculator, but not a computer, cell phone or any other communication device. Unless otherwise noted, each part of each question is worth 2 points.

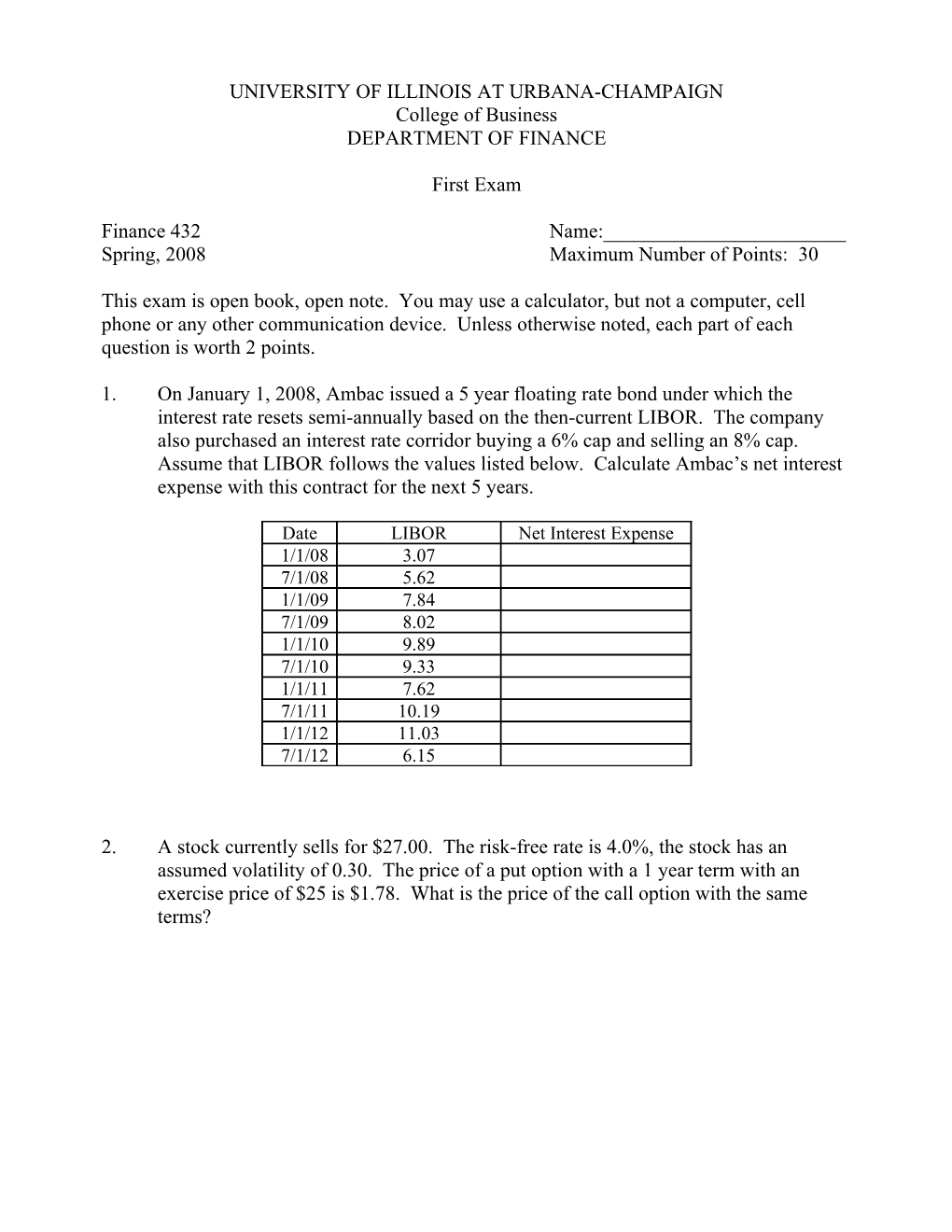

1. On January 1, 2008, Ambac issued a 5 year floating rate bond under which the interest rate resets semi-annually based on the then-current LIBOR. The company also purchased an interest rate corridor buying a 6% cap and selling an 8% cap. Assume that LIBOR follows the values listed below. Calculate Ambac’s net interest expense with this contract for the next 5 years.

Date LIBOR Net Interest Expense 1/1/08 3.07 7/1/08 5.62 1/1/09 7.84 7/1/09 8.02 1/1/10 9.89 7/1/10 9.33 1/1/11 7.62 7/1/11 10.19 1/1/12 11.03 7/1/12 6.15

2. A stock currently sells for $27.00. The risk-free rate is 4.0%, the stock has an assumed volatility of 0.30. The price of a put option with a 1 year term with an exercise price of $25 is $1.78. What is the price of the call option with the same terms? 3. The attached data represent sorted aggregate monthly losses based on a run of 200 iterations with a negative binomial loss frequency with parameters of 3 and 0.2 and a lognormal severity distribution with a mean of 5 and a standard deviation of 2.

98086 24510 14668 9331 6013 4224 2235 691 76836 24294 14482 9257 5921 4006 2200 542 53907 24087 13600 9213 5816 3881 1993 452 52187 23632 13205 8949 5692 3765 1803 363 51907 23121 12603 8915 5603 3708 1734 360 51314 23016 12446 8580 5590 3433 1686 312 49315 22724 12349 8532 5502 3356 1600 308 44535 21886 12157 8190 5241 3271 1597 308 42540 20778 12092 7931 5170 3254 1459 266 40050 20223 11723 7870 5133 3210 1367 253 38084 20203 11685 7857 5122 3096 1324 248 34579 19298 11419 7787 4983 3066 1270 246 32648 18766 11361 7728 4889 3014 1266 229 32623 18009 11178 7643 4861 3006 1255 204 30001 17987 11129 7552 4818 2934 1075 199 29871 17302 10872 7522 4774 2859 1056 159 29386 17138 10731 7456 4730 2756 996 155 29001 16978 10379 7375 4677 2723 967 133 28342 16850 10348 6799 4573 2714 888 128 28236 16654 10339 6750 4557 2662 877 126 27850 16571 10014 6609 4533 2517 876 110 27079 16014 9917 6355 4518 2472 775 75 27012 16000 9767 6352 4404 2376 773 25 26476 15752 9731 6183 4296 2309 743 17 25893 15350 9688 6088 4277 2268 712 3

a. What is the 95% VaR for this sample?

b. What is the 95% Tail VaR for this sample?

c. Explain, in terms that the Vice President of Claims who is not familiar with financial economics or mathematics would understand, what this value of VaR means for the company. 4. Draw the risk profile, including numerical values, for the change in value of the surplus of a property-liability insurer to changes in interest rates given the following information:

DA = 4.5 DL = 2.5 Assets = $100 million Liabilities = $75 million Current interest rate = 5%

5. Below are the U.S. Treasury interest rates for different maturities as of February 26, 2008:

Date 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr a. 02/26/08 2.34 2.14 2.09 2.07 2.04 2.32 2.92 3.36 3.88 4.64 4.66 Calculate the following implied forward rates to the nearest basis point:

2f1

10f10

b. How would the market segmentation theory explain this shape for the term structure? 6. Based on interest rate parity, what is today’s one-year forward rate in terms of Australian $ / US $ if the current spot rate is $1.072 AUD/ $1 US, the yield on 1-year US Treasuries is 2.07%, and the yield on a 1-year, risk-free asset in Australia is 7.00%?

7. An insurer has agreed to buy 10,000 ounces of gold through the futures market at a price of $950 per ounce. The initial margin required is $250,000 and the maintenance margin is $150,000. Given the following futures prices, fill in the following table, and show how much money is in the insurer’s account at the end of each day. If the insurer has a margin call, assume the insurer adds only the minimum amount required. Round all figures to the nearest dollar.

a) Day Price of Contract Change in Margin Amount Added Gold per Value Value Account (if any) ounce 0 950 $9,500,000 - $250,000 - 1 932 2 918 3 926 4 912

b) Explain how marking-to-market works to a Vice President of Claims for a life insurance company who is not familiar with finance. 8. Bond A is a 10 year zero coupon bond with a face value of $1,000,000. Bond B makes a single payment of $1,000,000 at a time depending on the current interest rate based on the following relationship:

Year of payment = 5 + r, where r is the interest rate

The current interest rate is 5%, so the expected date of payment is in 10 years.

a. Calculate the modified duration of Bond A.

b. Calculate the effective duration of Bond B for a change in interest rates of 50 basis points.

c. Explain, in terms that an underwriter without an understanding of finance would understand, why you calculated the effective duration of Bond B rather than the modified duration.

9. Why are the banks that purchased CDS from the financial guaranty insurers now considering providing capital to those insurers?