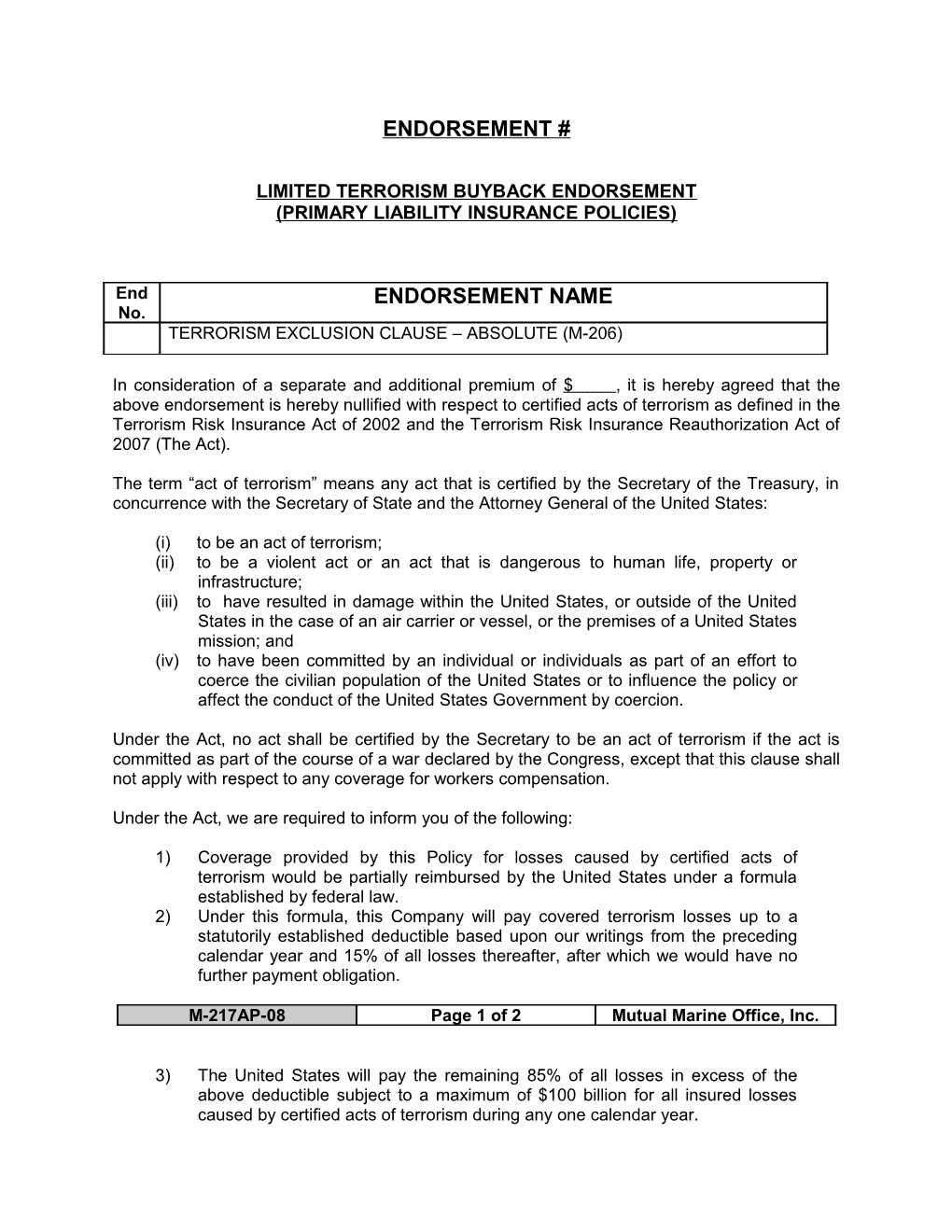

ENDORSEMENT #

LIMITED TERRORISM BUYBACK ENDORSEMENT (PRIMARY LIABILITY INSURANCE POLICIES)

End ENDORSEMENT NAME No. TERRORISM EXCLUSION CLAUSE – ABSOLUTE (M-206)

In consideration of a separate and additional premium of $ , it is hereby agreed that the above endorsement is hereby nullified with respect to certified acts of terrorism as defined in the Terrorism Risk Insurance Act of 2002 and the Terrorism Risk Insurance Reauthorization Act of 2007 (The Act).

The term “act of terrorism” means any act that is certified by the Secretary of the Treasury, in concurrence with the Secretary of State and the Attorney General of the United States:

(i) to be an act of terrorism; (ii) to be a violent act or an act that is dangerous to human life, property or infrastructure; (iii) to have resulted in damage within the United States, or outside of the United States in the case of an air carrier or vessel, or the premises of a United States mission; and (iv) to have been committed by an individual or individuals as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion.

Under the Act, no act shall be certified by the Secretary to be an act of terrorism if the act is committed as part of the course of a war declared by the Congress, except that this clause shall not apply with respect to any coverage for workers compensation.

Under the Act, we are required to inform you of the following:

1) Coverage provided by this Policy for losses caused by certified acts of terrorism would be partially reimbursed by the United States under a formula established by federal law. 2) Under this formula, this Company will pay covered terrorism losses up to a statutorily established deductible based upon our writings from the preceding calendar year and 15% of all losses thereafter, after which we would have no further payment obligation.

M-217AP-08 Page 1 of 2 Mutual Marine Office, Inc.

3) The United States will pay the remaining 85% of all losses in excess of the above deductible subject to a maximum of $100 billion for all insured losses caused by certified acts of terrorism during any one calendar year. 4) In the event that the government portion exceeds $100 billion, the 85% portion payable by the United States could be reduced proportionately.

Punitive Damage Exclusion: The Act does not provide any reimbursement for punitive damages claims arising out of an act of terrorism. Therefore, this policy shall not apply to any claim for punitive damages arising out of a certified act of terrorism that would not have been recoverable in the absence of this endorsement. If a suit is brought against you for a claim falling within the coverage provided by the policy seeking both compensatory and punitive damages, then we will afford a defense to such action. We will not, however, have any obligation to pay for any costs, interest or damages attributable to punitive or exemplary damages.

This endorsement shall not be cancelable unless the entire policy is cancelled.

ALL OTHER TERMS AND CONDITIONS REMAINING UNCHANGED.

M-217AP-08 Page 2 of 2 Mutual Marine Office, Inc.