MORTGAGE MECHANICS

(Note: All of the tables and calculations may be found on the Mortgage Spreadsheet on my website.)

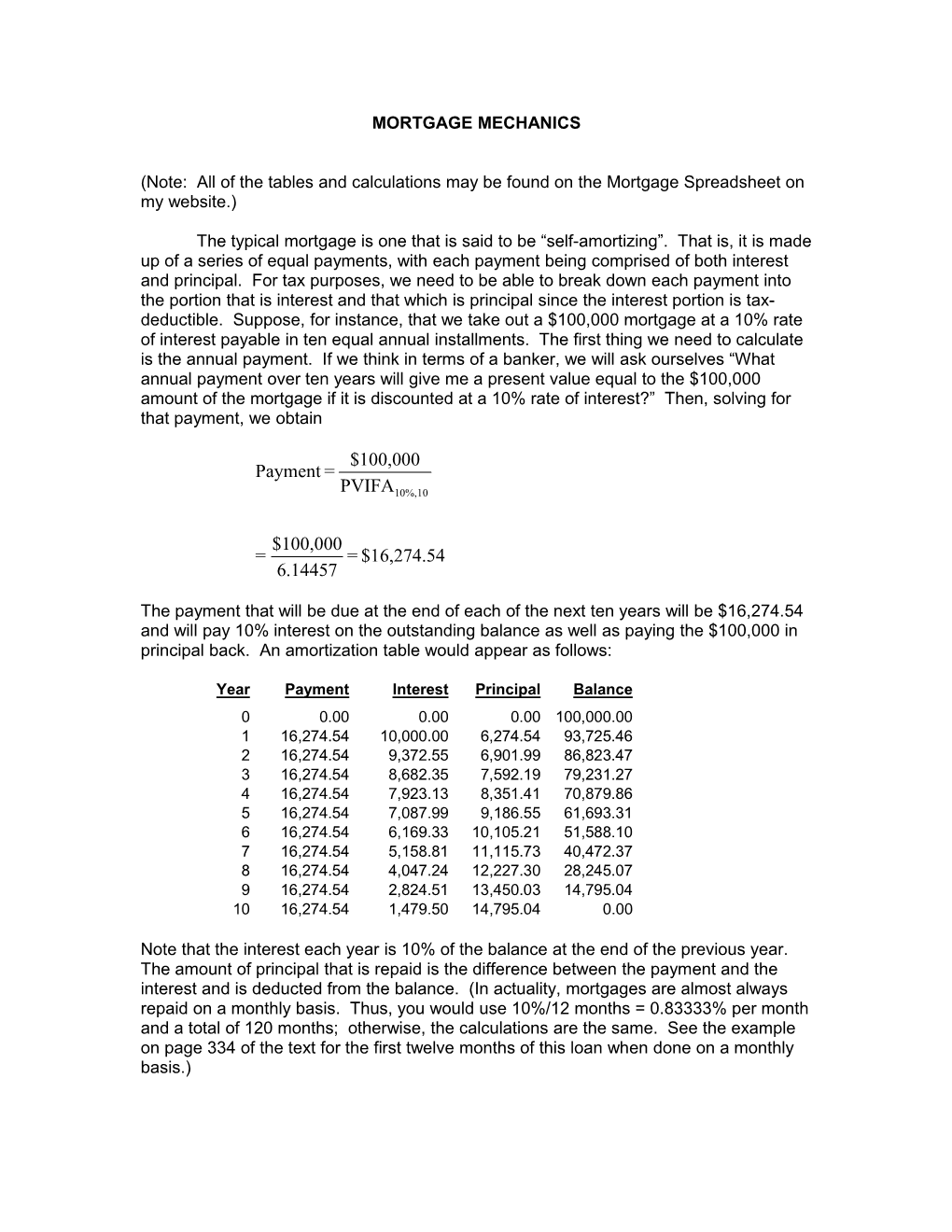

The typical mortgage is one that is said to be “self-amortizing”. That is, it is made up of a series of equal payments, with each payment being comprised of both interest and principal. For tax purposes, we need to be able to break down each payment into the portion that is interest and that which is principal since the interest portion is tax- deductible. Suppose, for instance, that we take out a $100,000 mortgage at a 10% rate of interest payable in ten equal annual installments. The first thing we need to calculate is the annual payment. If we think in terms of a banker, we will ask ourselves “What annual payment over ten years will give me a present value equal to the $100,000 amount of the mortgage if it is discounted at a 10% rate of interest?” Then, solving for that payment, we obtain

$100,000 Payment = PVIFA10%,10

$100,000 = = $16,274.54 6.14457

The payment that will be due at the end of each of the next ten years will be $16,274.54 and will pay 10% interest on the outstanding balance as well as paying the $100,000 in principal back. An amortization table would appear as follows:

Year Payment Interest Principal Balance 0 0.00 0.00 0.00 100,000.00 1 16,274.54 10,000.00 6,274.54 93,725.46 2 16,274.54 9,372.55 6,901.99 86,823.47 3 16,274.54 8,682.35 7,592.19 79,231.27 4 16,274.54 7,923.13 8,351.41 70,879.86 5 16,274.54 7,087.99 9,186.55 61,693.31 6 16,274.54 6,169.33 10,105.21 51,588.10 7 16,274.54 5,158.81 11,115.73 40,472.37 8 16,274.54 4,047.24 12,227.30 28,245.07 9 16,274.54 2,824.51 13,450.03 14,795.04 10 16,274.54 1,479.50 14,795.04 0.00

Note that the interest each year is 10% of the balance at the end of the previous year. The amount of principal that is repaid is the difference between the payment and the interest and is deducted from the balance. (In actuality, mortgages are almost always repaid on a monthly basis. Thus, you would use 10%/12 months = 0.83333% per month and a total of 120 months; otherwise, the calculations are the same. See the example on page 334 of the text for the first twelve months of this loan when done on a monthly basis.) Another thing you’ll notice is that the early payments are more interest than principal, slowly decreasing as time passes. The following diagram depicts the portion of each payment and illustrates this point. It is even more dramatic when the mortgage is on a monthly basis over a thirty-year period.

Virtually all mortgages allow you to prepay as well, either paying the entire balance or paying an additional amount that is applied to the principal of the loan. This will accelerate the repayment of the loan (although it does not change the fact that you must pay at least the regular payment, which is $16,274.54 in this case, at all times). In the following table shows how the ten-year mortgage would be paid off if you made annual payments of $20,000 per year:

Year Payment Interest Principal Balance 0 0.00 0.00 0.00 100,000.00 1 20,000.00 10,000.00 10,000.00 90,000.00 2 20,000.00 9,000.00 11,000.00 79,000.00 3 20,000.00 7,900.00 12,100.00 66,900.00 4 20,000.00 6,690.00 13,310.00 53,590.00 5 20,000.00 5,359.00 14,641.00 38,949.00 6 20,000.00 3,894.90 16,105.10 22,843.90 7 20,000.00 2,284.39 17,715.61 5,128.29 8 5,641.12 512.83 5,128.29 0.00 9 0.00 0.00 0.00 0.00 10 0.00 0.00 0.00 0.00

The last payment ($5,128.29) would be for the remaining balance and the interest due on it only. Some lenders do not really want to lend for a full thirty years and will, instead, have the unpaid balance come due before the full balance of the debt is repaid. The payment of the unpaid balance is referred to as a “balloon” payment. The following table shows our same mortgage but with a balloon payment at the end of five years. Note that the annual payments up to the time of the balloon payment are still based upon a ten- year amortization period:

Year Payment Interest Principal Balance 0 0.00 0.00 0.00 100,000.00 1 16,274.54 10,000.00 6,274.54 93,725.46 2 16,274.54 9,372.55 6,901.99 86,823.47 3 16,274.54 8,682.35 7,592.19 79,231.27 4 16,274.54 7,923.13 8,351.41 70,879.86 5 77,967.85 7,087.99 70,879.86 0.00 6 0.00 0.00 0.00 0.00 7 0.00 0.00 0.00 0.00 8 0.00 0.00 0.00 0.00 9 0.00 0.00 0.00 0.00 10 0.00 0.00 0.00 0.00

The balloon payment in year 5 is the combined $7,087.99 of interest for the year plus the unpaid balance of $70,879.86 that remained at the end of the previous year.

Some mortgages will have graduated payments reflecting the fact that the rate of interest is increasing at different points in time. These graduated mortgages calculate the payment based on the interest rate that applies for each period, the remaining balance of the loan and the remaining duration of the mortgage. For example, suppose that our original $100,000 ten-year mortgage carried a 10% rate of interest for 5 years, and then the rate of interest increases to 20% for the last 5 years. The payment for the first five years would be the same $16,274.54 as before, but after five years the payment would increase to $20,628.99 each year. This amount is based on a loan of $61,693.31 (the remaining balance of the debt after the fifth year), an interest rate of 20% and a term of five years:

$61,693.31 Payment = PVIFA20%,5

$61,693.31 = = $20,628.99 2.99061

Of course, the real reason your payment is increasing is because you have to pay more in interest. The full amortization table would now look like this: Year Payment Interest Principal Balance 0 0.00 0.00 0.00 100,000.00 1 16,274.54 10,000.00 6,274.54 93,725.46 2 16,274.54 9,372.55 6,901.99 86,823.47 3 16,274.54 8,682.35 7,592.19 79,231.27 4 16,274.54 7,923.13 8,351.41 70,879.86 5 16,274.54 7,087.99 9,186.55 61,693.31 6 20,628.99 12,338.66 8,290.33 53,402.98 7 20,628.99 10,680.60 9,948.39 43,454.59 8 20,628.99 8,690.92 11,938.07 31,516.51 9 20,628.99 6,303.30 14,325.69 17,190.83 10 20,628.99 3,438.17 17,190.83 0.00

A situation that is often encountered is the opportunity to refinance a mortgage in the event that interest rates decrease. There are, of course, costs associated with refinancing the mortgage, but if the savings are great enough it may well be worth the cost. Suppose that interest rates fell to 8% after two years of our mortgage. If our cost of refinancing was $2,000 would it be worth it to do so? What we need to do is compare our cash flows with the old mortgage versus the cash flows with the new mortgage. Here was our original mortgage:

Original Loan

Year Payment Interest Principal Balance 0 0.00 0.00 0.00 100,000.00 1 16,274.54 10,000.00 6,274.54 93,725.46 2 16,274.54 9,372.55 6,901.99 86,823.47 3 16,274.54 8,682.35 7,592.19 79,231.27 4 16,274.54 7,923.13 8,351.41 70,879.86 5 16,274.54 7,087.99 9,186.55 61,693.31 6 16,274.54 6,169.33 10,105.21 51,588.10 7 16,274.54 5,158.81 11,115.73 40,472.37 8 16,274.54 4,047.24 12,227.30 28,245.07 9 16,274.54 2,824.51 13,450.03 14,795.04 10 16,274.54 1,479.50 14,795.04 0.00

Our new mortgage would be based on the $86,823.47 balance at the end of the second year with an 8% interest rate and, in this case, an eight-year term. The payments and amortization schedule would appear as follows: New Loan Balance After 2 Years $86,823.47 Payment @ 8% for 8 Years $15,108.56

Year Payment Interest Principal Balance 0 0.00 0.00 0.00 0.00 1 0.00 0.00 0.00 0.00 2 0.00 0.00 0.00 86,823.47 3 15,108.56 6,945.88 8,162.69 78,660.78 4 15,108.56 6,292.86 8,815.70 69,845.08 5 15,108.56 5,587.61 9,520.96 60,324.12 6 15,108.56 4,825.93 10,282.64 50,041.49 7 15,108.56 4,003.32 11,105.25 38,936.24 8 15,108.56 3,114.90 11,993.67 26,942.58 9 15,108.56 2,155.41 12,953.16 13,989.42 10 15,108.56 1,119.15 13,989.41 0.01

Now let’s look at the differences in the cash flows of the two mortgages for years 2-10.

Difference in Cash Flows

New Year Old Payment Payment Difference 0 0.00 2,000.00 -2,000.00 Initial Cost 1 16,274.54 15,108.56 1,165.97 Annual Savings 2 16,274.54 15,108.56 1,165.97 Annual Savings 3 16,274.54 15,108.56 1,165.97 Annual Savings 4 16,274.54 15,108.56 1,165.97 Annual Savings 5 16,274.54 15,108.56 1,165.97 Annual Savings 6 16,274.54 15,108.56 1,165.97 Annual Savings 7 16,274.54 15,108.56 1,165.97 Annual Savings 8 16,274.54 15,108.56 1,165.97 Annual Savings

Notice that the $2,000 cost of refinancing was included as a payment on the new loan at time zero. Whether it is desirable to refinance or not depends upon the Internal Rate of Return (IRR) on the difference in cash flows. That is, what rate of interest would we be earning on a $2,000 investment that would pay us $1,165.97 at the end of each of the following eight years? The answer is a 56.7% rate of return. We want to compare this to our cost of the debt of 8% (our opportunity cost since we can borrow at that rate). Obviously, a 56.7% rate of return is phenomenal (and exceeds the cost of the debt) so we would definitely want to refinance the loan.

Finally, we need to focus on the fact that the stated rate of interest on a mortgage is usually not the effective rate of interest, or what is disclosed as the APR for consumer loans. The true cost of any loan is the Internal Rate of Return between the net amount that you receive for a loan and the amounts that you must pay back. Suppose that we are considering a $100,000 ten-year loan but we must pay a 1% loan origination fee and that we can buy-down the interest rate to 9% by paying two “points”, or 2% of the loan amount. Thus, we must pay $1,000 in loan origination fees and another $2,000 to get the lower 9% rate of interest. Since we are only paying a 9% rate of interest, the payments are lower and the amortization table appears as this: Year Payment Interest Principal Balance 0 0.00 0.00 0.00 100,000.00 1 15,582.01 9,000.00 6,582.01 93,417.99 2 15,582.01 8,407.62 7,174.39 86,243.60 3 15,582.01 7,761.92 7,820.08 78,423.52 4 15,582.01 7,058.12 8,523.89 69,899.62 5 15,582.01 6,290.97 9,291.04 60,608.58 6 15,582.01 5,454.77 10,127.24 50,481.34 7 15,582.01 4,543.32 11,038.69 39,442.66 8 15,582.01 3,549.84 12,032.17 27,410.49 9 15,582.01 2,466.94 13,115.07 14,295.42 10 15,582.01 1,286.59 14,295.42 0.00

However, we didn’t really get $100,000 since we had to pay a total of $3,000 in origination fees and points. Thus, we really only netted $97,000 for the loan but we still have to pay $15,582.01 for ten years. This is how our net cash flows would appear:

Year Cash Flow 0 $97,000.00 1 -15,582.01 2 -15,582.01 3 -15,582.01 4 -15,582.01 5 -15,582.01 6 -15,582.01 7 -15,582.01 8 -15,582.01 9 -15,582.01 10 -15,582.01

The Internal Rate of Return for this loan is 9.7% which is the effective interest rate we’re paying.

Now go back and look at the graduated mortgage where we paid 10% interest for the first five years and 20% for the last five years. What is the effective rate of interest on that loan? Here are the cash flows:

Cash Flows 100,000.00 -16,274.54 -16,274.54 -16,274.54 -16,274.54 -16,274.54 -20,628.99 -20,628.99 -20,628.99 -20,628.99 -20,628.99 The IRR on this is 12.2%, so that is the effective rate of interest, or average rate of interest, on this particular graduated mortgage.