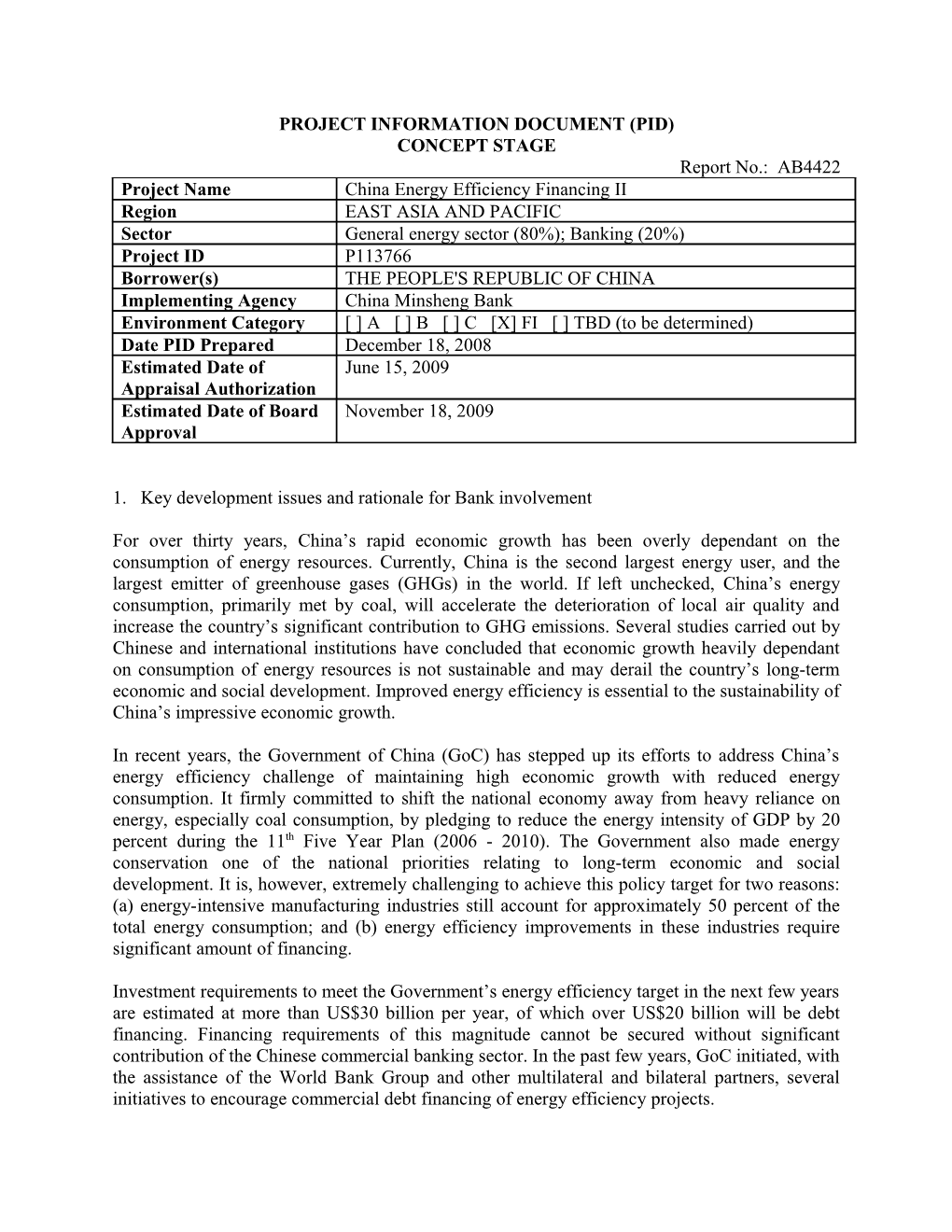

PROJECT INFORMATION DOCUMENT (PID) CONCEPT STAGE Report No.: AB4422 Project Name China Energy Efficiency Financing II Region EAST ASIA AND PACIFIC Sector General energy sector (80%); Banking (20%) Project ID P113766 Borrower(s) THE PEOPLE'S REPUBLIC OF CHINA Implementing Agency China Minsheng Bank Environment Category [ ] A [ ] B [ ] C [X] FI [ ] TBD (to be determined) Date PID Prepared December 18, 2008 Estimated Date of June 15, 2009 Appraisal Authorization Estimated Date of Board November 18, 2009 Approval

1. Key development issues and rationale for Bank involvement

For over thirty years, China’s rapid economic growth has been overly dependant on the consumption of energy resources. Currently, China is the second largest energy user, and the largest emitter of greenhouse gases (GHGs) in the world. If left unchecked, China’s energy consumption, primarily met by coal, will accelerate the deterioration of local air quality and increase the country’s significant contribution to GHG emissions. Several studies carried out by Chinese and international institutions have concluded that economic growth heavily dependant on consumption of energy resources is not sustainable and may derail the country’s long-term economic and social development. Improved energy efficiency is essential to the sustainability of China’s impressive economic growth.

In recent years, the Government of China (GoC) has stepped up its efforts to address China’s energy efficiency challenge of maintaining high economic growth with reduced energy consumption. It firmly committed to shift the national economy away from heavy reliance on energy, especially coal consumption, by pledging to reduce the energy intensity of GDP by 20 percent during the 11th Five Year Plan (2006 - 2010). The Government also made energy conservation one of the national priorities relating to long-term economic and social development. It is, however, extremely challenging to achieve this policy target for two reasons: (a) energy-intensive manufacturing industries still account for approximately 50 percent of the total energy consumption; and (b) energy efficiency improvements in these industries require significant amount of financing.

Investment requirements to meet the Government’s energy efficiency target in the next few years are estimated at more than US$30 billion per year, of which over US$20 billion will be debt financing. Financing requirements of this magnitude cannot be secured without significant contribution of the Chinese commercial banking sector. In the past few years, GoC initiated, with the assistance of the World Bank Group and other multilateral and bilateral partners, several initiatives to encourage commercial debt financing of energy efficiency projects. The First and Second China Energy Conservation Projects and the recently approved China Energy Efficiency Financing Project (CHEEF), funded by the International Bank for Reconstruction and Development (IBRD) and the Global Environment Facility (GEF), contributed to the development of China’s energy services industry and the start-up of energy efficiency business lines in one commercial bank and one policy bank. The ongoing International Finance Corporation (IFC)/GEF China Utility-Based Energy Efficiency Project (CHUEE) project focuses on commercial financing of small-scale industrial energy conservation investments. It promotes energy efficiency improvements with commercial bank financing backed by a partial risk guarantee facility.

Although fragmented, these initiatives substantially and separately increased the involvement of commercial banks in financing energy efficiency projects. However, despite the large energy efficiency (EE) investment needs and the commitments of the commercial banks to the Government targets, the respective EE portfolios of Chinese banks remain small compared to their total lending volumes, abundant liquidities and the potential size of the EE market. Barriers to building sizable and healthy EE portfolios are still very common.

On the one hand, commercial banks are still more comfortable with capacity expansion investments that generate revenues than with EE investments that improve efficiency and reduce expenditures, and perceive these investments as riskier. In addition, EE lending may require modification in operational processes and procedures as well as additional financial products. Commercial banks view EE projects as fragmented, small and riskier, and also see them as representing a relatively small market segment compared to capacity expansion investments, especially in a fast-growing economy. The banks also, in general, lack the skills to evaluate EE investments. Although many Chinese commercial banks are claiming that they are providing significant amounts of financing to “EE investments,” a recent overview of their EE portfolios found that most of the investments are in fact capacity expansion with relatively advanced technologies. Few of the investments focus on the demand side or on energy conservation.

On the other hand, Chinese enterprises, the potential clients of commercial banks, prefer to direct their own as well as debt funds towards revenue generation and expansion investments, to keep or strengthen their market position in the fast-growing economy, rather than towards energy conservation and ensuing expenditure reduction. In general, they underestimate the impact of high-return EE investments on efficiency gains that would increase their tight profit margins. Small and medium enterprises (SMEs) face even more difficulties in accessing commercial debt financing for energy efficiency improvements.

The current global financial crisis is slowing down China’s economic growth and creating even higher barriers to EE debt financing. During recent meetings with some Chinese commercial banks, the Bank’s project team learned that defaults are increasing and risk aversion is growing in the banking sector. In the current environment, commercial banks would be more reluctant to finance projects with perceived high risks. China’s recent announcement of a huge stimulus program to encourage investments and boost domestic demand could also slow the momentum created by the Bank Group in the past few years to direct part of the commercial banks’ huge liquidities towards economically and financially sound EE investment financing, and result in an increase of energy intensity as experienced during the post-1998 Asian Financial Crisis period.

It is therefore imperative for the Government to sustain and strengthen its efforts to scale-up commercial EE debt financing1. The World Bank Group is well positioned to assist the Government, given the successful partnership it established with China in promoting EE financing. The World Bank Group involvement will also bring recent international experience and lessons learned in other countries. Finally, the Bank’s involvement directly supports a major strategy of the Bank’s new Country Partnership Strategy (CPS) for China (2006 – 2010): managing resource scarcity and environmental challenges (pillar 3).

2. Proposed objective(s)

The development objective of the project is to scale-up commercial debt financing for EE investment across China through an EE debt financing mechanism. The financing mechanism will be initiated with: (i) the proposed IBRD loan; and (ii) a loan from the China Clean Development Mechanism Fund (CCDMF)2. It will be complemented by a possible the International Finance Corporation (IFC) risk-sharing facility.

Key performance indicators include: (a) the amount of incremental EE debt financing supported and leveraged by the project; (b) the amount of energy saved through investments financed and leveraged by the project; and (c) associated reductions of GHGs.

It is anticipated that this approach would sustain EE commercial investments because, if successful, the approach developed by Minsheng Bank under the proposed project would be scaled up within Minsheng Bank and replicated by other financial institutions in China. Furthermore, it is expected that this mechanism would form the foundation for the eventual creation of a separate debt investment fund structure in the future. Such a fund would catalyze a wide array of commercial investments in the EE sector.

3. Preliminary description

The proposed project will support the creation of an EE financing facility within Minsheng Bank to provide debt financing for EE investments. If implemented successfully, this facility will be firstly scaled up within Minsheng Bank and then open to other parties, such as commercial banks, bilateral and multilateral financial institutions as well as to private and public sector investors that would be interested in pooling their funds to mitigate the perceived high risk of the EE business. It will not be a legal entity, but instead will be created by bilateral agreements 1 Early 2008, the GoC included the proposed project, as an innovative project to catalyze commercial financing for EE in China, in the lending pipeline for the Bank to finance and selected the China Minsheng Bank Corp Ltd (“Minsheng”) as the participating financial intermediary of the proposed project. Minsheng was selected because: (a) it is considered as one of the best Chinese commercial banks and is one of the first fully private owned banks in China; and (b) it was the most willing bank to test innovative approaches for EE financing and was very proactive during the selection process.

2 The CDMF was established by seven ministries including the Ministry of Finance (MOF) and the National Development and Reform Commission (NDRC) with the objective to finance climate change related projects. The source of the funds mainly comes from government tax levies on carbon credit transactions in China. between each individual participant and Minsheng Bank (see the attached Annex for a detailed diagram of the financing facility design). Agreements will be based on a common set of principles and governed by a common structure. A governing body / Participants Committee would play a significant a role in developing sub-project eligibility criterion for EE lending and advising on the operation of the Facility. Minsheng Bank will be responsible for managing the portfolio and the lending processes, including identification, appraisal and approval of the EE projects, and for servicing of the EE loans. Other responsibilities and commitments are to be defined in the individual bilateral agreements.

Each individual participant will lend to Minsheng Bank at agreed upon terms and conditions, and Minsheng will then lend to individual EE projects. It is expected that the participants will provide an upfront umbrella funding loan commitment to Minsheng Bank, subject to agreed upon criteria for EE lending. The participants in the financing facility will take the risk of lending to Minsheng, and Minsheng will take the full credit risk in lending to eligible EE projects. The pricing of Minsheng Bank’s loans to the EE borrowers will be market-based. The definition of EE investments, the size of the individual project loans and the required equity will be determined during project preparation. The loans to the EE projects will follow Minsheng Bank’s lending policies and an operational manual that includes procedures and eligibility criteria to be agreed with the Bank. The financing mechanism would be initiated by a US$100 million IBRD loan to Minsheng, and a US$20 million public sector debt financing from CCDMF.

The proposed project will mainly target EE investment opportunities in manufacturing industries. A certain amount of the Bank loan will be allocated to finance EE investments of small and medium sized enterprises (SMEs) in these industries. For this purpose, IFC has offered to develop, in parallel or subsequently, a risk sharing product / guarantee to Minsheng’s underlying EE loans through the IFC China Clean Development Finance Program ("CCDF"). This program is a risk-sharing facility that supports a loan portfolio of US$600 million in energy efficiency, renewable energy and waste treatment projects. As part of the platform set up in the proposed project, this risk-sharing support would be prepared and operated in parallel with the proposed project.

A technical assistance (TA) program will be developed to support Minsheng Bank and other project participants. It will be funded by a grant under the umbrella of the Bank’s on-going CHEEF project and a possible grant from CCDMF to expand EE financing. The grant-based TA will support the development of an EE portfolio, including: EE project identification, appraisal, and risk management; addressing environmental and social safeguards issues related to EE investments; lending to SMEs for energy efficiency improvements; and carbon finance. A medium-sized GEF project is also under consideration mainly to assist CCDMF in building its capacity to manage the fund properly to finance low carbon investments in China.

The proposed project will create a facility that provides fund mobilization for additional EE debt financing and a platform to easily bring in additional participants and risk sharing in EE debt financing. The project will also provide capacity building to do additional commercial EE financing, an avenue for developing new financial products and business lines for EE. It supports participants’ responses to government policies and targets, as well as a transfer of global experience in EE financing and international visibility from World Bank Group engagement. In addition, the proposed project has potential for leveraging significant carbon finance and represents a possible precursor to the development of a market-driven financing approach that in the future may take on the form of an EE debt investment fund.

4. Safeguard policies that might apply

The only Safeguard Policy likely to apply is Environmental Assessment (OP 4.01). Since actual sub-projects are not known at this stage, other safeguard policies might be triggered during project implementation. During project preparation, the Task Team will work with the participating bank to develop specific environmental safeguard framework documents (to be incorporated into the Operation Manuals) which would include screening procedures to establish if other safeguards are triggered and the actions necessary to comply with both Chinese environmental requirements and World Bank safeguard policies.

5. Tentative financing Source: ($m.) Borrower 100 International Bank for Reconstruction and Development 100 Total 200

6. Contact point

Mr. Leiping Wang Sr. Energy Specialist/Task Team Leader Transport, Energy and Mining Sector Unit Sustainable Development Department East Asia and Pacific Region E-mail: [email protected] Tel: (202) 458-8095 Fax: (202) 522-1648 Room # MC9-243 MSN # MC9-919