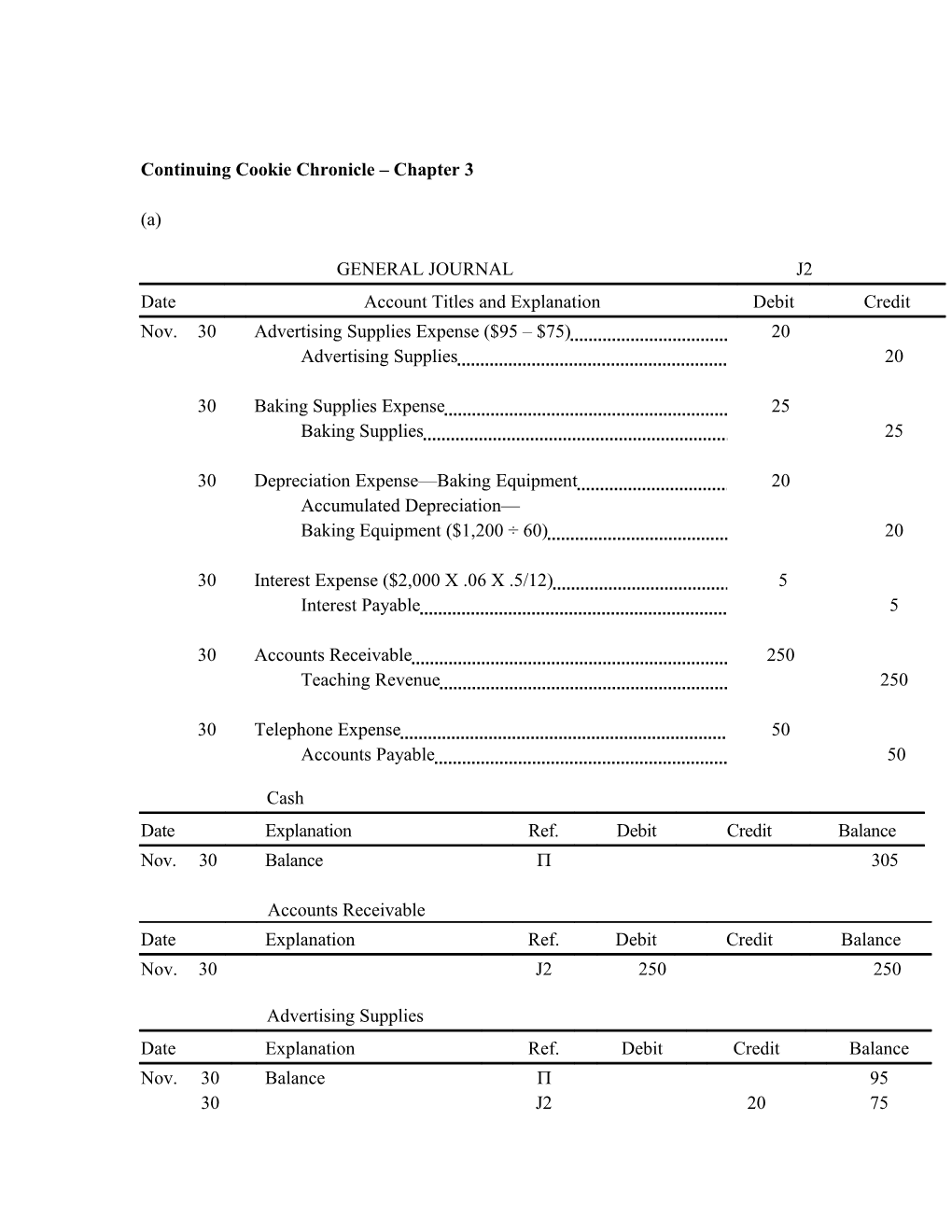

Continuing Cookie Chronicle – Chapter 3

(a)

GENERAL JOURNAL J2 Date Account Titles and Explanation Debit Credit Nov. 30 Advertising Supplies Expense ($95 – $75) 20 Advertising Supplies 20

30 Baking Supplies Expense 25 Baking Supplies 25

30 Depreciation Expense—Baking Equipment 20 Accumulated Depreciation— Baking Equipment ($1,200 ÷ 60) 20

30 Interest Expense ($2,000 X .06 X .5/12) 5 Interest Payable 5

30 Accounts Receivable 250 Teaching Revenue 250

30 Telephone Expense 50 Accounts Payable 50

Cash Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 305

Accounts Receivable Date Explanation Ref. Debit Credit Balance Nov. 30 J2 250 250

Advertising Supplies Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 95 30 J2 20 75 Baking Supplies Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 125 30 J2 25 100

Prepaid Insurance Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 1,200

Baking Equipment Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 1,200

Accumulated Depreciation—Baking Equipment Date Explanation Ref. Debit Credit Balance Nov. 30 20 20

Website Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 600

Accounts Payable Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 600 30 J2 50 650

Interest Payable Date Explanation Ref. Debit Credit Balance Nov. 30 J2 5 5

Unearned Revenue Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 25 Notes Payable Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 2,000

Common Stock Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 800

Teaching Revenue Date Explanation Ref. Debit Credit Balance Nov. 30 Balance 100 30 J2 250 350

Telephone Expense Date Explanation Ref. Debit Credit Balance Nov. 30 J2 50 50

Advertising Supplies Expense Date Explanation Ref. Debit Credit Balance Nov. 30 J2 20 20

Baking Supplies Expense Date Explanation Ref. Debit Credit Balance Nov. 30 J2 25 25

Depreciation Expense—Baking Equipment Date Explanation Ref. Debit Credit Balance Nov. 30 J2 20 20

Interest Expense Date Explanation Ref. Debit Credit Balance Nov. 30 J2 5 5 (b) COOKIE CREATIONS Adjusted Trial Balance November 30, 2005

Debit Credit Cash...... $ 305 Accounts Receivable...... 250 Advertising Supplies...... 75 Baking Supplies...... 100 Prepaid Insurance...... 1,200 Baking Equipment...... 1,200 Accumulated Depreciation—Baking Equipment...... $ 20 Website...... 600 Accounts Payable...... 650 Interest Payable...... 5 Unearned Revenue...... 25 Note Payable...... 2,000 Common Stock...... 800 Teaching Revenue...... 350 Telephone Expense...... 50 Advertising Supplies Expense...... 20 Baking Supplies Expense...... 25 Depreciation Expense—Baking Equipment...... 20 Interest Expense...... 5 0,000 Totals...... $3,850 $3,850 (c) COOKIE CREATIONS Income Statement Month Ended November 30, 2005

Revenues Teaching revenue...... $350 Expenses Telephone expense...... $50 Baking supplies expense...... 25 Advertising supplies expense...... 20 Depreciation expense...... 20 Interest expense...... 5 120 Net income...... $230

COOKIE CREATIONS Retained Earnings Statement For the Month Ended November 30, 2005

Retained earnings, November 1...... $ 0 Add: Net income...... 230 Deduct: Dividends Declared...... 0 Retained earnings, November 30...... $230

COOKIE CREATIONS Balance Sheet November 30, 2005

Assets Cash...... $ 305 Accounts receivable...... 250 Advertising supplies...... 75 Banking supplies...... 100 Prepaid insurance...... 1,200 Website...... 600 Baking equipment...... $1,200 Less: Accumulated depreciation—baking equipment...... 20 1,180 Total assets...... $3,710

Liabilities and Stockholders’ Equity

Liabilities Notes payable...... $2,000 Accounts payable...... 650 Interest payable...... 5 Unearned revenue...... 25 Total liabilities...... 2,680

Stockholders’ equity Common stock...... $800 Retained earnings...... 230 1,030 Total liabilities and stockholders’ equity...... $3,710