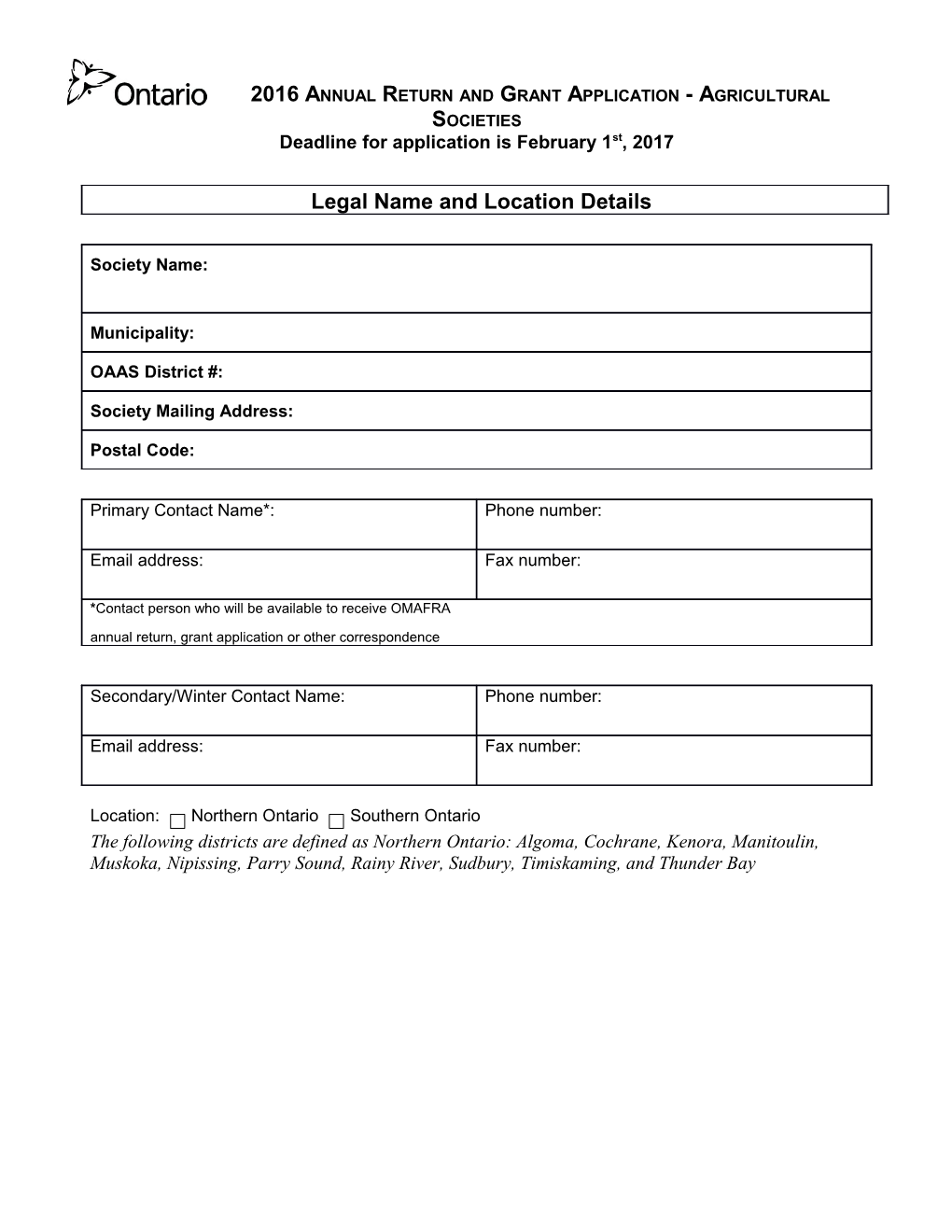

2016 ANNUAL RETURN AND GRANT APPLICATION - AGRICULTURAL SOCIETIES Deadline for application is February 1st, 2017

Legal Name and Location Details

Society Name:

Municipality:

OAAS District #:

Society Mailing Address:

Postal Code:

Primary Contact Name*: Phone number:

Email address: Fax number:

*Contact person who will be available to receive OMAFRA annual return, grant application or other correspondence

Secondary/Winter Contact Name: Phone number:

Email address: Fax number:

Location: Northern Ontario Southern Ontario The following districts are defined as Northern Ontario: Algoma, Cochrane, Kenora, Manitoulin, Muskoka, Nipissing, Parry Sound, Rainy River, Sudbury, Timiskaming, and Thunder Bay

Agricultural Exhibition Grant Expenses listed below must be visible and clearly identified in the financial statements. If it is not visible in the financial statements, provide a separate breakdown of these expenses. A. CLASS EXPENDITURES $ For example: Livestock Competitions (beef, dairy, sheep, swine, goats, horse) Crop Competitions (horticulture and field crop competitions) Farm Fresh Food Products (honey, maple, dairy livestock products) Homecraft and Cultural Expression (baking, preserves, quilting, clothing) Youth Competitions (4-H, school classes, etc.) Judge's costs for the above competitions B. AMATEUR TALENT (must be local - see guide) $

C. FARMSTEAD IMPROVEMENT COMPETITIONS $

D. TOTAL OF AMATEUR TALENT AND FARMSTEAD $ IMPROVEMENTS (B PLUS C, WHICH CANNOT EXCEED $1,000)

E. ENTER ½ OF A $

F. Enter the amount on line D or E whichever is less $

TOTAL ELIGIBLE EXPENDITURES (A PLUS F) $ $

CALCULATION OF AGRICULTURAL EXHIBITION GRANT 1/3 of Total Eligible Expenditures from line F (2/3 in Northern Ontario) to a maximum of $3,000.00 Grant Requested $

NOTE: Horse pulls, rodeos etc. are not eligible competitions under any category. Copies of all paid receipts of expenditures must be kept on file and, if requested made available to OMAFRA for audit purposes. See Guide for clarification of expenses.

Wet Weather Grant

In a year where wet weather causes a decrease in the revenue an agricultural society receives from admission revenue, a grant to the society may be increased by the difference between the admission revenues for that year and 90 percent of the average admission revenue for the three preceding years of normal weather. OMAFRA will use data supplied by the society on previous returns. Refer to the “Guide” for more details.

Are you applying for a wet weather grant? Yes No Total Gate Receipt Revenues (current year) $ Improvements and Repairs Grant

The improvement and repairs grant is based on last year’s expenses paid by the Society for improvements and repairs to leased or owned grounds and buildings used by the Society.

Please refer to the guide for a list and examples of eligible vs non-eligible expenses. Attach separate pages if necessary. The expenses must be visible and identified on your Financial Statements.

TYPE OF IMPROVEMENT AND COST 1. $ 2. $ 3. $ 4. $ 5. $ 6. $ TOTAL $

CALCULATION OF IMPROVEMENT AND REPAIRS GRANT 25 % of total to a maximum of $2,000.00 Grant Requested $

Copies of all paid receipts of expenditures must be kept on file and, if requested, made available to the Ministry of Agriculture, Food and Rural Affairs for audit purposes. Society Information

Number of members in society during 2016:

(Total paid members at fiscal year-end, not junior or life members)

Does the Society own its own land? Yes No

Does the Society own its own buildings? Yes__ No

If no, does the Society have a lease agreement for use of land and buildings for events? Yes No

Expiration date of lease:

Date of the Annual Meeting: (DD/MM/YY) Note: The auditor’s report must be completed before the AGM Total Number of Volunteer Hours by your membership and directors for all of your agricultural society activities. Include board and committee meetings, fund raisers, activities, events, etc.

DATES OF ANNUAL FAIR OR EXHIBITION For 2016: (DD/MM/YY) Total Number of Days: Approximate attendance at 2016 Fair or Exhibition:

Total Gate Receipts Only: $ Do not include admission to special events, dances, etc. if this does not include admission to the grounds during the fair or exhibition. Figures must match the information submitted on your financial statement.

Activities of Compliance with the AHOA Act Please check off the boxes below that show how your agricultural society encouraged interest and improvement in agriculture. Check only those categories that apply to your agricultural society.

Should your application be audited by the ministry, you will be required to provide justification and evidence to show how your society performed the checked off statements.

Researching the needs of the agricultural community and developing programs to meet those needs

Holding agricultural exhibitions featuring competitions for which prizes may be awarded

Promoting the conservation of natural resources

Encouraging the beautification of the agricultural community

Supporting and providing facilities to encourage activities intended to enrich rural life

Conducting or promoting horse races when authorized to do so by a by-law of the society Centennial Grant and Sesquicentennial Bronze Plaque Indicate by checking the box if the Society will be requesting a Centennial grant or Sesquicentennial (150th Anniversary) plaque for the 2016 year. A written request should be sent with this annual return. Refer to the “Guide for Completing the Agricultural Society Return” for details. Certification by Authorized We the undersigned signing officers (President, Treasurer, Secretary or Board member with signing authority) hereby certify that all information given in this annual return and grant application is true and correct. Name of Signing Officer:

Position: Phone:

Signature: Date:

Name of Signing Officer:

Position: Phone:

Signature: Date:

Attachments

The following information MUST be submitted with the annual return :

1. List of incoming Executive Officers and incoming Directors and their contact information including: phone numbers, addresses, postal codes and email addresses

2. Audited Annual Financial Statements

3. Report from Auditors or Financial Reviewers (must be completed prior to the annual meeting) Reviews that are completed by professional accounting persons (copies are acceptable) OR Audit Certificate if the financial review is completed by non-professional accounting persons (audit certificate forms are available on the OMAFRA website (www.ontario.ca/aghortgrants) or by calling 1-877-424-1300)

NOTE: Compilations, also known as Notice to Readers will no longer be acceptable as formats for reviews. If your financial statements are in this format, please also supply the Audit Certificate as described above.

Deadline to submit completed annual return and grant application, along with other required documentation is February 1st, 2017. If the date is not met you will not be eligible for grant funding.

Any officer, director or auditor of an organization who makes a false statement in any report or information required under the Agricultural and Horticultural Organizations Act is guilty of an offence and on conviction is liable to a fine of not more than $2000. R.S.O. 1990, c. A.9, s. 16