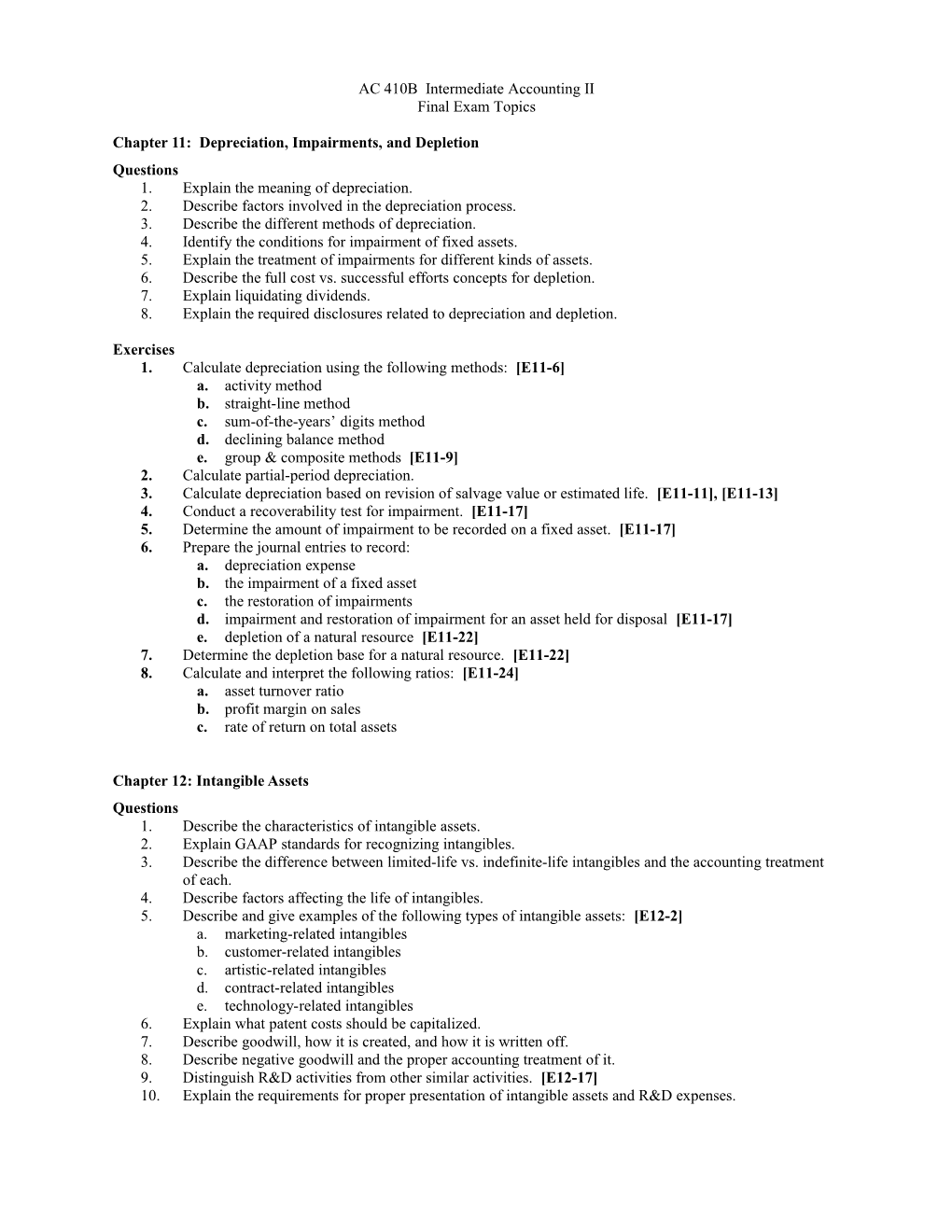

AC 410B Intermediate Accounting II Final Exam Topics

Chapter 11: Depreciation, Impairments, and Depletion Questions 1. Explain the meaning of depreciation. 2. Describe factors involved in the depreciation process. 3. Describe the different methods of depreciation. 4. Identify the conditions for impairment of fixed assets. 5. Explain the treatment of impairments for different kinds of assets. 6. Describe the full cost vs. successful efforts concepts for depletion. 7. Explain liquidating dividends. 8. Explain the required disclosures related to depreciation and depletion.

Exercises 1. Calculate depreciation using the following methods: [E11-6] a. activity method b. straight-line method c. sum-of-the-years’ digits method d. declining balance method e. group & composite methods [E11-9] 2. Calculate partial-period depreciation. 3. Calculate depreciation based on revision of salvage value or estimated life. [E11-11], [E11-13] 4. Conduct a recoverability test for impairment. [E11-17] 5. Determine the amount of impairment to be recorded on a fixed asset. [E11-17] 6. Prepare the journal entries to record: a. depreciation expense b. the impairment of a fixed asset c. the restoration of impairments d. impairment and restoration of impairment for an asset held for disposal [E11-17] e. depletion of a natural resource [E11-22] 7. Determine the depletion base for a natural resource. [E11-22] 8. Calculate and interpret the following ratios: [E11-24] a. asset turnover ratio b. profit margin on sales c. rate of return on total assets

Chapter 12: Intangible Assets Questions 1. Describe the characteristics of intangible assets. 2. Explain GAAP standards for recognizing intangibles. 3. Describe the difference between limited-life vs. indefinite-life intangibles and the accounting treatment of each. 4. Describe factors affecting the life of intangibles. 5. Describe and give examples of the following types of intangible assets: [E12-2] a. marketing-related intangibles b. customer-related intangibles c. artistic-related intangibles d. contract-related intangibles e. technology-related intangibles 6. Explain what patent costs should be capitalized. 7. Describe goodwill, how it is created, and how it is written off. 8. Describe negative goodwill and the proper accounting treatment of it. 9. Distinguish R&D activities from other similar activities. [E12-17] 10. Explain the requirements for proper presentation of intangible assets and R&D expenses. Exercises 1. Record journal entries for: a. acquisition and amortization of an intangible asset [E12-4], [E12-10] b. initial cost of a franchise c. annual franchise payments d. purchase of goodwill [E12-12], [E12-13] e. impairment of an intangible asset [E12-14] f. payment of R&D expenses [E12-16], [E12-17] g. payment of start-up costs 2. Determine the value of goodwill purchased. [E12-13] 3. Determine whether or not the following assets are impaired and calculate the amount of the impairment: a. limited-life intangible [E12-14] b. indefinite-life intangible other than goodwill c. goodwill

Chapter 17: Investments (excluding appendix) Questions 1. Explain the reasons that companies hold investments. 2. Describe the three categories of securities and the valuation methods used for each. 3. Describe the difference between realized and unrealized gains and losses. 4. Describe the difference between debt and equity securities. 5. Describe the requirements for using the equity method and rationale behind it. 6. Describe financial statement disclosures for investments [E17-9]

Exercises 1. Record journal entries (fair value method) for: a. purchase of securities [E17-11] b. interest revenue on debt securities and the amortization of premium or discount [E17-3], [P17-1] c. dividend revenue d. sale of securities with a realized gain or loss [E17-9], [E17-11] e. unrealized holding gain or loss for available-for-sale securities [E17-4], [E17-11], [P17-1] f. unrealized holding gain or loss for trading securities [E17-7] 2. Show the proper financial statement presentation of securities and related revenues, gains, and losses. 3. Record journal entries (equity method) for: [E17-12], [E17-16] a. purchase of securities b. dividend revenue c. net income of the investee 4. Calculate and report the reclassification adjustment in the Statement of Comprehensive Income [E17-10] 5. Record an impairment of value on investment securities [E17-18]

Chapter 13: Current Liabilities and Contingencies Questions 1. What is a liability? 2. What is a current liability? 3. Describe the appropriate accounting treatment of: a. current maturities of long-term debt b. short-term obligations expected to be refinanced [E13-3] c. gain and loss contingencies d. litigation claims e. environment liabilities f. self insurance 4. Describe the types of income tax liabilities. 5. Describe the required conditions for accruing loss contingencies. [E13-14], [P13-11] 6. Explain and give examples of asset retirement obligations. 7. Describe the appropriate presentation of short-term and long-term liabilities. [E13-3]

Exercises 1. Record journal entries for: a. purchase of goods on account [E13-2], [P13-1] b. issuance of interest-bearing or zero-interest-bearing note [E13-2], [P13-1] c. payment of interest on note and amortization of premium or discount [E13-2] d. receipt of returnable deposits e. receipt of unearned revenue [BE13-5] f. recognition of revenue that was previously unearned [BE13-5] g. collection of sales tax from customers [E13-7] h. payment of wages involving payroll tax deductions [E13-8] i. accrual and payment of vacation wages and sick pay [E13-5], [E13-6] j. selling products with a warranty and recognizing warranty costs using: [E13-11] i. expense warranty approach ii. sales warranty approach k. accrual of estimated liability for premiums and coupons [E13-12] l. recording asset retirement obligations 2. Calculate and interpret the current ratio.

Chapter 14 - Long Term Liabilities Questions 1. Vocabulary a. nominal vs. effective rate b. face value vs. carrying value c. bond covenants d. secured vs. debenture bonds [P14-10] e. serial and term bonds f. registered and bearer bonds 2. Meaning and account classification of bond discount and bond premium. 3. Meaning and examples of off-balance-sheet financing. 4. Classification and reporting of current and long-term liabilities. [E14-2], [E14-19] 5. Reporting: future payments and maturities of long-term debt. [P14-10] 6. Interpreting debt to total asset ratio.

Exercises 1. Calculate present value of a bond. [P14-5] 2. Record the journal entries for the following transactions: a. issuance of bond at premium or discount. [P14-5], [P14-10] b. issuance of bond between interest dates. [E14-3], [P14-10] c. payment of bond issue costs d. payment of bond interest e. amortization of bond issue costs f. early extinguishment of debt. [E14-13] g. issuance of note at a discount. h. exchange of note for property or rights. [E14-18], [P18-8] 3. Record accrual of interest expense at year-end. [E14-3] 4. Calculate and record amortization of bond premium or discount: a. straight line method [E14-4] b. effective interest method [E14-5] 5. Calculate and record amortization of discount on note. [E14-17] 6. Calculate debt to total asset ratio.

Chapter 15 – Contributed Capital and Retained Earnings Questions 1. Explain advantages and disadvantages of corporate form. 2. Explain rights of common and preferred stockholders. 3. Explain the meaning of retained earnings and contributed capital. 4. Explain the treatment of stock issue costs. 5. Explain the reasons companies acquire treasury stock. 6. Identify how various stock transactions affect authorized, issued, and outstanding stock. 7. Indicate how various stock transactions affect major balance sheet categories and net income [E15-11] 8. Vocabulary a. cumulative preferred b. participating preferred c. convertible preferred d. callable preferred e. liquidating dividend f. stock dividend g. stock split 9. Explain factors affecting a company’s dividend policy. 10. Explain meaning and appropriate disclosure of R/E restrictions.

Exercises 1. Record the journal entry for the following transactions: a. issuance of common stock [E15-1] b. issuance of no-par stock c. issuance of stock with other securities [E15-5] d. issuance of stock in noncash transactions [E15-3] e. purchase of treasury stock [E15-7] f. sale of treasury stock [E15-7] g. retirement of treasury stock h. declaration and payment of cash dividend [E15-12] i. declaration and distribution of property dividend j. declaration and payment of liquidating dividend [E15-12] k. declaration and issuance of small stock dividend l. declaration and issuance of large stock dividend [E15-14] m. stock split [E15-14] 2. Prepare statement of stockholders’ equity. [E15-17] 3. Report R/E correction of prior-year error. 4. Calculate common and preferred dividends based on dividend preferences. [E15-22] 5. Calculate rate of return on common equity and book value per share.

Chapter 16 – Dilutive Securities and Earnings per Share Questions 1. Explain why companies issue convertible securities. 2. Explain stock warrants and the three situations under which they are normally issued. 3. Explain the difference in accounting treatment between convertible debt and debt issued with warrants. 4. Explain why companies use stock option plans. 5. Provide a basic explanation of option pricing models. 6. Describe the characteristics of non-compensatory stock purchase plans. 7. Explain the controversy surrounding the accounting treatment of stock option plans.

Exercises 1. Record journal entries for: a. conversion of bonds into common stock [E16-1] b. payment of sweetener to induce conversion c. retirement of convertible debt d. conversion of preferred stock into common stock e. issuance of stock warrants with other securities (proportional or incremental) [E16-9] f. granting and exercise of stock options [E16-11] g. recognition of expense related to stock options [E16-11] h. expiration of stock options [P16-3] i. forfeiture of stock options [E16-11] j. stock appreciation rights [E16-28] 2. Calculate a. weighted average shares outstanding [E16-14], [E16-18] b. basic earnings per share (EPS) [E16-14] c. diluted EPS [E16-21], [E16-23] d. compensation expense related to stock appreciation rights [E16-28] 3. Show the proper presentation of EPS on the income statement