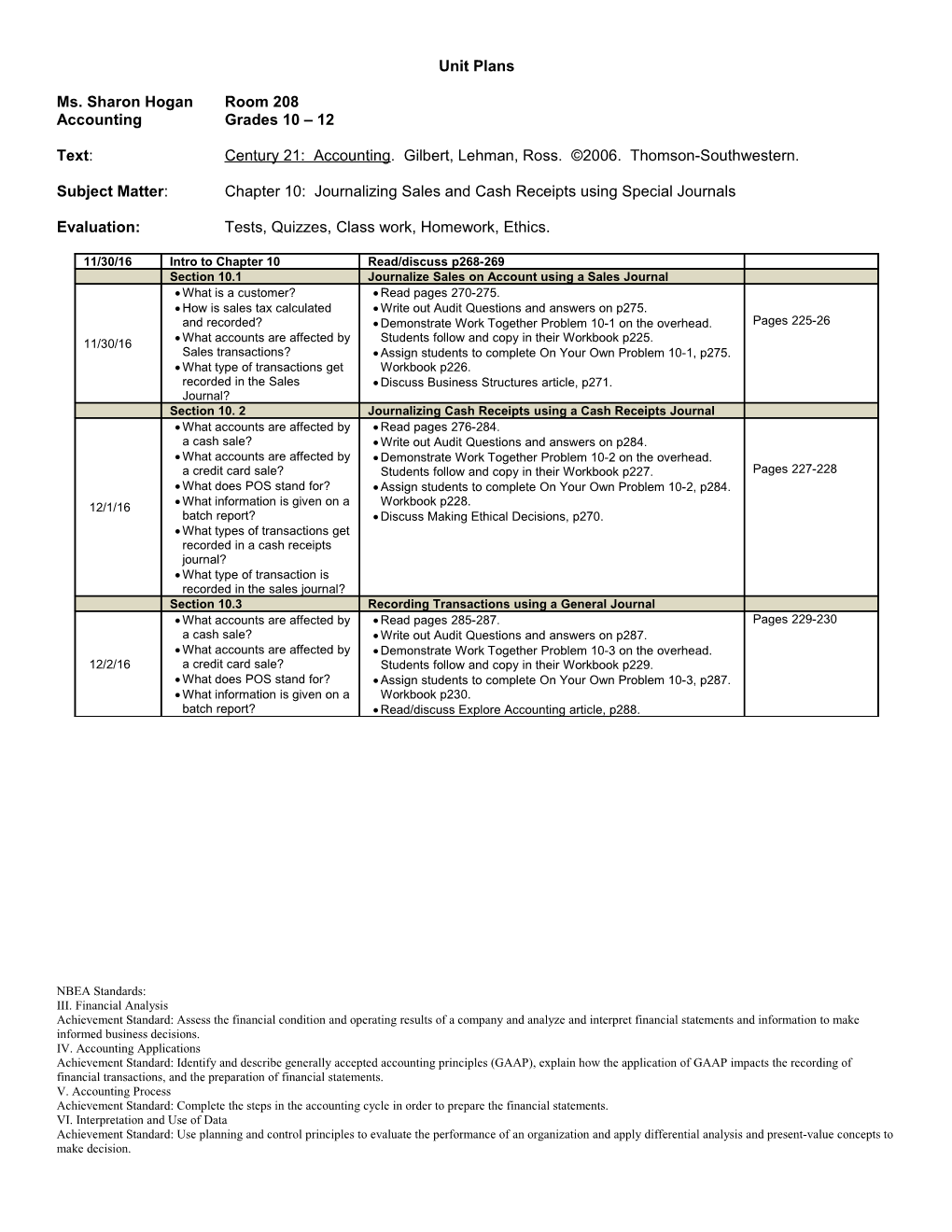

Unit Plans

Ms. Sharon Hogan Room 208 Accounting Grades 10 – 12

Text: Century 21: Accounting. Gilbert, Lehman, Ross. ©2006. Thomson-Southwestern.

Subject Matter: Chapter 10: Journalizing Sales and Cash Receipts using Special Journals

Evaluation: Tests, Quizzes, Class work, Homework, Ethics.

11/30/16 Intro to Chapter 10 Read/discuss p268-269 Section 10.1 Journalize Sales on Account using a Sales Journal What is a customer? Read pages 270-275. How is sales tax calculated Write out Audit Questions and answers on p275. and recorded? Demonstrate Work Together Problem 10-1 on the overhead. Pages 225-26 11/30/16 What accounts are affected by Students follow and copy in their Workbook p225. Sales transactions? Assign students to complete On Your Own Problem 10-1, p275. What type of transactions get Workbook p226. recorded in the Sales Discuss Business Structures article, p271. Journal? Section 10. 2 Journalizing Cash Receipts using a Cash Receipts Journal What accounts are affected by Read pages 276-284. a cash sale? Write out Audit Questions and answers on p284. What accounts are affected by Demonstrate Work Together Problem 10-2 on the overhead. a credit card sale? Students follow and copy in their Workbook p227. Pages 227-228 What does POS stand for? Assign students to complete On Your Own Problem 10-2, p284. 12/1/16 What information is given on a Workbook p228. batch report? Discuss Making Ethical Decisions, p270. What types of transactions get recorded in a cash receipts journal? What type of transaction is recorded in the sales journal? Section 10.3 Recording Transactions using a General Journal What accounts are affected by Read pages 285-287. Pages 229-230 a cash sale? Write out Audit Questions and answers on p287. What accounts are affected by Demonstrate Work Together Problem 10-3 on the overhead. 12/2/16 a credit card sale? Students follow and copy in their Workbook p229. What does POS stand for? Assign students to complete On Your Own Problem 10-3, p287. What information is given on a Workbook p230. batch report? Read/discuss Explore Accounting article, p288.

NBEA Standards: III. Financial Analysis Achievement Standard: Assess the financial condition and operating results of a company and analyze and interpret financial statements and information to make informed business decisions. IV. Accounting Applications Achievement Standard: Identify and describe generally accepted accounting principles (GAAP), explain how the application of GAAP impacts the recording of financial transactions, and the preparation of financial statements. V. Accounting Process Achievement Standard: Complete the steps in the accounting cycle in order to prepare the financial statements. VI. Interpretation and Use of Data Achievement Standard: Use planning and control principles to evaluate the performance of an organization and apply differential analysis and present-value concepts to make decision. Review Exercises Application Problems 10-1, 10-2, 10-3, 10-4 Pages 231-233 Ch10 Study Guide in workbook. Pages 221-223 12/5/16 Complete EXCEL Spreadsheet Problems 10-1, 10-2, 10-3 On Wikispace And Mastery Problem 10-4, p290. Pages234-236 12/6/16 Challenge Problem 10-5, p290 Pages 237-241 Recycling Problem 10-1 pE8-E9 in back of text. Print Worksheets needed Vocabulary Terms Customer, sales tax, sales journal, cash sale, credit card sale, Vocabulary sheet point-of-sale terminal, terminal summary, batch report, batching – definitions due out, cash receipts journal, sales discount, sales return, sales at beginning of 11/21/16 allowance, credit memorandum Ch10

Assessment Daily assignments 12/7/16 One Open Book Quiz 12/8/16 One Chapter Test

This unit will take 6-7 Blocks to complete.

NBEA Standards: III. Financial Analysis Achievement Standard: Assess the financial condition and operating results of a company and analyze and interpret financial statements and information to make informed business decisions. IV. Accounting Applications Achievement Standard: Identify and describe generally accepted accounting principles (GAAP), explain how the application of GAAP impacts the recording of financial transactions, and the preparation of financial statements. V. Accounting Process Achievement Standard: Complete the steps in the accounting cycle in order to prepare the financial statements. VI. Interpretation and Use of Data Achievement Standard: Use planning and control principles to evaluate the performance of an organization and apply differential analysis and present-value concepts to make decision.