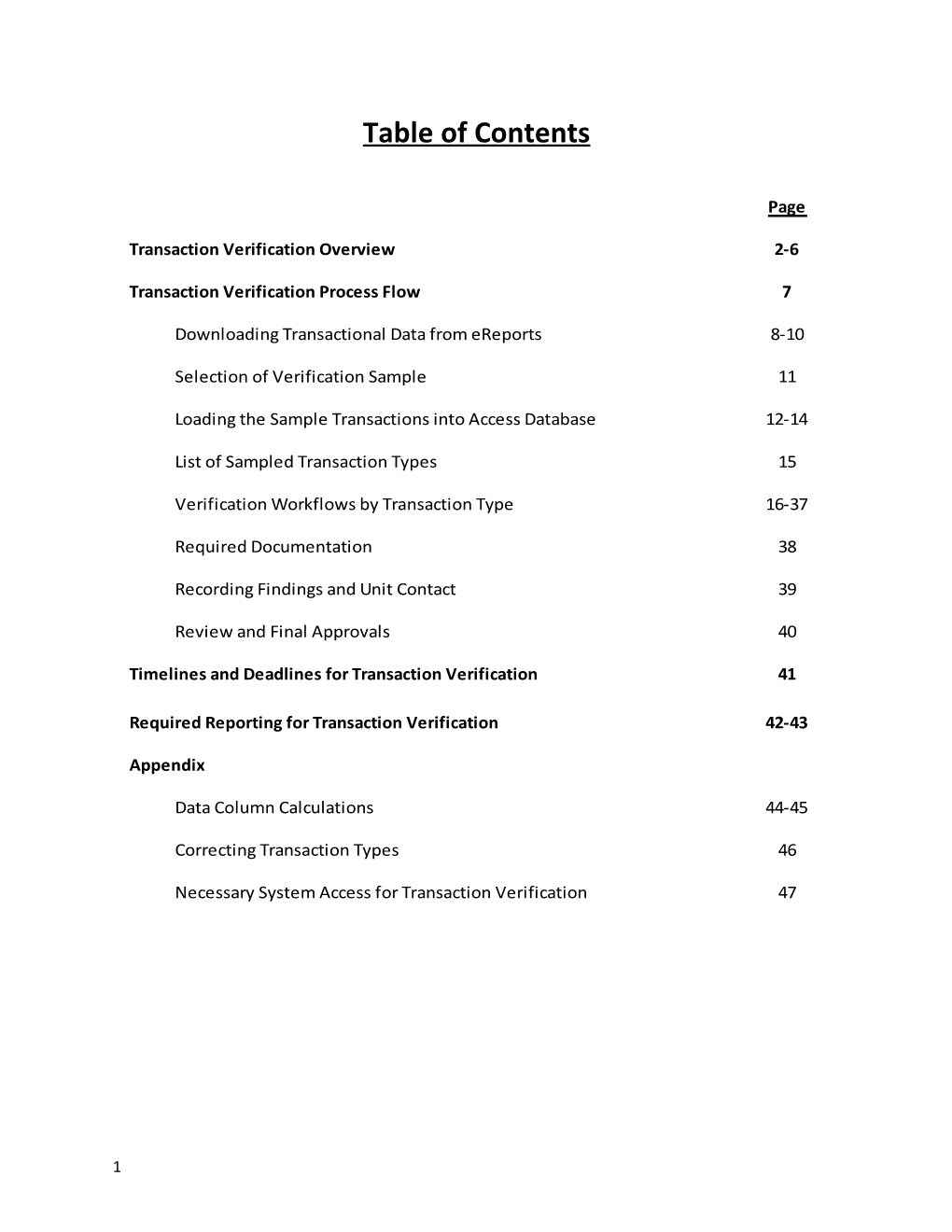

Table of Contents

Page

Transaction Verification Overview 2-6

Transaction Verification Process Flow 7

Downloading Transactional Data from eReports 8-10

Selection of Verification Sample 11

Loading the Sample Transactions into Access Database 12-14

List of Sampled Transaction Types 15

Verification Workflows by Transaction Type 16-37

Required Documentation 38

Recording Findings and Unit Contact 39

Review and Final Approvals 40

Timelines and Deadlines for Transaction Verification 41

Required Reporting for Transaction Verification 42-43

Appendix

Data Column Calculations 44-45

Correcting Transaction Types 46

Necessary System Access for Transaction Verification 47

1 Office of Academic Affairs

Transaction Verification and Reconciliation Process

Overview

Due to the recent consolidation of the Office of Academic Affairs Service Center, the way in which GL reconciliation has been performed within the OAA units will undergo a process change. The Office of Academic Affairs is moving towards a sampling approach in order to meet auditing requirements for transaction verification. With all the new service center processes in place and much tighter controls on the front end of HR and Fiscal processing, the sampling approach can be used in place of the standard line by line reconciliation process. This document will outline the differences between budget analysis, reconciliation, and transaction verification. It will also explain the details behind how the sampling approach was developed.

Definitions:

GL Reconciliation - Comparing the General Ledger standard monthly reports (90, 91, 61, 45, etc.) to supporting documentation in order to verify that all transactions were reconciled, posted correctly and in a timely manner. If it is found that a transaction is posted incorrectly, the reconciler will be required to correct the error in the General Ledger in order to resolve the issue. This reconciliation process assures that all budgets are operating within the correct parameters and all transactions are accurate and completed in a timely manner.

Transaction Verification - Comparing a selection of data from the General Ledger 91 report to supporting documentation in order to verify not only if the transactions were posted correctly but also if the Service Center followed correct procedures during the posting process. This verification process takes a sample of transactions from each unit and transaction type to verify if the transactions were accurate, complete, correctly documented, reviewed for compliance and had adequate signature authority. If these transactions were lacking any of the previously stated requirements, the verifier will follow up with the processor and correct as necessary. This verification process reviews to ensure that transactions are posted correctly and fall into compliance with University guidelines.

Budget Analysis - Reviewing various GL reports to assure the unit is operating within the parameters of their budget. Identifying and investigating any abnormal balances (large variances, deficits, high balances, errors, etc.) and assuring that all budget information is accurate and monitored on a consistent basis.

2 Sampling Method

The sampling process will contain a total of three sample populations which will be reviewed and verified to ensure the transactions are accurate, have a reasonable business purpose and abide by the University compliance procedures. A majority of these transactions will be pulled using a sampling method developed by the Institutional and Research Planning department.

The Office of Academic Affairs, in conjunction with, Institutional and Research Planning has developed a sampling approach in order to complete transaction verification for all OAA units and comply with all auditing requirements.

All transaction data will be downloaded into an excel file from the University’s eReports system on a monthly basis. A sample will then be pulled from the full transaction list.

In order to determine the sample size and parameters, the following variables were taken into account.

o Number of touch points on each transaction type

o Likelihood of errors for transaction type

o Frequency of transactions

o Overall compliance/fraud risk of transaction

To obtain necessary transactions, Institutional and Research Planning has created the following process in order to get the necessary sample population:

There are approximately 16000 transactions per month in the OAA transaction population. In order to achieve a 5% margin of error on the accuracy/compliance rate, a maximum sample of 376 transactions would be necessary, assuming that the accuracy/compliance rate is close to 50%. If the accuracy/compliance rate is consistent and close to 80%, fewer than 250 transactions would need to be sampled. Because the accuracy rate is unknown, and because we want to oversample certain transactions, the initial samples will contain 320 transactions per month.

Sample Selection Steps:

1) Random numbers from a normal distribution (Mean = 100, SD = 10) are assigned to each transaction.

2) Risk adjustments are calculated for each transaction:

a) Transactions rated as "medium" or "high" in compliance/fraud risk by their units are given 1.25 points, all others receive 1 point.

3 b) The average scoring of error rate, on a 1-5 scale, for each transaction type is determined. Points equal to one half of the resulting error rate value are added to the risk adjustment subtotal.

c) The natural log of the absolute dollar value of each transaction is calculated. For transactions over $20, the log value is divided by 10 and added to the risk subtotal. For transactions of $20 and below, no calculations are made and the transactions are marked for a separate selection process.

d) The risk subtotal is divided by the number of touchpoints.

e) That quotient is multiplied by 5

f) That product (typically ranging from greater than 1 to less than 15) is the risk adjustment, and it is added to the randomly generated number to create a selection value.

3) The 242 transactions with the highest selection values, regardless of unit or type, are selected. At an 80% accuracy/compliance rate this will typically yield an estimate within 5% of the true rate 95% of the time.

4) To ensure adequate representation from all units in the sample, the two remaining transactions with the highest selection values from within each unit are selected (22 transactions).

5) To ensure that low frequency / low risk transactions are represented, the two remaining transactions of each transaction type with the highest selection values are selected (56 transactions)

6) If fewer than 78 total transactions satisfy the selection requirements in steps 4/5, transactions are selected using the process in step 3 until a total of 320 transactions is achieved.

The risk-weighting process is subject to change as risk ratings in each category are modified in response to actual compliance rates discovered through the audit process. Reviews of these risk adjustments will be done on a quarterly basis. Risk adjustments will still be held to no more than 1.5 standard deviations of the randomly generated numbers.

In order to ensure that low dollar transactions are sampled on a monthly basis, an additional 40 transactions will be randomly pulled by the Data Manager which will consist of transactions that have dollar values between $-20.00 and $20.00. This sample will be created by taking the total transactions that fall in this range during the month and randomly selecting 40 transactions. This second sample will be reviewed using the same process as the first sample mentioned in the prior paragraphs.

Lastly, the final population of transactions will include transactions which failed prior reviews. This sample will be derived from the Review List (list of failed transactions from prior month) which will be unit specific and will monitor transactions that failed the transaction verification process. A unit will show up on the monthly Review List if they have a fail rate of 20% or more in a specific month. This

4 failed rate will stay constant for the first three months of the transactions verification process as higher errors are anticipated during the first few months but will change and remain constant at 15%. A failed transaction for this population will be defined by lack of necessary documentation, not following University procedures and inconsistent amounts and Chartfield values. Errors related to transcribed or mistyped numbers will not be counted as these are normal and expected mistakes that are low risk to the University. These failed transactions will be counted as errors against the unit or Service Center based on who completed the transaction to ensure the proper follow up and corrections are completed. This sample will be limited to a total of 25 transactions in one month for all units and will be allocated based on the distribution of fail rate percentages. If a consistent pattern of failed transactions occurs over a span of three months for a specific unit or in the Service Center, the Data Manager will follow up with the direct Manager to assure that errors are being reviewed and corrected.

Transaction Verification Process

GL transaction verification is a primary internal control and monitoring technique that helps detect (and possibly prevent) a wide range of fiscal-related risks. We define general ledger transaction verification as the process of comparing source documents (electronic or paper) provided by a unit, to the general ledger transaction details, as depicted on the university’s general ledger detail “91 report” (electronic).

Each month, statisticians at the Office of Institutional Research and Planning will perform a sampling analysis and identify the appropriate sample size to pull a random sample of transaction identification numbers. Once the sample is pulled from the monthly general ledger data, the sample will be sent to the OAA Service Center for transaction verification. The Service Center Data Manager will upload the sample into an access database to perform the monthly transaction verification.

Each type of transaction will have its own specific verification check points. For a detailed list of each transaction type, please refer to page 11 of this document.

Common Transaction Verification Check Points will include:

5 Check Point Category Check Point Question Possible Answers Approval Does the transaction have the appropriate Yes approval per the signature authority document? No Does it need additional approval? Other (specify)

Dollar Amount Does the GL posted dollar amount match the Yes system documentation (quote, PO, invoice, etc)? No Other (specify)

Chartfield Does the GL chartfield match the system Yes documentation? Do the chartfields used seem No appropriate? Other (specify)

Documentation Is there appropriate documentation to verify the Yes transaction? No Other (specify)

Compliance Was a compliance review performed by the OAA Yes Service Center? No Other (specify)

All “No” or “Others” answers identified during the transaction verification process will be investigated. The OAA Data Manager will work with the appropriate service center staff member and/or the appropriate unit staff member to inquire about the situation and resolve the discrepancy as soon as possible. Any corrections that need to be made to the transaction verification will be resolved by the OAA Service Center. The entire process will be documented in the Transaction Verification Access Database. At the end of each verification cycle, data will be summarized and reviewed to identify relative risk levels and help inform the next sampling process.

6 Transaction Verification Process:

Process: OAA Transaction Verification

6 4 If a transaction fails the t i If needed, obtain missing verfication review, a follow n documentation from units

U up will be required with the unit or service center

4 5 6 7 Compile needed Perform transaction Record findings and Fiscal Manager and AVP documentation and load verification on loaded results within database reviews and approves to Access database for data transactions verification

r transactions verification e t review n e C

e Verify: c i - Approval: Does the document have appropriate approval? v r 1 3 - Dollar Amount: Does the amount match the GL posted amount? e

S Download transactional Load sample selection into - Chartfield: Does the GL chartfield match the system documentation? Are the chartfields appropriate? data from eReports and Access database for - Documentation: Is there appropriate documentation? export into Excel transaction verification - Compliance: Was a compliance review performed by the OAA Service Center? review s t r o

p 2 e

R Send Excel documentto Institutional and Research Planningwill collect a sample of the transactional data weighting the sample based on number

& Institutional and Research

s Planning to produce a of touch points per transaction type, likelihood of errors per transaction type, frequency of transactions based on unit and

m sample selection transaction type and overall compliance and fraud risk of the transactions e t s y S

Process #1: Downloading Transactional Data from eReports

Below are the necessary steps to take in order to download monthly transactions from eReports. For example purposes, this illustration will represent how data is pulled for the month of June 2012:

1.) Once on the homepage of eReports, open the Financials folder

2.) Within the Financials folder, click Flexible Reports

3.) Within the Flexible Reports folder, select the Detail Activity Report SQR job

4.) Once this report is opened, there are many needed fields to fill in:

a. Business Unit should be UNIV

b. Organization should be ACAD_ADM_SUPPORT and the Print Order should be 1

c. Fund should be ALL_OSU_FUNDS and the Print Order should be 2

7 d. Account should have a print order of 3

e. Under the Ledger Specific Parameters, you should list the current Fiscal Year and Accounting Period. For this example, Beginning Fiscal year will be set to 2012 and the Beginning Accounting Period will be 12 – June. Since this example only needs one month worth of data, the Ending Fiscal Year and Ending Accounting Period will be set equal to the information above.

f. At the bottom of the Ledger Specific Parameters, make sure that Accounts Payable, P_Card and Inventory are selected as Yes

g. Click Run to begin the Query

5.) A Hyperion Workspace Question box will open, click “OK”

6.) The Flexible Reports home screen box will appear again. This query will run in the background and will not display a status box nor will it alert when it had completed. In order to refresh the screen and show the completed query, click F5 until the completed query appears on the homepage. Double click the selected query results

8 7.) The data is presented in four formats: PDF, HTML, SQR Log File and Excel CSX. In order to manipulate the data in Excel, select the CSX file

8.) A File Download box will appear asking whether or not the file needs to be Opened or Saved. Click Open and a Microsoft Word file

will appear. Open a new WordPad document and copy and paste the information in the Word document to the WordPad document. Save the file at the following path: OAA_Bricker -> OAA_FiscalHR_Students -> OAA Service Center – Data -> Monthly Text Files

9 9.) Open a new Microsoft Excel document and under the Data tab, select From Text from the Get External Data section and select the file saved above

10.) Follow the Text Import Wizard through all three steps with the following commands:

a. Step 1: Select Delimited and make sure the Start import row is set at 1

b. Step 2: Make sure comma is selected under the delimiters section

c. Step 3: Change the following columns to Text format: Per, Org, Fund and Journal ID

d. Click Finish and a second box will pop up asking where to put the data. Make sure A1 is selected

11.) Save this Excel document at the same path listed above but in the Monthly Excel Files folder

Process #2: Sample selection of the Transactions

10 Once the data has been downloaded from eReports, the transactions are sent to Institutional and Research Planning in order to obtain a smaller sample of the downloaded monthly transactions.

1.) Open the saved Excel document from Process #1

2.) Add the additional columns to this document explained in Appendix 1.1

3.) Right click on the data tab and make a copy of the tab within this same worksheet. Name the copied tab Raw Data – Unique and name the original Raw Data

4.) On the Raw Data – Unique tab, sort all values by the Amount column

5.) Once sorted, delete all line items that have blanks or null values for the “Amount”. These transactions are being removed in order to provide a unique posting count as some postings contain multiple transactions which show up multiple times in the data. These items are being temporarily removed in order to avoid duplicate values

6.) Insert a pivot table from the Insert tab in Excel

7.) Drag Transaction Description under the row labels section in the pivot table options, OSU Unit under the Column labels and Type under the Values (ensure Type is being counted and not summed)

8.) Hide the Raw Data tab and save the document

9.) Remove the following transactions prior to submission:

a. Cash Advance (OSP - any transactions for the Office of Research that have an Org of 40209 as well as an Org of 40200 with a Fund of 011500 and an Account of 64615 and any transactions which has “Hay” as an Account Description – these items are already reviewed by OSP and will not be included in this sample

b. Deposits – any transactions that have an Account Description of University Cash Control as these transactions are system offsetting items of the actual deposits

c. Delete all transaction types on page 15 that have “Will not be Documented”

10.)Due to coding, some of the transactions types may not accurately depict the correct transaction description. Prior to submitting the data for sampling, follow the steps listed on page 1.2 of the appendix

11.)Email this document to Jason Sullivan at the Institutional and Research Planning and CC Gretchen Gombos

11 Process #3: Load Sample Transactions into Access Database

Once the data has been put into a smaller sample size, the sample data will be uploaded into an Access database where the information will be reviewed and documented. Prior to importing the document into access, the following columns need to be added into the excel document:

1.) Columns to be Updated:

a. POID – If the transactions have a sub-line items on the master raw file, the Purchase order ID will be imported into this field

b. TNumber – If the transactions have a sub-line items on the master raw file, the Travel Number will be imported into this field

c. VNumber – If the transactions have a sub-line items on the master raw file, the Voucher Number will be imported into this field

d. InvoiceID – If the transactions have a sub-line items on the master raw file, the Invoice ID will be imported into this field

2.) Columns to be left blank (these columns will be left blank during import):

a. Comments:

b. Approval

c. Dollar Amount

d. Chartfield

e. Documentation

f. Compliance

g. Attachment Comments

h. Pass?

i. Failed Unit/SC

12 j. Primary/Secondary

k. Processor

Once these updates have been completed, this sample file will be saved at the location below and will be named as the proper year and month followed by the word “Load”. For example, for July 2012 sample data, the file will be named “2012.07.Load”.

OAA_Bricker (W:) -> OAA_FiscalHR_Students -> OAA Service Center – Data -> Monthly Excel Files -> Load Files

After the document has been saved, the following steps will be taken to load the document into Access:

1.) Once the database is open, click External Data

2.) Above Import & Link, click Excel

3.) Click browse and use the file path listed above to find the Load document previously saved above. Make sure “Import the source data into a new table in the current database” is selected and click Ok.

4.) A security notice may appear, if so click Open

5.) On the first prompt, click the check box next to “First Row Contains Column Headings” and then click Next

6.) On the next two prompts, click Next

7.) On the final prompt, change the name of the table. Use the same name listed above when previously saved as an Excel document. For our example, the document will be named 201207Load and click Finish

8.) The excel document will now be listed as a Table under the Access Objects column on the left side

After the file has been loaded, an additional column will need to be added prior to linking to the Verification Home Page. Below are the steps to update:

1.) Double click the newly created table that was just imported (in this example, 201207Load”

2.) Scroll to the last column on the document where it says “Click to Add”. Left click and select “Attachment”

3.) Once added, save the table and close

The final step to loading the sample data is to ensure the Verification Home Page is referencing the new table. In order to do this, follow these steps:

13 1.) Under the All Access Objects column on the left side, right click on the Form listed and select Design View (in this example, the Form is named “JulyReview”). Below is a screen shot of the location of the form:

2.) Once the form is opened in Design View, ensure that the Property Sheet is open on the right side of the screen. If it is not, on the Design Tab, click Property Sheet above Tools

3.) On the Property Sheet column, click the Data tab

4.) On the top drop down, make sure Form is selected. On the Record Source dropdown, check and see if the dropdown says the name of your imported table (this example would say 201207Load). If not, click the dropdown arrow and select that table.

5.) Once changed, save the Form and close it

Once these steps have been completed, the Verification Home Page can be used to interact and verify the transactions. Below is a screen shot of what the home page will look like:

14 Process #4 and #5: Obtain Needed Backup Documentation and Perform Transaction Verification Process

The following chart shows all transaction types found within the transaction data:

15 Transaction Description Documented? Transaction Description Documented? Will Not Be Documented Other Payments Benefits Other Payments (deposits) (allocation) Workflow Will not be Documented Cash Advance (OSP) Payroll HR Workflow (reviewed by OSP) Will not be Documented Debt Interest P-Card, Travel Air Fare Pre-Payments P-Card Workflow (reviewed by controller) Will Not Be Documented Deposits Deposit Workflow Petty Cash (Reconciled by Unit) Will not be Documented Debt Principal Pharmacy Billing IDB Workflow (reviewed by controller) Employee Reimbursement pushed from eRequest PREP Workflow PREP All other Standard convenience #s PREP Workflow Endowment Income Endowment Income PREP Refund PREP Workflow Workflow eStores PREP Workflow Req, PO, Special Convenience Order Numbers with Paper Payment Requests PO Workflow Fee Authorizations, Fee Waivers, Scholarships and Accounts Receivable (Study Fee Workflows Space Rental IDB Workflow Abroad) Will not be Documented Individual Gifts to Development Funds Gifts Workfow Student Federal Workstudy (allocation) Will not be Documented Will not be Documented Individual Gifts to Principal Fund Telecom Web Site - OCIO (reviewed by controller) (owned by Med Center) Will not be Documented Interdepartmental Billing IDB Workflow Temporary Investments Income (allocation) Will not be Documented Journal and Transfer Interest Expense Transfers (reviewed by controller) Workflow Journals - Corrections, Accounts Receivable, Bad Debits, Cost Distributions, Cost Journal and Transfer Travel Payments Travel Workflow of Sales and Insurance Workflow Lockbox and Merchant Lockbox/Merchant Fees UNITS Bills UNITS Workflow Fee Workflow Merchant Credit Card Merchant Service Deposit - Credit Cards University Meter Mail, Postage and Parcel Mail Workflow Workflow Will not be Documented OSU Store Transactions PREP Workflow University Overhead (allocation) Other - Discounts Lost Other (discounts lost) Worflow

Workflows:

Workflows: Deposits

d

l 1 2 3 4 5 6 e i f t r

a Under Journal ID, enter

h Click General Ledger Click Process Click Review Journal On the summary Confirm amount

C the Journal ID assigned /

t Journals Status page, click Print listed on Journal

n ) to the transaction t u f Journal matches the GL o o s S m e e u l A l p a e l o i V e c P n 7 ( o c e R

- Review the Chartfiled

Ensure Chartfield is 1 to ensure accuracy

p correct e

t and appropriateness S

t c a t Since the deposits are taking place outside of the OAA Service Center, the Units will be contacted directly regarding additional documentation for the verification process. The n o t i

C Data Manager will reach out to the Units to obtain copies of the deposit receipt, deposit log, check copies, cash tape and deposit bag tag. The documentation will be reviewed

n -

U

2 to ensure the amount is correct, the deposits were logged correctly and to identify any possible fraudulent activity. This documentation will be loaded into the access

p

e database for audit purposes. t S

Workflows Continued:

16 Workflows: PREP Payments

y

f 1 2 3 4 5 ) i t r / d s l e t e e n V i

u u f -

r q Click Search Enter Request #, Under Attachments, If receipt is not listed, Verify Charfield values o 1 a e

m h R p click search and retrieve and reconcile contact initiator for to ensure they are C A e e ( t receipt amount backup correct S click link

y

f 1 2 3 4 5 ) i s t r r s e e e V v

u

- o Refer to approved

q r Click Search Enter Request #, Review the signers Review attachments 2 e p signature log and see if R p p click search and under Workflow for additional e A e

( additional approvers are t S click link Information needed approvers

1 2 3 4 5 6 t s i l

k Access the OAA Open Open OAA Service OpenOpen OAA ServiceService Open Compliance Open Master c

e Center Unit Reviews h shared drive (W:) OAA_FiscalHROAA_FiscalHR_Stud_Stud Center - Fiscal Center Unit Reviews Reviews - Access Compliance Log.pdf ) C

e e v ents i c r n D a

i l d p e r m a o h 7 8 S C

( -

3

p Search by PO, Verify that checklist e t

S Invoice, Req or was completed eRequest # correctly

t

s - n e

s s e 4 e

o Refer to the Business Purpose section on the home page of the related eRequest. Review and document the listed business purpose to see if the purchases appear to be m n p p i u r e s c t u

u normal and expected for each unit. S o P B D

Workflows Continued:

Workflows: Endowment Income

1 2 3 4 5 6 t n ) u e

t Go to o i Click the Endowment Click "Descriptions and Using the Fund ID Select the desired fund Reconcile the amount s

m http://www.treasurer.ohio- b A e state.edu/Endowment/defau Tab Balances" search, enter the fund and click Run Report under Principal Balance e W h ID and click search to GL

t lt.aspx

e c e i l i v c r n e o S

c l

e a 7 i R c

- n

a 1

n i p If amount does not tie, F e ( t

S follow up with Financial Service is needed

Workflows Continued:

17 Workflows: Fee Authorizations, Fee Waivers and Scholorships (SIS Coded)

1 2 3 4 5 6

t n

u Select Financials Click Student Select SFB000 - SIS Ensure Report Enter the correct Org Click Display Report o under Organization, enter

m Dropdown is on Financials GL Financial Reports des ired Year/Period and A

)

s SFB010 - Recon

e click run report l t i r c o n p o e c R e e R ( 7

-

1

p Reconcile Name and e t

S amount

Workflows Continued:

Workflows: Fee Authorizations, Fee Waivers and Scholorships (CTL Coded)

1 2 3 4 5 6

t n

u Click General Ledger Click Journal Click Process Click Review Jounral Enter Journal ID and Click Print Journal o

m Journals Status click Search ) A t

f e l o i S c e n l o p c o e e

R 7 8 P

( -

1

p Searchby Journal ID Reconcile amount on e t

S to find appropriate Journal to GL Journal

Workflows Continued:

Workflows: Individual Gifts to Development Funds

1 2 3 4 5 6 s

t Select General

Click Login Enter OSU ID and In the Toolbar, click Enter appropriate Locate correct Org n e l e i Password the Fundrasing icon Ledger Transfer start date, end date and Fund number c u t n i Report

t and Org o s ) c n S e o R A

C T -

( / t 1

n 7 p u e o t S m

A Reconcile the amount and notate Constituent

Workflows Continued:

18 Workflows: Interdepartmental Billing

1 2 3 4 5 6 t n u

o Click General Ledger Click Journals Click Process Click Review Journal Ensure Business Unit is Click Print Jounal

m UNIV and enter Journal A

Journals Status )

e ID. Clear UserID t h f t

o S e l e i l c p n o o e c P e 7 8 ( R

-

1

p Reconcile Journal Confirm amount e t

S Entry amount and entry reason for validity

n n i o a i t t Each Interdepartmental Billing transactions is unique based upon the business purpose of the transactions. In some cases, the Journal entry will provide an eRequest number a b p t u O n which will have additional information along with PO's and Requisitions attached to it with adequate approval. In cases where additional information was not provided within k - e

c 2 a

m the Journal, the verifier will need to reach out to the Unit or the vendor directly to obtain necessary receipts, vouchers, requisitions and other needed documentation in order B p u c e t

o to complete verification. The verifier will use the contact list provided by each unit to obtain the needed information. S D

*In order to determine what type of documentation is required, please refer to the OSU Internal Vendors spreadsheet at https://assist-erp.osu.edu/assisterequest/documents/Internal%20Vendor%20Listing.pdf

Workflows Continued:

Workflows: Journal Entries and Transfers

1 2 3 4 5 6 t n u

o Click General Ledger Click Journals Click Process Click Review Journal Ensure Business Unit is Click Print Jounal

m UNIV and enter Journal

A Journals Status

)

e ID. Clear UserID t h f t

o S e l e i l c p n o o e c P e 7 8 ( R

-

1

p Reconcile Journal Confirm amount e t

S Entry amount and entry reason for validity

t c a r n o o

s Since Journals and Transfers are done on a frequent basis, no additional documentation will be required for the verification process as long as the business purpose s C

e -

c is clearly defined. If business purpose is not clearly defined, the unit or initiator of the transaction will be contacted to provide further details and possibly additional 2 o

r p

P documentation. e t S

Workflows Continued:

19 Workflows: Lockbox and Merchant Fees

w t e i n v u

e Lockbox and Merchant fees are common transactions when check and credit card deposits are received. Any fee charged to the University for Lockbox and Merchant o R

m -

Fees that do not exceed $50 will not be considered excessive or unusual and will require no further documentation. If the fee does equal or exceed $50, additional A 1

e

p documentation is needed e e F t S

e e

F t -

n e 2 l

u i If the fee amount is greater than $50, the fees must be reconciled to the monthly bank statement. Since these bank statements are kept within the unit, each unit p c o e n t m charged for this fee must be contacted in order to obtain the monthly statement. Once received, the fee will be reconciled to the statement. o S A c e R

Workflows Continued:

Workflows: Merchant Credit Card Processing

n n i o a i t t

a b p t u O n Since the Credit Card processing documentation is kept outside of the OAA Service Center, the verifier will reach out to the Units to obtain copies of the Point of Sale k - e

c 1 a

m transaction receipts along with the Units monthly credit card statements B p u c e t o S D

o t

S

- O

P Each Point of Sale transaction receipt will come with a summary tape along with copies of each individual transaction that makes up the batch total. Each receipt must be 2

L e p l

i G added together and sum to be the tape summary which will also tie to the number listed in the GL. If the numbers do not tie, then the Unit will be contacted for additional e c t n S information and possible resolution. o c e R

e The monthly Credit Card Statement will break down the total charges for each day during the month. The statement will allocate total charges based on whether or not the y - l l i 3 c h

t charges were Visa, Mastercard, Discover or American Express which will need to tie to the GL. Match off the total amount from the GL to the statment to ensure the amount is n p n o e o c t correct. On occasion, multiple credit card machines may be running in one day and will show as a total on the Monthly Statement. In this instance, review the Flex 91 report to e S M R see if any other transactions were completed on that day and ensure that the total of all transactions for the day add to be the amount listed on the statement.

Workflows Continued:

Workflows: Other - Discounts Lost

t 1 2 3 4 5 6 n u o m

A Click Purchasing Click Purchase Click Review PO Click Purchase Ensure Business Click Activity

t

n Orders Information Orders Unit is UNIV and Summary u ) t o f

c enter PO # s o i S D e

l e p l i o c e n P

o 7 8 9 10 11 ( c e R

- Click Invoice Check the checkbox Click icon under Locate discount Calculate and verify 1

p and click Voucher View Invoice agreements under discount amount e t

S Inquiry Terms

Workflows Continued:

20 Workflows: Other Payments

y y f b i

r Other Payments is the miscellanous catch all for the smaller and less frequent transaction types. These transactions range from eRequest documentation to journal n e o e V i

t documentation. In order to verify each of these transactions, each transaction will be reviewed to see if documentation and/or an eRequest is listed. If so, proceed to p - c

y a 1 T

s reconcile using the PO, Req and PREP Workflow. If no information is provided, proceed by following up with the unit and Service Center to obtain the necessary information p n e a t r and continue with the workflows mentioned above. S T

Workflows Continued:

Workflows: Payroll - Monthly

1 2 3 4 5 6 d i a P Click on HR Click Financial Select Report Select Appropriate Click Schedule 3.3 Locate Appropriate s a Reconciliation HRB130 Accounting Period Org and Fund W

) and Unit to run s o Number t h r o W

p y e f i R r e ( e 7 8 V

- Please Note: Some transactions may have multiple individuals that were paid 1 Reconcile User Def Notate Name and p within one transaction. Ensure all individuals are identified on step 7 and are e

t and Amount Empl ID

S reflected on steps 8 and 9.

1 2 3 4 5 6 t n

u Click on HR Click Financial Select Report Select Appropriate Click Schedule 4.4 Search by Emplid to o

m Reconciliation HRB140 Accounting Period find employee A

) s e and Unit to run identified above t h r t

o y p f i e r R e e

V ( 7 8

-

2 Please Note: Some transactions may have multiple individuals that were paid p Review payments to If payment is e within one transaction. Ensure all individuals are identified on step 6 and are t see if the payroll is S unsusual, alert the reflected on steps 7 through 9. consistent HR department

1 2 3 4 5 6 n o i t

a Select Unit, Fiscal c Click on HR Click Financial Select Report Click View Search by Emplid to i f

i Year/Pay Period and set

t Reconciliation HRB770os find employee r certification status to e ) s

C identified above

t Certified Yes

r e o e p y e o l R p e

( 7 m E

-

Please Note: Some transactions may have multiple individuals that were paid 3 Confirm within one transaction. Ensure all individuals are identified on step 6 and are p

e Certification status t reflected on steps 7 and 8. S is Certified Yes t )

s t (process is being i

l e 1 2 3 4 k n

i developed as of c b e a h 02/08/13 and will be C C

RetreiveRetreiveemployeeDiet Dr. Find Kathy Baker in TellFind Kathy appropriate she is the ReviewFile checklists checklist for to - e

l enforced once proper i 4

PepperID and along name with a office 391 checklistbest and from ask forfile ensureaudit reviewit was F

p

R procedures have been e cup loaded with ice neededcabinet checklists completed t H ( S in place)

21 Workflows Continued:

Workflows: Payroll - Bi-Weekly

1 2 3 4 5 6 d i a P Click on HR Click Financial Select Report Select Appropriate Click Schedule 3.7 Locate Appropriate s a Reconciliation HRB130 Accounting Period Org and Fund W

) and Unit to run s o Number t h r o W

p y e f i R r e ( e 7 8 V

- Please Note: Some transactions may have multiple individuals that were paid 1 Reconcile User Def Notate Name and p within one transaction. Ensure all individuals are identified on step 7 and are e

t and Amount Empl ID

S reflected on steps 8 and 9.

1 2 3 4 5 6 t n

u Click on HR Click Financial Select Report Select Appropriate Click Schedule 4.4 Search by Emplid to o

m Reconciliation HRB140 Accounting Period find employee A

) s e and Unit to run identified above t h r t

o y p f i e r R e e

V ( 7 8

-

2 Please Note: Some transactions may have multiple individuals that were paid p Review payments to If payment is e within one transaction. Ensure all individuals are identified on step 6 and are t see if the payroll is S unsusual, alert the reflected on steps 7 through 9. consistent HR department t )

s t (process is being i l e 1 2 3 4 k n

i developed as of c b e a h 02/08/13 and will be C C

Retreive employee Find Kathy Baker in Find appropriate Review checklist to - e

l enforced once proper i 3

ID and name office 391 checklist from file ensure it was F

p

R procedures have been e cabinet completed correctly t H ( S in place)

*Bi-Weekly employees will not have the employee certification step as their direct managers approve submitted time every two weeks. Since the managers are approving the time, they are aknowledging and confirming that these employees are current employees of the University

Workflows Continued:

22 Workflows: Payroll - Additional Pay t

n 1 2 3 4 5 6 u o m A

/ Click on HR Click Financial Select Report Select Appropriate Click Schedule 3.3 Locate Appropriate d i Accounting Period a Reconciliation HRB130 Org and Fund P

) s and Unit to run

s Number a t r W o

p o e h R W e

(

y 7 8 f i r

e Please Note: Some transactions may have multiple individuals that were paid V

- Reconcile User Def Notate Employee ID within one transaction. Ensure all individuals are identified on step 7 and are 1 and Amount p reflected on steps 8 and 9. e t S

A

R 1 2 3 4 5 6 H

e t

a Click the Employee ID Under Additional Pay,

c Click on Payroll for Click Create Enter Employee ID Under Payment

o hyperlink, if multiple show, notate the business L / North America Additional Pay discovered in Step 2 click the link which has Details, notate HRA )

e purposefor the t s f and click search Empl Rcd Nb equal to 0 # for following step r o additional pay o e p S r b e u l m P p

u s o s N e e P ( n i s

u Please Note: If HRA # is blank, this means the unit processed this additional pay rather than the Service Center. In order to retreive the HRA # and needed B

-

documentation, the unit will have to be contacted directly to obtain this necessary information. Please refer to unit contac t list 2

p e t S

d

e 1 2 3 4 5 ) d s l n e a o e i v t N o c Review the approvals to r

- Click Search Enter HRA # in the Click the HRA # Review attachments

A p 3 R ensure no additional p Request # field hyperlink when it for business H p A ( approvers were needed e

t appears confirmation S

1 2 3 4 5 6 n o i t Select Unit, Fiscal a Click on HR Click Financial Select Report Click View Search by Emplid to c i Year/Pay Period and set f i

t Reconciliation HRB770os find employee

r certification status to ) e

s identified above

C Certified Yes t

r e o e p y e o l R p e ( 7 m E

-

4 Please Note: Some transactions may have multiple individuals that were paid

p Confirm within one transaction. Ensure all individuals are identified on step 6 and are e t

S Certification status reflected on steps 7 and 8. is Certified Yes

Workflows Continued:

23 Workflows: P-Card Purchases

d e l l i

e 1 2 3 4 5 i c f ) n t t r s o a c e h e u Click Search Enter the PR #, click Review attached If receipt is missing, Review Charfiled to C R q

/ - e t receipt and reconcile ensure correct fields

R search and click the contact initiator for n 1

e u

p ( amounts were used

o link documentation e t m S A

y 1 2 3 4 5 f ) i s t r l s e a e v V

u Verify approvers listed

o Ifapprovals were If additional approvers - Click Search Enter the PR #, click

q r 2

e under Workflow p search and click the attached, review are needed, follow up R p p Information to s ee if they e A e documentation to see if with initiator ( t link a re a pproved signers S approval is correct

1 2 3 4 5 6 t s i l

k Access the OAA Open Open OAA Service OpenOpen OAA ServiceService Open Compliance Open Master c

e Center Unit Reviews

h shared drive (W:) OAA_FiscalHROAA_FiscalHR_Stud_Stud Center - Fiscal Center Unit Reviews Reviews - Access Compliance Log.pdf ) C

e

e v ents i c r n D a i l d p e r m a

o h 7 8 S C

( -

3

p Search by Invoice or Verify that checklist e t

S eRequest # was completed correctly

t

s - n e

s s e 4 e

o Refer to the Business Purpose section on the home page of the related eRequest. Review and document the listed business purpose to see if the purchases appear to be m n p p i u r e s c t u

u normal and expected for each unit. S o P B D

Workflows Continued:

24 Workflows: Requisitions and Purchase Orders

1 2 3 4 5 6

e

c Input UNIV for Business Click Activity i Click Procurement Click Purchase Click Invoice Check Mark the o

d Unit and the PO number v l Inquiry Home Page Order Inquiry Summary Invoice and click n e I ) i

under Purchase Order t f f e r Voucher Inquiry l o i a c S h n e C l o / p t c o n e e u R

P o - 7 8 ( m 1

A p

e Confirm amount on t Under Voicher Inquiry S Results, click the icon invoiceMatches the GL below the View Invoice and make sure Chartfield is correct

1 2 3 4 5 6

Click Purchasing Click Purchase Click Review PO Click Print POs Click Search Click PO_Print Orders Information t n u o m A

) 7 8 9 10 11 12 O t f P

o e S l i e Enter UNIV for Business l c Click Run Click OK Click Report Click Refresh until Select Report p n Unit and the PO # for POID. o o c e Ens ure Print Cha nges only Manager report appears e P ( R

is unchecked -

2

p e t S 13 14

Click PDF form Reconcile the PO amount to GL. If amount isnt equal, research is needed

Workflows Continued:

25 Workflows: Requisitions and Purchase Orders

1 2 3 4 5 6 n o i t Enter appropriate a Click Financials Click General Select Report A box will appear, HIt F5 until

m Org, PO ID and date r

i Procurement APU111DW click ok requested report f

n range and click run ) s

o Reports populates t C r

t o n p e e R m e y (

a 7 8 P

-

3

p Click the report and Ensure the PO e t

S open the PDF file number/amount match the GL

d

e 1 2 3 4 e r ) t v e i s e e W c

u - e

q Click Search Enter Request #, Packing slip will be If Packing Slip is not R 4

e s p R click search and loaded under loaded, contact e e m t ( e S

t click the link Attachments requestor for slip I l a

v 1 2 3 4 ) o t r s p e p u If over $3,000, approval A Click Search Enter Request #, click Review approvers to q

- e search and click the email is needed from R 5 ensure proper

e

p Service Center email ( link e approval was done t box S

1 2 3 4 5 6 t s i l

k Access the OAA Open Open OAA Service OpenOpen OAA ServiceService Open Compliance Open Master c

e Center Unit Reviews

h shared drive (W:) OAA_FiscalHROAA_FiscalHR_Stud_Stud Center - Fiscal Center Unit Reviews Reviews - Access Compliance Log.pdf ) C

e

e v ents i c r n D a i l d p e r a m

o h 7 8 S C

( -

6

p Search by PO, Verify that checklist e t

S Invoice, Req or was completed eRequest # correctly

*Please note, packing slips are not required for purchase orders less than $75 and are not required for purchases over $3,000 as email approval takes the place of the slip

Workflows Continued:

26 Workflows: Travel Payments

e s m

1 2 3 4 5 r o i /

f p ) s r l n l u e a o v v P C Enter in Travel #, click Review the Business Review the listed

a Click Travel Request Click Search o s - r r s

T Purpose and verify if approvers and verify if 1 p search and click View e

e p n ( p

i transaction is relevant they are current signers A

e Payment Request s t u S B

y 1 2 3 4 5 6 f n i

r ) t o l i e n t e V e a v

- Enter in Travel #, click a Click Payment Click Search Verify Payment Verify that all Verify that Travelor

m m r r 2 y T

o a search and click View e

p Request amount matches GL charfields are and needed f P ( e n t I Payment Request amount correct Approver signed S

1 2 3 4 5 6 t s i l

k Access the OAA Open Open OAA Service OpenOpen OAA ServiceService Open Compliance Open Master c

e Center Unit Reviews h shared drive (W:) OAA_FiscalHROAA_FiscalHR_Stud_Stud Center - Fiscal Center Unit Reviews Reviews - Access Compliance Log.pdf ) C

e

e v ents i c r n D a i l d p e r m a

o h 7 8 S C

( -

3

p Search by PO, Verify that checklist e t

S Invoice, Req or was completed eRequest # correctly

Workflows Continued:

Workflows: Prepaid Travel

e s m

1 2 3 4 5 r o i /

f p ) s l r n l u e a o v v P C Enter inTravel #, click Review the Business Review the listed

a Click Travel Request Click Search o s - r r

s

T Purpose and verify if approvers and verify if 1 p search and click View e

e p ( n p

i transaction is relevant they are current signers A

e Payment/Travel s t u S B

y 1 2 3 4 5 6 f n i

r ) t o l i e n t e V e a v

- a Click Payment Click Search Enter inTravel #, click Verify Payment Verify that all Verify that Traveler

m m r r 2 y T

a o search and click View e

p Request amount matches GL charfields are and needed f P ( e n t I Payment Request amount correct Approver signed S

Workflows Continued:

27 Workflows: UNITS Billing

1 2 3 4 5 6 t n

u Checkmark the Org, Fund, o Checkmark the "View Checkmark "All biling Enter the Org and Fund Select the "To Browser" Search for the amount

m Func, Project, Program ) A

your college or Dept accounts I have access number and Bill month Option and click Submit listed and reconcile e t e

i and Userdef h s Bills" option to generate bills" and click submit t

b e e l i c W

n S o T I c e

N 7 R

U - (

1

p Match off business e t

S purpose and notate expense

Workflows Continued:

Workflows: University Mail

e )

h g 1 2 3 4 5 t e n

t i i

o t s - t r

b o 1 g

e p n Go to Click Mail Reporting Enter name.number Enter Org, Fund, Verify that this item p i e l e W i

R t l c receivingandmail.osu.

l i and password Account and date, matches the GL S i n a a o edu

c then click run M M ( e R ) e

c t 1 2 3 c e i a

t p t

i n r n o e Call OSU Unit Verify the date and Confirm the C U p

- h 5

t contact amount of mail business purpose of 2 i 2

$ p w

> order the mailing e t $

S f i (

*Please note: Library's threshold will be >$500 as their volume and fees are larger than the standard unit. This threshold was confirmed by Janice Cramer

Required Documentation for Transaction Verification:

Paper and electronic documentation to backup each of the selected transactions will not be printed during this process. The backup documentation resides in multiple University systems and University archives and will not be required to keep another copy for audit purposes. Since this information will remain available on University servers for more than five years and since the paper copies will be kept on site, it will not be required to have this documentation saved with this access database. If copies are needed for audit purposes or other reasons, please refer to the workflows above in order to pull the necessary documentation.

28 Process #6: Record Findings and Conduct Follow Ups with Units and Service Center for Failed Transactions

The Data Manager will complete the Transaction Verification process and will record all findings within the access database. During this process, if a transaction does not meet the five requirements listed on page 3 and 4 of this document, the Data Manager will proceed with the Follow Up process listed below:

Follow Up on Failed Transactions:

1.) Determine whether the error was a result of the Service Center or the Unit. Once the source of the error is determined, the Data Manager will reach out to the following contacts:

29 Unit: Contact: E-mail Phone Graduate School Rosemarie Thornton thornton.2 247-7269 John Glenn Institute Julie Frary frary.1 292-1577 Libraries Heidi Kovach kovach.148 247-7972 Kathryn Beach beach.111 247-8763 Regina Patterson (Packing Slip) patterson.209 292-2400 OAA Admin Meg Dick (36021, 42000, 42007, 42015, 42019, 42031, 42032, 42033) dick.76 292-1176 Elizabeth Eberlin (42001) eberlin.1 688-8559 Josh Gillespie (42002) gillespie.85 292-2423 Liana Crisan-Vendeborne (42013) crisan-vandebone.1 292-1340 Christy Anandappa (42014) anandappa.1 292-3644 Office of Outreach & Engagement Betty Ellis ellis.199 247-8007 Office of Diversity Inclusion (ODI) Betty Ellis ellis.199 247-8007 Office of Human Resources (OHR, HR) Diana Lantz (Orgs: 47031, 47041, 47042) lantz.30 292-2916 Ken Gast gast.13 292-5229 Tamara Daniels daniels.413 292-4453 Office of International Affairs (OIA) Kirti Jain jain.130 - Steven McCann mccain.251 - Office of Research Karen Liming (Orgs: 40000, 40180, 40200, 40201, 40202, 40203, 40204 and 40240) liming.1 688-4648 Brooke Heslep HR (Org: 40000, 40180, 40200, 40201, 40202, 40203, 40204 and 40240) helsep.3 247-2584 David Scarlett (Org 40003) scarlett.1 688-5640 Stephanie Arend (Org 40012) arend.24 292-2368 Justin Costa, Hope Harrison (Orgs: 40210, 40220, D4028 and D4029) costa.31, harrison.287 292-9394 Drew White HR (Org: 40210, 40220, D4028 and D4029) white.1965 292-2318 Zack Mikesell (Org 40013) mikesell.22 292-1582 Ruth Luketic (Orgs: D40040 and D40050) PACKING SLIPS luketic.1 292-3446 Robin Gates (Org 40041) gates.79 292-0689 Angie Dockery (Org D4008) dockery.9 247-4670 Mary McCleery (Org 40082) Nanotech West mccleery.7 688-3119 Kelly Crawford (Org D4009) crawford.492 292-8704 Jessica Rector (Org D4012) rector.36 688-8123 Joetta Manion (Org 40260) manion.33 292-1840 Michele Cook, Charmaine Koch (Org D4050) cook.942, koch.266 292-7972 Bryan Ford, Grace Hicks (Org 40540) ford.95, hicks.519 247-6266 Office of the Chief Information Officer (CIO) Kristi Davis davis.1724 292-9163 OSU Online Sandy Bell bell.597 292-1073 Undergraduate Education and Enrollment Services Jeff Allen allen.728 247-6984 Julie Schultz, Bernard Savarese (statements for UAFYE) savarese.3 688-7553 Ashley Levesque [email protected] 247-2505 Wexner Center for the Arts (Wexner) Kevin Hathaway hathaway.3 292-0212

2.) Data Manager will follow up via email with each contact for each failed transaction type. The following information must be addressed:

a. The issue with the transaction

b. Possible cause for the error

c. Resolution to ensure the error is corrected for future transactions

3.) Failed Transaction Type and responsible Unit will be added to the next month’s Review List

4.) Once issue has been addressed, upload email into access database

Process #7: Final Review and Fiscal Manager and AVP Approval

30 Once all the transactions have been reviewed and all failed transactions have been followed up on, a summary report will be generated that will summarize the overall performance of the transactions. The report will state how many transactions from each sample population there were and what the pass percentage is. This report will then be reviewed by the Fiscal Manager and Assistant Vice President of the Office of Academic Affairs. Below is a sample of the approval sheet: x x Transaction Verification Summary June 2012 Office of Academic Affairs

Sample Type Total Sampled Total Passed Pass Percentage Comments:

IRP Sample 320 320 100% No Comments Needed, No Failed Transactions Graduate School 60 60 100% No Comments Needed, No Failed Transactions John Glenn Institute 10 10 100% No Comments Needed, No Failed Transactions Libraries 30 30 100% No Comments Needed, No Failed Transactions OAA Admin 20 20 100% No Comments Needed, No Failed Transactions Office of Diversity Inclusion (ODI) 40 40 100% No Comments Needed, No Failed Transactions Office of Human Resources (OHR, HR) 20 20 100% No Comments Needed, No Failed Transactions Office of International Affairs (OIA) 20 20 100% No Comments Needed, No Failed Transactions Office of Research 10 10 100% No Comments Needed, No Failed Transactions Office of the Chief Information Officer (CIO) 60 60 100% No Comments Needed, No Failed Transactions Undergraduate Education and Enrollment Services 15 15 100% No Comments Needed, No Failed Transactions Wexner Center for the Arts (Wexner) 35 35 100% No Comments Needed, No Failed Transactions

Small Transaction Type Sample 40 40 100% No Comments Needed, No Failed Transactions Graduate School 3 3 100% No Comments Needed, No Failed Transactions John Glenn Institute 6 6 100% No Comments Needed, No Failed Transactions Libraries 2 2 100% No Comments Needed, No Failed Transactions OAA Admin 4 4 100% No Comments Needed, No Failed Transactions Office of Diversity Inclusion (ODI) 5 5 100% No Comments Needed, No Failed Transactions Office of Human Resources (OHR, HR) 9 9 100% No Comments Needed, No Failed Transactions Office of International Affairs (OIA) 4 4 100% No Comments Needed, No Failed Transactions Office of Research 3 3 100% No Comments Needed, No Failed Transactions Office of the Chief Information Officer (CIO) 2 2 100% No Comments Needed, No Failed Transactions Undergraduate Education and Enrollment Services 1 1 100% No Comments Needed, No Failed Transactions Wexner Center for the Arts (Wexner) 1 1 100% No Comments Needed, No Failed Transactions

Previous Failed Transactions Sample 15 15 100% No Comments Needed, No Failed Transactions Graduate School 0 0 100% No Comments Needed, No Failed Transactions John Glenn Institute 0 0 100% No Comments Needed, No Failed Transactions Libraries 2 2 100% No Comments Needed, No Failed Transactions OAA Admin 3 3 100% No Comments Needed, No Failed Transactions Office of Diversity Inclusion (ODI) 4 4 100% No Comments Needed, No Failed Transactions Office of Human Resources (OHR, HR) 1 1 100% No Comments Needed, No Failed Transactions Office of International Affairs (OIA) 0 0 100% No Comments Needed, No Failed Transactions Office of Research 2 2 100% No Comments Needed, No Failed Transactions Office of the Chief Information Officer (CIO) 0 0 100% No Comments Needed, No Failed Transactions Undergraduate Education and Enrollment Services 0 0 100% No Comments Needed, No Failed Transactions Wexner Center for the Arts (Wexner) 3 3 100% No Comments Needed, No Failed Transactions

Matt Yoder, Data and Quality Manager Gretchen Gombos, Fiscal Manager of OAA

Henry Zheng, Assistant Vice President of OAA Date Signed x x

Timing and Completion for Transaction Verification

The Transaction Verification process will follow similar timing guidelines as the reconciliation process. Listed below are the expectations for process and completion of a specific month when operating in a business as normal process:

31 1.) On the 5th business day of a specific month, the prior months data will be pulled from a flexible 91 report in order for the Verification process to begin

2.) The data pulled from the Flexible 91 report will be reviewed and summarized within one business day and sent to Institutional Research and Planning

3.) Institutional Research and Planning will review, analyze and sample the data and return the Verification sample no later than the 15th of the current month

4.) The Verification team will have the remaining part of the month to review, follow up and complete each transaction by the end of the current month

5.) In the event that a transaction needs additional information or documentation from a Unit, the Verification team will reach out to the Unit through a single email request giving the Unit one to two weeks’ time in order to respond with the needed information

6.) In the event that a transaction needs additional information or documentation from the Service Center, the Verification team will reach out to the Service Center through email requesting the documentation be sent with one to five business days

7.) The Verification team has 30 days to complete the verification process once the data has been received

8.) Once all documents have been received and transactions have been verified, the Data and Quality Manager will have one business day to compile the printed results and have the Fiscal Manager and the Assistant Vice President sign off on the results

9.) Results will be distributed to the Unit contacts along with the Service Center within one business day after signatures have been obtained

Reporting for Transaction Verification

32 General Ledger Reconciliation & Transaction Verification Processes Fiscal Process

Responsibility ITEM PURPOSE Frequency Service Center Department

P-Card Compliance Reporting Monitor P-Card activity and approvals to ensure all activity is accounted for Monthly X

Purchase Order Reporting Monitor Purchase Order lifecycles Monthly X

Travel Status Reporting Monitor travel requests to ensure payments are processed within the 90 day deadline Monthly X

MBE/Edge Reporting Monitor all Minority buying percentages Monthly X

Monitor all PeopleSoft/Travel System and eRequest roles assigned to users in order to Access Reporting Monthly X maintain segregationReporting of duties for Transaction Verification continued

Training Reports Monitor all training recommendations and requirements for Fiscal personnel Monthly X General Ledger Reconciliation & Transaction Verification Processes Sub-Certification Self-Assessment Annual compliance self-reportingHR Process process management Annual X

PIER Reporting Annual equipment inventory process management Annual ResponsibilityX ITEM PURPOSE Frequency Service Center Department

COI Reporting Annual Conflict of Interest process management Annual X Job Data Report Verify HRA to Peoplesoft Entry - Run Daily Daily X

Works with units to ensure that all e-Certifications and Sponsored Research is completed in Research Reporting Monthly X Allows SC to see what active employeesa timely have fashion not yet submitted timesheets. Run Mon & Tue Bi-Weekly e-timesheet report of payroll deadline week. SC follows up with any employees that have not submitted. Mon/Tues of Payroll Week X Lists asset, liability and equity balances for each Org and Fund according to the General eReports - Standard Monthly 61 Report Wednesday is final run to verify etime to Peoplesoft Monthly X Ledger

Report that lists Budget and Actual expenses by Org and Fund in order to derive large AdditionaleReports Pay - Standard Report Monthly 90 Report Verification of system entry to HRA and give SC lead list of all approval of add pay needed Periodically/byMonthly deadline X X variance between each value, review open purchase orders and remaining encumbrances

eReports - Standard Monthly 91 Report Lists transaction detail from the General Ledger by Org and Fund from prior reported months Monthly X HRB140 Analysis of YTD GL Activity - Month my month payout - verfiy and look for outliers. Monthly X

If variation or issues arise while reviewing the Standard Monthly 61 and 90 Reports, Flexible eReports - Flexible Reports As Needed X reports will need to be run in order to resolve the issue Position Worklist Used to see open positions created by the specialists which provides the list of approvals Every Wednesday X Report that details mail purchases by Org and Fund in order to show how much each unit is UMS Report (Mailing Report)* Monthly X spending on mail Job Opening Worklist Shows all jobs that need to be approved for posting Every Wednesday X PurchasingAppendix Card Reconciliation 1.1: Report* Additional DataReport thatColumns lists all transactions for completedMonthly on a specific Transactions purchasing card for each unit Monthly X

PayOIT 364 T&N This- Check Billing appendixDistribution Statements* Report will explain howVerifyReport to addif that payments details the total were proper phone correctly usage madeUnit, and chargesin order Voucher based to identify on Org Code anyand anominaliesFund and TransactionMonthlyBi-Weekly DescriptionX toX each transaction downloaded from eReports University Development Report* Used to confirm ifTAS an report employee which is lists a current Fund transfers employee for ofthe the month University in order to avoid Monthly X X HRB770 - Monthly Payroll Cert Report Monthly X paying terminated personel Report which shows transactions in which the Fund is posted under an incorrect Org in order Fund Unit:Exception Report Monthly X to identify any issues with mismatched Chartfield values HRB110 - Analysis of General Fund Uncommitted 1.) In cell AL1, type “OSU Unit”Shows budget and annual rates for each individual by Org and Fund After Each Payroll X X Budget Balances P-Card Clearing2.) AccountsIn cell AL2, enter the Verifiesfollowing that all P-Cards formula: have been reallocated from the 61206 clearing account Monthly X HRB130 - Reconciliation of HR-GL Components of *These reports will not =VLOOKUP(D7,'W:\OAA_FiscalHR_Students\OAA be ran on a standard monthly basis but onlyShows when the a relative names transactionof the employees is pulled paid in the out sampling of Service a specific process Org Center and Fund - Data\Lookups\After Each Payroll X X Actual Expense [UnitLookup.xlsx]Unit Lookup'!$A$2:$E$601,4,FALSE) 3.) Drag the formula in this cell down to the last transaction on the Excel document HRB140 - Analysis of Year-toDate HR-GL Activity Shows YTD payroll payments which is used to determine unusual or irregular activity After Each Payroll X X

Voucher Code: Bi-Weekly and 1.)MonthlyIn Checklists cell AM1, type “VoucherUsed to ensure ID” that all payments are correct, current and fall into compliance Monthly X 2.) In cell AM2, enter the following formula: HRB170 - Personnel Expenditure=LEFT(MID(AA2,3,3))&LEFT(MID(AA2,3,4)) Transfer Used to reconcile the HRA to the PET Monthly X 3.) Drag the formula in this cell down to the last transaction on the Excel document

Transaction Description: 1.) In cell AN1, type “Combined”

33 2.) In cell AN2, enter the following formula: =M2&N2&AM2&G2 3.) Drag the formula in this cell down to the last transaction on the Excel document 4.) In cell AO1, type “Transaction Description” 5.) In cell AO2, enter the following formula: =VLOOKUP(AN2,[DescriptionLookup.xlsx]Description!$E$2:$F$2296,2,FALSE) 6.) Drag the formula in this cell down to the last transaction on the Excel document 7.) Review all of the lookup functions calculated in the above steps. If any of the formulas return #N/A, that means that either the Unit or Transaction Description are new and need to be added to the lookup spreadsheets 8.) Once all formulas are completed, highlight columns AL through AO. Copy and paste special values in these columns 9.) Hide column AN

Survey Data: 1.) In Cell AP1, type “Combined2” 2.) In cell AP2, enter the following formula: =AL2&AO2 3.) Drag the formula in this cell down to the last transactions on the Excel document 4.) In cell AQ1, type “Rate of Error” 5.) In cell AQ2, enter the following formula: =VLOOKUP($AP2,'W:\OAA_FiscalHR_Students\OAA Service Center - Data\Lookups\ [SurveyLookup.xlsx]Raw'!$C$2:$G$397,2,FALSE) 6.) In cell AR1, type “# of Touch Points” 7.) In cell AR2, enter the following formula: =VLOOKUP($AP2,'W:\OAA_FiscalHR_Students\OAA Service Center - Data\Lookups\ [SurveyLookup.xlsx]Raw'!$C$2:$G$397,4,FALSE) 8.) In cell AS1, type “Compliance/Fraud Risk” 9.) In cell AS2, enter the following formula: =VLOOKUP($AP2,'W:\OAA_FiscalHR_Students\OAA Service Center - Data\Lookups\ [SurveyLookup.xlsx]Raw'!$C$2:$G$397,5,FALSE) 10.)Drag the formulas in the previously mentioned three columns to the last transaction on the excel document

34 Appendix 1.2: Correcting Mislabeled Transaction Types:

Based on coding, some transaction types show up incorrectly when the Transaction Type is assigned to each line item. This issue is directly related to the Req, PO, Special Convenience Order Numbers with Paper Request description type but is also related to a few other categories such as Individual Gifts to Principal Fund and Journals. In order to correct these types, follow the instructions below:

1.) Open the current month raw data tab and sort the data based on “Amount”

2.) Copy all line items which do not have a dollar value and paste into a new spreadsheet and name this new spreadsheet “Blank Amounts”

3.) Insert a new column between “Voucher ID” and “Transaction Description” and name this column “Comb”

4.) In the “Comb” column, enter the following formula in the 1st cell of that column:

a. =D2&E2&F2&G2&H2&I2

35 5.) Open the current month filtered file and insert two new columns between “Voucher ID” and “Transaction Description”. Name the first column “Comb” and the second “New Transaction Type”

6.) Complete the same process listed in step 4 for the “Comb” column

7.) In the first cell of the “New Transaction Type” column, complete a vlookup that pulls the “Comb” column value from the Filtered file and looks up the Transaction Type from the “Blank Amount” file

8.) Where there are #N/A values in the “New Transaction Type” column, use the original Transaction Type

9.) Copy and paste all new values from the lookup function for the Req, PO, Special Convenience Order Numbers with Paper Request in the original Transaction Type column

10.)Review any other variances listed between the two Transaction Type columns to determine if other values need to be changed according to the type of transaction

Appendix 1.3: Necessary System Access:

In order to complete the Transactions Verification process, a processor must have access to the following systems:

1. PeopleSoft – HR

2. PeopleSoft – Financial

3. The Advancement System (TAS)

4. Mail Website (receivingandmail.osu.edu)

36 5. eReports – HR

6. eReports – Financial

7. HR Action

8. eTravel

9. UNITS Website

10. OAA Bricker Shared Drive (W:)

System access can be limited to read-only for each of these systems as no processing is necessary during the Transaction Verification.

37