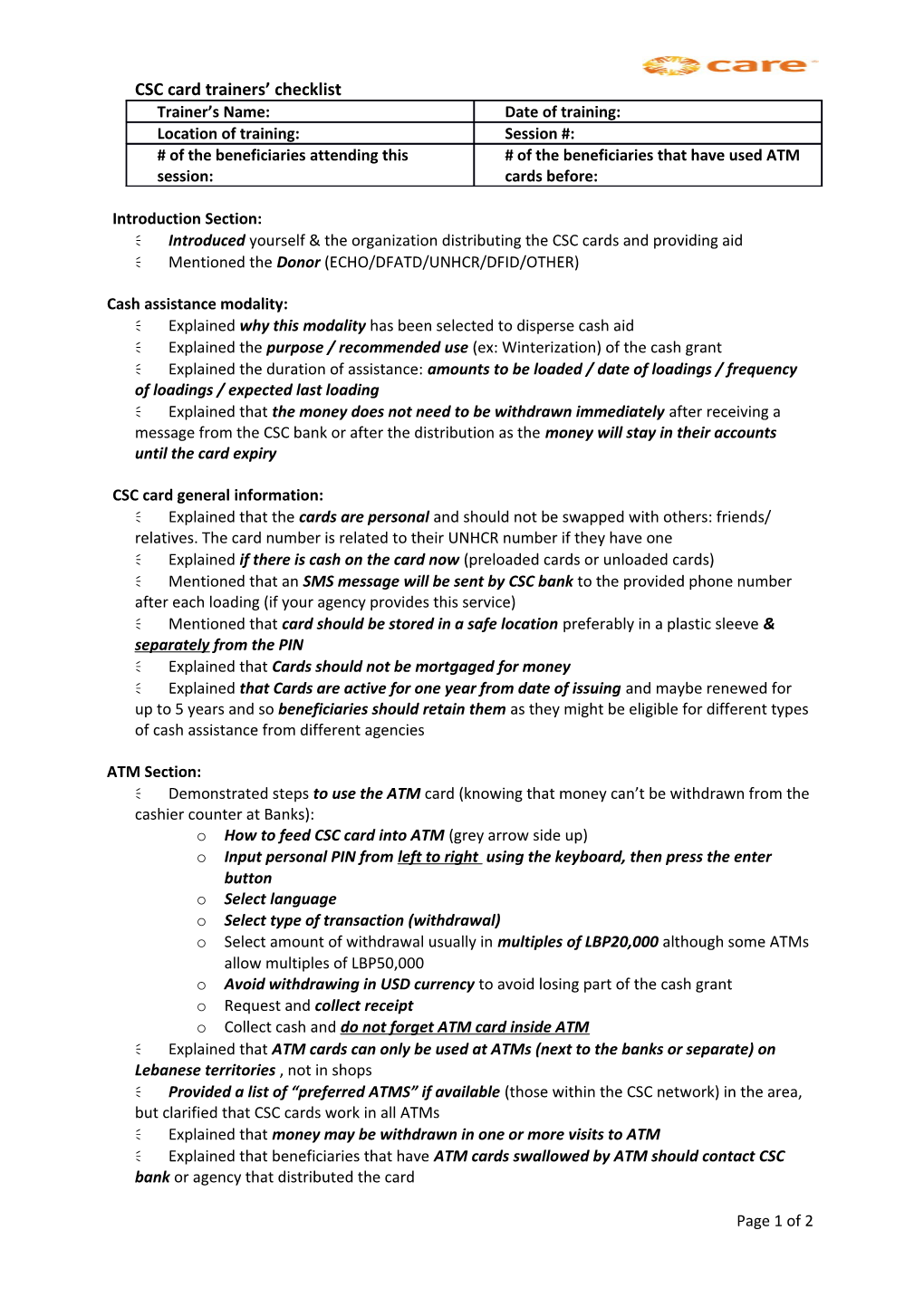

CSC card trainers’ checklist Trainer’s Name: Date of training: Location of training: Session #: # of the beneficiaries attending this # of the beneficiaries that have used ATM session: cards before:

Introduction Section: Introduced yourself & the organization distributing the CSC cards and providing aid Mentioned the Donor (ECHO/DFATD/UNHCR/DFID/OTHER)

Cash assistance modality: Explained why this modality has been selected to disperse cash aid Explained the purpose / recommended use (ex: Winterization) of the cash grant Explained the duration of assistance: amounts to be loaded / date of loadings / frequency of loadings / expected last loading Explained that the money does not need to be withdrawn immediately after receiving a message from the CSC bank or after the distribution as the money will stay in their accounts until the card expiry

CSC card general information: Explained that the cards are personal and should not be swapped with others: friends/ relatives. The card number is related to their UNHCR number if they have one Explained if there is cash on the card now (preloaded cards or unloaded cards) Mentioned that an SMS message will be sent by CSC bank to the provided phone number after each loading (if your agency provides this service) Mentioned that card should be stored in a safe location preferably in a plastic sleeve & separately from the PIN Explained that Cards should not be mortgaged for money Explained that Cards are active for one year from date of issuing and maybe renewed for up to 5 years and so beneficiaries should retain them as they might be eligible for different types of cash assistance from different agencies

ATM Section: Demonstrated steps to use the ATM card (knowing that money can’t be withdrawn from the cashier counter at Banks): o How to feed CSC card into ATM (grey arrow side up) o Input personal PIN from left to right using the keyboard, then press the enter button o Select language o Select type of transaction (withdrawal) o Select amount of withdrawal usually in multiples of LBP20,000 although some ATMs allow multiples of LBP50,000 o Avoid withdrawing in USD currency to avoid losing part of the cash grant o Request and collect receipt o Collect cash and do not forget ATM card inside ATM Explained that ATM cards can only be used at ATMs (next to the banks or separate) on Lebanese territories , not in shops Provided a list of “preferred ATMS” if available (those within the CSC network) in the area, but clarified that CSC cards work in all ATMs Explained that money may be withdrawn in one or more visits to ATM Explained that beneficiaries that have ATM cards swallowed by ATM should contact CSC bank or agency that distributed the card

Page 1 of 2 Recommended that beneficiaries avoid going to the ATM directly after distribution or after receiving SMS from CSC bank, allow a day or two to avoid crowding at the ATMs as it is a risk for them. ATMs are located outside the bank therefore visit can be done outside its opening hours; although it’s safer in the daylight Explained that due to large numbers of transfers ATMs may run out of cash, beneficiaries can try again later to withdraw cash or try using a different ATM Explained that ATM will swallow the card if PIN is input incorrectly 3 times (ask the bank if they can retrieve the card and return it to you, if not contact the CSC bank or the distributing agency)

Complaints & Accountability Section: Mentioned that this cash transfer service is free of charge to beneficiaries. They should report any solicitations to the distributing agency at which point it will be dealt with confidentially Explained that beneficiaries should have their CSC card number (A15***, DRC***, etc.) readily available to enable them to register complaints effectively Explained that beneficiaries can call CSC bank for account balance inquiries Explained that beneficiaries who lose their cards or have their cards stolen should first contact CSC to freeze their card then the agency that distributed the card so they can be issued a new one Explained that replacing cards is a lengthy process (one month usually) therefore much care should be taken to avoid delays of access to cash grants; knowing that the amount found on the old card will be transferred as is to the new one Explained that they will receive two hotline numbers, one for the CSC and another for the distributing agency (if agency has setup a hotline) and each serves a separate purpose Explained that CSC bank is not aware of the loading dates or selection of beneficiaries or possible future programs Mentioned that if they are asked for money while standing in line at an ATM by a bank employee, beneficiaries should call the agency that distributed the card and register a complaint (also explained that this will be dealt with confidentially & that their names will not be mentioned) Explained that if beneficiaries get a text message from the bank and cannot withdraw the money that they should first check with the CSC bank for account balance, if there is money then try again and if not contact the distributing agency Explained that any individual who physically has the card and knows the PIN can withdraw money from the card

Training materials: Distributed flyers with all necessary information given during the training session along with snapshots of the different steps of the ATM withdraw process

This document has been produced in consultation with the Cash Core Group and is intended to be dispersed to all agencies that are distributing CSC cards. It serves as a reminder to the trainers and should be completed by trainers at the end of each training session before CSC cards are distributed to beneficiaries. It is also considered as a monitoring tool to measure the quality of training sessions. *Upon completing this checklist (39 items in total), trainers are requested to inform beneficiaries of any checklist items that they have not mentioned to ensure an effective cash transfer program and reduce the number of hotline inquires received by the distributing agency and CSC Bank.

Page 2 of 2