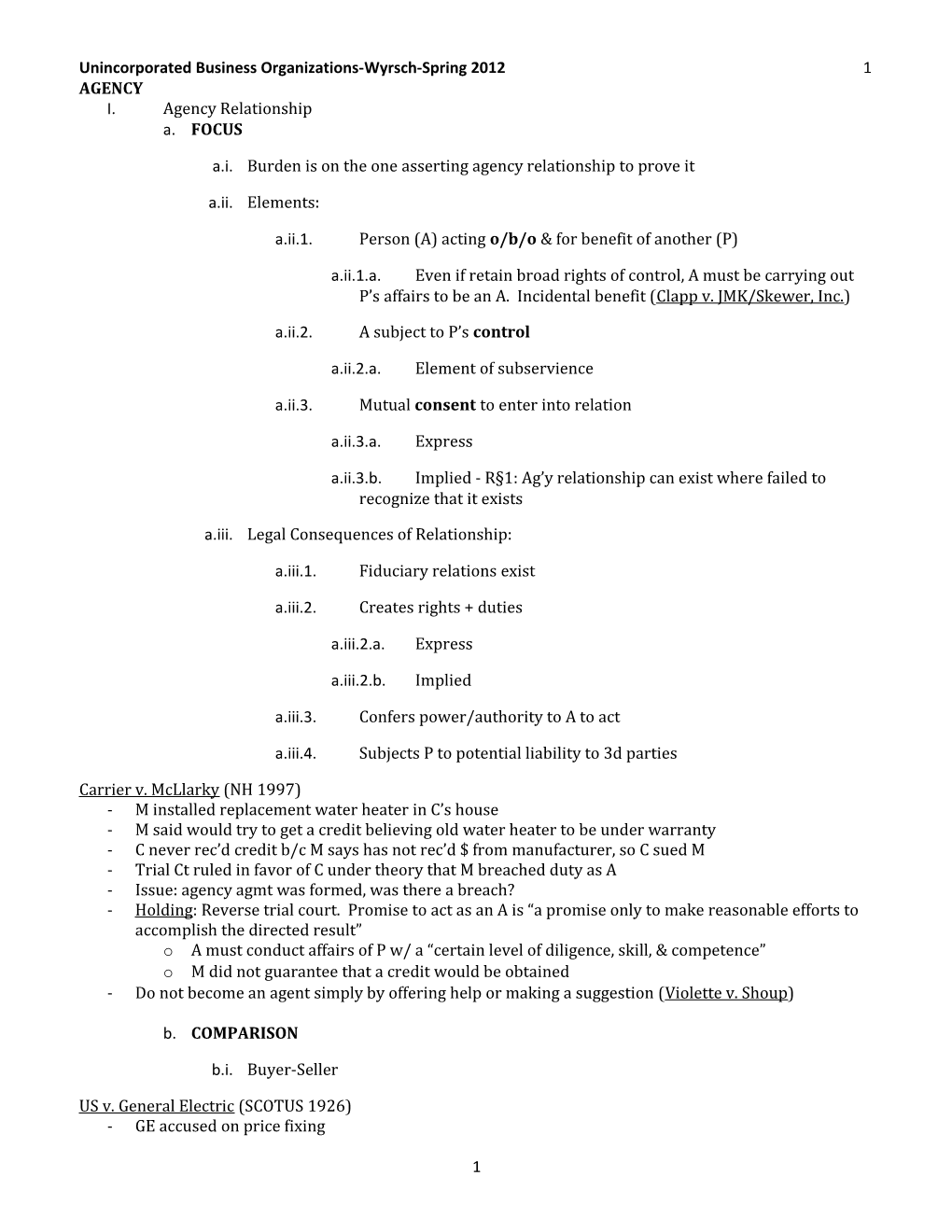

Unincorporated Business Organizations-Wyrsch-Spring 2012 1 AGENCY I. Agency Relationship a. FOCUS

a.i. Burden is on the one asserting agency relationship to prove it

a.ii. Elements:

a.ii.1. Person (A) acting o/b/o & for benefit of another (P)

a.ii.1.a. Even if retain broad rights of control, A must be carrying out P’s affairs to be an A. Incidental benefit (Clapp v. JMK/Skewer, Inc.)

a.ii.2. A subject to P’s control

a.ii.2.a. Element of subservience

a.ii.3. Mutual consent to enter into relation

a.ii.3.a. Express

a.ii.3.b. Implied - R§1: Ag’y relationship can exist where failed to recognize that it exists

a.iii. Legal Consequences of Relationship:

a.iii.1. Fiduciary relations exist

a.iii.2. Creates rights + duties

a.iii.2.a. Express

a.iii.2.b. Implied

a.iii.3. Confers power/authority to A to act

a.iii.4. Subjects P to potential liability to 3d parties

Carrier v. McLlarky (NH 1997) - M installed replacement water heater in C’s house - M said would try to get a credit believing old water heater to be under warranty - C never rec’d credit b/c M says has not rec’d $ from manufacturer, so C sued M - Trial Ct ruled in favor of C under theory that M breached duty as A - Issue: agency agmt was formed, was there a breach? - Holding: Reverse trial court. Promise to act as an A is “a promise only to make reasonable efforts to accomplish the directed result” o A must conduct affairs of P w/ a “certain level of diligence, skill, & competence” o M did not guarantee that a credit would be obtained - Do not become an agent simply by offering help or making a suggestion (Violette v. Shoup)

b. COMPARISON

b.i. Buyer-Seller

US v. General Electric (SCOTUS 1926) - GE accused on price fixing

1 - GE said that title passed directly from GE to customer, b/c distributors are an A of GE, thus, there is no intermediate sale to distributor - GE’s Apparent Marketing Strategy: o Control sale of products to consumers (Be competitive) o Maintain quality control over products o Place business risks on distributors (expenses, damages) o Avoid application of antitrust laws (price fixing) . Price fixing among competitors: horizontal . Vertical price fixing debated issue as to whether it should be considered illegal - Lamps remain in GE’s control until sold by A - A is to pay amount equal to total sale for the month less the A’s compensation of all lamps sold by the A - Issue: whether As to be treated as owners of the lamps, thus, fixed pricing violates anti-trust laws? - Holding: nothing in the form of the K saying they are owners thus making them As, and “delivery of stock to each A anything more than a consignment to the A for his custody and sale as such” Three Structure Options: 1. Too large of a work force a. GE Depts. Sales Employees Consumers 2. Offices Sales Employees Consumers 3. Possible Price Fixing Violation – Sell to Wholesaler a. GE Wholesalers Retailers Consumers b. Wholesalers are separately owned businesses 4. GE’s Chosen Method – Give Power/authority to Sell (Consignment) a. GE Distributors/Cosignees Agents Consumers b. Distributors work for GE with power to sell its products but the products are never owned by the distributors

TEST: whether the actor is acting primarily for his own benefit or for the benefit of the other party when acting pursuant to the arrangement b/w the parties

b.ii. Debtor-Creditor

A. Gay Jenson Farms v. Cargill (MN 1981) - Farmers (3d Party) sold grain to Warren (A), who was financed by Cargill (P) to ensure that Warren had enough grain for C - W collapses financially - Farmers sue C, saying W bought Grain as C’s agent - C says typical supplier relationship - Issue: Did C become liable through course of dealings for Ks W made? - Holding: Yes. All 3 elements of agency are met—not merely a B-S relationship o C told W to implement its recommends., manifesting consent that W would be its A o W acted o/b/o C when procuring grain for C and C financed W o C exhibited control over W by interfering w/ W’s internal affairs o Servant-IC distinction does not matter here b/c K issue

b.iii. Bailor-Bailee

b.iv. Other—

b.iv.1. Franchisee Unincorporated Business Organizations-Wyrsch-Spring 2012 3 b.iv.1.a. H& R Block v. Lovelace: franchise = license from the owner of a TM or trade name [franchisor] permitting another [franchisee] to sell a product or service under that name

b.iv.1.b. Exercise of considerable amount of control by Franchisor

b.iv.1.c. Parties had different purposes and objects, concluding franchisee did not act for benefit of franchisor or on its behalf

b.iv.2. Marriage - Cannot infer agency, but such a relationship is entitled to great weight, when considered with other circumstances, as tending to establish the fact of agency

b.iv.3. Property

b.iv.3.a. Co-owners: joint ownership of property does not in itself establish agency

b.iv.3.b. LL-T: no unless lessee makes improvements b/c lease requires such, then becomes lessor’s A

b.iv.4. Corporate

b.iv.4.a. Directors are not SHs’ or corp’n’s A

b.iv.4.b. SHs generally cannot control directors

b.iv.4.c. Alter Ego/Mere Instrumentality

b.iv.4.c.i. Corp’ns are separate & distinct unless PCV to show that one is alter ego of the other by showing it is so controlled & affairs conducted that it is a mere instrumentality of another & observing separate existence would sanction fraud or promote injustice

b.iv.4.c.ii. Disregard when:

b.iv.4.c.ii.1. Gross undercapitalization

b.iv.4.c.ii.2. Fraud

b.iv.4.c.ii.3. Failure to observe corp formalities

b.iv.4.c.ii.4. Non-functioning of off’rs & directors

b.iv.4.c.ii.5. Sub mere shadow of parent

b.iv.4.d. General A’gy Principles: Must demonstrate relationship that one corp’n is acting for other

c. RELATIONSHIP

c.i. Informal & Formal

c.ii. Agreement

c.ii.1. Written matter of interpretation

3 c.ii.2. Oral evidentiary issues

c.ii.3. No agmt or gaps in agmt implied rights + duties

c.iii. Types

c.iii.1. Employer-employee

c.iii.2. Principal-professional agent

c.iv. Everything negotiable except employment laws & regs

II. Rights & Duties B/w P&A

a. Principal

a.i. Duties to A

a.i.1. To exonerate & indemnify: so long as conduct w/in scope of authority

a.i.1.a. Express commitment

a.i.1.a.i. Not entitled to reimbursement in defending suit if IC

a.i.1.b. Implied: reasonable expectations of parties

a.i.1.b.i. Nature of relationship

a.i.1.b.i.1. Depends on reasonable inferences drawn from circumstances

a.i.1.b.ii. Nature of expense/customs of business

a.i.1.c. A’s misconduct? No indemnity for own negligence, illegal acts, or other wrongful conduct (R 8.14)

a.i.2. To pay compensation

a.i.2.a. Express k

a.i.2.b. Implied k = conduct + other circumstances

a.i.2.c. Dependent on result

a.i.2.d. Subagent?

a.i.2.d.i. P must know or have reason to know that A will hire someone else to act o/b/o P & consent, express or implied, to such arrangement

a.i.2.d.ii. Otherwise SubA only has claim against A not P

McKnight v. Peoples-Pittsburgh Trust Co. (PA 1948) - Bank owned Theatres, which McKnight then managed on salary & commission basis - M entered military, rec’d no commission on sale when theatres sold - But W.D. George was the bank’s A; M rec’d compensation from George, who had chosen M in the first place Bank George Bros McKnight Unincorporated Business Organizations-Wyrsch-Spring 2012 5 - At no time was there any expectation that the bank would pay McKnight - Holding: M was not a subA of Bank, thus, M only has claim against G for compensation, not bank o Important that the P keeps relationship clean with A and not interact directly with the subagent so that you cannot be ultimately seen as a principal of the subagent a.i.3. To exercise due care a.i.3.a. Traditional approach

a.i.3.a.i. “construction, inspection, and maintenance of the premises, selection of fellow employees, & mgmt. of the work”

a.i.3.a.ii. Can discharge duty by warning of risks of unsafe conditions

a.i.3.a.iii. Duty is nondelegable

a.i.3.b. Restrictions on liability

a.i.3.b.i. Fellow-servant rule: “he who engages in the employment of another for performance of specified duties for compensation, takes upon himself natural and ordinary risks & perils incident to the performance of such services, each employee can observe conduct of others, give notice of misconduct and leave, if employer does not take precautions, thus, safety of each more effectually secured than done by indemnity

a.i.3.b.ii. Contributory negligence

a.i.3.b.iii. Assumption of risk

a.i.3.c. Worker’s comp (only for employees)

a.i.3.c.i. Entitled to compensation even if not fault of employer

a.i.3.c.ii. No recovery for P&S

b. Agent

b.i. Fiduciary Duties

b.i.1. Fiduciary (R§13): a person who has a duty, created by his undertaking, to act primarily for the benefit of another in matters connected with his undertaking

b.i.2. Why?

b.i.2.a. Acting o/b/o & for benefit of P

b.i.2.b. Engaging in legally binding conduct

b.i.2.c. Not in physical presence of P, less control

b.i.2.d. In control of & using another person’s property ($)

b.i.2.e. Deterrent effect to exercise caution

b.i.3. Cuts across all relations

b.i.3.a. Corp. off’rs, partners 5 b.i.3.b. Employees (sales persons, blue collar)

b.i.3.c. Professional As (att’y, acct’t)

b.i.3.d. Well-established businesses

b.i.3.e. Gov’t off’ls

b.i.4. Series of judgment calls

b.i.4.a. Reasonable

b.i.4.a.i. Objective

b.i.4.a.ii. Subjective

b.i.4.b. Conflict of interest

b.i.4.b.i. Actual

b.i.4.b.ii. Appearance

b.i.4.c. Material, important v. trivial, irrelevant

b.i.4.d. Degree of disclosure

b.i.4.e. A’s intent

b.i.4.e.i. Entirely innocent

b.i.4.e.ii. Deceptive

b.i.4.f. Damage, if any; if so, Cx-tion?

b.i.5. Differing Ct analyses

b.i.5.a. Conclusionary

b.i.5.b. Detailed

b.i.6. Major sources of:

b.i.6.a. Common law: inherent relationships

b.i.6.b. Agmt of parties (employment or other K)

b.i.6.c. Statute or Regs

b.i.6.d. Stds of Professional Conduct b.ii. A’s Fiduciary Duties

b.ii.1. To perform

b.ii.1.a. Follow instructions (obey reasonable directions)

b.ii.1.b. Exercise reasonable care Unincorporated Business Organizations-Wyrsch-Spring 2012 7 b.ii.1.b.i. Inaction

b.ii.1.b.ii. Action

b.ii.1.b.ii.1. Duty to indemnify P when P pays for damages resulting from A’s negligence while acting w/in scope of employment

b.ii.2. To disclose (Tied into duty of care/duty of loyalty)

b.ii.2.a. Relation to “perform” & “loyalty” duties

b.ii.2.b. Material info

b.ii.2.c. Duty to account: keep accurate record of $ rec’d & pd out o/b/o P

b.ii.2.d. Ltd to actions w/in scope of agency & creation of agency is not itself w/in scope. General rule: no duty prior to relationship but there is the possibility of a factual exception (Martin v. Heinold Commodities, Inc.)

b.ii.2.e. Enhanced duty to disclose for certain As, if relationship involves “peculiar trust & confidence”

Gelfand v. Horizon Corp. (10th Cir. 1982) - G employed by Horizon, a RE Co. - Horizon decides to lower G’s salary & pay commissions + overrides on sales - Horizon fires G, claims benefiting more than Horizon - G sues for unpaid commissions + overrides - H accuses G of breach of fiduciary duty for selling property to corp’n which wife had 1/3 interest in o Using breach of duty of loyalty as a defense - Issue: a breach is undisputed, but how much of an offset is Horizon entitled to for sale, 1/3 or all? - Holding: where an A seeks to recover compensation out of same transaction in which he was guilty of being disloyal to P, Ct is justified in denying compensation for fiduciary, should not profit from own wrongdoing thus, G should be held responsible for the profit he made and wife made AND the trial court could force G to disgorge the profit the other 2/3s owners of the corp’n made o P does not need to prove any loss was cx-d by misconduct o Enough that Horizon would have objected to sale if it had known about the interest in the transaction o Extenuating circumstances: instances in past where Horizon employees could obtain a 20% discount on purchases of unimproved property o Ct more upset w/ not disclosing rather than actual sale

b.ii.3. Of loyalty

b.ii.3.a. Best interests of P

b.ii.3.b. Self-dealing (financ’l material interest)

b.ii.3.c. Transactions w/ P

b.ii.3.c.i. Middle-man: need not disclose to all parties his acceptance of dual commissions b/c has nothing to do w/ negotiations

7 b.ii.3.d. Competition w/ P

b.ii.3.d.i. During relationship

b.ii.3.d.i.1. Courts split on whether A should forfeit all compensation during period of disloyalty b.ii.3.d.ii. After relationship b.ii.3.d.ii.1. Depends on circumstances in which A left

Town & Country House & Home Serv. v. Newbery (NY 1958) - Home and cleaning service, N worked there for 3 years - T&C allege it is a “unique, personal & confidential” enterprise - Issue: Was plan to terminate employment & solicit T&C’s customers a breach of duty? - Holding: the only trade secret involved was the customer list. Even if did not operate under banner of former employer, he still may not solicit his customers who are not openly engaged in business in advertised locations or whose availability as patrons cannot readily be ascertained but who through years of trade built such list. - Trade secret (R of Torts § 757): any formula, pattern, device or compilation of info which is used on one’s business, and which gives him an opportunity to obtain an advantage over competitors who do not know or use it

b.ii.3.d.iii. Agmt

b.ii.3.d.iii.1. Subject to strict test of reasonableness if restrict a person’s means of procuring a living

b.ii.3.d.iii.2. Covenant not to compete: Robbins v. Falay

b.ii.3.d.iii.2.a. Liquidated damages clause b/c difficult to calculate how much damages should be

b.ii.3.d.iii.2.b. Restriction unenforceable b/c it overreached

b.ii.3.d.iv. No agmt

b.ii.3.e. Corporate opportunity doctrine

b.ii.3.f. Use of inside info

b.ii.3.f.i. Duty not to use or communicate information confidentially given on acct of agency, in competition w/ or to injury of P, although such info does not relate to the transaction in which he is them employed, unless info is a matter of general knowledge

b.ii.3.g. No dual agency

b.iii. Restrictions on Employees Re: Trade Secrets

b.iii.1. Balancing of interests required b.iii.1.a. Employer’s need to protect confidential nature of info

b.iii.1.b. Employee’s right to engage in work of his/her choice & use general knowledge, expertise & experience Unincorporated Business Organizations-Wyrsch-Spring 2012 9 b.iii.2. Situations where raised

b.iii.2.a. During employment

b.iii.2.a.i. Agmt: express commitment

b.iii.2.a.ii. No agmt: implied duties

b.iii.2.b. After employment

b.iii.2.b.i. Agmt: express commitment

b.iii.2.b.ii. No agmt: implied duties

b.iii.3. Types of restrictive agmts

b.iii.3.a. Nondisclosure of protected info/data

b.iii.3.b. Nonuse of protected info/data

b.iii.3.c. Noncompetition w/ employer’s business (territory + time period)

b.iii.4. Source of restrictions: 18 USC 207 + 208

b.iii.5. Professional firms

b.iii.5.a. Main Asset: clients

b.iii.5.b. Law firm

b.iii.5.b.i. Special rules when att’y leaves firm

b.iii.5.b.ii. Need to protect client’s best interests

b.iv. Employer’s Legitimate Property Interest Entitled to Protection (“Trade Secrets”)

b.iv.1. Employers are entitled to protection of a legitimate, valuable property interest: some confidential, nonpublic info/data that gives employer some competitive advantage

b.iv.2. Forms:

b.iv.2.a. Customer/vendor lists

b.iv.2.b. Special info re: customers

b.iv.2.c. Special manufacturing processes

b.iv.2.d. Business & manufacturing strategies

b.iv.2.e. Personnel data

b.iv.2.f. R&D projects

9 b.iv.2.g. PPI

b.iv.2.h. Product formulas

b.iv.2.i. Product design & spec data

b.iv.2.j. Financ’l data re: operations/results

b.iv.2.k. Future development plans

b.iv.2.l. Patent, TM, copyright info

b.iv.2.l.i. Shop rights doctrine: where, during hours of employment, w/ employer’s materials & appliances, conceives & perfects and invention for which he obtains a patent, he must accord his master a non-exclusive right to practice the invention

b.iv.2.m. Professional firms: clients

III. P’s Vicarious Liability (Strict Liability)

a. General Approach:

a.i. P’s no fault/strict liability

a.i.1. Vicarious liability can be imposed even when actual consent over tortfeasor at time of accident is absent

a.ii. Negligent hiring – not conducting a proper background check

a.ii.1. Rebuttable presumption that use due care when hiring

a.iii. Negligent oversight

a.iii.1. Some jurisdictions hold ownership of car as rebuttable presumption of agency

a.iv. Employment relation not necessary

a.v. Relationship: master-servant v IC Determined by trier of fact

a.v.1. Master: P who employs an A to perform service in his affair & who controls or has the right to control the physical conduct of the other in the performance of the service (R (2d Agency) § 2)

a.v.2. Servant: A employ by a master to perform service in his affairs whose physical conduct in the performance of the service is controlled or is subject to the right of control by the master

a.v.3. IC: person who Ks w/ another to do something for him but who is not controlled by the other nor subject to the other’s right to control wrt his physical conduct in the performance of the undertaking—may or may not be an A

b. Relation (control)

b.i. Employee v. IC Unincorporated Business Organizations-Wyrsch-Spring 2012 11 Kane Furniture Corp. v. Miranda (FL 1988) - K sold carpet installation business to Perrone, K supplies carpet, provides installation services through P - P assigned jobs to Kraus, when he could not perform - Kraus finished jobs, got drunk at bar, drove Carleton to car at warehouse parking lot - On way, struck Miranda’s vehicle, died at hospital - Issue: Were Perrone and Kraus employees of Kane? - Holding: Reverse trial ct, Perrone & Kraus are ICs o Factors to consider whether an employee or IC (R (2d Agency) § 220): . Extent of control which, by agmt, master may exercise over details of the work Most important factor Once carpet installer got job, he was on his own . Whether the one employed is engaged in a distinct occupation or business Carpet installing can be viewed as a unique business . Kind of occupation, w/ reference to whether, in the locality, the work is usually done under the direction of the employer or by the specialist w/o supervision . Skill required in the particular occupation . Whether employer or workman supplies the instrumentalities, tools, & place of work for the person doing the work Perrone & Kraus supplied own tools & equipment . Length of time for which the person is employed Employed on an “as needed” basis . Method of payment whether by the time or by the job Paid per installation rather than by time . Whether the work is part of the regular business of the employer Only factor favoring e’ee – installation was part of business . Whether the parties believe they are creating relationship of master & servant All factors indicate they meant an IC relationship . Whether the P is in business “relevance of this factor is obscure”

b.i.1. Modern Day Factors to determine whether E’ee or IC:

b.i.1.a. Federal & state income tax w/holdings

b.i.1.b. Employer files w-2 form w/ IRS

b.i.1.c. Social security & medicare deductions

b.i.1.d. Other employer deductions taken from paycheck

b.i.1.e. Unemployment compensation

b.i.1.f. Worker’s comp

b.i.1.g. Participate in health or life insurance program

b.i.1.h. Participate in retirement plan

b.i.1.i. Participate in stock-option plan

b.i.1.j. Covered by labor-mgmt agmt

b.i.1.k. Entitled to benefits under family & medical leave act 11 b.i.1.l. Entitled to protection under fair employment (anti- discrimination) provisions in civil rights act Lazo v. Mak’s Trading Co. (NY 1994) - 3 men assist grocer by unloading trailer - Driver of trailer and one of the men got into an altercation - Men came and went, free to hold other employment, no on payroll, no fringe benefits, single payment - Issue: are they employees or ICs? - Holding: No Q of fact, IC - Dissent: Men did not have authority of where & when to perform the unloading no control over price; no control over results or means used to achieve results; no connection b/w assault & tortfeasor’s duty as a day laborer; regardless of control, not liable for separate assault

b.i.2. Fact that law requires an exam & certain std of skill does not prevent master-servant relationship from arising (i.e., dr, lawyer)

b.i.3. Possible implication that IC: Not protected by certain employee protections

b.i.3.a. One in pursuit of an independent business

b.i.4. Main laws protecting “e’ees” (fed + state):

b.i.4.a. Unemployment comp (salary)

b.i.4.b. Workman’s comp (injury)

b.i.4.c. Anti-discrimination (race, color, religion, sex)

b.i.4.d. Age discrimination

b.i.4.e. Min wage

b.i.4.f. Mgmt-labor relations

b.i.4.g. Employee safety (OSHA)

b.i.4.h. Disabilities

b.i.4.i. Veterans (rehiring)

b.i.4.j. Family & medical leave

b.i.4.k. Retirement benefits (ERISA)

b.ii. Exceptions to IC exception:

b.ii.1. Employer negligence (hiring or oversight)

b.ii.2. Inherently dangerous activity: work which in its nature will create some peculiar risk of injury to others unless special precautions are taken

b.ii.2.a. Inherently dangerous/hazardous activities

b.ii.2.a.i. Use of explosives to take a building down Unincorporated Business Organizations-Wyrsch-Spring 2012 13 b.ii.2.a.ii. Transportation of hazardous waste materials, chemicals

b.ii.2.a.iii. Construction/maintenance of high voltage electric lines

b.ii.2.a.iv. Construction/maintenance of very high office bldgs.

b.ii.2.a.v. Excavations in or near a public hwy or a heavily populated area

b.ii.2.a.vi. Manufacture of lethal weapon systems (bombs, rockets)

b.ii.2.a.vii. Public fireworks exhibition in crowded area

b.ii.2.a.viii. Use of heavy construction equipment

b.ii.2.a.ix. Production, testing, and use of nuclear energy

b.ii.2.a.x. Construction of underground subway system

b.ii.2.a.xi. Flying helicopters in & around large cities

b.ii.2.a.xii. Use of new medical devices, x-ray equipment

b.ii.2.a.xiii. Recovery efforts in a heavily damaged area (hurricane)

b.ii.3. Nondelegable duty

b.ii.3.a. Employer’s duty is so important that law should not allow person to transfer duty/responsibility to another if 3d party injured

b.ii.3.b. Based on statute, K, or common law

b.ii.3.c. Examples:

b.ii.3.c.i. Duty of common carrier to transport passengers safely

b.ii.3.c.ii. Duty of landowner to keep premises reasonably safe

b.ii.3.c.iii. Duty of LL to comply w/ building codes

b.ii.3.c.iv. Duty of employer to keep work areas reasonably safe

b.ii.3.c.v. Duty of law firm to represent clients most effectively

b.ii.3.c.vi. Duty to comply w/ statutory requirements

b.ii.3.c.vii. Duty of hospital to maintain safe bldgs. For patients

b.ii.3.c.viii. Duty of homeowners to ensure home reasonably safe

b.ii.3.c.ix. Duty to ensure hazardous materials discarded properly

b.ii.3.c.x. Duty of gen. k-ors to ensure works areas safe

b.ii.3.c.xi. Duty of car owner to keep car in safe condition

13 b.ii.3.c.xi.1. Maloney v. Ruth: held liable when brakes failed after just having brakes overhauled at a service station

b.ii.3.c.xi.1.a. This is an exceptional case! Not the law!

Kleeman v. Rheinegold (NY 1993) - 5 days before SOL to expire on med mal claim, att’y sent process server to serve dr “immediately” - Papers served to dr’s secretary, not dr, so case dismissed - Trial Ct found process server to be an IC - Issue: whether att’y may be held vicariously liable to client for negligence of a process server hired o/b/o client? - Holding: proper SOP is part of lawyer’s over-all responsibility. Att’y has nondelegable duty to clients to exercise due care in SOP, so att’y can be held liable for negligent SOP even if IC performed SOP o Duty is nondelegable when so important to the community that the employer should not be permitted to transfer it to another o Client’s reasonable expectation & beliefs about who will render a particular service are a significant factor in ID-ing duties deemed to be nondelegable

b.ii.4. Apparent relation b.ii.4.a. Raised where this is some sort of business relation, i.e., franchisor-franchisee relationship b.ii.5. Financial responsibility

b.ii.5.a. Contributory negligence – master is barred from recovery against a 3d person who negligently cx-d a loss to the master if the servant also was negligent in the accident giving rise to the loss

b.iii. Employee’s personal liability – remains personally liable, employer is just also liable

b.iii.1. For affirmative acts of wrongdoing committed while acting o/b/o master

b.iv. Employer’s direct liability

c. Activity (scope of employment)

c.i. SOE Test: whether or not employee’s actions or inactions fell w/in scope of employer’s business

c.i.1. IC – about control

c.i.2. E’ee – needs to be close enough to the business

c.ii. Nexus Test:

c.ii.1. How close are employee’s actions or inactions connected to employer’s business?

c.ii.2. If fairly and reasonably connected, incidental to employer’s business liable for e’ee’s negligent and int’l acts that injured 3d persons

c.ii.3. If not fairly & reasonably connected, actions outside SOE Unincorporated Business Organizations-Wyrsch-Spring 2012 15 c.ii.4. Matter of Degree, judgment;

c.ii.4.a. If slight deviation = detour (within)

c.ii.4.b. If substantial deviation = frolic (outside)

c.ii.5. Factors: (R§228)

c.ii.5.a. Kind = conduct must be of the same general nature or incident to conduct authorized

c.ii.5.b. Purpose (to serve master)

c.ii.5.b.i. Cardozo: whether it is the employment or something else that has sent the traveler forth upon the journey or brought exposure to its perils

c.ii.5.b.ii. Outside SOE when engaged in an independent course of conduct not intended to further any purpose of employer

c.ii.5.c. Time & Place

c.ii.5.d. If force used, force not unexpectable by master

c.iii. Negligent Torts

c.iii.1. E’ee return to employment: re-entry rule

c.iii.1.a. Reenters after a frolic when employee “breathes a sigh of relief”

c.iii.2. Employer’s work rules: e’ee disobedience

c.iii.3. E’ee’s personal habits, conduct: Horseplay, tricks, games

c.iii.4. Business connected activities (office parties, outings)

c.iii.4.a. Is it on premises?

c.iii.4.b. Does employer pay for food/drinks?

c.iii.4.c. Are e’ees helping with serving the food?

c.iii.5. E’ee commuting: going & coming rule

c.iii.5.a. On commute – outside SOE

c.iii.5.b. BUT what if they pay for gas? Or parking?

c.iii.6. E’ee having a dual purpose

Clover v. Snowbird Ski Resort (Utah 1991) - Two restaurants, one at bottom and one at midpoint of ski mountain - Zulliger & Norman went skiing before reporting to work - Supposed to return to Plaza Restaurant after inspecting Mid-Gad Restaurant - But made 5 runs in b/w returning to restaurant

15 - On 5th run, Z took a jump despite signage saying not to, landing on Clover - Issue: was Z acting w/in SOE to hold Snowbird liable? - Holding: a jury could reasonably find w/in SOE b/c there was a predominant business purpose for trip to Mid-Gad Restaurant o Dual purpose of benefiting employer + serving a personal interest = w/in SOE

c.iii.7. 24 hour on call – working “around the clock” c.iii.8. Business work during personal time (cell phones)

c.iii.9. Work at home

c.iv. Intentional torts

c.iv.1. A&B (police brutality)

c.iv.2. Employee fraud (insurance/cc agent)

c.iv.3. Employee stealing/robbery (purse/laptop)

c.iv.4. Sexual misconduct (rape, harassment)

c.iv.4.a. Mere fact that an e’ee has opportunity to abuse facilities necessary to performance of duties does not render an employer vicariously liable for abuse, nor does fact that occurred during working hours (Alma v. Oakland Unified School Dist.)

c.iv.5. Extreme racial, religious discrimination, abuse (exclusion, refusal to serve)

c.iv.6. Criminal violation of fed or state statute (price fixing/bribery/overbilling)

c.iv.7. Outrageous misconduct (violence in workplace)

c.iv.8. Substantial property damage (arson, explosives)

Ira S. Bushey v. US (2d Cir. 1968) - Drunk coast guard, Lane, turns 3 wheels that open water intake valves of ship being serviced

- Ship begins to list, slips off blocks & falls against dry dock wall

- Dry dock owner sues US

- Issue: were Lane’s acts while drunk w/in SOE after he turned valves upon returning to duty? - Holding: Lane’s conduct was not so unforeseeable as to make it unfair to charge the gov’t w/ responsibility. Employer should be held to expect risks which arise out of and in the course of his employment of labor. o Risk that seamen might cause in coming and going is enough to make it fair that gov’t bear loss o Rejected motive test but find fact that is better able to afford damages not alone sufficient to justify legal responsibility either

c.v. Theories of Intentional tort liability

c.v.1. Motive – looked at motive of employee at time of tort Unincorporated Business Organizations-Wyrsch-Spring 2012 17 c.v.1.a. No longer followed, tended to favor no liability for employer

c.v.2. Foreseeability

c.v.2.a. Incident must be a foreseeable consequence of employment

c.v.3. Characteristic of business

c.v.3.a. Must be engendered by or arise from the work

c.v.3.b. Incident must be outgrowth of employment

c.v.4. Outgrowth of the work environment

c.v.4.a. Injury must be inherent in working env’mt

c.v.5. Enterprise liability

c.v.5.a. Injury typical or broadly incidental to enterprise

c.v.6. Policy analysis (application of vicarious liability justifications)

c.v.6.a. Abuse of power/authority exception

c.v.7. Work precipitating cause

c.v.7.a. General duty of care (security)

c.v.8. SL

c.v.9. Implied K

c.v.9.a. General duty of care (security)

c.v.10. Agency relation aided person in accomplishing tort

c.vi. Lisa M. Case- Basic Test: Employee’s intentional conduct must have a causal nexus to employee’s work

IV. P’s K Liability

a. Relation (Representative)

a.i. Person w/ power of attorney: financial/medical decisions

a.ii. Corporate president’s authority to sell all corp. assets

a.iii. Former employee’s power to bind employer (new order)

a.iv. Lawyer’s power to bind client (settle litigated dispute)

a.v. University president’s authority to hire professors

a.vi. Agent’s authority to appoint/hire subagents

a.vii. Employer’s liability for agent’s defrauding customer ($)

17 a.viii. Telephone operator’s power to bind employer (insurance)

a.ix. Partner/member’s power to bind business (order supplies) b. Activity (Scope of Authority)

b.i. Actual Authority

b.i.1. Express

b.i.1.a. Oral v. Written

b.i.1.b. Power of Att’y

b.i.2. Implied

b.i.2.a. R(3d): actual authority to

b.i.2.a.i. (1) do what is necessary, usual, and proper to accomplish or perform an A’s express responsibility

OR

b.i.2.a.ii. (2) act in a manner in which an A believes the P wishes the A to act based on A’s reasonable interpretation of P’s manifestation in light of P’s objectives and other facts known to the A

b.i.2.b. Necessary

b.i.2.c. Position

b.i.2.d. Past conduct

b.i.2.e. Custom

b.i.2.f. Delegation of authority

b.i.2.f.i. General rule: A’s powers cannot be delegated in absence of authority to do so

b.i.2.g. Incidental authority: R(2d) § 35 “unless otherwise agreed, authority to conduct a transaction includes authority to do acts which are incidental to it, usually accompany it , or are reasonably necessary to accomplish it”

b.ii. Apparent Authority (estoppels)

b.ii.1. R(2d) § 27: act is created as to a 3d person by written or spoken words or any other conduct of P which reasonably interpreted, cxs the 3d person to believe that the P consents to have the act done o/b/o P by person purporting to act for him

b.ii.2. 3d Party’s reasonable belief

b.ii.2.a. Manifestation Unincorporated Business Organizations-Wyrsch-Spring 2012 19 b.ii.2.b. Position

b.ii.2.b.i. R(3d) § 1.03: placing A in a position customarily having authority of a specific scope, absent notice to 3d parties, constitutes a manifestation that P assents to be bound by actions of A

b.ii.2.c. Past dealings

b.ii.2.c.i. Dealings must be similar to one at issue and there must be a degree of repetitiveness

b.ii.2.d. Custom

b.ii.3. Duty of inquiry by 3d parties triggered when A employed power in a manifestly suspicious way so that there had to arise a reasonable doubt as to whether A was not violating a fiduciary duty

b.ii.3.a. Court looks from a subjective and objective view

Smith v. Hansen, Hansen & Johnson, Inc. (WA 1991) - Owner of bldg. hires HHJ to renovate it, including an exterior glass wall - Glass wall began to leak 1 yr later, HHJ settled w/ owner, sought reimbursement from glass installer- Fentron - Foster, worked for Fentron, told HHJ about glass Fentron had, but his job was to solicit sales for Fentron products and services - HHJ requested salvage glass, which Foster sold, when in fact, Fentron had rejected glass itself for manufacturing deficiencies, Foster sold on his own - Wrote checks for payment of glass to Foster - Trial Ct found apparent authority, holding Fentron liable when Foster absconded to CA - Issue: Did Foster have apparent authority? - Holding: No, Foster was mgr of manufacturing services, no manifestation that this gave him authority to sell materials and designs o/b/o Fentron. Made check paid personally to him and glass was not in control of Fentron but at a salvage yard. o Manifestations to 3d party must: . 1. Cx the one claiming apparent authority to actually believe that the A has authority to act for the P . 2. Be such that the claimant’s actual subjective belief is objectively reasonable o Foster did not have actual authority to enter into this transaction, moreover it is a fraudulent transaction b/c Foster absconded w/ the $

b.iii. Inherent

b.iii.1. General A – incidental to P’s business

b.iv. Ratification

b.iv.1. Express – P’s specific affirmation

b.iv.2. Implied

b.iv.2.a. Conduct (use/payment)

b.iv.2.b. Failure to object

19 c. Att’y’s Authority- Litigation decision-making

c.i. Unless otherwise agreed, client controls substantive matters & att’y controls procedural

c.ii. An att’y has no implied actual or apparent authority for substantive matters but has such authority over procedural and administrative matters

c.ii.1. But in general legal practice context (not litigation!) att’y has broad implied actual authority & apparent authority (Bucher)

c.ii.2. Client may be estopped to deny his/her att’y’s apparent authority to 3d person (Szymkowski)

Substantive Procedural File Suit Determine overall strategy Settle case Present evidence (select witnesses) Appeal case Raise & argue issues Stipulate essential facts Hire specialists (blood samples, detectives)

V. Undisclosed Ps

a. R(3d) § 6.03: when an A acting w/ actual authority makes a K o/b/o an undisclosed P, (1) unless excluded by the K, the P is a party to the K; (2) the A and 3d party are parties to the K; and (3) P, if a party to K, and 3d party have the same rights, liabilities, and defenses against each other as if the P made K personally

b. Undisclosed Ps v. Partially Disclosed

b.i. Nature

b.ii. Use & benefits

b.iii. Intentional v. unintentional

b.iv. Inherent problems:

b.iv.1. Conceptual

b.iv.2. Practical

b.v. Relation to law of Ks (3d party rights)

c. Rights – can enforce unless there is need to protect 3d party’s legitimate interests: LIMITATIONS

c.i. Express limitation against

c.ii. Personal services

c.iii. False denial

c.iv. Known 3d party refusal if ID disclosed c.v. Mere suspicion? Unincorporated Business Organizations-Wyrsch-Spring 2012 21 Kelly Asphalt Block v. Barber Asphalt Paving Co. (NY 1914) - Kelly sues as undisclosed P, Barber made K w/ Kelly’s A, Booth - Kelly and Barber were competitors - Booth asked Barber for a price on asphalt blocks, which were furnished and pd by Booth, o/b/o Kelly - Barber believes rule should be changed where ID of P concealed b/c belief that, if disclosed, K would not be made - Issue: is K enforceable? - Holding: yes, there was a meeting of minds. If Booth had made K and assigned right later to Kelly, it would have been enforceable all the same. o There was no fraud b/c never questioned about agency, and Booth never misrepresented who he was representing o The blocks were sold at FMV

d. Liabilities (3d Parties’ Rights)

d.i. Authorized transactions: 3d party can enforce – but Election Doctrine

d.i.1. English rule (traditional common law)

d.i.1.a. 3d Party has only one COA

d.i.1.b. If 3d Party obtains judgment against A, 3d Party cannot bring suit against P

d.i.1.c. Regardless whether or not 3d Party aware of P’s existence

d.i.2. American rule (Election Rule)

d.i.2.a. 3d Party can make a valid election only if aware of P’s existence at time

d.i.2.a.i. If unaware and obtains judgment against A, an still sue P

d.i.2.a.ii. If aware and obtains judgment against A, cannot sue P

d.i.3. Restatement view (probably majority) R(3d) § 6.09

d.i.3.a. No restrictions are placed on 3d Party in terms of suing A v. P

d.i.3.b. Can obtain judgment against both and seek satisfaction against both until fully recovers

d.ii. Unauthorized transactions

d.ii.1. Still liable if w/in scope of agency and 3d party could have reasonably believed

e. Unintentionally undisclosed P

e.i. Business owners fail to disclose to 3d parties that business is incorporated (or LLC)

e.ii. Could occur where a sole proprietorship has done business for many years but later incorporates (or converts to a LLC), failing to disclose changed status

f. Ways to put 3d parties on notice of agency relation:

21 f.i. Specific notice via ltr

f.ii. Business ltrhead

f.iii. K-ual docs

f.iv. Representative signatures

f.v. POs, invoices

f.vi. Business cards

f.vii. Business checks/CCs (avoid paying bills w/ personal checks)

f.viii. Website

f.ix. Faxed copies of docs, other materials

f.x. Emails

f.xi. Promotional materials

f.xii. Yellow pages

f.xiii. Meetings

f.xiv. Orally

VI. A’s Liability to 3d Parties

a. Authorized Transactions

a.i. Disclosed P: A of disclosed P will not be held liable unless there is clear and explicit evidence of A’s intention to substitute or superadd his own personal liability

a.i.1. Exceptions:

a.i.1.a. Express assumption

a.i.1.b. Implied promise

a.i.1.c. Custom, profession

Copp v. Breskin (WA 1989) - Breksin & Robbins, a law firm, hired an expert witness - B&R informed Copp that client would pay his fees - Client pd some but not all, B&R informed Copp that client was willing to only pay 30% of the fees billed by Copp - B&R commenced litigation o/b/o Copp to get expenses - Issue: is the law firm liable even though it disclosed the P? - Holding: when a litigation service provider Ks w/ an att’y based on the att’ys credit, and the attorney is ware or should be aware of this, it should not matter that the client’s ID is known. The SP reasonably expects that the att’y will be responsible, as surety or guarantor of the client’s performance o Owe an express disclaimer of responsibility if att’y intends not to be bound by a K for litigation services Unincorporated Business Organizations-Wyrsch-Spring 2012 23 o The primary responsibility of making it clear that the att’y acts in an agency capacity w/ no personal liability rests upon the att’y o Custom is for expert to look to att’y to be pd

a.ii. Undisclosed P: A is liable when P is undisclosed when party to a K

Jensen v. Alaska Valuation Service (Alaska 1984) - 1970-1979: AVS conducted appraisals for Jensen - Pre-1972: Sole proprietorship business: “Jensen Builders” o AVS’ Acct record has “Art Jensen, Jensen Builders” - 1972: “Arthur Jensen, Inc.” is incorporated housing construction business Jensen is President & owned 50% of stock AVS not specifically notified of status change But 4 corporate checks used before July 1979 - July 1979: Jensen ordered 5 appraisals by phone - Late 1979: AVS informed of corporate status - 1980: Corporate insolvent - 1982: AVS filed suit against Jensen personally to recover for $831 unpaid - Jensen says AVS notified of corporate status b/c: o Corporates checks used pre-July 1979 o Corporate signs on property o K-or plans submitted to AVS ID-ing corp’n - Issue: is Jensen personally liable b/c he failed to notify AVS of his corporate status? - Holding: AVS accepted appraisals before seeing plans or receiving checks, an A is liable for a K entered unless P is disclosed at time K is formed o A has burden of proving that agency relationship and ID of P disclosed o Std is that 3d party knew, should have known, had reason to know, or was given notification

a.iii. Partially disclosed P

a.iii.1. When an A acting w/ actual or apparent authority makes a K o/b/o an unidentified P:

a.iii.1.a. (1) the P and 3d party are parties to the K and

a.iii.1.b. (2) the A is a party to the K unless the A and 3d party agree otherwise

b. Unauthorized Transactions

b.i. Disclosed P: implied warranty concept

Husky Industries v. Craig Industries (Missouri 1981) - Craig in business of manufacturing coal w/ two plants, incorporated under one name - Craig k-d w/ Kingsford Co. to seel 1500 tons of coal/month for 2 years, which was more than output of both plants - Craig called to see if Gideon would be interested in buying Mountain View plant - Craig signed sales offer o/b/o corporation as “Craig, Pres.” - Craig then rejected formal offer to buy as Bd (consisting of Craig’s family) rejected it - Issue: did Craig, as A, have authority and should be held liable for sale? - Holding: when purporting to act as A for a P, reasonable to assume that A has power to bind P, and if it is found otherwise, an A who makes such an assertion should be personally liable for consequences

23 o Unless agmt expressly binds an A personally, who discloses a P, the liability of the A is not predicated upon the K itself but rather upon the A’s breach of the express or implied covenant of warranty of authority

b.i.1. Limitations:

b.i.1.a. Express disclaimer

b.i.1.b. Later approval needed

b.i.1.c. A’s authority uncertain (duty to inquire?)

b.i.1.d. 3d Party knowledge

b.ii. Undisclosed P: A party of K

b.ii.1. But can still sue P

c. Nonexistent P

c.i. Defectively organized corp’n or LLC

c.ii. Preincorporation transactions

c.iii. Unincorporated nonprofit ass’n

d. The manner in which an A signs a K (promissory note) may affect his/her liability:

d.i. *usually arises in the case of small corp’n or LLC

d.ii. Basic Rules:

d.ii.1. If clearly signs as A, no liability Mary Jones, as Agent for Smith

d.ii.2. If clearly does not sign as A, liable Mary Jones

d.ii.2.a. No parol evidence can be introduced to show otherwise

d.ii.3. If unclear, ambiguous, need to determine parties’ intent Mary Jones, Agent or Mary Jones, President

d.ii.3.a. Parol evidence admissible to show parties’ understanding

d.ii.3.b. Should avoid this as it may trigger the doctrine of description personae, meaning that it merely characterizes the description of the person rather than the person’s intention to be bound

VII. P’s Ratification of A’s Actions

a. P’s Conduct

a.i. Express

a.ii. Implied

b. P’s Knowledge

b.i. Actual Unincorporated Business Organizations-Wyrsch-Spring 2012 25 b.ii. Imputed

VIII. Termination of A’s Authority or Relationship

a. By Acts of Parties

b. By Acts of Law

UNINCORPORATED BUSINESS ORGANIZATIONS

I. Major Forms and Comparison

a. Possible Situations and Approaches:

a.i. Set Up New Business

a.ii. Purchase Existing Business

a.iii. Join Existing Business

a.iv. Obtain Franchise

a.v. Major Pts

a.v.1. State statutes allow major “customizing” (via default provisions) in all business org’l forms for most of above features EXCEPT taxation & liability

a.v.2. Most features are considered “washouts” in deciding which type of business form to select

b. Financing

b.i. Outside (Creditors) – Debt Financing

b.ii. Inside (Investors) – Equity Financing

c. Operation

c.i. External (3d Party Relations):

c.i.1. K Liability (Scope of authority)

c.i.2. Tort liability (SOE)

c.ii. Internal (Owner-Mgmt-E’ee Relations)

c.ii.1. Rights

c.ii.1.a. Compensation

c.ii.1.b. Profits/losses

c.ii.1.c. Transfer of ownership

c.ii.1.d. Mgmt (decision-making authority)

c.ii.1.e. Other ownership rights (records-information) 25 c.ii.2. Duties

c.ii.2.a. To perform (reasonable care)

c.ii.2.b. Loyalty (act in best interests)

c.ii.2.c. Disclose (important info)

d. Termination

d.i. By acts of parties

d.ii. By operation of law

II. Drafting Agmts

a. Major Parts:

a.i. Description, purpose, term of business

a.ii. Capital contributions (money or property)

a.iii. Returns to owners (salary, sharing of profits, other distributions)

a.iv. Acct’g (responsibility, methods, types of records and access to)

a.v. Mgmt (equal voice or delegation, approval of actions)

a.vi. Restrictions/limitations of actions

a.vii. Settling of disputes (majority, unanimous, or other means)

a.viii. Death, disability, removal, bankruptcy, or withdrawal of owner

a.ix. Insurance (life, liability, property)

a.x. Admission of new owners (majority or unanimous approval)

a.xi. Termination of business (situations triggering, procedure, distribution)

a.xii. Valuation of business, ownership interest (method of calculation)

b. Possible implications of one’s ownership interest: not protected by certain e’ee protections

c. Main laws protecting “employees” (fed & state):

c.i. Unemployment compensation (salary)

c.ii. Workman’s compensation (injury)

c.iii. Anti-discrimination (race, color, religion, sex)

c.iv. Age discrimination

c.v. Minimum wage

c.vi. Mgmt.-labor relations Unincorporated Business Organizations-Wyrsch-Spring 2012 27 c.vii. Employee safety (OSHA)

c.viii. Disabilities

c.ix. Veterans (rehiring)

c.x. Family and medical leave

c.xi. Retirement benefits (ERISA)

GENERAL PARTNERSHIPS

I. Nature and Creation RUPA Articles 1 & 2

a. Creation (Express v. Implied Creation)

a.i. UPA § 6(1): partnership

a.i.1. Association

a.i.1.a. Voluntary agmt, express or implied

a.i.2. Persons

a.i.2.a. Can be a corp’n

a.i.2.b. Just need capacity to K

a.i.3. To carry on as co-owners of a business

a.i.3.a. Ownership = power to ultimate control

a.i.4. For profit

a.ii. Manner: no magic moment but when person consent to carry-on as co-owners a business for profit

a.ii.1. Agmt v. No agmt

a.ii.2. Marriage and partnership have common elements, must show evidence that spouses held themselves out as partners

a.iii. When raised:

a.iii.1. 3d Party

a.iii.2. Gov’t (IRS)

a.iii.3. Parties

a.iv. Major Factors: (no one is a controlling factor)

a.iv.1. Sharing of profits (general v. net) + losses

a.iv.1.a. Sharing of profits(losses) is substantial evidence of partner status b/c individual has assumed owners’ risk of operating the business 27 a.iv.1.b. Non-equity partner: are not required to make a capital contribution to partnership nor own an equity interest in partnership

a.iv.2. Participation in substantive mgmt., decision-making

a.iv.3. Right & duty to act as an agent-partner in a partnership business (TPs)

a.iv.4. Fiduciary relation w/ other partners

a.iv.5. Unlimited liability for partnership debts/losses

a.iv.6. Made true capital contribution to partnership

a.iv.7. Comparable ownership interest in partnership

a.iv.8. Co-owner of partnership property

a.iv.9. Right to examine partnership books + records

Lupien v. Malsbenden (ME 1984) - entered into K w / Craigin for construction of a Bradley automobile - checked on status of car once or twice a week, dealing w/ Malsbenden as C was seldom present - M told to sign over ownership of his pickup truck to pay for balance for Bradley vehicle - never rec’d the Bradley he had k-d to purchase - M asserted that his interest in Bradley operation was solely as a banker, who loaned $ (w/o interest) - C had disappeared and M had physical control of Motor Mart - Issue: were M and C partners? - Holding: whatever the intent of these two means as to their irrespective involvements in the business, joint control over the business and intent to share the fruits of the enterprise amounted to a partnership

b. Nature b.i. Aggregate theory- collection of individuals

b.i.1. Partners own in common the partnership property and they are all joint principals in partnership transactions

b.ii. Entity theory- partnership has separate legal existence

b.ii.1. RUPA § 201

b.iii. Importance:

b.iii.1. Creditor’s rights

b.iii.2. Individual’s status w/in partnership

b.iii.3. State/federal regulation

b.iv. Today- trend towards entity approach although traits of both still exist b/c entity approach facilitates business transactions

b.iv.1. Examples:

b.iv.1.a. Taxation Unincorporated Business Organizations-Wyrsch-Spring 2012 29 b.iv.1.a.i. IRC § 701: each partner taxed directly on share of partnership income and losses (aggregate theory)

b.iv.1.a.ii. But entity files its own tax return for informational purposes under § 6031

b.iv.1.b. Liability

b.iv.1.c. Dissolution

b.iv.1.d. Enforce Ks

b.iv.1.e. Title of property

b.iv.1.f. Filing lawsuits

b.v. Creditor’s rights? (partnership + individual)

c. Applicable Acts

c.i. Uniform Partnership Act

c.ii. Revised Uniform Partnership Act

II. Financial Structure & Partners’ Contributions

a. Financial Structure

a.i. Partnership Acct’g

a.i.1. Income stmt: sets forth revenues and expenses during an acct’g period

a.i.2. Balance sheet: stmt of assets, liabilities and owners’ equities

a.i.3. Capital acct: shows equity of each partner

b. Contributions

b.i. UPA & RUPA contain no restrictions, limitations or requirements on the nature & amount of partners’ contributions to the partnership fully negotiable

b.ii. Kinds:

b.ii.1. Cash

b.ii.2. Property (real + personal)

b.ii.3. Securities

b.ii.4. Services (present + future)

b.ii.5. Promissory notes

b.ii.6. Ks (“rainmaker”)

b.ii.7. Person’s name, reputation

29 b.ii.8. Experience

b.ii.9. Expertise

b.ii.10. Anything else considered of value to the partnership

III. Partners’ Property Rights

a. Individual v. Partnership Property [UPA § 8; RUPA § 203, 204]

a.i. Key: Intention of Partners – Partners are free to determine

a.ii. Partners’ Property rights: partnership

a.ii.1. To specific partnership property

a.ii.2. Interest in the partnership

a.iii. Partnership creditors’ rights

a.iii.1. Partnership property

a.iii.2. Individual partners’ property

a.iv. Individual partners’ creditors’ rights

a.iv.1. Partnership property

a.iv.2. Individual partners’ property

a.v. Why is distinction important?

a.v.1. Creditors: individual & partnership

a.v.2. Partners: departing & joining

a.v.3. Partners: distribution – termination & liquidation

a.v.4. Heirs: settlement of partnership affairs & estate

a.v.5. Gov’t: taxation

a.vi. Factors to determine intent:

a.vi.1. Purchase money

a.vi.2. Use/possession

a.vi.3. Record title

a.vi.4. Payment of taxes, improvements, repairs

a.vi.5. Recorded as a partnership asset

a.vi.6. Payment of underlying loan

a.vi.7. Other factors/circumstances Unincorporated Business Organizations-Wyrsch-Spring 2012 31 b. Partners’ Rights re: Partnership Property

b.i. When the intention of the partners to convert individually owned property into firm property is inferred from circumstances, the circumstances must be such as do not admit of any other equally reasonable and satisfactory explanation (UPA)

b.ii. RUPA has two presumptions:

b.ii.1. Property purchased w/ partnership funds is partnership property

b.ii.2. Property acquired in the name of one of more of the partners w/o indication of their status as partners & w/o the use of partnership funds is presumed to be the partners’ separate property, even if used for partnership purposes

c. Partner’s Interest in the Partnership UPA RUPA Specific Partnership Property § 25 Specific Partnership Property § 501 - Co-owners (undivided) - Partnership property owned by partnership - Possessory (partnership purposes) - Not by individual partners - Not assignable - Not co-owners - Not subject to attachment - No interest to transfer Interest in Partnership § 26 Interest in Partnership § 502 - Economic right - Same as UPA - Profits + surplus - Assignable 9§ 502 + 503) - Assignable (§ 27) - Subject to changing order (§ 504) - Subject to changing order (§ 28)

Putnam v. Shoaf (Tenn. 1981) - Mrs. Putnam has 50% interest in cotton gin partnership, Frog Jump - She wants out of partnership & pays $21K to Shoafs to take over her debt o Partnership has $90K debt o Charlestons own other 50% - Shoafs fire old bookkeeper & discover bookkeeper was embezzling

- S recovers $68K, ½ goes to the Cs and Mrs. P wants her share

- Issue: Can a partner recover in a judgment after transferring interest?

- Holding: No, the partnership recovered the $, which is now owned by S, not Mrs. P

o Mrs. P clearly intend to dissolve the partnership by transferring her interest, she transfers everything that partner has—present, future and assets of mutual ignorance

. Conveyed her interest which was her share of the profits and surplus

o Partnership property is owned by the partnership not individual partners

o Default rules:

. Can only sell partnership property w/ unanimous consent

. Can only add partners w/ unanimous consent

31 d. Partnership property rights:

d.i. Rights in specific partnership property

d.ii. Interest in the partnership

d.iii. Right to participate in mgmt

IV. Operation

a. Decision-making & Contractual Powers of Partners

a.i. Transactions/matters covered include:

a.i.1. Ordinary v. extraordinary decisions

a.i.1.a. Sale of a partnership’s only asset is beyond the scope of usual partnership business and thus cannot be effected by a single partner

a.i.2. Amending partnership agmt

a.i.3. Fundamental changes in structure (merger)

a.i.4. Significant changes in line of business/mkt

a.i.5. Allocation of workload/clients/cases

a.i.6. Allocation of profits + compensation + bonuses

a.i.7. Other personnel decisions (hiring-firing-promotions)

a.i.8. Purchasing/selling products, services

a.i.9. Acquisition/selling of facilities or other property

a.i.10. Maintenance of buildings, plants + equipment

a.i.11. Fin’l decisions (loans, investments)

a.i.12. Mkt’g/advertising decisions

a.i.13. Resolving disputes/deadlocks

a.ii. Possibilities

a.ii.1. Single partner

a.ii.2. Group or committee

a.ii.3. Majority of all partners

a.ii.4. Supermajority of all partners (3/4 or 2/3)

a.ii.5. Unanimous approval of all partners

a.iii. Partnership’s Act’s default rules- Mgmt Rights

a.iii.1. In general: [UPA § 18(2); RUPA § 401(f)] Unincorporated Business Organizations-Wyrsch-Spring 2012 33 a.iii.1.a. Subject to agmt of partners

a.iii.1.b. In absence of agmt UPA default rules apply

a.iii.1.c. Total equally among partners, one vote per partner, regardless of contributions /services

a.iii.2. Levels of Decision-making: Partnership provisions Id some specific decisions but otherwise does not define what constitutes fundamental v. ordinary decisions

a.iii.2.a. Level I Decisions [UPA § 18(g), (h); RUPA § 401(i), (j)]

a.iii.2.a.i. Fundamental decisions

a.iii.2.a.i.1. Altering partnership business

a.iii.2.a.i.2. Changing terms of partnership agmt

a.iii.2.a.i.3. Admission of a new partner

a.iii.2.a.ii. Unanimous approval

a.iii.2.b. Level II Decisions [UPA § 18(h); RUPA § 401(j)]

a.iii.2.b.i. Ordinary course of business decisions

a.iii.2.b.i.1. New supplier

a.iii.2.b.i.2. K commitment

a.iii.2.b.i.3. Product pricing

a.iii.2.b.ii. Majority vote

a.iv. Partnership agmt controls

a.iv.1. Key: how to allocate mgmt functions? Need to balance interests of –

a.iv.1.a. Facilitating conduct of business (lower costs)

a.iv.1.b. Risks of partner acting contrary to the interests of other partners (+ liability to 3d parties)

a.v. Actual authority UPA § 18; RUPA § 401

Elle v. Babbitt (Oregon 1971) - 3 Partners of The Pipe Machinery sue for an acct’g from Beall Pipe & Tank from the leasing of two pipe mills by the partnership to Beall - Beall formed the partnership when it decided to switch to the tooling method for creating steel pipes - Beall did not have enough capital to buy a tube mill so partnership would buy it and lease it back to Beall - Beall eventually terminated its lease offering to buy both mills from the partnership, which was refused by some of the partners

33 - Lowered royalties for Cascade job to be competitive, but royalties lowered by partners who were accused of acting for Beall and there was no meeting of all the partners about cut in royalty - Issue: was this allowed by the partnership? - Holding: it is clear that the mgmt of the partnership had been handled by mgmt-level employees and officers of Beall over the years and none of the partners ever objected to conducting the partnership this way. Decision to cut royalties was part of this exercise of mgmt, and those partners had the authority to make that decision and bind the partnership.

Summers v. Dooley (Idaho 1971) - S & D form partnership in trash collection business - Agmt allows them to hire someone to replace them when they can’t work - S hires a 3d employee despite D’s objections - S pays for 3d employee at own expense & argues D owes him $ b/c D benefited from the profits - Issue: Is D liable for expenses arising out of S’s choice despite objections? - Holding: there was no majority vote, each partner has equal rights contrary a differ agmt, so no partner is responsible for expenses incurred w/o the majority’s approval o D did not ratify S’s decision—manifestly unjust to hold D responsible for expense from S’s sole decision

o Not in ordinary course of business to have a 3d person

a.vi. Apparent authority

a.vi.1. Partner binds the partnership when his act is in the usual way (UPA) or in the ordinary course of business of the kind carried on by the partnership (RUPA)

RNR Investments Limited Partnership v. Peoples First Community Bank (FL 2002) - RNR’s affirmative defense that Bank was negligent in lending $960K to RNR w/o consent of the LPs when RNR’s GP was ltd to obtaining financing up to $650K in their partnership agmt - RNR defaulted of the note and mortgage for construction of a house for resale - RNR LPs did not know about total loan until 2 years after loan secured - No evidence to show that partnership agmt was ever given to Bank - Issue: Did the Bank have actual knowledge or notice of GP’s restricted authority or did RNR rely upon GP’s apparent authority to bind RNR? - Holding: each partner is an A of the partnership for the purpose of its business, an act of a partner in ordinary course of business binds the partnership unless partner has no authority to act for the partnership AND the person whom partner was dealing with know or had received notification of the partner’s lack of authority o Absent actual knowledge, 3d parties have no duty to inspect the partnership agmt or inquire otherwise to ascertain the extent of a partner’s actual authority

a.vi.2. Partners’ Vicarious Liability: Agency law- SOE

a.vi.2.a. Joint and Several Liability

a.vi.2.b. UPA § 13 – differ terms than RUPA

a.vi.2.c. RUPA § 305. Partnership Liable for Partner’s Actionable Conduct

a.vi.2.c.i. (a) A partnership is liable for loss or injury cx-d to a person, as a result of a wrongful act or omission ,or other actionable Unincorporated Business Organizations-Wyrsch-Spring 2012 35 conduct, of a partner acting in the ordinary course of business of the partnership or w/ authority of the partnership

a.vi.2.c.ii. (b) If, in the course of the partnership’s business or while acting w/ authority of the partnership, a partner receives or causes the partnership to receive money or property of a person not a partner, and the money or property is misapplied by a partner, the partnership is liable for the loss

a.vi.2.d. LLC Act § 302 contains similar terms

a.vi.3. Partners’ K Liability- Agency law- Scope of Authority

a.vi.3.a. Joint Liability (under UPA; RUPA is joint and several)

a.vi.3.b. RUPA § 303: Stmt of Authority – provides a partnership the option of filing a stmt of authority concerning transfers of real property held in the name of partnership and other transactions

a.vi.3.c. UPA § 9 usual kind

a.vi.3.d. RUPA § 306 – ordinary course of business

a.vi.3.d.i. Nature of business

a.vi.3.d.i.1. Must be doing something in furtherance of purpose for which relationship was created

a.vi.3.d.ii. Type of transaction

a.vi.3.e. LLC Act § 301 contains similar terms

a.vi.4. Professional Ass’n

a.vi.4.a. In the context of a law practice, more closely resembles the conduct of a partnership than that of a corp’n

b. Tort Liability and the Fraudulent Partner (fraud is part tort and part K)

b.i. SOE v. Scope of Authority (narrow v. broad application)

b.i.1. Prevailing view that the partnership is liable for punitive damages assessed against a partner for her wrongful or actionable conduct

b.ii. Motive (person v. business)

b.iii. Foreseeability

b.iv. Apparent authority

b.v. Position to deceive

b.vi. Indicia authority

b.vii. Basic fairness

35 b.viii. Estoppel

b.ix. Direct responsibility

b.ix.1. Principal’s knowledge, implicated

b.ix.2. Negligent hiring, oversight

c. Lawsuits by and against partnerships & partners

c.i. Partner’s liability RUPA § 306: except as otherwise provided, all partners are liable jointly and severally for all obligations of the partnership unless otherwise agreed by the claimant or provided by law

c.i.1. Therefore partners are subject to liability for all tort & K claims against the partnerships but:

c.i.1.a. The partnership may have sufficient assets or insurance to coverthe claims and

c.i.1.b. RUPA § 307 requires 3d persons to follow certain steps to hold partners liable -- judgment against the partner plus exhaustion of partnership assets

c.ii. Suits by & against the partnership (3d parties)

c.ii.1. Joint debtors: proceed against fewer than all the debtors if all the debtors are named as s, w/ the judgment enforceable against the jt property of all and the separate property of the debtors actually served w/ process

c.ii.2. Suits to enforce partnership rights must be brought in the name of all partners, unless provided otherwise by statute

Adams v. Land Services, Inc. (CO 2008) - Brighton Farms’ LLP status was revoked years earlier and is a GP - BF hired LSI to manage and find a purchaser for its Adams Cty property - LSI had a broker’s commission of 40% in order to increase the value of the property - Plot of land sold, proceeds distributed, partnership dissolved - Minority partners who disapproved of sale sued LSI and Barnes Family who bought land saying failed to perform the services that entitled LSI to the compensation he rec’d - Issue: Can GPs sue o/b/o Brighton Farms? Do they have standing? - Holding: partners cannot bring a derivative action o/b/o the partnership property (like SHs in a corp’n can); cannot sue to enforce a partnership claim unless majority of partners agree to do so - There is precedent out there that a minority partner would be able to bring a derivative action—but only in exceptional circumstances where partnership declined to sue on a valid, valuable, partnership COA

d. Partners v. Partners

d.i. Partners’ rights – subject to agmt (expressed/implied) by the partners: UPA & RUPA contain very similar rules

d.i.1. To participate in mgmt. (see above)

d.i.2. To share in profits/distributions (EQUALLY – UPA § 18(a) & RUPA § 401(b)) v. Compensation (Not equally – UPA § 18(f) & RUPA § 401(h)) Unincorporated Business Organizations-Wyrsch-Spring 2012 37 d.i.2.a. Share in profits equally w/o regard to contributions

d.i.2.b. Not entitled to separate compensation over and above other partners

d.i.3. To a formal acct/information (UPA § 22 & RUPA § 403(c))

d.i.3.a. Whenever circumstances “render it just and reasonable”

d.i.3.b. Two parts:

d.i.3.b.i. (1) acct’g is required

d.i.3.b.ii. (2) sum certain is determined to be due to the

d.i.4. To access records (UPA § 19 & RUPA § 403(b))

d.i.5. To reimburse/indemnify (UPA § 18(b) & RUPA § 401

d.i.6. To transfer ownership interests

d.i.6.a. RULE: unless partnership agmt otherwise provides –

d.i.6.a.i. Partners cannot transfer ownership (mgmt.) position

d.i.6.a.i.1. Requires unanimous consent of partners

d.i.6.a.ii. But partners can assign economic ownership (fin’l interest) in the partnership w/o other partners’ approval (UPA § 27 & RUPA § 503)

d.i.6.b. Partnership agmt CAN ALTER –

d.i.6.b.i. Can allow transfer of ownership (mgmt.) position OR

d.i.6.b.ii. Can restrict transfer of economic ownership

d.i.6.c. Common types of restrictions:

d.i.6.c.i. Right of first refusal (price as per 3d party offer)

d.i.6.c.ii. First option to purchase (price set by partnership)

d.i.6.c.iii. Partners’ consent or approval (e.g., unanimous, majority)

d.i.6.c.iv. Buy-sell requirement (mandatory)

d.i.6.c.v. Other restrictions (e.g., w/in specific profession, area)

d.i.7. To participate in winding up process (if termination) (UPA § 37 & § RUPA 803)

d.i.8. To maintain an action against partnership and/or partners (RUPA § 405)

d.ii. Partners’ duties (to partnership + partners)

37 d.ii.1. Subject to partnership agmt, but RUPA places limitation d.ii.2. In absence of agmt: UPA/RUPA statutory provisions apply AND traditional common law concepts apply d.ii.3. Queries:

d.ii.3.a. When do partners’ fiduciary duties begin/end?

d.ii.3.b. To what extent can a part act in own interests?

d.ii.3.c. To what extent can the partners vary traditional duties? d.ii.4. Loyalty – Act w/in best interests [UPA § 21 (marginal); RUPA § 404(b) & 103]

d.ii.4.a. Businesses having potential conflicts of interest:

d.ii.4.a.i. Oil & gas

d.ii.4.a.ii. Real estate (residential & commercial)

d.ii.4.a.iii. Professional sports

d.ii.4.a.iv. Car & boating dealerships

d.ii.4.a.v. Shopping malls

d.ii.4.a.vi. Golf courses

d.ii.4.a.vii. Clothing, retail stores

d.ii.4.a.viii. Restaurants

d.ii.4.a.ix. Telecommunications

d.ii.4.a.x. Hotels & vacation resorts

d.ii.4.a.xi. Investment advisors

d.ii.4.a.xii. Professional consulting (taxing, acct’g, law) d.ii.5. Care – exercise reasonable care [RUPA § 404(c) & 103] d.ii.6. Disclose [UPA § 20 & RUPA § 403] d.ii.7. *Good Faith and Fair Dealing* (id-d as an obligation) [RUPA § 404(d)]

d.ii.7.a. Terms are not found in UPA but appears in RUPA, not as a partner’s separate duty but instead an obligation – applies to partners’ exercising his/her powers & rights w/in partnership & w/ other partners

d.ii.7.b. Not specifically defined in RUPA b/c really not susceptible to precise meaning – boundaries of terms are amorphous, vague and indefinite – therefore, left for case-by-case development by the cts Unincorporated Business Organizations-Wyrsch-Spring 2012 39 d.ii.7.c. Similar problems exist in the corp arena when determining extent of fiduciary duties of officers, directors, & majority SHs

d.ii.7.d. Generally:

d.ii.7.d.i. Good Faith = partners’ subjective intentions as to particular actions/decisions – honesty-in-fact, sincere, genuine, bona fide

d.ii.7.d.ii. Fair Dealing:

d.ii.7.d.ii.1. Process: How partner carried out action – fairly, properly, above board, full disclosure

d.ii.7.d.ii.2. Substance: overall fairness to partnership or other partner(s) – secret benefits, profits

d.iii. Suits by & against the partnership

e. Creditor’s Claims: individual v. partnership’s creditors (RUPA Art. 5)

e.i. Individual

e.i.1. UPA

e.i.1.a. Partner’s individual property, not partnership property

e.i.1.b. But can seek assignment of partnership interest (§ 27) or charging order (§ 28)

e.i.2. RUPA

e.i.2.a. Partner’s individual property, but not partnership property which is insulated because the partners are not owners (§ 501)

e.i.2.b. But can seek assignment of partnership interest (§ 502 & 503) and charging order (§ 504)

e.ii. Partnership creditors

e.ii.1. UPA - § 40(h)+(i): double priorities rule

e.ii.1.a. Partner’s individual property for majority (§ 15), but minority say partnership property first

e.ii.1.b. No specific provision, but partnership property can be used

e.ii.2. RUPA – pro rata sharing b/w assets of partner’s estates wrt individual creditors

e.ii.2.a. Partnership Property first, then property of individual partners (§ 307)

Bauer v. Blomfield Co./Holden Joint Venture (Alaska 1993) - Bauer, assignee of a partnership interest, sued saying partnership interests wrongfully withheld from him - B loaned $800K to the Holdens who assigned their rights in the partnership Blomfield/Holden 39 - Defaulted, soon after, stopped making payments as assigned from the partnership - B not entitled to interfere in mgmt of administration of partnership business affairs, so could not stop the $877K commission paid to partner, Blomfield - Only entitled to profits & surplus that Holdens would have been entitled to - Issue: did the commission violate the assignment? - Holding: No b/c the commission was agrd to by all partners and the Holdens would have not been entitled to receive it - Dissent: thinks ct needs to address first whether depleting profits through commission was done in good faith

V. Dissociation/Dissolution and Termination a. Dissociation (Partner) and Dissolution (Partnership)

a.i. Dissolution occurs anytime a change in relation of partners—applied to both continuation & termination of business – partnership continues until “winding-up” process ends

a.ii. Causes of Dissolution(UPA § 31 + 32)

a.ii.1. § 31: Specified Events (Proper grounds, i.e., w/o violating agmt of partners)

a.ii.1.a. Termination of definite term or particular undertaking

a.ii.1.b. Express will of any partner

a.ii.1.b.i. Power to dissolve, even if don’t have the right to dissolve at any time

Page v. Page (CA 1961) - Two brothers, π (HB) and Δ (George) partner in linen services - Brothers has done other business together in past - HB owns entity that extended loan to partnership - Interested transaction okay so long as all partners know - HB wants declaratory judgment that partnership terminable at will - Judicial dissolution only in extreme cases - Business is picking up not extreme circumstance - G says there is a term based on profitability - But business is profiting right now - Issue: Can HB dissolve partnership at will? - Holding: G failed to prove any facts to imply term to continue partnership & can dissolve absent bad faith or breach of fiduciary duty w/ express notice to partner o Can be dissolved by express will of any partner if partnership agmt specifies no definite term or particular undertaking o Wrongful if trying to take profits for himself & freeze brother out o Hope that partnership will be profitable, not enough to make a partnership for term

a.ii.1.c. Express will of all partners (mutual agmt)

a.ii.1.d. Expulsion of any partner bona fide IAW partnership agmt

a.ii.1.e. Any event making partnership business illegal

a.ii.1.f. Death of any partner Unincorporated Business Organizations-Wyrsch-Spring 2012 41 a.ii.1.f.i. Partner is required to buy the estate’s interest

a.ii.1.g. Bankruptcy of any partner

a.ii.1.h. Court decree under § 32

a.ii.2. § 32: Court Decree

a.ii.2.a. Partnership declared a lunatic by a court or of unsound mind

a.ii.2.b. Partner incapable of performing his role in partnership

a.ii.2.c. Partner guilty of such conduct as to prejudicially affect carrying on business

a.ii.2.d. Partner willfully of persistently commits breach of partnership business so that not reasonably practical to carrying on business

a.ii.2.e. Partnership business can only be carried on at a loss

a.ii.2.f. Other circumstances render a dissolution equitable

a.iii. RUPA continues 2 concepts:

a.iii.1. It continues the UPA rule that any member of an at-will partnership has the right to force a liquidation

a.iii.2. By negative implication, it continues the rule that the partners who wish to continue the business of a term partnership cannot be forced to liquidate the business by a partner who withdraws prematurely in violation of the partnership agmt

a.iv. Effect

a.iv.1. Operational

a.iv.2. Liability

a.iv.3. Valuation

b. Continuation of Business – Consequences:

b.i. Partner v. Partners

b.i.1. Need for continuation clause

b.i.2. “Winding-up” partner’s interests

b.i.3. Partner’s role and rights in process

b.i.4. Valuation of partner’s interest (incoming/outgoing)

Seattle First National Bank v. Marshall (WA 1982) Buy-sell agmts - Purpose of partnership was to acquire land and lease it for billboard advertising- Roy Marshall, Burt Marshall & Olsen - Roy died, agmt amended to give Burt 80% of partnership and Olsen 20%

41 - Then Olsen died, buy-sell provision in agmt saying surviving partner can buy out deceased partner - Partnership agmt provided for the determination of the reasonable mkt value of a deceased partner’s share, but agmt did not mention discounts for sales costs and minority interest - To compute reasonable mkt value of the partnership interest, the partnership assets must be valued to determine the net worth of the partnership - Issue: was the partnership meant to be valued w/o usual discounts for sales costs, minority interests & capital gain taxes? - Holding: not unreasonable to interpret agmt as indicated, w/o discounts o When planning buy-sell provisions—dual role: as continuing partner want a conservative valuation of partnership; as retired or decease partner, want a liberal valuation o In determining net worth of the partnership, the entire inventory of land tather than merely partnership interest is to be priced at current mkt value

b.i.5. Business valuation methods – partner is entitled to Fair Value of partnership (absent agmt)

b.i.5.a. Situations needed:

b.i.5.a.i. Purchasing a business

b.i.5.a.ii. Investing in a business

b.i.5.a.iii. Deciding ownership interests (incoming/departing)

b.i.5.b. Methods:

b.i.5.b.i. Liquidation (salvage)

b.i.5.b.ii. Book value (equity: assets – liabilities)

b.i.5.b.ii.1. Net worth

b.i.5.b.iii. FMV (criteria stipulated)

b.i.5.b.iv. Appraised Value (independent opinion)

b.i.5.b.v. Mutual agmt (periodic v. time of event)

b.i.5.b.vi. Capitalized earnings (past/future earnings)

b.i.5.b.vi.1. Cash flow

b.i.5.b.vi.2. Amount set by estimated avg. earnings for set period of time + partner’s % share of those earnings

b.i.5.b.vi.3. Earning power of the business

b.i.6. Partner’s authority

b.i.7. Partners’ rights and fiduciary duties

b.i.8. Application of uniform partnership acts

b.ii. 3d Parties v. Partnership/Partner - *Partners cannot unilaterally alter 3d Party rights

b.ii.1. Continuing Ks and business (unfinished business) Unincorporated Business Organizations-Wyrsch-Spring 2012 43 b.ii.2. “old” debts/claims & “new” debts/claims

b.ii.3. Partnership’s liability: lingering apparent authority

b.ii.3.a. Actual authority

b.ii.3.a.i. UPA § 33: DISSOLUTION (both continuation and/or termination scenario) – terminates all authority of partner(s), except as necessary to wind up partnership affairs or complete transactions

b.ii.3.a.ii. RUPA

b.ii.3.a.ii.1. § 603 DISSOCIATION – terminates partner’s right to participate in mgmt. and conduct of partnership business no actual authority