Insurance Requirements for Ministry Contracts Natural Resource Sector

Contract/Project Name: Contract or File No:

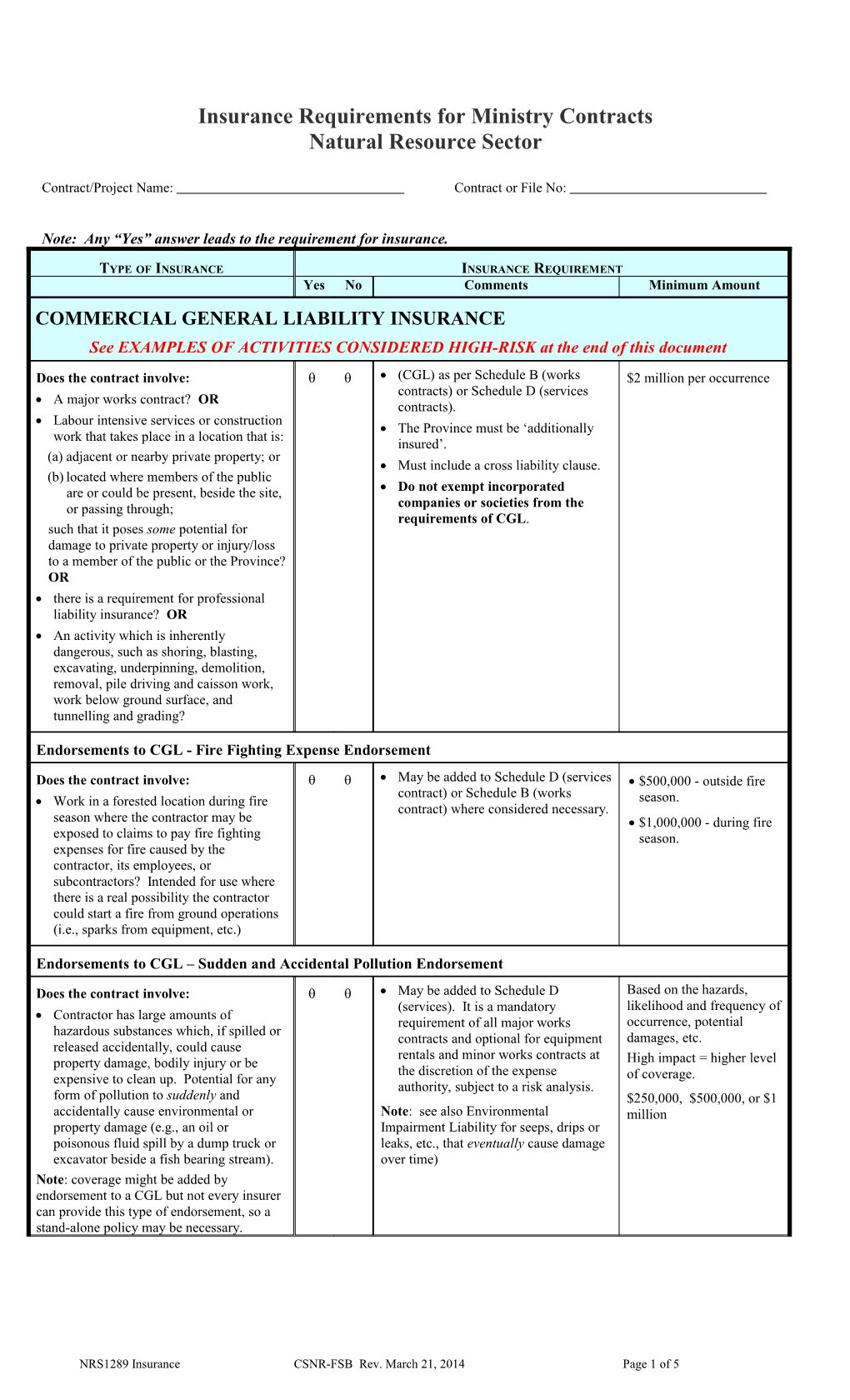

Note: Any “Yes” answer leads to the requirement for insurance.

TYPE OF INSURANCE INSURANCE REQUIREMENT Yes No Comments Minimum Amount COMMERCIAL GENERAL LIABILITY INSURANCE See EXAMPLES OF ACTIVITIES CONSIDERED HIGH-RISK at the end of this document

Does the contract involve: (CGL) as per Schedule B (works $2 million per occurrence contracts) or Schedule D (services A major works contract? OR contracts). Labour intensive services or construction The Province must be ‘additionally work that takes place in a location that is: insured’. (a) adjacent or nearby private property; or Must include a cross liability clause. (b) located where members of the public are or could be present, beside the site, Do not exempt incorporated or passing through; companies or societies from the requirements of CGL. such that it poses some potential for damage to private property or injury/loss to a member of the public or the Province? OR there is a requirement for professional liability insurance? OR An activity which is inherently dangerous, such as shoring, blasting, excavating, underpinning, demolition, removal, pile driving and caisson work, work below ground surface, and tunnelling and grading?

Endorsements to CGL - Fire Fighting Expense Endorsement

Does the contract involve: May be added to Schedule D (services $500,000 - outside fire contract) or Schedule B (works Work in a forested location during fire season. contract) where considered necessary. season where the contractor may be $1,000,000 - during fire exposed to claims to pay fire fighting season. expenses for fire caused by the contractor, its employees, or subcontractors? Intended for use where there is a real possibility the contractor could start a fire from ground operations (i.e., sparks from equipment, etc.)

Endorsements to CGL – Sudden and Accidental Pollution Endorsement

Does the contract involve: May be added to Schedule D Based on the hazards, (services). It is a mandatory likelihood and frequency of Contractor has large amounts of requirement of all major works occurrence, potential hazardous substances which, if spilled or contracts and optional for equipment damages, etc. released accidentally, could cause rentals and minor works contracts at property damage, bodily injury or be High impact = higher level the discretion of the expense expensive to clean up. Potential for any of coverage. authority, subject to a risk analysis. form of pollution to suddenly and $250,000, $500,000, or $1 accidentally cause environmental or Note: see also Environmental million property damage (e.g., an oil or Impairment Liability for seeps, drips or poisonous fluid spill by a dump truck or leaks, etc., that eventually cause damage excavator beside a fish bearing stream). over time) Note: coverage might be added by endorsement to a CGL but not every insurer can provide this type of endorsement, so a stand-alone policy may be necessary.

NRS1289 Insurance CSNR-FSB Rev. March 21, 2014 Page 1 of 5 TYPE OF INSURANCE INSURANCE REQUIREMENT Yes No Comments Minimum Amount AUTOMOBILE LIABILITY INSURANCE (ICBC),

Does the contract involve: As per Schedule D (services Based on the hazards, likelihood and frequency of The use of one or more vehicles owned, contract) and Schedule B (works contract). occurrence, exposure, operated, or licensed in the name of the potential damages, etc. contractor, which are used extensively in the performance of the work/services by High impact/exposure = the contractor while on Crown Provincial higher level of coverage. forest land or ministry property For example, fuel tanker (excluding driving to/from the work site trucks. and not using the vehicle any further) $2 to $3 million per (e.g., recreation site maintenance)? occurrence and up to $5 million for higher hazard PROFESSIONAL ERRORS AND OMISSIONS LIABILITY INSURANCE

Does the contract involve: As per Schedule D (services The required amounts are contracts). dependent on the type of Services of professionals providing professional services being services that require a degree of used and are laid out in the specialized skills, expertise or knowledge Insert the following special indemnification clause into the FS1-d under Options #1, and who are held to a higher standard of #2, & #3. (Be sure your care than the average person. AND services schedule (typically schedule A) or additional terms schedule hidden text is turned on Could the advice provided, the written ONLY if the work is to be performed and you delete hidden specifications, a prescription, assessment by an engineer, architect, landscape text when finalized.) or appraisal, improper treatment, architect, surveyor, construction and inaccurate advice, inaccurate or project manager, applied science If your ministry uses the inadequate information, typographical or technologist, and geoscientist (NOT recording errors, or the design of a GSA contract form, the structure that is negligent or faulty by for any other professional): FS1-d will provide easy access to copy and paste means of error or omission of the The Contractor and the Province agree the appropriate clause for professional result in significant financial that Section ____ of the Agreement is your use. losses or damages or cause bodily injury deleted and replaced with the following: or property damage to the ministry or a third party? The Contractor hereby agrees to indemnify and save harmless the NOTE: professional liability insurance Province, its successor(s), assign(s) and would not be required if the professional’s authorized representative(s) and each of advice will not be the final recommendation them from and against all losses, claims, and solely relied on without further review damages, actions and causes of action by internal ministry or other 3rd party (collectively referred to as “claims”) that expertise. the Province may sustain, incur, suffer or Professionals include, but not limited to: be put to at any time either before or architects/landscape architects after the expiration or termination of this engineers (structural, mechanical, Agreement, that arise out of errors, electrical, geotechnical, civil, etc.) omissions or negligent acts of the surveyors Contractor or its subcontractor(s), construction and project managers servant(s), agent(s) or employee(s) under applied science technologists this Agreement, excepting always that this indemnity does not apply to the geoscientist extent, if any, to which the Claims are information technology consultants caused by errors, omissions or the management consulting professionals negligent acts of the Province, its other financial assurance services contractor(s), assign(s) and authorized lawyers/law firms representative(s) or any other person. accountants/financial advisors employment agencies advertising agencies/graphic designers forensic and accident investigators forestry/environmental consultants scientists like biologists, geologists, chemists testing/diagnostic laboratories

NRS1289 Insurance CSNR-FSB Rev. March 21, 2014 Page 2 of 5 TYPE OF INSURANCE INSURANCE REQUIREMENT Yes No Comments Minimum Amount AVIATION LIABILITY INSURANCE Does the contract involve: The Province must be ‘additionally The required amounts are insured’. laid out in the FS1-d (if The operation or use of owned or non- Must have cross-liability clause. your ministry uses the GSA owned aircraft necessary for the contract form, the FS1-d performance of the contract (i.e., infrared Note: where the entire aviation portion will provide easy access to scanning , aerial or drift misapplication of of the contract will be sub-contracted to copy and paste the herbicide or fertilizers)? another party by the contractor, the air appropriate clause for your Note: aircraft insurance is not required provider’s own certificate of insurance use). where the aircraft is not used in the may be substituted for our BC Certificate of Insurance for this coverage only. Minimum $50,000 aerial performance of the services under the drift or misapplication. contract (i.e., the contractor has opted to utilize aircraft as a means of transportation to/from the work site). (Incidental use as a means of transportation to and from the worksite does not require this liability insurance.)

WATERCRAFT LIABILITY INSURANCE (also known as marine liability insurance) Does the contract involve: The Province must be ‘additionally $2 million per occurrence insured’. Is the use of a floating vessel or structure for contractors’ own necessary for the performance of the Must have cross-liability clause operations and float homes. contract and an integral part of the Note: in some cases this coverage can $5million per occurrence contractor’s operations (e.g., silviculture be included in a CGL policy (as for ferry services, water contract requiring the barging of determined by the insurance broker). taxi, floating lodges and crew/equipment to the work site)? AND Ask for this policy if you are unsure any towing operations. It would not be possible to perform the about the type of watercraft or whether agreement without it? there would be coverage under the CGL. The certificate of insurance may come back noting that there is no policy but that coverage required is already included in the CGL Note: for marina facilities, boat storage, boat repair etc. please contact a CSNR Procurement Specialist. Endorsements to Watercraft Liability Insurance - Sudden and Accidental Pollution Endorsement

Does the contract involve: Note: if no endorsement available, a Based on the hazards, likelihood and frequency of Will there be higher risks due to separate policy is required and the COI may come back from the insurance occurrence, potential contractor having large amounts of damages, etc. hazardous substances on the vessel broker noting this. which, if spilled or released accidentally High impact = higher level could cause property damage, bodily of coverage. injury or be expensive to clean up? $250,000, $500,000, or $1 million

PROPERTY INSURANCE (ministry assets) Does the contract involve: Coverage for ministry owned assets An amount to cover full Will the province’s property be used by The Province must be “named replacement cost. the contractor? OR insured” Will the province’s property be in the Must include a waiver of subrogation care, custody or control of the contractor in favour of the Province. (e.g., storage facilities)? Note: does not include vehicle out for repair or transportation only (e.g., courier, shipping) of ministry property (see Motor Truck Cargo Insurance)

NRS1289 Insurance CSNR-FSB Rev. March 21, 2014 Page 3 of 5 TYPE OF INSURANCE INSURANCE REQUIREMENT Yes No Comments Minimum Amount ALL-RISK PROPERTY INSURANCE

Option #1 - Does the contract involve: Coverage for services taking place in An amount to cover full Is the contractor performing the work out contractor’s own facilities replacement cost and extra of their own facilities? AND expenses to continue Must include a waiver of subrogation operations. Is the services being provided major or an in favour of the Province. essential service? AND If the contractor’s assets are lost or damaged, will it impair the contractor’s ability to perform the contract? Option #2 - Does the contract involve: Coverage for expensive, special, An amount sufficient to Is the contractor using expensive, special electronic equipment. replace the equipment. equipment to perform key electronic- Must include a waiver of subrogation based services? AND in favour of the Province. If the contractor’s assets are lost or damaged, will it impair the contractor’s ability to perform the contract? BUILDERS ALL-RISK INSURANCE (construction contracts)

Does the contract involve: As per Schedule B (works contract), Standard: full value of the Construction of buildings or other above- where considered necessary contract price; or, for road construction, the full ground structures and the contract value Must have a waiver of subrogation in is > $25,000? value/price of the bridge, favour of the Province. building, culverts, or other Construction of bridges and the contract permanent structure only value is >$100,000? Construction of where these comprise a gravel roads is non-insurable. Where the high proportion of the project includes a high proportion of project, but not its full culverts, guard rails, or other value since there are other above-ground permanent structures, that construction aspects in the portion is insurable. contract that are non-insurable (i.e., excavations, gravel roads, etc.) CONTRACTOR’S CONSTRUCTION EQUIPMENT INSURANCE (construction contracts) Does the contract involve: As per Schedule B (works contract) An amount to cover all Are there heavy construction machinery, and equipment rental agreements equipment used under the equipment, or other assets used by the condition. contract to enable prompt contractor for performance of the repair/ replacement of the contract, that, if lost or damaged, would equipment, at contractor’s result in significant delays in contract discretion, in accordance completion due or costs associated with with contract insurance abandonment of the contract? requirements. MOTOR TRUCK CARGO INSURANCE Does the contract involve: The Province must be ‘named An amount sufficient to Stand-alone contract to supply insured’. cover the maximum value transportation only of ministry owned of the load(s) being machinery or equipment? (e.g., courier, transported per vehicle shipping company, etc.) EMPLOYEE DISHONESTY INSURANCE

Does the contract involve: Must protect the Province by way of Minimum of $5,000 and up Does the service include security or a "third party endorsement" to $100,000 depending on janitorial services, armoured car services, the values at risk and the couriers, debt collectors, any contractor number of contractor’s handling money or who has access to personnel exposed to ministry cash or assets? ministry assets.

NRS1289 Insurance CSNR-FSB Rev. March 21, 2014 Page 4 of 5 TYPE OF INSURANCE INSURANCE REQUIREMENT Yes No Comments Minimum Amount

ENVIRONMENTAL IMPAIRMENT LIABILITY (also known as Pollution Legal Liability, Environmental Site Liability, and Pollution Premises Liability)

Does the contract involve: Contact a ministry Contract This coverage includes Procurement Advisor at Will there be significant risk of removal, transportation and [email protected] discharge, dispersal, release or escape of disposal of contaminants significant quantities of irritants, from the site. contaminants, or pollutants into or upon It does not typically cover land, air, or water and cause harm if for the sole function of accidentally spilled and/or which transporting, warehousing gradually over a slow, lengthy period of and ultimate disposal of time seep to neighboring properties hazardous waste unless building contamination (i.e., release of specifically obtained by a pollutants from a pulp mill into the company in that business. environment over a 20 year period, leaks from fuel tanks at gas stations, etc.)? PERSONAL LIABILITY INSURANCE

Does the contract involve: Coverage is part of Homeowners Minimum amount of $1 Is the contract with a private individual Policy. million. that relates to use of their private Contact a ministry Contract residence for non-commercial purposes Procurement Advisor at on the land or the improvements (e.g., [email protected] private moorage, staging site, etc.)? a

Completed by: Name (print): Signature: Date:

EXAMPLES OF ACTIVITIES CONSIDERED HIGH-RISK Mandatory CGL Requirements Include (but not limited to): all major works contracts all Equipment Rental Agreements all contracts where Professional Liability Insurance is a requirement aerial fertilization3 aerial cone collection2 (other methods1, 3) mechanical site preparation3 vegetation management (Includes aerial2, ground3, mechanical brushing, or livestock3 methods) (physical methods1, 3) forest health - MSMA application3 forest health - fall and burn2 (pheromone bait trap placement, assessment, and eradication1) Optional Requirements for CGL (include but not limited to): juvenile spacing1, 3 pruning1, 3 tree planting1, 3 1 CGL required only if work area adjacent (means bordering or if during fire season, 1 km) to private property or near public facilities or recreational areas (near means potential to encounter users on a regular basis) or if contract term is between April 1 and October 31 or other periods of extreme fire hazard 2 Forest Fire Fighting Liability endorsement to the CGL required throughout the term of the contract 3 Forest Fire Fighting Liability endorsement to the CGL required during fire season (April 1 and October 31st or other extreme fire hazard)

NRS1289 Insurance CSNR-FSB Rev. March 21, 2014 Page 5 of 5