November 12, 2007

Research Associate: Shalu Saraf, M. Fin. Zacks Research Digest Editor: Payal Jalan, M. Fin.

Sr. Ed.: Ian Madsen, CFA; [email protected]; 1-800 767 3771 x9417

www.zackspro.com 111 N. Canal Street, Suite 1101 Chicago, IL, 60606

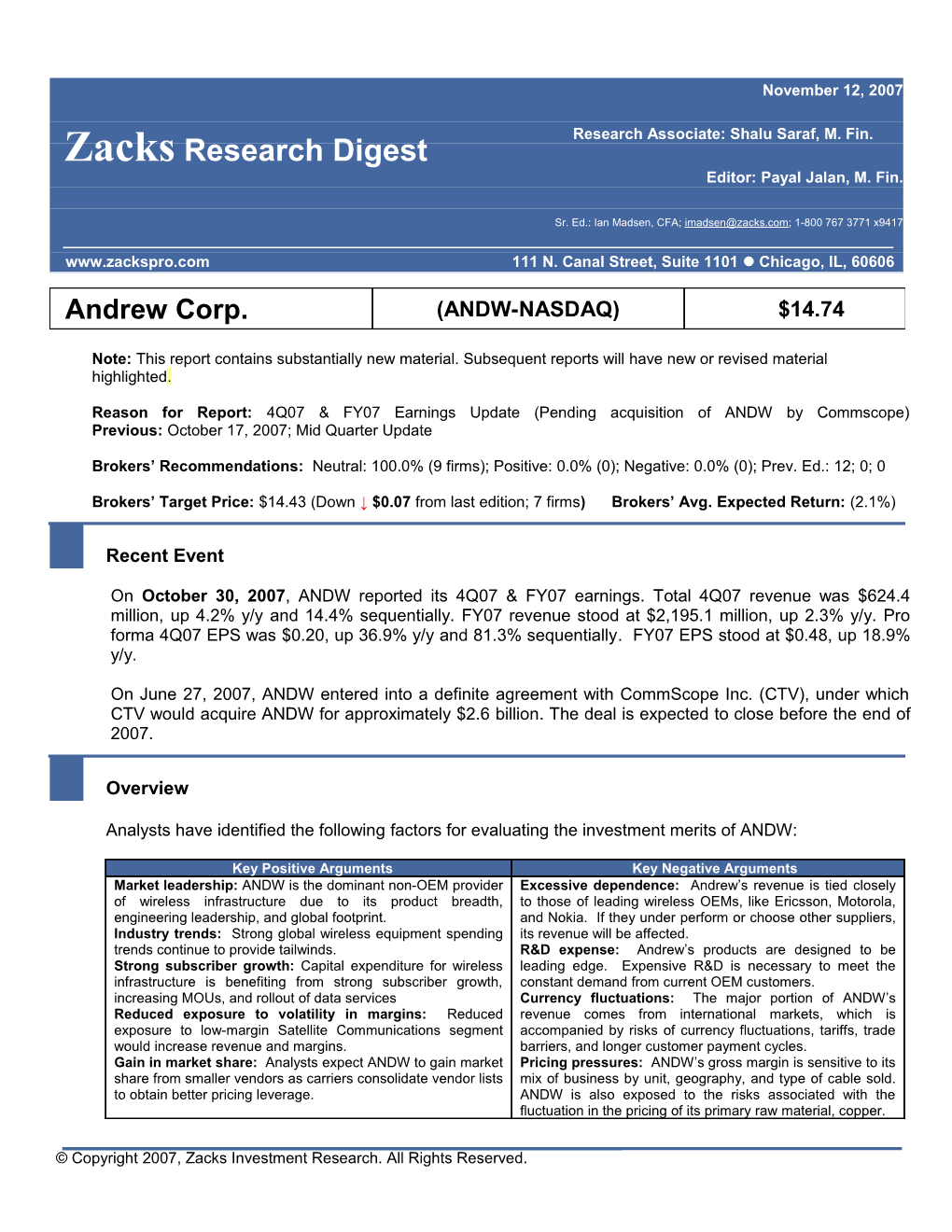

Andrew Corp. (ANDW-NASDAQ) $14.74

Note: This report contains substantially new material. Subsequent reports will have new or revised material highlighted.

Reason for Report: 4Q07 & FY07 Earnings Update (Pending acquisition of ANDW by Commscope) Previous: October 17, 2007; Mid Quarter Update

Brokers’ Recommendations: Neutral: 100.0% (9 firms); Positive: 0.0% (0); Negative: 0.0% (0); Prev. Ed.: 12; 0; 0

Brokers’ Target Price: $14.43 (Down ↓ $0.07 from last edition; 7 firms) Brokers’ Avg. Expected Return: (2.1%)

Recent Event

On October 30, 2007, ANDW reported its 4Q07 & FY07 earnings. Total 4Q07 revenue was $624.4 million, up 4.2% y/y and 14.4% sequentially. FY07 revenue stood at $2,195.1 million, up 2.3% y/y. Pro forma 4Q07 EPS was $0.20, up 36.9% y/y and 81.3% sequentially. FY07 EPS stood at $0.48, up 18.9% y/y.

On June 27, 2007, ANDW entered into a definite agreement with CommScope Inc. (CTV), under which CTV would acquire ANDW for approximately $2.6 billion. The deal is expected to close before the end of 2007.

Overview

Analysts have identified the following factors for evaluating the investment merits of ANDW:

Key Positive Arguments Key Negative Arguments Market leadership: ANDW is the dominant non-OEM provider Excessive dependence: Andrew’s revenue is tied closely of wireless infrastructure due to its product breadth, to those of leading wireless OEMs, like Ericsson, Motorola, engineering leadership, and global footprint. and Nokia. If they under perform or choose other suppliers, Industry trends: Strong global wireless equipment spending its revenue will be affected. trends continue to provide tailwinds. R&D expense: Andrew’s products are designed to be Strong subscriber growth: Capital expenditure for wireless leading edge. Expensive R&D is necessary to meet the infrastructure is benefiting from strong subscriber growth, constant demand from current OEM customers. increasing MOUs, and rollout of data services Currency fluctuations: The major portion of ANDW’s Reduced exposure to volatility in margins: Reduced revenue comes from international markets, which is exposure to low-margin Satellite Communications segment accompanied by risks of currency fluctuations, tariffs, trade would increase revenue and margins. barriers, and longer customer payment cycles. Gain in market share: Analysts expect ANDW to gain market Pricing pressures: ANDW’s gross margin is sensitive to its share from smaller vendors as carriers consolidate vendor lists mix of business by unit, geography, and type of cable sold. to obtain better pricing leverage. ANDW is also exposed to the risks associated with the fluctuation in the pricing of its primary raw material, copper.

© Copyright 2007, Zacks Investment Research. All Rights Reserved. Andrew Corporation (ANDW) is a global designer, manufacturer, and supplier of communications equipment, services, and systems. It serves operators and equipment manufacturers from facilities in 35 countries. Its products and expertise are found in communications systems worldwide. These include wireless and distributed communications, land mobile radio, cellular and personal communications, broadcast, radar, and navigation. ANDW is headquartered in Westchester, Illinois. Its website is www.andrew.com.

Note: The company’s fiscal year ends on September 30; fiscal references differ from the calendar year.

Revenue

Provided below is a summary of revenue as compiled by Zacks Research Digest:

Revenue in $ (M) 4Q06A FY06A 3Q07A 4Q07A FY07A 1Q08E 2Q08E FY08E FY09E Total Revenue $599.0 $2,146.2 $545.8 $624.4 $2,195.1 $581.0↑ $554.6↑ $2,371.2↑ $2,584.5 Digest High $599.1 $2,147.0 $546.0 $624.4 $2,195.1 $616.5 $582.0 $2,438.1 $2,584.5 Digest Low $599.0 $2,146.0 $545.7 $624.4 $2,195.0 $550.0 $525.9 $2,309.3 $2,584.5 YOY Growth 9.4% -0.9% 4.2% 2.3% 11.3% 10.3% 8.0% 9.0% QoQ Growth 8.8% 8.6% 14.4% -7.0% -4.5% Zacks Consensus $580.0 $551.0 $2,375.0

Zacks Digest total revenue in 4Q07 stood at $624.4 million, up 4.2% y/y and 14.4% sequentially. FY07 total revenue stood at $2,195.1 million, up 2.3% y/y. Revenue of $624.4 million was above the Street consensus of $603.0 million. The increase was driven primarily by growth in antenna and cable products, incremental sales from recent acquisitions, a favorable foreign exchange impact and increased sales of coverage solutions, which was partially offset by a sales decline in base station components, satellite communications products and network solutions.

Provided below is a summary of Segmental Revenue as compiled by Zacks Research Digest:

Revenue 4Q06A FY06A 3Q07A 4Q07A FY07A 1Q08E 2Q08E FY08E FY09E Antenna & Cable Products $371.0 $1,248.9 $356.0 $398.0 $1,413.0 $378.4↑ $364.3↑ $1,526.2↑ Network Solutions/Geolocation $19.0 $90.0 $23.0 $19.0 $86.0 $25.0↓ $24.0↓ $104.0↓ Wireless Innovation $48.0 $180.0 $43.0 $49.0 $189.0 $51.8↓ $50.1↓ $204.3↓ Satellite Communications $35.0 $122.0 $23.0 $27.0 $104.0 $26.5↓ $26.0↓ $105.3↓ Base Station Subsystems $126.0 $505.9 $101.0 $131.0 $403.0 $109.0 $100.6↓ $430.1↓ Total Revenue $599.0 $2,146.2 $545.8 $624.4 $2,195.1 $581.0↑ $554.6↑ $2,371.2↑ $2,584.5

Provided below is the Pie Chart representation of Segmental Revenue:

2007A Antenna & 2008E Ante nna & Cable Cable Products Products 18% Netw ork 18% Ne tw ork Solutions/Geol Solutions /Ge o ocation 4% location 5% Wireless Wireles s Innovation Innovation 9% 9% Satellite Sate llite Com m unicati 4% Com m unicatio 4% 64% ns ons Base Station 65% Bas e Station Subsystem s Subs yste m s

Zacks Investment Research Page 2 www.zackspro.com Segment Breakdown of Revenue: The Company has two reporting segments: Wireless Network Solutions and Antenna and Cable Products. Wireless Network Solutions include the Base Stations Subsystems, Wireless Innovations and Network Solutions segments, and the Antenna and Cable Products Group includes the Satellite Communications segment.

Antenna and Cable Products (63.7% of 4Q07 revenue): The Antenna group of products include base station antennas, earth station antennas (ESA), multi-band antennas, and point-to-point antennas. Cable products include coaxial cables, connectors, cable assemblies, and accessories. Revenue in this segment stood at $398.0 million, up 7.3% y/y and 11.8% sequentially. The increase was attributable to the price increase of cable products and strong sales of antenna products.

Base Station Subsystems (21.0% of 4Q07 sales): Base Station Subsystems products are integral components of wireless base stations, and include products such as power amplifiers, filters, duplexers, and combiners that are sold individually or as parts of integrated subsystems. Base Station Subsystems revenue stood at $131.0 million, up 4.0% y/y and 29.7% sequentially, driven by increased sales of power amplifiers to operators, which was partially offset by a decrease in sales of base station components to certain original equipment manufacturer (OEM) customers.

Network Solutions (3.0% of 4Q07 sales): Network Solutions include software and equipment to locate wireless 911 callers as well as equipment and services for testing and optimizing wireless networks. Revenue in this segment stood at $19.0 million, flat y/y but down 17.4% sequentially.

Wireless Innovations (7.8% of 4Q07 sales): Wireless Innovations products are used to extend the coverage of wireless networks in areas where signals are difficult to send or receive and include both complete systems and individual components. Wireless Innovations revenue stood at $49.0 million, up 2.1% y/y and 14.0% sequentially. The increase was primarily driven by an increase in project-oriented sales for distributed coverage solutions, which was partially offset by a decrease in repeater sales.

Satellite Communications (4.3% of 4Q07 sales): The Satellite and Broadband Communications segment offers high-performance, high-reliability wireless broadband products, and system solutions to the end user. Revenue stood at $27.0 million, down 22.9% y/y but up 17.4% sequentially. The yearly decline was attributable to decreased direct-to-home satellite product sales.

Total orders in the quarter stood at $610.0 million, up 11.0% y/y, owing to solid demand across all wireless infrastructure products, which was partially offset by a decrease in orders for satellite communications products. Orders declined in North America, offset by strong orders in EMEA and Latin America. Ending backlog was $304 million, versus $316 million in 4Q06.

The top 25 customers represented 73% of sales in 4Q07, versus 70% in 3Q07 and 71% in 4Q06. Major OEMs accounted for 47% of sales in 4Q07, versus 45% in 3Q07 and 41% in 4Q06. Ericsson, Nokia Siemens Networks and Alcatel-Lucent each represented more than 10% of the company’s sales in 4Q07.

On a geographic basis, sales grew in all regions except for North America, which was impacted by a reduction in spending by the company’s two key customers.

Outlook

The company did not provide any revenue guidance due to the pending acquisition of ANDW by CommScope.

One analyst (R W. Baird) believes that subscriber growth, increasing demand for mobility, and rollout of 3G and 4G data services would help to expand the wireless industry going forward.

Please see the separately saved ANDW.xls spreadsheet for more details.

Zacks Investment Research Page 3 www.zackspro.com Margins

Provided below is a summary of margins as compiled by Zacks Research Digest:

Margins 4Q06A FY06A 3Q07A 4Q07A FY07A 1Q08E 2Q08E FY08E FY09E Gross Margin 23.0% 22.2% 21.5% 21.4% 22.1% 21.9%↓ 22.1%↓ 22.3%↓ 24.5% Operating Margin 6.5% 5.1% 5.2% 6.8% 5.8% 6.1%↓ 6.0%↓ 6.5%↓ 8.5% Pretax Margin 5.8% 4.5% 4.6% 6.1% 5.1% 5.4%↓ 5.4%↓ 5.8%↓ 7.8% Net Margin 4.0% 3.1% 3.4% 5.2% 3.5% 3.6%↓ 3.5%↓ 3.9%↓ 5.4%

The Zacks Digest average gross profit in 4Q07 was $133.7 million, down 3.1% y/y but up 14.0% sequentially. Gross margin stood at 21.4%, reflecting a decrease of 160 bps y/y and 10 bps sequentially. The decline in gross margin was largely attributable to higher commodity costs and an unfavorable sales mix significantly impacted by reduced demand in North America. FY07 gross profit stood at $486.0 million, up 2.1% y/y.

SG&A for the quarter increased 4.0% q/q to $63.0 million, and represented 10.1% of total revenue. R&D expense decreased 3.7% sequentially to $27.9 million, and represented 4.5% of total revenue. The decline in R&D expense was attributable to the transition of certain research and development resources to lower-cost regions and headcount reductions.

Operating income in 4Q07 was $42.8 million, up 10.2% y/y and 50.7% sequentially. Operating margin stood at 6.8%, reflecting an increase of 30 bps y/y and 160 bps sequentially. The increase was attributable to higher sales volume and lower expenses. Operating income in FY07 was $126.6 million, up 16.5% y/y.

Net interest expense for the quarter stood at $4.6 million, up 9.3% y/y and 45.9% sequentially. Pretax income in 4Q07 was $38.1 million, up 8.8% y/y and 50.9% sequentially. Pretax income in FY07 stood at $112.5 million, up 17.7% y/y. The effective tax rate was 18.4% in 4Q07.

Outlook

The company did not provide any margin guidance due to the pending acquisition of ANDW by CommScope.

One analyst (R W. Baird) believes that the global restructuring efforts and the divestiture of unprofitable divisions (SatCom) will help to drive gross margins going forward.

Please see the separately saved ANDW.xls spreadsheet for more details.

Earnings per Share

Provided below is a summary of EPS as compiled by Zacks Research Digest:

EPS 4Q06A FY06A 3Q07A 4Q07A FY07A 1Q08E 2Q08E FY08E FY09E Digest High $0.15 $0.44 $0.12 $0.21 $0.49 $0.17 $0.16 $0.72 $0.81 Digest Low $0.13 $0.38 $0.11 $0.20 $0.47 $0.10 $0.07 $0.38 $0.81 Digest Avg. $0.15 $0.40 $0.11 $0.20 $0.48 $0.13↓ $0.12↓ $0.59↓ $0.81 YOY Growth -14.5% 17.5% 36.9% 18.9% 63.8% 37.5% 22.6% 38.3% QoQ Growth 55.6% 24.2% 81.3% -35.4% -5.5% Zacks Consensus $0.15 $0.13 $0.64

Zacks Investment Research Page 4 www.zackspro.com 4Q07 pro forma EPS as compiled by Zacks Digest was $0.20, up 36.9% y/y and 81.3% sequentially. FY07 EPS stood at $0.48, up 18.9% y/y. The increase was driven by revenue growth and a lower tax rate. EPS of $0.20 was above the street consensus of $0.18.

GAAP EPS for the quarter stood at ($0.40), down 6.9% y/y but up 32.7% sequentially. FY07 GAAP EPS stood at ($1.00). GAAP EPS includes $0.60 per share of one-time significant charges.

Outlook

The company did not provide any EPS guidance, owing to the pending acquisition of ANDW by CommScope.

The Digest Model projects EPS of $0.59 for 2008 and $0.81 for 2009, representing a y/y growth of 22.6% and 38.3% in 2008 and 2009, respectively. The average estimated 3-year Compounded Annual Growth Rate (CAGR) based on 2005 EPS is 7.6%.

Highlights from the above chart are as follows:

2008 forecasts (9 analysts) range from $0.38 (Piper Jaffray) to $0.72 (FTN Midwest Res.) the average is $0.59. 2009 forecast (1 analyst) (Stephens) is $0.81.

Following the 4Q07 earnings release, few analysts decreased their EPS estimates for FY08, based on the uncertain business environment and weak gross margins assumptions while one analyst (J.P. Morgan) increased their EPS estimates for FY07, attributable to higher revenue and lower operating expenses.

Please see the separately saved ANDW.xls spreadsheet for more details.

Target Price/Valuation

Of the 9 analysts covering the stock, all the analysts gave a Neutral rating. There are currently no negative or positive ratings on the stock. Zacks average price target is $14.43 ($0.07 down ↓ versus the previous report and 2.1% downside from the current price). The price target ranges from $11.00 (25.4% downside from the current price) (Lehman) to $15.00 (1.8% upside from the current price) (Jefferies).

Provided below is a summary of target prices and ratings as compiled by Zacks Research Digest:

Rating Distribution Positive 0.0% Neutral 100.0% Negative 0.0% Avg. Target Price $14.43↓ Digest High $15.00 Digest Low $11.00 No of analysts with target price/Total 7/9

Risks to the target price include the timing of new technology deployment, the prospect of an unfavorable pricing environment, weakness in infra market, less-than-expected benefit from cost reduction efforts, and rising component costs, reduction in capital spending budgets by wireless carriers, and copper price volatility.

Zacks Investment Research Page 5 www.zackspro.com Metrics detailing current management effectiveness are as follows:

Metric (TTM) Company Industry S&P 500 Return on Assets (ROA) -6.84% 8.23% 8.59% Return on Equity (ROE) -11.27% 13.88% 21.45% Return on Investment (ROI) -9.89% 10.05% 12.60%

The Company’s ROA, ROE and ROI of negative 6.84%, 11.27% and 9.89% are lower than the market average (measured by the S&P500) of 8.59%, 21.45% and 12.60%, respectively.

Please see the separately saved ANDW.xls spreadsheet for more details.

Capital Structure/Solvency/Cash Flow/Governance/Other

Capital Structure

Cash and cash equivalents stood at $155.0 million in 4Q07, versus $119.0 million in 3Q07. The increase was attributable to normal seasonality and improved working capital performance. Accounts receivable was $646.0 million in 4Q07 versus $552.0 million in 3Q07. The increase in accounts receivable was primarily attributable to strong sales in the quarter and a favorable geographic mix. Inventories for the quarter stood at $364.0 million in 4Q07, versus $389.0 million in 3Q07. DSO at the end of the quarter stood at 91 days versus 89 days in 3Q07. Inventory turns were 5.4x in 4Q07, versus 4.5x in 3Q07.

Total debt outstanding stood at $345.0 million in 4Q07, versus $351.0 million in 3Q07.

Cash Flow/ Capital Expenditure

Cash flow from operations stood at $46.0 million in 4Q07, versus $55.6 million in 4Q06. Capital expenditure decreased to $10.2 million in 4Q07, versus $20.2 million in 4Q06 primarily due to the completion of two significant cable and antenna facility moves during FY07.

Share Repurchase

Average shares outstanding decreased to approximately 156 million in 3Q07 from approximately 159 million in 4Q06, primarily due to shares that have been repurchased by the company.

ANDW agrees to sell its Satellite Communications Business

On November 5, 2007, Andrew Corporation, entered into a Purchase and Sale Agreement with ASC Signal Corporation, affiliated with Resilience Capital Partners, for the sale of the Company's Satellite Communications business. Under the agreement, Andrew will receive up to $39 million in total potential cash consideration. In addition, ANDW will also get an ownership stake of about 17% to 20% in the new satellite communications company that Resilience will establish with the acquired Andrew assets.

The Company will receive $9.0 million in cash at closing, which is expected to occur prior to the end of the 2007 calendar year, and $5 million in seller's notes that will mature three years after closing. In addition, the Company may receive up to an additional $25 million in cash after three years based upon the achievement of certain financial targets by the new company.

Zacks Investment Research Page 6 www.zackspro.com Dependent upon the ownership stake received and the book value of the Satellite Communications assets at the date of closing, Andrew expects to record a charge against earnings of approximately $15 million to $20 million related to the sale of this underperforming business.

Andrew-CommScope Acquisition

CTV and ANDW announced an agreement under which CTV would acquire all of the outstanding shares of ANDW for $15.00 per share, at least 90% in cash, creating a global leader in infrastructure solutions for communications networks. The transaction is valued at approximately $2.6B and is expected to close by the end of 2007. The deal is expected to close before the end of 2007.

The combined company will be a global leader in infrastructure solutions for communications networks, including structured cabling solutions for the business enterprise, broadband cable and apparatus for cable television applications; and antenna and cable products, base station subsystems, coverage and capacity systems, and network solutions for wireless applications. The combination of respective operations of the two companies is expected to result in meaningful operating, cost and sales synergies, and other important benefits to shareholders, customers, and the employees.

Potentially Severe Problem

There are none other than those mentioned in other sections of this report.

Long-Term Growth

Long-term growth rate estimates for the company range from 7.0% (FTN Midwest Res.) to 15.0% (Piper Jaffray), with an average of 11.0%.

According to management, the company’s offer of mobile location systems to Nokia's GSM network base- station subsystem (BSS) customers and the acquisition of certain assets of Nortel's wireless location business would help stabilize the geolocation business, and could lead to renewed growth over the medium term, as location-based services (LBS) gain traction. ANDW's growth prospects tend to track with the forecasts for overall wireless infrastructure spending. Analysts believe the company has the potential to grow its topline at a faster rate than the broader market through the expansion of its served available market.

Management expects increased business opportunities through EV-DO and W-CDMA in the US as well as a steady W-CDMA uptake in Western Europe. W-CDMA opportunities may also emerge in Eastern Europe and Russia (with issuance of new licenses) in the next 12–18 months. The growing demand for wireless products in developing economies, particularly in China and India, presents a significant long- term growth opportunity for ANDW. Positive trends in the company’s Wireless Innovation group (indoor coverage solutions), and a reversal of negative trends at the Satellite Communications and Network Solutions units could also act as topline growth catalysts in the forthcoming quarters.

The company believes the key growth opportunities for its major product segments include EVDO and UMTS upgrades in the United States, 3G expansions in Europe, 2G growths in emerging markets, and 3G licensing in China (ramping into 2007). The company also believes it can benefit from the positive global wireless capex trends in FY08 as carriers build out 3G networks and improve capacity and coverage to address more subscribers.

Zacks Investment Research Page 7 www.zackspro.com Upcoming Event

By the end of 2007: ANDW is expected to be acquired by CommScope.

Individual Analyst Opinions

POSITIVE RATINGS (0.0%)

None

NEUTRAL RATINGS (100.0%)

Zacks Investment Research – Hold ($15.00) – (11/08/07). The firm has maintained a Hold rating on the stock with a target price of $15.00 per share. INVESTMENT SUMMARY: The firm believes that the planned divestiture of the Satellite Communications business will improve the company’s bottom line going forward. However, given the uncertainty prevailing with the company’s business trends, the analyst prefers investors to remain on the sidelines.

B. of America – Neutral ($15.00) – (10/30/07): The firm has reiterated a Neutral rating on the stock with a target price of $15.00 per share. INVESTMENT SUMMARY: The firm believes that CommScope's announcement to acquire ANDW for $15.00 per share would limit further upside to estimates. Further, it believes that the rebound in wireless infrastructure has already been factored in the company’s fundamentals. Hence, the firm prefers to remain on the sidelines.

FTN Midwest Res. – Neutral – (10/31/07): The firm has retained a Neutral rating on the stock. INVESTMENT SUMMARY: The firm believes that the merger would derive product and cost synergy in the long term but also expects some operational disruption as the merger commences. Hence, it remains cautious on the stock.

J.P. Morgan – Neutral – (10/31/07): The firm has reaffirmed a Neutral rating on the stock.

Jefferies – Hold ($15.00) – (10/31/07): The firm has maintained a Hold rating on the stock with a price target of $15.00 per share. INVESTMENT SUMMARY: Although the firm remains encouraged by the company’s 4Q07 results, it remains on the sidelines due to the pending acquisition and the weak spending environment.

Lehman– Equal Weight ($11.00) – (10/31/07): The firm has reiterated an Equal Weight rating on the stock with a target price of $11.00 per share.

Piper Jaffray – Market Perform ($15.00) – (10/30/07): The firm has retained a Market Perform rating on the stock with a target price of $15.00.

R W. Baird – Neutral ($15.00) – (10/31/07): The firm has reaffirmed a Neutral rating on the stock with a target price of $15.00 per share. INVESTMENT SUMMARY: Although the firm remains cautious in the near term due to carrier and OEM consolidation, it is positive about the long term secular trends of the wireless industry.

Stephens – Equal Weight ($15.00) – (10/31/07): The firm has maintained an Equal Weight rating on the stock with a target price of $15.00 and expects the pending ANDW-CTV deal to close by the end of 2007.

Zacks Investment Research Page 8 www.zackspro.com NEGATIVE RATING (0.0%)

None Research Associate: Shalu Saraf Copy Editor: Ian Madsen, CFA Content Ed.: Payal Jalan

Zacks Investment Research Page 9 www.zackspro.com