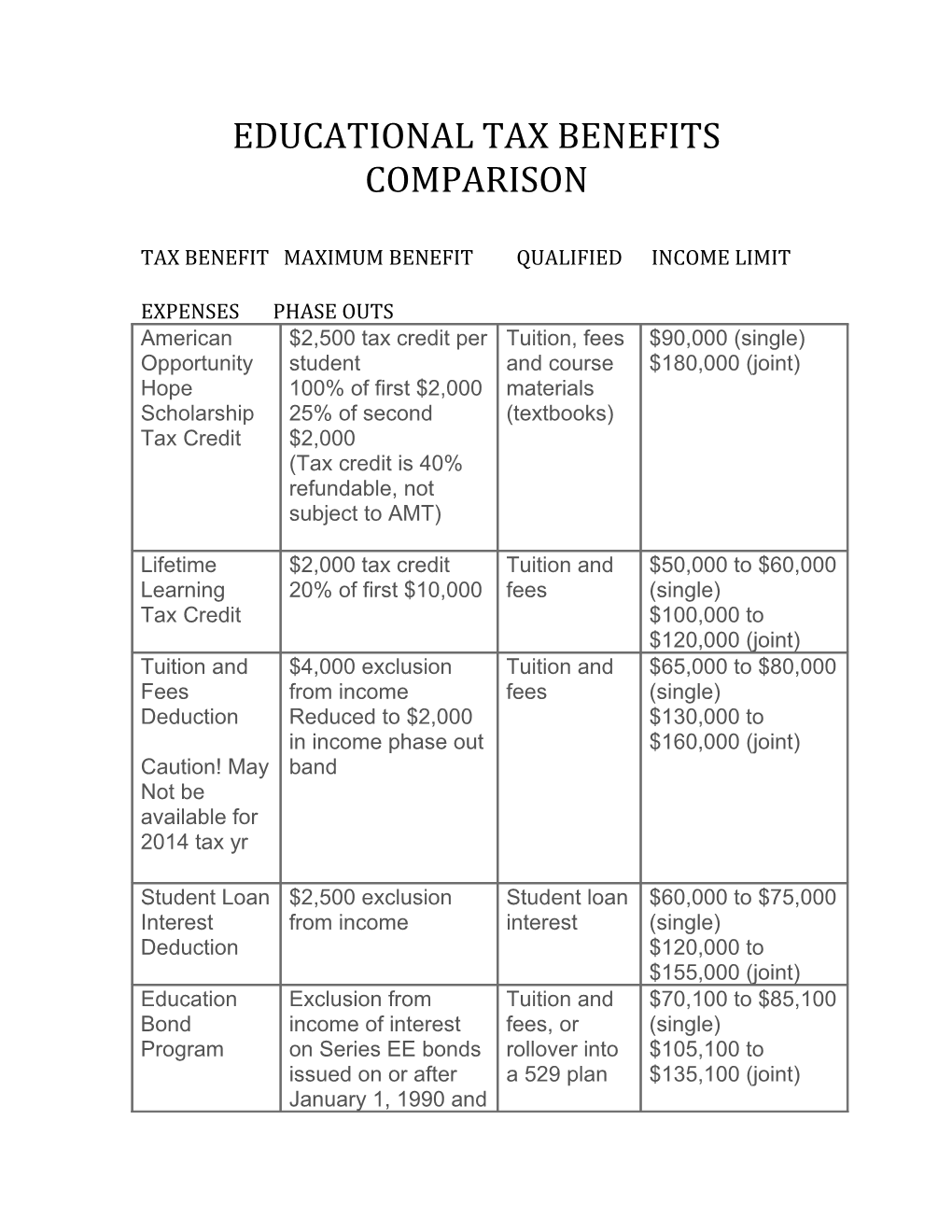

EDUCATIONAL TAX BENEFITS COMPARISON

TAX BENEFIT MAXIMUM BENEFIT QUALIFIED INCOME LIMIT

EXPENSES PHASE OUTS American $2,500 tax credit per Tuition, fees $90,000 (single) Opportunity student and course $180,000 (joint) Hope 100% of first $2,000 materials Scholarship 25% of second (textbooks) Tax Credit $2,000 (Tax credit is 40% refundable, not subject to AMT)

Lifetime $2,000 tax credit Tuition and $50,000 to $60,000 Learning 20% of first $10,000 fees (single) Tax Credit $100,000 to $120,000 (joint) Tuition and $4,000 exclusion Tuition and $65,000 to $80,000 Fees from income fees (single) Deduction Reduced to $2,000 $130,000 to in income phase out $160,000 (joint) Caution! May band Not be available for 2014 tax yr

Student Loan $2,500 exclusion Student loan $60,000 to $75,000 Interest from income interest (single) Deduction $120,000 to $155,000 (joint) Education Exclusion from Tuition and $70,100 to $85,100 Bond income of interest fees, or (single) Program on Series EE bonds rollover into $105,100 to issued on or after a 529 plan $135,100 (joint) January 1, 1990 and all Series I bonds. Employer $5,250 exclusion Tuition, fees, None Tuition from income per books, Assistance student supplies, equipment Scholarships Exclusion from Tuition, fees, None income of amounts required spent on qualified course- expenses if the related student is a degree materials candidate and the (books, scholarship is not supplies, payment for equipment) services. The full amount is exempt from FICA whether or not the student is a degree candidate. 529 College Earnings are tax- Tuition, fees, None Savings deferred. Qualified books, Plans distributions are supplies and excluded from equipment, income. The expenses for earnings portion of a special non-qualified needs distribution is taxed services. at the beneficiary's Room and rate and subjected board if to a 10% tax enrolled at penalty. least half- time.

NOTE: Information here is for tax year 2013, as Congress has not as of the time of publication finalized approval of all credits for 2014. Check with your tax professional for updates before relying on this information. Tuition & Fees credit may not be renewed for 2014.