News from The Chubb Corporation

The Chubb Corporation 15 Mountain View Road • P.O. Box 1615 Warren, New Jersey 07061-1615 Telephone: 908-903-2000

FOR IMMEDIATE RELEASE

Chubb’s First Quarter Earnings Increase 15%

WARREN, N.J., April 24, 2001 – The Chubb Corporation [NYSE: CB] today reported a 15% increase in operating earnings for the first quarter of 2001, largely because of improved results in Chubb Commercial Insurance, which includes Chubb’s standard commercial and property & marine lines. Net written premiums grew 9%, or 11% excluding the effects of currency fluctuation. U.S. premiums grew 10%, and non-U.S. premiums grew 16% in local currencies. The combined ratio for the first quarter was 99.9%, compared with 101.9% in the corresponding year-earlier quarter.

Chubb Personal Insurance and Chubb Specialty Insurance, which together account for 62% of net written premium, experienced premium growth of 14% and 16%, respectively, during the quarter. Although Chubb Commercial Insurance had flat premiums overall, the multiple peril and workers’ compensation lines had solid growth, offset by a decline in casualty premiums and flat premiums for property & marine.

First quarter operating earnings, which exclude realized investment gains, increased 15% to $172.7 million from $149.9 million. Operating earnings per share increased 13% to $.96 per share from $.85 per share in 2000. Net income in the 2001 first quarter was $175.0 million or $.97 per share compared with $153.7 million or $.87 per share last year.

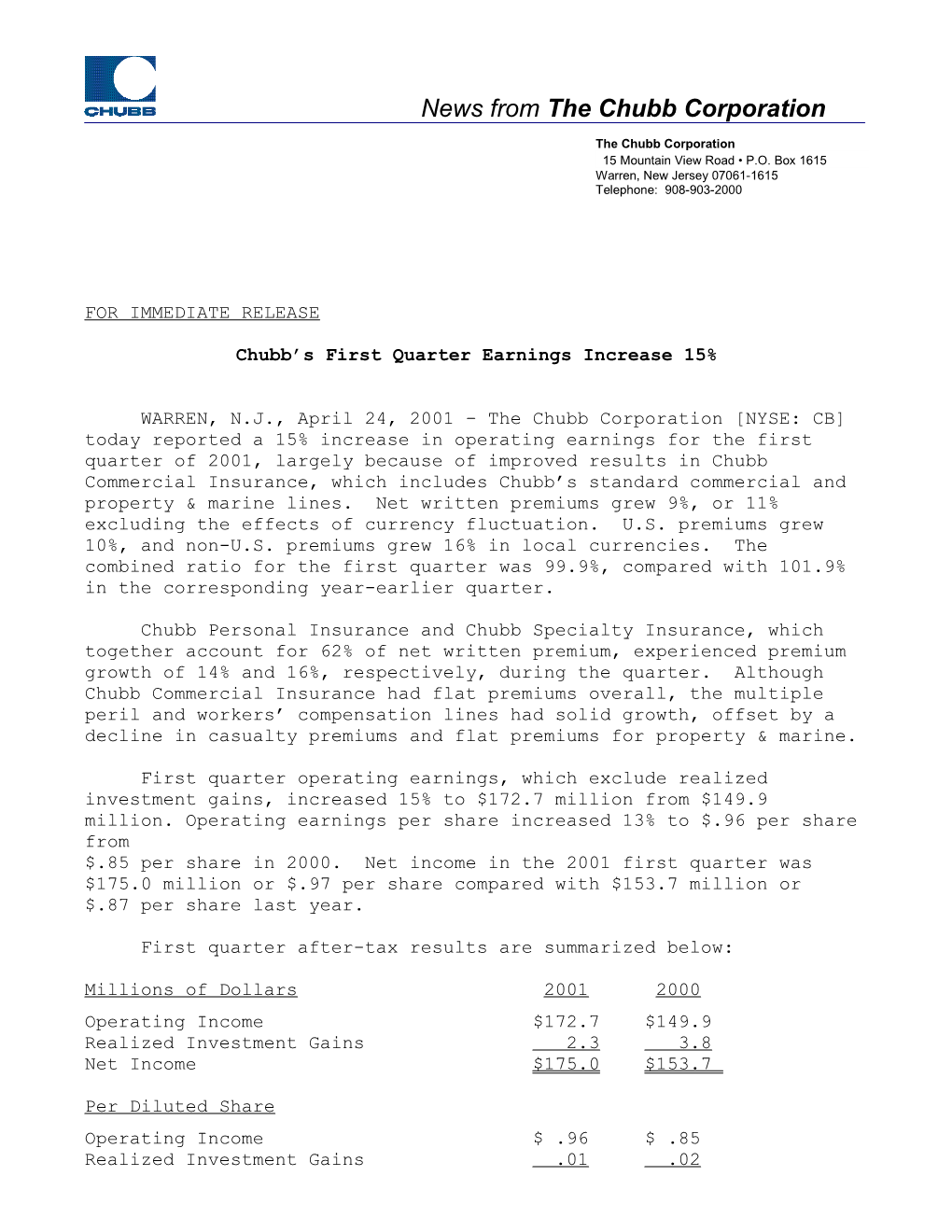

First quarter after-tax results are summarized below:

Millions of Dollars 2001 2000 Operating Income $172.7 $149.9 Realized Investment Gains 2.3 3.8 Net Income $175.0 $153.7

Per Diluted Share Operating Income $ .96 $ .85 Realized Investment Gains .01 .02 2 Net Income $ .97 $ .87

Effect of Catastrophe Losses $ .04 $ .11 3

Personal lines, now known as Chubb Personal Insurance, produced a combined ratio of 100.8% in the first quarter. "Non-catastrophe weather-related losses again contributed to what we expect will be a temporary interruption in the profitability of homeowners results," said Dean R. O’Hare, chairman and chief executive officer. "We had a similar seasonal blip in homeowners results in the first quarter last year, and the business rebounded handsomely in the balance of the year. The combined ratio for the homeowners business was 114.3% compared with 109.7% in the first quarter of 2000. Personal automobile insurance produced a combined ratio of 96.6%. Other personal lines, which include valuable articles and personal excess liability, had a combined ratio of 73.9% for the quarter.

Chubb Commercial Insurance produced a combined ratio of 106.6%, compared to 116.3% in the first quarter of 2000 and 116.6% in the fourth quarter of 2000. "Margins in these lines were nearly 10 percentage points better than in the first quarter of 2000," said Mr. O’Hare. Rates continued to improve, with rate increases on renewed policies averaging 15.3% in the U.S. during the first quarter, compared with 9.9% in the first quarter of 2000 and 13.7% in the fourth quarter of 2000. The combined ratio in every line of Chubb Commercial Insurance improved significantly over the 2000 first quarter, with the greatest improvement in workers’ compensation, which had a combined ratio of 94.1% compared with 109.1% a year ago. Mr. O’Hare said that premium growth was restrained by the company’s preference for stringent risk selection and profitability over growth.

Specialty Commercial Lines, now known as Chubb Specialty Insurance, showed strong results for the quarter, producing a combined ratio of 92.6%. Executive Protection lines had a combined ratio of 90.4%. "These lines performed well," said Mr. O’Hare, "but recent trends in frequency and severity indicate a need for higher rates and even better risk selection. We are implementing a pricing and pruning program in these lines similar to the one that has been so successful in improving our standard commercial lines’ performance." The financial institutions business had a combined ratio of 101.5%, reflecting one large property loss during the quarter.

Catastrophe losses totaled $11.5 million and represented 0.7 percentage point of the 2001 first quarter combined ratio. In the first quarter of 2000, catastrophe losses were $30.3 million and represented 2.0 percentage points.

Property and casualty investment income after taxes was $184.6 million or $1.03 per share, compared with $181.3 million or $1.03 per share in 2000.

In the first quarter, Chubb purchased 565,000 shares of its common stock in the open market. 4

For further information contact: Weston M. Hicks (908) 903-4334

Glenn A. Montgomery (908) 903-2365

FORWARD LOOKING INFORMATION

Certain statements in this communication may be considered to be "forward looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995 such as statements that include words or phrases "will result", "is expected to", "will continue", "is anticipated", or similar expressions. Such statements are subject to certain risks and uncertainties. The factors which could cause actual results to differ materially from those suggested by any such statements include but are not limited to those discussed or identified from time to time in the Corporation's public filings with the Securities and Exchange Commission and specifically to: risks or uncertainties associated with the Corporation's expectations with respect to premium price increases and profitability or growth estimates overall and by line of business, as well as its expectations with respect to business retention or the non-renewal of underpriced insurance accounts; and, more generally to: general economic conditions including changes in interest rates and the performance of the financial markets, changes in domestic and foreign laws, regulations and taxes, currency fluctuation, changes in competition and pricing environments, regional or general changes in asset valuations, the occurrence of significant natural disasters and weather-related losses, the inability to reinsure certain risks economically, the adequacy of loss reserves, as well as general market conditions, competition, pricing and restructurings. 5

THE CHUBB CORPORATION

SUPPLEMENTARY FINANCIAL DATA (Unaudited)

Three Months Ended March 31 2001 2000 (in millions)

PROPERTY AND CASUALTY INSURANCE Underwriting Net Premiums Written...... $1,732.9 $1,589.3 Increase in Unearned Premiums...... (112.3) (97.4) Premiums Earned...... 1,620.6 1,491.9 Claims and Claim Expenses...... 1,081.0 1,027.4 Operating Costs and Expenses...... 568.4 518.0 Increase in Deferred Policy Acquisition Costs...... (28.2) (29.0) Dividends to Policyholders...... 7.0 6.7

Underwriting Loss...... (7.6) (31.2)

Investments Investment Income Before Expenses...... 225.4 220.3 Investment Expenses...... 4.6 4.3

Investment Income...... 220.8 216.0

Amortization of Goodwill and Other Charges...... (10.4) (11.4)

Property and Casualty Income...... 202.8 173.4

CORPORATE AND OTHER...... 3.1 (5.1)

CONSOLIDATED OPERATING INCOME BEFORE INCOME TAX...... 205.9 168.3

Federal and Foreign Income Tax...... 33.2 18.4

CONSOLIDATED OPERATING INCOME...... 172.7 149.9 6 REALIZED INVESTMENT GAINS AFTER INCOME TAX...... 2.3 3.8

CONSOLIDATED NET INCOME...... $ 175.0 $ 153.7

PROPERTY AND CASUALTY INVESTMENT INCOME AFTER INCOME TAX...... $ 184.6 $ 181.3 7

Three Months Ended March 31 2001 2000

OUTSTANDING SHARE DATA (in millions) Average Common and Potentially Dilutive Shares...... 179.0 176.3 Actual Common Shares...... 176.0 174.9

DILUTED EARNINGS PER SHARE DATA Operating Income...... $ .96 $ .85 Realized Investment Gains...... 01 .02 Net Income...... $ .97 $ .87

Effect of Catastrophe Losses...... $ .04 $ .11

Mar. 31 Dec. 31 2001 2000

BOOK VALUE PER COMMON SHARE...... $41.12 $39.91

BOOK VALUE PER COMMON SHARE, with Available-for-Sale Fixed Maturities at Amortized Cost...... 39.24 38.60

PROPERTY AND CASUALTY UNDERWRITING RATIOS THREE MONTHS ENDED MARCH 31

2001 2000

Losses to Premiums Earned...... 67.0% 69.2% Expenses to Net Premiums Written...... 32.9 32.7

Combined Loss and Expense Ratio...... 99.9% 101.9%

PROPERTY AND CASUALTY CLAIMS AND CLAIM EXPENSE COMPONENTS THREE MONTHS ENDED MARCH 31

2001 2000 (in millions)

Paid Claims and Claim Expenses...... $1,146.3 $ 892.4 Increase (Decrease) in Unpaid Claims and Claim Expenses...... (65.3) 135.0

Total Claims and Claim Expenses...... $1,081.0 $1,027.4 8

PROPERTY AND CASUALTY PRODUCT MIX THREE MONTHS ENDED MARCH 31

Net Premiums Combined Loss and Written Expense Ratios 2001 2000 2001 2000 (in millions)

Personal Insurance Automobile...... $ 106.6 $ 88.7 96.6% 97.1% Homeowners...... 223.5 197.5 114.3 109.7 Other...... 98.5 90.3 73.9 69.5 Total Personal 428.6 376.5 100.8 97.5

Commercial Insurance Multiple Peril...... 204.5 192.3 104.6 111.5 Casualty...... 205.5 222.4 110.1 120.6 Workers' Compensation...... 108.2 101.0 94.1 109.1 Property and Marine...... 145.0 144.7 112.7 121.3 Total Commercial 663.2 660.4 106.6 116.3

Specialty Insurance Executive Protection...... 329.8 305.3 90.4 83.8 Financial Institutions...... 160.1 135.4 101.5 92.2 Other...... 151.2 111.7 88.8 94.5 Total Specialty 641.1 552.4 92.6 87.8

Total $1,732.9 $1,589.3 99.9% 101.9%

The property and casualty product mix for 2000 includes certain reclassifications to conform with the 2001 presentation, which more closely reflects the way the property and casualty business is now managed. The total net premiums written and combined loss and expense ratio are not affected.