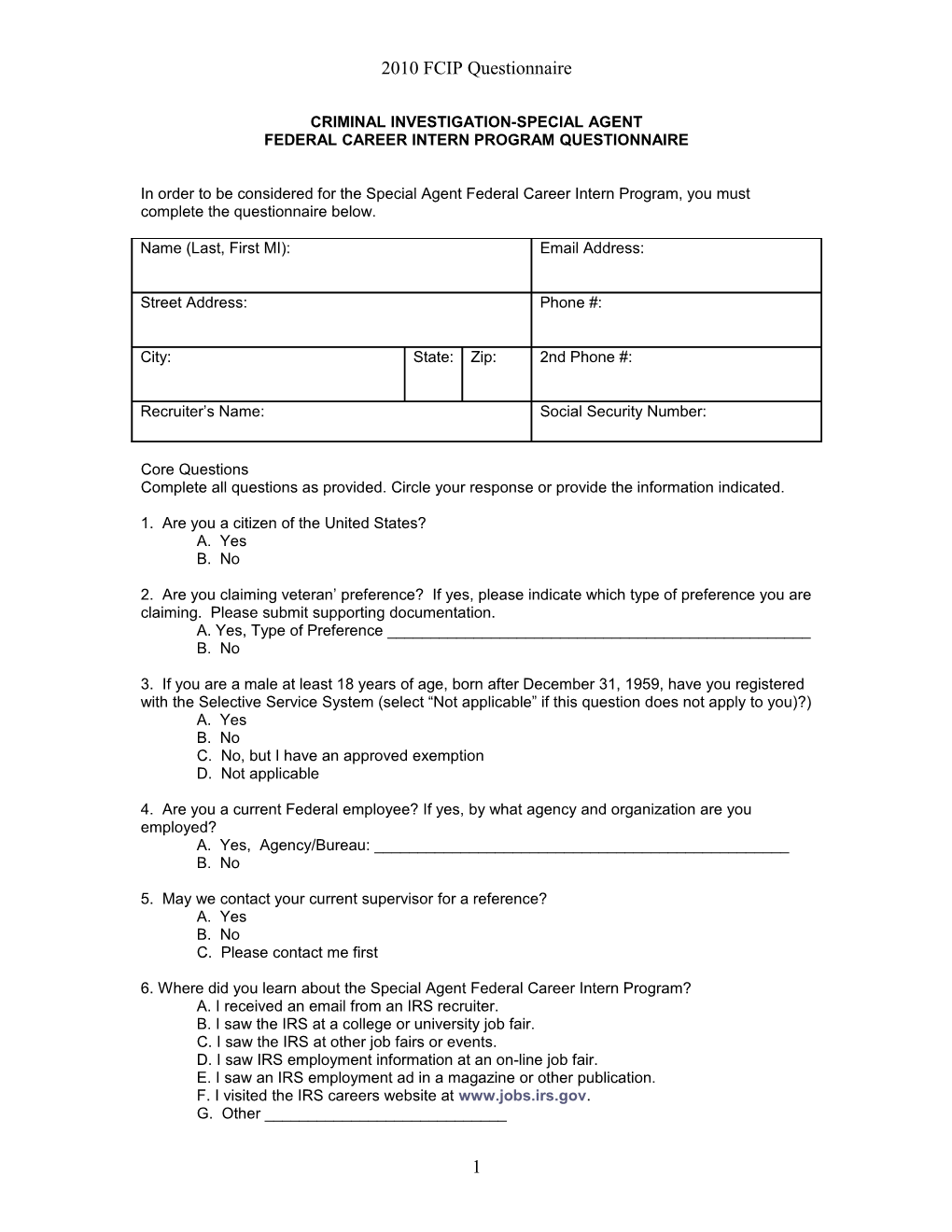

2010 FCIP Questionnaire

CRIMINAL INVESTIGATION-SPECIAL AGENT FEDERAL CAREER INTERN PROGRAM QUESTIONNAIRE

In order to be considered for the Special Agent Federal Career Intern Program, you must complete the questionnaire below.

Name (Last, First MI): Email Address:

Street Address: Phone #:

City: State: Zip: 2nd Phone #:

Recruiter’s Name: Social Security Number:

Core Questions Complete all questions as provided. Circle your response or provide the information indicated.

1. Are you a citizen of the United States? A. Yes B. No

2. Are you claiming veteran’ preference? If yes, please indicate which type of preference you are claiming. Please submit supporting documentation. A. Yes, Type of Preference ______B. No

3. If you are a male at least 18 years of age, born after December 31, 1959, have you registered with the Selective Service System (select “Not applicable” if this question does not apply to you)?) A. Yes B. No C. No, but I have an approved exemption D. Not applicable

4. Are you a current Federal employee? If yes, by what agency and organization are you employed? A. Yes, Agency/Bureau: ______B. No

5. May we contact your current supervisor for a reference? A. Yes B. No C. Please contact me first

6. Where did you learn about the Special Agent Federal Career Intern Program? A. I received an email from an IRS recruiter. B. I saw the IRS at a college or university job fair. C. I saw the IRS at other job fairs or events. D. I saw IRS employment information at an on-line job fair. E. I saw an IRS employment ad in a magazine or other publication. F. I visited the IRS careers website at www.jobs.irs.gov. G. Other ______

1 2010 FCIP Questionnaire

Assessment Questions

To be minimally qualified for the Special Agent Intern, GL-1811-9, you must meet the basic requirements below. Circle your response or provide the information indicated. (A) (B) or (C)

A. You must possess one of the following education requirements: 1. A course of study that includes 2 full years of progressively higher-level graduate education. 2. A Master's Degree. 3. An equivalent graduate degree (i.e.; L.L.B. or JD).

All of the above educational requirements must be supplemented by at least 15 semester hours (or 23 quarter hours) in accounting, AND an additional 9 semester hours (14 quarter hours) from among the following or closely related fields: finance, economics, money and banking, tax law, and business law. OR

B. You must have at least one (1) year of specialized experience. Specialized experience is defined as experience in or related to investigation of criminal violations that provided the specific knowledge, skills, and abilities needed to successfully perform the duties of this position. The experience must have been acquired in investigative work related to the accounting, auditing, business, or commercial practices of subject(s) investigated. OR

C. A combination of education and specialized experience may be used to meet the total qualification requirements. Note: to combine education and experience, do the following computations: Divide the total number of completed graduate education hours in excess of the first year of graduate education by 18 semester hours (or 27 quarter hours), and add that figure to your completed months of experience divided by 12 months. Round your answers to the nearest hundredth decimal place (xx.yy). To qualify under this provision, the resulting figure must be 1.00 or greater. For example, consider an individual with nine (9) graduate education semester hours completed in excess of the first year and seven (7) months of specialized experience: Nine (9) semester hours completed divided by eighteen (18) semester hours = 0.50. Seven (7) months of specialized experience divided by twelve (12) months = 0.58. The individual qualifies under this provision because 0.50 + 0.58 = 1.08, which is greater than 1.00.

EXAMPLES OF QUALIFYING SPECIALIZED EXPERIENCE:

The following are examples of qualifying specialized experience ONLY if the duties described were performed while doing investigative work related to the accounting, auditing, business, or commercial practices of subject(s) investigated. Leader or member of a military intelligence or criminal investigative team or component in which the principal duties consisted of financial investigation, intelligence gathering, or criminal prosecution. Analyzed or evaluated raw investigative financial data and prepared comprehensive written investigative reports. Investigated complex financial claims involving suspected crimes or alleged fraud. Investigative accounting work that required rapid, accurate judgments and sound decision-making in applying regulations, instructions, and procedures. Investigated criminal cases which required the use of, recognized investigative methods and techniques and that might have included appearing in court to present evidence. Supervised or conducted interviews or interrogations that involved eliciting evidence, data or surveillance information related to accounting. Law enforcement work in which 50 percent or more of the time involved criminal investigations that required the use of surveillance, undercover, or other criminal detection methods or techniques (stated above).

2 2010 FCIP Questionnaire

Investigated computerized business and/or accounting systems and formed sound conclusions as to related criminal business practices and compliance with Federal laws and regulations.

EXAMPLES OF NON-QUALIFYING SPECIALIZED EXPERIENCE:

The following are examples of experience that cannot be used to meet all or a portion of the one (1) year of specialized experience described above. This list is not inclusive. Performing the work of an Accountant, Tax Examiner, Tax Specialist, or Tax Fraud Investigator, Financial investment planning.

1. Please circle which of the following is true about your education and/or experience?

A. I have one of the following education requirements: (1) course of study that includes 2 full years of progressively higher-level graduate education, OR (2) Masters Degree, OR (3) equivalent graduate degree (i.e., L.L.B. or JD). My educational requirement is supplemented by at least 15 semester hrs (or 23 quarter hrs) in accounting, AND an additional 9 semester hrs (14 quarter hrs) from among the following or closely related fields: finance, economics, money & banking, tax law, & business law.

B. I have at least one (1) year of specialized experience (as specified in section B above) in or related to investigation of criminal violations that provided the specific knowledge, skills, and abilities needed to successfully perform the duties of this position. The experience was acquired in investigative work related to the accounting, auditing, business, or commercial practices of subject(s) investigated.

C. I have a combination of graduate education and specialized experience that when combined using the above formula results in an answer of 1.00 or greater. This combination of education and experience includes financial investigative experience as well as accounting and business related courses.

D. I have 2 or more of the above choices.

E. None of the above.

If you have answered that you have specialized experience or a combination of education and specialized experience, please tell us where and how you acquired this specialized experience. Be specific and provide us with a detailed description that includes the job you held, the duties you performed, and the length of time that these duties were performed. (You may attach a separate sheet of paper to address this item) ______

2. Are you currently certified as a Certified Public Accountant (CPA)? If yes, please provide the state and license number. A. Yes, CPA License Number/State: ______B. No

3. From the following statements, please circle the statement that best describes your graduate education. A. I have a Master's of Business Administration (MBA) degree with emphasis in Accounting, Finance, Taxation, Management, Economics, or Money/Banking.

3 2010 FCIP Questionnaire

B. I have a Master's of Business Administration (MBA) degree with emphasis in an area other than Accounting, Finance, Taxation, Management, Economics, or Money/Banking. C. I have a Master's degree in Criminal Justice/Criminology. D. I have a Master's degree in a field other than Criminal Justice/Criminology. E. I have a Juris Doctorate. F. None of the above.

Consider the following examples of specialized experience in financial and investigative areas: Criminal tax attorney or prosecution/defense attorney with direct experience in white collar crimes (e.g., money laundering, financial fraud investigations, bankruptcy, criminal or civil tax fraud, embezzlement, health care fraud, bank fraud, corporate fraud, investment fraud, trust fraud, securities fraud, tax evasion, employment tax, internet fraud); Law Enforcement Officer/Detective/Investigator with experience leading fraud/financial investigations, or white collar crime investigations (e.g., see above); Military law enforcement or military intelligence (e.g., JAG, CID) involving finance or fraud/financial investigations; Fraud investigation experience, compliance and/or auditing experience involving fraud determinations (e.g., tax fraud, employment tax fraud, sales tax fraud, fuel tax fraud, mortgage fraud, real estate/financing fraud, securities fraud, embezzlement fraud)

4. Please circle the statement that best describes your highest level of experience with respect to the above definitions of specialized experience in financial and investigative areas. A. I have at least 3 years of full-time experience in at least one of the above financial and investigative areas. B. I have between 2 and 3 years of full-time experience in at least one of the above financial and investigative areas. C. I have less than 2 years of full-time experience in at least one of the above financial and investigative areas. D. I do not have experience in any of the above financial and investigative areas.

4.1 Please tell us where and how you acquired this specialized experience. Be specific and provide us with a detailed description that includes the job you held, the duties you performed, and the length of time that these duties were performed. (You may attach a separate sheet of paper to address this item) ______

Consider the following examples of specialized experience in financial and investigative areas: General accounting experience (e.g., bookkeeping with double entry set of books, accounts payable and accounts receivable, tax preparation, accounting paraprofessional); General investigative experience (e.g., private investigator, law enforcement/task force member, claims adjuster, claims examiner, investigative support personnel)

5. Please circle the statement that best describes your highest level of experience with respect to the above definitions of specialized experience in financial and investigative areas.(Please circle one answer) A. I have at least 2 years of full-time experience in at least one of the above financial and investigative areas. B. I have less than 2 years of full-time experience in at least one of the above financial and investigative areas. C. I do not have experience in any of the above financial and investigative areas.

4 2010 FCIP Questionnaire

5.1 Please tell us where and how you acquired this specialized experience. Be specific and provide us with a detailed description that includes the job you held, the duties you performed, and the length of time that these duties were performed. (You may attach a separate sheet of paper to address this item) ______

Provisions of Public Law 93-950 and Public Law 100-238 allow the imposition of a maximum age for original appointments to a law enforcement officer position within the Federal government. The date immediately preceding your 37th birthday is the final date of entry. This age restriction does not apply to those who have previously served in a Federal civilian (not military) law enforcement position covered by Title 5 U.S.C. Section 8336 (c) provisions. Also, if you are a preference eligible veteran, you may be eligible for this position after your 37th birthday; you will need to supply a copy of your DD-214 with your application.

6. Based on the age restriction information provided above, circle the answer that accurately describes your situation. A. I am under 37 years of age. B. I am 37 years of age or older. C. I am 37 years of age or older, but I have prior Federal civilian law enforcement experience covered by Title 5 U.S.C. Section 8336 c that will result in less than 37 years when the years of Federal civilian law enforcement service are subtracted from my current age. D. I am 37 years of age or older and am a preference eligible veteran. My DD-214 is attached.

7. What is your date of birth (mm/dd/yyyy)? ______

8. As a Special Agent, you will be required to routinely carry and maintain proficiency in using a firearm. Are you willing to assume this responsibility? Please circle the answer. A. Yes B. No

9. As a Special Agent, you may be called upon to protect yourself and others. During the course of these activities, you may be required to use deadly force with a firearm. Are you willing to assume this responsibility? Please circle the answer. A. Yes B. No

11. I am aware that I must pass the physical fitness standard test which will include the following five elements: o Vertical Jump of 12 inches o Bench Press of 51% of body weight or 90 lbs. o Agility Run in 20.3 seconds o 26 Sit Ups in a minute o 300 Meter Run in 82 seconds. Please circle the answer. A. Yes B. No

5 2010 FCIP Questionnaire

12. Please indicate the language(s) (other than English) in which you are PROFICIENT. You may be asked to demonstrate your proficiency through a bilingual assessment at some point in the hiring process. You must be able to speak, read, and write the selected language in order to be considered proficient in that language. (Please circle all that apply)

A. Arabic B. Cambodian C. Cantonese D. Chinese E. Farsi F. French G French Creole H. German I. Hindi J. Hmong K. Italian L. Japanese M. Korean N. Mandarin Chinese O. Polish P. Portuguese Q. Russian R. Somali S. Spanish T. Vietnamese U. Specify Other Language: ______V. None of the Above

All the information you provide may be verified by a review of the work experience and/or education as shown on your resume, by checking references and through other means, such as the interview process. Any exaggeration of your experience, false statements, or attempts to conceal information may be grounds for not hiring you, or for firing you after you begin work.

You will be disqualified from consideration if do not complete the questionnaire and/or not submitting your resume. All supporting documentation must be sent to the Internal Revenue Service, Cincinnati Employment Branch, 550 Main Street, Room 5015, Cincinnati, OH 45202 for proper consideration. For additional information, please contact Kevin Dallas at 513-263-3628 or at [email protected]

Supporting Documentation: In addition to submitting your resume and questionnaire, please submit the following forms if applicable: DD-214, Certificate of Release or Discharge from Active Duty, if claiming Veterans' Preference. Standard Form 15, Application for 10-Point Veterans' Preference and supporting documents. Official College Transcripts (copies will be accepted initially, however, prior to selection eligible applicants must submit official transcripts) Equivalency Evaluation from an accredited private organization of foreign education. CPA License SF-50

Thank you for your interest in employment with the Internal Revenue Service, Criminal Investigation Division.

______Applicant's Signature/Date

______Applicant's Name Printed 6