PROGRAMME SPECIFICATION TEMPLATE

Please see Guidance Notes in the Programme Approval Guidance for Programme Teams to assist in the completion of this template.

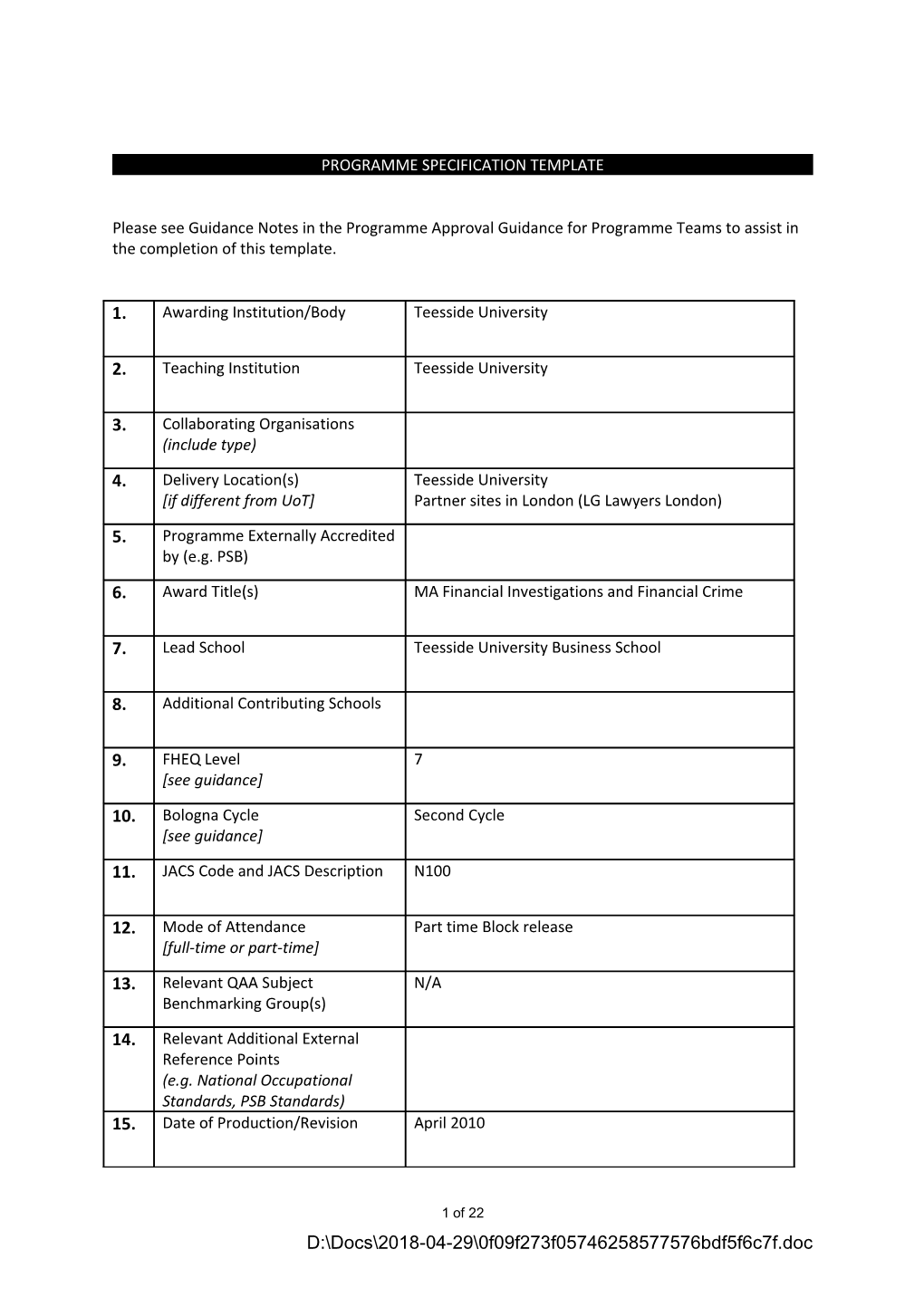

1. Awarding Institution/Body Teesside University

2. Teaching Institution Teesside University

3. Collaborating Organisations (include type) 4. Delivery Location(s) Teesside University [if different from UoT] Partner sites in London (LG Lawyers London) 5. Programme Externally Accredited by (e.g. PSB) 6. Award Title(s) MA Financial Investigations and Financial Crime

7. Lead School Teesside University Business School

8. Additional Contributing Schools

9. FHEQ Level 7 [see guidance] 10. Bologna Cycle Second Cycle [see guidance] 11. JACS Code and JACS Description N100

12. Mode of Attendance Part time Block release [full-time or part-time] 13. Relevant QAA Subject N/A Benchmarking Group(s) 14. Relevant Additional External Reference Points (e.g. National Occupational Standards, PSB Standards) 15. Date of Production/Revision April 2010

1 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc 16. Criteria for Admission to the EITHER [1]: Programme (if different from standard satisfactorily completed the full training requirement of ARA University criteria) as follows: Mandatory: FINANCIAL INVESTIGATION plus 2 from CONFISCATION; MONEY LAUNDERING; ENHANCED FINANCIAL INVESTIGATION. OR [2]:

satisfactorily completed PG Cert/Dip Anti Money Laundering (currently offered by Manchester University and CASS)

17. Educational Aims of the Programme

The overall aims of the programme are to:

The overall aim of the programme is to develop those working in a financial investigation environment and to improve the quality of investigations and investigation management as a specialist investigative and management function.

It will: Contribute to the professional, educational and personal development of participating students Enhance and extend the student’s knowledge of contemporary issues and practices in financial investigation and financial crime Develop depth of understanding of complex and sophisticated financial investigation and financial crime Provide a forum for debate, exchange and reflexivity which will support and strengthen student’s understanding and practice Develop the student’s awareness and skills in their own research, and in the evaluation of existing research 18. Learning Outcomes

The programme will enable students to develop the knowledge and skills listed below. Intended learning outcomes are identified for each category, together with the key teaching and assessment methods that will be used to achieve and assess the learning outcomes.

Knowledge and Understanding (insert additional rows as necessary) K1 Demonstrate a comprehensive and critical understanding of techniques/methodologies appropriate to their own research or advanced scholarship K2 Demonstrate originality in the application of knowledge, together with a practical understanding of how established techniques of research and enquiry are used to create and interpret knowledge in the discipline K3 Demonstrate a systematic and critical understanding of the breadth and depth of knowledge in the discipline of financial investigation and a critical awareness of current problems and/or new insights, much of which is aimed at, or informed by, the forefront of their academic discipline or area of professional practice

2 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc K4 Critically evaluate and select from a wide range of knowledge in the area.

K5 As appropriate to the field, has the awareness and ability to manage the implications of ethical dilemmas and work pro-actively with others to formulate solutions K6

Cognitive/Intellectual Skills (insert additional rows as necessary) C1 Able to integrate and synthesise diverse knowledge, evidence, concepts, theory and practice to promote understanding and/or good practice and solve foreseen and unforeseen problems C2 Able to make argued conclusions on the basis of incomplete and/or contested data

C3 Able to challenge orthodoxy and formulate new/alternative hypotheses or solutions C4

C5

C6

Practical/Professional Skills (insert additional rows as necessary) P1 Can operate in complex and unpredictable, possibly specialised, situations and has a critical understanding of the issues governing good practice P2 Act autonomously in planning and implementing tasks at a professional or equivalent level P3 Act ethically in a range of professional contexts

P4

P5

P6

Key Transferable Skills (insert additional rows as necessary) T1 Plan & Manage Own Learning

T2 Demonstrate the independent learning ability required for continuing professional development T3 Communicate complex academic or professional issues clearly to specialist and non-specialist audiences T4 Competent in the numeracy skills commensurate with the demands of research and scholarship in ways appropriate to the academic / professional context T5 Competent in the IT skills commensurate with the demands of research and scholarship in ways appropriate to the academic / professional context T6 Collaborate effectively with others in ways appropriate to the professional/academic context Pathway Specific Outcome for Pathway 1 [please give name], if applicable (insert additional rows as necessary) S1

3 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc S2

S3

S4

S5

S6

Pathway Specific Outcome for Pathway 2 [please give name], if applicable (insert additional rows as necessary) S1

S2

S3

S4

S5

S6

Pathway Specific Outcome for Pathway 3 [please give name], if applicable (insert additional rows as necessary) S1

S2

S3

S4

S5

S6

19. Key Learning & Teaching Methods

4 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc 20. Key Assessment Methods

5 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc 1. Programme Modules (additional copies to be completed for each named pathway) Level Non- Code Title Credits Status Compensatable Compensatable KNOWLEDGE DEVELOPMENT AND RESEARCH IN FRAUD AND 10 C FINANCIAL CRIME RESEARCH METHODS FOR FRAUD AND FINANCIAL CRIME 10 C FINANCIAL CRIME 20 C COMPANY STRUCTURES 20 O FINANCIAL INVESTIGATION AND ASSET RECOVERY 20 O TRENDS AND JURISDICTIONS 20 O BIN4009 MONEY LAUNDERING CONCEPTS AND PRACTICE 20 O

BIN4013 TERRORISM AND COUNTER TERRORIST FINANCE 20 O BIN4010 ORGANISED CRIME IN THE UK 20 O PRINCIPLES AND PRACTICE OF MANAGEMENT IN FINANCIAL CRIME 20 O DISSERTATION 60 C

6 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc 21. Programme Structure

Overview of structure of the modules across the Academic Year. The programme is delivered in two day blocks with preparatory materials and post meeting support provided through the VLE, emails and telephone communication.

Options will be chosen on entry (for year one and dependent on entry qualifications) and at the start of year 2.

Year 1 Knowledge Development and Research In Financial Crime Financial Crime Company Structures or Financial Investigation and Asset Recovery Research Methods for Financial Crime

Year 2 choose any three modules from Trends and Jurisdictions Money Laundering Concepts and Practice Terrorism and Counter Terrorist Finance Organised Crime in the UK Principles and Practice of Management In Financial Crime

Dissertation

Note that delivery is in two day bloc 22. Support for Students and Their Learning

The programme is structured in a way that ensures participants are immediately introduced to knowledge in the discipline and how to access that knowledge through the library. This module forms the basis for an induction programme tailored to the needs of students spending much of their time in employment and working away from the University. Key support mechanisms include Programme leader support Access to tutors and guest practitioners Electronic and telephone communication with tutors prior to and following contact sessions. Access to University e-journals Special borrowing arrangements Communication with DISSC and other learning support materials. VLE support using Blackboard. Contact with NPIA named manager

7 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc 23. Distinctive Features

The programme is the only one offering academic and professional development in financial investigations in the UK. The programme provides participants with an award that enables them to make a contribution to their organisation at managerial level. The programme provides contact with practitioners at all stages. Practitioners, where appropriate, are willing to make direct contact with students and give guidance support and advice. The programme enables practitioners in a specialist field to contact peers to give mutual support.

8 of 22 D:\Docs\2018-04-29\0f09f273f05746258577576bdf5f6c7f.doc