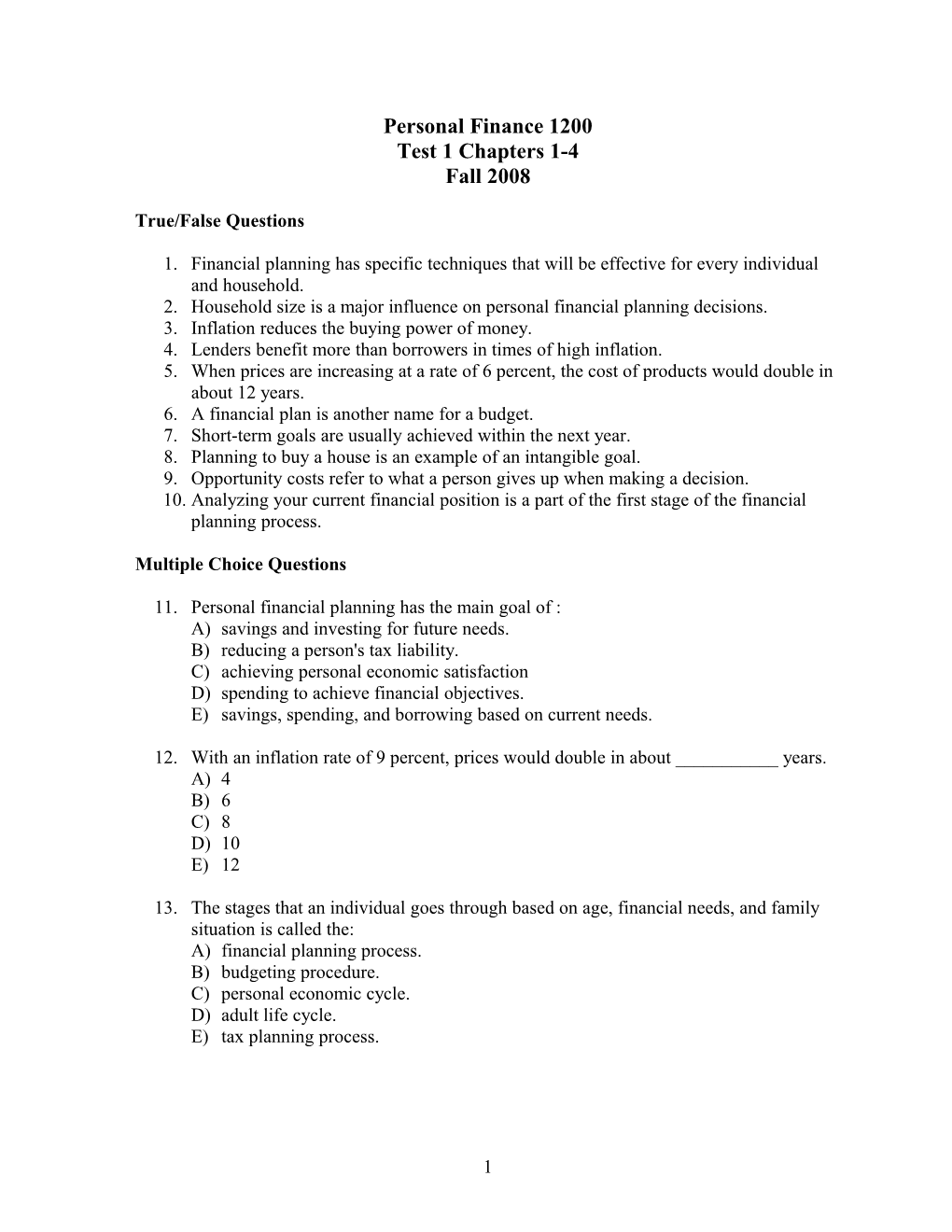

Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008

True/False Questions

1. Financial planning has specific techniques that will be effective for every individual and household. 2. Household size is a major influence on personal financial planning decisions. 3. Inflation reduces the buying power of money. 4. Lenders benefit more than borrowers in times of high inflation. 5. When prices are increasing at a rate of 6 percent, the cost of products would double in about 12 years. 6. A financial plan is another name for a budget. 7. Short-term goals are usually achieved within the next year. 8. Planning to buy a house is an example of an intangible goal. 9. Opportunity costs refer to what a person gives up when making a decision. 10. Analyzing your current financial position is a part of the first stage of the financial planning process.

Multiple Choice Questions

11. Personal financial planning has the main goal of : A) savings and investing for future needs. B) reducing a person's tax liability. C) achieving personal economic satisfaction D) spending to achieve financial objectives. E) savings, spending, and borrowing based on current needs.

12. With an inflation rate of 9 percent, prices would double in about ______years. A) 4 B) 6 C) 8 D) 10 E) 12

13. The stages that an individual goes through based on age, financial needs, and family situation is called the: A) financial planning process. B) budgeting procedure. C) personal economic cycle. D) adult life cycle. E) tax planning process.

1 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008

14. Some savings and investment choices have the potential for higher earnings. However, these may also be difficult to convert to cash when you need the funds. This problem refers to: A) Inflation risk B) Interest rate risk C) Income risk D) Personal risk E) Liquidity risk

15. The ability to convert financial resources into usable cash with ease is referred to as: A) bankruptcy. B) liquidity. C) investing. D) saving. E) opportunity cost.

16. A formalized report that summarizes your current financial situation, analyzes your financial needs, and recommends a direction for your financial activities is a(n): A) insurance prospectus. B) financial plan. C) budget. D) investment forecast. E) statement.

17. As Jean Tyler plans to set aside funds for her young children's college education, she is setting a(n) ______goal. A) intermediate B) long-term C) short-term D) intangible E) durable

18. ______goals relate to personal relationships, health, and education. A) Durable-product B) Short-term C) Consumable-product D) Intangible-purchase E) Intermediate

2 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008 19. Brad Opper has a goal of "saving $50 a month for vacation." Brad's goal lacks: A) measurable terms. B) a realistic perspective. C) specific terms. D) the type of action to be taken. E) a time frame.

20. Which of the following goals would be the easiest to implement and measure its accomplishment? A) "Reduce our debt payments." B) "Save funds for an annual vacation." C) "Save $100 a month to create a $4,000 emergency fund." D) "Invest $2,000 a year for retirement."

21. Opportunity cost refers to: A) money needed for major consumer purchases. B) the trade-off of a decision. C) the amount paid for taxes when a purchase is made. D) current interest rates. E) evaluating different alternatives for financial decisions.

22. The time value of money refers to: A) personal opportunity costs such as time lost on an activity. B) financial decisions that require borrowing funds from a financial institution. C) changes in interest rates due to changes in the supply and demand for money in our economy. D) increases in an amount of money as a result of interest. E) changing demographic trends in our society.

23. The amount of interest is determined by multiplying the amount in savings by the: A) annual interest rate. B) time period. C) number of months in a year. D) time period and number of months. E) annual interest rate and the time period.

24. If a person deposited $50 a month for 6 years earning 8 percent, this would involve what type of computation? A) simple interest B) future value of a single amount C) future value of a series of deposits D) present value of a single amount E) present value of a series of deposits

3 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008

25. If you put $1,000 in a saving account and make no further deposits, what type of calculation would provide you with the value of the account in 20 years? A) future value of a single amount B) simple interest C) present value of a single amount D) present value of a series of deposits E) future value of a series of deposits

Chapter 2 Financial Aspects of Career Planning

True/False Questions

26. A job tends to have less of a long-term commitment to a field than a career. 27. Very little evidence exists that a person's choice of employment influences his or her lifestyle. 28. Certain careers increase and decrease in demand based on changes in interest rates. 29. Education, training, and the demands for a person's skills are major influences on salary. 30. A cafeteria-style employee benefits program allows a person to select the items that are most needed. 31. A tax-exempt employee benefit is usually more advantageous than a tax-deferred benefit. 32. The purpose of a cover letter is to determine if a company has jobs available.

Multiple Choice Questions

33. Compared to a job, a career: A) is often less financially rewarding. B) requires minimum training. C) demands regular updating of knowledge. D) has limited opportunities for advancement.

34. Natural abilities that people possess are: A) interests. B) aptitudes. C) attitudes. D) survival skills. E) occupation techniques.

4 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008

35. The abilities to work well with numbers, possess problem-solving skills, and have physical dexterity are examples of: A) interests. B) survival skills. C) aptitudes. D) occupational attitudes. E) on-the-job training.

36. To assess the current value of a lump-sum retirement benefit that will be received in 10 years, use the ______calculation. A) present value of annuity B) present value of a single amount C) future value of an annuity D) future value of a single amount

37. Barb Hotchkins is in the 28 percent tax bracket. A tax-exempt employee benefit with a value of $500 would have a tax-equivalent value of: A) $694. B) $528. C) $500. D) $360. E) $140.

38. Tax-deferred employee benefits are A) not subject to federal income tax. B) not subject to state income tax. C) taxed at some future time. D) are taxed at a special rate.

Chapter 3 Money Management Strategy: Financial Statements and Budgeting

True/False Questions 39.Opportunity costs are only associated with money management decisions involving long- term financial security. 40.Financial records that may need to be referred to on a regular basis should be kept in a safe-deposit box. 41.A budget is a record of how a person or family has spent their money. 42.A personal balance sheet reports your income and expenses.

5 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008 43. A person’s net worth is the difference between the value of the items owned and the amounts owed to others. 44.Furniture, jewelry, and an automobile are examples of liquid assets. 45.Current liabilities are amounts that must be paid within a short period of time, usually less than a year. 46.A personal cash flow statement presents income and outflows of cash for a given time period, such as a month. 47.Take-home pay is a person's earnings after deductions for taxes and other items. 48.Medical expenses, clothing, and telephone are examples of fixed expenses. 49.If expenses for a month are greater than income, an increase in net worth will result. 50.If budgeted spending is less than actual spending, this is referred to as a deficit. 51.“Pay yourself first" is an attitude that can assure building savings for the future.

Multiple Choice Questions

52.Opportunity costs refers to: A) current spending habits. B) changing economic conditions that affect a person's cost of living. C) storage facilities to make financial documents easily available. D) trade-offs associated with financial decisions. E) avoiding the use of consumer credit. 53. A home file should be used for: A) storing all financial documents and records. B) financial records for current needs. C) documents that require maximum security. D) obsolete financial documents. E) records that are difficult to replace. 54.Which of the following are considered to be personal financial statements? A) Budget and credit card statements B) Balance sheet and cash flow statement C) Checkbook and budget D) Tax returns E) Bank statement and savings passbook 55. A personal balance sheet presents: A) amounts budgeted for spending. B) income and expenses for a period of time. C) earnings on savings and investments. D) items owned and amounts owed. E) family financial goals.

6 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008 56. A family with $45,000 in assets and $22,000 of liabilities would have a net worth of: A) $45,000. B) $23,000. C) $22,000. D) $67,000. E) $41,000.

57 Items that you own with a monetary worth are referred to as: A) liabilities. B) variable expenses. C) net worth. D) income. E) assets. 58. An individual retirement account is an example of a(n) ______asset. A) liquid B) common C) investment D) household E) budgeted 59 Current liabilities differ from long-term liabilities based on: A) the amount owed. B) the financial situation of the creditor. C) the interest rate charged. D) when the debt is due. E) current economic conditions. 60 A cash flow statement (income statement) reports a person's or a family's: A) net worth. B) current income and payments. C) plan for spending. D) value of investments. E) balance of savings. 61 Total earnings of a person less deductions for taxes and other items is called: A) budgeted income. B) gross pay. C) net worth. D) total revenue. E) take-home pay.

7 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008 62 Payments that do not vary from month to month are ______expenses. A) fixed B) current C) variable D) luxury E) budgeted

63. Which of the following payments would be considered a variable expense? A) Rent B) An installment loan payment C) A mortgage payment D) A monthly parking fee E) A telephone bill 64. A decrease in net worth would be the result of: A) income greater than expenses for a month. B) expenses greater than income for a month. C) assets greater than expenses. D) increased earnings on the job. E) income and expenses equal for a month. 65. During the past month, Jennifer Ernet had income of $3,000 and had a decrease in net worth of $200. This means Jennifer's payments for the month were: A) $3,200. B) $3,000. C) $2,800. D) $200. 66. The payment items that should be budgeted first are: A) variable expenses. B) investment funds. C) fixed expenses. D) unplanned living expenses. 67. The difference between the amount budgeted and the actual amount is called a: A) financial plan. B) current liability. C) change in net worth. D) budget variance. E) variable living expense. 68. If a family planned to spend $370 for food during March but only spent $348, this difference would be referred to as a: A) surplus. B) deficit. C) fixed living expense. D) budget reduction. E) contribution to net worth.

8 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008 69. Katherine Kocher has determined the following information about her own financial situation. Her checking account is worth $850 and her savings account is worth $1200. She owns her own home that has a market value of $98,000 that has a mortgage balance of $72,000. She has furniture and appliances worth $12,000 and a home computer and laptop worth $3300. She has a car worth $12,500 with a car loan of $6,500. She has also purchased some stock worth $5,500 and she has a retirement account worth $38,550. What is the total value of her assets? A) $2,050 B) $98,000 C) $27,800 D) $44,050 E) $171,900

Chapter 4 Planning Your Tax Strategy

True/False Questions

70. .Taxes are only considered in financial planning activities in April. 71. The principal purpose of taxes is to control economic conditions. 72. An estate tax is imposed on the value of an individual's property at the time of his or her death. 73. Exemptions are expenses that a taxpayer is allowed to deduct from adjusted gross income. 74. A tax credit is an amount subtracted directly from the amount of taxes owed. 75. Most taxpayers have to file quarterly payments of estimated amounts owed for taxes. 76. The simplest federal tax return form is the 1040A. 77. The amount of a person's standard deduction is determined on Schedule A of Form 1040. 78. Tax avoidance refers to illegal actions to reduce one's taxes. 79. Interest paid on credit cards and charge accounts may be deducted from your taxes. 80. Tax-exempt income has a greater financial benefit than tax-deferred income. 81. Capital gains refer to profits from the sale of investments.

9 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008 Multiple Choice Questions

82. The main purpose of taxes is to: A) generate revenue for funding government programs. B) reduce the chances of inflation. C) create jobs. D) discourage use of certain goods and services. E) decrease competition from foreign companies. 83. Taxable income is used to compute a person's: A) exemptions. B) income tax. C) deductions. D) capital gains. E) exclusions. 84. Money not included in gross income is: A) a tax credit. B) an exemption. C) an exclusion. D) earned income. E) portfolio income. 85. An expense that would be included in the itemized deductions of a taxpayer is: A) travel to work. B) life insurance premiums. C) real estate property taxes. D) a driver's license fee. 86. A deduction from adjusted gross income for yourself, your spouse, and qualified dependents is: A) the standard deduction. B) a tax credit. C) an itemized deduction. D) an exclusion. E) an exemption. 87. Michele Barbour is considering an additional charitable contribution of $2,000 to a tax-deductible charity, bringing her total itemized deductions to $16,000. If Michelle is in a 28 percent tax bracket, how much will this $2,000 contribution reduce her taxes? A) nothing B) $560 C) $1,600 D) $2,000 E) $4,480

10 Personal Finance 1200 Test 1 Chapters 1-4 Fall 2008 88. A tax ______is an amount subtracted directly from the amount of taxes owed. A) credit B) exemption C) deduction D) exclusion E) shelter 89. A tax credit of $50 for a person in a 28 percent tax bracket would reduce a person's taxes by: A) $10. B) $28. C) $14. D) $50. E) $35. 90. Itemized deductions are recorded on: A) Form 1040A. B) Schedule A. C) Schedule B. D) Form 2106. 91. A person with a total tax liability of $4,350 and withholding of federal taxes of $3,975 would: A) receive a refund of $3,975. B) owe $4,350. C) owe $375. D) receive a refund of $4,350. E) receive a refund of $375. 92. The Roth IRA differs from the regular IRA in that: A) earnings on the account are tax free after five years. B) contributions may exceed $2,000. C) deposits must be in federally-insured accounts. D) funds are only to be used for education expenses. E) only self-employed workers can use this account.

11