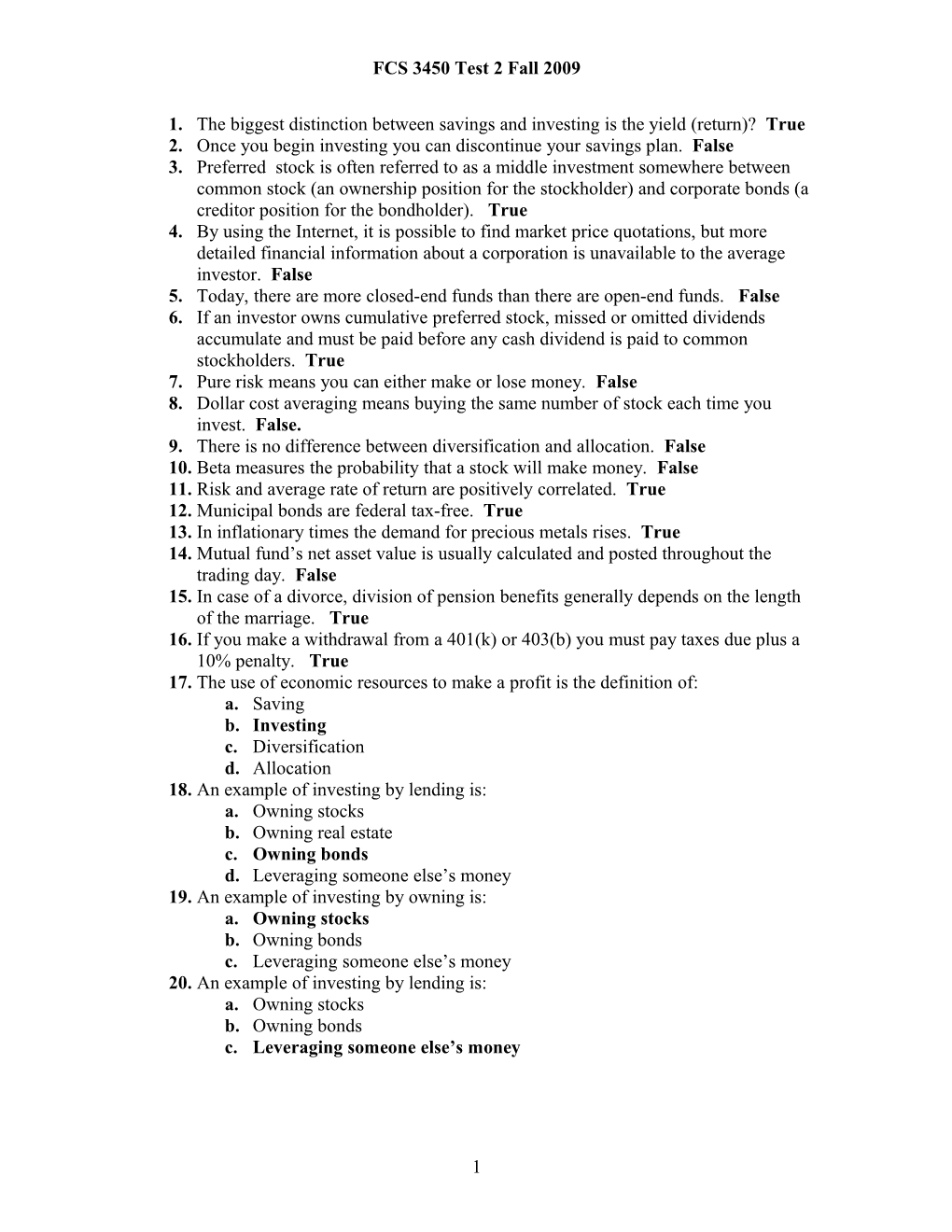

FCS 3450 Test 2 Fall 2009

1. The biggest distinction between savings and investing is the yield (return)? True 2. Once you begin investing you can discontinue your savings plan. False 3. Preferred stock is often referred to as a middle investment somewhere between common stock (an ownership position for the stockholder) and corporate bonds (a creditor position for the bondholder). True 4. By using the Internet, it is possible to find market price quotations, but more detailed financial information about a corporation is unavailable to the average investor. False 5. Today, there are more closed-end funds than there are open-end funds. False 6. If an investor owns cumulative preferred stock, missed or omitted dividends accumulate and must be paid before any cash dividend is paid to common stockholders. True 7. Pure risk means you can either make or lose money. False 8. Dollar cost averaging means buying the same number of stock each time you invest. False. 9. There is no difference between diversification and allocation. False 10. Beta measures the probability that a stock will make money. False 11. Risk and average rate of return are positively correlated. True 12. Municipal bonds are federal tax-free. True 13. In inflationary times the demand for precious metals rises. True 14. Mutual fund’s net asset value is usually calculated and posted throughout the trading day. False 15. In case of a divorce, division of pension benefits generally depends on the length of the marriage. True 16. If you make a withdrawal from a 401(k) or 403(b) you must pay taxes due plus a 10% penalty. True 17. The use of economic resources to make a profit is the definition of: a. Saving b. Investing c. Diversification d. Allocation 18. An example of investing by lending is: a. Owning stocks b. Owning real estate c. Owning bonds d. Leveraging someone else’s money 19. An example of investing by owning is: a. Owning stocks b. Owning bonds c. Leveraging someone else’s money 20. An example of investing by lending is: a. Owning stocks b. Owning bonds c. Leveraging someone else’s money

1 FCS 3450 Test 2 Fall 2009

21. Cindy Scymanski purchased 100 shares of Gleason Systems stock for $42.50 per share. Her commission for this purchase was $35. She sold the stock two years later for $55 per share and a commission of $50. While she held the stock it paid a dividend of $1.50 per share. What was Beverly's total dollar return on this stock? A. $1,250 B. $1,165 C. $150 D. $1,315 E. $1,400 22. Patty Hoskins owns 220 shares of General Mills Corporation. For the last calendar quarter, General Mills Corporation paid a dividend of $0.47 a share. What is the total amount she received in her dividend check for this quarter? A. $0.47 B. $47 C. $94 D. $103.40 E. It is impossible to calculate the total dividend amount with this information. 23. Jo Bower owns 150 shares of Data General stock. She purchased the stock for $24 a share. She sold her stock for $30 a share. The commissions required to buy and sell her stock totaled $120. Assuming that she received no dividends during the time she owned the stock, what is her total return for this transaction? A. $600 B. $780 C. $900 D. $2,400 E. $3,000 24. A stock that remains stable during declines in the economy is called a(n) ______stock. A. defensive B. cyclical C. growth D. income E. blue-chip 25. The value of the mutual fund's portfolio minus the mutual fund's liabilities divided by the number of shares outstanding is called the: A. book value. B. outstanding balance. C. per share value. D. net asset value. E. accounting value.

2 FCS 3450 Test 2 Fall 2009

26. Assume you invest $3,000 in a mutual fund. Also assume the mutual fund pays you $50 dividends this year and that the mutual fun is worth $3,275 at the end of the year. What is your rate of return? a. 8.4% b. 9.9% c. 10.8% d. 0% 27. A fee that some investment companies charge for advertising and marketing a mutual fund is called a: A. 14A-1 fee. B. 12b-1 fee. C. 18-2 fee. D. 21-AB fee. E. None of these answers are correct. 28. Earnings from a Roth IRA may be withdrawn after the account is 5 years old and: a. After the investor is 50 years old. b. For the down payment on a secondary home. c. For higher education expenses for yourself, spouse, children or grandchildren. d. If you want to donate to a charity. e. All of the above 29. An investor can borrow from his/her 401(k) or 403(b) with the following restrictions: a. The interest must be repaid. b. If you change jobs you must pay the repay the loan immediately. c. If you default you must pay taxes due plus 10% penalty. d. All of the above 30. In Utah, if property transfer is not specified, the law assumes a. Joint tenancy with rights of survivorship b. Tenancy in common c. Joint tenancy with rights in common d. Every person for him/herself

3