Course Student Name: Course Number Section: University or College Professor’s Name

$Distribution Problem #5 Answers ( points)

Open the $Distribution module and look over the “Initial Income Distribution” data.

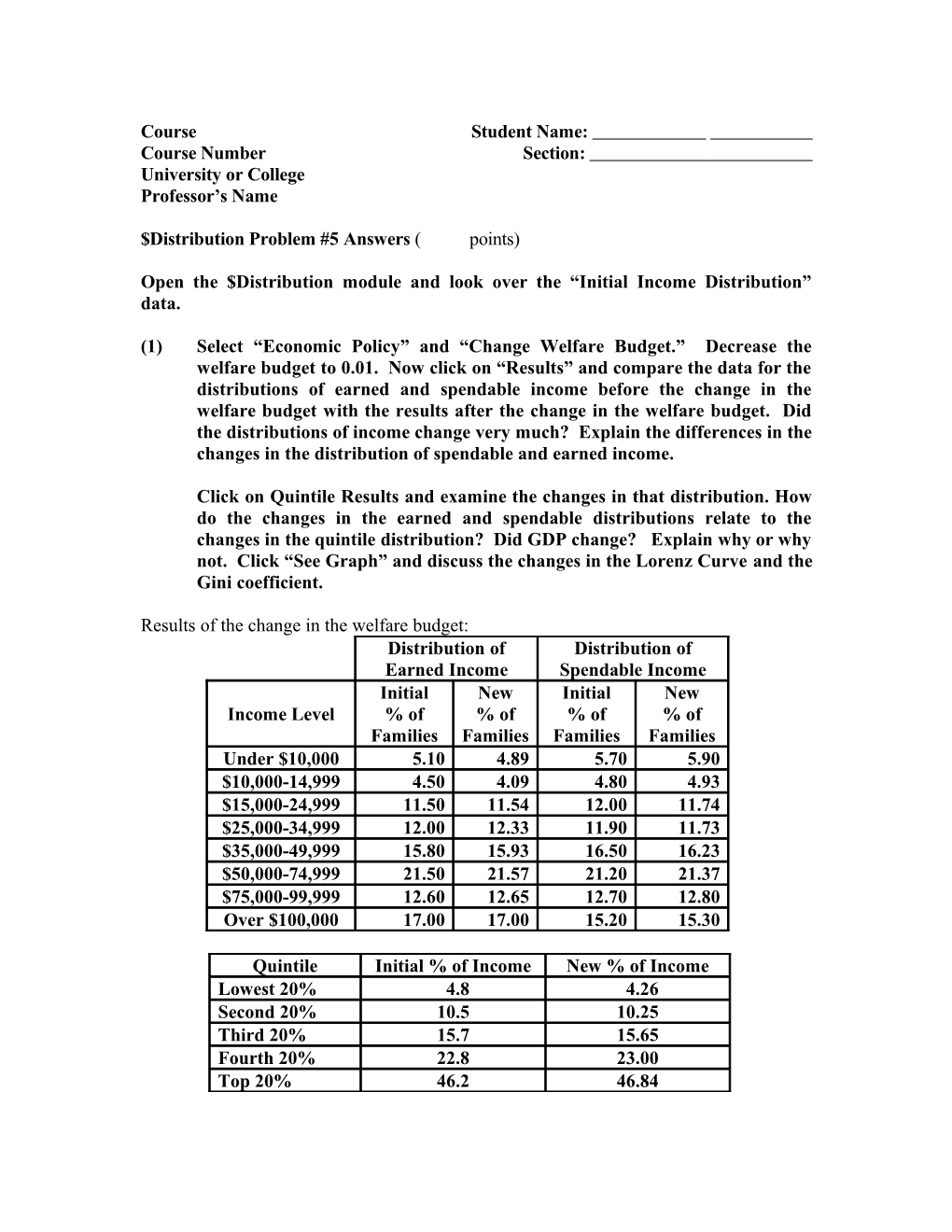

(1) Select “Economic Policy” and “Change Welfare Budget.” Decrease the welfare budget to 0.01. Now click on “Results” and compare the data for the distributions of earned and spendable income before the change in the welfare budget with the results after the change in the welfare budget. Did the distributions of income change very much? Explain the differences in the changes in the distribution of spendable and earned income.

Click on Quintile Results and examine the changes in that distribution. How do the changes in the earned and spendable distributions relate to the changes in the quintile distribution? Did GDP change? Explain why or why not. Click “See Graph” and discuss the changes in the Lorenz Curve and the Gini coefficient.

Results of the change in the welfare budget: Distribution of Distribution of Earned Income Spendable Income Initial New Initial New Income Level % of % of % of % of Families Families Families Families Under $10,000 5.10 4.89 5.70 5.90 $10,000-14,999 4.50 4.09 4.80 4.93 $15,000-24,999 11.50 11.54 12.00 11.74 $25,000-34,999 12.00 12.33 11.90 11.73 $35,000-49,999 15.80 15.93 16.50 16.23 $50,000-74,999 21.50 21.57 21.20 21.37 $75,000-99,999 12.60 12.65 12.70 12.80 Over $100,000 17.00 17.00 15.20 15.30

Quintile Initial % of Income New % of Income Lowest 20% 4.8 4.26 Second 20% 10.5 10.25 Third 20% 15.7 15.65 Fourth 20% 22.8 23.00 Top 20% 46.2 46.84 Total GDP = $10,025

The cut in benefits caused the percentage of families in the groups whose earned incomes ranged from $0 to $14,999 to decrease as some people who were getting benefits and lost them increase their work efforts and move up in earnings. The increased labor supply from these families also helps explain the increase in total GDP. Families in higher income groups had little if any change in their incentives, but the increase in production and profits led to some increases in income levels even for those not previously receiving benefits. Except at the very highest levels this led to increases in the percentage of families receiving the given ranges of income.

The cut in benefits also cause the percentage of families with very low spendable incomes to increase. Families whose benefits under the welfare system gave them spendable incomes above $10,000 now may have spendable incomes below that level even if they have increase their labor supply, and similarly some families losing benefits may move down from above $15,000 to below that level. At the same time, a larger percentage of families have moved up to upper income levels.

The Lorenz curve, like the quintile distribution, hardly changed at all. Most of the changes were within the various quintiles. The change in the Gini coefficient was very small, a decrease from 0.598 to 0.596 shows a very small increase in inequality.

(2) Click on “Back” until you reach the “Change Income Distribution” screen. Select the “Economic Policy” option then select “Change Income Tax Rates.” Enter the following tax rate schedule (from lowest quintile to highest quintile): 0.20, 0.20, 0.20, 0.20, and 0.20. What type of tax system is this, progressive, regressive or proportional? Explain. Click on “Results” and see what impact your new tax rate schedule had on the quintile distribution. First, compare this quintile distribution with the one in (1). Why do the two initial distributions differ? Discuss the changes in the distribution of income due to the change in tax structure. If the level of GDP changed, explain why it changed the way it did. Click “See Graph” and discuss the changes in the Lorenz Curve and the Gini coefficient.

Quintile Initial % of After Tax New % of After Tax Income Income Lowest 20% 5.2 4.3 Second 20% 11.6 9.9 Third 20% 17.2 15.6 Fourth 20% 23.6 22.8 Top 20% 42.4 47.4

Total GDP = $9,787

This is a proportional tax structure, with people at all levels of income paying the same percentage of their incomes in taxes. The initial distributions in (1) and (2) differ because

2 the quintile distribution in (1) is the distribution of before tax income, while the distribution in (2) is the distribution of after tax income.

The change from the previous, progressive tax system (higher income people pay higher tax rates) to a proportional system reduced the after tax incomes of those in the lowest quintiles (their tax rates went up)—reducing their shares of total income. The people in the fourth quintile experienced very little change in their tax rates, and their share of income changed very little. Those in the top quintile had a tax reduction so their share of total income rose. The effect of this type of tax change on total output (GDP) is ambiguous in principle. The increase in taxes on those in the lower quintiles should reduce their incentive to work and produce. On the other hand, the lower tax rates for those at the highest levels should increase their incentives and increase GDP. The overall effect on GDP in reality could be positive or negative, in this module the result is a decrease in GDP. (This analysis does not include the possible long run growth effects of lower tax rates on overall rate of savings and investment and, consequently, the effect on long run growth.)

The Lorenz curve changed very little since the distribution by quintiles did not change very much. This conclusion is supported by the Gini coefficient which did not change at all. However, looking at the individual values many would consider that key aspects of equality did decrease a little as a result of the tax change.

(3) Some in the United States have argued for a flat rate tax system where everyone pays the same rate with absolutely no deductions. What are the arguments for and against this idea given the results obtained in the last section?

As noted in (2) the degree of equality decreased. If equality is a goal the results in the module indicate the flat tax would move the country away from that goal. (Note that there was no explicit modeling of deductions, exemptions, and all the other complex aspects of the real tax system. The effects of such were simply absorbed into the overall tax rates for the various group.) The decrease in equality was accompanied in the module by a reduction in GDP, so the cost of a loss of equality was accompa- nied by an overall reduction in income. In this module a flat tax does not seem like a good idea (unless you are in the highest quintile). Whether this would be true in re- ality is another matter.

(4) Suppose you were an advocate of maximum economic efficiency and of having the government play the least possible role in determining outcomes in the economy. If you could get either the reduction in welfare payments or the change to a flat tax system that would you prefer?

An advocate of a minimal role for the government in determining economic outcomes would want to get both, but if forced to choose, the reduction in welfare benefits would look better. At least that change increases the level of output (and income) so the overall effect is an increase in economic activity.

3 (5) If you are not in favor of equality, but want the government to allow a greater degree of inequality based on market performance, which of these two measures would you prefer to see implemented?

There is no direct comparison between the effects of the two changes on distribution -- and the degree of government impact on economic outcomes. A comparison of share changes can be made (see below) but without additional information it is not possible to determine whether one change or the other promotes a result closer to what the distribution would be like in the absence of government intervention partly because there is no information as to what that distribution would be like, and partly because the two distributions are basically different. At the minimum it would be necessary to see the after tax distribution for the welfare change to make a good comparison.

Two comparisons:

The shares of the top two quintiles divided by the shares of the bottom two quintiles:

Tax Rates Welfare Change Before Change (42.4+23.6)/(11.6+5.2) = (46.2+22.8)/(10.5+4.8) = 3.93 4.51 After Change (47.4+22.8)/(9.9+4.3) = (46.84+23.0)/(10.25+4.26)= 4.94 4.81

By this measure the degree of inequality increased more for the tax change (3.93 to 4.94) than for the welfare change (4.51 to 4.81).

The share of the top quintile divided by the share of the bottom quintile:

Tax Rates Welfare Change Before Change 42.4 / 5.2 = 8.15 46.2 / 4.8 = 9.63 After Change 47.4 / 4.3 = 11.02 46.84 / 4.26 = 11.00

This measure also indicates the tax change had a larger effect on the degree of inequality.

4