Section VIII - Timekeeping Procedures (Also refer to: Attachment C to the Grant Agreement - Grant Provision 3 - Allowability of Costs; Subrecipients refer to: Attachment C to the Subagreement - Grant Provision 2).

Timesheets

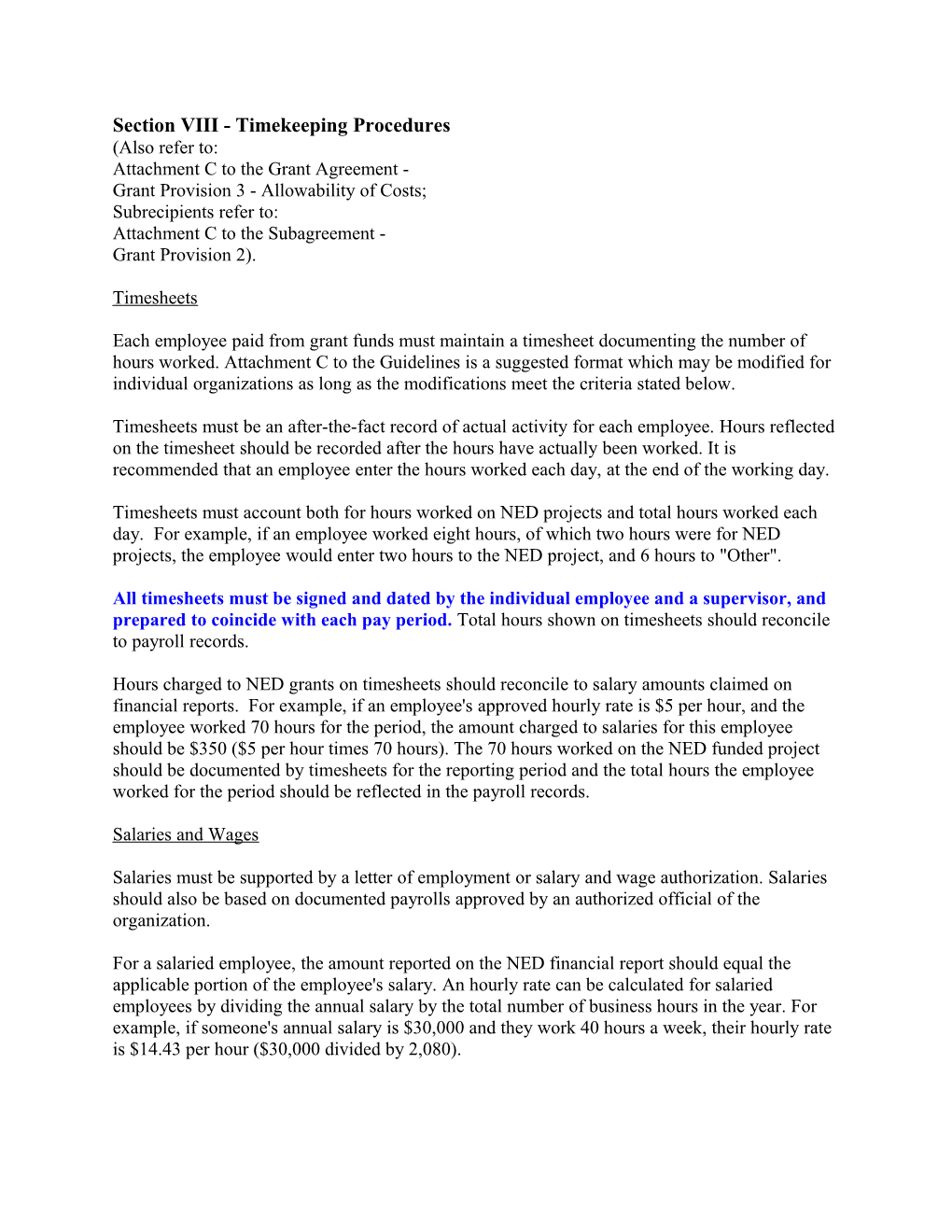

Each employee paid from grant funds must maintain a timesheet documenting the number of hours worked. Attachment C to the Guidelines is a suggested format which may be modified for individual organizations as long as the modifications meet the criteria stated below.

Timesheets must be an after-the-fact record of actual activity for each employee. Hours reflected on the timesheet should be recorded after the hours have actually been worked. It is recommended that an employee enter the hours worked each day, at the end of the working day.

Timesheets must account both for hours worked on NED projects and total hours worked each day. For example, if an employee worked eight hours, of which two hours were for NED projects, the employee would enter two hours to the NED project, and 6 hours to "Other".

All timesheets must be signed and dated by the individual employee and a supervisor, and prepared to coincide with each pay period. Total hours shown on timesheets should reconcile to payroll records.

Hours charged to NED grants on timesheets should reconcile to salary amounts claimed on financial reports. For example, if an employee's approved hourly rate is $5 per hour, and the employee worked 70 hours for the period, the amount charged to salaries for this employee should be $350 ($5 per hour times 70 hours). The 70 hours worked on the NED funded project should be documented by timesheets for the reporting period and the total hours the employee worked for the period should be reflected in the payroll records.

Salaries and Wages

Salaries must be supported by a letter of employment or salary and wage authorization. Salaries should also be based on documented payrolls approved by an authorized official of the organization.

For a salaried employee, the amount reported on the NED financial report should equal the applicable portion of the employee's salary. An hourly rate can be calculated for salaried employees by dividing the annual salary by the total number of business hours in the year. For example, if someone's annual salary is $30,000 and they work 40 hours a week, their hourly rate is $14.43 per hour ($30,000 divided by 2,080). TIMESHEET Attachment C

MONTH

NAME GRANT #

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 TOTAL

NED GRANT

OTHER HOURS

TOTAL HOURS

16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 TOTAL

NED GRANT

OTHER HOURS

TOTAL HOURS

Employee Signature ______Date______Supervisor’s Signature______Date______