1

Corporations Professor Bradford Fall 2007

Exam Answer Outline

The following answer outlines are not intended to be model answers, nor are they intended to include every issue students discussed. They merely attempt to identify the major issues in each question and some of the problems or questions arising under each issue. They should provide a pretty good idea of the kinds of things I was looking for. If you have any questions about the exam or your performance on the exam, feel free to contact me to talk about it.

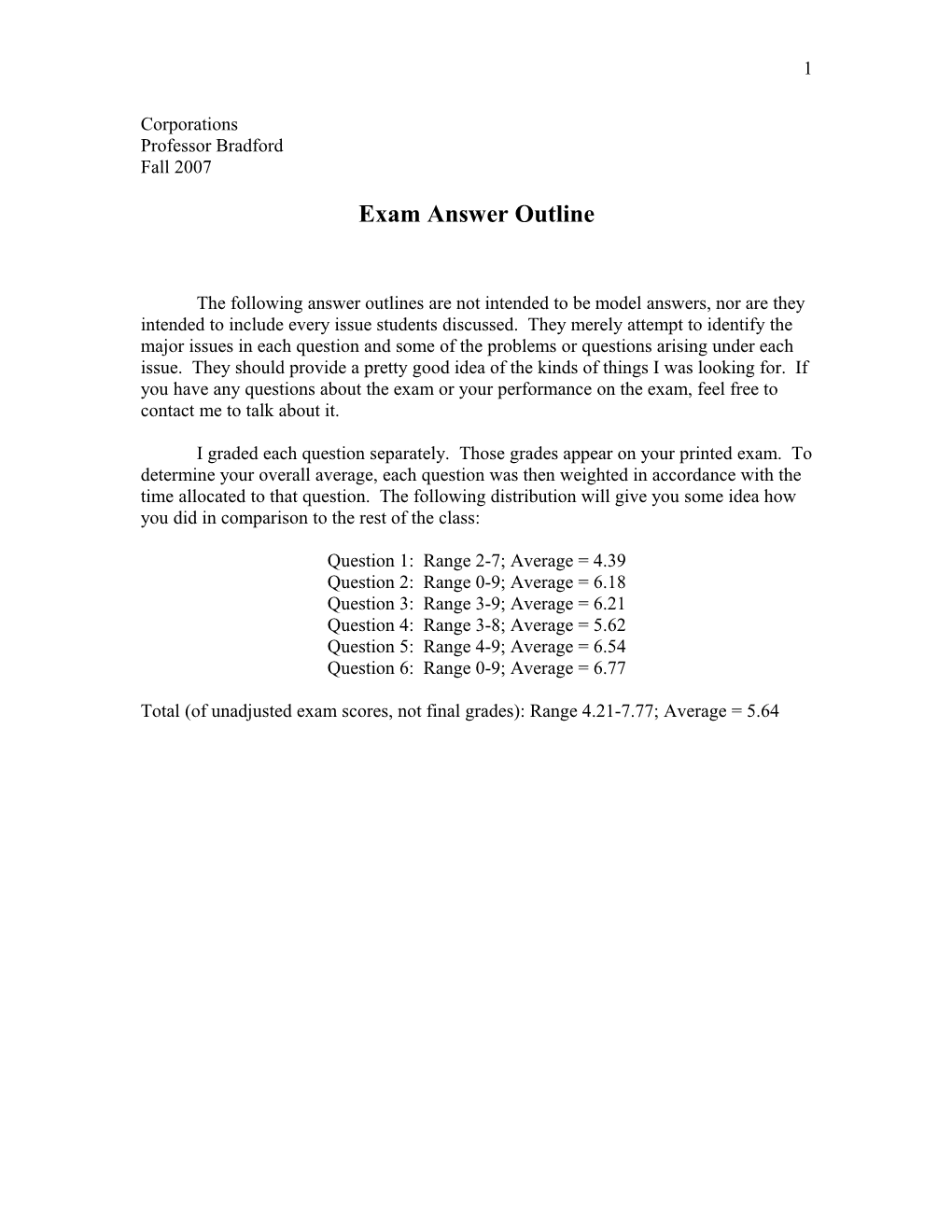

I graded each question separately. Those grades appear on your printed exam. To determine your overall average, each question was then weighted in accordance with the time allocated to that question. The following distribution will give you some idea how you did in comparison to the rest of the class:

Question 1: Range 2-7; Average = 4.39 Question 2: Range 0-9; Average = 6.18 Question 3: Range 3-9; Average = 6.21 Question 4: Range 3-8; Average = 5.62 Question 5: Range 4-9; Average = 6.54 Question 6: Range 0-9; Average = 6.77

Total (of unadjusted exam scores, not final grades): Range 4.21-7.77; Average = 5.64 2

Question One

Holder has several potential different types of liability in connection with its sale of Publix shares back to Publix.

Section 16(b)

Holder clearly is liable under § 16(b) of the Exchange Act. Publix is registered pursuant to section 12 of the Exchange Act, and Holder is a 10% beneficial owner of a class of equity securities. For a particular trade to be covered by § 16(b), Holder must have been a 10% beneficial owner immediately before the trade. Immediately before the Aug. 15 purchase, Holder owned 11% of Publix’s common stock (110,000 shares). Thus, this purchase falls within §16(b). Holder was also a 10% shareholder immediately before the Dec. 10 sale, so it also falls within § 16(b). Thus, there is a matching purchase and sale of the same equity security within 6 months and Holder is liable to Publix for any profit on that matching purchase and sale. The amount of the liability is $60 - $50 x 10,000 shares = $100,000. (The other 20,000 shares sold don’t match with any purchases in the six-month period.)

Insider Trading

Holder will not be liable under Rule 10b-5 for insider trading. Holder had nonpublic, inside information when he sold the stock back to Publix; it knew that the balance sheet overvalued the assets. However, Chiarella says there must be a breach of fiduciary duty for there to be liability under Rule 10b-5. Holder is not breaching any duty to the source of the information, Publix, because Publix knows Holder has the information. And the person who provided the information did not breach any duty that might create tippee liability because it wasn’t done for personal gain. It was done so Publix could buy back the shares. Because there is no breach of duty, there is no liability. Even if there were a breach of duty, there is no deception because the purchaser, Publix, already knew the information and that Holder was using it. See O’Hagan.

Duty of Controlling Shareholders

Donohue

Holder has no liability pursuant to the special, partnership-like fiduciary duty recognized in Donohue. Donohue says that, when a corporation repurchases stock from one shareholder, it has an obligation to purchase from other shareholders as well. However, this obligation applies only in a closely held corporation, where the selling shareholder is getting an opportunity to sell that wouldn’t be available to other shareholders. Here, Publix is a public corporation, and the other shareholders have a ready market for their stock (at the same price). Donohue doesn’t apply. 3

Sinclair

Some courts say that controlling shareholders (and their nominees on the board) owe fiduciary duties of loyalty to the other shareholders. See Sinclair v. Levien. If Holder controls Publix, then its sale to Publix is potential self-dealing and triggers fairness review.

Holder, which owns only 12% of Publix’s stock, does not appear to control Publix. And, if Holder does not control Publix’s board, there’s no conflict of interest that should concern us when Publix decides to repurchase the stock. This would be subject to ordinary business judgment review and Publix appears to have a valid business reason for the repurchase—to avoid a significant drop in the market price of its stock.

If Holder does control of Publix, then Holder would be liable unless Holder could show that the transaction is fair. Holder is receiving the same market price other shareholders would receive if they should their stock, an argument that the price is fair. However, based on Publix’s concerns about the price dropping, the trading at this market price may be thin. Holder would not have been able to sell all of its stock at this price, so Publix is giving it a greater price than it otherwise could have obtained. Thus, if Holder does have sufficient control to create a duty of loyalty issue, there’s at least an arguable claim that the price was not fair. The other element of fairness—fair dealing—is unclear here, as the question doesn’t indicate how the transaction was arranged.

Limits on Distributions

Holder does not appear to be liable for violating the restrictions on distributions in RMBCA § 6.40. A repurchase of stock is a distribution covered by § 6.40. See § 1.40(6). Therefore, it is allowed only if, after the distribution, the two tests in § 6.40(c) are met.

The first test appears to be met, as the directors believe Publix will still be able to pay its debts as they come due. Publix clearly has enough cash left to pay its short-term liabilities and the board believes it will be able to pay the note when it comes due in 15 years.

The second test also appears to be met. After the distribution, Publix’s total assets ($50 million) still exceed its total liabilities ($48 million). If you consider the market value of Publix’s assets ($47 million), that’s not true, but § 6.40(d) doesn’t say the board must take fair market values into account. It indicates the board may base its determination on either accepted accounting principles or a fair valuation. Assuming the financial statements comply with generally accepted accounting principles, the distribution is lawful. 4

Question Two

A distribution is a transfer of money or property from the business (Bell, LLC) to the members (the investors). See RULLCA § 102(5). In effect, the company is transferring part of its earnings to the investors. Those distributions aren’t automatic; it’s a management decision, and you can’t individually force the payment of a distribution.

The language in quotations relates to what happens when Bell’s management decides to make a distribution. The units you’re considering buying have a “$5.00/unit . . . distribution preference.” Before Bell can pay money to other members, it must first pay you and other people who own this type of investment $5 per unit.

That preference is “participating.” After Bell pays your $5.00 per unit, it can then pay money to other members, but you get to share in that payment as well. In other words, after your $5.00 per unit, you also receive the same amount per unit that everyone else does.

Finally, that preference is “cumulative.” If Bell doesn’t pay you $5.00 per unit this year, the amount it doesn’t pay carries over to the next year. Then, before they can make a distribution to anyone else, they have to pay you $10.00. If they don’t pay that, then it carries over and becomes $15.00 the next year. In other words, if Bell ever wants to make a distribution to the members, it is first going to have to pay you $5.00 for each year. 5

Question Three

Default Rules

In a manager-managed LLC such as this, except as otherwise provided in the Act, the manager has the exclusive right to make any decision “relating to the activities of the company.” RULLCA § 407(c)(1). However, even in a manager-managed company, the default rule is that the consent of all members is required to sell substantially all of the company’s property, outside the ordinary course of business. RULLCA § 407(c)(4)(A). Road Kill’s ordinary business is operating the restaurant, so a sale of all the restaurant’s assets is undoubtedly outside the ordinary course of its business. Thus, under the statute, Martin could not do this without the approval of the other members.

Effect of the Operating Agreement

The operating agreement governs as to questions concerning the rights of a manager. RULLCA § 110(a)(2). Section 110(c) specifies certain rules the operating agreement cannot change, but the rules in § 407 are not among those.

Road Kill’s operating agreement provides that the manager “has the right to make all business decisions on behalf of Road Kill.” Has that changed the default rule in RULLCA § 407(c)(4)(A)? The words “business decisions” might mean only decisions involving Road Kill’s ordinary business, which is to operate restaurants. Or it might include all decisions on Road Kill’s behalf, including the sale of all its assets. The language itself is unclear, so it might be appropriate to look at the intent of the members, if there is any evidence of that.

The Act’s default rules apply “to the extent the operating agreement does not otherwise provide for a matter.” RULLCA § 110(b). Absent any evidence of intent, one could argue that the default rule applies, because the agreement does not clearly otherwise provide. But is an interpretative rule favoring the default rules consistent with the idea in section 110 that one should look to the agreement first, and only use the default rules in the absence of any agreement to the contrary? 6

Question Four

Duty of Loyalty: Self-Dealing by Groucho

The first possible liability is Groucho’s potential breach of the duty of loyalty. This is clearly a self-dealing transaction. Groucho has a 40% interest in Krazy, which is contracting with Marx. Groucho clearly will benefit from any gain Krazy gets from this contract.

Del. § 144

This is the kind of transaction covered by Del. § 144. It’s a contract “between a corporation and any other corporation . . . in which one or more of its directors . . . have a financial interest.” Section 144(a)(1) says that transaction is not voidable, and presumably does not create liability, if Groucho discloses the materials facts about his interest and the transaction and the disinterested directors in good faith authorize it.

There is no question that the other three directors are disinterested, and Groucho disclosed all of the material facts when he provided the file, even though the board members didn’t pay attention to those facts. But approving the transaction, knowing that Groucho had a conflict of interest, without even looking at the file was probably not in good faith. Del. § 141(e) says board members may rely in good faith on information and opinions presented by the corporation’s officers, but surely it’s not good faith to rely solely on Groucho’s opinion when they know he has a conflict of interest. Therefore, the board’s approval probably is not protected by Del. § 144.

Fairness

Groucho may also avoid liability by showing that the transaction, at the time it was approved, was fair to the corporation. Del. § 144(a)(3). Fairness has two elements: (1) fair dealing and (2) fair price. Weinberger. The price might be fair, given the information Groucho has about other companies charging the same price for similar contracts (and the percentage-of-completion payment appears to be standard, so that’s fair). It’s not clear that there was fair dealing. The deal was negotiated by Anne, who’s Groucho’s assistant and therefore under his control. He has control over her employment, so can we really trust her to negotiate diligently against Krazy? Neither fair dealing nor fair price alone is determinative. HMG/Courtland Properties v. Gray. But Groucho has the burden of showing fairness, and it’s not clear he can meet his burden here.

Duty of Care

The self-dealing claim doesn’t make disinterested directors liable, but they are probably liable for a breach of the duty of care in approving the transaction. Van 7

Gorkom says they have a duty to inform themselves before making a decision, and they did almost nothing. They refused to review the materials Groucho had in his file, relying solely on his statement that the transaction was fair. As previously discussed, Del. § 141(3) probably would not protect reliance on a person who has a conflict of interest. This is similar to Van Gorkom itself, where the court refused to allow the directors to rely on another director who was himself uninformed.

Caremark Duty to Establish a Compliance System

The final question raised is whether the board is liable for Freddy’s theft of $5 million. No one on the board was aware of the theft, or had any suspicion about it. So the directors had no duty to inquire further. Graham v. Allis-Chalmers. However, Caremark says the board has a duty, even in the absence of any red flags, to establish a system to monitor and report wrongdoing.

The directors do not appear to have violated that duty here. They acted carefully and fully informed themselves when they established the system, and it appears to be a reasonable one. They haven’t had any problems in five years and Freddy succeeded only through a clever, unanticipated fraud.

Caremark says that, if the directors have established a corporate compliance system, the business judgment rule protects their determination of the parameters of that system, and they’re not liable just because wrongdoing slips through. The board appears to have acted in good faith, and this is not the kind of “sustained or systematic failure to exercise oversight” that Caremark says creates liability. 8

Question Five

Personal Liability

Leonard, Sheldon, and Raj, as partners of Geek, are jointly and severally liable for the obligations of the partnership, including this judgment. RUPA § 306(a).

Possible Exceptions to Personal Liability

There are two exceptions that might apply here. One is if Penny agreed not to hold one or more of them personally liable; the liability in § 306(a) does not apply if “otherwise agreed by the claimant.” The second possible exception is if one or more of the partners joined the partnership after the contractual obligation to Penny was incurred (not after the date of the judgment, but after the contract). In that case, that partner would not be liable, RUPA § 306(b), but the others still would be.

Judgment Against the Partners Individually

The judgment Penny has against the partnership is not sufficient to recover from the personal assets of the three partners. To recover from Leonard, Sheldon, or Raj individually, she must first obtain a judgment against them individually. RUPA § 307(c). That judgment should be relatively easy to obtain; the partnership is liable as a result of the judgment against it and § 306 therefore makes Leonard, Sheldon, and Raj liable. To obtain that judgment, Penny may sue all three partners in the same action. RUPA § 307(a).

Unable to Collect from the Partnership

Even after she has judgments against the individual partners, Penny usually may not levy execution on the partners’ individual assets unless she has first tried to collect from the partnership and the writ of execution is returned unsatisfied. RUPA § 307(d)(1). It is not enough that she thinks Geek will have insufficient assets to pay the entire judgment. She may, however, look to the partners’ assets first if Geek is in bankruptcy, if the partner in question agrees that she may, if she gets permission from a court to do so, or if the partner is individually liable independent from his status as partner (if, for example, he personally guaranteed the contract). RUPA § 307(d)(2),(3),(4). 9

Question Six

As an employee, Barney Fife clearly is an agent of Club Soda. However, that alone is not enough to make Club Soda liable for his negligent tort. A master can be liable for the torts of a servant, Restatement (Second) of Agency § 219, but is not usually liable for the torts of a non-servant. RSA § 250. Two issues must be resolved: (1) is Barney a servant of Club Soda?, and (2) If so, was Barney acting within the scope of his employment?

Servant or Independent Contractor?

Whether Barney is a servant depends on the extent to which he is subject to the principal’s “control or right to control” “with respect to the physical conduct of the services.” RSA § 220(1).

RSA § 220(2) lists a number of factors to help make this determination. Club Soda is in business, RSA § 220(2)(j); the work is part of Club Soda’s regular business, RSA § 220(2)(h); Barney is employed on a regular, although part-time basis, RSA 220(f); Barney is paid by the hour, RSA § 220(2)(g); the work is done on Club Soda’s premises, RSA § 220(e); and Barney is required to follow Club Soda’s extensive rules, RSA § 220(2)(a). All of these point towards a servant relationship. On the other hand, being a security guard is arguably a “distinct occupation,” RSA § 220(2)(b), and at least some of the work is often done without direct supervision. RSA § 220(2)(c). These point toward an independent contract relationship. On the whole, however, there seems to be a stronger argument that Barney is a servant.

Scope of Employment

Even if Barney is a servant, Club Soda is liable for Barney’s torts only if he was acting within the scope of employment. RSA § 219(1). None of the exceptions in § 219(2), providing for liability outside the scope of employment, appear to apply here.

Section 228(a) says that conduct is within the scope of employment only if four requirements are met. This is the kind of thing Barney was hired to perform. RSA § 228(1)(a). He was breaking up a fight. Force was used, but the use of force was not unexpected by Club Soda. RSA § 228(1)(d). Barney was specifically authorized to use force. Barney’s conduct was probably actuated in part by a desire to serve the master. RSA § 228(1)(c). Although not on Club property, these were undoubtedly patrons of the club, and Barney’s job was to maintain order among the patrons. The real issue is whether Barney’s conduct occurred “substantially within the authorized time and space limits.” RSA § 228(1)(b). It was within the authorized time limits, as Barney was on the job. However, it was not on Club property, but on the public sidewalk. The question is what “substantially” means. Section 228(2), which says the master is not liable, talks about conduct “far beyond” the authorized time or space limits. This is probably close enough, given that activity on the public sidewalk outside the club could clearly spill over 10 and affect the club. Therefore, Barney was probably acting within the scope of employment and Club Soda is liable for his negligence. RSA § 219(1).