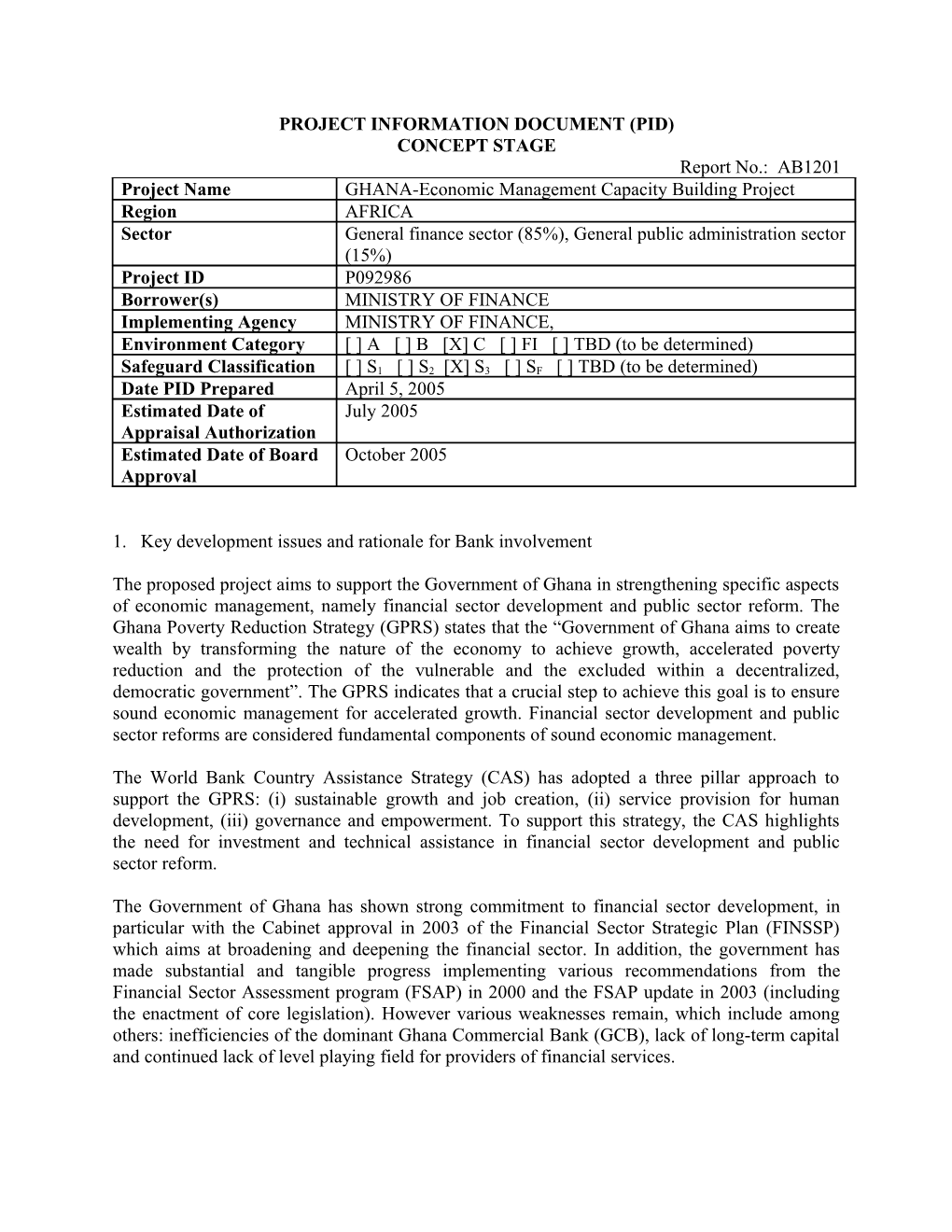

PROJECT INFORMATION DOCUMENT (PID) CONCEPT STAGE Report No.: AB1201 Project Name GHANA-Economic Management Capacity Building Project Region AFRICA Sector General finance sector (85%), General public administration sector (15%) Project ID P092986 Borrower(s) MINISTRY OF FINANCE Implementing Agency MINISTRY OF FINANCE, Environment Category [ ] A [ ] B [X] C [ ] FI [ ] TBD (to be determined)

Safeguard Classification [ ] S1 [ ] S2 [X] S3 [ ] SF [ ] TBD (to be determined) Date PID Prepared April 5, 2005 Estimated Date of July 2005 Appraisal Authorization Estimated Date of Board October 2005 Approval

1. Key development issues and rationale for Bank involvement

The proposed project aims to support the Government of Ghana in strengthening specific aspects of economic management, namely financial sector development and public sector reform. The Ghana Poverty Reduction Strategy (GPRS) states that the “Government of Ghana aims to create wealth by transforming the nature of the economy to achieve growth, accelerated poverty reduction and the protection of the vulnerable and the excluded within a decentralized, democratic government”. The GPRS indicates that a crucial step to achieve this goal is to ensure sound economic management for accelerated growth. Financial sector development and public sector reforms are considered fundamental components of sound economic management.

The World Bank Country Assistance Strategy (CAS) has adopted a three pillar approach to support the GPRS: (i) sustainable growth and job creation, (ii) service provision for human development, (iii) governance and empowerment. To support this strategy, the CAS highlights the need for investment and technical assistance in financial sector development and public sector reform.

The Government of Ghana has shown strong commitment to financial sector development, in particular with the Cabinet approval in 2003 of the Financial Sector Strategic Plan (FINSSP) which aims at broadening and deepening the financial sector. In addition, the government has made substantial and tangible progress implementing various recommendations from the Financial Sector Assessment program (FSAP) in 2000 and the FSAP update in 2003 (including the enactment of core legislation). However various weaknesses remain, which include among others: inefficiencies of the dominant Ghana Commercial Bank (GCB), lack of long-term capital and continued lack of level playing field for providers of financial services. The Government recognizes that its past efforts in Public Sector Reform have not had the desired impact reflected also in the World Bank’s self assessment of recent projects in Public Sector Reform. The CAS highlights that two of the main public sector issues are: (i) the current institutional setup in the public sector which is characterized by weak policy and implementation coordination among government ministries, subvented agencies and local governments; (ii) the competence and professionalism of the public service which remains inadequate. To tackle these issues, the Government decided in 2003 to refocus its strategy for public sector reform. To consolidate public sector reform efforts, oversight of the reform agenda was transferred to the office of the Senior Minister in early 2003. In June 2004, the office of the Senior Minister formally issued a Public Sector Strategy document “Towards a New Public Service for Ghana: a Working Document” to improve effectiveness, efficiency and accountability of the public sector. In February 2005, the government appointed a new Minister of State for Public Sector Reform to spearhead the reform agenda.

The GPRS has created the momentum for a significant group of donors to align their budgetary support under a common framework, the Multi-Donor Budgetary Support (MDBS), of which the PRSC is part. Through support to the implementation of FINSSP, the MDBS and the PRSC aim to diversify the financial sector and to improve access to financial services. The MDBS and the PRSC also intend to support the implementation of a refocused public sector reform. However, the MDBS and PRSC would support reforms at the policy level. There is therefore a need, as indicated in the CAS, for targeted capacity building operations to support government implementation of these reforms.

Considering the different stages at which the financial sector and public sector strategies stand, the project proposes a synchronized approach: on one side, it would support the implementation of FINSSP; on the other side, it would support the strengthening of the Public Sector Strategy document and the development of implementation plans. The FINSSP process would serve as role model for this exercise. FINSSP is the fruit of a long consultation process between the government and key stakeholders (including the World Bank, DFID and the IMF). This thorough consultation process has resulted in a high level of stakeholders’ ownership and commitment to the FINSSP strategy, both at the political and technical levels. This consultation process ultimately led to the adoption of a detailed implementation plan, with a timeline, supported by strong monitoring and evaluation mechanisms. The government recently finalized its Public Sector Strategy document. However, this strategy document has not yet benefited from the same level of stakeholders’ consensus and commitment as FINSSP.

2. Proposed objective(s)

The proposed project aims at supporting the government to define and perform its role as a facilitator for economic development. The project seeks to establish a level playing field in the finance sector focusing upon outcomes rather than institutions, together with a clear policy to improve the efficiency of public sector management for an enhanced service delivery (where institutions respond to the incentives available to them under the project). The project, through support to FINSSP, will seek to catalyze the allocation of capital to Ghanaians and improve competitiveness and governance of long term savings institutions and markets. The project aims to strengthen the Public Sector Strategy through providing a framework for prioritization, consensus building and budgeting and to translate the strategy into detailed action plans supported by a thorough monitoring and evaluation mechanism. While this project might support future implementation of any action plan through collaboration with Development Partners, any more substantive engagement would be covered through a supplemental operation. As such, the objective of the Public Sector component would be to facilitate a reform initiative in the public sector which would be comparable to that achieved through FINSSP in the financial sector in recent years. In addition, it is proposed to design this project component with an open architecture to maximize the involvement of interested Development Partners (DPs).

3. Preliminary description

The project focus will be on knowledge transfer, capacity enhancement and the promotion of best practice on an incremental basis with the understanding that the MDBS should be the appropriate mechanism for the support of recurrent costs.

Key potential areas aimed at improving service delivery capacity of the civil and public service may include: development of a professional HR framework, development of an effective performance related pay policy and reform of subvented agencies. However additional issues could be tackled, depending on the commitment of key stakeholders, including Development Partners.

The project will also support the implementation of FINSSP in the areas of capital markets, improvement of financial institution legal and regulatory environment, insurance regulatory reform and microfinance regulation and supervision strengthening as these represent the areas of most need for external support.

4. Safeguard policies that might apply No safeguard policies apply.

5. Tentative financing Source: ($m.) BORROWER/RECIPIENT 0 INTERNATIONAL DEVELOPMENT ASSOCIATION 20 DFID 8 Total 28

6. Contact point Guillemette Jaffrin Juan Costain Annette Minott Title: Young Professional Lead Financial Sector Specialist Information Assistant Tel: (202) 458 9794 (202) 473 9494 (202) 458 8633 Fax: (202) 477 6391 (202) 522 1145 (202) 477 6391 Email [email protected] [email protected] [email protected]