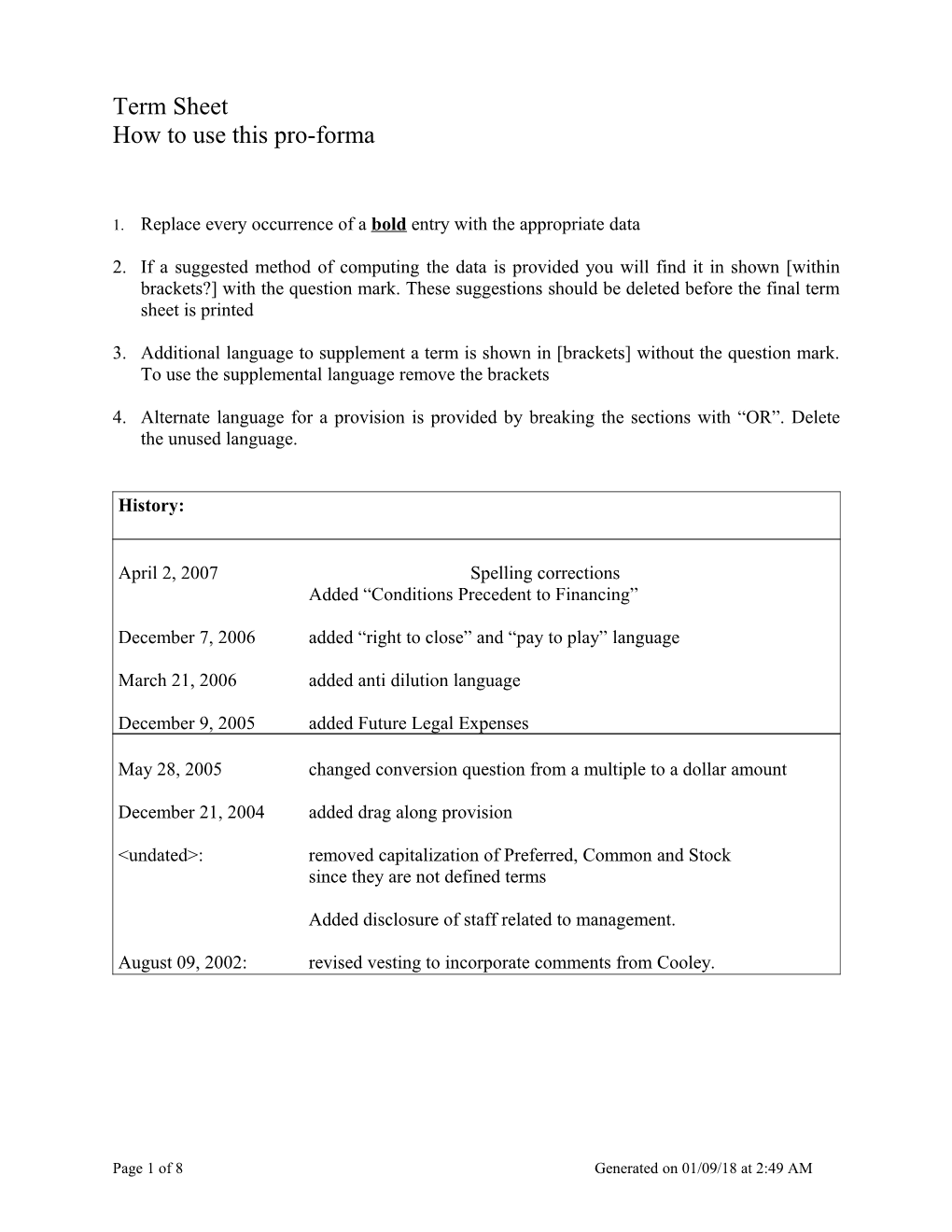

Term Sheet How to use this pro-forma

1. Replace every occurrence of a bold entry with the appropriate data

2. If a suggested method of computing the data is provided you will find it in shown [within brackets?] with the question mark. These suggestions should be deleted before the final term sheet is printed

3. Additional language to supplement a term is shown in [brackets] without the question mark. To use the supplemental language remove the brackets

4. Alternate language for a provision is provided by breaking the sections with “OR”. Delete the unused language.

History:

April 2, 2007 Spelling corrections Added “Conditions Precedent to Financing”

December 7, 2006 added “right to close” and “pay to play” language

March 21, 2006 added anti dilution language

December 9, 2005 added Future Legal Expenses

May 28, 2005 changed conversion question from a multiple to a dollar amount

December 21, 2004 added drag along provision

Added disclosure of staff related to management.

August 09, 2002: revised vesting to incorporate comments from Cooley.

Page 1 of 8 Generated on 01/09/18 at 2:49 AM This memorandum is issued by Alloy Ventures, Inc. and summarizes the principal terms of the financing of company name (the "Company") under which an investment is proposed. The following terms reflect our discussions in which we have expressed an interest in proceeding with negotiations for a proposed investment by us in company name. As such, it supercedes all prior discussions and written communications between us concerning the proposed transaction. Changes to this memorandum can only be made in writing by Alloy Ventures, Inc.

MEMORANDUM OF TERMS FOR PRIVATE PLACEMENT OF SERIES A PREFERRED STOCK OF company name

Security # of shares shares of Series A preferred stock (representing percentage of the total equity computed on a fully diluted basis)

Price per share $x.xx (“Original Issue Price”)

Proceeds amount

Purchaser Entities affiliated with Alloy Ventures, Inc.

Dividends 10% of Original Issue Price per share dividend, payable when and if declared by Board; dividends are not cumulative. For any other dividends or distributions, preferred stock participates with common stock on an as-converted basis.

Liquidation Preference In a liquidation or merger the preferred has a preference equal to 2 times the Original Issue Price plus accrued dividends. After payment of this, and any other preferences and accrued dividends, the common receives $x.xx per share. After that payment the remaining balance will be distributed on an as if converted basis.

OR

Series A shall be entitled to receive the Original Issue Price plus declared and unpaid dividends in preference to the common stock. Any remaining assets after payment of this, and any other preferences and accrued dividends, shall be distributed ratably to the holders of common and preferred, with holders of preferred participating on an as-converted basis [until the holders of the preferred stock have received a

Page 1 of 8 Generated on 01/09/18 at 2:49 AM combined amount equal to 3 times the Original Issue Price].

Conversion Rights Convertible on a one-for-one basis into shares of common stock subject to proportional adjustments for stock splits and stock dividends. Automatically converted into common stock (i) upon closing of a firmly underwritten public offering of common stock with net proceeds of at least $10,000,000 at a public offering price of at least $x per common share; (ii) upon the vote of 75% of the then outstanding Series A preferred stock, (iii) if less than 25% of Series A preferred stock remains outstanding.

Voting Rights Votes on an as-converted basis, but also has class vote as provided by law and on (i) the creation of any senior or pari passu security, or (ii) any transaction in which control of the Company is transferred, or (iii) any amendment to the Articles of Incorporation, or (iv) any increase or decrease in the number of members of the Board of Directors.

Representations and Warranties Standard representations and warranties. [Debt on closing not to exceed $]

Qualified Small Business Company to represent and warrant, with respect to s1202 of IRS code that (a) it is a qualified small business and that these shares will qualify as qualified small business stock, (b) it meets the active business requirement, and (c) it will use its best commercial efforts to not undertake redemptions which would cause the loss of the qualified small business stock status for these shares.

Registration Rights (a) Beginning earlier of date [a date 5 years from now?] or 180 days after initial registration, two demand registrations upon initiation by holders of 40% of outstanding preferred. Expenses paid by Company.

(b) Unlimited piggybacks subject to full pro rata cutback at the underwriter's sole discretion for the initial public offering and subject to a pro rata cutback to a minimum of 10% of the offering thereafter. Expenses paid by the Company.

(c) Unlimited S-3 registrations of at least amount provided, however the Company shall not be obligated

Page 2 of 8 Generated on 01/09/18 at 2:49 AM to effect more than two such S-3 registrations a year. Expenses paid by selling shareholders.

Financial Information Standard rights to annual financial statements with each Investor holding at least 25% of the Series A preferred stock initially sold (“Major Investor”) having the right to monthly financial information, capitalization summary and annual budget as well as standard inspection rights.

Board of Directors seven authorized directors, with five initial members:

Management Company to represent that no member of the Company management is related by blood, marriage, legal adoption, guardianship or other legally authorized custodial relationship to any board member or employee of the company.

Right of First Refusal Each Major Investor shall be entitled to purchase a portion of each subsequent equity financing equal to the percentage of the outstanding stock held by such Major Investor, calculated on an as-if-converted basis.

Expenses Company to pay reasonable fees and expenses of one special counsel to the investors (up to $25,000).

Future Legal Expenses If requested by Investors holding at least 500,000 Shares and/or Conversion Stock (as adjusted for stock splits, stock dividends and recapitalizations after the date hereof) of Registrable Securities, the Company shall reimburse (i) up to $3,000 of the reasonable fees and expenses of one counsel selected by the Investors to review transaction documents on their behalf in connection with each future financing transaction of the Company involving gross proceeds to the Company of at least $1,000,000 and (ii) up to $30,000 of the reasonable fees and expenses of one counsel selected by the Investors to review transaction documents on their behalf in connection with any merger, acquisition or other change of control transaction involving the Company (other than equity financing transactions) or the sale or other transfer of all or substantially all of the Company’s assets.

Attorney Counsel to prepare customary documents (stock purchase agreement, co-sale agreement, investors rights agreement) with standard language at company expense.

Page 3 of 8 Generated on 01/09/18 at 2:49 AM Redemption The Series A preferred stock will not be redeemable.

Purchase Agreement The sale of the Series A preferred stock will be pursuant to a stock Purchase Agreement prepared by Company counsel with standard covenants and conditions, including those necessary to reflect this term sheet.

Proprietary agreements All employees and consultants have signed inventions and confidentiality agreements and all necessary intellectual property has been assigned to the Company. All new employees, consultants, advisors must sign appropriate and acceptable confidentiality and IP assignment agreements with the company.

Employee Vesting 25% vesting after the end of the first year of full-time employment; the balance in 36 equal monthly installments per month thereafter such that an option grant is fully vested 48 months from the date of the vesting commencement date (“Normal Vesting”). Unvested shares purchasable at the lower of cost or the fair market value at the time of repurchase upon termination of employment for any reason. [In the event that a Key Employee is terminated without cause within 12 months following a change in control of the company, the vesting of the Key Employee’s shares shall be accelerated by one year]. A “Key Employee” shall include all founders and executive officers of the Company with the title of Vice President or above.

Restrictions on Transfer No transfer allowed prior to vesting. Co-sale agreement with customary terms and conditions.

Market Stand-off Earlier of 180 days or the first day when the closing market price is 1.5x the IPO price; provided that all officers, directors and 1% stockholders are bound by the same lock-up.

Expiration date This term sheet expires at noon Pacific Time on date, unless accepted in writing by an authorized representative of the Company.

Right to Close In the event that a proposal of merger, consolidation or sale of the Company is received by the Company before the closing of the Series A Preferred Stock, the Purchaser will have the right, but not the obligation, to purchase the Series A Preferred Stock prior to the effective time of such merger or sale.

Page 4 of 8 Generated on 01/09/18 at 2:49 AM Finders Fees None

Drag Along If at any time on or after the 1 year anniversary of the closing, the holders of two-thirds of the preferred stock vote in favor of a liquidation event, the key employees and other holders of at least 1% of the outstanding shares of common stock agree to also vote in favor of, and to otherwise support, such liquidation event.

Anti Dilution None

OR

The conversion price of the Series A Preferred will be subject to a broad-based weighted average adjustment to reduce dilution in the event that the Company issues additional equity securities at a purchase price less than the applicable conversion price.

Pay to Play [Unless the holders of [__]% of the Series A elect otherwise,] on any subsequent [down] round all [Major] Investors are required to participate to the full extent of their participation rights, unless the participation requirement is waived for all [Major] Investors by the Board [(including vote of [a majority of] the Series A Director[s])]. All shares of Series A Preferred Stock of any [Major] Investor failing to do so will automatically [lose anti-dilution rights] [lose right to participate in future rounds] [convert to Common Stock and lose the right to a Board seat if applicable].

Conditions Precedent to Financing: This summary of terms is not intended as a legally binding commitment by Alloy Ventures, and any obligation on the part of Alloy Ventures is subject to the following conditions precedent:

1. Completion of legal documentation satisfactory to Alloy Ventures.

2. [Satisfactory completion of due diligence by Alloy Ventures, including, but not limited to, customer calls, personal reference checks and technical due diligence.]

State of Incorporation Delaware

Page 5 of 8 Generated on 01/09/18 at 2:49 AM Management Rights A Management Rights letter substantially in the form provided by Purchaser shall be executed by the Company and delivered to each Purchaser.

Confidentiality This term sheet and any related correspondence is to be held in strict confidence and is not to be disclosed to any party without the prior written approval of Alloy Ventures, Inc.

Page 6 of 8 Generated on 01/09/18 at 2:49 AM