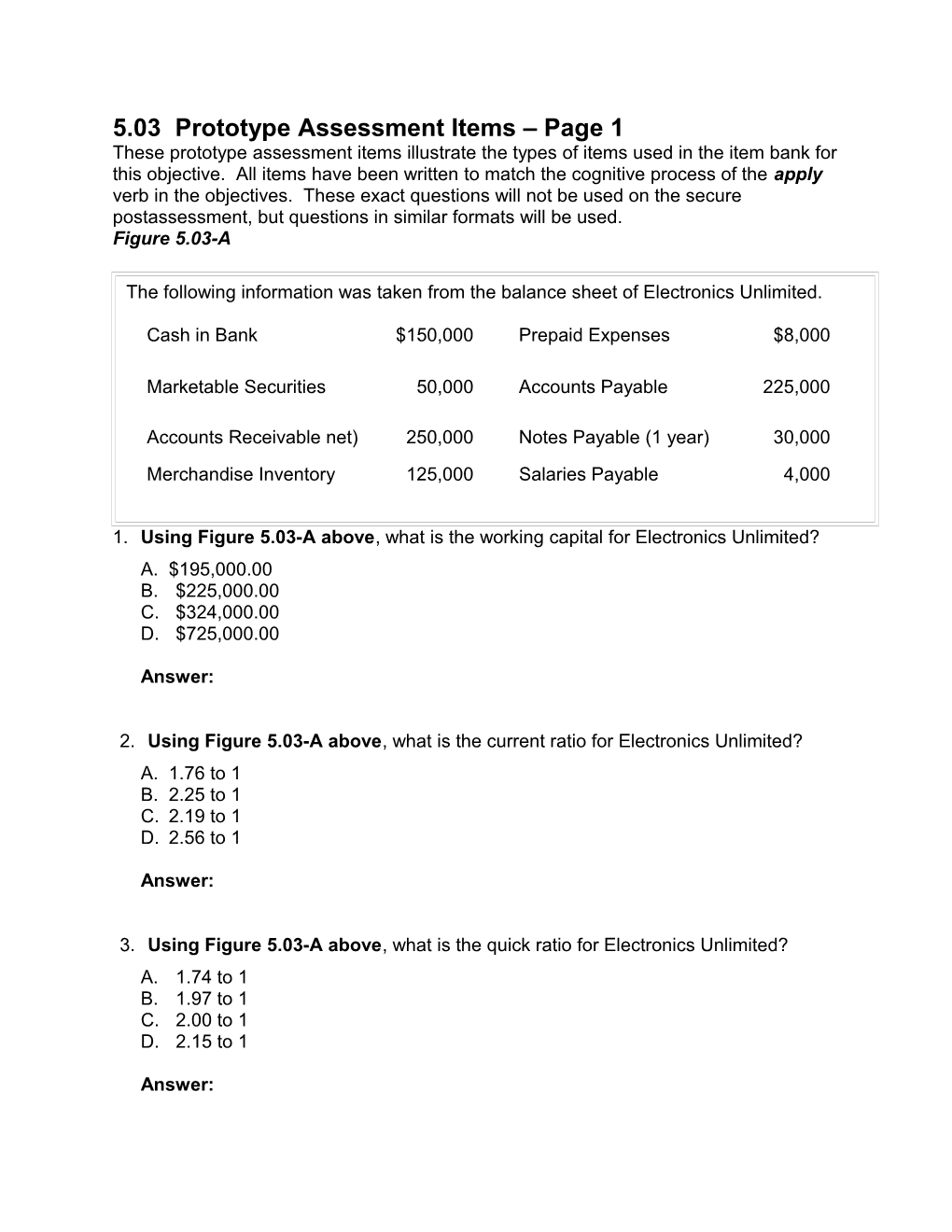

5.03 Prototype Assessment Items – Page 1 These prototype assessment items illustrate the types of items used in the item bank for this objective. All items have been written to match the cognitive process of the apply verb in the objectives. These exact questions will not be used on the secure postassessment, but questions in similar formats will be used. Figure 5.03-A

The following information was taken from the balance sheet of Electronics Unlimited.

Cash in Bank $150,000 Prepaid Expenses $8,000

Marketable Securities 50,000 Accounts Payable 225,000

Accounts Receivable net) 250,000 Notes Payable (1 year) 30,000 Merchandise Inventory 125,000 Salaries Payable 4,000

1. Using Figure 5.03-A above, what is the working capital for Electronics Unlimited? A. $195,000.00 B. $225,000.00 C. $324,000.00 D. $725,000.00

Answer:

2. Using Figure 5.03-A above, what is the current ratio for Electronics Unlimited? A. 1.76 to 1 B. 2.25 to 1 C. 2.19 to 1 D. 2.56 to 1

Answer:

3. Using Figure 5.03-A above, what is the quick ratio for Electronics Unlimited? A. 1.74 to 1 B. 1.97 to 1 C. 2.00 to 1 D. 2.15 to 1

Answer: 5.03 Prototype Assessment Items – Page 2

Figure 5.03-B The following information was taken from the comparative income statement of Ryan’s Sporting Goods. 2010 2009 Merchandise Inventory, Jan. 1 $ 75,000 $65,000 Merchandise Inventory, Dec. 31 25,000 75,000 Cost of Merchandise Sold 225,000 200,000

4. Using Figure 5.03-B above, what is the merchandise inventory turnover rate for 2010 and 2009? A. 3.00 times in 2010; 3.08 times in 2009 B. 9.00 times in 2010; 2.67 times in 2009 C. 3.04 times in 2010; 4.25 times in 2009 D. 4.50 times in 2010; 2.86 times in 2009

Answer:

Figure 5.03-C The following information was taken from the comparative income statement of Grace’s Sock Stop. 2010 2009 Net Accounts Receivable, Jan. 1 $60,000 $45,000 Net Accounts Receivable, Dec. 31 50,000 60,000 Net Credit Sales 425,000 380,000

5. Using Figure 5.03-C above, what is the accounts receivable turnover rate for 2010 and 2009? A. 7.73 times for 2010; 7.24 times for 2009 B. 7.08 times for 2010; 8.44 times for 2009 C. 8.50 times for 2010; 6.33 times for 2009 D. 7.32 times for 2010; 7.67 times for 2009

Answer: 5.03 Prototype Assessment Items – Page 3

Figure 5.03-D The Stockholders’ Equity section of the balance sheet for WHS Corporation is shown below. The beginning stockholders’ equity amount was $275,000.00. Net income for the year was $75,000.00. The current market price of the stock is $25 per share.

Paid-In Capital: Common stock, $2 par (150,000 shares authorized; 100,000 shares outstanding) $200,000.00 Paid-In Capital in Excess of Par 25,000.00 Total Paid In Capital $225,000.00 Retained Earnings 75,000.00 Total Stockholders’ Equity $300,000.00

6. Using Figure 5.03-D above, what is the return (rate earned) on average common stockholders’ equity for WHS Corporation? A. 25.0% B. 26.1% C. 27.2% D. 33.0%

Answer:

7. Using Figure 5.03-D above, what is the earnings per share for WHS Corporation? A. $0.50 per share B. $0.75 per share C. $0.85 per share D. $1.60 per share

Answer: 5.03 Prototype Assessment Items – Page 4

Figure 5.03-E The following information was taken from the financial statements of Liza’s Boutique.

Total Assets, Jan 1 $250,000 Total Assets, Dec 31 $320,000 Net Sales $695,000 Net Income $135,000

8. Using Figure 5.03-E above, what is the return (rate earned) on average total assets for Liza’s Boutique? A. 42.2% B. 47.4% C. 54.0% D. 57.5%

Answer:

9. Using Figure 5.03-E above, what is the return (rate earned) on net sales for Liza’s Boutique? A. 19.4% B. 29.2% C. 45.2% D. 74.4%

Answer: 5.03 Prototype Assessment Items – Page 5

Figure 5.03-F

The following information was taken from the financial statements of Nutrition Universe. Property, plant and equipment (net) $250,000 Current Liabilities $15,000 Long-term liabilities $125,000 Stockholders’ Equity $ 150,000 Shares of common stock outstanding 10,000 shares

10. Using Figure 5.03-F above, what is the ratio of stockholders’ equity to liabilities for Nutrition Universe? A. 1.07 to 1 B. 1.20 to 1 C. 8.50 to 1 D. 10.0 to 1

Answer:

11. Using Figure 5.03-F above, what is the ratio of property, plant and equipment to long-term liabilities for Nutrition Universe? A. 1.67 to 1 B. 1.76 to 1 C. 1.79 to 1 D. 2.00 to 1

Answer:

12. Using Figure 5.03-F above, what is the equity per share for Nutrition Universe? A. $14.00 per share B. $15.00 per share C. $25.00 per share D. $39.00 per share

Answer: 5.03 Prototype Assessment Items – Page 6

Figure 5.03-G The following information was taken from the financial statements of William Fabrics. Current assets $175,000 Property, plant and equipment (net) $220,000 Current Liabilities $95,000 Long-term liabilities $215,000 Stockholders’ Equity $ 85,000 Shares of common stock outstanding 20,000 shares

13. Using Figure 5.03-G above, what is the equity ratio for William Fabrics?

A. 21.5% B. 38.6% C. 46.5% D. 48.5%

Answer:

14. Using Figure 5.03-G above, what is the debt ratio for William Fabrics?

A. 24.1% B. 54.4% C. 78.5% D. 97.7%

Answer: 5.03 Prototype Assessment Items – Page 7

Figure 5.03-H The following information was taken from the financial statements of CCM Corporation. Cash $30,000 Accounts Receivable $75,000 Prepaid Insurance $5,000 Merchandise Inventory $25,000 Property, Plant & Equipment $125,000 Accounts Payable $30,000 Accrued Salaries $6,000 Note Payable-Current $5,000 Note Payable-Long-term $75,000 Capital Stock $10,000 Retained Earnings $135,000

13. Using Figure 5.03-H above, what is the working capital for CCM Corporation? A. $69,000 B. $89,000 C. $94,000 D. $144,000

Answer: