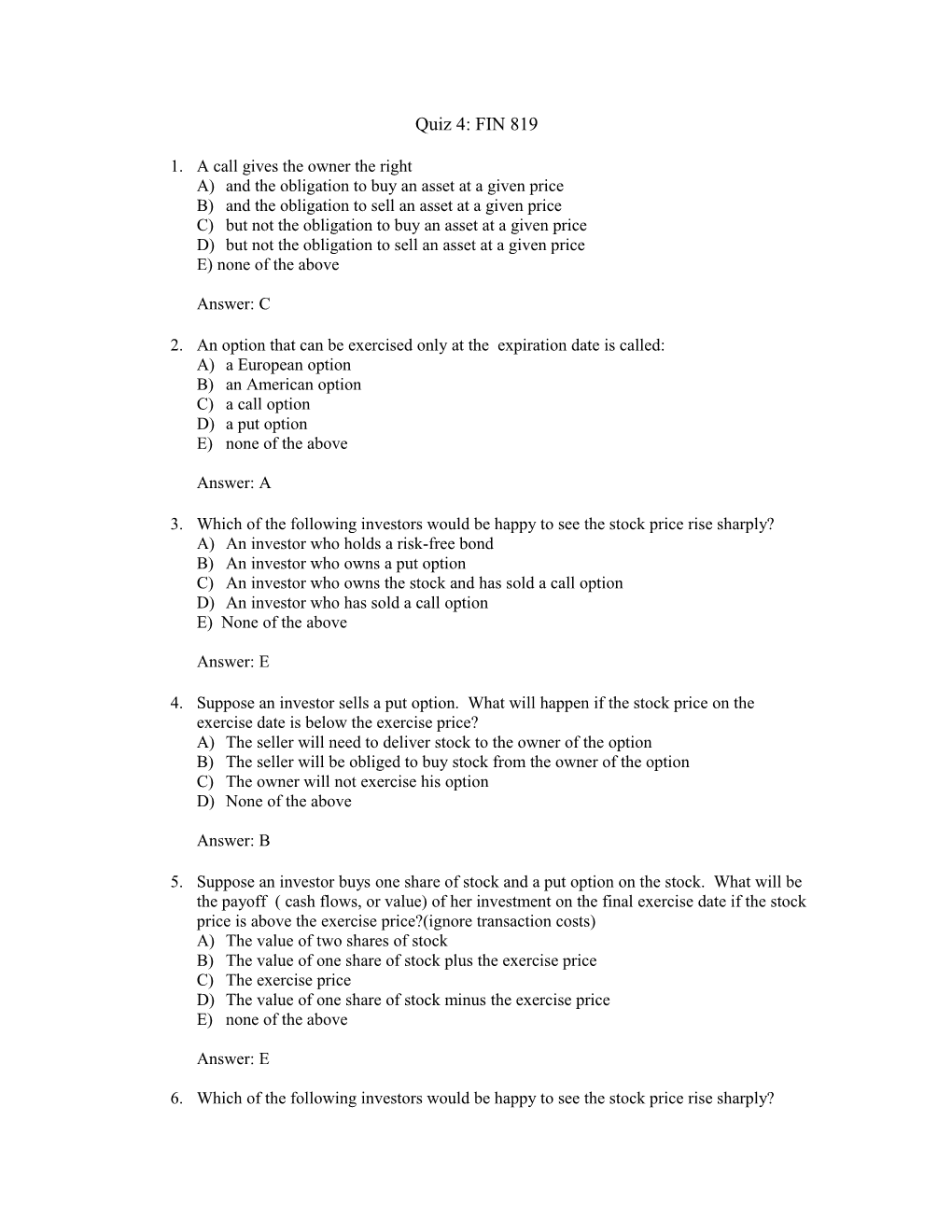

Quiz 4: FIN 819

1. A call gives the owner the right A) and the obligation to buy an asset at a given price B) and the obligation to sell an asset at a given price C) but not the obligation to buy an asset at a given price D) but not the obligation to sell an asset at a given price E) none of the above

Answer: C

2. An option that can be exercised only at the expiration date is called: A) a European option B) an American option C) a call option D) a put option E) none of the above

Answer: A

3. Which of the following investors would be happy to see the stock price rise sharply? A) An investor who holds a risk-free bond B) An investor who owns a put option C) An investor who owns the stock and has sold a call option D) An investor who has sold a call option E) None of the above

Answer: E

4. Suppose an investor sells a put option. What will happen if the stock price on the exercise date is below the exercise price? A) The seller will need to deliver stock to the owner of the option B) The seller will be obliged to buy stock from the owner of the option C) The owner will not exercise his option D) None of the above

Answer: B

5. Suppose an investor buys one share of stock and a put option on the stock. What will be the payoff ( cash flows, or value) of her investment on the final exercise date if the stock price is above the exercise price?(ignore transaction costs) A) The value of two shares of stock B) The value of one share of stock plus the exercise price C) The exercise price D) The value of one share of stock minus the exercise price E) none of the above

Answer: E

6. Which of the following investors would be happy to see the stock price rise sharply? A) Investor who owns the stock and a put option B) Investor who has sold a put option and bought a call option C) Investor who owns the stock and has sold a call option D) Investor who has sold a call option E) A and B

Answer: E

7. The buyer of a call option has the choice to exercise, but the writer of the call option has: A) The choice to offset with a put option B) The obligation to deliver the shares at exercise C) The choice to deliver shares or take a cash payoff D) The choice of exercising the call or not E) none of the above

Answer: B

8. Buying a call option and investing the present value of the exercise price in T-bills (risk- free securities) is the same as: A) Buying a call and a put B) Buying a put and a share C) Selling a put D) Selling a call E) None of the above

Answer: B

9. The value (price) of a European call option (a) can be negative (b) is always zero (c) is always non-negative (d) either of them (e) none of the above

Answer: (C)

10. The value of an American put option a. can be negative b. is always zero c. is always non-negative d. either of them e. none of the above Answer (C) 11. Put-call parity can be used to show: A) How far in-the-money put options can get B) How far in-the-money call options can get C) The precise relationship between put and call prices given equal exercise prices and equal expiration dates D) That the value of a call option is always twice that of a put given equal exercise prices and equal expiration dates E) none of the above

Answer: C

12. The value of a put option is always A) larger than the current stock price. B) larger than the strike price C) equal or less than the strike price D) less than the present value of strike price E) none of the above

Answer C)

13. Buying a call option, investing the present value of the exercise price in T-bills, and selling the underlying share is the same as: A) buying a call and a put B) buying a put and a share C) buying a put D) selling a call E) none of the above

Answer: C

14. Suppose an investor buys one share of stock and a put option on the stock and simultaneously sells a call option on the stock with the same exercise price. What will be the value of his investment on the final exercise date? A) Above the exercise price if the stock price rises and below the exercise price if it falls B) Equal to the exercise price regardless of the stock price C) Equal to zero regardless of the stock price D) Below the exercise price if the stock price rises and above if it falls E) None of the above

Answer: B

Use following information for questions 15-24.

Stock A is now selling at $10. One year later, it will have prices of $13 and $7, respectively, depending on the state of economy. The annual risk-free rate is 8%. Suppose there is a European put option written on stock A, with a strike price of $8 and a maturity of one year. Suppose you have formed a portfolio of the stock and the risk-free security to generate exactly the same payoffs as the put option does at maturity.

15. The portfolio is called the A) tangent portfolio of the call option B) minimum-variance portfolio of the call option C) efficient portfolio of the call option D) replicating portfolio of the put option E) none of the above Answer: D)

16. The number of shares of the stock in the portfolio is A) 1.00 B) -0.71 C) 0.83 D) -0.167 E) none of the above

Answer D)

17. The amount of money invested in the risk-free security in your portfolio is A) $5.04 B) $2.01 C) $3.03 D) -$5.04 E) none of the above Answer B)

18. The cost of your portfolio is A) $0.34 B) $0.71 C) $1.93 D) $2.93 E) none of the above

Answer A)

19. The value of the put option is A) $1.34 B) $0.71 C) $1.71 D) $2.93 E) none of the above

Answer E)

20. The risk-neutral probability for the stock price going up is A) 1.21 B) 0.37 C) 0.63 D) -0.37 E) none of the above Answer C)

21. The risk-neutral probability for the price going down is A) 1.30 B) 0.37 C) 0.63 D) 1.1 E) none of the above

Answer B)

22. The expected payoff using the risk-neutral probability is A) $1.00 B) $0.37 C) $0.83 D) $0.21 E) none of the above

Answer B)

23. The present value of the expected payoff calculated in the above question is A) $1.00 B) $0.93 C) $0.34 D) $1.21 E) none of the above Answer C)

24. The relation between the present value calculated in question 23 and the value of the put option calculated in question 19 is A) They are the same B) They are different C) They have no relation D) It cannot be decided E) none of the above Answer A)

Use following information for questions 25-30 Stock A is selling at $10 now. The annual return volatility is 90% The annual risk-free rate is 8%. Suppose there is a European call option written on stock A, with a strike price of $8 and a maturity of one year. Suppose you want to use the Black-Scholes formula to calculate the value of this call option.

25. The value of d1 is A) 0.22 B) 0.79 C) 0.87 D) 1.2 E) none of the above Answer B)

26. N(d1) is A) 1.10 B) 0.79 C) 1.43 D) 1.21 E) none of the above Answer B) 27. d2 = d1 - T is A) 1.00 B) 0.71 C) -0.11 D) 1.2 E) none of the above

Answer C) 28. N(d2) is A) 1.10 B) 0.71 C) 0.46 D) 1.21 E) none of the above

Answer C)

29. The value of the call option is A) $1.00 B) $2.93 C) $0.83 D) $4.48 E) none of the above

Answer D) 30. Suppose there is a European put option also written on stock A, with a strike price of $ 8 and the maturity of one year, the value of this put option can be calculated by using A) Put-call parity B) Black-Scholes formula C) Binomial tree D) Any of the above E) none of the above Answer D)