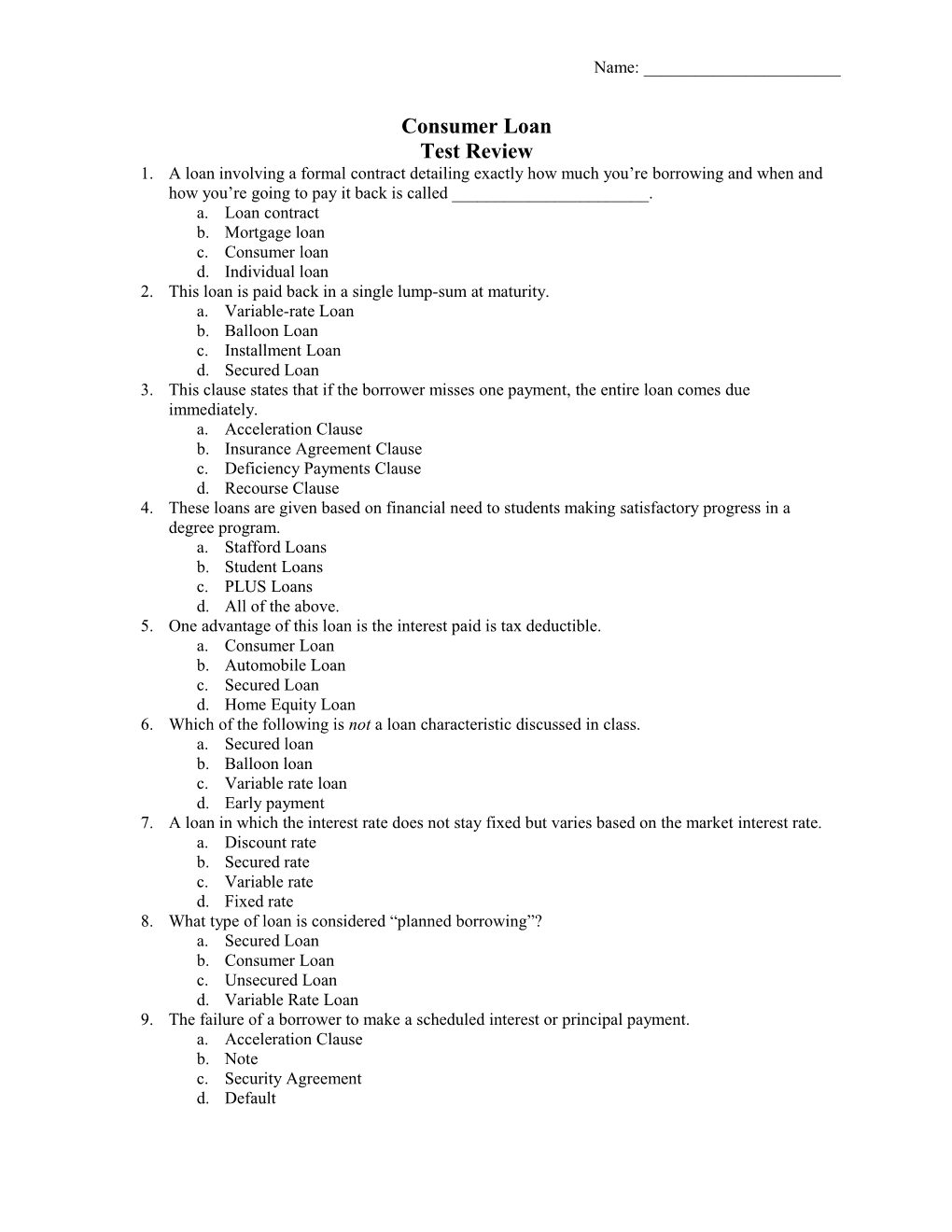

Name: ______

Consumer Loan Test Review 1. A loan involving a formal contract detailing exactly how much you’re borrowing and when and how you’re going to pay it back is called ______. a. Loan contract b. Mortgage loan c. Consumer loan d. Individual loan 2. This loan is paid back in a single lump-sum at maturity. a. Variable-rate Loan b. Balloon Loan c. Installment Loan d. Secured Loan 3. This clause states that if the borrower misses one payment, the entire loan comes due immediately. a. Acceleration Clause b. Insurance Agreement Clause c. Deficiency Payments Clause d. Recourse Clause 4. These loans are given based on financial need to students making satisfactory progress in a degree program. a. Stafford Loans b. Student Loans c. PLUS Loans d. All of the above. 5. One advantage of this loan is the interest paid is tax deductible. a. Consumer Loan b. Automobile Loan c. Secured Loan d. Home Equity Loan 6. Which of the following is not a loan characteristic discussed in class. a. Secured loan b. Balloon loan c. Variable rate loan d. Early payment 7. A loan in which the interest rate does not stay fixed but varies based on the market interest rate. a. Discount rate b. Secured rate c. Variable rate d. Fixed rate 8. What type of loan is considered “planned borrowing”? a. Secured Loan b. Consumer Loan c. Unsecured Loan d. Variable Rate Loan 9. The failure of a borrower to make a scheduled interest or principal payment. a. Acceleration Clause b. Note c. Security Agreement d. Default Name: ______

10. A loan where an automobile is used as collateral against the loan. a. Balloon Loan b. Stafford Loan c. Insurance Agreement Clause d. Automobile Loan 11. What two factors are used to calculate the debt limit ratio? a. Total monthly taxes and monthly take-home pay b. Total monthly gross pay and mortgage payment c. Total monthly take-home pay and nonmortgage debts d. Monthly mortgage and monthly debts 12. A variable-rate loan that can be changed into a fixed-rate loan at the borrower’s option at specified dates in the future is called ______. a. Changed Loan b. Converted Loan c. Variable to Fixed Loan d. Convertible Loan 13. ______is used by 70% of those filing for bankruptcy. a. Chapter 3 b. Chapter 7 c. Chapter 12 d. Chapter 13 14. To file for this type of bankruptcy you must have a regular income and are given a repayment schedule so that you can cover normal expenses and still make the repayments required. a. Chapter 7 b. Chapter 12 c. Chapter 11 d. Chapter 13 15. According to the debt resolution rule, what is the time frame for repayment of short-term debt? a. 2 years b. 4 years c. 7 years d. 10 years 16. A trained professional specializing in developing personal budgets and debt repayments programs is called ______. a. Loan Specialist b. Loan Officer c. Budget Analyst d. Credit Counselor 17. The inability to repay your debts a. Bankruptcy b. Financially unable c. Credit user d. Charged-off 18. Describe a payday loan. What are the disadvantages of this type of loan? Name: ______

19. Noel and Herman need to replace her car. But with the furniture and appliance payments, the credit card bills, and another car payment, they are uncertain if they can afford another payment. Current payments total $475 of their $2800 combined monthly take-home pay. Calculate the debt limit ratio and help them decide about the car purchase. Based on the debt limit ratio should they buy a new car or not? Explain.

20. List two inexpensive sources of funds. List two most expensive sources of funds.

21. What is the formula for simple interest? If $10,000 were borrowed for 6 months at an interest rate of 12 percent, how much would you pay in interest?

22. Define loan amortization.

23. What is the prime rate?

24. Calculate the following, Jane has the following nonmortgage bills: Appliance payments: $90 Credit Card bills: $100 Car payment: $200 Furniture payments: $45 Jane’s monthly take home pay is $3200. Calculate the debt limit ratio.