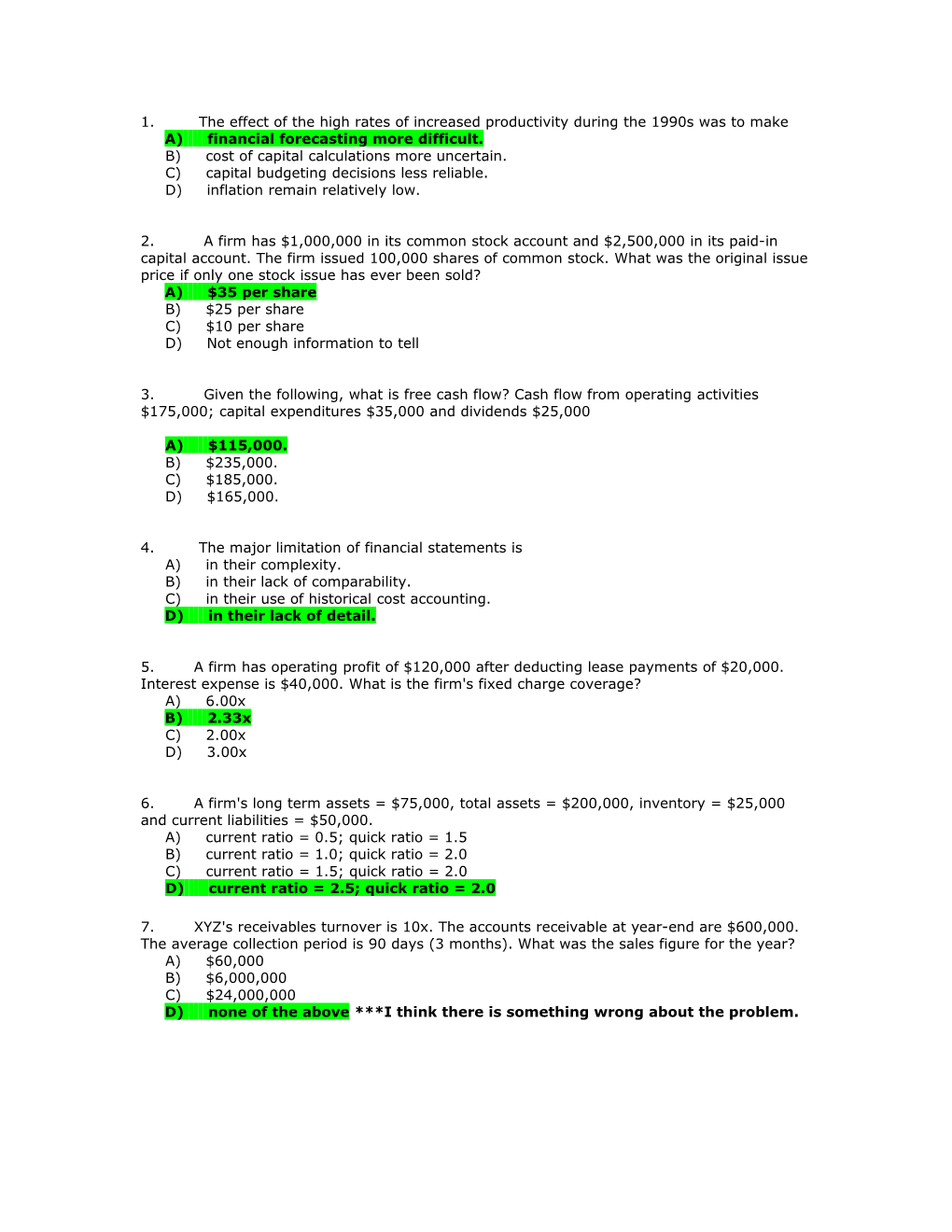

1. The effect of the high rates of increased productivity during the 1990s was to make A) financial forecasting more difficult. B) cost of capital calculations more uncertain. C) capital budgeting decisions less reliable. D) inflation remain relatively low.

2. A firm has $1,000,000 in its common stock account and $2,500,000 in its paid-in capital account. The firm issued 100,000 shares of common stock. What was the original issue price if only one stock issue has ever been sold? A) $35 per share B) $25 per share C) $10 per share D) Not enough information to tell

3. Given the following, what is free cash flow? Cash flow from operating activities $175,000; capital expenditures $35,000 and dividends $25,000

A) $115,000. B) $235,000. C) $185,000. D) $165,000.

4. The major limitation of financial statements is A) in their complexity. B) in their lack of comparability. C) in their use of historical cost accounting. D) in their lack of detail.

5. A firm has operating profit of $120,000 after deducting lease payments of $20,000. Interest expense is $40,000. What is the firm's fixed charge coverage? A) 6.00x B) 2.33x C) 2.00x D) 3.00x

6. A firm's long term assets = $75,000, total assets = $200,000, inventory = $25,000 and current liabilities = $50,000. A) current ratio = 0.5; quick ratio = 1.5 B) current ratio = 1.0; quick ratio = 2.0 C) current ratio = 1.5; quick ratio = 2.0 D) current ratio = 2.5; quick ratio = 2.0

7. XYZ's receivables turnover is 10x. The accounts receivable at year-end are $600,000. The average collection period is 90 days (3 months). What was the sales figure for the year? A) $60,000 B) $6,000,000 C) $24,000,000 D) none of the above ***I think there is something wrong about the problem. 8. If the business cycle were just beginning its upswing, which firm would you anticipate would be likely to show the best growth in EPS over the next year? Firm A has high combined leverage and Firm B has low combined leverage. A) Firm A B) Firm B C) Indifferent between the two D) It depends on how much financial leverage each firm has.

Use the following to answer questions 9 & 10:

Sales (75,000 units) $750,000 Variable costs 225,000 Contribution margin $525,000 Fixed manufacturing costs 187,500 Operating income $337,500 Interest 75,000 Earnings before taxes $262,500 Taxes (at 31%) 81,375 Net Income $181,125 Shares outstanding 15,000

9. The Degree of Operating Leverage is A) 1.43x B) 1.56x C) 3.33x D) 2.22x 10. The Degree of Combined Leverage is A) 2.2x B) 1.9x C) 2.9x D) 2.0x

11. XYZ Co. has forecasted June sales of 600 units and July sales of 1000 units. The company maintains ending inventory equal to 125% of next month's sales. June beginning inventory reflects this policy. What is June's required production? A) 1100 units B) -0- units C) 500 units D) 400 units

12. BHS Inc. determines that sales will rise from $300,000 to $500,000 next year. Spontaneous assets are 70% of sales and spontaneous liabilities are 30% of sales. BHS has a 10% profit margin and a 40% dividend payout ratio. What is the level of required new funds? A) $50,000 B) $20,000 C) $100,000 D) BHS is in balance and no new funds are needed.

13. A firm utilizing FIFO inventory accounting would, in calculating gross profits, assume that A) all sales were from current production. B) all sales were from beginning inventory. C) sales were from beginning inventory until it was depleted, and then use sales from current production. D) all sales were for cash.

14. Which of the following combinations of asset structures and financing patterns is likely to create the least volatile earnings? A) Illiquid assets and heavy short-term borrowing B) Illiquid assets and heavy long-term borrowing C) Liquid assets and heavy long-term borrowing D) Liquid assets and no debt

15. Massa Machine Tool expects total sales of $10,000. The price per unit is $5. The firm estimates an ordering cost of $7.50 per order, with an inventory cost of $0.70 per unit. What is the optimum order size? A) 327 units B) 463 units C) 147 units D) 207 units

16. Analog Computers needs to borrow $800,000 from the Midland Bank. The bank requires a 15% compensating balance. How much money will Analog need to borrow in order to end up with $800,000 spendable cash? A) $920,000 B) $1,058,264 C) $941,177 D) none of the above

17. The IF for the future value of an annuity is 4.5 at 10% for 4 years. If we wish to accumulate $8,000 by the end of 4 years, how much should the annual payments be? A) $2,500 B) $2,000 C) $1,778 D) none of the above

18. Mr. Blochirt is creating a college investment fund for his daughter. He will put in $850 per year for the next 15 years and expects to earn a 8% annual rate of return. How much money will his daughter have when she starts college? A) $11,250 B) $12,263 C) $24,003 D) $23,079

19. Dr. J. wants to buy an IBM personal computer which will cost $2,788 four years from today. He would like to set aside an equal amount at the end of each year in order to accumulate the amount needed. He can earn 7% annual return. How much should he set aside? A) $697.00 B) $627.93 C) $823.15 D) $531.81

20. Lou Lewis borrows $10,000 to be repaid over 10 years at 9 pecent. Repayment of principal in the first year is: A) $1,558 B) $658 C) $742 D) $885

21. An issue of common stock has just paid a dividend of $3.75. Its growth rate is 8%. What is its price if the market's rate of return is 16%? A) $25.01 B) $46.88 C) $50.63 D) none of the above

22. An issue of common stock is selling for $57.20. The year end dividend is expected to be $2.32 assuming a constant growth rate of 6%. What is the required rate of return? A) 10.3% B) 10.1% C) 4.1% D) none of the above

23. A firm in a cyclical industry should use A) a large amount of debt to lower the cost of capital. B) no debt at all. C) preferred stock in place of debt. D) a limited amount of debt to lower the cost of capital.

24. A firm is paying an annual dividend of $3.63 for its preferred stock which is selling for $62.70. There is a selling cost of $3.30. What is the after-tax cost of preferred stock if the firm's tax rate is 33%? A) 2.02% B) 4.09% C) 5.79% D) 6.11%