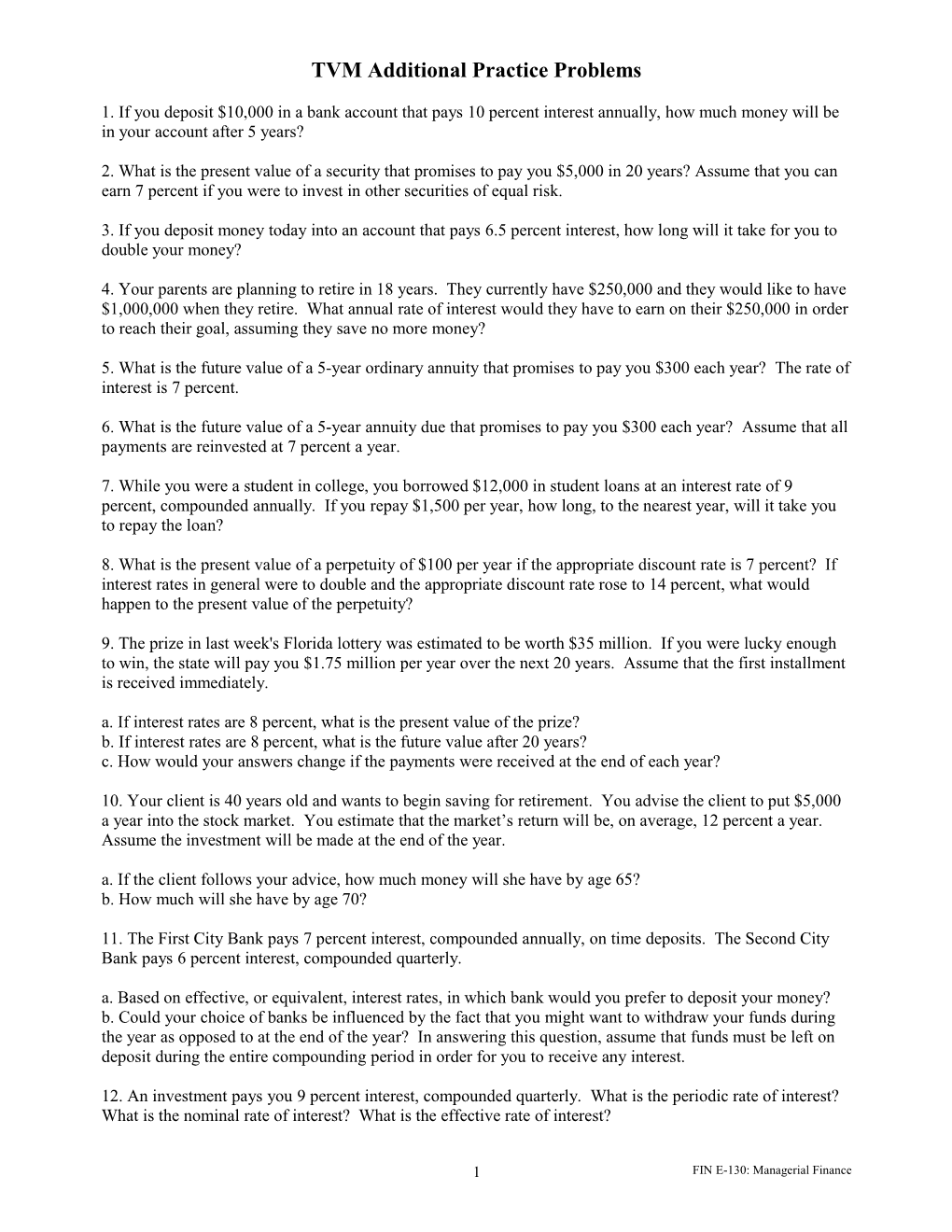

TVM Additional Practice Problems

1. If you deposit $10,000 in a bank account that pays 10 percent interest annually, how much money will be in your account after 5 years?

2. What is the present value of a security that promises to pay you $5,000 in 20 years? Assume that you can earn 7 percent if you were to invest in other securities of equal risk.

3. If you deposit money today into an account that pays 6.5 percent interest, how long will it take for you to double your money?

4. Your parents are planning to retire in 18 years. They currently have $250,000 and they would like to have $1,000,000 when they retire. What annual rate of interest would they have to earn on their $250,000 in order to reach their goal, assuming they save no more money?

5. What is the future value of a 5-year ordinary annuity that promises to pay you $300 each year? The rate of interest is 7 percent.

6. What is the future value of a 5-year annuity due that promises to pay you $300 each year? Assume that all payments are reinvested at 7 percent a year.

7. While you were a student in college, you borrowed $12,000 in student loans at an interest rate of 9 percent, compounded annually. If you repay $1,500 per year, how long, to the nearest year, will it take you to repay the loan?

8. What is the present value of a perpetuity of $100 per year if the appropriate discount rate is 7 percent? If interest rates in general were to double and the appropriate discount rate rose to 14 percent, what would happen to the present value of the perpetuity?

9. The prize in last week's Florida lottery was estimated to be worth $35 million. If you were lucky enough to win, the state will pay you $1.75 million per year over the next 20 years. Assume that the first installment is received immediately. a. If interest rates are 8 percent, what is the present value of the prize? b. If interest rates are 8 percent, what is the future value after 20 years? c. How would your answers change if the payments were received at the end of each year?

10. Your client is 40 years old and wants to begin saving for retirement. You advise the client to put $5,000 a year into the stock market. You estimate that the market’s return will be, on average, 12 percent a year. Assume the investment will be made at the end of the year. a. If the client follows your advice, how much money will she have by age 65? b. How much will she have by age 70?

11. The First City Bank pays 7 percent interest, compounded annually, on time deposits. The Second City Bank pays 6 percent interest, compounded quarterly. a. Based on effective, or equivalent, interest rates, in which bank would you prefer to deposit your money? b. Could your choice of banks be influenced by the fact that you might want to withdraw your funds during the year as opposed to at the end of the year? In answering this question, assume that funds must be left on deposit during the entire compounding period in order for you to receive any interest.

12. An investment pays you 9 percent interest, compounded quarterly. What is the periodic rate of interest? What is the nominal rate of interest? What is the effective rate of interest?

1 FIN E-130: Managerial Finance TVM Additional Practice Problems

13. If you deposit $750 in a money market deposit account paying 7%, how much will it be worth in 9 years?

14. You decide you would like to buy a retirement home on the Maine seacoast when you say goodbye to the working world in 40 years. The house now costs $300,000 and should go up 5% per year. What will be the cost of the house when you retire?

15. Suppose Abigail has $2,500 in her bank account today. She would like to have $30,000 saved at the end of 6 years to make a down payment on a house. If she wants to make equal annual deposits at the end of each of the next 6 years, how much should she deposit each year if the interest rate is 6%?

16. Further, suppose Abigail is able to reach her goal of owning a home. She purchased a home for $250,000, making the $30,000 down payment above. She took out a 30 year mortgage on the $220,000 balance. If her mortgage rate is 7% per year, compounded monthly, what are her monthly mortgage payments?

17. Vanguard has just signed a 15 year lease to rent out office space for $60,000 per year. Payments are made at the beginning of each year. If the firm's interest rate is 8%, find the present value of the lease payments.

18. Your parents plan on retiring in 10 years. They would like to have an annual income of $60,000 starting 11 years from now. They expect to need an annual income of $60,000 for 20 years. How much do they need today to reach their retirement goal if their interest rate is 8%?

19. Find the present value of $750 received at the end of year 1, $1,800 received at the end of year 2 and $2,600 received at the end of year 3. Assume the appropriate interest rate is 17%.

20. A new Ford Taurus currently costs $18,000 (In Ford’s dreams!). Ford expects this model will increase in cost to the consumer by 4% annually for the next five years (Not very likely!). What is the expected cost of a Ford Taurus in five years?

21. Your aunt, in her will, left you the sum of $5,000 a year forever. Given an interest rate of 12%, what is the present value of this inheritance?

22. The monthly payment on your house mortgage is $663.81. It is a 30 year mortgage at 9% compounded monthly. How much did you borrow?

23. What is the present value of $911 if it is received six and one-half years today and the appropriate interest rate is 8.4% annual interest compounded semi-annually?

2 FIN E-130: Managerial Finance TVM Additional Practice Problems

Solutions:

1 2 N = 5 N = 20 I = 10% I = 7% PV = $10,000.00 PV = Solve For $1,292.10 FV = Solve For $16,105.10 FV = $5,000.00 PMT = 0 PMT = 0

3 N = Solve For 11.01 I = 6.5% PV = ($100.00) FV = $200.00 $16,105.10 PMT = 0

Just double the PV, could be anything. For example, could be $1 = PV and $2 = FV. When entering both a PV and a FV, make sure one has a negative sign.

4 5 N = 18 N = 5 I = Solve For 8.01% I = 7.0% PV = ($250,000.00) PV = $0.00 FV = $1,000,000.00 FV = Solve For $1,725.22 PMT = 0 PMT = $300.00

6 N = 5 I = 7.0% PV = $0.00 FV = Solve For $1,845.99 PMT = $300.00

Be sure to change the calculator to Begin mode, to reflect payments at the beg. of the period. Note that number 6 is greater than number 5 due to the payments being received at the beg. of the period resulting in more compounding.

7 N = Solve For 14.77 = 15 years I = 9.0% PV = $12,000.00 FV = 0 PMT = -$1,500.00

8 100 = $1,428.57 0.07

100 = $714.29

3 FIN E-130: Managerial Finance TVM Additional Practice Problems

0.14

It decreases because of the higher discount rate.

9a 9b N = 20.00 N = 20.00 I = 8.0% I = 8.0% PV = Solve For $18,556,298.60 PV = $0.00 FV = 0 FV = Solve For $86,490,112.52 PMT = $1,750,000.00 PMT = $1,750,000.00

9c 9c - contd. N = 20.00 N = 20.00 I = 8.0% I = 8.0% PV = Solve For $17,181,758.00 PV = 0 FV = 0 FV = Solve For $80,083,437.52 PMT = $1,750,000.00 PMT = $1,750,000.00

Note the PV and FV in 9c are lower because the payments are rec. at the end of the year.

10a 10b N = 25.00 N = 30.00 I = 12.0% I = 12.0% PV = 0 PV = $0.00 FV = Solve For $666,669.35 FV = Solve For $1,206,663.42 PMT = $5,000.00 PMT = $5,000.00

11a First City = 7% effective yield = Preferred Second City = 6.1364% effective yield 11b Yes, if you withdraw during the year you will not get any interest with First, however Second will post quarterly.

12 13 Periodic = 9%/4 = 2.25% N = 9.00 Nominal = 9% I = 7.0% Effective Annual Rate = 9.31% PV = 750 FV = Solve For $1,378.84 PMT = $0.00

14 15 N = 40.00 N = 6.00 I = 5.0% I = 6.0% PV = $300,000.00 PV = $2,500.00 FV = Solve For $2,111,996.61 FV = ($30,000.00) PMT = $0.00 PMT = Solve For $3,792.47

16 17

4 FIN E-130: Managerial Finance TVM Additional Practice Problems

First you need to adjust so it is on a monthly basis. N = 15.00 Periodic Rate = 7/12 = .5833% = I I = 8.0% Number of Periods = 30 X 12 = 360 = N PV = Solve For $554,654.22 PV = $220,000.00 FV = 0 PMT = Solve For = $1,463.67/month PMT = $60,000.00

18 First you need to determine how much you will need in 10 years N = 20.00 I = 8.0% PV = Solve For $589,088.84 FV = 0 PMT = $60,000.00

Next you have to find the PV of the above number. N = 10.00 I = 8.0% PV = Solve For $272,862.11Amount needed today FV = $589,088.84 PMT = $0.00

19 You need to enter all the cash flows and find the NPV Year 1 $750.00 Year 2 $1,800.00 Year 3 $2,600.00 PV = $3,579.31

20 21 N = 5.00 $5,000.00 = $41,666.67 I = 4.0% 0.12 PV = $18,000.00 FV = Solve For $21,899.75 PMT = $0.00

22 23 N = 360.00 N = 13.00 Make Periodic I = 9/12 = .75 I = 8.4/2 = 4.2 PV = Solve For $82,499.55 PV = Solve For $533.63 FV = 0.00 FV = $911.00 PMT = $663.81 PMT = $0.00

5 FIN E-130: Managerial Finance