June 08, 2012

Eaton Corporation (ETN-NYSE)

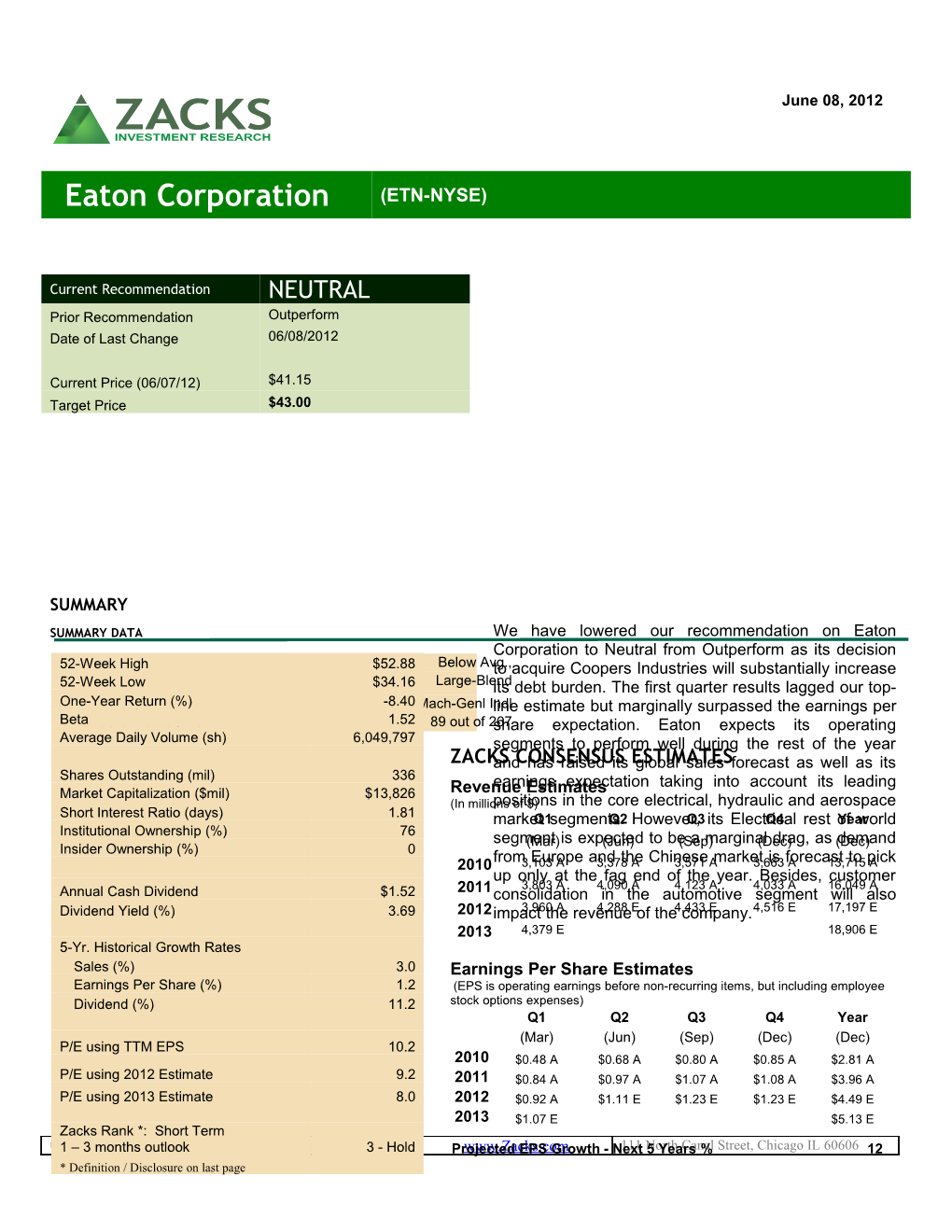

Current Recommendation NEUTRAL Prior Recommendation Outperform Date of Last Change 06/08/2012

Current Price (06/07/12) $41.15 Target Price $43.00

SUMMARY

SUMMARY DATA We have lowered our recommendation on Eaton Corporation to Neutral from Outperform as its decision 52-WeekRisk HighLevel * $52.88 Below Avg.,to acquire Coopers Industries will substantially increase 52-WeekType Low of Stock $34.16 Large-Blendits debt burden. The first quarter results lagged our top- One-YearIndustry Return (%) -8.40Mach-Genl Indlline estimate but marginally surpassed the earnings per Beta Zacks Industry Rank * 1.52 89 out of 267share expectation. Eaton expects its operating Average Daily Volume (sh) 6,049,797 segments to perform well during the rest of the year ZACKSand CONSENSUS has raised its ESTIMATESglobal sales forecast as well as its Shares Outstanding (mil) 336 earnings expectation taking into account its leading Market Capitalization ($mil) $13,826 Revenue Estimates (In millionspositions of $) in the core electrical, hydraulic and aerospace Short Interest Ratio (days) 1.81 marketQ1 segments.Q2 However,Q3 its ElectricalQ4 rest ofYear world Institutional Ownership (%) 76 segment(Mar) is expected(Jun) to be(Sep) a marginal(Dec) drag, as (Dec)demand Insider Ownership (%) 0 2010from3,103 Europe A and3,378 the A Chinese3,571 Amarket3,663 is forecastA 13,715 to pickA up only at the fag end of the year. Besides, customer 3,803 A 4,090 A 4,123 A 4,033 A 16,049 A Annual Cash Dividend $1.52 2011consolidation in the automotive segment will also Dividend Yield (%) 3.69 2012impact3,960 the A revenue4,288 E of the4,433 company. E 4,516 E 17,197 E 2013 4,379 E 18,906 E 5-Yr. Historical Growth Rates Sales (%) 3.0 Earnings Per Share Estimates Earnings Per Share (%) 1.2 (EPS is operating earnings before non-recurring items, but including employee Dividend (%) 11.2 stock options expenses) Q1 Q2 Q3 Q4 Year (Mar) (Jun) (Sep) (Dec) (Dec) P/E using TTM EPS 10.2 2010 $0.48 A $0.68 A $0.80 A $0.85 A $2.81 A P/E using 2012 Estimate 9.2 2011 $0.84 A $0.97 A $1.07 A $1.08 A $3.96 A P/E using 2013 Estimate 8.0 2012 $0.92 A $1.11 E $1.23 E $1.23 E $4.49 E 2013 $1.07 E $5.13 E Zacks Rank *: Short Term ©1 2012 – 3 monthsZacks Investment outlook Research, All Rights reserved.3 - Hold Projectedwww.Zacks.com EPS Growth - Next111 North5 Years Canal % Street, Chicago IL 60606 12 * Definition / Disclosure on last page OVERVIEW Automotive segment (11%): The Cleveland, Ohio-based Eaton Corporation is a automotive segment produces diversified power management company and a superchargers, engine valves and valve global technology leader in electrical components actuation systems, cylinder heads, locking and systems for power quality, distribution and and limited slip differentials, mirror control; hydraulics components, systems and actuators, transmission controls, engine services for industrial and mobile equipment; controls and fuel vapor components. aerospace fuel, hydraulics and pneumatic systems for commercial and military use; and truck and Aerospace segment (10%): This segment automotive drivetrain and powertrain systems for designs, manufactures and integrates performance, fuel economy and safety. The advanced hydraulic systems, fuel systems, company sells its products to customers in more motion control systems, propulsion sub- than 150 countries. Eaton has approximately systems and cockpit interface and circuit 73,000 employees. The company’s 2011 sales protection applications for commercial and were $16.04 billion. military programs.

Eaton operates through five business segments: The company's primary markets for Electrical Electrical, Hydraulic, Aerospace, Automotive, and Americas and Electrical Rest of World segments Truck. The Electrical segment is divided into are industrial, institutional, government, utility, Electrical Americas and Electrical Rest of World. commercial, residential, information technology and The Hydraulics, Aerospace, Truck, and Automotive original equipment manufacturers and customers. segments continue as individual reporting The principal markets for its Hydraulics segment segments. include oil and gas, renewable energy, marine, agriculture, construction, mining, forestry, utility, Electrical segment (45% of total 2011 material handling, truck and bus, machine tools, sales): This segment manufactures power molding, primary metals, power generation, and distribution and power protection equipment entertainment. Markets for the Aerospace segment used in the commercial, residential, and include manufacturers of commercial and military industrial end markets. These products aircraft and related after-market customers. The cater to the demand for electrical power in Truck and Automotive segments deal with original commercial buildings, data centers, equipment manufacturers (OEMs) and after-market residences, apartment and office buildings, customers of heavy, medium, and light-duty trucks, hospitals and factories. SUVs, CUVs, and passenger cars.

Hydraulics segment (18%): The hydraulics segment manufactures and markets a Revenue Decomposition 2011 comprehensive line of reliable, high- efficiency hydraulic systems and Automobile 11% components. It provides hydraulics to large Electrical on-road and off-road mobile OEMs in the Truck 45% agriculture, construction, mining, marine 16% and lawn and garden markets.

Truck segment (16%): The truck unit Aerospace 10% produces drivetrain systems for medium Hydraulics and heavy-duty commercial vehicles. 18% Products include transmissions, clutches, collision warning systems, mobile diagnostics and hybrid electric powertrain systems. It also provides aftermarket sales Source: Company and support services to both medium and heavy duty commercial vehicles.

Equity Research ETN | Page 2 REASONS TO BUY paid dividends since 1923. This signifies that the company’s dividends are stable, an Eaton Corporation operates in a number of encouraging sign for investors even if another markets and faces a wide array of competitors recession is round the corner. During the first in varied niches. The company produces quarter 2012, the board of directors of Eaton everything from cockpit controls to hydraulic approved a $0.04 per share increase to its pumps; therefore, direct comparisons with other quarterly dividend rate. With the increase the companies are difficult. However, the company present quarterly dividend rate comes to $0.38 in general competes on price, geographic per share. This dividend yield presently stands coverage, service and product performance. at 3.1% compared to the industry average of Competitors include ITT Corporation, Johnson 0.7%. Controls Inc., Parker Hannifin Corporation and others. Eaton is stronger than the competitors in various segments and bags the leading REASON TO SELL position with respect to several products. The decision to acquire Cooper Industries will The strong momentum across Eaton’s business substantially increase the debt burden of the segments should continue amidst buoyant end- company. Eaton will issue long-term debts market demand and market share gains. After worth $5.1 billion to fund the acquisition. the steep decline in Eaton's end markets in Besides, the company will also assume $1.4 2009, the company experienced a turnaround in billion of outstanding debt held by Cooper. The 2010. It gained more velocity in 2011, with the long-term debt level will expand beyond $8 sustained improvement in economic conditions. billion, increasing the interest burden The company expects this growth trend to substantially and will stretch the balance sheet. continue in 2012 as well. Eaton expects its global market will increase by 5% in 2012, backed by increasing sales in the U.S. The non- The lingering debt crisis in Europe continues to US market contribution will however be lower tarnish demand in the electrical markets. The than previous estimates. reduced demand in Europe and uncertainty in Asia-Pacific will affect the performance of Eaton has grown through strategic acquisitions Eaton’s Electrical Rest of World. Consequently, and joint ventures, which either complement or contributions from this segment will remain low expand its businesses. The company continued in 2012 with a recovery expected not earlier this trend in 2011 as well and utilized $325 than the second half of the year. million for acquisitions, the largest of which were Internormen Technology Group, E. Higher materials cost from increased copper Begerow GmbH & Co. KG, and ACTOM Low and steel prices, along with higher pension and Voltage. In 2011, the acquired businesses healthcare expenses, can negatively impact contributed 2% to net sales growth versus 1% margins. in 2010. The company continued its acquisition spree in the first few months of 2012. The The company has significant customer company has decided to acquire Polimer consolidation, particularly in the automotive Kauçuk Sanayi ve Pazarlama A.Ş., a Turkish segment. Hence, the loss of a major customer manufacturer of hydraulic and industrial hose would negatively impact earnings. and South Korea based Jeil Hydraulics, a manufacturer of track drive motors, swing drive motors, main control valves and remote control RECENT NEWS valves for the construction equipment market. Both these acquisitions will expand the Eaton Strengthens EMEA Footprint – June 4, operational reach of its Hydraulics segment. 2012

Eaton continues to reward shareholders Eaton Corporation has completed the acquisition of through its dividend program. The company has a unit of Gycom Group based in Stockholm. The

Equity Research ETN | Page 3 acquired unit engages in low-voltage power expense associated with amortization of intangible distribution and the supply of control and assets owing to purchase accounting, the automation components in the Nordic countries, acquisition is expected to increase operating primarily Sweden, Denmark and Finland. earnings per share by $0.65 per share and $0.75 per share in 2014 and 2015, respectively. Per the agreement, Eaton will function closely with Gycom till October 2012. The latter will provide Eaton Beats Earnings Est, Lags Rev – April 23, operational assistance during this period. 2012 Subsequent to the transition period, both the companies will operate independently effective Industrial manufacturer Eaton Corporation released November 2012. its first quarter 2012 results, clocking operating earnings of $0.92 per share compared with $0.84 Eaton Buys Cooper, Forms New Entity – May per share in the year-ago quarter. The quarterly 22, 2012 earnings beat the Zacks Consensus Estimate of $0.90 per share. Eaton Corporation is set to acquire Irish electrical equipment supplier Cooper Industries plc. Both the In the reported quarter, GAAP earnings were $0.91 companies have already signed a definitive per share, up 10% from $0.82 in the year-ago agreement related to the proposed acquisition. The period. The variation between operating and GAAP total equity value of this transaction is estimated at earnings was due to an acquisition integration $11.8 billion. charge of $0.01.

Post regulatory, shareholders and other approvals, Operating Statistics the new organization will be named Eaton Global Corporation Plc and will be based in Ireland. The Eaton reported quarterly revenue of $3,960 million, shares of the new entity will be registered with the up 4% year over year from $3,803 million in year- U.S. Securities and Exchange Commission and ago quarter. The revenue growth was attributable trade under the symbol of ETN on the New York to a 4% increase associated with organic growth Stock Exchange. and a 1% rise related to acquisitions. This was partially offset by a 1% dip related to lower foreign The acquisition will be financed with a combination exchange rates. The first quarter revenue missed of cash, debt and equity. As of March 31, 2012, the Zacks Consensus Estimate of $4,006 million. Eaton had a cash balance of $367 million. Also, the company has already secured $6.75 billion fully Eaton posted net income of $313 million in the first underwritten bridge financing commitments from quarter of 2012, up 8.3% from $289 million in the several multinational institutions to finance a part of year-ago quarter. this acquisition. Segment Analysis Per the agreement, the Eaton shareholders will own 73% of the combined entity while Cooper Electrical Americas: Within its Electrical unit, shareholders will enjoy 27% ownership. The Electrical Americas’ revenues in first quarter 2012 shareholders of Cooper are expected to receive improved by 13% from the year-ago quarter to $72.00 per share based on the closing price of $1,087 million, while operating profit (excluding Eaton common stock as of May 18, 2012. This acquisition integration charges) was up 21% to includes a cash consideration of $39.15 per share $162 million. Growth in Electrical Americas’ and 0.77479 shares of the newly formed company revenues reflected growth of 7% in end-markets for each Cooper share. and 6% in orders.

Eaton expects this transaction to create cost Electrical Rest of the World: The Electrical Rest synergies of $535 million by 2016. The acquisition of the World segment’s first quarter 2012 sales is expected to be accretive to the company’s were down 12% from the year-ago quarter to $651 operating earnings by $0.35 per share in 2014 and million. In the reported quarter, operating profit was by $0.45 per share in 2015. Excluding non-cash $53 million, down 24.3% from $70 million in the

Equity Research ETN | Page 4 year-ago quarter. This was due to weakness in the Eaton has gradually transformed itself from an electrical markets in Europe and the Asia-Pacific automotive and truck component manufacturer into region. In this quarter, segment bookings a diversified industrial enterprise with leading experienced a dip of 6%. positions in its core electrical, hydraulic and Hydraulics: This segment’s sales rose 7% year aerospace market segments. In our view, the over year to $735 million and operating profits company’s organic growth will be driven by strength came in at $109 million, with growth of 2.8% from in its end markets. the year-ago quarter. In this quarter, the segment bookings declined 15% due to absence of orders In 2012, the company is expected to continue with from OEM customers. its good performance across the board, except for the Electrical Rest of the World business, which will Aerospace: Segmental sales in the first quarter be adversely affected by decreasing demand from 2012 increased 11% to $430 million and operating the European countries and China. profits spiked 33% to $60 million. In the reported quarter, the aerospace markets grew 6%. We note that the decision to acquire Cooper Industries will increase the debt levels of the Truck: This segment posted a 10% improvement in company substantially higher and the possibilities sales to reach $631 million. It earned an operating of customer consolidation in the automotive profit of $116 million during the quarter, compared segment will impact earnings. Hence, we have with $90 million in the year-ago quarter. Despite a decided to lower our recommendation to Neutral 7% decline in non-U.S. markets, due to a dip in from Outperform. Brazilian production, Eaton posted a 50% increase in truck production attributable to growth in NAFTA Shares of Eaton are presently trading at 10.2x Class 8 manufacturing. trailing 12-month EPS, compared to the 13.8x average for the peer group and 13.6x for the S&P Automotive: This segment’s first quarter sales 500. The trailing 12-month EV/EBITDA multiple is were down 4% year over year to $426 million. This above the industry average. Our target price of was due to a 3% dip related to foreign exchange $43.00 is based on a P/E multiple of 9.6 based on rates and a 4% decrease for a recently completed 2012 EPS. divestiture; partially offset by a 3% increase in core growth area. It posted an operating profit of $44 million, reflecting a drop of 12% year over year. In this quarter, the global auto markets registered growth of 4%.

Guidance

Eaton expects pro forma and GAAP earnings for the second quarter of 2012 to be in the range of $1.05 – $1.15 per share and $1.04 – $1.14 per share, respectively. Pro forma earnings estimates exclude acquisition integration charges. The company expects its fiscal 2012 pro forma and GAAP earnings to be in the range of $4.30 – $4.70 per share and $4.23 –$4.63 per share, respectively. At the same time, the company expects to increase its fiscal 2012 sales by 7.5%.

VALUATION

Equity Research ETN | Page 5 Key Indicators Earnings Surprise and Estimate Revision History

P/E P/E 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) EATON CORP (ETN) 9.2 8.0 12.0 7.2 10.2 27.8 5.3

Industry Average 13.7 11.5 15.7 11.3 13.8 51.6 8.5 S&P 500 12.8 12.0 10.7 11.2 13.6 27.7 12.0

Illinois Tool Works Inc. (ITW) 13.0 11.8 12.4 10.2 14.4 28.0 8.7 Ingersoll-Rand Plc (IR) 13.3 11.0 11.1 9.3 14.7 21.8 4.3 Parker Hannifin Corp. (PH) 10.8 9.9 7.5 9.4 11.0 34.9 6.1 TTM is trailing 12 months; F1 is 2012 and F2 is 2013, CF is operating cash flow

P/B Last P/B P/B ROE D/E Div Yield EV/EBITDA Qtr. 5-Yr High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) EATON CORP (ETN) 1.7 3.2 0.9 17.6 0.4 3.6 7.4

Industry Average 2.5 2.5 2.5 17.1 0.4 0.8 5.3 S&P 500 7.9 8.6 2.9 29.3 2.2

Equity Research ETN | Page 6 rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1020 companies covered: Outperform - 15.1%, Neutral - 77.3%, Underperform – 6.5%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Eaton Corp. (ETN) at StockResearchWiki.com:

http://www.stockresearchwiki.com/tiki-index.php? page=ETN/Ticker

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of ETN. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following

Equity Research ETN | Page 7