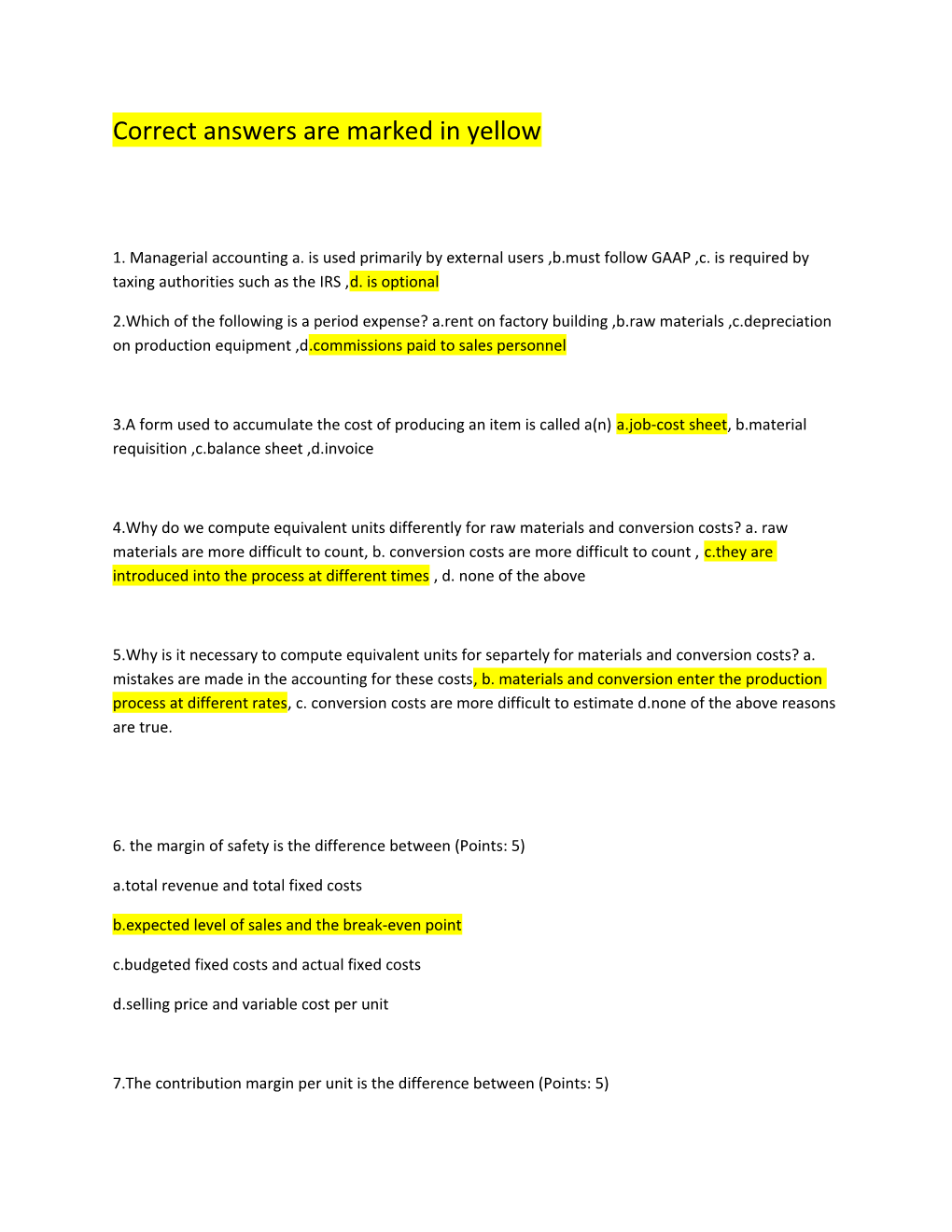

Correct answers are marked in yellow

1. Managerial accounting a. is used primarily by external users ,b.must follow GAAP ,c. is required by taxing authorities such as the IRS ,d. is optional

2.Which of the following is a period expense? a.rent on factory building ,b.raw materials ,c.depreciation on production equipment ,d.commissions paid to sales personnel

3.A form used to accumulate the cost of producing an item is called a(n) a.job-cost sheet, b.material requisition ,c.balance sheet ,d.invoice

4.Why do we compute equivalent units differently for raw materials and conversion costs? a. raw materials are more difficult to count, b. conversion costs are more difficult to count , c.they are introduced into the process at different times , d. none of the above

5.Why is it necessary to compute equivalent units for separtely for materials and conversion costs? a. mistakes are made in the accounting for these costs, b. materials and conversion enter the production process at different rates, c. conversion costs are more difficult to estimate d.none of the above reasons are true.

6. the margin of safety is the difference between (Points: 5) a.total revenue and total fixed costs b.expected level of sales and the break-even point c.budgeted fixed costs and actual fixed costs d.selling price and variable cost per unit

7.The contribution margin per unit is the difference between (Points: 5) a.total revenue and total fixed costs b.selling price and variable costs per unit c.anticipated level of sales and break-even sales d.budgeted fixed costs and actual fixed costs

8.Which of the following items on a variable costing income statement will change in direct proportion to a change in units sold? (Points: 5) a.sales, contribution margin, income b.sales, variable costs, contribution margin c.sales, variable costs, fixed costs d.sales, fixed costs, net income

9.If the number of units sold is less than the number of units produced (Points: 5) a.full costing and variable costing will yield the same net income b.full costing will assign some fixed manufacturing overhead to the units in the ending inventory c.net income will be higher under variable costing than under full costing d.inventory levels will decrease

10.A major problem with cost-plus contracts is that they (Points: 5) a.are not acceptable under GAAP b.cause suppliers to significant financial risks c.require suppliers to use variable costing d.create an incentive to allocate as much cost as possible to the goods produced under the cost-plus contract

11.Which of the following steps is not involved in the ABC approach? (Points: 5) a.identify activities which cause costs to be incurred. b.allocate costs to products based on activity usage c.group costs of activities into cost pools d.Improve processes based on benchmarking

12.Which of the following is never considered in incremental analysis? (Points: 5) a.incremental revenues b.sunk costs c.incremental profit d.differential costs

13Fixed costs that will be eliminated if a particular course of action is undertaken are called (Points: 5) optional costs opportunity costs direct costs avoidable costs

14.Target costing (Points: 5) a.starts with the features a customer wants and what they will pay for them b.is used after the product is designed c.focuses on including all features in a product that a customer may want d.all of the above

15.Customer profitability analysis would trace which of the following to each customer? (Points: 5) sales revenue cost of goods sold cost of filling the customer order all of the above

16.Present value techniques (Points: 5) ignore cash flows that will occur more than ten years in the future are a way of converting future dollars into equivalent current dollars provide more conservative results than similar time value of money computations treat dollars received today the same as dollars received in the future.

17.Which of the following techniques uses time value of money? (Points: 5) payback period internal rate of return accounting rate of return relative sales value method

18. TCO10. The ratio that measures the return earned independently of how the firm is financed is the (Points: 5) return on stockholders' equity price earnings ratio earnings per share return on assets

19. TCO10. Asset turnover is a measure of (Points: 5) a.how quickly a company is moving its inventory b.how quickly a company is turning it accounts receivable into cash c.the overall efficiency with which the company uses its assets to generate revenues d.how rapidly the market believes the company will grow

20. TCO10. Which ratio measures the rate earned on total capital provided by the owners? (Points: 5) return on assets return on stockholders' equity earnings per share price earnings ratio

21. TCO10. In general, an unfavorable material variance arises from (Points: 5) using more material than planned paying a higher price for material than planned both A and B none of the above

22. TCO10. Why is ROI better than income as a measurement of performance for an investment center? (Points: 5)

ROI follows GAAP

ROI is simpler to compute than income

ROI considers the amount invested as well as the net income

ROI is forward looking 23. TCO10. Which of the following is a responsibility that distinguishes an investment center manager from a profit center manager? (Points: 5) setting prices for products controlling costs generating revenues significant influence over investment decisions

24. TCO10. A subunit that has responsibility for controlling cost but not revenues is a(n)? (Points: 5) profit center cost center investment center business center