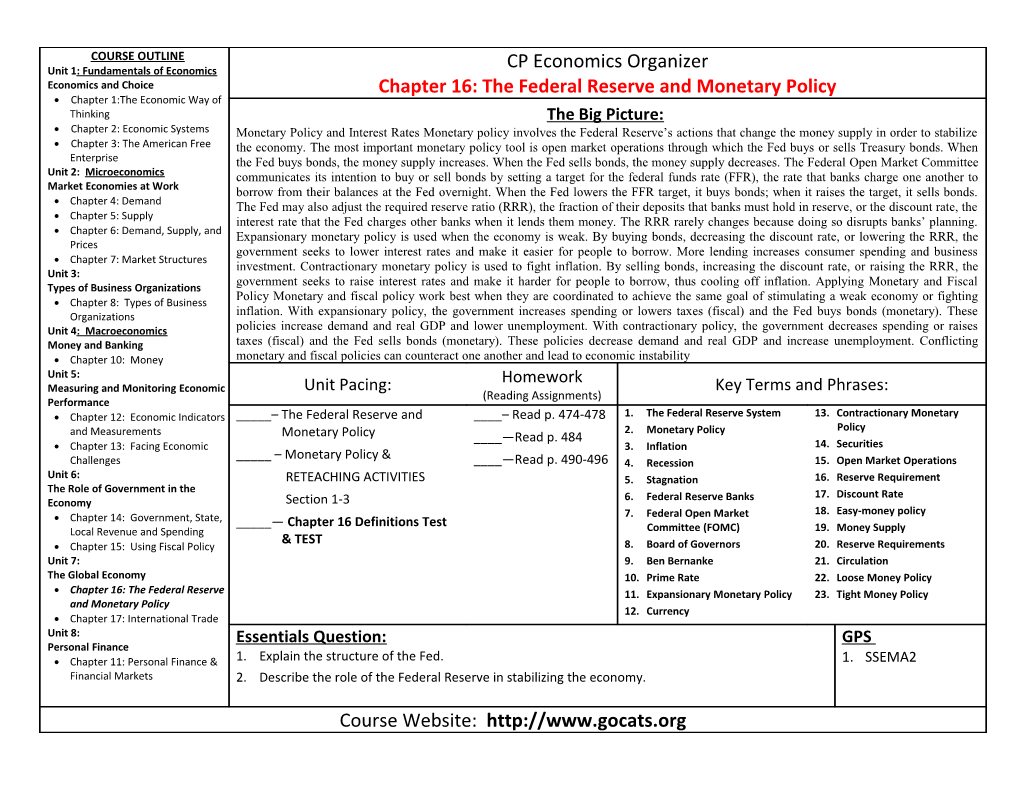

COURSE OUTLINE Unit 1: Fundamentals of Economics CP Economics Organizer Economics and Choice Chapter 16: The Federal Reserve and Monetary Policy Chapter 1:The Economic Way of Thinking The Big Picture: Chapter 2: Economic Systems Monetary Policy and Interest Rates Monetary policy involves the Federal Reserve’s actions that change the money supply in order to stabilize Chapter 3: The American Free the economy. The most important monetary policy tool is open market operations through which the Fed buys or sells Treasury bonds. When Enterprise the Fed buys bonds, the money supply increases. When the Fed sells bonds, the money supply decreases. The Federal Open Market Committee Unit 2: Microeconomics communicates its intention to buy or sell bonds by setting a target for the federal funds rate (FFR), the rate that banks charge one another to Market Economies at Work borrow from their balances at the Fed overnight. When the Fed lowers the FFR target, it buys bonds; when it raises the target, it sells bonds. Chapter 4: Demand The Fed may also adjust the required reserve ratio (RRR), the fraction of their deposits that banks must hold in reserve, or the discount rate, the Chapter 5: Supply interest rate that the Fed charges other banks when it lends them money. The RRR rarely changes because doing so disrupts banks’ planning. Chapter 6: Demand, Supply, and Expansionary monetary policy is used when the economy is weak. By buying bonds, decreasing the discount rate, or lowering the RRR, the Prices government seeks to lower interest rates and make it easier for people to borrow. More lending increases consumer spending and business Chapter 7: Market Structures investment. Contractionary monetary policy is used to fight inflation. By selling bonds, increasing the discount rate, or raising the RRR, the Unit 3: government seeks to raise interest rates and make it harder for people to borrow, thus cooling off inflation. Applying Monetary and Fiscal Types of Business Organizations Policy Monetary and fiscal policy work best when they are coordinated to achieve the same goal of stimulating a weak economy or fighting Chapter 8: Types of Business Organizations inflation. With expansionary policy, the government increases spending or lowers taxes (fiscal) and the Fed buys bonds (monetary). These Unit 4: Macroeconomics policies increase demand and real GDP and lower unemployment. With contractionary policy, the government decreases spending or raises Money and Banking taxes (fiscal) and the Fed sells bonds (monetary). These policies decrease demand and real GDP and increase unemployment. Conflicting Chapter 10: Money monetary and fiscal policies can counteract one another and lead to economic instability Unit 5: Homework Measuring and Monitoring Economic Unit Pacing: Key Terms and Phrases: (Reading Assignments) Performance Chapter 12: Economic Indicators _____– The Federal Reserve and ____– Read p. 474-478 1. The Federal Reserve System 13. Contractionary Monetary 2. Monetary Policy Policy and Measurements Monetary Policy ____—Read p. 484 Chapter 13: Facing Economic 3. Inflation 14. Securities _____ – Monetary Policy & Challenges ____—Read p. 490-496 4. Recession 15. Open Market Operations Unit 6: RETEACHING ACTIVITIES 5. Stagnation 16. Reserve Requirement The Role of Government in the 6. Federal Reserve Banks 17. Discount Rate Economy Section 1-3 7. Federal Open Market 18. Easy-money policy Chapter 14: Government, State, _____— Chapter 16 Definitions Test Local Revenue and Spending Committee (FOMC) 19. Money Supply & TEST Chapter 15: Using Fiscal Policy 8. Board of Governors 20. Reserve Requirements Unit 7: 9. Ben Bernanke 21. Circulation The Global Economy 10. Prime Rate 22. Loose Money Policy Chapter 16: The Federal Reserve 11. Expansionary Monetary Policy 23. Tight Money Policy and Monetary Policy 12. Currency Chapter 17: International Trade Unit 8: Essentials Question: GPS Personal Finance Chapter 11: Personal Finance & 1. Explain the structure of the Fed. 1. SSEMA2 Financial Markets 2. Describe the role of the Federal Reserve in stabilizing the economy.

Course Website: http://www.gocats.org